The financial landscape is undergoing a massive transformation, driven by the rapid adoption of financial technology, or fintech. From digital banking and mobile payments to blockchain and artificial intelligence, fintech is reshaping how individuals and businesses manage their finances.

With increased accessibility, speed, and efficiency, fintech solutions are eliminating traditional barriers and redefining financial services. Whether it's a small business owner automating accounting tasks or a consumer making instant cross-border payments, fintech is making financial transactions more seamless than ever.

The global fintech market is experiencing exponential growth, with no signs of slowing down. According to industry estimates, the market size is projected to expand at a CAGR of 16.8% between 2024 and 2032, reaching an impressive USD 917.17 billion by 2032.

This rapid expansion is fueled by the increasing demand for digital financial services, growing smartphone penetration, and advancements in technologies such as AI, blockchain, and cloud computing. As fintech continues to evolve, its impact extends beyond convenience—it is fostering financial inclusion, reducing costs, and enhancing security in transactions.

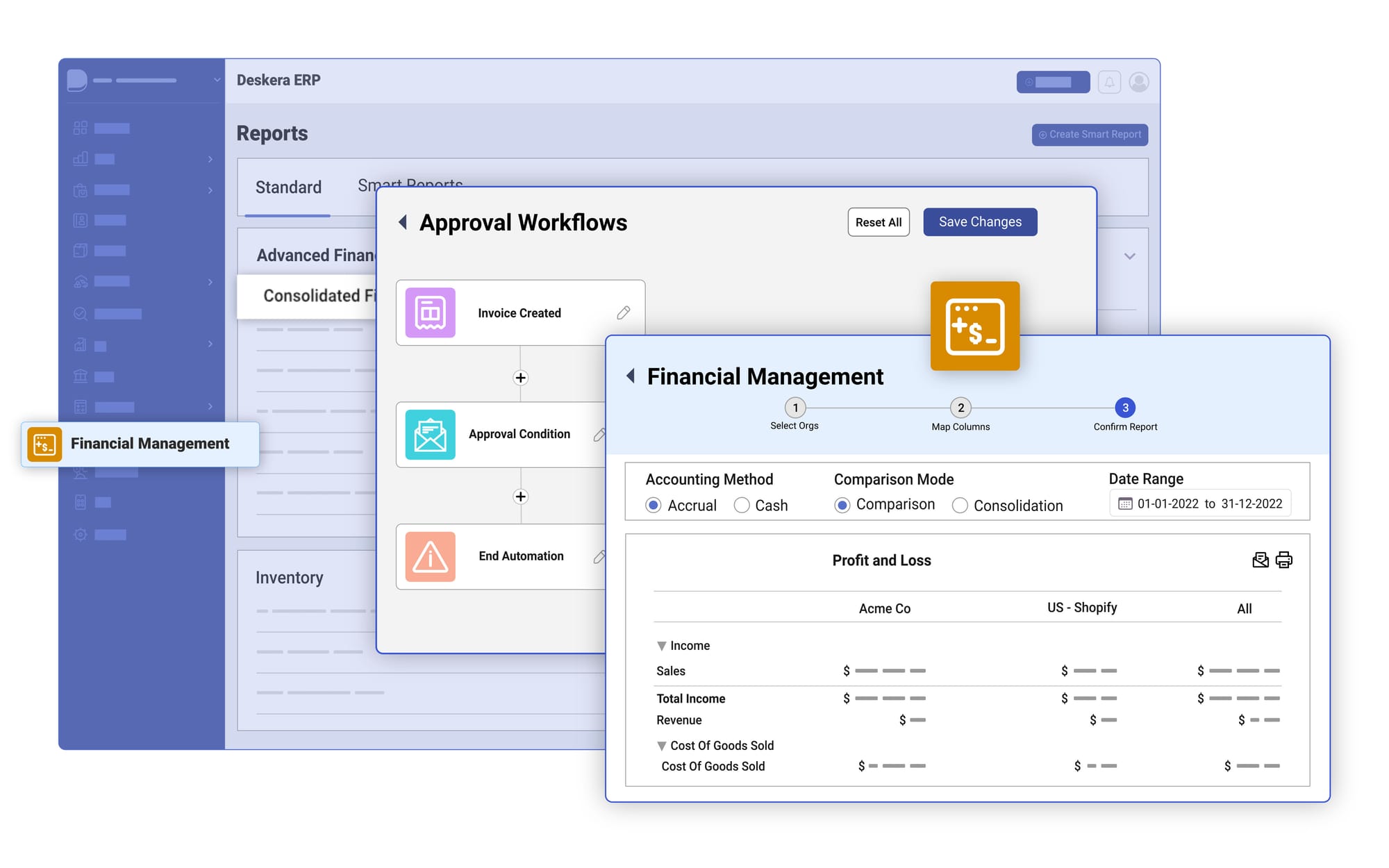

Businesses, particularly in manufacturing, retail, and e-commerce, are increasingly leveraging fintech-powered enterprise solutions to streamline operations. Deskera ERP, for instance, integrates advanced financial management tools with inventory, procurement, and sales automation, enabling businesses to maintain real-time financial visibility.

With AI-driven analytics, mobile accessibility, and seamless integrations, Deskera ERP empowers businesses to make data-driven decisions, optimize cash flow, and stay compliant with financial regulations.

As fintech continues to disrupt the financial industry, understanding its key components, benefits, challenges, and future trends is crucial for individuals and businesses alike.

What is Fintech?

Fintech, short for financial technology, refers to the innovative use of technology to enhance, automate, and streamline financial services. It encompasses a broad spectrum of applications, from digital banking and mobile payments to peer-to-peer lending and blockchain-based transactions.

At its core, fintech aims to make financial processes faster, more accessible, and efficient, reducing the reliance on traditional banking infrastructure. Instead of brick-and-mortar institutions handling all financial transactions, fintech enables consumers and businesses to interact directly, cutting down costs and improving user experience.

