Cash flow is one of the top 5 issues for small businesses of all sizes. 60 percent of unsuccessful SMEs attributed their demise to cash flow.

One of a small business owner's biggest worries, and regrettably one of the most frequent, is running out of money. Another widespread misunderstanding is that cash flow issues only affect firms that are struggling; nevertheless, even successful small enterprises can experience these issues. In some cases, it may even occur as a result of their success.

Table of contents

- What us Cash Flow?

- What are Cash Flow Types?

- What is Profit?

- How to Never Run Out of Money When Owning a Business?

- Proven Strategies for Small Business Growth

- How to Quickly Expand Your Business?

- Key Takeaways

What us Cash Flow?

A firm constantly receives and expends cash. For instance, when a retailer buys merchandise, money leaves the company and goes to its suppliers. Cash from customers enters the business when that same shop sells something from its stock.

Paying employees or utility bills is an example of money leaving the company and going to its creditors. While receiving monthly payments on a customer purchase that was financed 18 months ago demonstrates money coming into the company.

Positive or negative cash flow is possible. A corporation with positive cash flow has more money coming in than going out. A corporation with negative cash flow has more money leaving than entering it, cash flow positive.

What are Cash Flow Types?

Operating cash flow

The net cash a corporation generates through its regular business operations. Positive cash flow is essential for maintaining business growth in organisations that are actively growing and expanding.

The term investing cash flow refers to the net cash made available by a company's investment-related operations, such as purchases of securities, purchases of tangible assets like property or equipment, or sales of assets. This figure will frequently be negative in strong corporations that actively invest in their enterprises, cash flow positive.

Financing cash flow

This especially relates to how money is transferred between a business and its shareholders, owners, or creditors. It is the net cash made available to finance the business and could come from dividends, debt, or equity.

The Cash Flow Statement

The cash flow statement, a financial document created to provide a complete analysis of what happened to a business's cash during a specific period of time, often includes cash flow information. The document displays various instances in which a business spent or received money and compares the beginning and ending cash balances, cash flow positive.

What is Profit?

Profit is commonly understood as the sum that is left over after all operational costs have been deducted from sales. It is what remains after expenses are deducted from revenues and the accounts are balanced, cash flow positive.

Either the company's owners and shareholders receive the profit (typically in the form of dividend payments) or the profit is reinvested in the business. Profits might be used to fund R&D for new products or services, or they could be used to buy new inventory for a company to sell, cash flow positive.

Profit can be shown as a positive or negative figure, similar to cash flow. Due to the fact that the business spent more money operating than it was able to recuperate from its operations, when this computation yields a negative number, it is often referred to as a loss, cash flow positive.

Gross Profits

Gross profit is the difference between revenue and the cost of products sold. It contains variable costs, such as the cost of materials and labour directly related to creating the product, which depend on the amount of output. It excludes other fixed expenditures, such as rent and employee salaries, which are not directly involved in the production of a good, which a business must cover regardless of output.

Operating profit

Like operating cash flow, operating profit exclusively refers to the net profit generated by a company's regular business operations. Negative cash flows like tax payments or loan interest payments are often excluded. The same holds true for positive cash flows from sources outside than the core business. Earnings before interest and tax is another name for it (EBIT).

Net profit

This is the amount left over after all costs and revenues have been subtracted. This often covers costs like tax and interest payments, cash flow positive.

How to Never Run Out of Money When Owning a Business?

Reopen negotiations with suppliers and vendors

Have you recently read through your supplier or vendor contracts? The agreements you currently have were probably made when you first started your company and were still in the beginning stages. You might have agreed to their terms outright in order to begin selling straight immediately.

It's time to go back and review those initial contracts at this point. Call your vendors to discuss revising the terms of the contract. Maybe after a specific number of years of partnership, there will be a chance for a discount. Don't be afraid to haggle over payment terms and schedules in order to improve your own cash flow. Keep in mind that your vendors are there to serve you, and they want you to succeed.

