With the tax season around the corner, you begin efforts for filing the W-3 form as an employer. If you have recently hired your first set of employees, you know that you must file a W-3. All businesses must file W-3 forms.

If you know about the W-2 forms, understanding W-3 wouldn’t be much of a task!

If you want to learn the details of W-2 and W-3, this post is for you.

This article clears up the smog around the forms W-2 and W-3, apart from imparting details on these points:

- What is W-3 Form and its Importance in Businesses?

- Form W-2 Vs. Form W-3

- What’s included in a W-3 Form?

- Timely Filing of W-3 Forms

- Information needed to complete the W-3 tax Form

- Form W-3 Instructions

- How to File

- Due Dates

- Fixing Form W-3 errors

- IRS Penalties

What is W-3 Form and its Importance in Businesses?

W-3 form, also known as Transmittal of Wage and Tax statements form, presents a summary of wages of all the employees along with the contributions made for the previous tax year.

As an employer, you need to be mindful of the annual reporting of employee wages and taxes through Form W-2. Yet, we must also understand that Form W-3 is an essential component while filing for Form W-2.

In order to report the wages and taxes of the employees for the previous year, employers are required to send to the Social Security Copy A of Forms W-2 (Wage and Tax Statement). Each employee must also receive a Form W-2 from the employer. With each W-2, Social Security receives a W-3 which is Transmittal of Income and Tax Statements. The employer must file a Form W-2 for each employee in the case:

- When the employee claims no more than one withholding allowance or does not claim exemption from withholding on Form W-4, income tax is withheld

- Withheld income taxes, Social Security taxes, or Medicare taxes

The W-3 allows the Social Security Administration to verify that all wages were reported for the previous year and that all FICA - Federal Insurance Contributions Act taxes were paid.

The IRS issues W-2 forms to employees and they prepare their taxes for the previous year with the hope of a refund. The deadline for businesses to provide staffers with their W-2 forms is January 31 of every year. This allows employees to prepare their own taxes by the individual deadline of April 15. However, businesses must also provide the IRS with identifying information and their tax documentation.

Form W-2 Vs. Form W-3

There is a series of W forms that have to be filed with the IRS such as W-2, W-3, and W-4. However, W-2 and W-3 are the forms that create the most confusion.

W-3 form brings together the W-2 information of multiple employees and reports it as a single form whereas the W-2 form displays your income from the prior year and the taxes you withheld. It is to be reported on your income tax return. Employers report FICA taxes to the IRS using W-2s. Tax obligations for individuals are also tracked by W-2 forms.

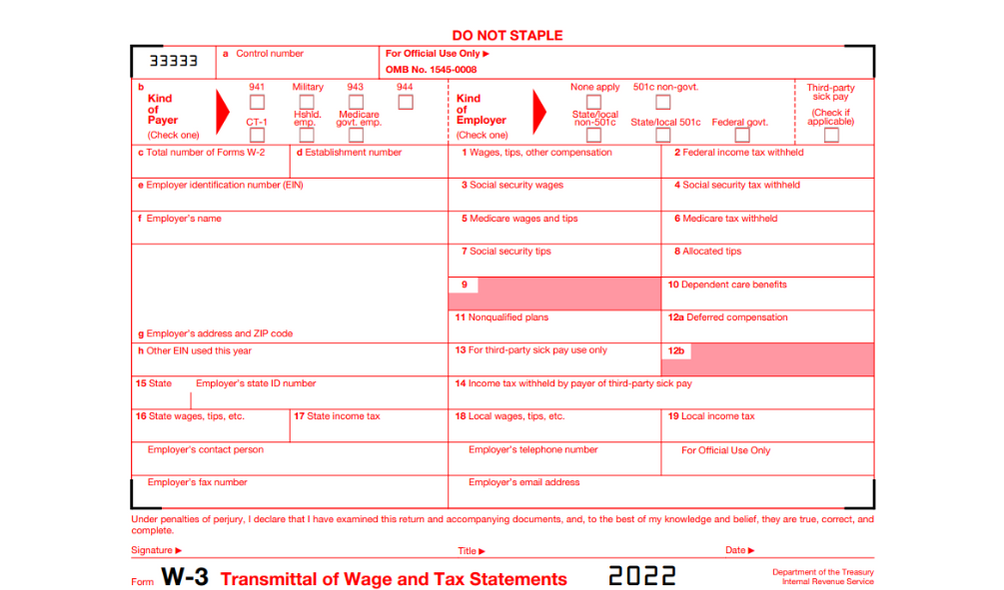

What’s included in Form W-3?

