Have you ever wondered why some businesses struggle with cash flow despite generating strong sales? The answer often lies in ineffective working capital management. Businesses need sufficient working capital to cover daily expenses, manage short-term debts, and sustain operations. Without it, even a profitable company can face liquidity issues and financial strain.

Working capital management is the process of optimizing a company’s short-term assets and liabilities to ensure smooth operations. It involves monitoring cash flow, managing receivables and payables, and maintaining the right inventory levels. A well-managed working capital cycle enables businesses to meet their financial obligations, invest in growth, and respond effectively to market fluctuations.

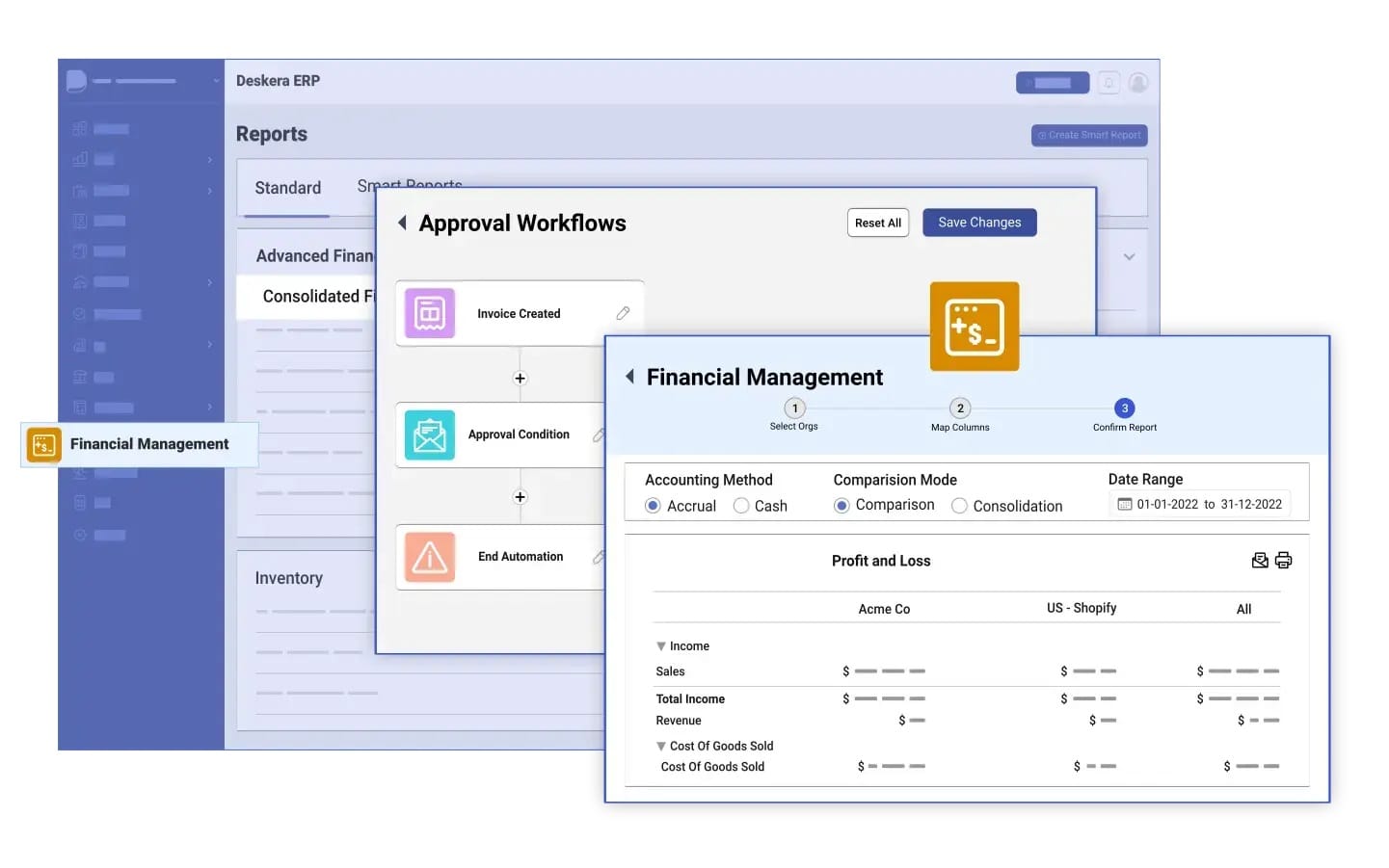

For modern businesses, leveraging ERP solutions like Deskera ERP can significantly enhance working capital management. Deskera ERP helps businesses automate financial processes, track real-time cash flow, and optimize inventory management. With built-in analytics and AI-driven insights, it enables decision-makers to improve financial stability and reduce operational inefficiencies.