Provide customers with a range of payment options

Do your clients pay you too slowly? Larger businesses may be accustomed to paying their invoices 30 or 60 days in advance if you engage with them. Many small firms, however, are unable to wait this long for payment since they must also take their own finances into account, cash flow positive.

Offer your customers a discount for paying in advance to prevent running out of money as you wait for sluggish payments. A reduction of merely 2%, for instance, could entice clients to make payments sooner, cash flow positive.

Another choice is invoice factoring, in which your business receives a fee-based cash advance from a third-party factoring organisation. When a customer pays the complete invoice, the transaction is finished. This is a typical method of enhancing cash flow and is frequently utilised as a revolving line of credit, cash flow positive.

Borrow sensibly

Securing additional funding might be one of your finest solutions if you are in a severe liquidity crunch. When attempting to obtain funding in this manner, there are numerous aspects to consider, such as the appropriate interest rates, repayment terms, and qualifications for your company.

A tiny government loan, such a microloan from the Small Business Administration, is one choice (SBA). For small firms in need of funding to expand or cover expenses, the SBA offers loans of $50,000 or less. Microloans are available to startups as well as established enterprises and might be more straightforward to get than standard finance.

Online lenders offer a variety of other lending options as well. Due to their bad credit, lack of assets, or short business histories, small businesses may not otherwise have access to financing, cash flow positive.

Alternative lending gives them this chance. You can also use traditional finance if you have excellent credit and a long history of operation. Simply be sure that whatever choice you make is carefully thought out and will ultimately benefit your business, cash flow positive.

Diversify Your Client Base

Simply put, you are in a risky area if one customer generates 50% or more of your total sales. There are several risk factors involved with stakes that large, even if you have a great relationship with this consumer, cash flow positive.

For instance, your consumer could choose a rival at any time who offers better prices or a superior offering. If you diversify your clientele, you may safeguard your business and prevent running out of money. Your company is more safe if you have a number of clients of various sizes rather than relying mostly on one revenue stream.

Be aware of your cash flow

A crucial aspect of managing your business is maintaining control of your finances. Your cash flow statement outlines the money coming into and going out of your company and how it will impact your assets, operating budget, and cash on hand.

Understanding how secure and viable your business's finances are depends on your ability to interpret a cash flow statement. You can manage your short-term debt and pay your expenses with its assistance. There are many blogs, seminars, and programmes available to help if you feel you need to strengthen your financial management skills, cash flow positive.

Construct a Cash Reserve

Future cash flow issues can be resolved quite successfully by creating a cash reserve. Your cash reserve will allow you some breathing room to discover a solution if you find yourself short on cash.

Save some money in a different bank account as soon as your business starts to generate revenue. Even while it appears straightforward, some small businesses find it challenging because it seems like wasted money, money that is simply sitting in a bank account that cannot be invested in the company.

Building a cash reserve can actually slow down your company's growth, but it will also provide you with a safety net you can use in case your business has any difficulties. Your company cannot run out of cash if it wants to remain successful. Cash is king.

Play the Float Game

Concentrate on accelerating your collection procedure and endeavor to obtain payments in advance whenever possible (retainers, deposits, pre-payments, C.O.D, etc.) If you do have receivables, set up a structure for collecting them and hire a collections company to expedite the procedure, cash flow positive. Start accepting credit cards and electronic payments if you haven't already.

Get Your Product to Market Quicker

Your overhead costs per unit will be reduced the quicker you turn things around, which will boost your profit margins. Analyze your processes to find areas where technology can speed up turnaround.

Master the Art of Upselling

In order to improve your revenue per transaction and per customer, master the art of the upsell or bundle. Depending on your industry, this will vary, but generally speaking, it costs more to sell to an existing customer than it does to acquire a new one, cash flow positive. Therefore, focus on repeat business for steady, predictable cash flow. Increasing the lifetime value of your consumers is the aim here.