Fundamentally, the W-3 form presents all the information of the employers in the form of an overview document. It essentially summarizes the data and includes the following:

- Wages, tips, and other compensation

- Allocated tips

- withheld Federal income tax

- withheld State income tax

- withheld Social security tax

- Wages and tips taxable under social security tax

- Wages and tips taxable under Medicare taxes

- withheld Medicare tax

- Benefits for Dependent care

- Compensation deferred

- Nonqualified plans

We must note that there is no payment made when filing the W-3 form. The only thing to be noted is to ensure that the corresponding W-2 forms accompany filing W-3.

Timely Filing of W-3 Forms

Timely filing of W-3 forms is essential as it is important to provide accurate payroll data to the SSA and the IRS. When filing, the employer or the tax preparer should include a copy of all their employees' W-3 forms with the respective W-2 forms. They must report last year's information by January 31 of the current year. Late filers may still file, but they will likely be penalized.

The filing of W-2s and the W-3 forms presents a summary of all employee earnings and payments for the previous year. No matter how you file (electronic or mail), the deadline remains unchanged: January 31.

It coincides with the deadline for providing employees a copy of their W-2 form by January 31 every year. W-2 forms should therefore be completed and sent to employees by the deadline. They must also ensure delivering Copy A of the W-2, along with the W-3 summary document, by January 31.

The SSA's website allows employers to submit W-2 and W-3 forms electronically. If a business wants to file manually, it can obtain a copy of the form from the IRS website. Whether it submits electronically or by mail, we must postmark it no later than January 31.

Unless an employer has provided a written waiver, the IRS requires businesses filing more than 250 W-2 forms to submit them electronically. Businesses can easily and quickly file IRS forms online by using various IRS resources that help employers file electronically.

Information Needed to Complete the W-3 Tax Form

Having the following elements ready will make the process more convenient for you. To complete Form W-3, the information required includes the following:

- Company’s name

- Federal Employer Identification Number, known as EIN or FEIN

- Mailing address

- Payroll records including Payroll registers, employees, gross wages, taxes, deductions, net wages

- W-2 forms

We suggest you tally and verify your Form-2 data with your payroll records to avoid errors and ensure accurate filing.

Form W-3 Instructions

These instructions will help you fill out your forms with a lot of ease, although the procedure is quite effortless. Follow closely what all you need to fill in each of the boxes:

How to File

While the SSA recommends e-filing, it accepts both e-filed and mailed Forms W-3 and W-2.

You have a few options when it comes to completing Form W-3:

- Online filing with Business Services Online (BSO)

- Mail Form W-3 and W-2 forms

- Use payroll or tax software

Online Filing With BSO

While using BSO, W-3 forms are automatically pre-populated based on the data from Form W-2. This process is ideal for small businesses that do not comprise more than 50 employees.

Here are the steps you need to follow in this process:

