If you have workers, you must pay them a wage for work. Payroll is the regular payment of wages to employees and withholding the appropriate amount for taxes, insurance premiums, or retirement plan contributions. Payroll tax management is complex, but it is a legal necessity to manage payroll taxes.

Virginia has an increasing state income tax with no municipal taxes, and its human resources rules typically adhere to federal principles. However, you must continue to pay strict attention to your payroll process to avoid errors.

So, if you're searching for a short and easy-to-understand introduction to payroll, you've come to the correct spot.

Table of Content

- Virginia Payroll Laws, Taxes & Regulations

- 1. Virginia State Taxes

- 2. Income Taxes

- 3. Employer Unemployment Taxes

- Workers' Compensation

- Virginia Minimum Wage Laws

- Virginia Overtime Provisions

- How to Pay Payroll Taxes in Virginia?

- Step-1: Establish your company as an employer

- Step-2: File a business registration with the state of Virginia

- Step-3: Design your payroll procedure

- Step-4: Have staff complete the necessary forms

- Step-5: Go over timesheets and approve them

- Step-6: Determine the employee's gross compensation and taxes

- Step-7: Pay employee salaries, benefits, and taxes

- Step-8: Make a backup of your payroll records

- Step-9: Submit payroll tax returns to the federal and state governments

- Step-10: Finish your year-end payroll reports

- Paying Employees

- Bottom Line

- Frequently Asked Questions

- What are the Child Labor Laws in Virginia?

- Do I need to file Form W-4?

- What are the requirements for Virginia New Hire Reporting?

- How Can Deskera Assist You?

- Key Takeaways

Let's start!

Virginia Payroll Laws, Taxes & Regulations

Payroll management entails more than just paying workers for their time. It also entails calculating Virginia payroll taxes and following all the provincial and federal labor rules. Examine Virginia's applicable laws below to help you stay in line with payroll requirements.

With a few caveats, most businesses in the United States need to pay FICA taxes. The FICA tax rate for Social Welfare is 6.2 percent, while the Medicare taxation is 1.45 percent. Both the business and the worker will be responsible for these expenditures, contributing 7.65% of the overall Social Security and Medicare payments.

Virginia payroll taxes have three elements:

1. Virginia State Taxes

Virginia, like other states, has a set of taxes that employers must pay and withhold from employees' paychecks. Employees in Virginia are not subject to municipal taxes.

2. Income Taxes

Virginia has a progressive tax. Here are the four tax rates that all Virginia workers are subject to.

|

Tax Rate |

Income |

|

2% |

$0 to $3,000 |

|

3% |

$3,001 to $5,000 |

|

5% |

$5,001 to $17,000 |

|

5.75% |

$17,001 and up |

If you're handling payroll by hand and need to figure out how much you need to withhold for each employee, the State of Virginia's withholding tax guide can help.

3. Employer Unemployment Taxes

All companies need to file State Unemployment Tax Act taxes. The current salary base is $8000, with rates ranging from 0.1% to 6.2%. The majority of new Virginia firms will pay a SUTA rate of 2.5 percent. Businesses that pay SUTA in full and on time are eligible for a 5.4 percent tax credit on their FUTA taxes.

Workers' Compensation

Every employer in Virginia with one or more employees needs to have workers' compensation insurance. Workers' insurance compensates injured employees by covering the costs of medical care and lost pay. In addition, you can opt to get pay-as-you-go insurance, which calculates your workers' compensation payable based on your current payroll levels; this ensures you don't have to play catch-up at the end of the year.

Virginia Minimum Wage Laws

Virginia's minimum wage is greater than the federal standard of $7.25 per hour. All firms in Virginia need to pay their employees at least $9.50 per hour. Companies must pay at least $2.13 per hour to tipped workers if their tips bring them to the hourly minimum wage. Otherwise, the corporation must make up the difference.

Virginia Overtime Provisions

The overtime restrictions in Virginia follow the FLSA. All companies are required under the FLSA to pay employees 1.5 times their usual hourly salary for hours worked more than 40 in a workweek.

How to Pay Payroll Taxes in Virginia?

Here's a quick primer on how to conduct payroll in Virginia.

Step-1: Establish your company as an employer

New businesses need to use the federal Electronic Federal Tax Payment System (EFTPS) to get the latest Federal Employer Identification Number (FEIN). To file federal taxes, you must have your FEIN.

Step-2: File a business registration with the state of Virginia

When starting a new firm, you must register on the Virginia Secretary of State's portal. Additionally, any firm that pays workers in Virginia needs to enroll with the Virginia Department of Revenue.

Step-3: Design your payroll procedure

If your company is new, you must create a payroll process from the ground up. You'll need to establish when and how often you'll pay staff and what payment options you'll provide.

Step-4: Have staff complete the necessary forms

During the onboarding process, you must have each employee complete payroll documents. In addition, every employee is required to undergo I-9 verification. New workers must also have a completed W-4 and, if applicable, direct deposit authorization on file.

Step-5: Go over timesheets and approve them

You must collect timesheets many days in advance to conduct payroll correctly. Reviewing your nonexempt workers' timesheets allows you to talk with anyone if they have made a mistake.

Step-6: Determine the employee's gross compensation and taxes

We do not suggest calculating Virginia payroll taxes by hand. Tax computations can get complicated, and even minor errors can lead to heavy fines. However, you may use payroll software, a calculator, or even Excel to perform basic calculations.

Step-7: Pay employee salaries, benefits, and taxes

Direct transfer is the best method of paying your staff. However, cash and paper cheques are also viable possibilities. If you use a service like Deskera, the firm should work with you to ensure simple, automated, and digital deductions.