Maintain Variable Costs

Reduce the amount of fixed overhead in your company to manage cash flow. To boost your margins, adopt performance-based pay models and J.IT management (Just In Time) whenever possible. Consider outsourcing it to someone who can handle it more quickly and affordably if it isn't a fundamental component of your company.

Be Lean & Mean

As your company expands, it is simple to become a lifestyler. However, the business owners that live within their means and keep as much profit flowing to the bottom line as possible are the most prosperous. To manage your effective tax rate, start by paying yourself in a tax-efficient way and look at everything on your P&L, cash flow positive.

Make a Cash Flow Plan

The next piece of advice for increasing profitability has to do with how you set your budget. When things are going well, you should create your budget on a monthly basis, but when things are tight, you should monitor your cash flow and budget regularly. Learn about your SGR since profitable expansion needs cash.

Proven Strategies for Small Business Growth

Recognize your clients

It's crucial to understand who your customers are and what they require. When creating your company strategy, the procedure of choosing a target market was involved. However, you now have a customer base that is active, therefore you need to interact with them to grow your company.

You should be requesting sincere input, whether it be through a quarterly poll, user reviews, or direct customer service conversations. Keep track of common complaints from your clientele and use them to introduce new features, alter internal procedures, or implement any other number of repairs, cash flow positive.

Direct consumer input is priceless, but you should also be keeping an eye on the marketplace and your rivals. Regular market analysis keeps you informed of any competition actions and how various economic events can effect your clients. It paints a complete picture of prospective growth opportunities when coupled with the insightful input from your customers, cash flow positive.

Put the consumer first

Customer satisfaction for your current clients may suffer while you try to expand your firm. Customer turnover is a fact of corporate life, but you don't want it to be a direct consequence of your expansion plans. Furthermore, you don't want to make customers more likely to leave by giving them a bad experience, cash flow positive.

At the same time, concentrating on providing high-quality customer service can be a clear path to development. If you treat your present customers well, they'll be more inclined to write nice reviews, refer you to their friends, and, of course, make another purchase from your company.

Increase the value of existing clients

It's customary to try to win over new clients right away while looking for expansion prospects, but what about your current clientele? As a result of the trust you've established with them, they're more inclined to make another purchase from you or even pay extra for additional services and new goods.

Look for ways to increase the value of your consumers. A new product line that complements existing purchases should be added, cash flow positive. Try raising the price of your services in exchange for extra features, personal guidance, or other improvements that your clients will value.

It doesn't necessarily follow that you can't gain more value from your existing target market even though you may have reached the point where it can no longer expand, cash flow positive. And who knows, whatever adjustments you make to boost the value for current clients could serve as a launchpad for enticing brand-new clients.

Make use of social media

It can be intimidating to start using social media. The truth is that you don't need prior experience to take advantage of social platforms. Opening a business profile and starting to build a customer base are two straightforward ways to get started.

Though you don't have to update frequently or even make stunning photographs and videos, stick to a regular schedule so that your followers and clients know what to expect. The onus is then on you to actively interact with your followers, read feedback, respond to messages, and overall develop your social media brand, cash flow positive.

Overall, it's an excellent method for discovering patterns and customer insights. You may even attempt running social advertisements using the newfound knowledge. It's simpler than you may imagine and a cheap way to test promotions, see whether a new consumer base is interested, or even carry out a full-fledged digital campaign.

Expand your team

Increasing your clientele and sales often entails expanding your staff. Additionally, you must concentrate on the calibre of the individuals who join your team in the same way that you must concentrate on offering outstanding customer service, cash flow positive.

Look for varied voices that can perform the necessary tasks for the position while also offering fresh viewpoints that differ from your own. A team overrun by yes sir is detrimental and could result in a bad internal culture and self-serving decisions. A diverse workforce with individuals with various backgrounds, experiences, ideologies, and skills contributes fresh viewpoints to the table that would not otherwise exist.