In this article, we’ll explore the fundamentals of working capital management, its key components, strategies to optimize it, and the challenges businesses face in maintaining a healthy cash flow. Whether you're a small business owner or a finance professional, understanding working capital management is crucial for long-term success.

What is Working Capital Management?

Working capital management is the process of efficiently managing a company's current assets and current liabilities to ensure smooth day-to-day operations and financial stability. It focuses on maintaining the right balance between cash flow, accounts receivable, accounts payable, and inventory to optimize liquidity and profitability.

The goal of working capital management is to minimize financial risks while maximizing operational efficiency. A well-managed working capital cycle ensures that a business has enough funds to cover short-term expenses, pay suppliers on time, and invest in growth opportunities without relying too heavily on external financing.

Key components of working capital management include:

- Cash management – Ensuring enough liquidity for daily operations.

- Receivables management – Accelerating customer payments while maintaining good relationships.

- Payables management – Negotiating favorable payment terms with suppliers.

- Inventory management – Keeping optimal stock levels to avoid shortages or excess storage costs.

Effective working capital management helps businesses improve cash flow, reduce financial stress, and enhance profitability, making it a crucial aspect of corporate financial planning.

Key Objectives of Working Capital Management

Effective working capital management is essential for maintaining financial stability, ensuring smooth business operations, and driving growth. The primary objectives of working capital management include:

1. Ensuring Liquidity to Meet Obligations

- Maintain sufficient cash flow to cover short-term liabilities.

- Collect receivables promptly and optimize supplier payment terms.

- Prepare for unexpected expenses by maintaining an adequate cash buffer.

2. Supporting Business Growth and Expansion

- Utilize available working capital for strategic investments such as R&D and market expansion.

- Avoid excessive inventory or overdue receivables that can hinder profitability.

- Balance liquidity with growth initiatives to ensure long-term sustainability.

3. Optimizing Capital Utilization

- Improve cash conversion cycles by reducing receivables collection time and optimizing inventory turnover.

- Reduce reliance on external financing by freeing up tied-up capital.

- Ensure that surplus funds are invested wisely to generate higher returns.

4. Enhancing Financial Efficiency and Profitability

- Minimize financing costs by improving cash flow efficiency.

- Reduce operational inefficiencies, such as excessive stock levels or delayed collections.

- Strengthen financial discipline through automated tracking and forecasting tools like Deskera ERP.

5. Maintaining Business Stability and Risk Mitigation

- Protect against financial distress by maintaining an optimal working capital ratio.

- Manage supply chain risks by ensuring timely supplier payments and inventory control.

- Adapt working capital strategies based on market fluctuations and business cycles.

Types of Working Capital Management

Effective working capital management requires businesses to adopt different strategies based on their financial structure, operational needs, and market conditions. Below are the key types of working capital management:

1. Permanent Working Capital Management

- Focuses on maintaining a minimum level of working capital required for uninterrupted business operations.

- Ensures that core expenses like salaries, utilities, and raw materials are consistently covered.

2. Regular Working Capital Management

- A subset of permanent working capital, this focuses on managing the day-to-day operational needs of a business.

- Ensures that short-term assets like cash, receivables, and inventory are efficiently utilized to sustain operations.

3. Reserve Working Capital Management

- Manages the additional capital kept aside for unexpected situations, seasonal fluctuations, or market uncertainties.

- Helps businesses navigate financial emergencies, preventing disruptions in operations.

4. Fluctuating Working Capital Management

- Addresses the variable nature of expenses such as supplier payments, inventory purchases, and production costs.

- Adjusts working capital based on business cycles and changing market demands.

5. Gross Working Capital Management

- Focuses on the total current assets without considering liabilities.

- Aims to maximize the return on short-term assets like cash, accounts receivable, and inventory.

6. Net Working Capital Management

- Manages the difference between current assets and current liabilities, ensuring financial stability.

- A positive net working capital indicates strong liquidity, while a negative net working capital may signal financial risk.

Importance of Working Capital Management

Effective working capital management is a critical aspect of financial planning that ensures a company maintains adequate liquidity to sustain daily operations while maximizing efficiency and profitability. Poor management of working capital can lead to cash shortages, production delays, and even business failure.

Here’s why working capital management is essential:

1. Ensures Business Continuity

Maintaining optimal working capital ensures that a business has sufficient funds to cover operational expenses, employee wages, and supplier payments. Without it, businesses may struggle to keep running, leading to financial distress or even shutdowns.