The fintech industry has seen exponential growth in recent years, driven by advancements in artificial intelligence (AI), blockchain, cloud computing, and big data analytics. These technologies enable financial institutions and startups to offer smarter, data-driven solutions that improve everything from risk assessment to fraud detection.

For example, AI-powered robo-advisors provide personalized investment strategies, while blockchain ensures secure and transparent digital transactions. As fintech continues to evolve, its applications are expanding into areas like insurance (InsurTech), real estate (PropTech), and regulatory technology (RegTech), further revolutionizing the financial landscape.

One of the key advantages of fintech is its ability to increase financial inclusion. Traditional banking services often exclude underserved populations due to high fees, geographic barriers, or stringent requirements.

Fintech bridges this gap by offering mobile-based financial services, enabling individuals in remote areas to access banking, credit, and payment solutions through their smartphones.

Similarly, small businesses can leverage fintech-powered tools like cloud-based accounting software, instant payment processing, and automated financial management to operate more efficiently and competitively.

As fintech continues to disrupt traditional financial models, businesses and consumers alike must stay informed about emerging trends and best practices. With its potential to reshape global finance, fintech is not just a trend—it’s the future of financial services.

Key Features and Functionality of Fintech

Fintech solutions are built on cutting-edge technologies that enhance the accessibility, security, and efficiency of financial services. From seamless digital transactions to AI-driven financial insights, fintech innovations are transforming how individuals and businesses manage their finances.

Below are the key features and functionalities that define modern fintech solutions:

1. User-Centric Interfaces

Fintech platforms prioritize ease of use with intuitive, mobile-first interfaces that make financial management simple and accessible. These interfaces often include personalized dashboards, real-time financial updates, and seamless navigation. Whether users are checking their bank balances, making payments, or tracking expenses, fintech apps provide a streamlined experience designed for convenience.