You should also concentrate on the professional growth of your current workers as you look to hire new personnel. Show them that you appreciate what they bring to your company. Give them additional chances to participate and lead, include them in the goal-setting process, and even pay for their seminar and training expenses, cash flow positive.

Your treatment of your clients will be influenced by how you treat your personnel. Your business will expand once you begin by internally optimising.

Showcase your expertise

You must demonstrate your knowledge if you want to keep gaining respect from your clients and other companies. This includes offering information, holding webinars, conducting research, and even having Q&A sessions on your social media platforms. Seek out opportunities to offer what you know and frame it as a free chance for others to gain knowledge and develop.

When you organise an event or allow download access, just be sure to collect contact information or provide a link to a specific promotional page. Not only are you exhibiting your skills, but you're also leveraging it to expand a potential customer base. You can convert that into ongoing growth if you follow up and maintain offering insightful advice.

Support your community

Being socially conscious and giving back to your community are excellent ways to build your brand and demonstrate your company's beliefs. You can hold community events, sponsor or donate to charities, or offer free goods or services to causes you support. To further the cause of change, you can even consider forming alliances with other companies that share your charity objectives.

You can look inward and encourage socially responsible corporate practices in addition to giving and sponsoring. This could entail switching to renewable energy for production, paying workers to volunteer, or using solely local suppliers for goods. Make the right choice and enhance your company's reputation for sustainability and accountability by supporting your neighbourhood.

Network

Making the correct alliances and being familiar with your business community are both essential to business growth. Spend some time networking and developing the kinds of connections that might help your firm, cash flow positive.

Having a large network can help you attract new clients, partners, workers, and even investors. Additionally, it's a fantastic method to exchange market insights, new trends, and best practices that you might not have discovered otherwise.

Create extra sources of income

Creating alternative income streams can be required if your primary business model has been having trouble increasing sales. A new product or service offering, varied pricing structures for various consumers or subscriptions, or even passive income through advertisements and sponsorships could all fit under this category.

Consider every new source of income as a way to grow your company. To make sure the new effort is viable and that your present firm can support it, you need to create at least a basic business plan, cash flow positive. Think about your expansion ambitions, startup and operating expenditures, and the time it will take to break even.

Last but not least, confirm that your new endeavour will benefit your company. It might initially only serve as supplemental money to fund operations, but it might eventually need to become a completely different firm.

Calculate and refine

Make sure you are actively tracking success however you decide to try and expand your firm. Making a change without having any specific objectives or important outcomes in mind can be really simple, cash flow positive. Without them, a growth initiative may quickly become an expensive scheme that destroys your company.

Establish your corporate goals in advance, and if you are not seeing success, don't be hesitant to kill or pivot projects. You may always set up fresh iterations and try the process again, perfecting your strategy to find the most effective route to victory.

Continue to measure and iterate even after you've scored a run. For a while, growth may result from a series of webinars or new product lines, but if you're not paying attention, that might quickly change, cash flow positive.

Keep looking for possibilities for advancement

The secret is to never stop looking for fresh opportunities for improvement and to never be scared to think outside the box and try them out. However, make sure to keep objectives and quantifiable outcomes in mind so you can prevent converting potential development into a serious error.

Review and revise your business plan and predictions if you're not sure whether you should take advantage of a growth opportunity. It can assist you in determining whether your initiative is feasible and whether your company can handle any prospective costs or short-term negative cash flow. To make updating and tracking results on a regular basis accurate and simple, you can always do this manually or try using a planning tool like LivePlan.

Set up a system

You must be organised if you want to succeed in business. It will assist you in completing activities and maintaining an organised schedule. Making a to-do list every day is a fantastic organisational strategy, cash flow positive. Check each thing off your list as you finish it. By doing this, you can be sure that you won't forget anything and will finish all the activities required to secure the sustainability of your company.

There are numerous SaaS technologies available to improve organisation. Slack, Asana, Zoom, Microsoft Teams, and more recent additions are examples of such tools. Having said that, a straightforward Excel spreadsheet will satisfy 95% of a business's organisational needs, cash flow positive.

