United Arab Emirates (UAE) is a tax-haven for start-ups, medium-sized corporations, and multi-million dollar companies. It has become one of the desired places for businesses to setup their HQs.

Aside from zero personal income tax and zero corporate tax, other benefits of starting your business in the UAE include zero-currency restrictions, various business licenses and activities permitted in the zone, and low import duties.

That's what makes the UAE an attractive place to run your businesses.

Suppose you are looking to start your business, expand, or relocate your business; you can consider the UAE due to its economic stability, investor-friendly, and tax-free regime. Before making your decision, you need to study or understand how the VAT system works in this country.

Read more below to understand better.

What is the VAT rate in the UAE?

Currently, the VAT rate in the UAE is 5% on most taxable goods and supplies.

The VAT-registered businesses will have to collect the VAT amount from their customers on behalf of the government. Hence, the consumers will have to bear the VAT cost.

What are the zero-rated products?

Not all products or services are subject to the VAT standard rate - 5%.

Some business activities that supply zero-rated goods and services charge VAT at 0%.

The zero-rated supplies include:

- Export of goods and services outside the Gulf Cooperation Council (GCC)

- International transportation, or any supply of sea, land, and air as a means of transportation

- Supply of investment-grade precious metals such as silver, gold, and platinum

- Residential new estate

- Supply of education services and healthcare services

Keep in mind that you must show the tax column even though it has zero value when you're generating an invoice for zero-rated supplies.

Note: You can claim the tax credit for zero-rated supplies.

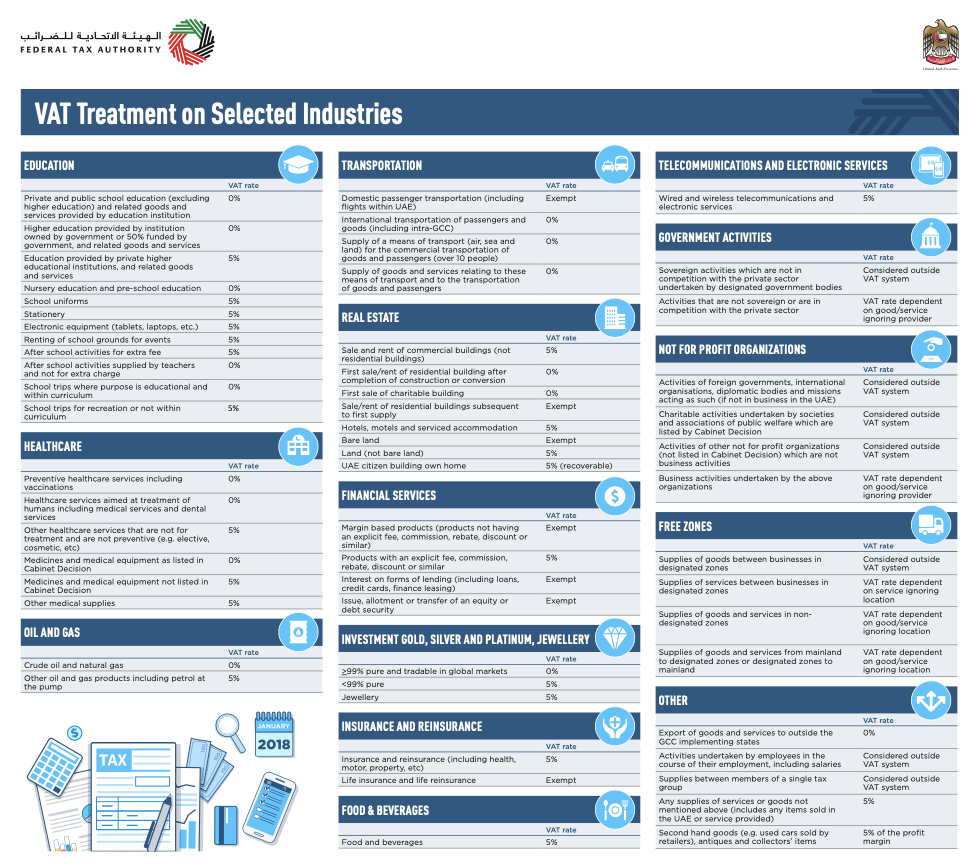

If you wish to find out more about the VAT rate for different industries in the UAE, do refer to the screenshot above.

