A budget is indeed important for businesses, especially for those that wish to lower their expenses and boost their profits. Budgeting in this manner promotes high accuracy. As a result, you gain a better understanding of financial operations and evaluate every department in terms of cash flows.

Therefore, Zero-Based budgeting is an effective strategy that helps you allocate your resources more efficiently. It is also interesting to note that zero-based budgeting helps employees communicate more often, which in turn, works towards generating better productivity for the organization.

Introduced by a former account manager in Texas, Peter Pyhrr, Zero-based budgeting has been in use since the 1960s. Although the method is considered to be laborious and uphill, the myriad benefits it offers cannot be overlooked.

We shall learn about the details related to Zero-based budgeting in this article along with the following points:

- What is Zero-Based budgeting?

- Steps involved in the process of Zero-based budgeting

- Examples, Advantages & Disadvantages

- Zero-Based Vs. Traditional Budgeting

- How Can Zero-based Budgeting Help Small Businesses?

What is Zero-Based Budgeting?

In management accounting, when a budget is prepared from scratch with its base as zero, it is called Zero-Based Budgeting. The process involves reassessing all the line items in the cash flow statement, followed by justifying the expenses that would be incurred by the company or a particular department of the company.

In other words, Zero-Based budgeting could be termed as a method of budgeting in which the expenses will be calculated based on the actual expenses that will be incurred for the new period. The process will not occur on a differential basis where the incurred expenses are changed based on the change in the operational activity. Simply put, the method justifies each activity along with its cost and explains the revenue it will create for the enterprise.

Understanding Zero-Based Budgeting

ZBB is instrumental in aligning the company’s most important strategic goals with the budgeting process. It does so by grouping the costs and then calculating them against the previous performance and current expectations.

This process could take several years where some of the operational activities will be reviewed sequentially by the managers. ZBB shows its efficiency in reducing the costs as it helps avoid blanket increases/decreases to the budget in the previous period. As a result of this, the ZBB process takes up a lot of time and effort and is, therefore, considered tedious when compared to other methods such as Traditional budgeting.

ZBB favors and provides great results for areas in a company that depicts direct revenues because their contributions can be justified visibly.

Zero-Based Budgeting Steps

ZBB involves the following steps:

Initiation

- Here, you begin from scratch, at zero, without taking into account the previous year’s baseline.

Identifying the Decision Units

This is the most important step where you will be shortlisting and identifying the areas for carrying out zero-based budgeting. A company comprises multiple departments and units that take care of diverse operations. For example, Marketing department, Human Resource department, Research & Development department, Production department and so on. These are cost centers and act as decision units.

These areas or units could be a single activity or a group of activities that will be independent of each other and will be identified meaningfully. These activities do not overlap with each other and will, therefore, be separate from each other.

Now, the manager of each of these units will provide details and justifications for their individual expenses and the required budget for their unit. However, these justifications should be independent of the prior period’s/year’s budget or expenditures. As goes the rule of Zero-based budgeting, the justifications for the budget requirement for the fresh period should also be fresh, I.e. starting from zero.

Making Decision Packages

This step involves breaking down the units identified in the previous step into further smaller segments or decision packages. Each of these smaller units will now appeal for an allocation of funds based on the goals they set for the upcoming period. The goals are based on the ultimate objectives of the company. These decision units must define and provide the details including functions, activities, the need of their proposal, the impact if the funds are not allocated.

Here’s a list of factors that a formal package must consist of:

- Description of the task

- Objectives of the broader decision unit

- Objectives of the decision unit

- Evaluate the need for the task

- Assess the technical and functional viability of the task

- Analysis of an alternate method to achieve similar goals

Ranking Decision Packages

This process involves the ranking of the different decision units in order of priority and urgency. The idea is to eliminate the chances of a flawed allocation of resources. Prioritizing the decision packages reduces the occurrence of the scarcity of funds. Cost-benefit analysis is the foundation on which the ranking of these decision units is done.

