Why is QuickBooks Desktop, a long-standing and popular accounting software, being phased out? If you're a business owner or an accounting professional who has been using QuickBooks Desktop for years, you may have heard rumors or noticed changes in Intuit's strategy that raise questions about the future of this software.

In this article, we will explore the reasons behind the decision to phase out QuickBooks Desktop and discuss the implications for users.

For decades, QuickBooks Desktop has been a reliable and widely-used accounting solution for businesses of all sizes. Its robust features, user-friendly interface, and comprehensive financial management capabilities have made it a go-to choice for many.

However, with the rapid advancement of technology and the increasing demand for cloud-based solutions, Intuit, the company behind QuickBooks, has made the strategic decision to transition its focus to QuickBooks Online, the cloud-based version of the software.

According to a recent report by Gartner, cloud-based accounting software adoption is growing rapidly, with 72% of businesses expected to use cloud accounting solutions by 2022. This statistic highlights the increasing demand for cloud-based software and the overall industry trend toward cloud adoption.

In this article, we will explore the factors behind Intuit's decision to phase out QuickBooks Desktop, the benefits of transitioning to QuickBooks Online, and the potential challenges and considerations for users.

As QuickBooks Desktop users face the reality of its phased-out status, understanding the reasons behind this shift and the opportunities presented by QuickBooks Online is crucial. By embracing the cloud-based solution, businesses can take advantage of modern accounting capabilities, drive operational efficiency, and position themselves for future growth and success.

So, let's dive into the details and explore why QuickBooks Desktop is being phased out and what it means for users like you.

Here is what we shall cover in this post:

- Introduction to Quickbooks Desktop

- Shifting Industry Trends Towards Cloud-Based Accounting Solutions

- Quickbooks Online Vs Desktop

- Transition Considerations for Quickbooks Desktop Users

- System Requirements for Upgrading to a Newer Version of Quickbooks Desktop

- Potential Challenges and How to Mitigate Them During the Transition

- Future Trends: The Evolving Landscape of Cloud Accounting Software

- How Deskera Can Assist You?

- Conclusion

- Key Takeaways

Introduction to Quickbooks Desktop

QuickBooks Desktop is a popular accounting software developed by Intuit. It is designed to help small and medium-sized businesses efficiently manage their financial transactions, including invoicing, expenses, payroll, inventory, and more.

QuickBooks Desktop offers a range of features and tools that simplify financial management and provide accurate insights into the company's financial health.

- With QuickBooks Desktop, users can create and customize invoices, track sales and expenses, manage accounts payable and receivable, generate financial reports, and reconcile bank transactions.

- The software also allows for easy payroll processing, tax calculations, and reporting compliance. QuickBooks Desktop is known for its user-friendly interface, making it accessible to both accounting professionals and non-accounting users.

- QuickBooks Desktop offers several versions tailored to specific industries, such as QuickBooks Pro, QuickBooks Premier, and QuickBooks Enterprise. Each version offers industry-specific features and functionalities to meet the unique needs of businesses in various sectors.

- One of the key advantages of QuickBooks Desktop is its robust desktop-based functionality. Users can store their financial data directly on their computers, ensuring data security and offline access. QuickBooks Desktop also allows for multi-user collaboration, where multiple users can access and work on the company's financial data simultaneously.

- In addition, QuickBooks Desktop integrates with a wide range of third-party applications, enabling users to extend the functionality of the software and integrate it with other business systems. This integration capability allows for seamless data transfer between different software platforms, enhancing workflow efficiency and reducing manual data entry.

- QuickBooks Desktop also provides excellent reporting and analysis capabilities, allowing users to generate financial statements, profit and loss reports, cash flow statements, and more. These reports provide valuable insights into the financial performance of the business, helping business owners make informed decisions and plan for the future.

Overall, QuickBooks Desktop is a comprehensive accounting solution that offers powerful features, industry-specific versions, and seamless integration capabilities. It is a reliable tool for businesses to streamline their financial management processes, improve accuracy, and gain better control over their finances.

Benefits of Quickbooks Desktop for Small Businesses

QuickBooks Desktop offers several benefits for small businesses. Here are some key advantages:

Robust Financial Management: QuickBooks Desktop provides comprehensive financial management tools, including invoicing, expense tracking, accounts payable and receivable management, and bank reconciliation. It allows small businesses to easily handle their day-to-day financial activities, ensuring accuracy and efficiency.

Customizable and Scalable: QuickBooks Desktop offers customizable features that can be tailored to meet the specific needs of a small business. It allows for easy customization of invoices, reports, and forms to reflect the business's branding.

Additionally, as the business grows, QuickBooks Desktop can accommodate increased data volume and handle more complex accounting requirements.

Offline Access and Data Security: Unlike cloud-based solutions, QuickBooks Desktop is installed directly on the user's computer, providing offline access to financial data. This ensures that small businesses can access and manage their financial information even without an internet connection.