What products are tax-exempt?

Tax-exempt supplies are the supplies that are free from VAT. So, do not confuse this with zero-rated supplies. Zero-rated supplies do attract VAT at 0%, whereas tax-exempt supplies are VAT-free.

Listed below are the categories of supplies that are VAT-free:

- Some financial services (clarified in VAT legislation) such as life insurance

- Residential properties

- Bare land

- Local passenger transport

Note: You cannot claim any input tax for tax-exempt purchases, even if the supplies are for business use.

What is Gulf Cooperation Council (GCC)?

After reading the VAT rate for zero-rated and tax-exempt supplies in UAE above, let us briefly explain GCC in this section.

GCC stands for Gulf Cooperation Council, an economic and political alliance between the 6 Kingdom of the Middle East - Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates.

Established in May 1981 in Saudi Arabia, the goal of GCC is to help the members in these territories unite in achieving their common objectives due to their similar political and cultural creeds.

If you have business transactions with any territory listed in GCC, you must note how the tax treatment works.

As of date, only the UAE and the Kingdom of Saudi Arabia have implemented the VAT regime.

Therefore, any export from the UAE to the GCC territories is considered zero-rated supplies, except export made to Saudi Arabia.

What is a designated zone in the UAE?

Also known as the free zone, the designated areas in UAE are treated as the territories outside the UAE for VAT purposes.

Although you might think that any supplies made in the designated zones are VAT-free, that is not always the case.

Not all free zones exclude VAT; only certain free zones listed in a cabinet decision have special restricted regulations for VAT.

What are the criteria to be classify as free zone?

Not all supplies in the free zones are considered VAT-free. VAT still applies for some supplies of goods and services.

Although you might argue that your business operates under the designated zone, you still need to ensure if you fulfill the following criteria.

Stated below are the criteria listed by the Federal Decree-Law on VAT and Executive Regulations for your business to be treated as outside the territory of the UAE:

- Your zone has to be in a fenced surrounding.

- It must have its security protocol and custom control unit for tracking and monitoring the movement of any person and goods in and out of this area.

- There are well-defined rules and regulations for storing, retrieving, and processing the inventory within this area

- An operator in charge of the zone must abide by all the rules and regulations provided by the Federal Tax Authority (FTA)

What are the list of designated zones?

As per Cabinet decision No. 59, listed below are the free zones a.k.a designated zones in the UAE.

You can refer to the table below.

VAT Treatment for Business Activities in the Designated Zones

You need to check whether you should impose VAT on the supplies of goods and services in the designated zones.

Refer to the scenarios in the table below and check whether if VAT is applicable under different circumstances under VAT regulations.

What is reverse charge mechanism in UAE?

Under the VAT law, the suppliers will collect VAT from the customers and help the customer remit the tax to the Federal Tax Authority (FTA).

However, the supplier doesn't need to collect and remit the tax portion themselves under the reverse charge mechanisms.

So what is a reverse charge mechanism?

A reverse charge mechanism is a VAT treatment whereby the supplier does not charge and collect VAT from their customers. The customers will pay the tax portion directly to the government. The RCM is typically used for cross-border transactions in the UAE.

As a result, the customers will have th record and remit the VAT amount to the FTA. Hence, the responsibility of reporting and paying VAT transactions is shifted from the seller to the recipient.

Why is there a need for reverse charge?

It can be complex and tedious for FTA to track the business transactions of a local business and their overseas' suppliers/sellers.

Under the RCM rules, the recipients of goods in the UAE will have to pay VAT 5% on their overseas purchases. Then, they will have to remit the VAT portion to the FTA.

Thus, it helps to reduce the burden of non-resident suppliers, as they can skip the hassles of registering and remitting VAT to the UAE.

When is reverse charge is applicable?

Under the following conditions below, the reverse charge mechanism applies to you:

- Import of goods and services from the overseas or non-GCC region. These foreign companies must not have a business in the UAE

- Any taxable supply of gold and diamonds

- Any taxable supply of crude oils/refined oil, processes/unprocessed gas or hydrocarbons for resale purposes or production by a registered supplier to the registered recipient in the mainland UAE

- Any purchases of goods from the designated zones to the mainland UAE

How does the reverse mechanism works?

