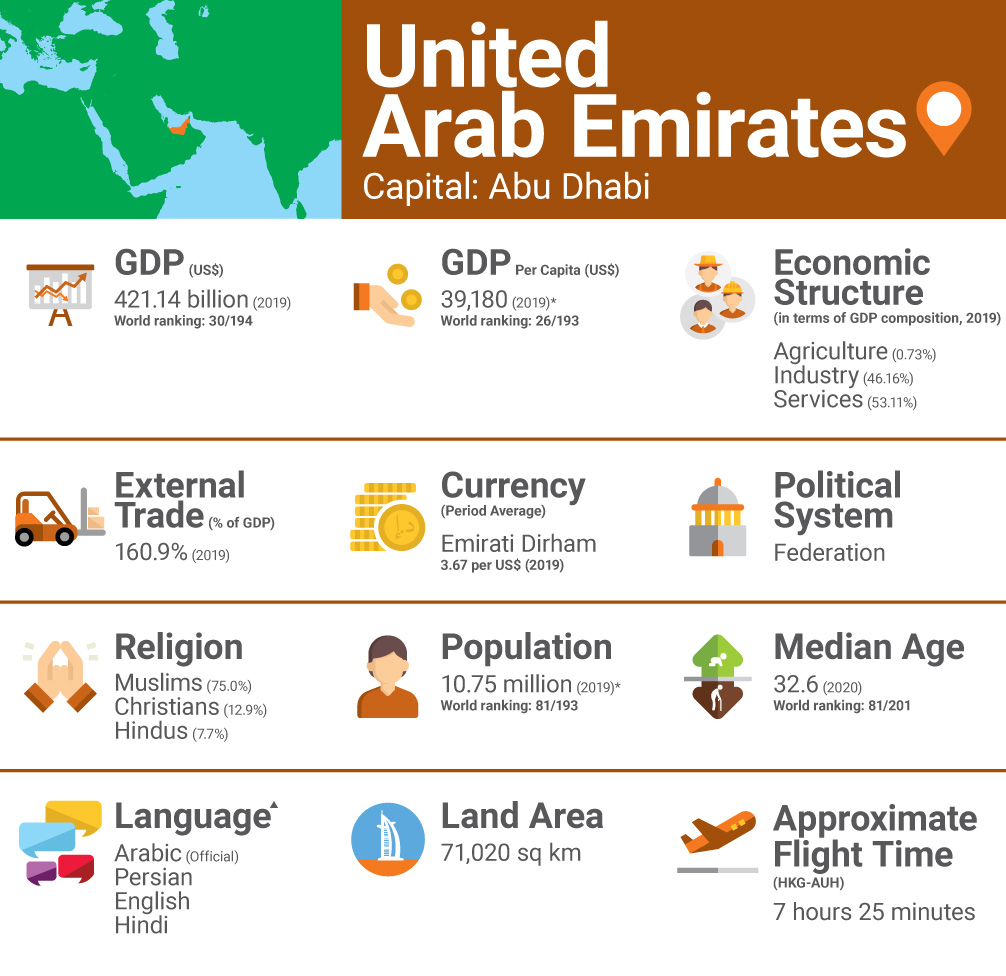

The United Arab Emirates(UAE) is known as the ‘Gateway to the Middle East. Over the last few decades, the UAE has undergone a tremendous and accelerated transformation. It is split over 7 Emirates; and has long been attractive to expanding businesses worldwide, offering a favorable tax regime, free trade zones, and access to some of the fastest and biggest -emerging markets on the planet.

In addition to its strategic location, the country has a robust economy, which is down to several compelling factors. The UAE has solid financial reserves, progressive policies regarding diversification, and benefits from increased foreign direct investment.