Keep Detailed Records

Successful firms all maintain thorough records. You'll be aware of the company's financial situation and any prospective difficulties by doing this. Just being aware of this offers you the opportunity to develop plans to deal with those difficulties.

The majority of firms opt to maintain two sets of records: one on paper and one online. A business can stop worrying about data loss by having records that are continuously updated and backed up. The physical record serves as a backup but is most frequently used to confirm the accuracy of the other data, cash flow positive.

Analyze Your Competition

The best outcomes come from competition. You must not be scared to research and pick up tips from your rivals if you want to succeed.

The way you evaluate competition will vary by industry. If you own a restaurant, you might be able to gather information by simply eating at your rivals' establishments, asking other patrons what they think, and so on, cash flow positive.

You can, however, be a business with far less access to your rivals, like a chemicals industry. In that instance, you would consult a business expert and an accountant to review not only how the company portrays itself to the public but also any financial data you may be able to find about it.

Recognize the Benefits and Risks

The key to being successful is taking measured risks to help your business develop. What are the drawbacks is an excellent thing to ask. You will know the worst-case situation if you can respond to this question. You'll be able to take the kind of calculated risks that can result in enormous profits thanks to this understanding.

Be Innovative

Always be on the lookout for methods to enhance your company and set it apart from the competition. Recognize your limitations and remain open to fresh perspectives and alternative business strategies.

There are numerous channels that could provide extra income. Amazon is a good example. The business began as a bookshop and developed into a major player in eCommerce. Few people anticipated that Amazon's Web Services section would be a significant source of revenue.

Prepare to Make Sacrifices

Even though starting a business requires a lot of labour, your work doesn't end when your doors are open. To succeed, you frequently need to put in more time than you would if you were working for someone else, which could entail sacrificing quality time with loved ones.

For people who are dedicated to making their firm successful, the proverb There are no weekends and no vacations for business entrepreneurs may be accurate, cash flow positive. There is nothing wrong with working a full-time job, and several business entrepreneurs overestimate the true cost of the sacrifices needed to launch and run a successful enterprise.

Deliver Excellent Service

Many prosperous companies overlook the significance of offering excellent customer service. If you give your clients better service, they'll be more likely to choose you over your rivals the next time they need something, cash flow positive.

How to Quickly Expand Your Business?

Although there is no definite recipe for overnight success, you can speed up the expansion of your company by following these startup pioneers' advice.

Your primary objective when starting a new firm is to build your brand and begin expanding. Unfortunately, this process takes time. Growth is a continuous process that calls for diligence, endurance, and commitment. There is no specific procedure or method to outperform other companies in the market or find quick success.

However, there are tried-and-true methods for achieving growth milestones that can propel a company to success. We requested advice from small business owners on how to hasten growth.

Make the appropriate hires

You need a strong crew to support you in achieving your objectives before you can even consider the growth trajectory of your business, cash flow positive.

In order to guarantee rapid growth, Christian Lanng, CEO and co-founder of business software supplier Tradeshift, said, "Hiring the best people you can is a certain approach to achieve fast growth.

Your business will be better prepared for future growth if you have diligent personnel who are committed to its success. Additionally, freeing up your time and energy to concentrate on critical work will enable you to perform at your best and foster a collaborative work environment, cash flow positive.

Pay attention to dependable sources of income

Bill Reilly, a Wisconsin-based auto repair entrepreneur, advised focusing on the core consumers you already have rather than trying to gain new ones. According to him, you may achieve this by putting in place a referral or customer loyalty programme or by experimenting with marketing techniques based on past purchase patterns to promote repeat business.

If you're looking for investment, it's especially crucial that you concentrate on your existing market, cash flow positive.

Take less risks

Starting and developing a business entails a certain amount of risk. While nothing can be completely controlled, there are several techniques to reduce internal and external risks to your business and its expansion. Your company insurance provider is a crucial tool to assist you in achieving this.