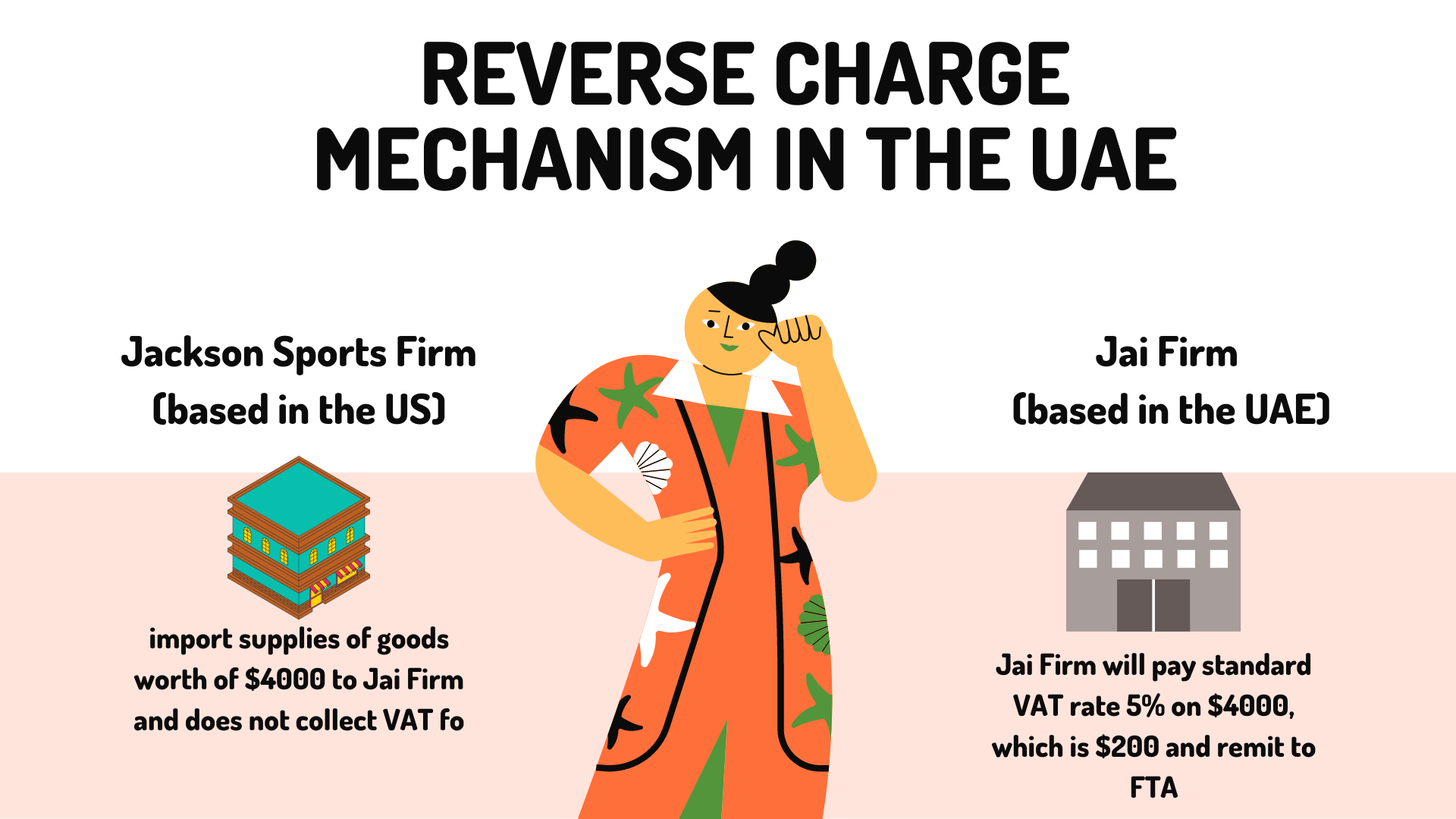

Let us show you an example of how the reverse charge mechanism works.

Jackson Sports Firm is based in the United States, and it's selling sports attire worth $4,000 to Jai Firm, located in the UAE.