2. Improves Cash Flow and Liquidity

Proper working capital management helps businesses maintain a steady cash flow, reducing the need for emergency loans or high-interest borrowing. By optimizing the cash conversion cycle, businesses can ensure they always have funds available to meet short-term financial obligations.

3. Reduces Financial Risk

A well-managed working capital position reduces dependence on short-term debt, minimizing financial risks associated with economic downturns, fluctuating interest rates, or unexpected business disruptions. Companies with strong working capital can withstand uncertainties better than those with cash flow challenges.

4. Enhances Profitability and Growth

By efficiently managing receivables, payables, and inventory, businesses can reinvest surplus funds into expansion, innovation, and strategic investments. Additionally, timely payments to suppliers can help businesses secure early payment discounts, boosting overall profitability.

5. Strengthens Supplier and Customer Relationships

A company with stable working capital can pay suppliers on time, fostering stronger relationships and negotiating better terms. Likewise, managing receivables efficiently ensures customers’ trust while reducing delays in payments.

6. Prevents Over- or Under-Investment in Inventory

Poor inventory management can lead to excess stock, increasing storage costs, or shortages that disrupt operations. Effective working capital management helps businesses maintain the right inventory levels, optimizing cash usage and minimizing waste.

7. Increases Creditworthiness and Financial Stability

Lenders and investors assess a company’s working capital position before providing financial support. A business with healthy working capital is more likely to secure loans at favorable interest rates and attract potential investors, strengthening financial stability.

8. Supports Better Decision-Making with Real-Time Insights

With advanced ERP solutions like Deskera ERP, businesses can track real-time cash flow, monitor receivables and payables, and optimize inventory management. These insights enable companies to make informed financial decisions that improve efficiency and profitability.

9. Helps Manage Seasonal Business Cycles

Many businesses experience seasonal fluctuations in demand. Strong working capital management ensures they have enough funds to stock up before peak seasons and sustain operations during slow periods, avoiding cash flow disruptions.

10. Enables Strategic Investment Without Disrupting Operations

Companies with optimized working capital can allocate funds for long-term investments, technology upgrades, or market expansion without compromising their day-to-day financial stability. This allows businesses to grow strategically while maintaining financial discipline.

Key Factors Affecting Working Capital Needs

The amount of working capital a business requires depends on several internal and external factors. Understanding these factors helps companies optimize their financial management and maintain a healthy cash flow.

1. Nature of Business

Different industries have varying working capital requirements. Manufacturing businesses require more working capital due to longer production cycles and high inventory needs, whereas service-based businesses may need less as they don’t require significant stock.

2. Business Size and Scale of Operations

Larger companies with high sales volumes and diverse product lines require more working capital to manage operations effectively. Small businesses, on the other hand, often function with lower working capital but may face liquidity challenges.

3. Production Cycle Length

Businesses with long production cycles—such as automobile manufacturing—require higher working capital to cover expenses before receiving revenue. Shorter production cycles, like those in retail, require less working capital as sales occur more frequently.

4. Seasonal Demand and Market Fluctuations

Businesses that experience seasonal variations—such as holiday retailers or agricultural firms—must adjust their working capital needs accordingly. They may need higher capital before peak seasons to stock inventory and lower capital during off-seasons.

5. Credit Terms with Suppliers and Customers

- Favorable supplier credit terms reduce immediate cash outflows, lowering working capital needs.

- Longer credit periods for customers increase receivables, leading to higher working capital requirements. Balancing these terms is crucial to maintaining liquidity.

6. Inventory Management Efficiency

Poor inventory management leads to excess stock, increasing storage costs and tying up capital. On the other hand, insufficient inventory may cause lost sales. Businesses with optimized inventory control require less working capital and improve cash flow.

7. Level of Competition

In highly competitive industries, businesses may need to offer discounted prices or extended credit terms to attract customers. This increases the need for higher working capital to sustain operations.

8. Inflation and Economic Conditions

During inflation, costs of raw materials, wages, and operational expenses rise, increasing working capital needs. Economic downturns may lead to lower sales and delayed customer payments, requiring better cash flow management.

9. Business Growth and Expansion

Expanding businesses require additional working capital to fund new product lines, increase inventory, hire staff, or enter new markets. Without sufficient working capital, growth plans may be delayed.

10. Use of Technology and Automation

ERP solutions like Deskera ERP help businesses automate financial processes, optimize inventory levels, and improve cash flow visibility, reducing overall working capital requirements. Automation enhances efficiency, minimizes delays, and improves decision-making.

Challenges of Working Capital Management

Managing working capital effectively is essential for maintaining business stability and financial health. However, businesses often face several challenges that can disrupt cash flow and operational efficiency.

