Employers seeking to enrich their employees' lives with personalized benefits have certainly heard of voluntary benefits. As a matter of fact, most employers offer voluntary benefits as they tend to fit the employees’ requirements and lifestyles along with the added benefit of enhancing their rewards package.

Voluntary benefits work both ways as they are advantageous for employees as well as employers. When the employees receive any additional service or product apart from the traditional benefits, this improves their retention, loyalty, and engagement towards the company. But what exactly are voluntary benefits?

This article provides an insight into the concept of voluntary benefits and the various aspects associated with it.

Here is what we shall learn:

- What are Voluntary Benefits?

- Advantages of Offering Voluntary Benefits to your Employees?

- Limitations of Voluntary Benefits

- Determine Which Voluntary Benefits to Offer

- Examples of Voluntary Benefits

- Are voluntary benefits taxable?

- How can Deskera Help You?

- Key Takeaways

What are Voluntary Benefits?

Employers offer products or services at a discounted rate to the employees but these products are paid for by the employees through payroll deductions; such benefits or services or products are termed Voluntary Benefits.

There are various traditional benefits offered to the employees such as health insurance and retirement plans. Voluntary benefits are offered in addition to these traditional benefits and the employer bears no direct cost.

Advantages of Offering Voluntary Benefits to your Employees?

While businesses must understand that offering these benefits comes at a very inexpensive rate for them, the voluntary benefits hold a lot of significance for the employees. Moreover, offering these benefits is a great way to keep employees retained and involved with the company.

There are numerous benefits both employers and employees can receive from this. Let’s take a look:

Limitations of Voluntary Benefits

We have known about the limitations that most of the traditional benefits have. Likewise, voluntary benefits also contain specific restrictions. Let’s observe them in the following table:

Determine Which Voluntary Benefits to Offer

Your company can determine the best offer to make to your employees in a variety of ways. To achieve this, it is recommended you identify the employees’ requirements. Aside from this, as an employer, you must also figure out and assess the providers and their benefits. Furthermore, you must also review the aspects that are covered by the traditional and voluntary benefits.

In order to successfully determine the type of benefits you should offer, you can ask the following questions:

- What are the advantages and disadvantages of our current benefits plan?

- In what ways is HR focused on achieving its goals?

- How valuable are the benefits to our employees' demographics?

- Will our employees see the value in these benefits and utilize them?

- Do these benefits help our company fulfill any legal obligations?

- Are there any current or upcoming laws that might impact traditional or voluntary benefits?

While working on this data may seem taxing, the end result will prove to be fruitful for both the business and the employees. If both the parties can reap the advantages of the voluntary benefits, then the entire exercise shall be worth the try.

Examples of Voluntary Benefits

Voluntary benefits can be organized into 7 general categories. Let’s look at them here:

- Health: Generally includes critical illness, disability insurance, accident insurance, emergency transportation to hospital insurance, Telehealth insurance

- Vision: Includes laser eye surgery, lenses, eyeglasses

- Dental: This includes dental procedures like tooth extraction, crowns, dentures, and so on

- Financial: This benefit aims at assisting employees in managing their finances and includes financial planning, tax help, student loan repayment services

- Wellness: This benefit offers lifestyle and wellness services to employees at discounted rates; introduces programs like gym memberships at reduced prices

- Personal: The personal benefits include any benefits that would add value to employees’ lives and would improve the retention rate for the employer. Employers can offer flexible working hours, pet insurance, remote working, and so on under this category

- Security: Benefits under this include term life insurance and identity theft protection

Are Voluntary Benefits taxable?

Some voluntary benefits are pre-tax and some are post-tax based on the type of the benefit. Pretax contributions can be taken from the employee's paychecks for some benefits. In this case, remember that some benefits you provide will result in employees paying taxes on them, if and when they use them.