Jackson Sports Firm will not charge VAT for its supplies as his business is not registered in UAE.

Under the reverse charge rules, Jackson Sports Firm will not charge and collect VAT when selling goods to Jai Firm as his business is not registered in the UAE.

On the other hand, Jai Firm will bear the VAT 5% - (4000 x 5% = $200) and remit the tax directly to the UAE government.

Also, Jai Firm can recover the input VAT of $200 and adjust this amount against his output tax liability. With the conditions - Jai Firm will have to keep a proper record of the invoicing, receipt vouchers, and refund vouchers as proof to claim their input tax credit.

What is Excise Tax?

The excise duty is an indirect tax levied on certain goods which are harmful to human health or the environment in general, which helps the government raise revenue at the same time.

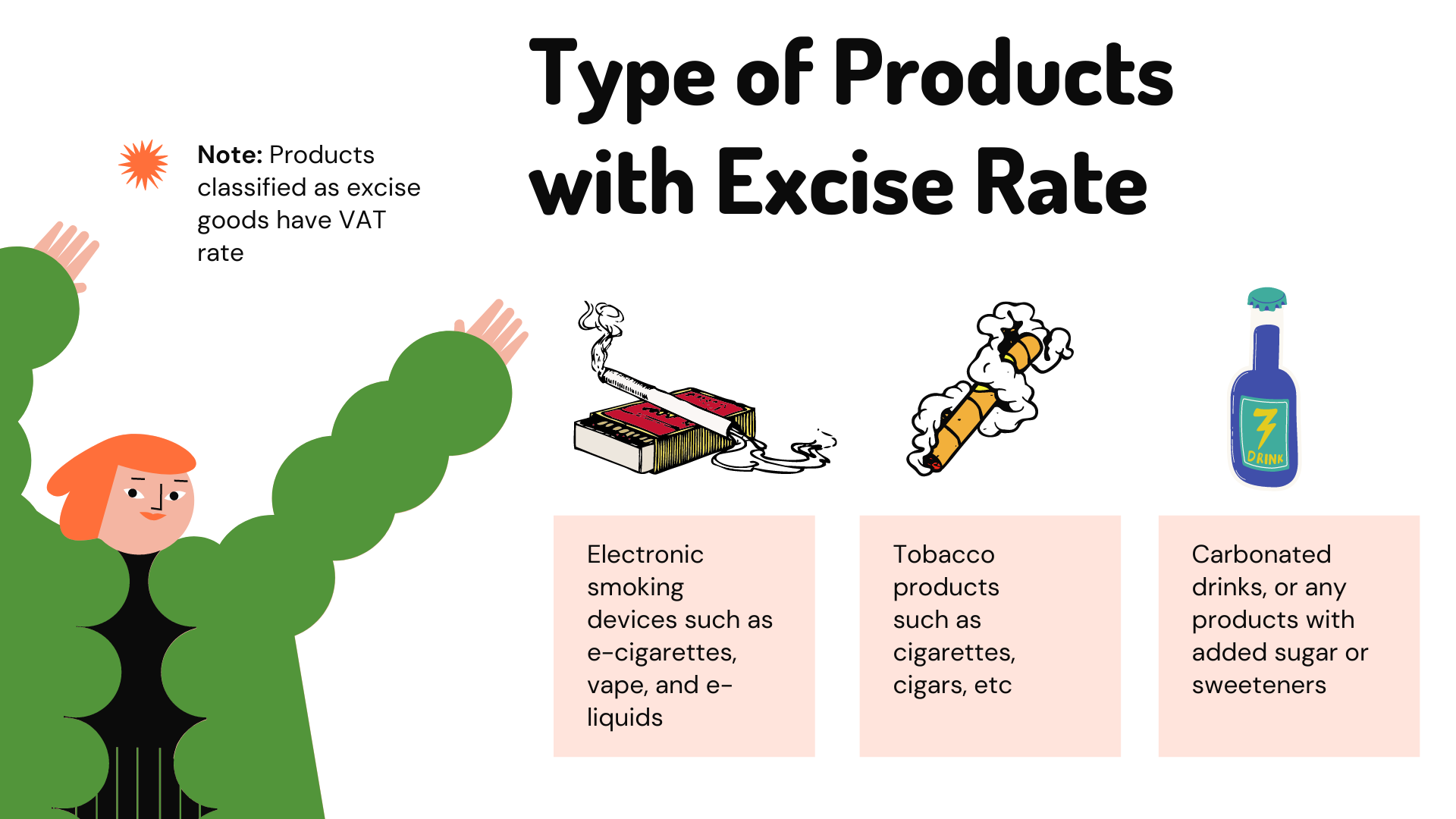

Introduced in 2017, businesses selling excise goods must register and collect a certain amount of excise rate on these goods. And the listed excise goods are:

