Making money-related decisions is one of the main and probably most stressful responsibilities of a business owner. In order to make these decisions the right way, you need to base them on reliable financial statements.

And a crucial step in creating these accurate accounting books is choosing the right basis of accounting.

The basis of accounting relates to the timing when transactions get recorded. The two bases businesses can choose from are either cash basis or accrual basis accounting.

In this article, we will explain their characteristics and differences in detail, along with choosing the right basis of accounting for your small business.

Read on to learn about:

- What Is the Basis of Accounting?

- Difference Between Cash Basis Accounting and Accrual Basis Accounting

- What Is Cash Basis Accounting?

- What Is Accrual Basis Accounting?

- Should Your Small Business Use Cash Basis or Accrual Basis Accounting?

What Is the Basis of Accounting?

Every business records revenues and expenses into its financial statements at a specific time. This timing of documentation is known as the basis of accounting.

There are two main types of accounting methods: cash basis accounting and accrual basis accounting.

A third option is the hybrid (or modified) cash basis method, which is a combination of the two above.

The IRS allows small businesses to pick whichever type they prefer, but they must stick to this chosen method until the very end.

On the other hand, public companies and those generating over $25 million for 3 years are obligated to use accrual basis accounting.

We will explain why as we go along. But first, let’s check out the main differences between cash basis and accrual basis accounting.

Difference Between Cash Basis Accounting and Accrual Basis Accounting

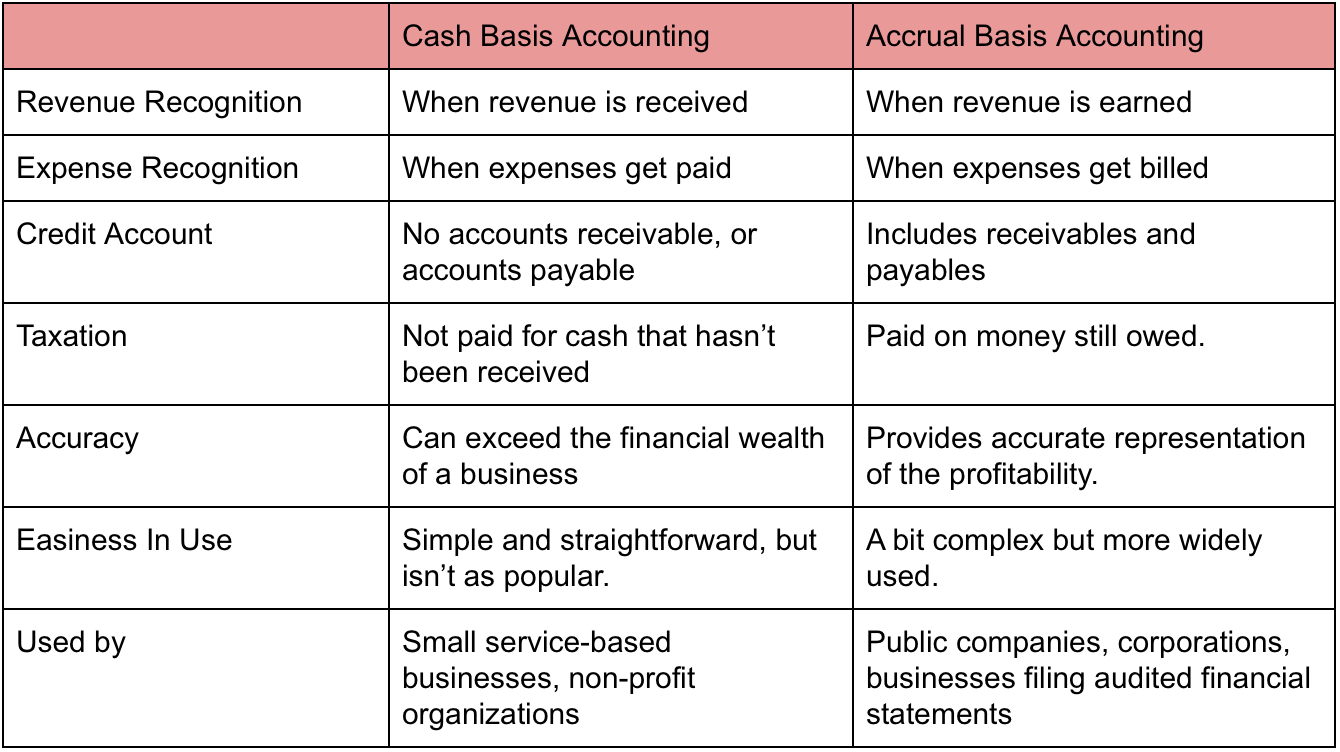

Cash and accrual accounting make similar journal entries, but the key difference between the two lays in the timing of recording.

