All businesses have financial debts towards their creditors. Even the largest and most successful companies purchase some of their equipment and supplies on account.

In accounting language, these liabilities are recognized as accrued expenses.

Now, you probably have a ton of questions.

What other types of expenses qualify as “accrued'? Is there a simple accounting method or tool I can use for these?

Our guide contains the answers to these questions, along with everything else you need to know about accrued expenses for small business accounting.

Table of Contents:

- What Are Accrued Expenses?

- Why Are Accrued Expenses Important?

- What Qualifies as an Accrued Expense?

- Journal Entries for Accrued Expenses

- Automate Accrued Expenses with Accounting Software

- Accrued Expense FAQ

What Are Accrued Expenses?

An accrued expense is a liability account that refers to an accumulated past expense that hasn’t been billed or paid yet.

Accrued expenses are considered to be current liabilities because the payment is usually due within one year of the date of the transaction (that means the date on the invoice, not the date when the invoice arrives).

This matters because most businesses use the accrual basis of accounting where revenue is recognized when it is earned, and expenses when they‘re incurred (not when they’re paid).

To understand the concept, let’s assume a business uses a utility (such as electricity) to keep their offices running throughout the entire month of January.

For these electricity expenses, the business is billed on a quarterly basis. That means that the bill won’t arrive until the end of March, even though an expense has been incurred in January.

This is where accrued expenses come into play.

Since the business uses the accrual basis of accounting, expenses are recorded when they happen. That means that the firm needs to accrue the utility expense for the end of January.

You might be wondering: how can that be done without an actual bill with the amount owed?

Well, an accrued expense is typically just an estimate and doesn’t represent the exact payment due. So, if electricity normally costs the business $50 per month, that’s the amount that would be accrued at the end of January through a journal entry.

We’ll go more in detail on how to make journal entries for accrued expenses as we go along.

Accrual vs Cash Basis of Accounting

As we previously mentioned, you can only record accrued expenses with the accrual basis of accounting. However, there is an alternative method you can use, known as the cash basis of accounting.

When using the cash basis, expenses and revenue are recorded only when money changes hands, rather than when goods are being sold or expenses made.

Although the cash basis might seem a more straightforward way of doing accounting, the accrual basis has proven to be the better measure for a company’s profitability.

That’s why accrual accounting is more commonly used overall, and is mandatory for all public companies.

Not sure which method to use for your small business accounting? Head over to our guide on the basis of accounting to learn everything you need to know about cash and accrual accounting.

What is the Difference Between Accounts Payable and Accrued Expenses?

In the accrual basis of accounting, unpaid expenses are tracked either as accounts payable or accrued expenses. These terms are sometimes used interchangeably, however, there are some key differences between the two.

Both of them are recorded under liabilities in the balance sheet, but each serves a different purpose.

Accounts payable (AP) represents the short-term debt that a business has to pay to its vendors and creditors for goods and services purchased on credit. AP is created only after an invoice is sent, and represents the exact amount owed to sellers.

On the other hand, accrued expenses are an estimated sum of the company's liabilities; these figures are eventually adjusted to reflect exactly what is owed after bills or invoices are received.

Why Are Accrued Expenses Important?

GAAP Compliant

Generally Accepted Accounting Principles, commonly known as GAAP, are a set of accounting principles considered the industry standard for preparing financial statements in the US.

GAAP only allows the accrual basis of accounting as a method of recognizing expenses and revenue. GAAP doesn’t apply to all types of business, though. It’s only relevant for public companies that release their financial statements.

But even if you’re a small business complying with the GAAP, it can grant you the benefits of comparability and transparency which investors and other interested third parties appreciate. It’s more likely that a bank will grant you a loan, and a supplier will sell you merchandise on credit if your accounting accurately portrays the business’s financial status.

Full Financial Picture

Accrued expenses, and accrual accounting in general, lets you keep a more accurate and complete record of your financial transactions.

As a business owner, this information allows you to better understand how profitable the firm is, where the profit is coming from, and where the expenses are going. Using the cash basis of accounting, on the other hand, is not nearly as accurate, and is more prone to error.

Preferred by Stakeholders

With the accrual basis of accounting, your businesses' finances become more transparent and predictable. This is very useful for interested third parties, such as creditors, investors, suppliers, and anyone else who needs to assess the financial situation of the business.