Additionally, since the data is stored locally, business owners have control over data security and can implement their own backup and security measures.

Industry-Specific Versions: QuickBooks Desktop offers industry-specific versions such as QuickBooks Pro, QuickBooks Premier, and QuickBooks Enterprise, which are tailored to the unique needs of different industries.

These versions provide industry-specific features, reports, and workflows, enabling small businesses to manage their finances in a way that aligns with their industry requirements.

Advanced Reporting and Analysis: QuickBooks Desktop offers robust reporting and analysis capabilities, allowing small businesses to generate financial reports, track key performance indicators, and gain valuable insights into their financial health.

With customizable reports and advanced analytics, businesses can make data-driven decisions and identify areas for improvement.

Integration with Third-Party Applications: QuickBooks Desktop integrates with a wide range of third-party applications, allowing small businesses to extend the functionality of the software and streamline their operations.

Integration with CRM systems, payment processors, and inventory management tools helps businesses automate processes, reduce manual data entry, and improve efficiency.

Compliance and Tax Management: QuickBooks Desktop simplifies tax management by providing tools for tax calculations, tax form generation, and tax payment tracking. It also helps businesses stay compliant with accounting standards and regulations, reducing the risk of errors and penalties.

Dedicated Support and Community: QuickBooks Desktop offers dedicated customer support, including phone and chat support, as well as online resources and a community forum where users can ask questions and share knowledge.

This support system ensures that small businesses can get the help they need to effectively use the software and resolve any issues.

Overall, QuickBooks Desktop provides small businesses with a powerful and customizable accounting solution that helps streamline financial management, enhance data security, and improve decision-making.

Its offline access, industry-specific versions, advanced reporting, and integration capabilities make it a valuable tool for small business owners.

Shifting Industry Trends Towards Cloud-Based Accounting Solutions

The accounting industry has witnessed a significant shift towards cloud-based accounting solutions in recent years. This transition is driven by various factors and has brought several benefits to businesses.

Let's explore some of the key industry trends that have contributed to the rise of cloud-based accounting solutions:

Accessibility and Convenience: Cloud-based accounting solutions offer anytime, anywhere access to financial data. With a stable internet connection, users can access their accounting software from various devices, including laptops, tablets, and smartphones.

This accessibility allows for greater flexibility in managing finances and enables remote collaboration among team members and accountants.

Cost-Effectiveness: Cloud-based accounting solutions often operate on a subscription-based model, eliminating the need for upfront hardware and software investments. This pay-as-you-go approach makes it more affordable for businesses, especially small and medium-sized enterprises (SMEs), to access sophisticated accounting features without significant upfront costs.

Additionally, cloud-based solutions typically handle software updates and maintenance, reducing IT-related expenses for businesses.

Scalability and Flexibility: Cloud-based accounting solutions offer scalability, allowing businesses to easily adjust their accounting software based on their changing needs.

As businesses grow or experience fluctuations in demand, they can easily upgrade or downgrade their subscription plans to accommodate the changing requirements. This scalability provides businesses with the flexibility to align their accounting software with their growth strategies.

Real-Time Data and Collaboration: Cloud-based accounting solutions offer real-time data synchronization, ensuring that all users have access to the most up-to-date financial information. This real-time data enables businesses to make informed decisions based on accurate and timely information.

Moreover, cloud-based solutions facilitate collaboration among team members and accountants, allowing multiple stakeholders to access and work on financial data simultaneously, improving efficiency and collaboration.

Automation and Artificial Intelligence: Cloud-based accounting solutions leverage automation and artificial intelligence (AI) technologies to streamline repetitive accounting tasks. Automated processes such as bank reconciliation, invoice generation, and expense categorization save time and reduce the risk of manual errors.

AI-powered features, such as automated expense tracking and intelligent data analysis, provide valuable insights and help businesses make data-driven decisions.

These industry trends demonstrate the growing preference for cloud-based accounting solutions among businesses of all sizes. The shift towards cloud-based solutions offers businesses enhanced accessibility, cost-effectiveness, scalability, integration capabilities, real-time data, data security, and automation.

As technology continues to evolve, cloud-based accounting solutions are likely to become even more advanced, empowering businesses with efficient and effective financial management tools.

Quickbooks Online Vs Desktop

When considering QuickBooks Online (QBO) vs. QuickBooks Desktop, it's essential to understand the differences and choose the option that best suits your business needs. Here's a comparison of QuickBooks Online and QuickBooks Desktop across various aspects:

- Accessibility: QuickBooks Online is cloud-based, allowing you to access your financial data from any device with an internet connection. QuickBooks Desktop, on the other hand, is installed on a specific computer and can only be accessed from that device.

- Updates and Upgrades: With QuickBooks Online, updates and upgrades are automatic, ensuring you always have the latest version of the software. QuickBooks Desktop requires manual updates, and you may need to purchase new versions as they are released.

