The terms - fixed assets or asset depreciation could intimidate you at times, especially if you are yet to learn the concepts of accounting or have come across them after a long time. Knowledge about these terms is essential for your business. Fixed or tangible assets that the organizations acquire deteriorate after a time. The companies calculate the value of the deteriorated asset as this value is reflected in the accounts.

While tangible assets are depreciated, intangible assets are amortized.

This article focuses on the Unit of Production method of depreciation.

Lot more in this post:

- What is depreciation, its types, and why you should calculate it

- Formula and calculation using Unit of Production method

- Example of the unit of production method

- Facts to know about the Unit of Production method

- Advantages and Disadvantages of the method

- Its effect on accounting

What is Depreciation?

Depreciation is a method to calculate the decrease in value of the physical asset over its useful years. In simple terms, companies use depreciation to understand how much the value of their asset decreased over the years of its useful life. Every asset deteriorates due to continuous use or due to obsolescence. Sometimes, the companies may decide the number of years for which they will use the asset.

What are the Types of Depreciation?

Most companies opt for one of the four methods of depreciation stated below:

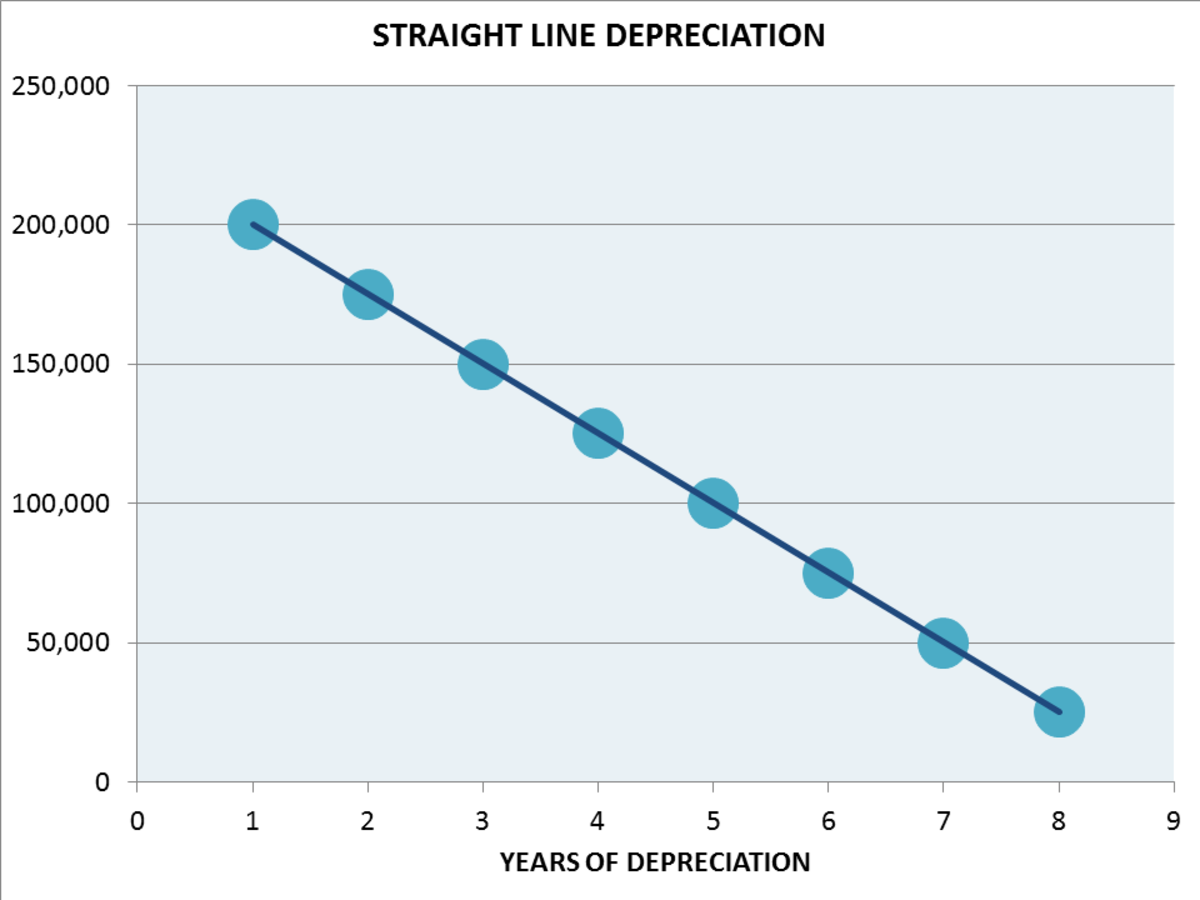

Straight-Line Method

The straight-line method is the default method that considers an even value for depreciating the asset over its useful life. The resultant difference of asset cost and salvage value is divided by the number of useful years of the asset.