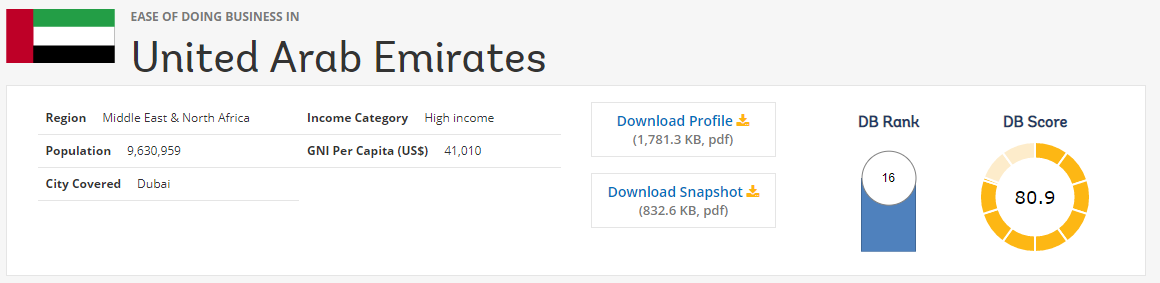

According to the World Bank, The United Arab Emirates has ranked 16 among 190 economies to ease doing business. However, the rank of the United Arab Emirates deteriorated to 16 in 2019 from 11 in 2018.

Click here to see all reforms made by United Arab Emirates

Starting a Business in UAE

In the UAE, starting a business is relatively easy due to the government's offering of incentives. To those of other countries, the process, therefore, has many similarities.

The most important task is to decide on the activity type your business will be involved in. It is critical because, in the UAE, it may not be fit for operations. The next important thing is to select the most relevant jurisdiction in the UAE, which includes whether your business may fall into a free-zone, mainland, or offshore jurisdiction based on the business activity purely.

Registrations and Establishing an Entity in UAE

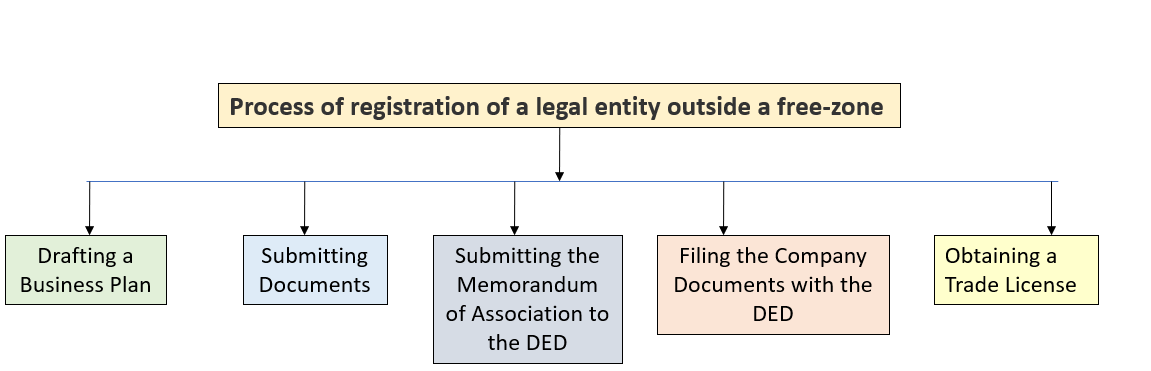

Based on the legal entity type, the estimated timeframe for a legal entity incorporation process may vary significantly. For example, in 2-3 weeks, Free-zone entities can be incorporated, while the legal entity registered outside a free-zone might take 2-3 months.

Below is the process of registration of a legal entity outside a free zone,

Drafting a Business Plan

The main factors of a business plan are market analysis, executive summary, organization/management, company description, market plan, financial plan. and product/service.

Submitting Documents

A complete company registration application must be submitted to the Department of Development along with the proposed company name. In addition, before a company registration, preliminary approvals from the Dubai Department of Economic Development(DED) license section need to be taken.

Submitting the Memorandum of Association to the DED

The Department of Economic Development (DED) will fulfill a standard Memorandum of Association–also called Articles of Association–that is signed in the presence of a notary.

Filing the Company Documents with the DED

The Memorandum of Association, the original and a copy; a letter issued from the DED confirming the company name approval; the initial letter of company approval from the DED Committee of Limited Liability Companies; and the prescribed application form signed by a director or representative must be rendered to the Commercial Registry and the DED.