- Cost: QuickBooks Online operates on a subscription-based pricing model, with different plans available based on your business needs. QuickBooks Desktop is a one-time purchase, but you may need to upgrade to newer versions periodically, which incurs additional costs.

- Features and Functionality: QuickBooks Desktop offers a comprehensive set of features, including advanced inventory management, job costing, and industry-specific versions. QuickBooks Online has a wide range of features, but some advanced functionalities available in QuickBooks Desktop may be limited.

- Integration and Add-ons: QuickBooks Online integrates with various third-party applications and has a vast marketplace of add-ons. QuickBooks Desktop also supports integrations but may have fewer options compared to QuickBooks Online.

- User Interface: QuickBooks Online has a modern and user-friendly interface accessible through a web browser or mobile app. QuickBooks Desktop has a more traditional desktop interface that some users may prefer.

- Multi-User Access: QuickBooks Online allows multiple users to access the software simultaneously, each with their login credentials. QuickBooks Desktop has different licensing options to enable multi-user access but may have limitations based on the edition and number of licenses purchased.

- Data Storage and Backup: QuickBooks Online stores data in the cloud, ensuring automatic backups and reducing the risk of data loss. QuickBooks Desktop data is stored locally, and users are responsible for manual backups to prevent data loss.

- Industry-Specific Features: QuickBooks Desktop offers industry-specific versions tailored to specific business types, such as contractors, nonprofits, and manufacturing. QuickBooks Online provides a more general solution but offers some industry-specific features.

It's important to consider your business requirements, preferences, and budget when choosing between QuickBooks Online and QuickBooks Desktop.

While QuickBooks Online provides the advantages of cloud accessibility, automatic updates, and scalability, QuickBooks Desktop offers robust features, customization options, and offline access. Assess your needs carefully to determine which version is the best fit for your business.

Service Tiers and Pricing

QuickBooks offers both a desktop version and an online version, each with different service tiers and pricing structures. Here's an overview of the service tiers and pricing for QuickBooks Desktop and QuickBooks Online:

QuickBooks Desktop:

- Pro: This tier is designed for small businesses and offers essential accounting features such as income and expense tracking, invoicing, and financial reporting. The pricing for QuickBooks Desktop Pro starts at a one-time purchase cost.

- Premier: The Premier tier builds upon the features of QuickBooks Pro and adds industry-specific functionality for businesses in manufacturing, construction, nonprofit organizations, and more. The pricing for QuickBooks Desktop Premier is also based on a one-time purchase cost.

- Enterprise: QuickBooks Desktop Enterprise is the most advanced version, suitable for larger businesses or those with more complex accounting needs. It offers advanced inventory management, advanced reporting, and other powerful features. The pricing for QuickBooks Desktop Enterprise is based on an annual subscription model and varies depending on the number of users and additional features required.

QuickBooks Online:

- Simple Start: This is the basic tier of QuickBooks Online and is suitable for self-employed individuals or small businesses with simple accounting needs. It offers features like income and expense tracking, invoicing, and basic reporting. The pricing for QuickBooks Online Simple Start is based on a monthly subscription cost.

- Essentials: The Essentials tier includes all the features of Simple Start and adds additional functionality such as bill management and time tracking. It is designed for small businesses with more complex accounting requirements. The pricing for QuickBooks Online Essentials is based on a monthly subscription cost.

- Plus: QuickBooks Online Plus is the most comprehensive tier and offers advanced features like inventory tracking, project management, and budgeting. It is suitable for growing businesses or those with more advanced accounting needs. The pricing for QuickBooks Online Plus is based on a monthly subscription cost.

It's important to note that pricing may vary depending on promotions, discounts, and additional services or add-ons that you may choose to include. It's always recommended to visit the official QuickBooks website or contact Intuit directly for the most up-to-date pricing information and to explore any available discounts or offers.

Quickbooks Online: The Future of Intuit’s Accounting Software

QuickBooks Online (QBO) offers a wide range of features to help small businesses manage their finances effectively. Here are some key features of QuickBooks Online:

- Financial Management: QBO allows you to track income and expenses, create and send invoices, manage accounts payable and receivable, and reconcile bank transactions. You can easily generate financial reports like profit and loss statements, balance sheets, and cash flow statements.

- Bank and Credit Card Integration: QBO integrates with your bank and credit card accounts, enabling automatic syncing of transactions and easy categorization. This helps streamline the process of reconciling accounts and ensures accurate financial data.

- Online Invoicing and Payments: You can create professional invoices and send them to your customers directly from QBO. Customers can make online payments, and you can track payment status in real time. This feature improves cash flow and reduces the time and effort spent on manual payment collection.

- Expense Tracking: QBO allows you to track and categorize business expenses, making it easier to monitor spending and identify areas for cost-saving. You can also capture and store receipts electronically using the mobile app.

- Sales and Sales Tax Tracking: You can track sales and sales tax in QBO, allowing you to stay on top of your revenue and tax obligations. QBO can automatically calculate sales tax based on your settings and generate reports for tax filing purposes.