This method calculates depreciation through this expression:

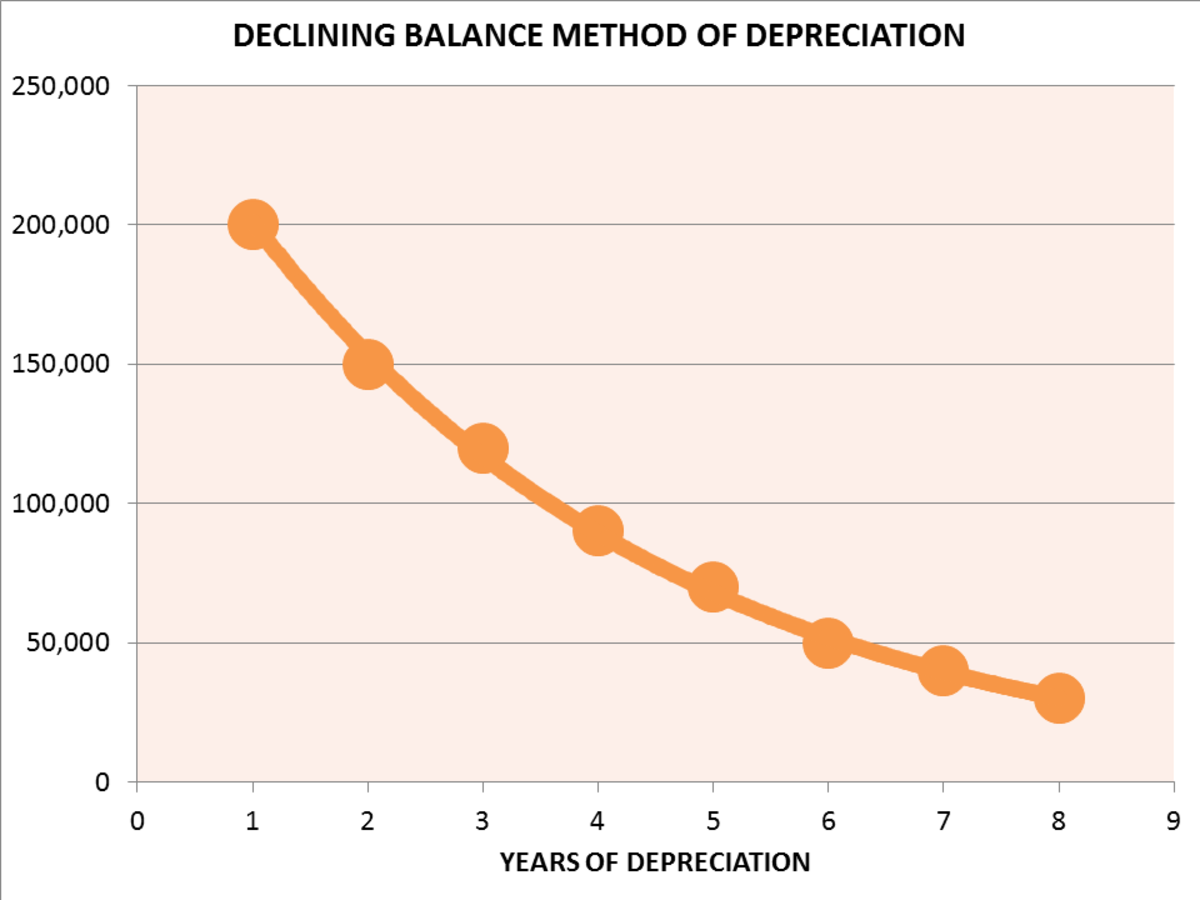

Declining Balance Method

This method is an accelerated method of calculating depreciation. It is a system that records larger expenses during the initial years of the asset’s useful life and smaller in the later years.

This is its formula:

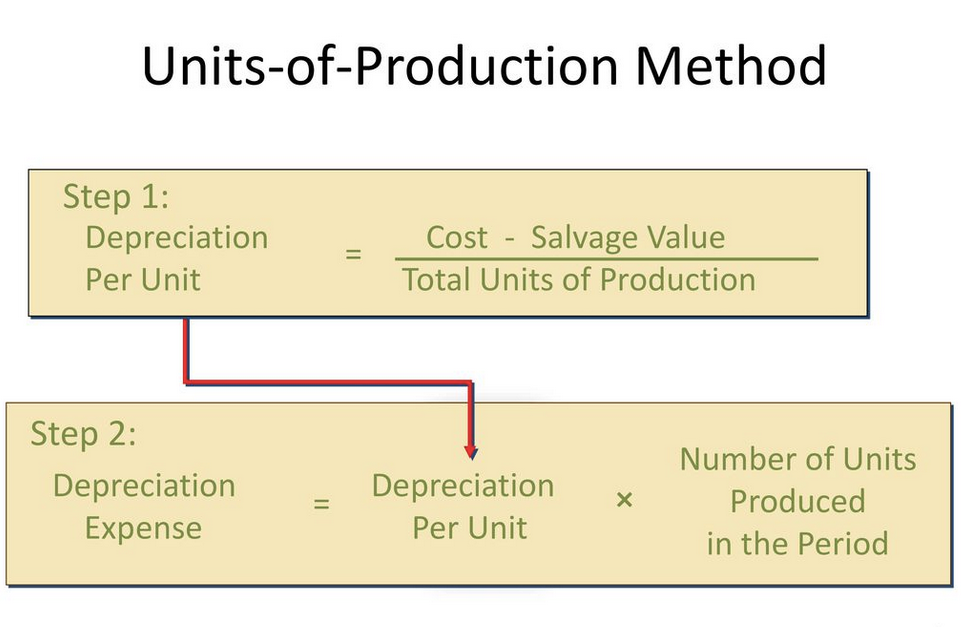

Unit of Production Method

This method calculates the depreciation for the asset when the asset’s value is closely related to the number of units produced instead of the number of useful years.