- Use your email address to register for BSO

- Fill out and submit a maximum of 50 W-2 forms

- Make sure the information on Form W-3 is correct

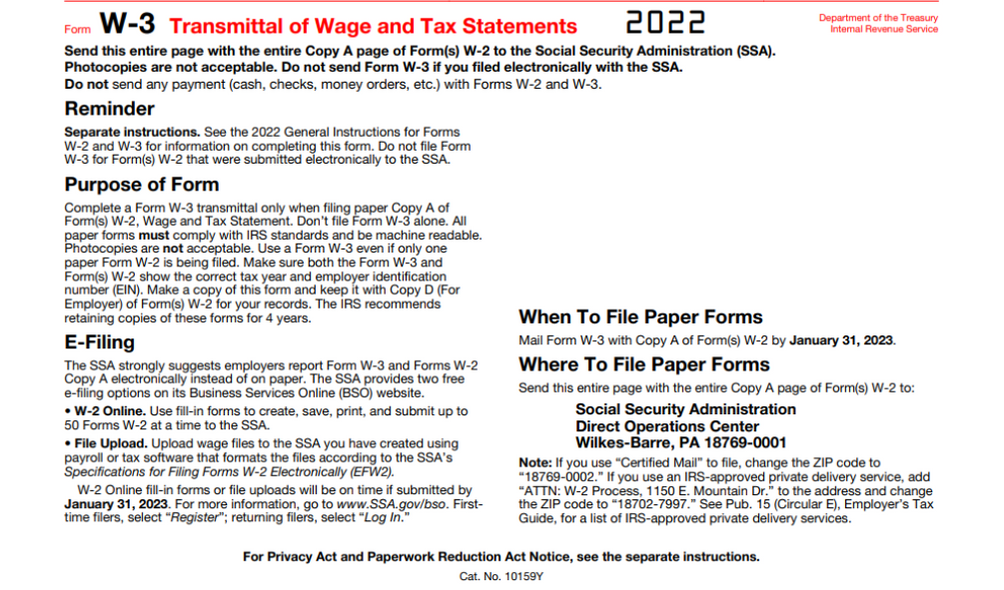

Mail Form W-3

The businesses that choose to file it through the physical W-3 forms, must send their forms to the address:

Social Security Administration

Direct Operations Center

Wilkes-Barre, PA 18769-0001

However, the physical filing of Form W-3 often tends to create confusion in context to its A-B boxes. Let's look at a description of the two:

Box A

- Control number: Although meant for optional use, control numbers can be helpful to businesses with more than one Form W-3 and over 50 employees. Using it allows for tying the Form W-2 of a particular individual to the Form W-3.

Box B

- Kind of Payer: Employers filing the form 944 can choose 944, else choose 941

- Kind of employer: Check 'none apply' in the case you are a non-profit organization or federal government business

Most of the remaining data can be copied from W-2 forms to W-3 forms. Attach Copy A of the Form W-2 to each Form W-3 once you have completed filling.

Use tax or payroll software

If yours is a business that comprises over 50 employees, you can simplify the process by using one payroll software. The software will help you upload numerous W-2 forms and tax forms on Business Services Online.

Due Dates

Along with Forms W-2, Forms W-3 are due by January 31 each year. In the case that January 31 falls on a weekend, the deadline is pushed to the following business day. The deadline applies to both paper and electronic filing.

Fixing Form W-3 Errors

We must be mindful and avoid errors while filing important forms as these could have dire consequences. Fill out the forms only when you have all the resources and accurate information at hand. Yet, if you still discover that there has been an error in your form W-3, you must use form W-3c which is the form for Transmittal of Corrected Wage and Tax Statements.

The IRS analyzes the types of errors to determine the corresponding penalties:

Incorrect Information: This includes entering an incorrect name, taxpayer’s ID number, amounts of money

Genuine or reasonable errors: This includes errors that are not intended or the ones that happen without your knowledge. A computer calculation error is an example of this.

Inconsequential errors: These errors do not really matter but are considered errors, after all. However, such errors do not hinder your filing process.

IRS Penalties

Now that we know of the several categories of errors, let’s also learn about the penalties. An intentional error may attract penalties of $50 per W-2 form. Also, smaller enterprises may be charged with lower amounts of penalties.

- Small businesses may attract a maximum fine of $187,500; for others, it could be $536,000 per year.

- The fine increases to $100 if you file between 30 days after the due date and August 1, with a maximum fine of $1,609,000, or $536,000 in case of a small business.