- Multi-Currency Support: If your business deals with international customers or vendors, QBO offers multi-currency support. You can invoice and receive payments in different currencies, and QBO will automatically convert the amounts based on the prevailing exchange rates.

- Reporting and Analytics: QBO provides a variety of pre-built reports to help you gain insights into your business performance. You can view reports on profit and loss, sales, expenses, cash flow, and more. Customizable reports allow you to tailor the data to your specific needs.

- Integrations and Apps: QBO integrates with various third-party apps, allowing you to extend the functionality of the software. You can integrate with popular tools like payment processors, CRM systems, inventory management software, and more, to streamline your business processes.

- Mobile Accessibility: QBO has a mobile app for iOS and Android devices, enabling you to access your financial data on the go. You can create and send invoices, track expenses, and view important reports from your mobile device.

These are just some of the features offered by QuickBooks Online. The platform is continually evolving, with new features and enhancements being added regularly to meet the needs of small businesses.

Whether you are a freelancer, consultant, or small business owner, QuickBooks Online provides a comprehensive set of tools to manage your financials efficiently.

Transition Considerations for Quickbooks Desktop Users

Transitioning from QuickBooks Desktop to another accounting software or version requires careful consideration and planning. Here are some key factors to consider during the transition:

- Data Migration: One of the critical aspects of transitioning is migrating your data from QuickBooks Desktop to the new software or version. Ensure that your new accounting software supports data migration from QuickBooks Desktop, and follow the recommended migration process to transfer your company data accurately.

- Feature Comparison: Evaluate the features and functionalities offered by QuickBooks Desktop and the new accounting software or version. Determine if the new software meets your business requirements and offers similar or enhanced features that will support your accounting processes.

- Training and Familiarization: Invest in training and familiarization with the new accounting software or version. The user interface, terminology, and workflows may differ from QuickBooks Desktop, so it's crucial to ensure that you and your team are well-trained to effectively utilize the new software.

- Data Compatibility: Check if your existing data, such as customer and vendor information, chart of accounts, and transaction history, can be seamlessly imported into the new software. Ensure that the data formats and structures are compatible to avoid any data loss or inconsistencies during the transition.

- Customizations and Integrations: If you have customized reports, templates, or integrations with other software systems in QuickBooks Desktop, assess if the new software supports similar customizations and integrations. Determine if any modifications or additional setups will be required to maintain your existing workflows.

- File Conversion and Compatibility: Verify if the new accounting software or version supports the file format used by QuickBooks Desktop. This is important if you need to share or collaborate with external accountants, auditors, or business partners who may still be using QuickBooks Desktop.

- Cost Considerations: Evaluate the cost implications of transitioning to the new software or version. Consider factors such as licensing fees, ongoing subscription costs, additional training expenses, and any potential savings or benefits that the new software may offer.

- Support and Maintenance: Assess the support and maintenance options provided by the new software vendor. Consider factors such as customer support availability, software updates and enhancements, and the vendor's reputation for delivering timely support services.

- Implementation Timeline: Develop a transition plan with a clearly defined timeline and milestones. Consider the impact on your day-to-day operations and ensure that you allocate sufficient time and resources for a smooth transition.

- Backup and Data Security: Before the transition, make sure to create a backup of your QuickBooks Desktop data and store it securely. This ensures that you have a reliable backup in case any issues arise during the transition process.

It is recommended to consult with your accounting team, IT professionals, and software vendors to ensure a successful and seamless transition from QuickBooks Desktop to the new accounting software or version.

Taking the time to plan and execute the transition carefully will help minimize disruptions to your business operations and ensure a smooth migration process.

Migration Process and Steps for Moving to Quickbooks Online

Migrating from QuickBooks Desktop to QuickBooks Online is a significant transition that requires careful planning and execution. Here we will outline the step-by-step migration process and provide insights into each stage to ensure a smooth and successful migration.

Step 1: Evaluate Compatibility

Before initiating the migration, it is essential to check the compatibility of your current QuickBooks Desktop version with QuickBooks Online. Some older versions may require an intermediate upgrade to a supported version of QuickBooks Desktop before proceeding with the migration.

Review the system requirements and compatibility guidelines provided by Intuit, the company behind QuickBooks, to ensure a seamless transition.

- Start by reviewing the system requirements specified by Intuit, the company behind QuickBooks Online. Ensure that your computer hardware, operating system, and internet connection meet the minimum requirements for running QuickBooks Online smoothly.

- Determine the version of QuickBooks Desktop that you are currently using. QuickBooks Online is compatible with specific versions of QuickBooks Desktop, so check if your version is supported for migration. You can find this information on the QuickBooks Online website or by contacting Intuit's customer support.