What Qualifies as an Accrued Expense?

Some of the most common examples of accrued expenses include:

- Accrued Interest refers to the amount of interest expense that has been added to a loan, bond, or other financial obligation that hasn’t been paid yet.

- Accrued Payroll is the compensation owed to an employee. This can be in the form of a wage, salary, or bonus.

- Accrued Utilities are the utility expenses such as water, electricity, garbage disposal, which have been used, and won’t be billed until the following month.

- Accrued Employee Benefits refer to benefits such as sick pay, unused vacation, personal time off, and other types of benefits that the employee has earned, but will be paid at a later date.

- Accrued Services include any services a business has received, such as consulting services, that are unpaid and that the consultant hasn’t sent an invoice for.

- Accrued Goods refer to unpaid supplies, equipment, or any other purchased goods that have been delivered, but the vendor hasn’t sent a sales invoice for.

Journal Entries for Accrued Expenses

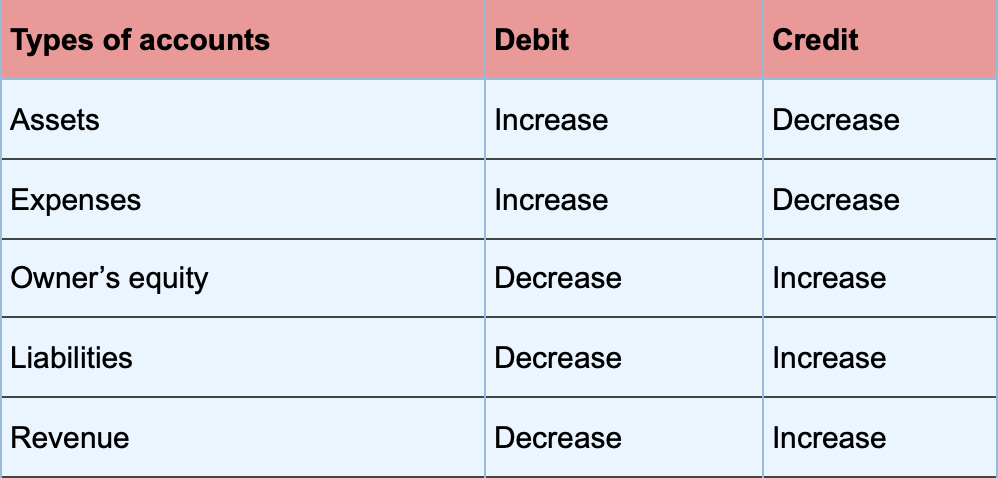

Before we get into how to make a journal entry for an accrued expense, let’s briefly touch upon some basics of debits and credits.

In every journal entry, at least two accounts will change, where one is debited and the other is credited.

Asset and expense accounts increase when debited, and decrease when credited. While the owner’s equity, liabilities, and revenue accounts decrease when debited and increase when credited.

Here’s a cheat sheet if you want to remember what happens to your cash when a certain account type is debited or credited:

Now, when we make accrued expenses, an expense and a liability account increase at the same time. As you can also see in the table above, that means that the expense account is debited, and the liability account credited.

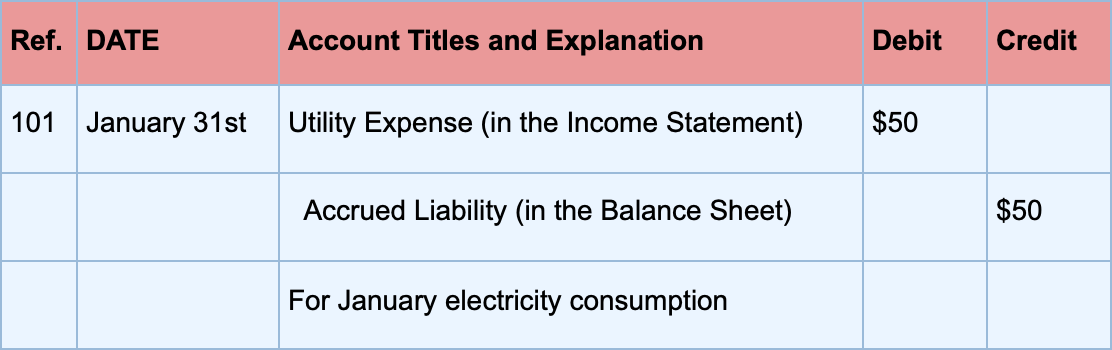

Let’s illustrate with our previous electricity utility expense example.

