Explanation of the single-step income statement in greater details. Find out the accounting equation to compute the net profit using the single-step income statement and examples of single-step income statement.

Preparing the income statements might differ for every company. Some companies prefer to use the single-step approach, whereas others will have to prepare the report using the multi-step method, abiding by the country's law.

In this article, we will explore the definition of the single-step income statement, the examples, and find out more about the types of businesses that use the single-step format.

Interested to read out more about comprehensive guide to income statement? Click here to find out more about the in-depth explanation of income statements and the comparison of income statement for various industries.

Definition of a Single-Step Income Statement

The single-step income statement is the most simplified version of the income statement.

The single-step income statement generally groups all the revenues and expenses account into their respective categories without further breakdown. The net income or losses equals to the subtraction of the total amount of expenses from the total amount of revenues. Hence, the net profit of the company will generally appear at the bottom of the report.

Here is the accounting equation to compute the net profit in the single-step income statement:

Net Profit= Total Revenue - Total Expenses

The single-step income statement is a more straightforward and uncomplicated report to prepare. Also, the single-step report it's easier for readers without financial expertise to interpret, analyze, and understand.

Examples of the Single-Step Income Statement

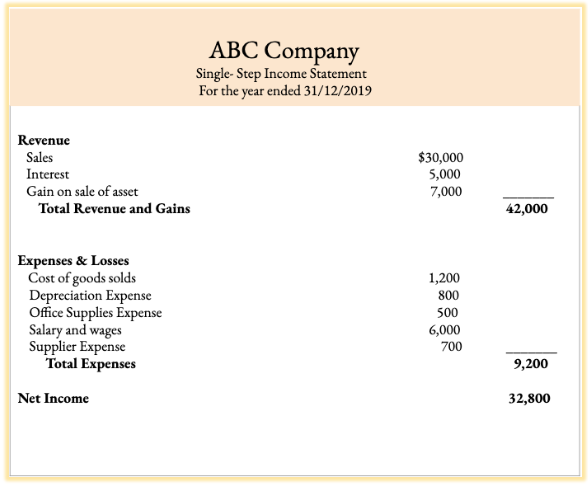

Here's an example of the single-step income statement for ABC Company:

Based on the image, as shown above, the single-step approach has two sections: the revenue and expense accounts. With the single-step approach, there is only a single lump-sum of the subtotal for the revenue and expense accounts.

The calculation of net profit involves deducting the company's total expenses from the total revenue. For instance, as per the snapshot above, the net income for ABC Company for the year 2019 is a total of $32,800 ($42,000 - $9,200).

Although this statement provides some necessary information about the company's finances, it does not provide extensive details about ABC Company's gross profit and operating profit.

Types of Company that Uses the Single-Step Format

The small-sized companies that are either sole-proprietor or partnership firms often use the single-step approach when generating the income statement. For instance, a small store that sells only mobile phones and accessories may only prepare a single-step income statement. Due to the diminutive size of business and limited variations of business activities, preparing the single-step income statement is sufficient enough for their business.

Conclusion

After reading this article, we hope that you have a better understanding of the single-step income statement. Although this format of the income statement is not as popular as the multi-step approach, this format might fit practically for tracking your business's income.

Are you interested in knowing more? Here are some further readings of other financial statements:

- Deskera Balance Sheet: A guide to understanding balance sheets

- The Complete Guide to Cash Flow and Cash Flow Statements (++ Examples and Free Templates for Download)