- Compare the features and functionalities of QuickBooks Desktop and QuickBooks Online. Understand the differences and determine if the features you rely on in QuickBooks Desktop are available in QuickBooks Online. QuickBooks Online may have some limitations compared to the desktop version, so ensure that it meets your business requirements.

Step 2: Set Up QuickBooks Online Account

If you don't already have a QuickBooks Online account, you will need to sign up for one. Visit the QuickBooks website and choose the appropriate subscription plan based on your business needs.

Take into consideration factors such as the number of users, advanced features required, and integration capabilities with other software applications.

Step 3: Back Up Your Data

Before migrating, it is crucial to create a backup of your QuickBooks Desktop data. This backup will serve as a safety net in case any issues arise during the migration process.

Use the backup feature within QuickBooks Desktop to create a copy of your company file and ensure that it is stored in a secure location.

Step 4: Prepare Your QuickBooks Desktop File

To ensure a smooth migration, it is recommended to perform some cleanup tasks in your QuickBooks Desktop file. This may include reconciling accounts, removing duplicate entries, and ensuring data accuracy. Review your chart of accounts, vendor and customer lists, inventory records, and other data to ensure they are up to date.

Step 5: Export Data from QuickBooks Desktop

Once your data is prepared, you can export it from QuickBooks Desktop. In QuickBooks Desktop, go to the Company menu and select "Export Company File to QuickBooks Online."

Follow the prompts and instructions provided by QuickBooks Desktop to export your data to a QuickBooks Online-compatible file format.

Step 6: Import Data into QuickBooks Online

Log in to your QuickBooks Online account and navigate to the Company Settings menu. From there, select "Import Data" and follow the instructions to upload the file exported from QuickBooks Desktop.

QuickBooks Online will guide you through the process of importing your company data and mapping fields from the exported file to the corresponding fields in QuickBooks Online.

Step 7: Verify Data Accuracy

Once the data is imported, it is crucial to review and verify the accuracy of your migrated information in QuickBooks Online. Compare account balances, transaction history, customer and vendor details, inventory records, and other important data points to ensure that everything is transferred correctly.

Perform reconciliations and run reports to ensure that the financial information in QuickBooks Online matches your expectations.

Step 8: Set Up a Chart of Accounts and Preferences

Customize your chart of accounts and other preferences in QuickBooks Online to align with your business needs. Review and adjust settings related to sales tax, payroll, inventory, and other key areas to ensure that QuickBooks Online is configured to support your business operations.

Step 9: Set Up Bank Feeds and Reconnect Integrations

To ensure seamless financial management, connect your bank accounts and credit cards to QuickBooks Online using the Bank Feeds feature. This allows for the automatic importing of transactions, simplifying bank reconciliation.

Additionally, if you had any integrations with other software applications in QuickBooks Desktop, such as CRM or e-commerce platforms, ensure that you reconnect these integrations in QuickBooks Online.

Step 10: Train Users and Adjust Workflows

Provide training and support to your team members who will be using QuickBooks Online. Familiarize them with the user interface, navigation, and features specific to QuickBooks Online.

Adjust any workflows or processes that may be different from what you were accustomed to in QuickBooks Desktop, ensuring a smooth transition for your team.

Step 11: Run Parallel Systems and Perform Testing

Before fully transitioning to QuickBooks Online, consider running parallel systems where you continue to use QuickBooks Desktop alongside QuickBooks Online for some time. This allows you to test the accuracy of data migration, identify any discrepancies, and ensure that your team is comfortable using QuickBooks Online.

Perform thorough testing of key functionalities, such as invoicing, expense tracking, payroll processing, and reporting, to verify that everything is functioning as expected.

Step 12: Complete the Transition and Close QuickBooks Desktop

Once you are confident that QuickBooks Online is working effectively for your business, you can complete the transition by closing QuickBooks Desktop. Ensure that all necessary data has been successfully migrated and that you have accounted for any outstanding transactions or records in QuickBooks Desktop.

Step 13: Ongoing Support and Maintenance

After the migration is complete, continue to provide support and training to your team members using QuickBooks Online.

Stay updated with new features and enhancements introduced by Intuit and make use of resources such as customer support, online forums, and training materials to optimize your experience with QuickBooks Online.

System Requirements for Upgrading to a Newer Version of Quickbooks Desktop

The system requirements for upgrading to a newer version of QuickBooks Desktop may vary depending on the specific version and release. It's important to refer to Intuit's official website or consult the product documentation for the most up-to-date and accurate information.

However, here are some general guidelines for system requirements when upgrading to a newer version of QuickBooks Desktop:

- Operating System: QuickBooks Desktop is compatible with Windows 10, Windows 8.1, Windows 7 SP1 (32-bit and 64-bit), and Windows Server 2019, 2016, 2012 R2, or 2008 R2 (SP1 or later). For macOS users, QuickBooks Desktop for Mac is compatible with the latest versions of macOS.

- Processor: The recommended processor speed for QuickBooks Desktop is 2.4 GHz or higher.