Obtaining a Trade License

A license application is completed in Arabic and signed by the entity representative, and filed with DED after the notary at the commercial registry notarizes the memorandum.

After this, you must submit the original lease of your entity's headquarter, business name in Arabic and English, and a designated form for getting clearance on the agreement of the premises from the Dubai Municipal Building Department, in case incorporated in Dubai.

To process payroll in the UAE, the company is required to have a legal entity establishment.

During the process of establishing the legal entity, all applicable payroll restrictions of the company are completed.

Banking

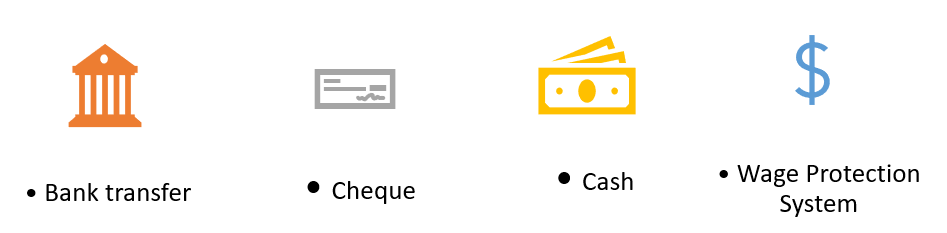

Once the employees are registered under the Wage Protection System(WPS), making payments from an in-country bank is mandatory. For all legal entities registered outside the free zones, the WPS is compulsory. However, in particular free zones (JAFZA Dubai Airport Free zone, etc.), the employees must also be registered and paid through WPS.

Usually, Islamic banks in the United Arab Emirates' opening hours are from 08:00 to 13:00. Opening days are from Saturday to Wednesday, except Thursday (08:00 to 12:00). Few banks also have afternoon opening hours from 16.30 to 18.30 or even continuous opening during the day.

Below listed are the options in UAE for making payments to the employees,

Note: Payment methods may be restricted depending on the authority to which the company is registered. 1-2 working days for local bank accounts must be transferred from the client account to the employee bank account. International transfers can take up to 4 working days.

Working Week in the UAE

In the UAE, the working week is Sunday to Thursday from 8 am to 5 pm, or in some cases, it is from Saturday to Thursday.

For an adult employee, the average maximum working hours shall be 8hours per day or forty-eight hours per week.