Here’s the formula:

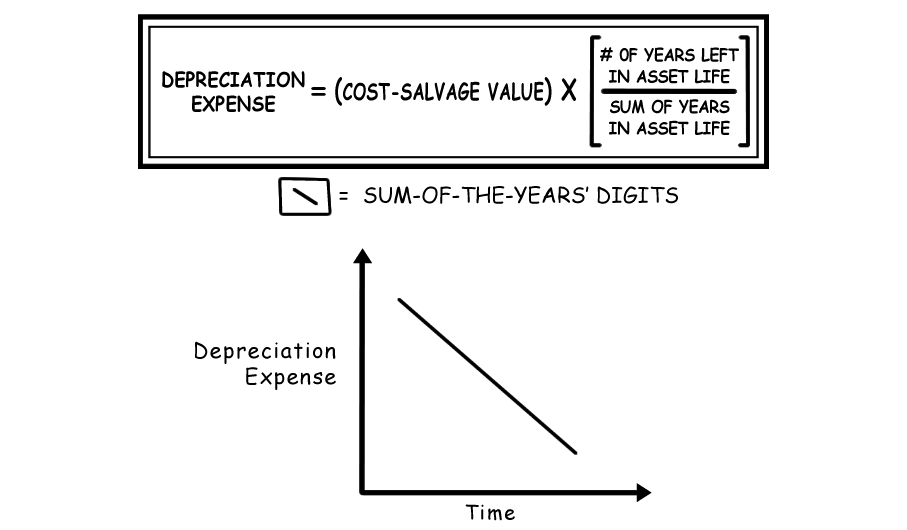

Sum-of-Year’s Digits Depreciation Method

While this is also an accelerated method, it is not as quick as the double declining balance method. Companies choose to go with this method as it facilitates larger depreciation tax benefits in the initial years of the asset’s useful life.

This is the formula:

3 Reasons Why You Must Calculate Asset Depreciation

Calculating depreciation is integral to your business. Without doing so could lead to a disastrous impact on the accounts of the business. Here are the top 3 reasons why you must calculate asset depreciation.

Prevent Distorted Values

Not calculating depreciation will keep you away from realizing the actual value of the asset at that time. The asset could be inaccurately recorded in the account books. An over-recorded value will show higher profits and hide the incurred losses. Moreover, the profit uncertainty could mislead the prospective investors and will eventually impede the overall business performance. A miscalculated profit and hidden loss will affect the health of the business.

Avoid Tax Trouble

If you miss out on calculating depreciation, you may have to face a higher tax amount because of an overstated profit. Also, there could be erroneous capital expenses. While a small error may be fixed easily, a bigger difference in tax return calculation may invite formal investigations from the tax department. Re-auditing the amount of tax return can hurt the credibility of your company.

Assess Utilization Period Accurately:

It is essential to assess the utilization period of an asset, and depreciation helps you to know that precisely. This also lets you know when to replace the assets and augment the useful life. This will help dispose or replace the assets which have deteriorated and lost productivity. This will in turn lead you to prepare an appropriate budget for your business operations.

What Is the Unit of Production Method?

The unit of production method is a way to calculate depreciation of an asset in cases when the asset’s value is related to the number of units it produced instead of the number of years it was useful.

This method offers greater deductions for depreciation in the time when the machine/ asset was heavily used, offsetting the periods when it will not be much in use.

It is a method that is completely different from the duration-based measurements of depreciation like the straight-line and double declining balance method.

Realistically, the depreciation expense shown using this method considers the percentage of the asset’s capacity that was used up for that year. Depreciation not only helps companies to depreciate assets but also helps in tax deductions. Higher deductions in the productive years enable the companies to achieve a balance for the higher production costs.

The Formula for the Units of Production Method

In the unit of production method, the depreciation expense is calculated by the formula below:

Here, estimated production capacity is the capacity of the asset to produce units. ‘Units per year’ is the number of units produced by the asset per year.

Examples of Unit of Production Method

This section highlights some examples where the unit of production is used for calculating depreciation expense.

Example 1: Sewing Machine

Let’s see this table relevant to the sewing machine as the depreciable asset.

These are the values we shall utilize in the calculation of depreciation using the Unit of Production method.

Step 1: Calculating Rate of Unit of Production for sewing machine

Step 2: Calculating Machine’s Depreciation Expense

So, the depreciation expense for the first year of use of the sewing machine is $1,620.

Example 2: Crude Oil Plant

A processing plant of crude oil is estimated to produce 60 million barrels of crude oil in its useful life. The residual value of the plant is $2 million. The base cost of the plant is $15 million. The actual units produced in the 1st year of its operations are 3 million barrels.

