When running your own business’ finances, you’ll likely make accounting errors from time to time. Even the most qualified accountants do.

And although it’s normal to make mistakes, it’s also essential to always notice them and get things right. At the end of the day, your business is only as reliable as the data you enter.

Now, you probably have a ton of questions.

How can I tell I’ve made an accounting error? Is there a way to prevent them from happening in the first place?

Well, don’t stress! In this guide, we cover everything you need to know about accounting errors for any business. Read on to learn about:

- What Is An Accounting Error?

- What Are the Different Types of Accounting Errors?

- How Can Accounting Errors Affect Your Business?

- How Can You Prevent Accounting Errors?

What Is An Accounting Error?

An accounting error is an unintentional mistake made in an accounting entry. For instance, including an item in the inappropriate account, or writing the incorrect description for it.

Don’t mix up errors with fraud, though. Fraud is intentional and done for ulterior motives such as hiding money to benefit the business.

Now, not all errors are the same.

Sometimes you can spot them right away, and fix them just as easily.

For example, say there’s an unequal ending balance of debits and credits in your trial balance. When this happens, it’s visibly clear which accounts don’t match. All you have to do is scan the document and make a correcting entry.

In other cases, however, the solution isn’t as immediate, and you’ll need to do a further review of your financial statements.

What Are the Different Types of Accounting Errors?

As previously mentioned, accounting errors won’t always be easy to reach. The accounting cycle is a complicated multi-step process, so mistakes can occur at any point in the way.

That’s why we divide accounting errors into two main categories: errors that affect the trial balance, and errors that don’t.

Errors That Affect The Trial Balance

The two most common mistakes that affect the trial balance are one-sided entries and incorrect additions.

Both of these errors leave an unbalanced ending amount, so they’re quickly noticeable in the trial balance.

If you’re using accounting software, the tool will let you know immediately how much that unbalanced amount is. However, if you’re manually recording your entries, you have to differentiate the debit and credit values to figure out the exact result of the error.

After you’ve found out the difference between debits and credits, the next step is to make a suspense account. The suspense account is an entry that holds the unresolved cash until further analysis.

Then, once the issue is identified, a correcting entry of the suspense account is carried out. This last step is known as reconciliation.

Sound confusing? Let’s check out an example.

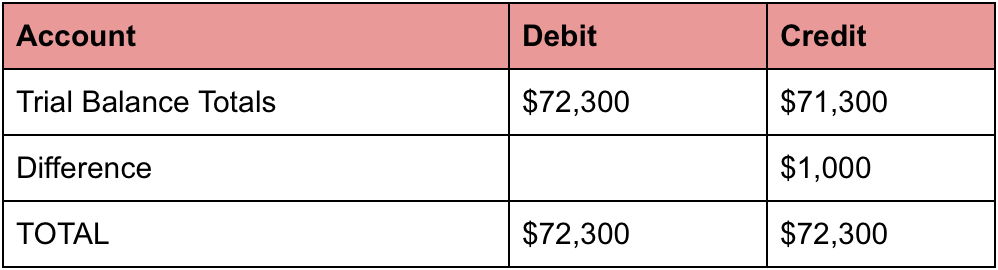

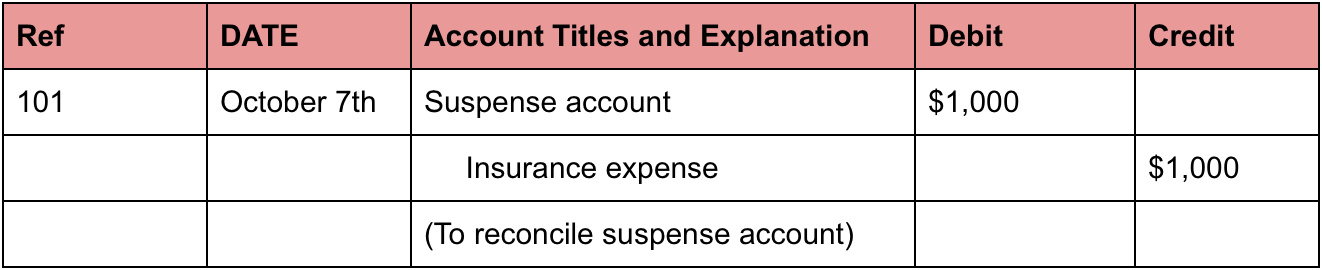

The table below shows a difference of $1,000 between debits and credits.