- Carbonated drinks - aerated beverages such as carbonated drinks of any concentrations, powder, gel, or extracts to be made into an aerated beverage

- Energy drinks - this includes caffeinated beverages, taurine, ginseng, guarana, or other substances with similar effects.

- Tobacco products - cigarettes, cigar, bidis, and kreteks

Excise tax is also levied on the following items such as electronic smoking devices, liquids used in such tools, and sweetened drinks, effective on 1 December 2019.

What is the excise duty rate?

The excise duty rate differ depending on the type of excise goods you’re selling.

According to Cabinet Decision No. 52 of 2019 on Excise Goods, Excise Tax Rates and the Methods of Calculating the Excise Price, the rate of excise tax is as follows.

Refer to the table below.

Who needs to register for an excise tax?

Businesses engaging in the business activities listed below will have to register for excise tax:

- Production of excise goods for the consumption in UAE

- Importers importing excise goods into UAE

- Storage of excise goods in the UAE

- The party involves in overseeing and tracking an excise warehouse or designated zone such as warehouse keeper

How can I register for excise tax?

If your business activities include one of the points mentioned above, you must register for excise tax.

You can register for excise tax online via the e-services section on the FTA website. Before this, please ensure that you have an existing account with FTA to sign up for excise tax.

Also, if you would like to find out more about tax registration, or application, you can contact FTA using three methods:

- through inquiry form

- send an email to info@tax.gov.ae

- make a call to FTA - dial 00 599 994 or 04-7775777

What is excise tax return?

An excise tax return is a form you must submit to the FTA for the excise amount paid during your tax period. There is only one way to file your excise return report that is online - the FTA portal.

Note: FTA doesn't accept a manual excise tax return

When should I file excise tax return?

Excise tax returns should be submitted within 15 days after the relevant tax period. And, the excise payment should be made 15 days after the end of the calendar month.

If the filing deadline falls on a weekend or a national holiday, you can file your excise tax report on the first working day after the holiday or the weekend.