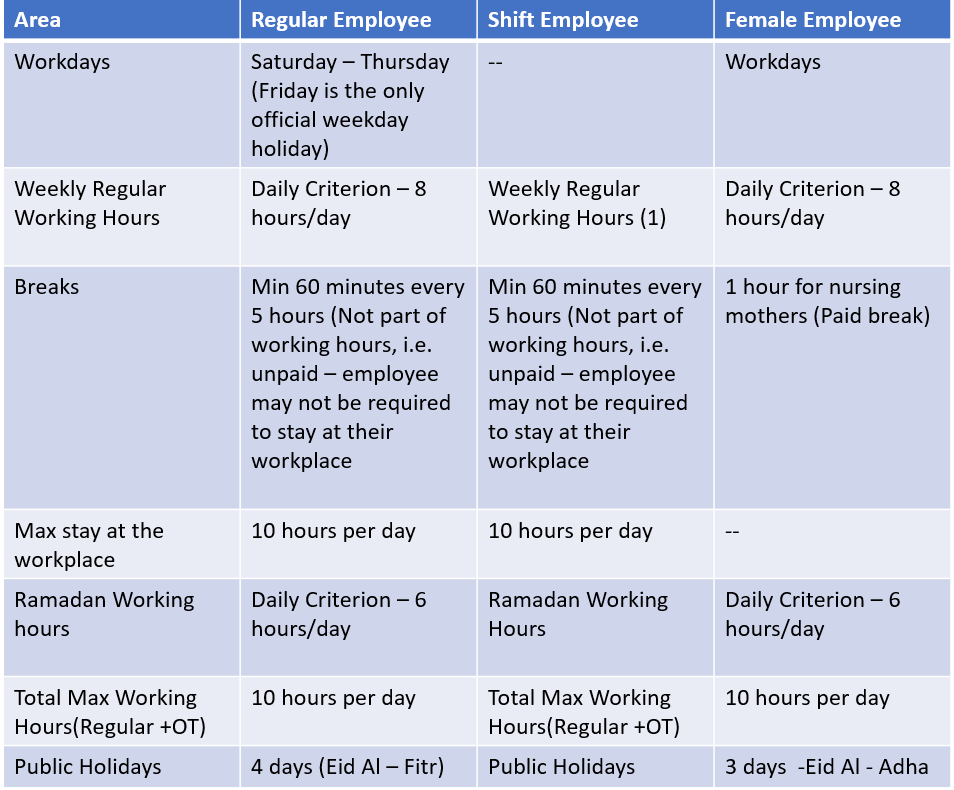

Below summarized are the working hour’s related regulations in the UAE,

Minimum Wage in UAE

There is no mandatory minimum wage for expatriates

For UAE nationals, the minimum wage is determined by the level of education:

- No high school certificate- 3,000 AED

- High school certificate- 4,000 AED

- College degree or higher- 5,000 AED

Immigration and Work Permit in UAE

In the UAE, to apply for a work permit, the candidates need to have a work contract. The employer will handle the application process through the Ministry of Human Resources and Emiratisation (MoHER).

To allow employees to enter the UAE, the initial work permit is issued for 2 months. In this period, the employer needs to collect all the required documents, including registering the employee as a resident and filing the work residency permit.

Once the employees' work permit is secured, they can apply for a new one independently if they want to change the employer or terminate.

However, to stay in the country, they must always have an employer as a sponsor.

Before changing the job, an unskilled worker has to wait for six months. However, for skilled workers, six months is waived.

Immigration

The UAE government needs that individuals seeking to reside in the UAE for employment purposes must be sponsored by their employer.

Below is an overview of the general steps necessary to secure a residency visa. Please note that some procedures will vary based on the employee’s country of citizenship or their immigration status at the time of hire. Also, the immigration process for a free zone may differ from the standard process,

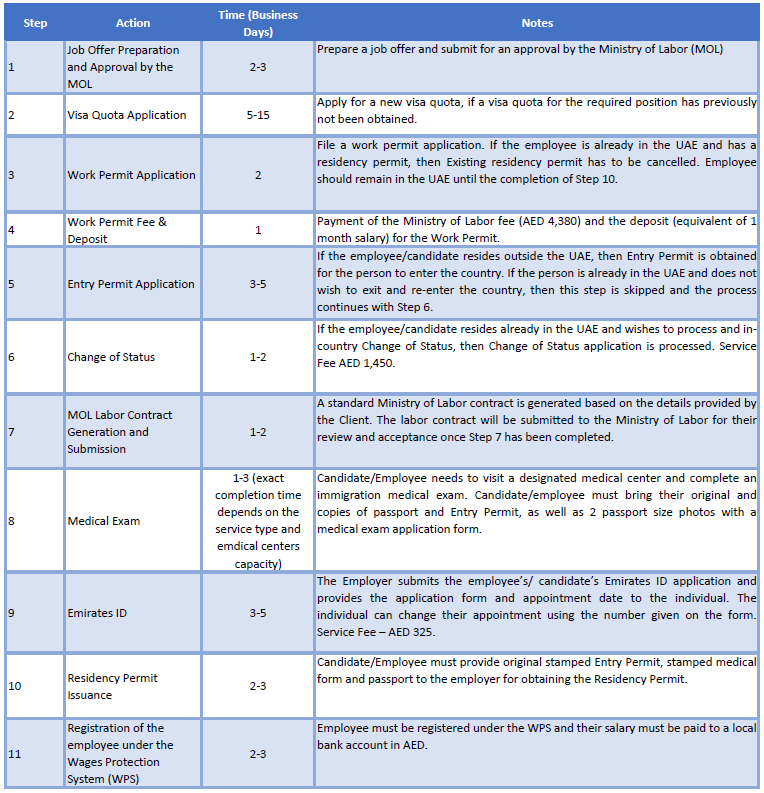

The residency permit issuance process takes typically 4-6 weeks, and it consists of the following steps:

Employment Law in the UAE

Let us see below the key provisions of the Federal Labor Law of the UAE pertaining to both onshore businesses licensed by the Department of Economic Development (DED) and companies incorporated within a UAE-free zone.