2. Automation and AI-Powered Services

Automation is at the core of fintech solutions, enabling faster, smarter, and more efficient financial processes. AI and machine learning power automated financial advisory services, personalized investment strategies, and loan underwriting. Robo-advisors, for instance, provide data-driven investment recommendations, while AI-powered chatbots assist with customer queries in real-time.

3. Advanced Security and Fraud Prevention

Security is a top priority in fintech, with companies leveraging biometric authentication, encryption, and blockchain technology to protect financial transactions.

Features like two-factor authentication (2FA), facial recognition, and fingerprint scanning enhance security while minimizing fraud risks. Blockchain technology ensures transparency and integrity in financial transactions by providing tamper-proof records.

4. Real-Time Processing and Transactions

Fintech companies leverage high-speed data processing to enable instant payments, real-time loan approvals, and up-to-the-second account updates. This reduces processing times for transactions, eliminating the delays associated with traditional banking services. Digital wallets and contactless payment solutions, such as Apple Pay and Google Pay, provide users with instant and secure payment options.

5. Data Analytics and Personalized Insights

Fintech platforms harness big data analytics to offer users personalized financial recommendations. By analyzing spending patterns, credit histories, and investment behaviors, fintech solutions can provide tailored financial advice, credit scoring insights, and risk assessments. This enables users to make better financial decisions and optimize their money management strategies.

6. API Integration and Open Banking

Application Programming Interfaces (APIs) allow fintech platforms to seamlessly integrate with other financial services. This enables interoperability between banks, payment processors, and third-party applications, fostering a more connected financial ecosystem. Open banking APIs give consumers greater control over their financial data, allowing them to access multiple services from different providers in one place.

7. Regulatory Compliance and Risk Management

To navigate the complex financial landscape, fintech companies incorporate automated compliance tracking and reporting tools. These tools help businesses adhere to global financial regulations, such as GDPR and AML (Anti-Money Laundering) requirements. Compliance automation reduces human errors and ensures that transactions remain secure and legally compliant.

8. Blockchain and Smart Contracts

Blockchain technology enhances fintech solutions by reducing transaction costs, improving transparency, and eliminating intermediaries. Smart contracts, which are self-executing agreements with predefined conditions, automate transactions in industries like trade finance and cryptocurrency. These innovations enable secure, trustless transactions without reliance on traditional financial institutions.

9. Peer-to-Peer (P2P) Platforms

P2P platforms connect individuals directly for transactions such as lending, investing, and crowdfunding, eliminating the need for banks or intermediaries. In the lending sector, P2P platforms provide borrowers with lower interest rates while offering investors better returns. Fintech-powered crowdfunding platforms also help startups and businesses raise capital efficiently.

10. Multi-Channel Accessibility

Modern fintech solutions are designed for cross-platform compatibility, allowing users to access financial services via websites, mobile apps, and third-party integrations. This flexibility ensures that users can perform financial transactions anytime, anywhere, whether through a smartphone, tablet, or desktop.

Fintech is revolutionizing the financial industry by offering faster, safer, and more efficient financial solutions. With continuous advancements in AI, blockchain, and open banking, the future of fintech promises even greater convenience and accessibility for businesses and consumers alike.

How Fintech Works: The Technology Behind Modern Financial Services

Fintech, or financial technology, transforms traditional financial services through digital innovation. It enables faster, more secure, and more accessible financial transactions by integrating cutting-edge technologies. At its core, fintech operates through three key components: Application Programming Interfaces (APIs), mobile applications, and web portals.

1. Application Programming Interfaces (APIs): The Backbone of Fintech

APIs enable fintech apps to connect securely with financial institutions and other applications, allowing seamless data exchange. Key functions of APIs in fintech include:

- Open Banking: APIs provide users with real-time access to their financial data across multiple banks in one dashboard.

- Payment Processing: APIs enable instant payments, peer-to-peer transfers, and embedded finance in digital wallets and e-commerce platforms.