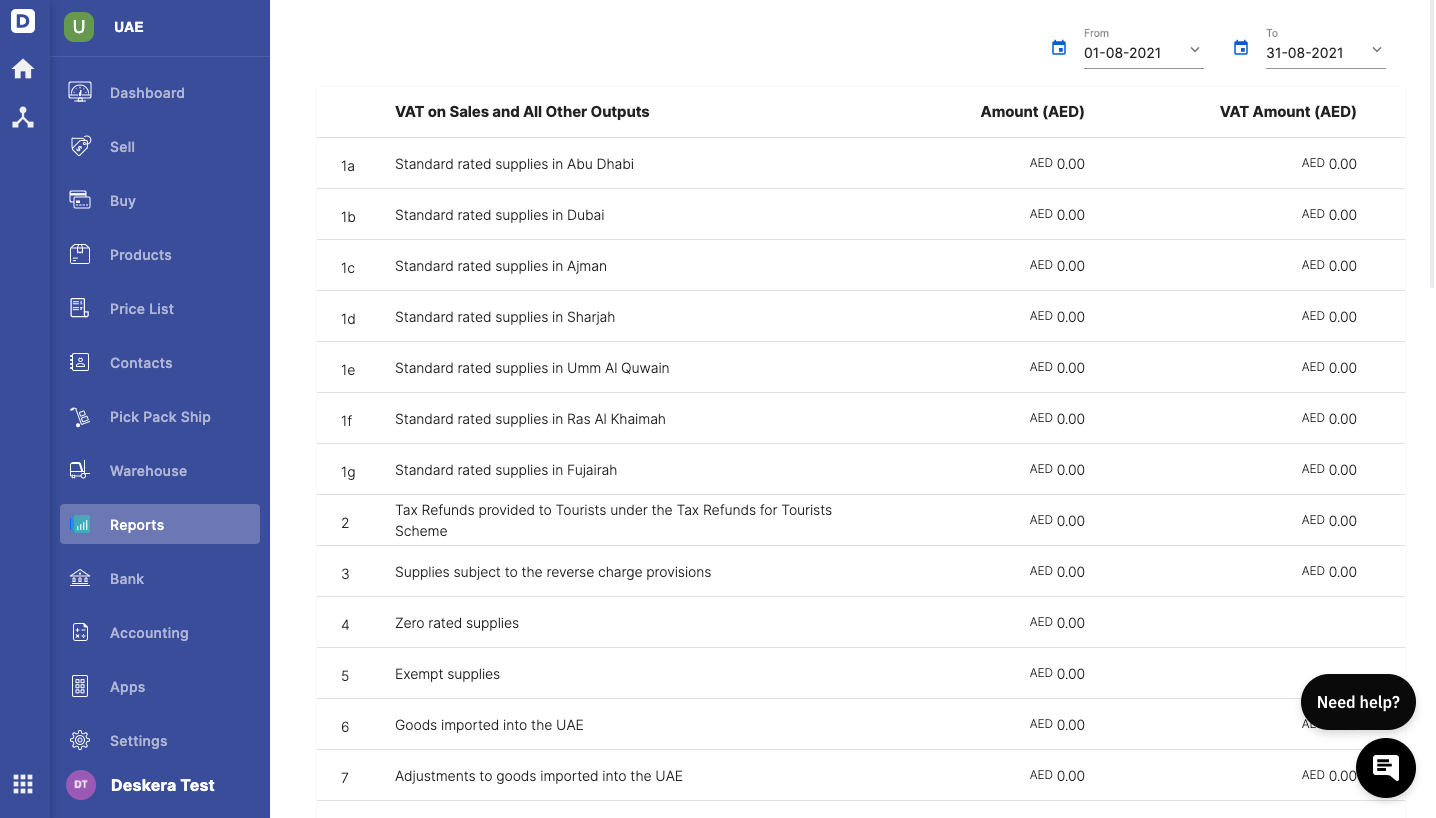

What is VAT 201 Return?

The VAT 201 Return is the declaration that business owners in the UAE need to make at the end of every tax period.

In the VAT 201 Return, you will have to indicate the amount charged on supplies, the section you are liable to declare as output tax, the amounts you believe you can claim as input tax, and the confirmation of your VAT submission.

Who should file VAT 201 Report?

Before registering for a VAT account, check if your taxable supplies and imports exceed the mandatory registrations threshold of AED375,000 over the previous 12 months or are expected to hit the required amount in the next 30 days.

If yes, you will have to register for a VAT account.

Also, you can choose to register for VAT voluntarily, where the total value of your taxable supplies and imports is more than the voluntary registration threshold of AED187,500.

How do I register for a VAT account?

You can register your account using the eServices portal via the Federal Tax Authority (FTA) website.

Access to your eServices account, you can view the Register for VAT account.

Click on this button to start your VAT registration process.

You are required to go through the eight steps during the registration process. Do enter the necessary information carefully and accurately.

Once you have filled in all the required information, click on the Submit button at the final stage.

If the application is successful, the FTA will provide you with a Tax Identification Number (TIN).

*If you fail to apply for VAT on time, a late penalty of AED 10,000 will apply.

VAT 201 Return Submission

Read more to find out more about the explanation for each line in the VAT 201 Return.

Before filing your VAT return, you need to know whether you are making payment to FTA or you are due to receive repayment from FTA.

If Box 14 is positive, it means you have to remit this payment to FTA.

