Financial Statements are important reports that show the financial condition of a company. They show you where the money is at, where it came from and where it went.

Financial Statements are important reports that show the financial condition of a company. They show you where the money is at, where it came from and where it went.

The four main financial statements are:

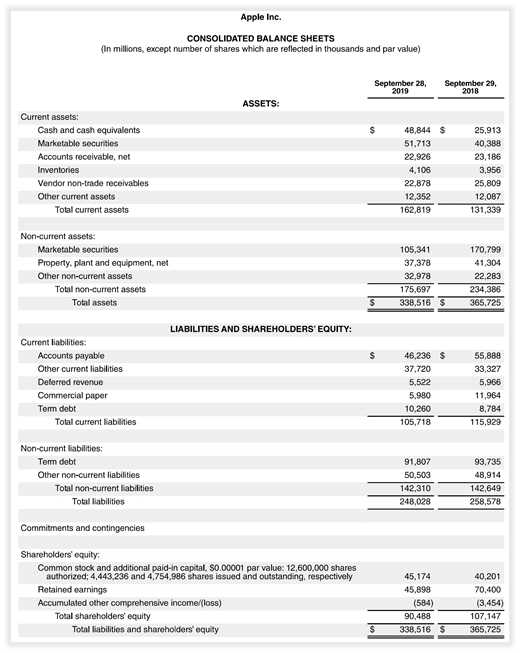

1/Balance sheet:

Offers a snapshot of your company’ financial condition at any single point in time. Show you what does your company owns (Assets), and how much of what you own was owed to creditor (Liabilities) or was contributed by your own fund (Equity)

This is where the fundamental formula of accounting plays out.

Assets = Liabilities + Equity

Thus, the name Balance Sheet.