Using these figures, the depreciation is calculated as follows:

Depreciation Expense = (15 - 3) x 2 / 60

= 0.4 million

So, the depreciation expense for the processing plant is $0.4 million.

Things You Should Know About Units of Production Method

The unit of production method is an atypical method that is unlike straight-line or other time-based methods for calculating depreciation. Here are certain facts that help us know about it better.

- The unit of production method is considered most accurate when the assets produce units. Through this, the company can keep a tab on the profits and losses with precision. In cases where the assets produce units, a chronology-based method would not work as accurately.

- Also, the unit of production method considers depreciating an asset when the asset starts producing units. The process completes only when either the machine’s cost has been covered fully or if it has produced all the units it was meant to.

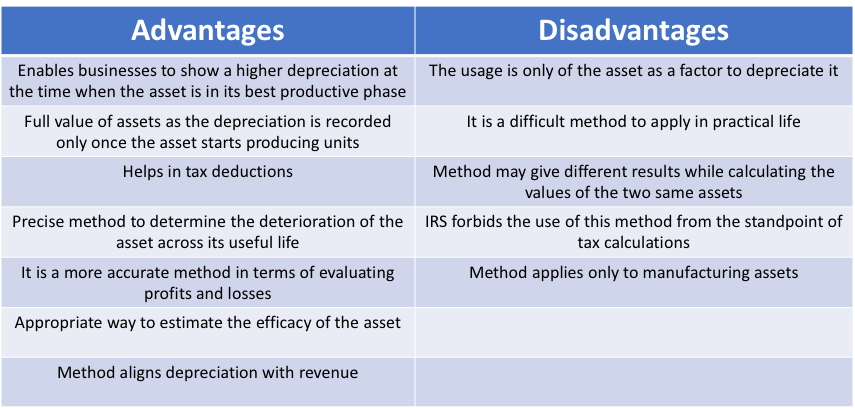

Advantages of Unit of Production

Let’s first look at the advantages of the unit of production method:

- The method enables businesses to show a higher depreciation at the time when the asset is in its best productive phase.

- The method makes use of the full value of assets as the depreciation is recorded only once the asset starts producing units.

- It helps in tax deductions. Higher the depreciation expense in the fruitful or productive years, higher the chances of countering costs of production; thereby, aiding in higher revenue in the productive years.

- It is a more accurate method in terms of evaluating profits and losses.

- It is a precise method to determine the deterioration of the asset across its useful life.

- It is a more appropriate way to estimate the efficacy of the asset.

- The method aligns depreciation with revenue.

Disadvantages of Unit of Production

The disadvantages of the unit of production method are:

- The primary disadvantage is that the method considers only the usage of the asset as a factor to depreciate it; while there could be numerous other ways in which the asset value drops.

- It is a difficult method to apply in practical life. This is so because, in reality, there are various machines and assets that a company uses to build a product/unit. Measuring the value of each such asset would prove to be a tedious and uphill task.

- The method may give different results while calculating the values of the two same assets. Such confusion is not a good signal for any business.

- The IRS forbids the use of this method from the standpoint of tax calculations.

- The method applies only to manufacturing assets and not for assets like furniture, building, or trading companies.

When and When Not to Use Unit of Production

When to use: The unit of production method is best suited for manufacturing companies. The companies which involve machinery or equipment for the production of products or units, use this method.

Such companies require to see through the profit and loss picture clearly which the method presents them with. Having an accurate chart of these figures, the companies can get a better grip over their business which caters to a market of fluctuating demand.

When not to use: The IRS prohibits the use of the unit of production method for tax purposes and therefore, it may be eventually used only for internal accountancy. The companies may use MACRS (Modified Accelerated Cost Recovery System) at the time of tax proceedings.

At this stage, knowing about Section 179 may prove beneficial as it empowers businesses to minus the full cost of the asset up to a million dollars in the year it was purchased.

How Does the Unit of Production Method Affect Accounting?