What Protections do Employees Have?

Employees are supported with certain minimum protections under the Labor Law.

If any employee works within one of the free zones, apart from the financial free zones of the ADGM and DIFC having their labor regulations, will be subject to both employment regulations and labor law in the free zone in which business is incorporated.

Obtaining an Establishment Card

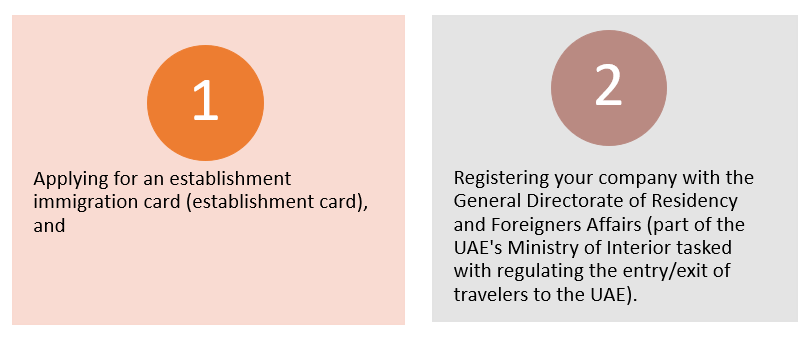

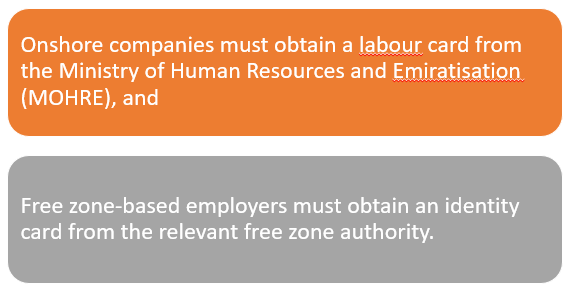

You must open a labor and immigration account after your business has received its trade license; this is done by,

Getting the establishment card will allow your company to hire staff from abroad and apply for different visa types. The validity of this card is one year and needs to be renewed before its expiry on an annual basis.

Hiring in the UAE and Sponsorship

For each new employee you hire:

All non-resident UAE nationals need to get a work permit and residency visa to stay and work in the UAE.

These visas are granted if the employee has the required skills and educational qualifications needed by the UAE and must be sponsored by the organization. Your company will sponsor its employee if your business is situated in mainland UAE, and on the other side, the free zone itself will sponsor free zone company employees.

Types of Employment Contract

All employees will need to sign a standard template offer letter declaring basic minimum terms of employment in English and Arabic. Also, an additional contact containing more detailed commercial terms.