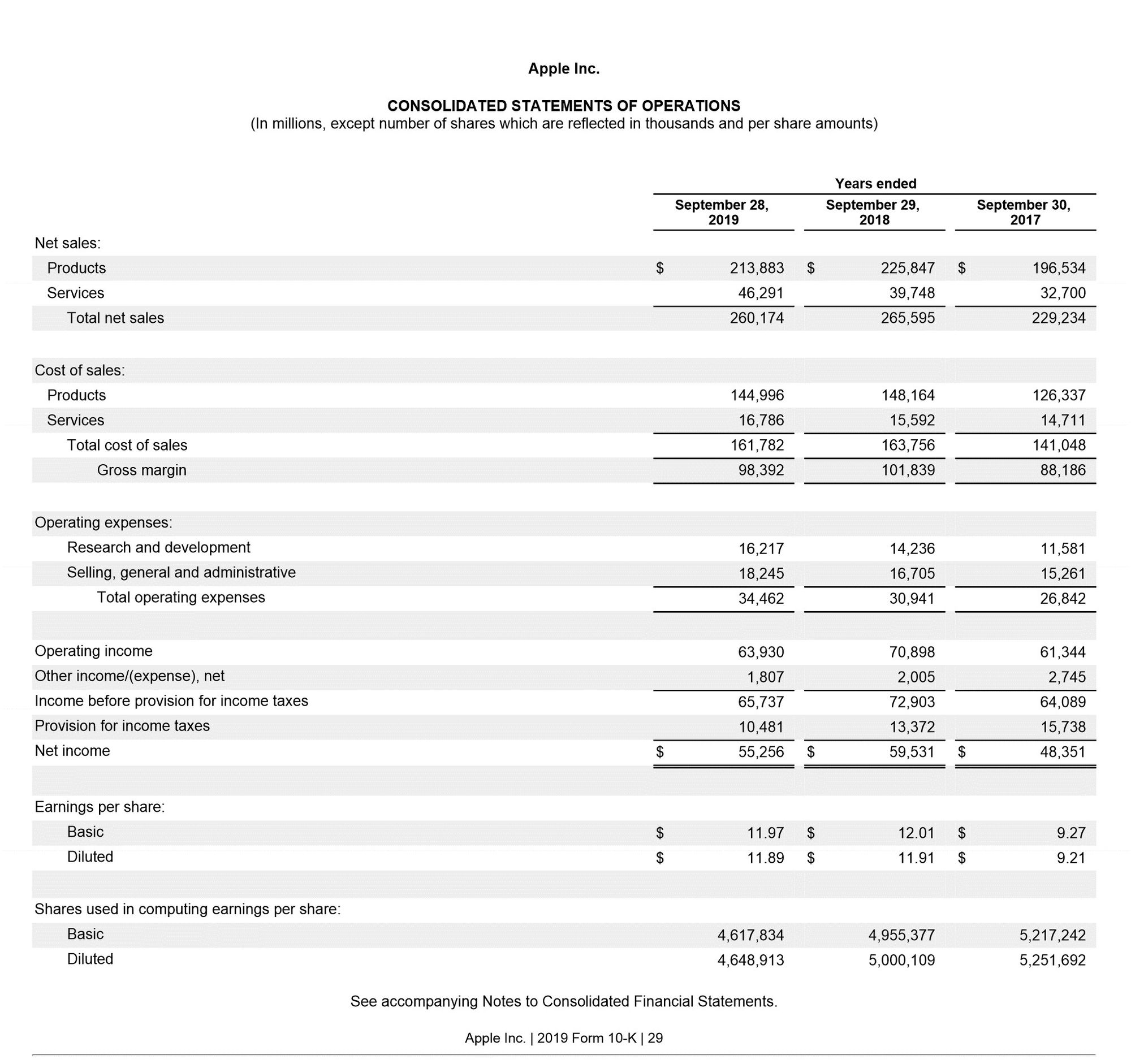

2. Income statement:

Shows you how much money you make within a period of time. It lists out Income, Expenses, and the Net Income figure (also called the bottom line)

At the end of each Accounting Period, all Income and Expenses are eventually shifted to the Retained Earning Account in the Balance Sheet.

This process is known as Closing the Books, which will refresh the Income and Expenses to 0 at the beginning of the next Accounting Period

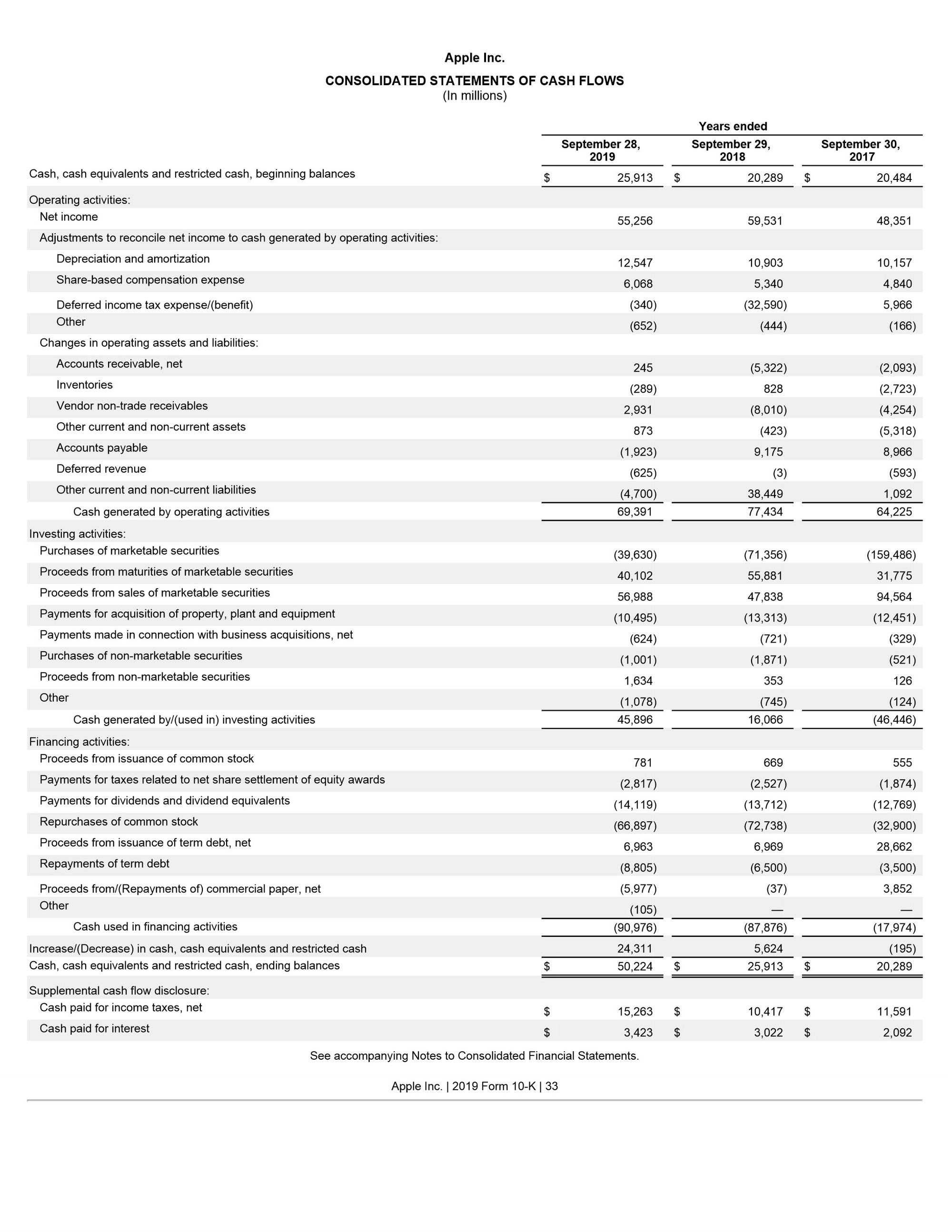

3. Cash flow statement:

The Income Statement shows you how much you earned in a period.