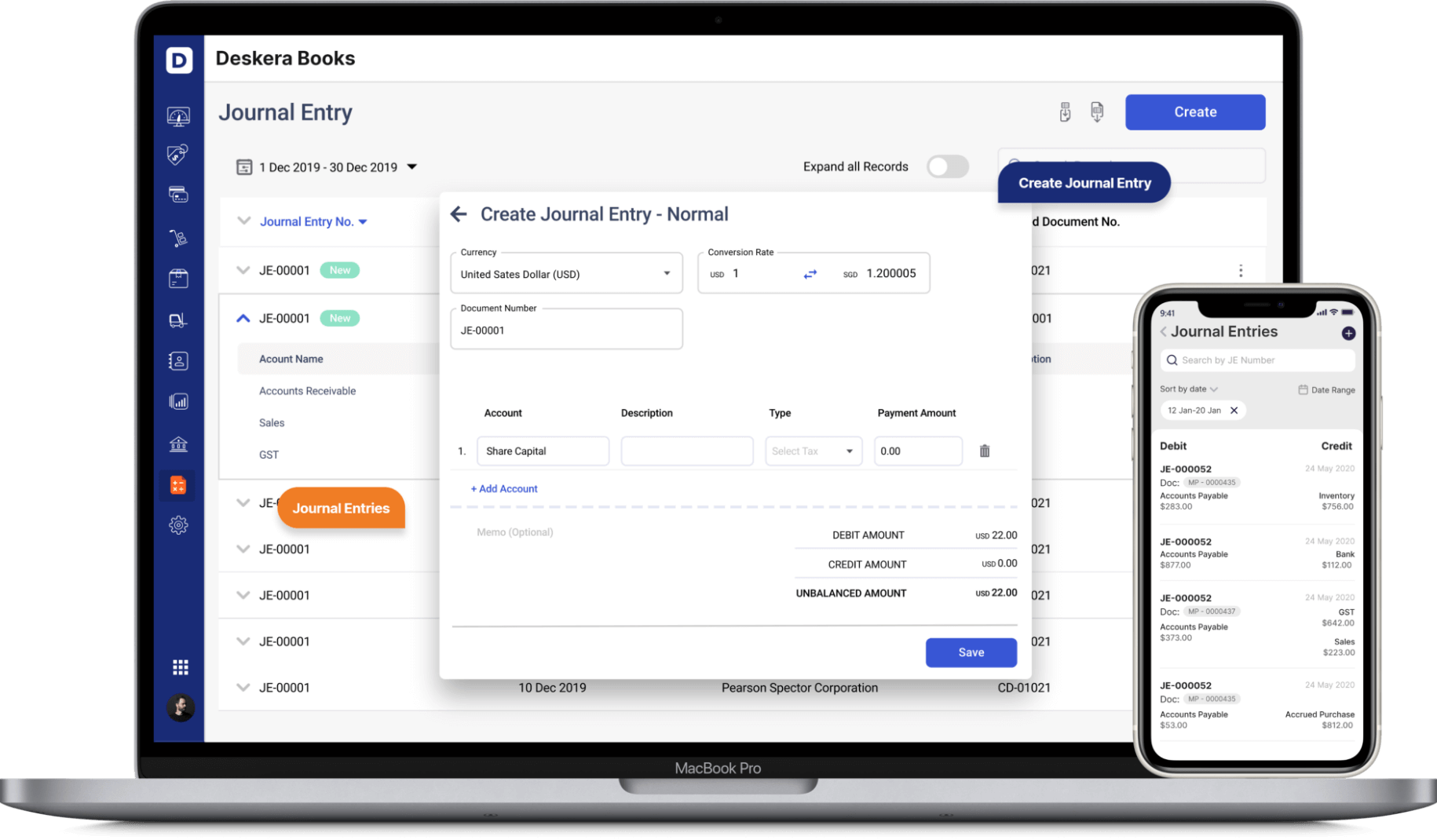

For financial accounting purposes, businesses need to maintain records of each asset. They also require to prepare a journal entry and prepare a depreciation schedule to closely look at the tax expenses.

We discuss the three steps for recording the depreciation expenses calculated through the unit of production method.

Prepare Depreciation Expense Journal Entry

A journal entry records depreciation expense and accumulated depreciation in the best possible manner. It begins with debit depreciation expense. This increases the overall expenses in the profit and loss statement.

Next comes the credit to accumulated depreciation on the balance sheet. It reduces the net value of all tangible assets.

A typical journal entry for a machine may look like this:

Maintaining Records

Keeping a tab of all receipts, contracts, or any other important deeds or papers to prove the ownership over the assets is essential. These papers must include the date of purchase and the cost of the asset.

Each of the assets owned will have these related documents and the businesses need to ensure that they keep a track of these papers. These are also required when there is an audit or a review.

Although, it should be remembered that this method will not be used for tax purposes and the company will have to utilize other methods for that. However, IRS may ask for supporting documents regarding assets and these receipts and papers should be presented at that time.

Preparation of Depreciation Schedule

The third step involves creating a depreciation schedule that will help monitor all assets. Using the unit of production method for bookkeeping purposes and MACRS for tax purposes can ease the creation of a depreciation schedule.

A typical example of a depreciation schedule with the required information looks like this:

How can Deskera help your Accounting and Business?