Cash accounting recognizes money only when it is received or paid. While accrual, recognizes revenue the second it gets earned, and expenses right when they get billed.

Listed on the table below you’ll find a summarization of the main distinctions between the two:

Now that we got an idea of how cash and accrual accounting differ, let’s explain each one in detail.

What Is Cash Basis Accounting?

Cash basis accounting documents revenues only when the money is received, and expenses only when they get paid. This means, there are no recordings of receivables or payables.

The same principle applies to taxation. In cash basis accounting, taxes get paid only when income is received.

The most common businesses that opt for cash accounting are:

- Sole proprietorships and partnerships, because these types of ownerships don’t have to publish their financial books.

- Businesses who use single-entry bookkeeping, instead of double-entry bookkeeping

- Businesses with few transactions and employees

- Businesses with no inventory

- Businesses who don’t sell or buy on credit

Now, this method may be the simplest to manage, but it’s not the most accurate. Cash basis accounting easily distorts the idea of how much your business can afford to spend.

For instance, assume the two following financial transactions occurred:

Purchase of $300 dollars of materials whose invoice arrives next month.

- Received $1000 from sales.

With cash-basis accounting, your profit for the month would be $1000, even though there was a $300 bill spent on materials. This can easily cause the business to overspend an extra $300 they can’t afford, and not be able to pay the invoice expense next month.

What Is Accrual Basis Accounting?

Accrual basis accounting measures a business’ financial performance by recognizing financial transactions when they occur, regardless of when the cash exchange takes place. In simpler terms, expenses are recorded when they get billed, and revenues when earned.

For example, a finished project will be recorded as income for the business, even if the customer hasn’t paid yet.

This method is considered as the standard accounting practice for most companies. In fact, the law requires public businesses such as C-corporations, and those who generate over $25 million in revenue for 3 preceding tax years, to use accrual accounting.

But what makes accrual accounting so necessary?

Well, first and foremost, it provides a more realistic and accurate picture of finances. It allows a business to realize the true profit they’re making, in real-time. And so, preparing budgets and other financial plans becomes way easier.

This method doesn’t just affect the business’s internal decision-making, however. Investors and creditors also prefer finances kept with accrual accounting.

Now, although accrual accounting is more used as an accounting basis, it has its own downsides.

The process is more complex, so it takes up extra time and resources to manage. Also, it could mess up the short-term view of your finances.

For example, say you send out invoices worth $10,000 every month. Accrual basis shows you have earned the cash, even if your business bank account is dry and empty. This “illusion” could affect the business’ ability to pay bills or even employee payrolls.

What Is the Modified Cash Basis Accounting?

The goal of modified cash basis accounting is to profit from the best of both worlds. This strategy combines elements from both cash and accrual accounting.

To be more specific, short term assets are recorded using a cash basis, while long-term ones through an accrual basis.

This approach is less costly, in comparison to full-accrual accounting.

However, it’s not allowed by GAAP or IFRS, so it should be used for internal purposes only.

Should Your Small Business Use Cash Basis or Accrual Basis Accounting?

Again, as far as the law is concerned, accrual accounting is only required for public businesses, and those generating over $25 million in a three year period.

If your small business doesn’t fall under these categories, you’re free to pick and choose any basis of accounting.

With that being said, cash basis accounting works best when the business has little cash in hand and is dealing with few transactions. It prevents cash flow issues from crippling these operations.

On the other hand, if you’re the owner of a busier business with more financial activity, it’s best to go for accrual accounting.

Now you’re probably wondering, can you switch from one method to the other

Short answer, yes.

However, it’s a lengthy process, which needs permission from the IRS to take place. You have to add up your accrued and prepaid expenses, subtract customer prepayments, file for a Form 3115, and make more adjustments.