Step 1: Incurring the Accrued Expense

We said that for January, our utility bill is estimated at around $50. In this case, the utility expense account is debited for $50, while the accrued expense account credit for $50.

The journal entry would look like this:

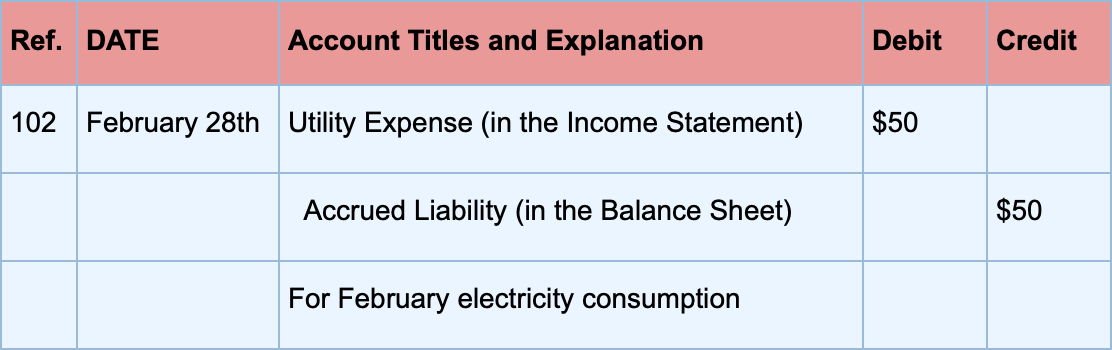

This step is repeated in February as well, to record electricity for the end of the month, as shown below:

Step 2: Recording the Bill/Invoice

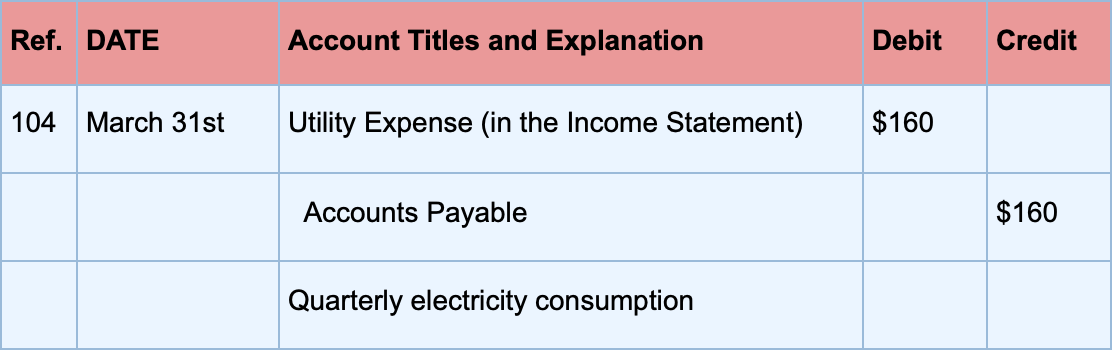

Jump forward to the end of March, the bill finally arrives, and it accounts for $160. In this case, we need to make two entries in order to adjust our accounts.

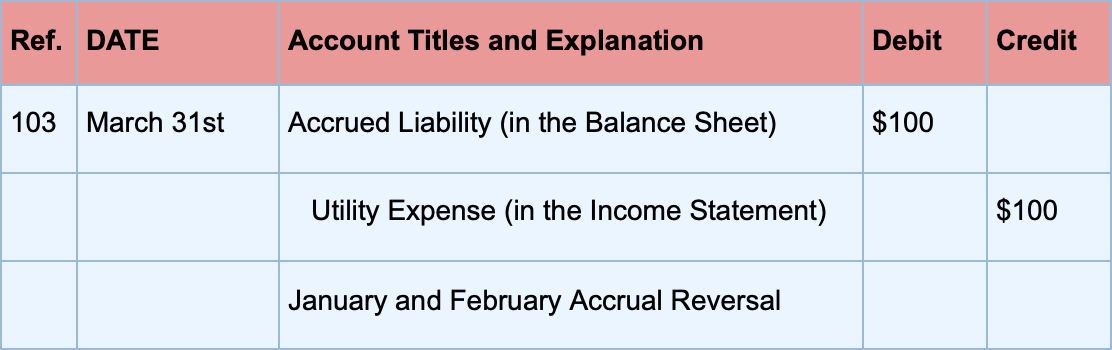

First, we reverse the accrued expenses previously recorded, since they were just estimates of the bill and didn’t represent the exact amount owed.