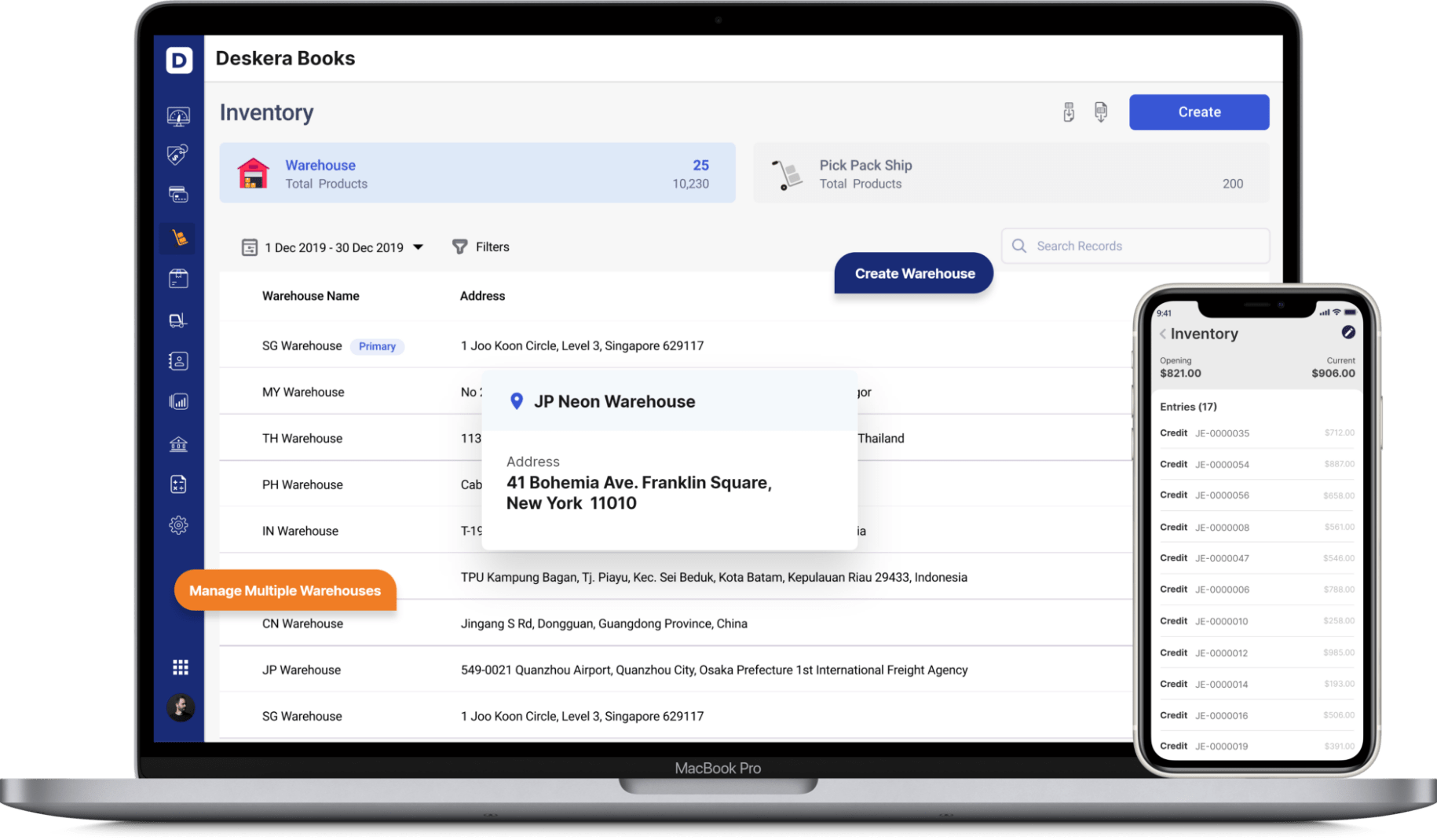

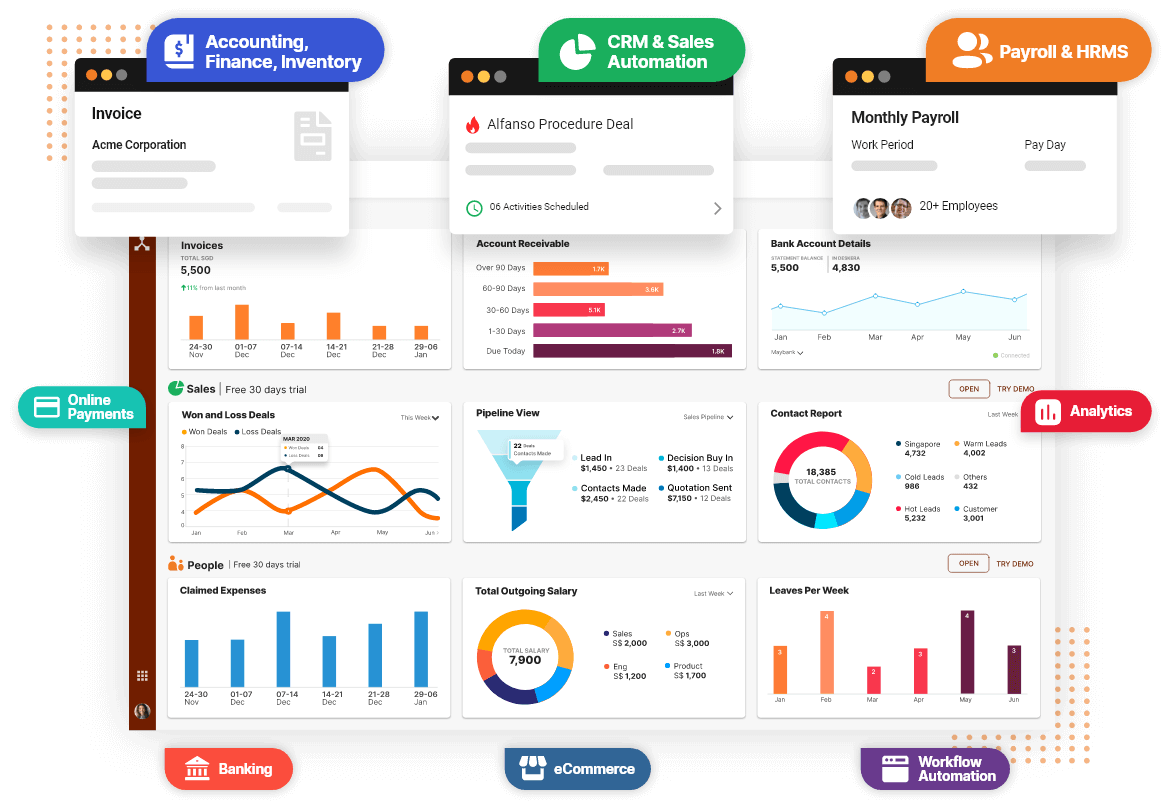

As a business owner, you can invest in accounting softwares that can help you keep track of your depreciating assets, scrape value, residual value, salvage value, journal entries, balance sheet, inventory and production costs. A successful business needs an efficient financing process that meets its specific needs.

Deskera Books is an online accounting software that your business can use to automate the process of journal entry creation and save time. The double-entry record will be auto-populated for each sale and purchase business transaction in debit and