According to Mike DeHetre, vice president of product development at Travelers, Small businesses need to manage their growth to avoid disruptions that might bring operations to a grinding halt, cash flow positive.

As an illustration, theft of staff information, customer information, and product ideas can kill a small organisation, creating considerable expenses and losing client confidence and loyalty. Data breaches and other cyber losses are not often covered by business owners' policies. Small firms should be ready by acquiring insurance policies that will aid in their recovery, such as those that will pay for legal fees and remediation costs.

DeHetre advises routinely reviewing your policy to make sure you have the appropriate coverage. As your small business expands, you might add furniture or equipment, develop new goods or services, or expand your operating and distribution footprint, cash flow positive.

Be flexible

The capacity to quickly alter paths in reaction to changes in the market is one quality that many prosperous entrepreneurs share. According to Lanng, adopting an agile development methodology will speed up the growth of both your business and your product.

According to Lanng, who spoke to Company News Daily, by allowing yourself to adapt and change quickly, you're able to explore multiple methods to business and find out what works best. It enables you to fall short, get back up, and keep going, cash flow positive.

Manhead Products founder and CEO Chris Cornell said his business has discovered adaptation to be essential in growing its clientele beyond its initial concentration on music merchandise.

When it makes sense, look to current pop culture trends for an opportunity to join the movement, he advised. In a time of internet celebrity, we sought to broaden our perspectives outside the music business. We collaborated with Doug the Pug, dubbed The King of Pop Culture, to launch his new gear. Because of Doug's notoriety and accessibility, we were able to expand our business model beyond bands and take his goods to the next level.

Put your customers' experiences first

Your company's success depends on how your customers perceive it. If you provide high-quality services and goods, people will instantly appreciate you on social media; if you make a mistake, they'll spread the word even faster, cash flow positive.

Small firms are frequently more agile and capable of recognising, anticipating, and responding to their consumers' requirements than giant corporations, according to DeHetre. The most prosperous small firms take use of this advantage by launching cutting-edge goods and services faster and fostering enduring relationships with their clients.

The president and CEO of Astro Gallery of Gems, Dennis Tanjeloff, concurred. He asserted that it is crucial to pay attention to what customers want and to deliver it, cash flow positive. Personalizing the experience can improve and strengthen the relationship with your audience, even though engaging with them is essential.

Develop yourself

Any profit you do make in the early phases of your business should be used to expand because you'll probably have a very slim profit margin (or none at all).

According to Lanng, a startup's capacity to make investments in itself aids in accelerating growth. To expand swiftly, early and significant investment is essential, cash flow positive.

While it may be tempting to keep all of your profits for yourself, it's wiser to invest in the expansion of your company so you can subsequently enjoy greater rewards. Decide which areas of your company require additional attention: Do you need to increase your workforce, increase your marketing budget, or all three, for instance? Give that area your financial support when you identify a vital area that needs repair.

Continually plan forward

Agility is a crucial trait for startups, but running a company isn't something you can do on the fly. The greatest method to stay grounded and secure while your business develops is to plan your next move in advance of all plausible outcomes, cash flow positive.

Although planning ahead is generally advised, it can be as easy as evaluating all current contracts, comparing prices with the finest credit card processors, and possibly negotiating a better deal.

Boost your customer service

Concentrating on offering top-notch customer service is a terrific way to expand your company, cash flow positive. Customers are more inclined to recommend your company to their friends, family, and followers when you surpass their expectations.

You build a reputation for excellent customer service when you go above and above, such as by providing discounts if a customer has a bad experience or checking in to make sure a client was happy with your product or service, cash flow positive.

Focus on social media

The creation of profiles on all of the major social media sites is another way to expand your business (Instagram, Facebook, Twitter, etc.). You can market your company more effectively and engage with a lot more potential consumers if your profile is active.

Customers can locate your business more readily and are more likely to recommend it to friends if your company has an account on the major platforms that is updated frequently. Additionally, you'll give your audience a more interesting experience, strengthening their sense of loyalty and building trust.