- Automation: They allow end-to-end automation of financial processes like loan approvals, credit scoring, and compliance reporting.

By leveraging APIs, fintech companies eliminate the need for manual intervention, making financial services faster and more efficient.

2. Mobile Applications: Financial Services at Your Fingertips

Mobile apps bring fintech services directly to consumers, allowing them to manage finances, invest, borrow, and trade from their smartphones. Common fintech mobile app functionalities include:

- Mobile Banking: Users can check balances, transfer funds, and pay bills via mobile banking apps.

- Digital Wallets: Apps like Apple Pay and Google Pay facilitate contactless payments and store digital assets securely.

- Robo-Advisors & Investment Platforms: AI-driven platforms like Wealthfront and Robinhood provide automated investment strategies.

- P2P Lending & Crowdfunding: Apps like LendingClub and GoFundMe connect borrowers and investors directly, bypassing banks.

Fintech apps combine convenience with security, using biometric authentication, encryption, and fraud detection algorithms to protect user data.

3. Web Portals: Accessing Fintech Services Online

Web-based platforms provide businesses and individuals with direct access to fintech solutions, enabling:

- Cloud-Based Financial Management: Businesses use web portals for accounting, payroll, and expense tracking.

- Online Trading & Investments: Users can trade stocks, cryptocurrencies, and commodities via web-based trading platforms.

- Financial Advisory Services: AI-driven chatbots and human advisors offer personalized financial insights through online portals.

Most fintech services offer both mobile apps and web-based access, ensuring users can manage their finances across different devices.

Supporting Technologies Powering Fintech

Beyond APIs, mobile apps, and web portals, fintech relies on advanced technologies to enhance efficiency and security:

- Cloud Computing: Enables scalable and cost-effective storage for financial data.

- Artificial Intelligence (AI): Powers chatbots, fraud detection, and personalized financial recommendations.

- Blockchain: Ensures transparency and security in transactions, especially in cryptocurrencies and smart contracts.

- Near-Field Communication (NFC): Allows contactless payments for seamless retail transactions.

Fintech simplifies financial processes by leveraging APIs for connectivity, mobile apps for accessibility, and web portals for comprehensive financial management. As technology advances, fintech will continue to evolve, making financial services more efficient, secure, and user-friendly for businesses and consumers alike.

Types of Fintech Companies

The fintech industry is diverse, with companies specializing in various financial services to enhance accessibility, efficiency, and security. Below are the main types of fintech companies and their roles in modern finance.

1. Digital Banks and Neobanks

- Offer online-only banking services without physical branches.

- Provide current and savings accounts, loans, and investment products.

- Use AI-driven personalization for better user experience and cost efficiency.

2. Payment Solutions

- Facilitate money transfers and payment processing for individuals and businesses.

- Includes mobile payment apps, digital wallets, and B2B payment systems.

- Features include real-time transactions, enhanced security, and global reach.

3. Personal Finance Management (PFM)

- Help individuals track spending, savings, and investments.

- Offer budgeting tools, financial advice, and expense categorization.

- Use AI and analytics to provide personalized insights.

4. Insurtech (Insurance Technology)

- Disrupt the traditional insurance model with digital-first policies and claims processing.

- Utilize AI and big data for risk assessment and policy customization.

- Enable faster underwriting and seamless customer experience.

5. Wealthtech (Wealth & Investment Technology)

- Automate investment management through robo-advisors.

- Offer digital wealth management tools and alternative investment platforms.

- Provide access to fractional investing and diversified portfolios.

6. Lending and Credit Tech

- Provide alternative lending solutions like peer-to-peer (P2P) lending and microloans.

- Use AI-based credit scoring models to assess creditworthiness.

- Enable access to financing for underserved individuals and businesses.

7. RegTech (Regulatory Technology)

- Help financial institutions comply with regulations and manage risk.