PRO TIP

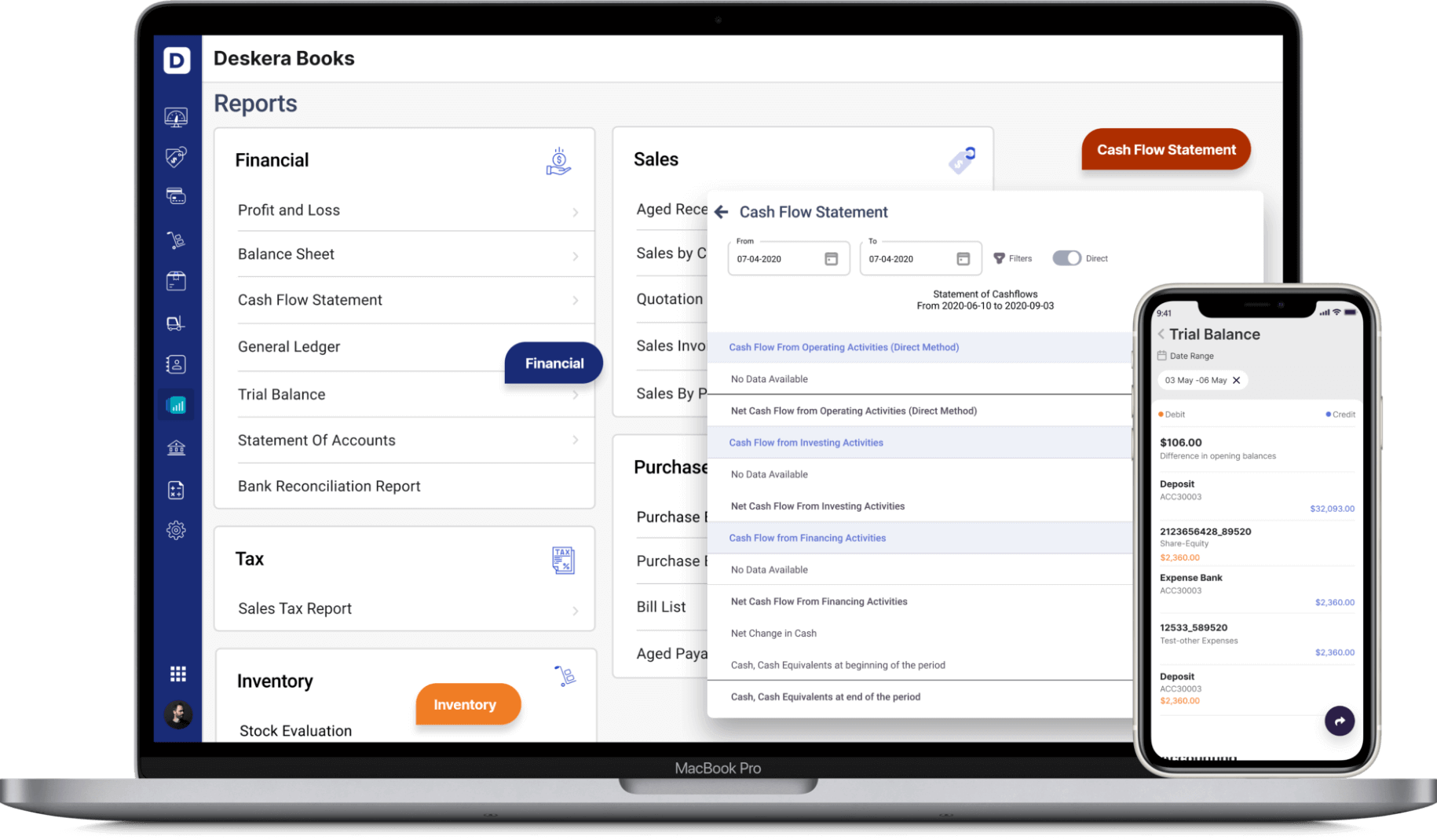

Accounting software like Deskera automates your accrual basis accounting for you. By integrating directly with your bank accounts, any payments or purchases made get immediately posted to the appropriate ledger account.

You can also use our professional invoice creation tool to easily send and receive bills, which get automatically entered into the right payable and receivable accounts.

Not convinced Deskera is the right choice for you?

Well, you can try it out yourself with our free trial! No credit card required.

How can Deskera Books Help Your Business

Take your business to the next level with Deskera All-in-One. It is a platform that offers Invoicing, Accounting, Inventory, CRM, HR & Payroll all under one roof. With Deskera books, you can keep track of your business cash flow and revenue using its financial reports. Accounting can be easily managed Deskera Books and can help you keep track of your balance sheet, profit and loss statement and journal ledger. All this simplifies your accounting and tracking of your financial records, making it easy for your business to get business credit and to secure loans.

With Deskera Books, you can avail of online invoicing, accounting & inventory software to boost your business. It covers all the significant aspects of business such as billing, payments, warehouse management, Credit & Debit Notes, financial reports, an elaborate business dashboard apart from many other features.

Key Takeaways

And that’s a wrap! We hope our guide to the basis of accounting was helpful.

To recap, here are the main points we’ve covered:

- The basis of accounting refers to the timing varieties when financial events get recorded.

- The two main types of bases are cash basis and accrual basis accounting.

- Cash basis records finances when money exchanges hands, while accrual basis when the transaction occurs, whether or not any cash has been received or paid.

- Public businesses and those with over $25 million in revenue are required by law to use accrual accounting. Small businesses, on the other hand, are free to choose their own basis.

If you want to learn more about doing accounting for your business, check out our Related Guides below.

Related Articles