- RAM: The minimum RAM requirement is 4 GB, but it is recommended to have 8 GB or more for better performance.

- Disk Space: QuickBooks Desktop requires at least 2.5 GB of disk space for installation. Additional space may be required for company files and data storage.

- Display: QuickBooks Desktop requires a screen resolution of at least 1280x1024, with a minimum of 4x DVD-ROM drive for CD installations.

- Internet Connection: QuickBooks Desktop requires an internet connection for certain features such as online banking, payroll processing, and software updates.

It's important to note that system requirements may vary for different versions and releases of QuickBooks Desktop. It's always recommended to check the specific system requirements provided by Intuit for the version you are planning to upgrade to.

This will ensure that your computer meets the necessary specifications to run the software smoothly and efficiently.

Training and Support Resources for the Transition

Transitioning to QuickBooks Online can be made easier with the help of training and support resources provided by Intuit, the company behind QuickBooks. Here are some resources you can utilize:

- QuickBooks Online Help Center: Intuit offers a comprehensive Help Center specifically for QuickBooks Online. It includes articles, guides, videos, and step-by-step instructions on various topics related to setting up and using QuickBooks Online.

- Video Tutorials: Intuit provides a library of video tutorials that cover different aspects of using QuickBooks Online. These videos offer visual demonstrations and explanations to help you navigate the software efficiently. You can find the video tutorials on the QuickBooks YouTube channel or within the QuickBooks Online Help Center.

- Webinars and Training Events: Intuit regularly hosts webinars and training events focused on QuickBooks Online. These sessions provide in-depth training on specific features, workflows, and best practices. You can check the QuickBooks website or sign up for email updates to stay informed about upcoming webinars and training opportunities.

- Community Forums: QuickBooks Online users can participate in community forums where they can ask questions, share experiences, and learn from other users. The QuickBooks Community provides a platform for connecting with fellow QuickBooks users and experts who can provide guidance and support.

- Live Chat and Phone Support: If you need immediate assistance, you can reach out to QuickBooks Online support via live chat or phone. Intuit's support team is available to answer your questions, troubleshoot issues, and provide guidance during the transition process. You can find the contact information for support on the QuickBooks website.

- QuickBooks ProAdvisors: QuickBooks ProAdvisors are certified professionals who specialize in QuickBooks and can provide expert guidance and support. They can assist with the transition to QuickBooks Online, offer personalized training sessions, and help optimize your use of the software for your specific business needs. You can find a QuickBooks ProAdvisor through the QuickBooks website.

- Online Learning Resources: Intuit offers a variety of online learning resources, including self-paced courses, interactive tutorials, and certification programs. These resources allow you to deepen your knowledge of QuickBooks Online at your own pace and become more proficient in using the software effectively.

By utilizing these training and support resources, you can enhance your understanding of QuickBooks Online and ensure a smoother transition from your previous accounting system. Take advantage of the available resources to maximize the benefits of QuickBooks Online for your business.

Potential Challenges and How to Mitigate Them During the Transition

While transitioning to QuickBooks Online can bring numerous benefits, it's essential to be prepared for potential challenges that may arise. Here are some common challenges and strategies to mitigate them during the transition:

Data Migration: The process of transferring data from your previous accounting system to QuickBooks Online can be complex. To mitigate this challenge, ensure that you have a comprehensive understanding of your data structure and formatting requirements.

Double-check data accuracy before importing, and consider seeking assistance from QuickBooks ProAdvisors or consultants with expertise in data migration.

Training and Familiarization: Adjusting to a new accounting software can be overwhelming for users, especially if they are accustomed to a different system. Mitigate this challenge by providing comprehensive training and support to your team.

Offer hands-on training sessions, encourage employees to explore QuickBooks Online's features, and provide access to training resources, such as tutorials and documentation.

Workflow Adaptation: QuickBooks Online may have different workflows and terminology compared to your previous accounting system. This can require employees to adjust their processes and adapt to new ways of performing tasks.

To mitigate this challenge, conduct a thorough analysis of your existing workflows and determine how they can be aligned with QuickBooks Online. Communicate the changes to your team and provide ongoing support during the transition.

System Integration: Integrating QuickBooks Online with other business systems, such as CRM or inventory management software, can be challenging. Ensure that you evaluate the compatibility of your existing systems with QuickBooks Online and explore available integration options.

Seek guidance from QuickBooks ProAdvisors or consultants to identify the best integration solutions for your specific needs.

Security and Data Privacy: Moving your financial data to the cloud introduces security and data privacy concerns. QuickBooks Online employs robust security measures, but it's important to understand and address any potential risks.

Implement strong password policies, enable multi-factor authentication, and regularly update your security settings. Additionally, educate your employees on data security best practices to minimize the risk of unauthorized access.

Customization and Reporting: QuickBooks Online offers a range of customization options and reporting capabilities. However, you may encounter limitations compared to your previous system.

