Wondering if Veterans’ day will affect your direct deposit and how you can handle it, then this post will direct you towards the measures you can adopt to handle it.

Whether your business pays its employees weekly, bimonthly, monthly, or fortnightly, chances are that sooner or later, the scheduled payday for your business will fall on a bank holiday or weekend. Don't freak out if something happens; you still have options. To make it easier for you to manage holiday and weekend paydays, we've broken out all the payroll holiday rules in this post.

Let’s walk through the points we shall be discussing here:

- What is a Direct Deposit?

- Why do Federal Holidays matter?

- When are Bank Holidays or Federal Legal Holidays?

- How to Handle Payroll when it falls on or around a bank holiday?

- How can I pay Employees on Time?

- Tips to Carryout Flawless Payroll Process during a Bank Holiday

- How can Deskera Help You?

- Key Takeaways

What is a Direct Deposit?

Direct deposit is the term used to describe the electronic deposit of money into a bank account as opposed to a physical, paper check. Utilizing an electronic network, Automated Clearing House, that enables deposits to be made between banks is necessary for direct deposit. You do not have to wait for the cash to settle because electronic cash transfers automatically credit recipients' accounts. Paychecks, tax refunds, and other perks are frequently deposited using direct deposit.

Why do Federal Holidays matter?

The majority of transactions cease entirely during bank holidays. The term – bank holiday – refers to a working day on which banks and other financial institutions are closed in observance of a public holiday, such as Veterans’ Day, Memorial Day, Martin Luther King Jr. Day, or Thanksgiving. The Federal Reserve sets and recognizes bank holidays in advance.

Banks are unable to process or transfer funds on the day of your planned payroll if they are closed for a holiday or the weekend. There will be fewer open banks and credit unions. Since they are closed during certain periods, many of them will suspend all forms of payment processing. Rarely, banks will remain open during the holidays but payment processing through the Federal Reserve System won't be possible. All payments or transactions will therefore be put on hold until the following business day.

Payroll consistency is mandated by federal and state labor regulations. Additionally, several states have regulations governing pay frequency that dictate how frequently employees must be paid. Some even get paid twice per month. You must pay employees in advance if a payday that coincides with a bank holiday puts your company's ability to comply with state rules governing pay frequency in jeopardy. Not to add, according to the payroll calendars maintained by the U.S. General Services Administration, workers receive their pay the day before a holiday.

Unlike in the yesteryears', today, many banks are open on holidays which enables employees to deposit checks and cash them. However, we must understand that even if a bank is open, there is no practical money movement if the Federal Reserve is closed. This leads to the deposits being temporarily blocked.

Direct deposits are made electronically. However, because the Automated Clearing House or the ACH abides by the same regulations as the reserve, they cannot be handled on holidays. The ACH is a network of electronic payment systems used in the US for tax payments, business payments, and direct deposit of paychecks. The other financial operations it includes are the consumer bills and Social Security, besides other operations.

Now, when there is no clearance, your employees won't receive their direct deposits on holidays. This makes it imperative for you to double-check the accuracy of your next planned check date. Furthermore, you may amend it to take into account the holiday.

To ensure you plan and handle it well, learn about the Federal holidays that the country observes each year. Let's check them in the next section.

List of Bank Holidays or Federal Legal Holidays?

The ACH, financial institutions, and the Federal Reserve System all observe the same holidays.

The table below presents the federally recognized holidays that are observed by banks.

If you are aiming to pay your employees on time, you need to be aware of the dates on which the various bank holidays fall in the year. The following table summarizes the dates for each event:

How to Handle Payroll when it falls on or around a bank holiday?

You have just observed that the payday will be coinciding with veterans day. How do you plan to handle your payroll in such a scenario and prevent delays?

We shall be going through some simple steps in which the employers can handle payroll in one of three ways when a payday falls on or close to a holiday. You may choose any of the following options:

Carry out payroll as usual: After the holiday, you conduct payroll as usual, and employees are paid just the way they are usually paid.

Pay employees earlier: Employees get paid a day earlier so that the holiday doesn't interfere with the payroll.

Speed up the procedure: You carry out payroll as usual, and since you paid the expedite costs, employees received their paychecks prior to the holiday.

Employers are free to choose any policy they wish or the one that best suits their business. Just make an effort to maintain consistency to prevent miscommunication between your payroll department or HR personnel and employees.

Your processing timelines may also be impacted by an earlier or later payroll date, so be sure to monitor them. The importance lies in letting your staff know the new payday date. Work with your third-party payroll processor to define your processing timeline if you use one.

How can I pay Employees on Time?

You have two choices if you wish to pay employees on time. You can process the payroll a day earlier or you may seek to expedite the payroll process. You will need to examine both procedures and also evaluate the timing of direct deposit in each scenario.

Here is how both the options may roll out for you:

Having your Payroll earlier

Let's assume that each week, payday is on Wednesday. In such a scenario, the employer must submit the payroll four working days before your employees' direct deposits are made. They may collect the timesheets on Wednesday preceding payday. The employer turns in the payroll on Thursday. Four days after that, the worker gets their direct deposit.

Therefore, it is recommended to run your payroll one business day earlier than typical if you wish to pay employees before the holiday. The business day before the holiday might be used for employees to get their direct deposit in this manner. Make a direct deposit holiday calendar so you won't forget. Moreover, give each employee a copy of the payday schedule so they are aware of the due dates.

Set alerts to ensure you maintain discipline. In this manner, you are aware of when to gather timesheets and initiate payroll earlier than usual. You may also invest in Some payroll software or services that notify you when there is a bank holiday to further aid you in staying on schedule.

Speeding Up the Process

In order to ensure that workers receive their paychecks on time if you forget that a payday falls on a bank holiday, you could wish to accelerate the procedure. In order to ensure that workers receive their paychecks on time if you forget that a payday falls on a bank holiday, you could wish to accelerate the procedure.