On the other hand, if this amount is negative, then you will receive repayment from FTA. Then you can choose whether you want a refund from FTA on Box 15;

- If you choose No, then the tax credit will be carried forward to the subsequent tax period so that you can offset this future tax liability

- If you choose Yes, the FTA website will direct you to complete a VAT Refund application after the submission of the VAT Return

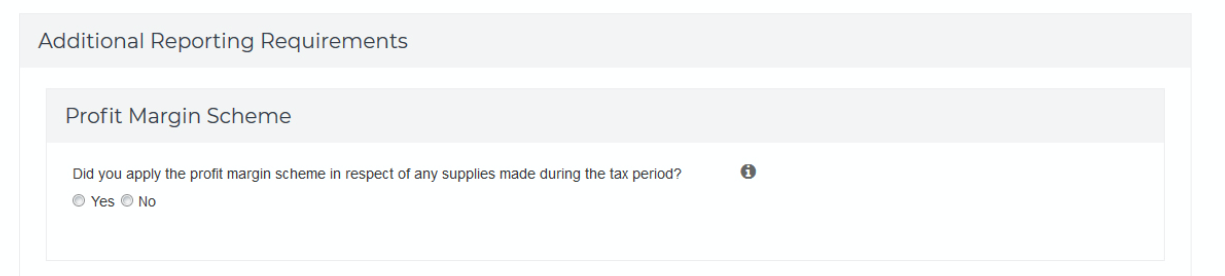

Additional Requirement

Enable the checkbox if you are under Profit Margin Scheme in respect of any supplies made during the tax period.

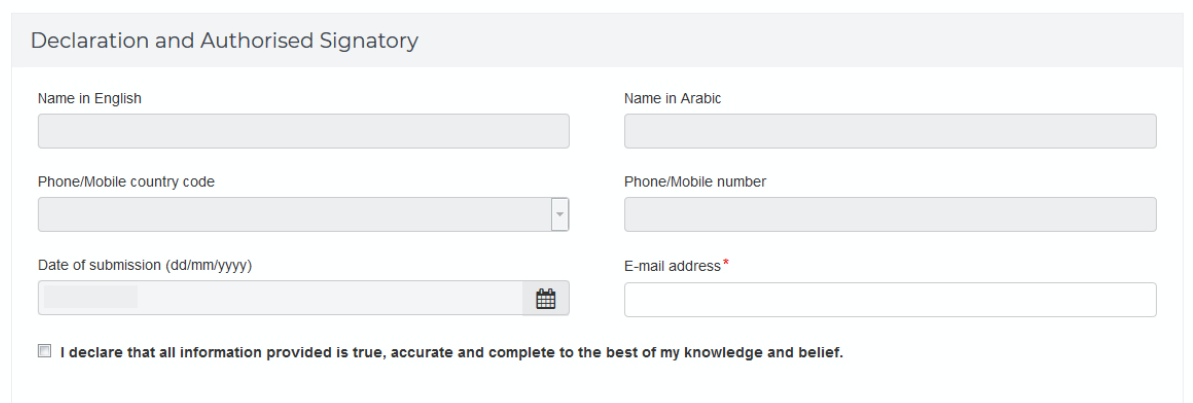

Declaration and Authorized Signatory

Next, you can enter the mandatory fields at the very last section of the VAT 201 Return:

- Your name

- Phone/Mobile country code

- Phone Number

- Date of Submission

- Email address

Enable the checkbox to acknowledge that all the information declared in the VAT 201 Return is accurate and complete based on your knowledge and belief.

Finally, you can click on the Submit button to file your VAT 201 Form online.

You will receive an email confirmation from FTA, and you can proceed to make payment.

Disclaimer: We do not have the service to submit your VAT 201 Report directly from Deskera software. You will have to submit the VAT 201 Report manually online.

How can I make VAT payment?

Once you have submitted your VAT201 Return, next, you need to remit the amount owe to FTA.

Enter the amount you'd like to pay in the eService portal. There are two pays you can make payment such as:

- bank transfer using GIBAN bank

- using an e-Dirham payment gateway that supports e-Dirham card or credit card (Visa and Mastercard only)

Note: An additional cost will be incurred for using an e-Dirham card or credit card to make payment

When is the due date of VAT Return in UAE?

There is no doubt that every tax report has its due date's submission all across the world. It's the same in the UAE.

As a business owner, it's your duty to ensure that you file your VAT 201 Report on time.

The due date to file your VAT return falls on the 28th of the following month after the end of your tax period.