Attend networking events

You can meet people who share your interests at networking events, many of whom have original viewpoints and insights that can advance your company. Attending networking events can result in relationships and contacts that can be useful for many years, cash flow positive.

Corporate social responsibility is a good idea.

Customers prefer to support companies that are enthusiastic about issues that improve the world. Find methods to make a difference by supporting your favourite causes, whether that means giving to cancer research or a homeless shelter, and let your clients know about it.

You might openly show your support for underserved populations, give to various charities, volunteer your time at fundraisers, and promote environmentally friendly products, cash flow positive. Find a handful that work for you among the various ways that business can be socially responsible.

Organize neighbourhood gatherings

Even though going to events is a great way to expand your network, holding your own events in your neighbourhood can be just as beneficial. Examples include holding a fundraiser, providing special discounts around a holiday, or supporting a neighbourhood sports team, cash flow positive. You can build more intimate relationships with your customers by providing them with a distinctive experience.

You can build brand recognition and demonstrate to your neighbourhood that you care about their welfare by holding activities there. They will feel more devoted to your company if you are committed to them, cash flow positive.

Do some competition research

One of the most crucial first steps in starting your business is researching your competition, even though it might not result in instant success, cash flow positive. Consider your competitors' identities, what they are doing (that you are not) that benefits them, and how you might set your company apart from theirs.

The answers to these questions can assist you in developing a more effective business strategy by identifying the areas of your company that need more care to thrive.

To manage your costs and expenses you can use many available online accounting software.

How Can Deskera Assist You?