In order for the trial balance to be in equilibrium, a single entry is posted in a suspense account.

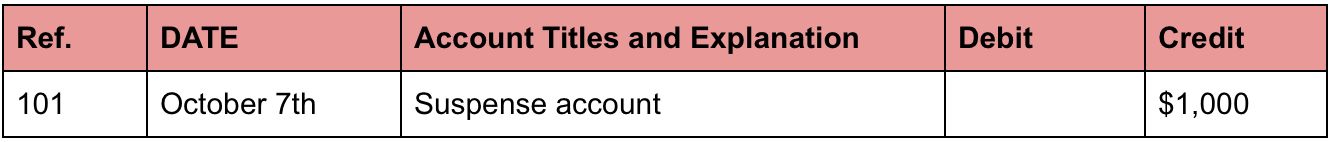

Let’s assume the difference was an addition error on the insurance expense account. This is how the correcting entry would look:

Errors That Don’t Affect The Trial Balance

Errors Of Principle

GAAP (Generally Accepted Accounting Principles) are the accounting rules you are obligated to follow when making financial statements. Violating these guidelines is called an error of principle.

Errors of principle are typically entries made in the wrong account. Meaning, the amounts recorded are correct, but the accounts aren’t.

Let’s check out an example.

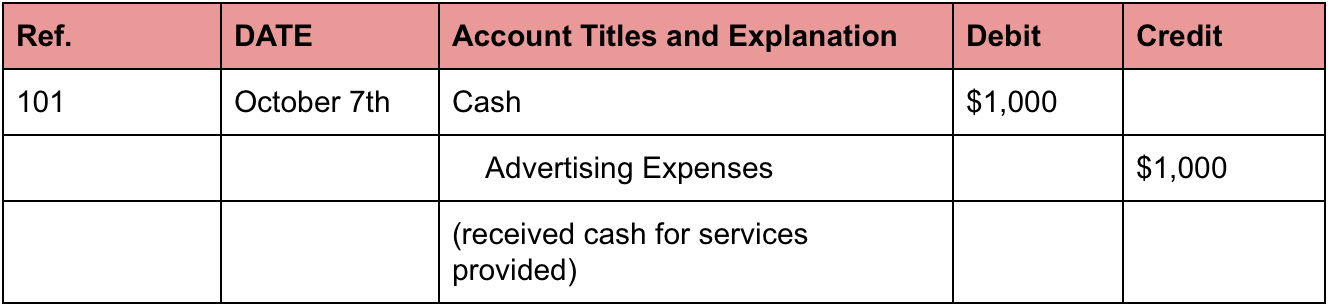

XYZ company receives $1,000 in cash for their advertising services.

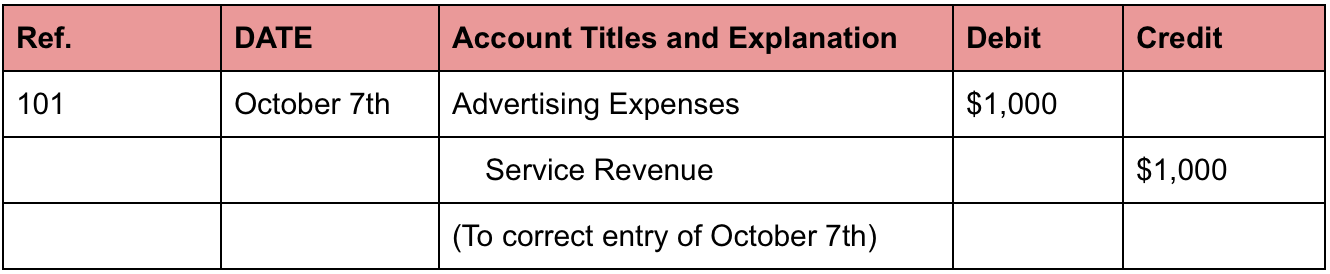

Now, an error of principle gets made. The advertising expenses account is credited for $1,000 instead of the service revenue, as the table below shows.