The Cash flow statement helps you know how much money did you really receive or pay out.

For example, Income Statement tends to record sales immediately, whereas Cash flow Statement only reflects the Cash inflow when you actually receive the payment.

The Cash flow statement will result in total cash that you have, which should match with your cash balance on the Balance Sheet.

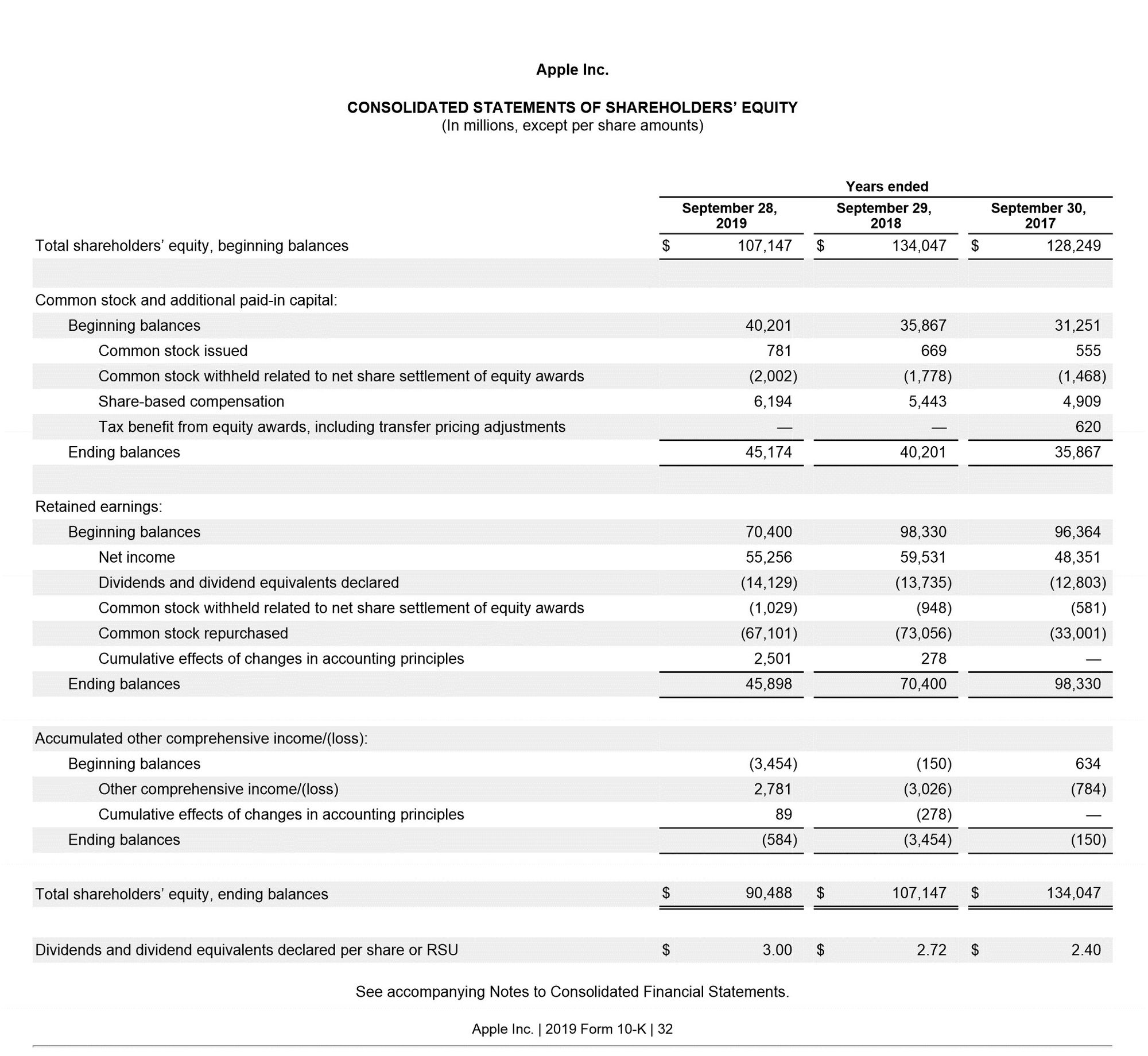

4. Statement of Retained Earnings

The Income Statement gives you the bottom line, the Net Income

The Statement of Retained Earnings tells you how much of that Net Income your company actually retained (after, for example, being paid out to investors as dividends)

The retained earnings will eventually be moved to the Balance Sheet in the Equity Section.

Related articles:

A Guide to fully understand Balance Sheet

The complete Guide to Cashflow Statement

Complete guide to Income Statement for small business