January and February accrued expense amounts to $100, so we make the following entry to release it:

Then, to record the $160 bill we make a second journal entry:

Want to learn more about how to record transactions for double-entry bookkeeping? Head over to our accounting guide on double-entry bookkeeping for small businesses.

Automate Accrued Expenses with Accounting Software

Don’t want to go through the hassle of dealing with debit and credit entries, and manually recording your accrued expenses?

Use cloud-based accounting software like Deskera to streamline your entire expenses.

Using the Deskera Buy dashboard, you can request orders and send payments in a matter of seconds, as well as get an overview of all of your bill details: due date, amount owed, invoice number.

All on one platform!

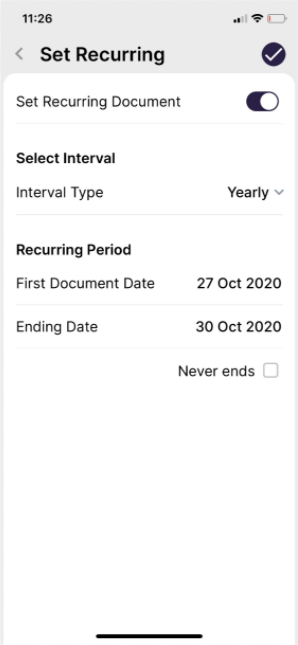

Don’t want to manually pay for regular and recurring invoice payments? No problem!

Automate your accounts payable with a recurring bill feature you can set up and switch on with just one click, by using the Deskera billing software.

And if you work with international, overseas suppliers Deskera allows you to create and pay bills in more than 120 currencies online.

Don’t worry about exchange rates, either - they’re updated in real-time.

The best part: Deskera is accessible anytime, anywhere! All you have to do is download the Deskera mobile app.

So, what are you waiting for?

Sign up for our completely free trial, no credit card details required.

Accrued Expense FAQ

#1. Is An Accrued Expense a Debit or Credit?

Accrued Expenses are a liability account.

To record an accrued expense you have to:

- Debit an expense account

- Credit accrued expenses (or accrued liabilities)

#2. Where Are Accrued Expenses in the Balance Sheet?

Accrued expenses are accounted for under “Current Liabilities” along with accounts payable.

Keep in mind that once the invoice for an accrued expense arrives, that amount is moved to accounts payable.

#3. What’s the Difference Between Prepaid Expenses and Accrued Expenses?

Prepaid expenses and accrued expenses are opposites.

A prepaid expense refers to payments made in advance, for an expense that hasn’t been incurred yet intended to pay for something not yet received. Prepaid expenses are recorded as assets on the balance sheet.

Whereas accrued expenses represent accumulated expenses that haven’t been paid yet and are recorded as liabilities on the balance sheet.

Key Takeaways

And that’s a wrap! We hope you found our guide to accrued expenses helpful.

To recap, here are some of the main points we’ve covered:

- An accrued expense is a liability account that recognizes past expenses not billed or paid yet.

- Accrued expenses don’t represent the exact amount due in the future, but only a close estimate.

- You can only record accrued expenses when using the accrual basis of accounting. With the cash basis, expenses are recorded only when there’s a cash exchange, rather than when they get made.

- The main difference between accounts payable and accrued expenses is that AP represents the exact amount owed to creditors after the invoice arrives. While accrued expenses purely serve as an estimate, and are recorded before the bill.

- Accrued expenses are important for three main reasons:

- Compliant with Generally Accepted Accounting Principles, and mandatory to use for public companies

- Provide a full and accurate picture of the financial health of the business

- Stakeholders such as investors and creditors appreciate and prefer the transparency

- The most common accrued expenses include interest, payroll, utilities, employee benefits, and unbilled goods and services.

- To make a journal entry for an accrued expense you have to debit an expense account, and credit the accrued liability. Then after payment gets made, the accrued expense is converted into the accounts payable account.

Related Articles