While this is done, the alternative course of action is also considered. There could be other methods that could be more cost-effective. The higher management reserves the right to approve or reject the proposal made by a decision unit. Management selects the decision units that offer to achieve the goals predetermined by the company along with being cost-efficient. This helps the organization to reach a precise and pragmatic decision.

Allocating Available Resources

This is the step where the funding decisions are made and where the funds are allocated to the decision units that were identified in the previous step. Consequently, the best funding goes to the most innovative and convincing decision packages.

Controlling and Monitoring

In the final step of zero-based budgeting, all the decision packages are assessed based on the performance and results they created. By doing so, the management attains clarity if the allocation of funds was accurately carried out.

Example of Zero-Based Budgeting

To understand the concept of Zero-based budgeting more accurately, we can consider the example of a book store that sold books through its conventional outlets. However, due to some turn of events, it has now decided to go online and turn the business into an eCommerce store.

It is a fast expanding business in the eCommerce space and is now contemplating the Zero-based model of budgeting due to a complete haul in its processes.

Zero-based budgeting would be apt for such a business that is now entering a completely new phase in terms of its functionality and the overall retail process. This way, it can keep away the expenses and the budgets it created while it operated from a physical outlet.

For this switch in operations, some of the areas/expenses the book company must pay attention to include Staff cost, advertising, and marketing cost, Rent cost.

Savings

Assuming they paid a rent of $2,000 in the 7 outlets they have across the city, the company can now easily save the amount.

Challenges

Being a newbie in the eCommerce arena can have its disadvantages. The primary challenge is the competition. The book company now needs to make an effective advertising strategy that leverages its value in the market.

The new numbers that we get here are completely independent of the previous year’s expenditures.

So, here we observe that the ZBB method starts from zero and takes into account each element for budgeting without considering the previous year’s figures.

Advantages and Disadvantages of Zero-Based Budgeting

Like any other method, the ZBB also has its share of benefits and drawbacks. In this section, we shall learn about the advantages and disadvantages of zero-based budgeting.

Advantages of Zero-based Budgeting

Emphasizes decision making: The ZBB considers the root of the estimated expenses and approaches them by questioning ‘why’ they are essential to the business. The method aims at accomplishing the major objectives of the company by ignoring the previous results and starting afresh with zero.

Oriented towards Cost-benefit estimate: Zero-based budgeting is based on the necessity of the proposed expenditures and the potential benefits the company can achieve from that expenditure. The company requires detailed and comprehensive information to prepare a zero-based budget. This data then enables the management to take beneficial decisions.

Efficient Resource Allocation: With an aim to maximize profitability, the organizations depend on the concepts of zero-based budgeting. The process helps them achieve the objective to fully leverage the company’s lucrativeness and also amplify the financial gains of their shareholders.

Aims at Improving Next Period: As zero-based budgeting eliminates the considerations made for the previous year, each of the departments in the company prepares an expense list for every year. By doing this, they can work on the errors made in the past and make improvements in the current year.

Ends Obsolete Procedures: This is one of the finest advantages of ZBB. It facilitates the identification of the processes that are no longer fruitful and that do not contribute to the welfare of the company. It then goes on to eliminating such procedures going forward, thereby resulting in better costing, pricing, and enhanced growth prospects for the organization.

Responsive to Changes in Organization: Over time, there are new changes and advances made in the technical as well as other elements of an organization. It is important to adapt to these changes for increasing and enhancing functionality. Because of its basic nature which is to start from zero each new period, ZBB enables the companies to keep up with the new changes and embrace them if required.

Disadvantages of Zero-based Budgeting

- Subjective Natured: The ZBB method may not allow the companies to accurately assess whether an expenditure is essential or not. The companies can work on this drawback by carefully analyzing each expense by inviting suggestions from the management consultants and experts.

- Unfavorable for Long-term Objective: The ZBB method can hamper the long-term goals as it considers only the expenses and proposals for the current year without considering the same for the previous years. Also, it will discard the figures generated in the current year when the budgets are prepared for the next year. In other words, it offers preparing a budget independently for each year or period. This does not allow the company to work on its long-term goals.