- Offer identity verification, fraud detection, and automated compliance reporting.

- Reduce regulatory costs and improve efficiency.

8. Blockchain and Cryptocurrency

- Leverage blockchain for secure and transparent transactions.

- Include cryptocurrency exchanges, decentralized finance (DeFi) platforms, and smart contracts.

- Enable borderless payments and digital asset management.

9. Trade Finance & Supply Chain Fintech

- Enhance international trade financing through digital platforms.

- Provide invoice factoring, cross-border payments, and trade credit solutions.

- Improve transparency and reduce transaction times.

10. Banking Infrastructure & API Providers

- Enable fintech startups and financial institutions to build banking services via APIs.

- Provide services like account management, payments, and lending infrastructure.

- Allow businesses to integrate financial products without developing full-fledged banking systems.

Fintech companies are revolutionizing the financial sector by providing faster, more accessible, and data-driven solutions. As technology evolves, these fintech segments will continue to drive innovation, security, and financial inclusion across industries.

Key Benefits of Fintech

Fintech has transformed the financial landscape by making services more accessible, efficient, and customer-centric. Its impact extends across industries, benefiting individuals, businesses, and financial institutions in numerous ways.

1. Financial Inclusion and Accessibility

Fintech has bridged gaps in financial access, empowering underserved communities with digital banking, mobile payment solutions, and alternative lending options. People who previously lacked access to traditional banking can now save, borrow, and transact with ease, regardless of location or economic status.

2. Enhanced Customer Experience

With intuitive digital interfaces, personalized financial recommendations, and round-the-clock availability, fintech eliminates the challenges of long wait times, complex paperwork, and restricted banking hours. Customers enjoy seamless interactions, real-time support, and a more tailored financial experience.

3. Streamlined Operations and Cost Efficiency

Automating financial processes reduces reliance on intermediaries, minimizing costs for both service providers and consumers. Fintech solutions accelerate transactions, optimize payment processing, and enable financial institutions to offer competitive rates and lower fees.

4. Greater Financial Control for Consumers

Real-time transaction tracking, AI-driven insights, and open banking initiatives give users unprecedented control over their financial decisions. Individuals and businesses can better manage their expenses, investments, and credit through transparent and data-driven solutions.

5. Innovation and Industry Transformation

Fintech continually challenges traditional financial models by introducing cutting-edge technologies such as blockchain, AI, and smart contracts. These innovations not only enhance security and efficiency but also open new opportunities in areas like decentralized finance and automated investing.

6. Agility in Product Development

Financial institutions leveraging fintech can quickly adapt to evolving customer needs, rolling out new services without requiring extensive infrastructure changes. The availability of ready-to-deploy fintech solutions enables businesses to remain agile and competitive in a fast-moving market.

7. Strengthened Business Growth and Retention

By integrating fintech capabilities, businesses can offer a more engaging and personalized user experience. AI-driven recommendations, seamless digital transactions, and improved financial services encourage customer loyalty and long-term retention.

8. Collaboration and Market Evolution

Fintech fosters an environment where startups and traditional financial institutions can collaborate, merging agility with established expertise. This dynamic interaction drives competition, leading to more customer-centric innovations and higher service standards across the industry.

Fintech is redefining financial services by enhancing accessibility, efficiency, and innovation. As it continues to evolve, its influence will shape the future of banking, payments, lending, and wealth management, ensuring a more inclusive and tech-driven financial ecosystem.

Challenges and Risks Facing Fintech

The rapid growth of fintech has brought innovation and convenience to financial services, but it also presents several challenges and risks that companies in the sector must navigate.

1. Regulatory Uncertainty and Compliance

The pace of fintech innovation often outstrips regulatory developments, creating compliance challenges for both startups and established players. Adapting to constantly evolving regulations across different jurisdictions can slow expansion, increase operational costs, and introduce legal risks.