credit terms. Deskera has the transaction data consolidate into each ledger account. Their values will automatically flow to respective financial reports.

You can have access to Deskera's ready-made Profit and Loss Statement, Balance Sheet, and other financial reports in an instant.

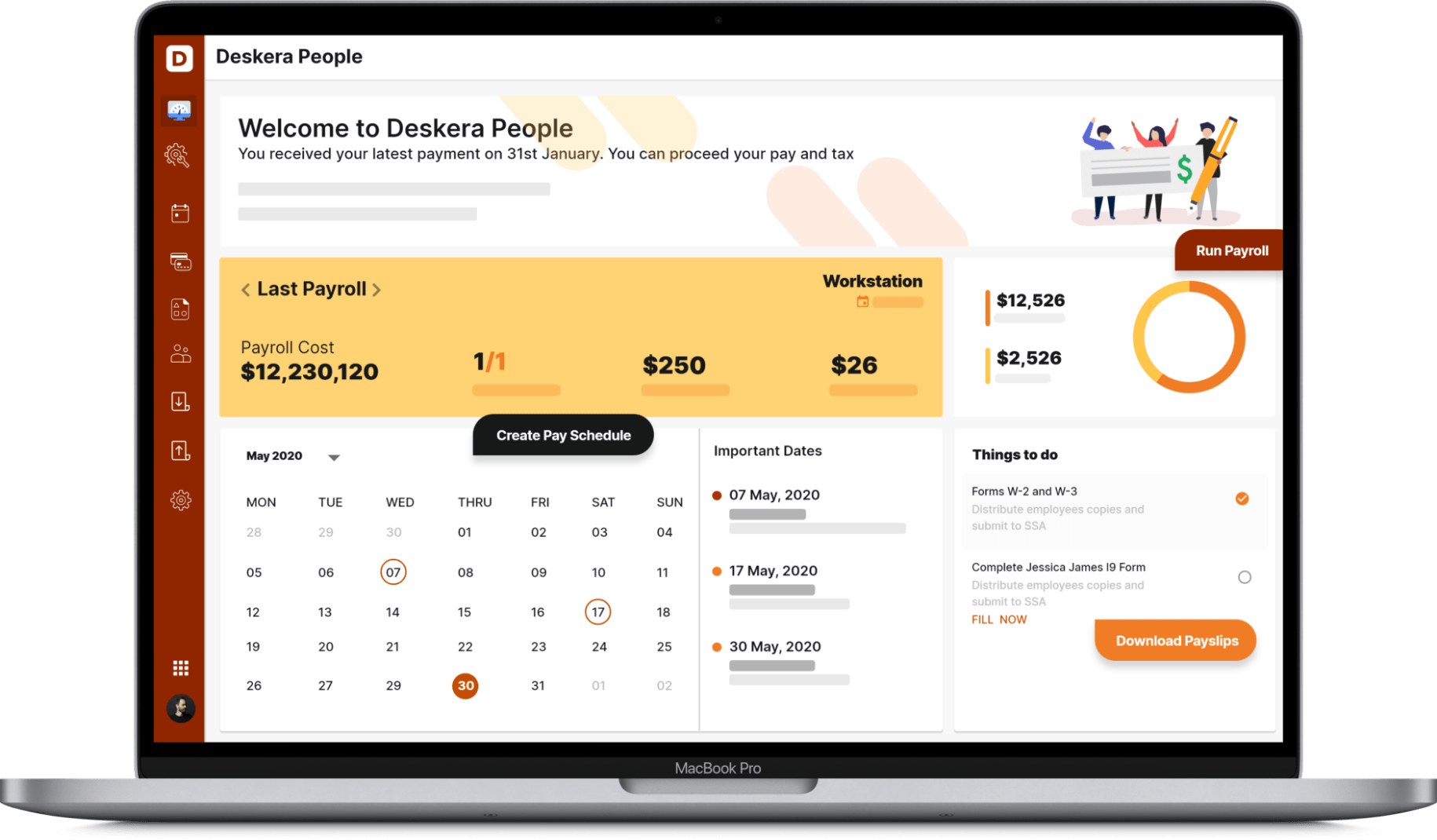

Deskera can also help with your inventory management, customer relationship management, HR, attendance and payroll management software. Deskera can help you generate payroll and payslips in minutes with Deskera People. Your employees can view their payslips, apply for time off, and file their claims and expenses online.