- Rigid Approach: There are times in a company when a department may not be able to stick to the budget and may need more allocation of funds. However, with ZBB this is not possible and its rigid nature, therefore, acts as a hindrance in the process.

- Managerial Conflicts: ZBB may give rise to managerial conflicts as the process requires lengthy discussions for budgeting. If the staff is not well-qualified for preparing the budget, there might be further issues in the organization. To tackle this problem, the company can include only the staff and team members who are well-learned and are competent enough to take decisions while preparing zero-based budgets.

Zero-Based Vs. Traditional Budgeting

Traditional budgeting is probably one of the most commonly used methods. The table below highlights the differences between traditional and zero-based budgeting.

How Can Zero-based Budgeting Help Small Businesses?

If small businesses are looking to enhance and manage their business effectively then zero-based budgeting could be their way forward. Here are the areas in which it could prove helpful:

Creating the First Budget: If you are a startup, then ZBB helps you with setting up your first budget.

Save Money: ZBB provides an exclusive insight into the areas where allocating funds may not be necessary. This could be instrumental in saving a considerable amount of money.

Helps You Know Where the Money Is Going: ZBB involves writing detailed descriptions and explanations of each expense made by the managers.

How Can Deskera Help With Your Budgeting?

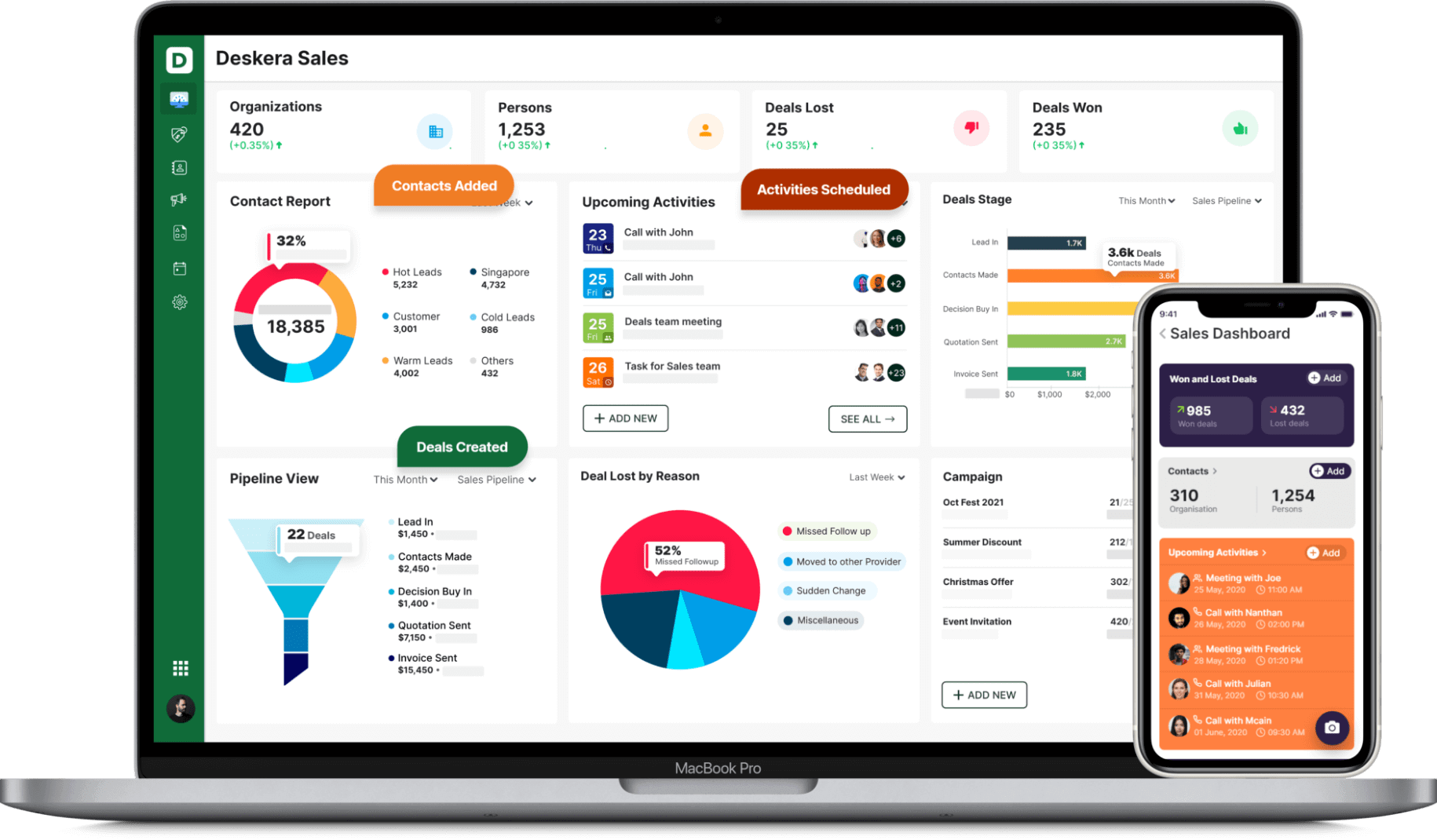

Deskera is the best platform for managing your financials and budgets. Be it invoicing, inventory, CRM, accounting, or HR & payroll, Deskera can help you in every aspect. Deskera’s blogs can help you get a better overview of the business topics such as What is Performance Marketing, What is Content Marketing, and the list. Deskera Books can help you get a clear understanding of online invoicing, accounting & inventory that can help to grow your business.

With the help of Deskera’s blogs, you can easily get a better understanding of various business topics such as How to Budget for Better Business Planning, Guide to Affiliate Marketing, and the list goes on. Deskera Books can help you become aware of online invoicing, accounting & inventory that can be quite beneficial for your business.