Below are the key challenges in working capital management:

1. Cash Flow Uncertainty

Irregular cash inflows and outflows can make it difficult to maintain an optimal working capital balance. Delayed customer payments, unexpected expenses, and market fluctuations can create liquidity issues, making it harder to meet short-term obligations.

2. Inefficient Inventory Management

Excess inventory ties up capital that could be used elsewhere, while insufficient inventory leads to stockouts and lost sales. Striking the right balance between demand and supply is a constant challenge, requiring accurate forecasting and inventory control.

3. Managing Accounts Receivable and Payable

- Late customer payments can increase the risk of bad debts and disrupt cash flow.

- Poor supplier negotiation may lead to unfavorable payment terms, reducing available working capital. Businesses need to optimize credit policies, monitor outstanding invoices, and maintain supplier relationships to manage these issues.

4. Seasonal Demand Fluctuations

Industries with seasonal peaks and off-seasons struggle to maintain stable working capital levels. High demand periods require more investment in stock and labor, while slow periods may lead to excess inventory and lower revenue, making liquidity management challenging.

5. Over-Reliance on Short-Term Debt

Businesses often rely on short-term loans or overdrafts to cover working capital shortages. High borrowing costs and frequent repayment obligations can strain cash flow, increasing financial risk and limiting long-term growth opportunities.

6. Inflation and Rising Costs

Inflation affects raw material costs, wages, and operational expenses, leading to increased working capital requirements. Businesses must adjust pricing strategies and optimize cost management to offset the impact of inflation.

7. Lack of Real-Time Financial Insights

Many businesses still rely on manual tracking or outdated financial systems, leading to errors and delays in decision-making. Implementing ERP solutions like Deskera ERP can help businesses automate financial processes, track real-time cash flow, and optimize working capital management.

8. Economic and Market Uncertainty

External factors such as economic recessions, regulatory changes, and supply chain disruptions can impact business cash flow and working capital needs. Companies need contingency plans and flexible financial strategies to navigate uncertainty effectively.

Key Ratios for Effective Working Capital Management

Working capital management relies on several financial ratios that help businesses assess their ability to manage short-term assets and liabilities efficiently. Below are the most important ratios used to evaluate working capital performance:

1. Working Capital Ratio (Current Ratio)

The working capital ratio (also called the current ratio) measures a company's ability to cover short-term liabilities with its short-term assets. It is calculated as:

Current Ratio = Current Assets / Current Liabilities

- Below 1.0 – Indicates potential liquidity issues, meaning the company may struggle to meet short-term obligations.

- 1.2 to 2.0 – Considered optimal, showing financial stability and a healthy balance of assets and liabilities.

- Above 2.0 – May suggest inefficiency, as excess assets are not being effectively used for growth.

2. Days Sales Outstanding (DSO) or Collection Ratio

The collection ratio (or Days Sales Outstanding - DSO) measures how quickly a company collects receivables after a sale. It is calculated as:

DSO = (Accounts Receivable x Number of Days / Total Credit Sales)

- A low DSO indicates faster cash collection, improving liquidity.

- A high DSO suggests that receivables take too long to be converted into cash, potentially impacting cash flow.

3. Inventory Turnover Ratio

The inventory turnover ratio evaluates how efficiently a company manages its inventory by showing how many times inventory is sold and replaced over a period. It is calculated as:

Inventory Turnover Ratio = Cost of Goods Sold (COGS) / Average Inventory

- A low inventory turnover suggests excess stock, increasing storage costs and risks of obsolescence.

- A high inventory turnover may indicate insufficient stock levels, potentially leading to missed sales opportunities.

4. Accounts Payable Turnover Ratio

The accounts payable turnover ratio assesses how efficiently a company manages its supplier payments. It is calculated as:

Accounts Payable Turnover = Total Supplier Purchases / Average Accounts Payable

- A high ratio means the company is paying suppliers quickly, which may impact cash reserves.

- A low ratio indicates delayed payments, which could improve liquidity but may strain supplier relationships.

5. Cash Conversion Cycle (CCC)

The cash conversion cycle (CCC) measures how long it takes for a company to convert investments in inventory and accounts receivable into cash from sales. It is calculated as:

CCC = DSO + DIO - DPO

Where:

- DSO (Days Sales Outstanding) – Time taken to collect receivables.

- DIO (Days Inventory Outstanding) – Time taken to sell inventory.

- DPO (Days Payable Outstanding) – Time taken to pay suppliers.

A shorter CCC indicates efficient working capital management, while a longer CCC may signal cash flow issues.