Section 125 cafeteria plans generally cover most of the employee benefits pre-tax. Examples of pre-tax voluntary benefits are:

- Adoption assistance programs

- 401(k) contributions

- Long-term and short-term disability coverage

- Employer-sponsored accident and health plans (which includes FSAs and accidental death and dismemberment policies)

- Dependent care assistance programs

- HSA contributions

- Group term life insurance ( of up to $50,000)

How can Deskera Help You?

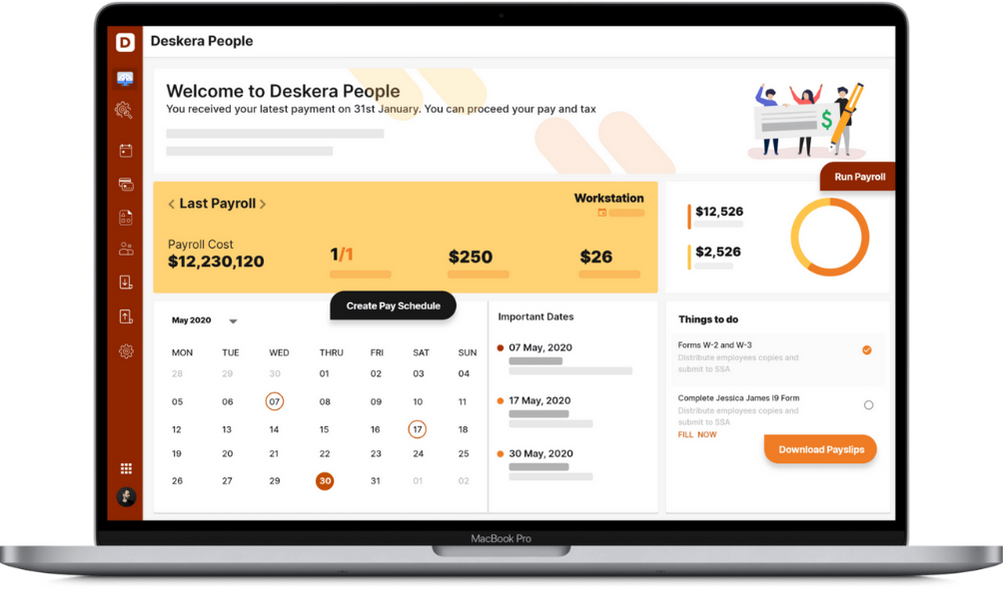

Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

Important points to learn from this article are as follows:

- When the employees receive any additional service or product apart from the traditional benefits, this results in improving their retention and loyalty, and engagement towards the company

- The employer offers products or services at a discounted price to the employee, but the employee pays for the products with payroll deductions; such benefits or services or products are termed Voluntary Benefits

- There are various traditional benefits offered to the employees such as health insurance and retirement plans

- offering these benefits is a great way to keep employees retained and involved with the company

- Voluntary benefits offer advantages like enhancing employee retention, enhancing company’s competitiveness, no direct costs to the employers

- Voluntary benefits offer advantages to employees in ways including acting as financial protection, being pre-tax deductible, available discounts owing to group rates, etc.

- Employees can enroll for voluntary benefits only through their employers

- There are age limits that apply while enrolling for the benefits

- Some voluntary benefits have policies that have a minimum age requirement

- Independent contractors cannot participate in these policies

- For remote workers and part-time workers, the benefits policy levies a minimum hour requirement to be eligible to enroll

- Identifying the employees’ requirements is a way to determine which benefits you can offer

- Finding answers to questions like what are HR goals, how valuable are the benefits to the employees' demographics, can help arrive at deciding which policies to offer

- Health, vision, dental, wellness, financial, personal, security are some of the examples of voluntary benefits commonly offered

- Some voluntary benefits are pre-tax and some are post-tax based on the type of the benefit

- Section 125 cafeteria plans generally cover most of the employee benefits pre-tax

- Pretax contributions can be taken from the employee's paychecks for some benefits. In this case, remember that some benefits you provide will result in employees paying taxes on them, if and when they use them

Related Articles