2. Cybersecurity Threats and Data Privacy Risks

Fintech companies handle vast amounts of sensitive financial and personal data, making them prime targets for cyberattacks. Risks such as data breaches, identity theft, and financial fraud not only jeopardize user security but also damage trust and company reputation.

3. Financial Stability and Systemic Risks

The interconnected nature of fintech and its reliance on emerging technologies can introduce financial stability concerns. The failure of a major fintech firm, a widespread cyberattack, or the collapse of a high-risk digital asset could have ripple effects across the broader financial system.

4. Consumer Protection and Ethical Concerns

As fintech services become more complex, consumers—especially those with limited financial literacy—may struggle to understand fees, terms, and potential risks. Issues like misleading marketing, hidden charges, and predatory lending practices can erode trust and lead to regulatory scrutiny.

5. Market Concentration and Competition Challenges

While fintech encourages innovation, the dominance of a few major players can stifle competition and limit opportunities for smaller startups. Market consolidation could reduce consumer choice and create barriers to entry for new businesses.

6. Operational Risks and Technological Disruptions

Fintech companies depend heavily on technology, making them vulnerable to system failures, software glitches, and cyber threats. Service outages, data loss, or infrastructure failures can disrupt financial transactions, harm customer experience, and result in financial losses.

7. Scalability and Growth Pressures

Rapid expansion can strain fintech startups, leading to operational inefficiencies, service disruptions, and regulatory compliance challenges. Maintaining high service quality while scaling up can be difficult, especially in highly competitive markets.

8. Intellectual Property Protection and Innovation Risks

The fast-moving nature of fintech makes protecting intellectual property challenging. Competitors, particularly in less regulated markets, may exploit loopholes to replicate or modify successful fintech products without proper oversight, potentially discouraging further innovation.

9. Financial Inclusion and the Digital Divide

While fintech aims to promote financial inclusion, the reliance on digital platforms can inadvertently exclude individuals without internet access, smartphones, or technological literacy. This can deepen financial disparities rather than bridge them.

10. Ethical Risks and AI Bias

The increasing use of AI and machine learning in fintech raises concerns about algorithmic bias and ethical decision-making. Biased data sets in credit scoring, loan approvals, and fraud detection could reinforce discrimination against certain demographics, leading to unfair financial practices.

11. Dependence on Third-Party Technologies

Many fintech companies rely on cloud computing, third-party APIs, and external infrastructure providers. Dependence on these external entities introduces additional risks, such as vendor failures, data security vulnerabilities, and compliance challenges.

12. Lack of Personalized Customer Support

While fintech prioritizes automation and self-service models, the lack of human interaction can be a drawback for customers who need personalized financial guidance. Unlike traditional banking, fintech users may struggle to get tailored advice for complex financial decisions.

Despite its transformative impact, fintech faces significant regulatory, technological, and ethical challenges. Addressing these risks proactively—through enhanced security measures, ethical AI practices, robust compliance frameworks, and inclusive financial strategies—will be crucial to ensuring fintech’s sustainable growth and trustworthiness in the evolving financial landscape.

Technologies Shaping the Future of Fintech Companies

The fintech industry is evolving rapidly, driven by emerging technologies that enhance efficiency, security, and customer experience. Here are the key technologies shaping the future of fintech companies:

1. Artificial Intelligence (AI) and Machine Learning (ML)

AI is revolutionizing fintech by enabling predictive analytics, fraud detection, and personalized financial services. Generative AI alone is projected to add up to $4.4 trillion annually to the global economy. Financial institutions are adopting AI-driven automation, chatbots, and risk assessment models to stay competitive.

2. Blockchain and Decentralized Finance (DeFi)

Blockchain technology is transforming financial transactions through smart contracts, zero-knowledge proofs, and decentralized ledgers. It is a key driver behind digital wallets, tokenized assets, and decentralized finance (DeFi). The security and transparency offered by blockchain make it crucial for the future of fintech.