- By not filing forms by August 1, small businesses will be fined $1,072,500 a year, and other businesses will be fined $3,218,500.

Businesses with gross receipts of under $5 million are classified as small.

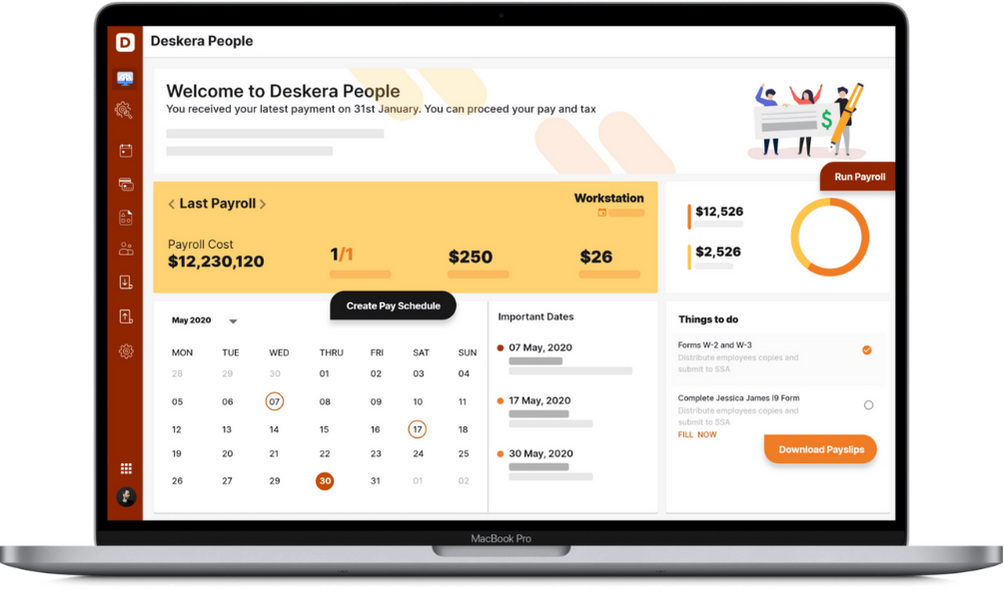

How can Deskera Help You

Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

Let’s take a look at the major highlights regarding Form W-3 here:

- W-3 form, also known as Transmittal of Wage and Tax statements form, presents a summary of wages of all the employees along with the contributions made for the previous tax year

- In order to report the wages and taxes of the employees for the previous year, employers are required to send to the Social Security Copy A of Forms W-2

- Each employee must also receive a Form W-2 from the employer. With each W-2, Social Security receives a W-3 which is Transmittal of Income and Tax Statements

- The employer must file a Form W-2 for each employee from whom when the employee claims no more than one withholding allowance or does not claim exemption from withholding on Form W-4, income tax is withheld

- The W-3 allows the Social Security Administration to verify that all wages were reported for the previous year and that all FICA - Federal Insurance Contributions Act taxes were paid

- The IRS issues W-2 forms to employees and they prepare their taxes for the previous year with the hope of a refund

- The deadline for businesses to provide staffers with their W-2 forms is January 31 of every year

- W-3 form brings together the W-2 information of multiple employees and reports it as a single form

- Fundamentally, the W-3 form presents all the information of the employers in the form of an overview document

- When filing, the employer or the tax preparer should include a copy of all their employees' W-3 forms with the respective W-2 forms. They must report last year's information by January 31 of the current year

- The SSA's website allows employers to submit W-2 and W-3 forms electronically. If a business wants to file manually, it can obtain a copy of the form from the IRS website. Whether it submits electronically or by mail, we must postmark it no later than January 31

- Company’s name, Federal Employer Identification Number, mailing address, payroll records including Payroll registers, employees, gross wages, taxes, deductions, net wages, W-2 forms is the information needed to complete W-3 form

- Online filing with Business Services Online (BSO), mailing Form W-3 and W-2 forms, or using payroll or tax software are the 3 methods through which you can file forms W-2 and W-3

Related Articles