Evaluate your reporting requirements and identify any gaps or limitations in QuickBooks Online. Explore available add-ons or integrations that can enhance reporting capabilities and address specific customization needs.

Continuous Support and Learning: Transitioning to QuickBooks Online is not a one-time event but an ongoing process. It's important to provide continuous support and learning opportunities to your team.

Encourage employees to ask questions, participate in training sessions, and stay updated on new features and enhancements. Leverage QuickBooks' support resources, such as the Help Center, community forums, and ProAdvisors, to address any challenges that arise.

By proactively addressing these potential challenges and implementing mitigation strategies, you can ensure a smoother transition to QuickBooks Online. Remember to allocate sufficient time and resources for the transition process, and seek assistance from experts when needed.

With proper planning and support, you can minimize disruptions and maximize the benefits of QuickBooks Online for your business.

Future Trends: The Evolving Landscape of Cloud Accounting Software

Cloud accounting software has revolutionized the way businesses handle their financial management processes. As technology continues to evolve, the landscape of cloud accounting software is also evolving, offering new possibilities and opportunities for businesses.

Here are some future trends to watch out for:

Artificial Intelligence and Machine Learning: The integration of artificial intelligence (AI) and machine learning (ML) in cloud accounting software is set to transform the way businesses handle financial tasks.

AI-powered algorithms can automate data entry, categorization, and reconciliation, reducing manual effort and improving accuracy. ML algorithms can also analyze financial data and provide insights for better decision-making.

Enhanced Automation: Automation will play a significant role in streamlining accounting processes further. Cloud accounting software will continue to automate repetitive tasks such as invoicing, bill payment, and bank reconciliation.

This automation will save time and improve efficiency, allowing businesses to focus on more strategic financial activities.

Advanced Reporting and Analytics: Cloud accounting software will continue to enhance its reporting and analytics capabilities. Businesses will have access to real-time dashboards and customizable reports that provide valuable insights into financial performance.

Advanced analytics tools will enable businesses to make data-driven decisions and identify trends and patterns in their financial data.

Enhanced Security and Data Privacy: As data security concerns continue to grow, cloud accounting software providers will invest heavily in enhancing security measures. Robust encryption, secure data centers, and multi-factor authentication will become standard features.

Compliance with data protection regulations such as GDPR (General Data Protection Regulation) will be a top priority for cloud accounting software providers.

Blockchain Technology: The integration of blockchain technology in cloud accounting software holds great potential. Blockchain can provide secure and transparent transactions, streamline auditing processes, and enable real-time tracking of financial transactions.

How Deskera Can Assist You?