The correcting entry for this error of principle would be:

Want to learn how to make the perfect journal entry? Check out our full guide with practical examples.

Errors of Omission

When you fail to record a transaction, you make an error of omission. This mistake isn’t intentional, just comes as a result of neglect.

Whether you misplace a receipt or simply forget to make an entry of it, an error of omission is usually difficult to find. The best way to prevent it is through a reliable routine for entering transactions.

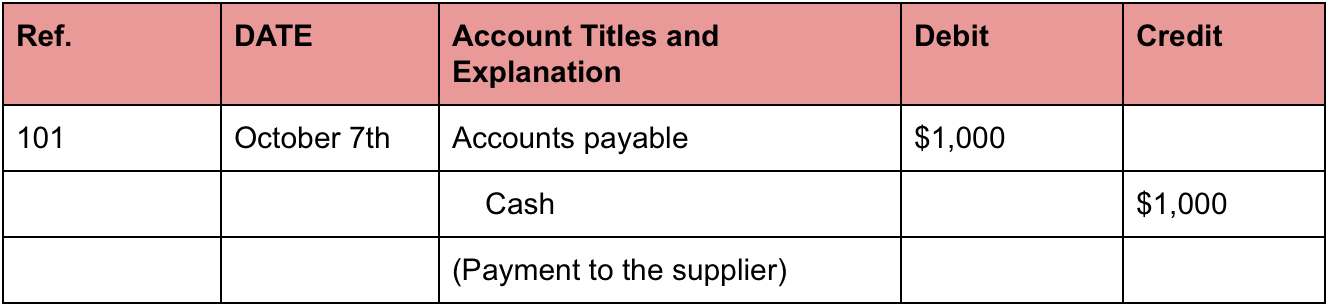

Let’s assume payment of $1,000 to a supplier has been omitted. After the mistake gets noticed, you make the following correcting entry:

Don’t want to manually record all of your transactions? No problem!

Use accounting software to integrate directly with your bank account, so every time a purchase or payment gets made, the journal entry is automatically posted into the correct ledger.

Transposition Error

When dealing with a lot of numbers, your eyes may sometimes deceive you. Digits get easily mixed up or reversed with one another. This mistake is called a transposition error.

Even though this error seems small, writing an expense amount of “$3,678” instead of “$6,378” can throw off your entire finances.

The good news is, there’s a specific way to confirm transposition errors revolving around mathematics and the number 9.

Let’s explain this method step by step.

The first step is differentiating the incorrect and correct amounts.

Now, if the difference between these two numbers is divisible by 9, it’s likely you have a transposition error.

For example, assume a bookkeeper records a revenue of $26 instead of $62.

When you differentiate the two, you’ll get an error of $36. Since $36 divided by 9 equals 4, this could mean that there was a transposition error.

Reversal Of Entry Error

A reversal of entry error occurs when you debit an entry instead of crediting it (or vice versa). The accounts and amounts are still correct, they’re just posted in the wrong direction.

Canceling out this error is fairly easy. The correcting entry has to be double the amount of the previous error.

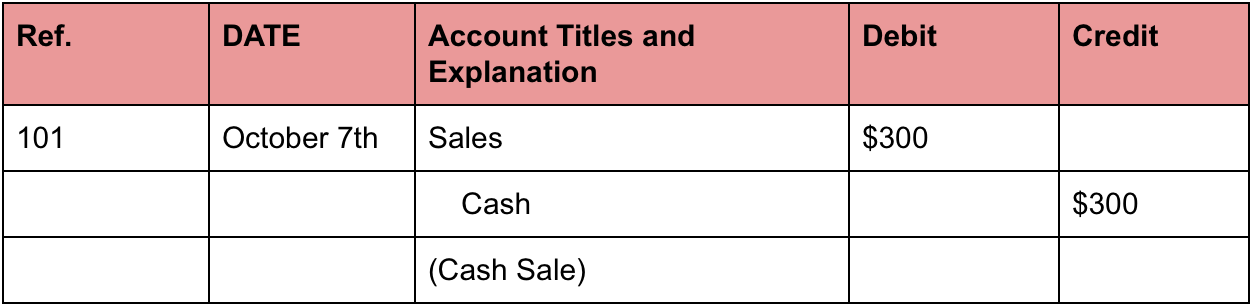

So, if a sale in cash for $300 has been recorded incorrectly like this:

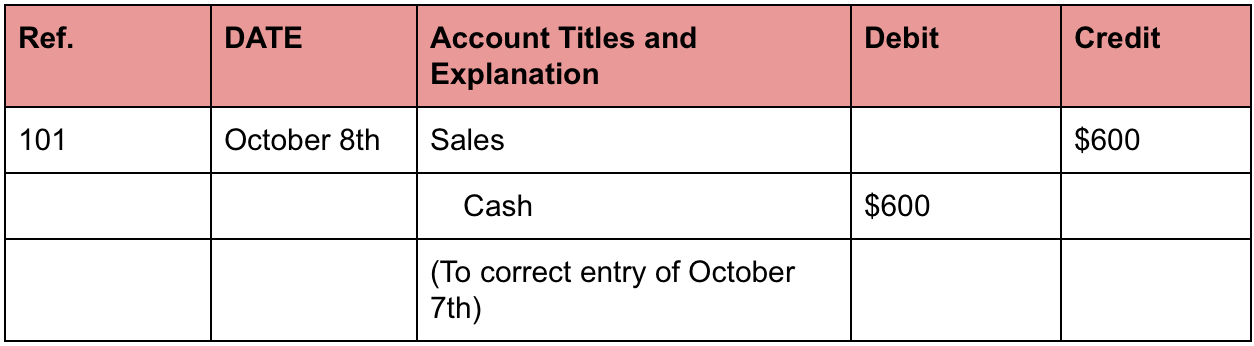

If the error is noticed the day after, the correcting entry would be:

Errors Of Commission

Also known as “the false positives”, errors of commission happen when you enter the correct amount in the right account, but in the wrong subcategory.

What does that mean, exactly?

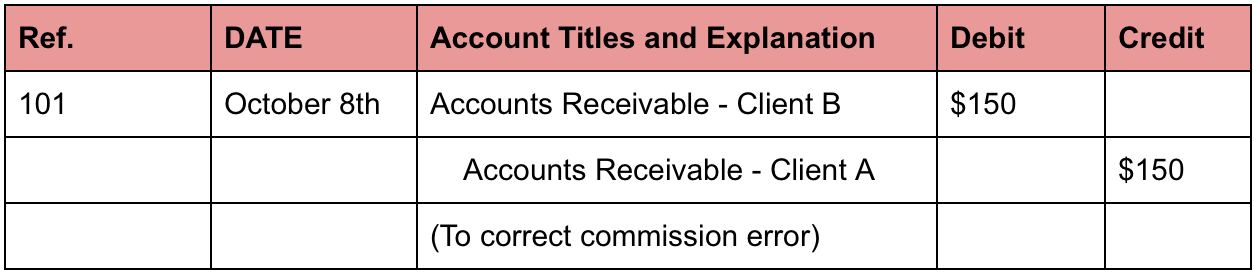

Say you receive payment from a client. Now, if you hold this receipt against another client’s bills, you’ve made a commission error.

This type of mistake is clearly noticeable because your client’s sub-ledger will be off.

Here’s how you would correct an error of commission if $150 cash received from client A is credited to the account of client B.

Compensating Errors

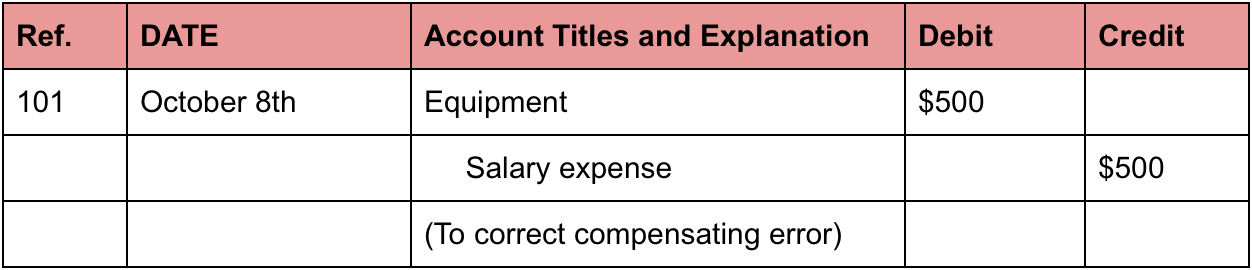

In some cases, two mistakes can occur at the same time and balance each other out. This is called a compensating error.