Effective Strategies for Optimizing Working Capital Management

Efficient working capital management ensures smooth business operations, improves liquidity, and enhances profitability. Below are the best strategies to optimize working capital:

1. Improve Accounts Receivable Management

- Implement strict credit policies to minimize overdue payments.

- Offer early payment discounts to encourage prompt collections.

- Use automated invoicing and reminders to reduce delays in payments.

- Regularly assess customer creditworthiness to minimize bad debts.

2. Optimize Inventory Management

- Use demand forecasting tools to maintain optimal stock levels.

- Implement Just-in-Time (JIT) inventory to reduce holding costs.

- Regularly review and eliminate slow-moving or obsolete stock.

- Leverage inventory management software like Deskera ERP for real-time tracking.

3. Streamline Accounts Payable

- Negotiate longer payment terms with suppliers to preserve cash flow.

- Take advantage of bulk discounts without straining liquidity.

- Use automated payment systems to avoid late fees and maintain supplier trust.

- Maintain strong supplier relationships for better financing options.

4. Enhance Cash Flow Forecasting

- Regularly update cash flow projections to anticipate shortfalls.

- Identify seasonal trends and adjust working capital needs accordingly.

- Create a buffer fund for unexpected expenses.

5. Reduce Operating Expenses

- Eliminate unnecessary expenses and renegotiate contracts with service providers.

- Outsource non-core functions to reduce fixed costs.

- Improve energy efficiency and resource utilization to lower operational costs.

6. Leverage Technology and Automation

- Implement ERP solutions like Deskera to integrate financials, inventory, and procurement.

- Automate invoice processing and payment approvals for efficiency.

- Use AI-powered analytics to gain insights into working capital trends.

7. Secure Flexible Financing Options

- Utilize business lines of credit for short-term cash flow needs.

- Consider invoice factoring or supply chain financing for liquidity.

- Explore government grants and low-interest loans for working capital support.

Implementing these strategies helps businesses maintain financial stability, improve cash flow, and enhance operational efficiency. By leveraging technology like Deskera ERP, companies can automate processes, gain real-time financial insights, and optimize working capital for sustained growth.

How Deskera ERP Helps in Working Capital Management

Managing working capital efficiently requires real-time financial insights, automated processes, and effective cash flow control. Deskera ERP is a cloud-based solution that streamlines working capital management by optimizing key financial functions. Here’s how it helps:

1. Improved Cash Flow Management

- Deskera provides real-time cash flow tracking, helping businesses monitor inflows and outflows.

- Automates accounts payable and receivable, ensuring timely payments and collections to maintain liquidity.

2. Optimized Inventory Management

- Reduces excess stock and prevents stockouts by enabling demand forecasting and real-time inventory tracking.

- Helps businesses maintain an optimal inventory level, reducing tied-up capital and improving turnover.

3. Faster Invoice Processing & Collections

- Automates invoice generation, reminders, and payment follow-ups, reducing the risk of delayed collections.

- Provides multiple payment integration options, improving cash inflows and reducing DSO (Days Sales Outstanding).

4. Efficient Expense and Budget Control

- Enables businesses to track expenses against budgets, ensuring controlled spending and better financial planning.

- Helps in identifying unnecessary expenditures, contributing to cost savings and improved working capital.

5. Accurate Financial Reporting & Insights

- Generates real-time reports on working capital ratios, liquidity, and cash conversion cycles to make data-driven decisions.

- Provides AI-driven insights into optimizing financial health and reducing reliance on external financing.

Key Takeaways

- Working capital management is the process of optimizing a company’s short-term assets and liabilities to ensure smooth operations and financial stability.

- The main goals include meeting financial obligations, optimizing capital efficiency, and ensuring the company has enough liquidity to sustain and grow its operations.

- Different approaches, such as permanent, fluctuating, reserve, gross, and net working capital management, help businesses maintain the right financial balance.

- Effective working capital management improves liquidity, enhances operational efficiency, and supports business growth by ensuring timely payments and stable cash flow.

- Several factors, such as business size, industry type, seasonal demand, credit terms, and market conditions, influence a company’s working capital requirements.

- Businesses often struggle with delayed receivables, excessive inventory, supplier payment constraints, and unpredictable cash flow, making working capital management complex.

- Key financial metrics like the working capital ratio, collection ratio (DSO), and inventory turnover ratio help assess a company’s efficiency in managing its working capital.

- Businesses can improve working capital by accelerating receivables, optimizing inventory levels, negotiating better supplier terms, and leveraging technology for automation.

- Deskera ERP automates cash flow tracking, invoice processing, inventory control, and financial reporting, helping businesses manage working capital more effectively.

Related Articles