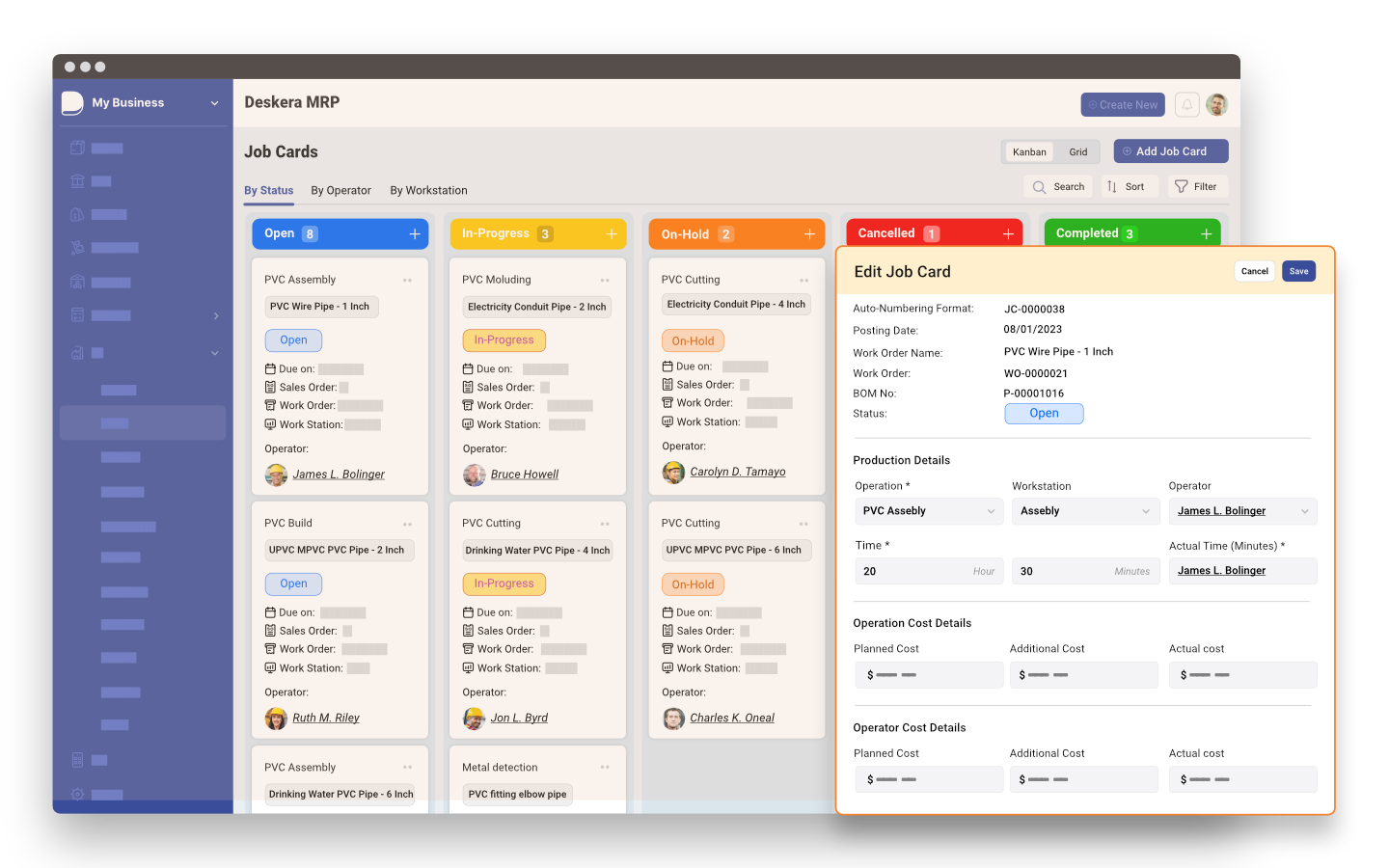

Deskera ERP and MRP system can help you:

- Manage production plans

- Maintain Bill of Materials

- Generate detailed reports

- Create a custom dashboard

Deskera ERP is a comprehensive system that allows you to maintain inventory, manage suppliers, and track supply chain activity in real time, as well as streamline a variety of other corporate operations.

Deskera MRP allows you to closely monitor the manufacturing process. From the bill of materials to the production planning features, the solution helps you stay on top of your game and keep your company's competitive edge.

Deskera Books enables you to manage your accounts and finances more effectively. Maintain sound accounting practices by automating accounting operations such as billing, invoicing, and payment processing.

Deskera CRM is a strong solution that manages your sales and assists you in closing agreements quickly. It not only allows you to do critical duties such as lead generation via email, but it also provides you with a comprehensive view of your sales funnel.

Deskera People is a simple tool for taking control of your human resource management functions. The technology not only speeds up payroll processing but also allows you to manage all other activities such as overtime, benefits, bonuses, training programs, and much more. This is your chance to grow your business, increase earnings, and improve the efficiency of the entire production process.

Conclusion

The phasing out of QuickBooks Desktop can be attributed to several factors that reflect the changing landscape of accounting software and technological advancements. This article has explored the reasons behind this transition and the implications it has for businesses and accounting professionals.

Cloud-based platforms offer numerous advantages, including real-time data accessibility, remote collaboration, and scalability. These benefits align with the evolving needs of businesses and the increasing demand for flexible and mobile accounting solutions.

Traditional desktop software requires manual backups and can be susceptible to data loss or theft. In contrast, cloud-based solutions provide automatic backups, enhanced security measures, and remote access to data from any device with an internet connection.

QuickBooks Desktop has limitations when it comes to automating repetitive tasks and integrating with other business systems. Cloud-based platforms offer seamless integration with a wide range of applications, enabling efficient data flow and streamlining workflows.

QuickBooks Desktop relies on manual data entry and lacks real-time updates, which can hinder efficient collaboration between team members and delay decision-making. Cloud-based platforms facilitate real-time collaboration, provide instant access to updated financial information, and enable seamless communication among stakeholders.

As businesses grow, they require accounting software that can accommodate increasing transaction volumes and expanding operations. Cloud-based solutions offer scalability without the need for extensive hardware upgrades or additional software installations.

Key Takeaways

- Cloud-based platforms offer advantages such as real-time data accessibility, remote collaboration, and scalability.

- Cloud-based accounting software provides automatic backups, enhanced security measures, and remote access to data.

- The cost considerations of QuickBooks Desktop, including upfront purchases and periodic upgrades, are a factor in its phase-out.

- Cloud-based solutions often operate on a subscription model, providing predictable and scalable costs.

- Scalability is a key advantage of cloud-based platforms as they can accommodate increasing transaction volumes and expanding operations.

- Cloud-based accounting software often features intuitive interfaces and user-friendly navigation, making it accessible to users with varying levels of accounting expertise.

- Advanced analytics tools and reporting capabilities in cloud-based software enable businesses to gain insights into financial performance.

- Compliance requirements and enhanced security measures in cloud-based platforms support regulatory standards.

- Automatic updates and ongoing support from software providers are benefits of cloud-based accounting software.

- Challenges of data migration, training, and change management need to be considered when transitioning from QuickBooks Desktop to cloud-based solutions.

Related Articles