3. Cloud Computing

Cloud technology is expected to generate over $1 trillion in EBITDA by 2030 for the world's top companies. It enables fintech firms to scale operations, reduce infrastructure costs, and enhance security through flexible and resilient cloud-based financial services.

4. Internet of Things (IoT) in Finance

IoT is increasingly used in fintech for real-time transaction monitoring, smart ATMs, and connected financial ecosystems. IoT-powered wearables and smart devices facilitate seamless digital payments, fraud prevention, and personalized financial services.

5. Open-Source Software, Serverless Architecture, and SaaS

These technologies are essential for fintech startups and financial institutions aiming for agility and scalability. Serverless architecture and SaaS models allow firms to rapidly deploy secure, cost-effective financial solutions without maintaining complex infrastructure.

6. No-Code and Low-Code Development Platforms

Fintech companies are leveraging drag-and-drop development platforms to accelerate software creation and reduce dependency on traditional coding. This approach speeds up the launch of fintech apps, making innovation more accessible to businesses of all sizes.

7. Hyper-Automation

By combining AI, deep learning, and event-driven software, hyper-automation enhances financial decision-making and process automation. From robo-advisors to automated credit approvals, this technology streamlines operations while reducing human errors.

Fintech companies must embrace these cutting-edge technologies to remain competitive and future-proof their operations. AI-driven automation, blockchain innovations, and cloud-based solutions are set to redefine financial services, creating a more efficient and inclusive global economy.

How Deskera ERP Supports Fintech Growth and Efficiency

Fintech companies rely on automation, data accuracy, and seamless financial management to stay competitive. Deskera ERP offers a comprehensive suite of tools that streamline operations, enhance compliance, and improve financial reporting, making it a valuable asset for fintech businesses.

1. Automating Financial Management

Fintech companies handle vast amounts of financial data. Deskera ERP automates accounting, invoicing, and cash flow management, reducing manual errors and ensuring real-time financial insights.

2. Ensuring Regulatory Compliance

With ever-changing financial regulations, compliance is a major challenge in fintech. Deskera ERP helps businesses track transactions, generate audit-ready reports, and adhere to tax regulations, ensuring smooth operations across multiple jurisdictions.

3. Enhancing Data Security and Integrity

Cybersecurity is a top concern in fintech. Deskera ERP offers secure cloud-based financial management solutions, ensuring data encryption, controlled access, and regular backups to protect sensitive financial data.

4. Improving Scalability and Efficiency

Fintech startups need flexible solutions that scale with their growth. Deskera ERP provides cloud-based scalability, automated workflows, and real-time financial analytics, allowing fintech companies to expand seamlessly.

5. Streamlining Multi-Currency Transactions

Fintech companies often operate across borders. Deskera ERP supports multi-currency transactions, automated tax calculations, and real-time exchange rate updates, simplifying global financial operations.

Key Takeaways

- Fintech refers to the use of technology to enhance, automate, and innovate financial services, improving accessibility, efficiency, and customer experience across banking, payments, lending, and investments.

- Fintech has evolved from basic digital banking solutions to advanced AI-driven financial services, blockchain innovations, and decentralized finance (DeFi), transforming the financial industry.

- Fintech encompasses various solutions such as mobile banking, digital wallets, AI-driven financial advisory services, peer-to-peer lending, and blockchain-based transactions.

- Fintech enhances financial inclusion, streamlines operations, improves customer experience, and fosters innovation through automation, cost reduction, and data-driven decision-making.

- Regulatory compliance, cybersecurity threats, financial stability concerns, and market competition are key challenges that fintech companies must navigate for sustainable growth.

- Emerging technologies like artificial intelligence, blockchain, cloud computing, and hyper-automation are driving the next wave of fintech advancements, making financial services more secure and efficient.

- Deskera ERP helps fintech companies manage finances, automate operations, ensure compliance, and scale efficiently with cloud-based solutions, making financial management seamless.

Related Articles