Since there’s no net effect, this slip up can be one of the most difficult to notice. Doing a statistical analysis is your best shot at it.

Now, assuming you’ve noticed the compensating error, what’s the practical fix? Let’s check out a practical example.

The equipment account is incorrectly totaled and understated by $500. So is the salary expense account.

The correcting entry, in this case, would be:

How Can Accounting Errors Affect Your Business?

Every accounting error, no matter how minor, can result in severe consequences for the business.

Incorrect reporting

Errors in financial reports, whether of income or expenses, can distort the idea of how much profit a business is actually making. And consequently, a business can end up overspending, paying too much or too little in taxes, or even dealing with tax fines.

Late payment charges

When an error gets noticed late, there could be additional expenses. For example, if you enter an invoice once the deadline for disbursement has passed, you have to pay an additional charge and interest.

Increase in labor expenses

Fixing errors is a time-consuming process. You might have to pay extra hours for the work they put in reviewing and correcting these mistakes.

Loss of reputation and trust

When finances are full of errors, a business becomes unreliable in the eyes of outsiders. Whether these result from process inefficiencies or simple human error, clients and investors will lose trust nonetheless.

How Can You Prevent Accounting Errors?

If you’re careful with your financial details from the beginning, you probably won’t need to worry about fixing them at all.

Luckily, there are plenty of measures that guarantee an error-free accounting process for your business. Let’s check them out one by one.

Put Internal Controls In Action

When managing a business, it’s always better to be safe than sorry.

Consider making monthly reconciliations for both your bank and credit card statements. That way you can catch errors right away and prevent them from loitering around your accounting.

Creating budgets is also a pretty essential tool. Planning business expenses doesn’t just help with making more strategic purchasing decisions, but it also aids in discovering any misclassifications. You can compare budgets to actual expenses to check whether finances are on the right track. Errors usually pop up along the way as well.

Save all receipts

We know it might be tempting to throw out bills and receipts once you’re done with them. But, they serve as proof for the digits in your financial books. Also, in case the IRS audits you, it is good to have them as a backup.

This doesn’t mean you have to hold them forever, though. We recommend keeping the accounting files of the last three years, to protect the business.

Don’t overwhelm employees

Overworked employees are a gateway to errors. If you don’t give them the right time and resources to handle tasks, your business will soon be holding itself with just a bobby pin.

Don’t get us wrong, not falling behind schedule is just as important. However, it’s best to consider ways to simplify the accounting process, such as by using accounting software.

Use online accounting software

Recording your accounting books by hand has gotten old-fashioned for a reason. Not only is it time-consuming, but it opens your business to a ton of potential accounting errors.

Online accounting software, on the other hand, is way more convenient and correct than a human mind.

Some of the main accounting software benefits include:

- Automation of journal entries

- Bank integration

- Professional invoice creation

- Safely securing data on the cloud

- Accessing data from any device

- Sending late payment reminders

- Managing inventory

- Creating financial reports in a few clicks

- And more!

We at Deskera, provide the best accounting software for business, with all of the above features - and so much more. Starting with just $9 per month! We make accounting for small businesses as easy as 1-2-3.

Still not convinced? Try Deskera out yourself! Sign up for our free trial, no credit card required!

Key Takeaways

And that’s a wrap! We hope you found our guide to accounting errors helpful.

Here are some key takeaways:

- Accounting errors are unintentional mistakes made when recording finances.

- We divide them into two main categories: errors that affect the trial balance, and errors which don’t.

- Some of the most severe consequences of accounting errors include incorrect reports, increase in labor expenses, additional fees, and loss of reputation.

- The best way to ensure a well-run accounting process is through accounting software like Deskera.

Related Articles