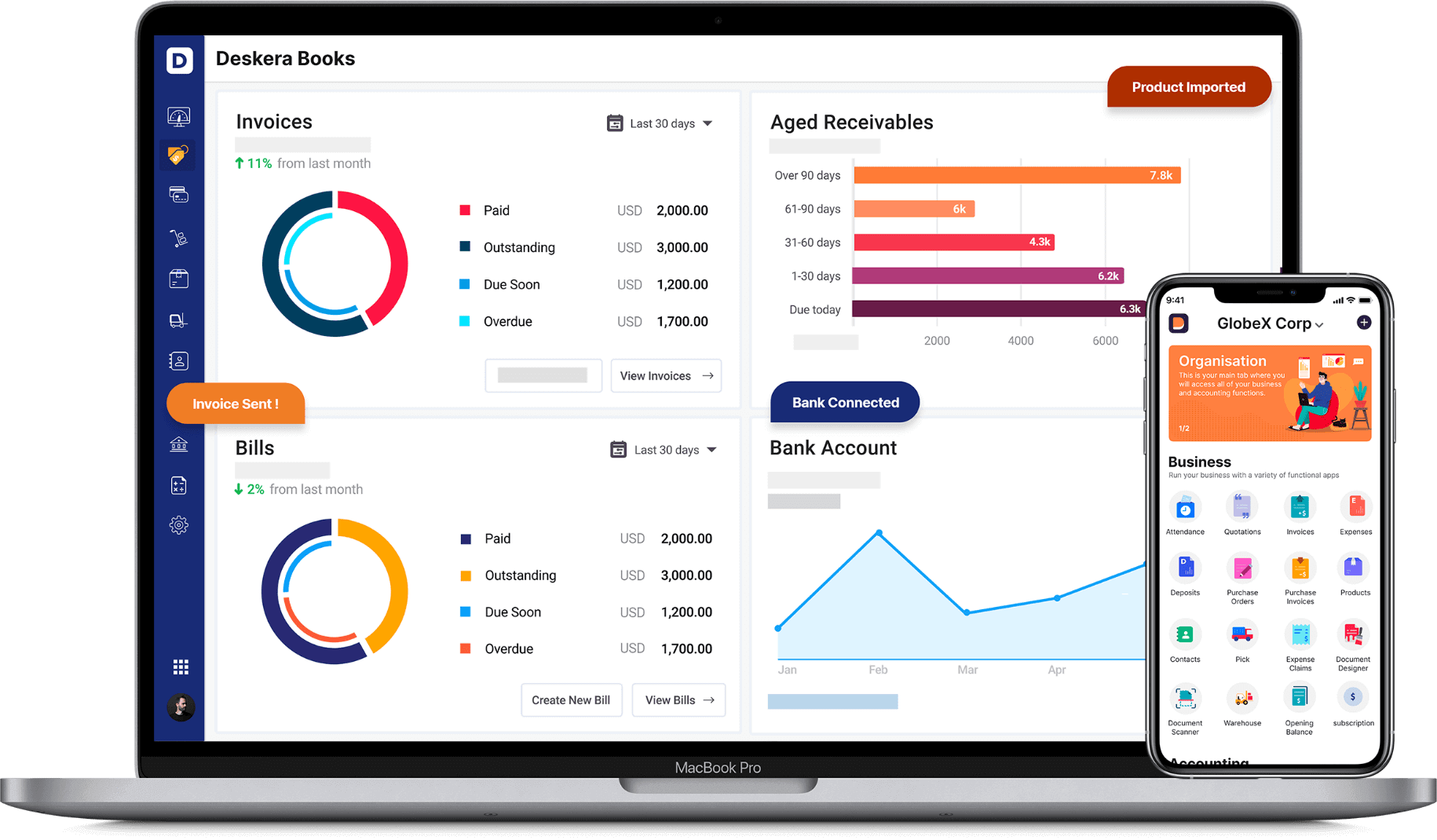

Deskera Books can help you automate your accounting and mitigate your business risks. Creating invoices becomes easier with Deskera, which automates a lot of other procedures, reducing your team's administrative workload.

Key Takeaways

A firm constantly receives and expends cash. For instance, when a retailer buys merchandise, money leaves the company and goes to its suppliers. Cash from customers enters the business when that same shop sells something from its stock.

Paying employees or utility bills is an example of money leaving the company and going to its creditors. While receiving monthly payments on a customer purchase that was financed 18 months ago demonstrates money coming into the company.

Positive or negative cash flow is possible. A corporation with positive cash flow has more money coming in than going out. A corporation with negative cash flow has more money leaving than entering it.

The net cash a corporation generates through its regular business operations. Positive cash flow is essential for maintaining business growth in organisations that are actively growing and expanding.

The term investing cash flow refers to the net cash made available by a company's investment-related operations, such as purchases of securities, purchases of tangible assets like property or equipment, or sales of assets. This figure will frequently be negative in strong corporations that actively invest in their enterprises.

Securing additional funding might be one of your finest solutions if you are in a severe liquidity crunch. When attempting to obtain funding in this manner, there are numerous aspects to consider, such as the appropriate interest rates, repayment terms, and qualifications for your company.

A tiny government loan, such a microloan from the Small Business Administration, is one choice (SBA). For small firms in need of funding to expand or cover expenses, the SBA offers loans of $50,000 or less. Microloans are available to startups as well as established enterprises and might be more straightforward to get than standard finance.

Simply put, you are in a risky area if one customer generates 50% or more of your total sales. There are several risk factors involved with stakes that large, even if you have a great relationship with this consumer.

For instance, your consumer could choose a rival at any time who offers better prices or a superior offering. If you diversify your clientele, you may safeguard your business and prevent running out of money. Your company is more safe if you have a number of clients of various sizes rather than relying mostly on one revenue stream.

Small firms are frequently more agile and capable of recognising, anticipating, and responding to their consumers' requirements than giant corporations, according to DeHetre. The most prosperous small firms take use of this advantage by launching cutting-edge goods and services faster and fostering enduring relationships with their clients.

One of the most crucial first steps in starting your business is researching your competition, even though it might not result in instant success. Consider your competitors' identities, what they are doing (that you are not) that benefits them, and how you might set your company apart from theirs.

Related Articles