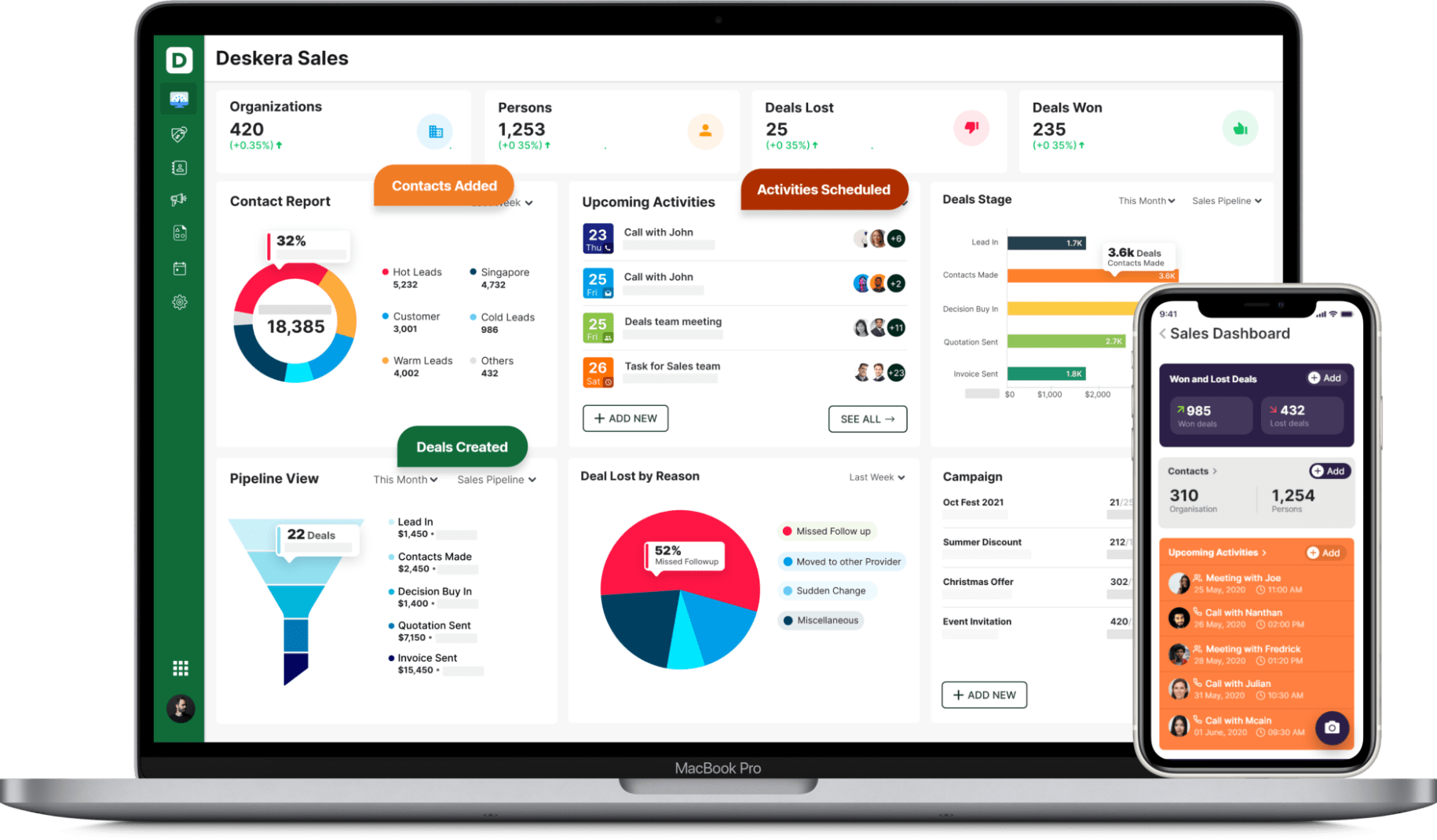

With Deksera CRM you can manage contact and deal management, sales pipelines, email campaigns, customer support, etc. You can manage both sales and support from one single platform. You can generate leads for your business by creating email campaigns and view performance with detailed analytics on open rates and click-through rates (CTR).

Deskera is an all-in-one software that can overall help with your business to bring in more leads, manage customers and generate more revenue.

Key Takeaways

Based on the detailed description of the unit of production method, we take home the following points:

- The unit of production method considers the asset’s practical usage in the process of production rather than considering the years it was in use.

- This technique is more applicable in cases where the machines undergo a higher deterioration while they were used for production.

- It also enables companies to show more depreciation in the productive years and offset the increased costs of production.

- Practically, the depreciation expense shown using this method considers the percentage of the asset’s capacity that was utilized for that year.

- The unit of production method is best suited for the manufacturing companies involved in the production of units.

- The unit of production will not be allowed by IRS for tax purposes. The businesses will have to use other methods like the MACRS for the same.

Related Articles