The time it takes to process your paycheck application can be sped up. However, doing this usually means paying more for each direct deposit transaction you wish to be accelerated. You can discuss your choices with your payroll service provider and get to understand how things will turn out eventually.

Tips to Carry out Flawless Payroll Process during a Bank Holiday

We are aware that it can be quite inconvenient when payday occurs on a bank holiday. Follow these suggestions to make sure your payroll process runs smoothly and to discover how to explain your strategy to staff members.

Maintain consistency

Choose when your business will pay employees, whether it's before or after a holiday or weekend, and adhere to that schedule all year long. Switching and turning could make them and your payroll team confused. Make sure your payroll procedure maintains regularity.

Be Specific

Ensure that your workers understand when they will be paid. One week before they expect to be paid, remind them of the most recent modifications to the payment schedule. You can share all the updates and details on your company intranet. You may also provide a payday calendar so that employees know when to anticipate their direct deposits.

Establish a schedule

Develop a payroll schedule with your HR or payroll department at the beginning of the year and give it to your staff. When sharing it with your staff, ensure that all the important changes in payday are well-highlighted when a bank holiday occurs.

Prepare in advance to avoid being caught off guard!

To avoid missing any critical dates or deadlines, use an HR calendar or the appropriate payroll software at the start of the year to keep track of upcoming bank holidays or weekend paydays. By doing so, you can prevent any last-minute unwanted surprises.

Keep on Track

An earlier or later payday than normal could confound you and your staff. Make sure that all employee hours are submitted in time to satisfy your processing requirements if you are running payroll sooner. You'll also need to print checks or submit payroll earlier. To avoid having to track down employees for their timesheets, and running the danger of missing deadlines, send out calendar invites to remind them to turn in their hours.

How can Deskera Help You?

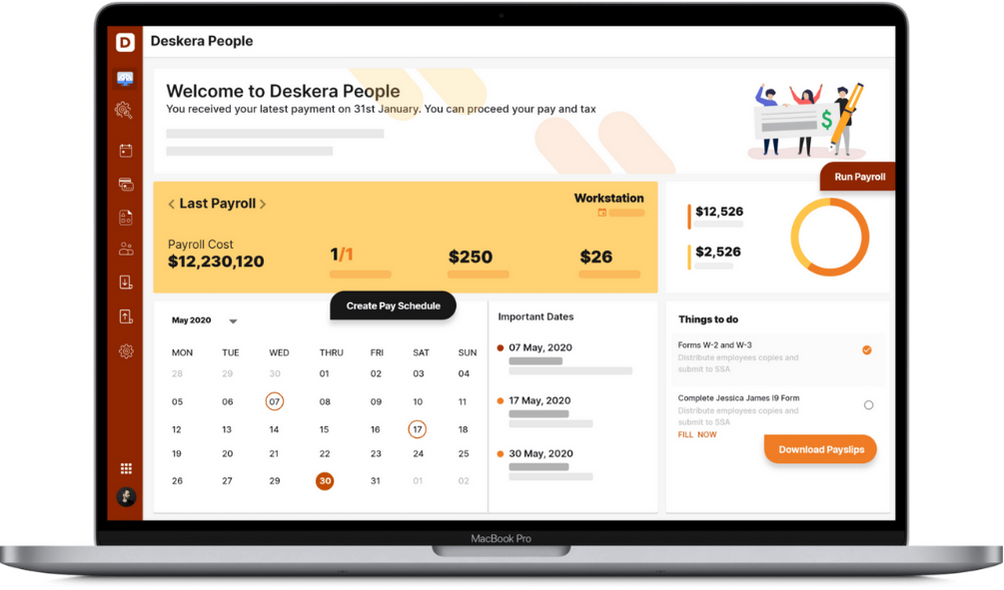

Deskera People has the tools to help you manage your payroll, leaves, employee onboarding process, and managing employee expenses, all in a single system. With features like a flexible payment schedule, custom payroll components, detailed reports, customizable pay slips, scanning, and uploading expenses, creating new leave types, and more, it makes your work simple.

Sign up now to avail more advantages from Deskera.

Key Takeaways

- Instead of using a real, paper check to deposit money into a bank account, you can use direct deposit. It necessitates the deployment of the automated clearing house, an electronic network that enables bank deposits.

- For direct deposit payments, payees must give the payer their banking information or a voided check.

- Direct deposits are frequently used to pay for wages, tax refunds, investment redemptions, and government benefits.

- ‘Bank holiday’ refers to a working day on which banks and other financial institutions are closed in observance of a public holiday, such as Veterans’ Day, Memorial Day, Martin Luther King Jr. Day, or Thanksgiving. The Federal Reserve sets and recognizes bank holidays in advance.

- Banks are unable to process or transfer funds on the day of your planned payroll if they are closed for a holiday or the weekend. There will be fewer open banks and credit unions. All payments or transactions will therefore be put on hold until the following business day.

- Payroll consistency is mandated by federal and state labor regulations.

- Direct deposits are made electronically, however, because the Automated Clearing House or the ACH abides by the same regulations as the reserve, they cannot be handled on holidays.

- The ACH is a network of electronic payment systems used in the US for tax payments, business payments, and direct deposit of paychecks.

- The Veterans’ Day 2022 (November 11) falls on Friday.

- While looking to handle payroll around the time of a bank holiday, you have three options: Carry out payroll as usual, pay earlier, and speed up the process.

- Employers are free to choose any policy they wish or the one that best suits their business. Just make an effort to maintain consistency to prevent miscommunication between your payroll department or HR personnel and employees.

- To ensure you pay your employees on time, you can either pay them a day earlier or speed up the process.

Related Articles