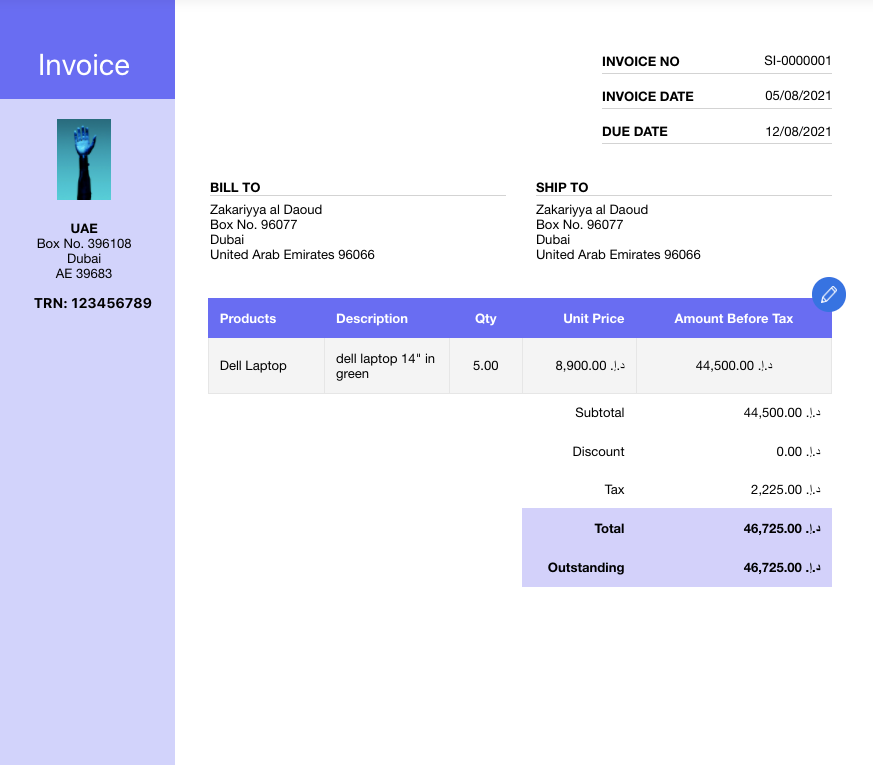

VAT, VAT 201 Report and Invoicing for UAE Company Using Deskera Books

Setting up your VAT rate in the UAE and generating the VAT 201 Report is a piece of cake with Deskera.

You can setup your UAE company in minutes and start creating and sending invoices immediately.

Strat generating beautiful invoice templates from the system without the need to design your template from scratch. Also, if you need to design your invoice from scratch, you have the option to do so as well.

You can specify your customers' location and charge the correct tax rate using the tax configuration in the system.

Here are the essential pieces of information that you can include in your invoice:

- Your company name and address

- The date when you issue the invoice

- Your tax registration number (TRN)

- The purchaser's name and address

- Term of Payment

- The name of the products or services purchased and their description

- Cost of each product and quantity purchased

- VAT amount

- Total amount payable

Learn more about the invoicing feature using Deskera Books.

Key Takeaways

And that is a wrap. From this article, you can take away the following points:

- What is the VAT rate in the UAE?

- What are the zero-rated products?

- What products are tax-exempt?

- What is Gulf Cooperation Council (GCC)?

- What is a designated zone in the UAE?

- What are the criteria to be classify as free zone?

- What are the list of designated zones?

- VAT Treatment for Business Activities in the Designated Zones

- What is reverse charge mechanism in UAE?

- Why is there a need for reverse charge?

- When is reverse charge is applicable?

- How does the reverse mechanism works?

- What is Excise Tax?

- What is the excise duty rate?

- Who needs to register for an excise tax?

- How can I register for excise tax?

- What is excise tax return?

- When should I file excise tax return?

- What is VAT 201 Return?

- Who should file VAT 201 Report?

- How do I register for a VAT account?

- VAT 201 Return Submission

- How can I make VAT payment?

- When is the due date of VAT Return in UAE?

- VAT, VAT 201 Report and Invoicing for UAE Company Using Deskera Books

With Deskera, you can easily apply the UAE GST VAT rates to your transactions, enable excise rate, and reverse charge mechanism, if applicable to your business.

You can rest assured as the software will do the work for your VAT calculation. Instead of spending a tremendous amount of time on manual tasks, you can have more time for the things you love with Deskera.