Deskera is a cloud system that brings automation and therefore eases business functioning. It reduces the admin time while also increasing efficiency. Deskera Books can be especially useful in improving cash flow and budgeting for your business.

One of its usability lies in creating invoices on behalf of your business that can be sent out immediately. Through Deskera books, a payment link can also be attached with your invoice. This payment link will have many options available like Stripe, VIM, PayPal, and more constantly added to the Deskera platform.

Not only this, but you can also set reminders with the invoices that are not being paid out with the help of Deskera Books. In certain cases, with recurring invoices, Deskera Books can become very handy especially with a payment link added to the invoice.

Deskera works on a cloud-based business model to simplify business functioning. It reduces the admin time while also increasing efficiency. Deskera Books can be a blessing in disguise if you want to improve your cash flow and budgeting for your business.

Through Deskera Books, reminders can be set with the invoices that are not being paid out, which are then sent out to the customers. Deskera Books will become very handy even in recurring invoices, especially with a payment link added to the invoice.

All in all, the follow-up system for all the invoices can be passed on to the system of Deskera Books, and it will look into it for you. You can have access to Deskera's ready-made Profit and Loss Statement, Balance Sheet, and other financial reports in an instant. Such cloud systems substantially improve cash flow for your business directly as well as indirectly.

Deskera can also help with your inventory management, customer relationship management, HR, attendance, and payroll management software. Deskera can help you generate payroll and payslips in minutes with Deskera People. Your employees can view their payslips, apply for time off, and file their claims and expenses online.

Deskera is all you need, isn't it?

Key Takeaways

Before we conclude the post, let’s revisit some of the important points from the article:

- Zero-based budgeting is a cost control technique.

- In order to implement zero-based budgeting properly and wisely, it is important to follow the steps properly and wisely. The allocation of the funds must be explained carefully.

- A detailed description of this must be provided so that the entire organization knows how the funds will be used.

- Despite the fact that zero-based budgeting is time-consuming, it is the most systematic way to allocate funds to a company.

Related Links