Step-8: Make a backup of your payroll records

Keeping business documents for your organization is a wise habit. For example, businesses in Virginia need to retain a record of all hours worked and earnings paid to each employee for at least three years, including their name, address, and date of birth.

Step-9: Submit payroll tax returns to the federal and state governments

You must pay all the Virginia state taxes to the appropriate state agency on the due date. The due date is quarterly and can be done online at the Virginia State Tax Commission website. You can pay federal taxes online using the EFTPS on a semi-weekly or monthly schedule.

Step-10: Finish your year-end payroll reports

Payroll in Virginia entails more than merely paying employees regularly. Every year, you must file payroll reports, which contain all W-2 forms and 1099 forms. You must distribute these forms to workers by January 31 of the following year.

Paying Employees

You need to pay a daily worker in Virginia by law at least twice per month. You must pay salaried Employees at least once a month. Whatever pay schedule you pick, be sure you stick to it and don't modify it on the spur of the moment.

Virginia also permits you to pay employees in:

- Cash

- Paper

- Direct deposit after written notice

- Payroll card, only if permitted in writing by the employee

Bottom Line

Virginia has a progressive state tax, but there are no local taxes. While most Virginia payroll standards follow federal principles, recognizing the variances is critical to ensuring that payroll and payroll taxes are calculated appropriately.

Frequently Asked Questions

What are the Child Labor Laws in Virginia?

Workers aged 16 and up are not subject to any limitations. However, 14 and 15 years old children must get an employment certificate under Virginia law. Minors can only work between 7 a.m. and 7 p.m. during the school year, not during school hours, for three hours each school day, and no more than 18 hours per week. Minors may work up to eight hours in a day and 40 hours per week during non-school weeks.

Do I need to file Form W-4?

Form VA-4 is the only payroll form used in Virginia. This is the state equivalent of the federal W-4 form.

What are the requirements for Virginia New Hire Reporting?

Every company in Virginia needs to report new hires and rehires to the Virginia New Hire Reporting Center within 20 days of the employee's first day of work. This information, which must contain the employee's name, address, and Social Security number, is used to enforce child support obligations.

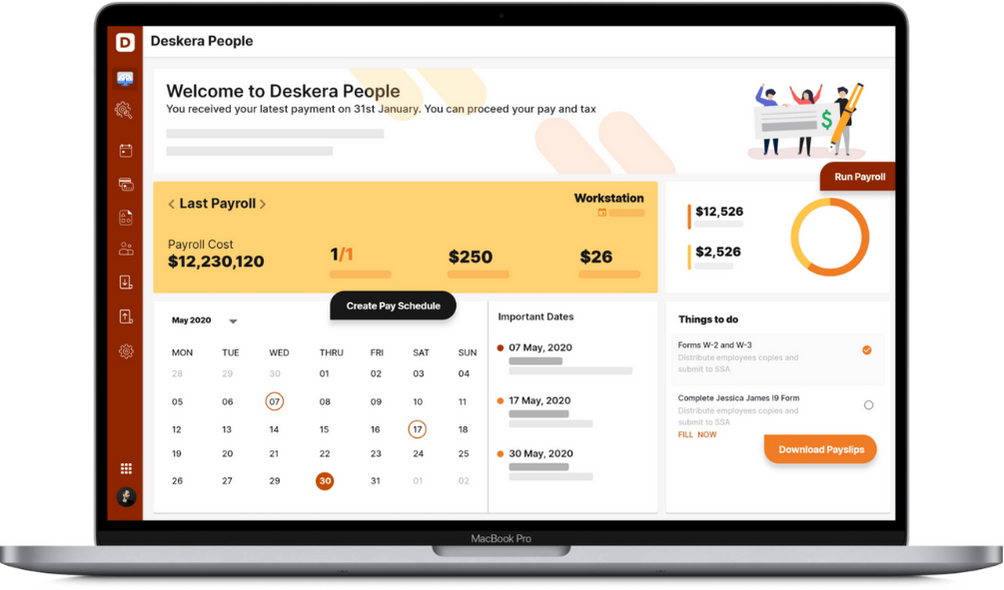

How Can Deskera Assist You?

As a business, you must be diligent with employee leave management. Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating payslips for your employees is now easy as the platform also digitizes and automates HR processes.

Deskera People make it simple to handle attendance, leave, payroll, and other processes so that you can focus on growing your business. For example, creating payslips for your employees is now simple since the platform also automates and digitizes HR tasks.

Key Takeaways

- Payroll in Virginia is more complicated than in many other states. Virginia has a progressive tax, making calculating the withholding amount from employee paychecks hard.

- Payroll in Virginia necessitates the calculation of Virginia payroll taxes and adherence to all federal and state employment rules.

- Most employers in the United States need to pay FICA taxes. The current FICA tax rate for Social Security is 6.2 percent, while the Medicare tax rate is 1.45 percent.

- There are three main components of Virginia Payroll Taxes:

- Virginia State Taxes.

- Income Taxes

- State Employer Unemployment Taxes (SUTA)

- Virginia's minimum wage is $9.50/hour.

- The overtime regulations in Virginia work on the FLSA, which requires all companies to pay employees 1.5 times their usual hourly salary for hours worked more than 40 in a workweek.

- How to Do Payroll Taxes in Virginia:

- Establish your company as an employer.

- File a business registration with the state of Virginia.

- Design your payroll procedure.

- Have staff complete the necessary forms.

- Go over timesheets and approve them.

- Determine the employee's gross compensation and taxes.

- Pay employee salaries, benefits, and taxes.

- Make a backup of your payroll records.

- Submit payroll tax returns to the state govt. and federal.

- Finish your year-end payroll reports.

- You need to pay a daily worker in Virginia by law at least twice per month. You must pay salaried Employees at least once a month.

- The state of Virginia has a progressive income tax and no local taxes

Related Articles