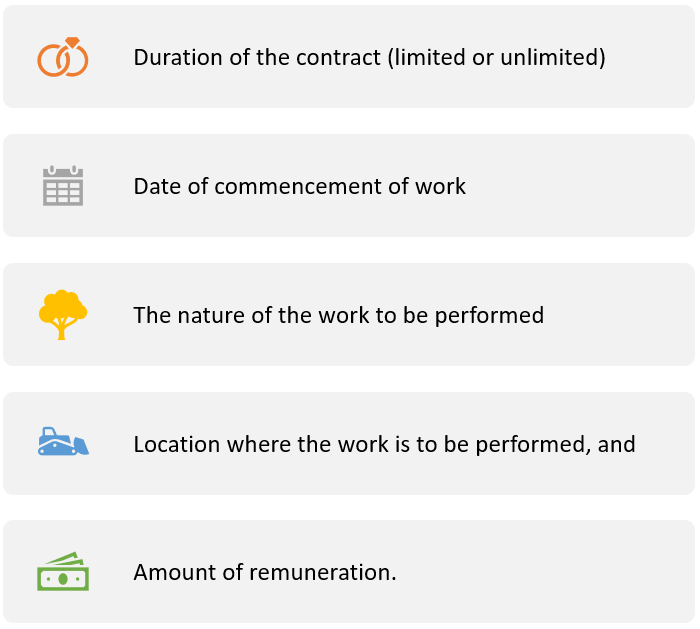

Under Article 36 of the labor law, a UAE employment contract must contain the following basic information:

Few economic free zones need the parties to enter into employment contracts on the terms contained in a specific template. Subject to the labor law provisions, the information that must be included in employment contracts varies among the free zones.

Terminating an Employee's Contract

For a certain work-related reason, a contract of unlimited time(an open-ended contract) can be terminated without cause with notice. However, as defined by article 120, if termination is not connected to an employee's work, it can be considered arbitrary for cause or any other justifiable reason. In this case, an employee can easily claim arbitrary dismissal and be given compensation of up to three months, which the competent court pays.

End of Service Gratuity

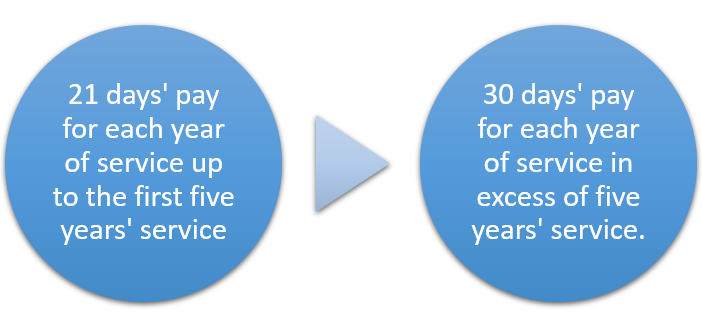

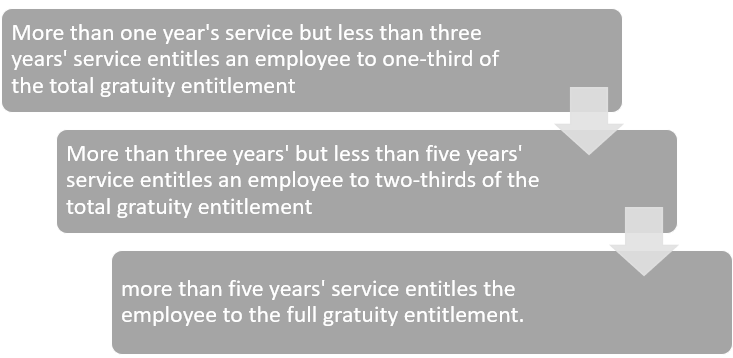

For new UAE employers, the most crucial consideration is to account for the payment of end-of-service gratuity (ESG). This payment is due once the employee is terminated and has worked at least one year with the company.

Based on the employee's last basic salary, the amount of ESG payment is calculated (Without allowances) before termination if the rate of,

An employee who resigns after serving less than five years, with an unlimited contract is entitled to a reduced gratuity payment, which is calculated as follows:

The maximum end-of-service gratuity is capped at two years' salary.

Steps for Processing Payroll In UAE

Processing payroll is a vital operation business that has to be carried out for businesses in the United Arab Emirates. Regarding Payroll Management, laws and regulations determine procedures that businesses adhere to; however, they are often altered, which can be challenging to keep up.

What is Company Payroll in UAE?

Payroll is a process that makes sure that all your business employees are paid on time with the amount due to them. Payroll also involves keeping track of work hours, paid leaves, and main calendar events.

In the UAE, all businesses are regulated by UAE labor law, which implies that businesses have to keep payroll systems well managed, allowing for the proper processing of employees' wages.

Steps In Processing Payroll in the UAE

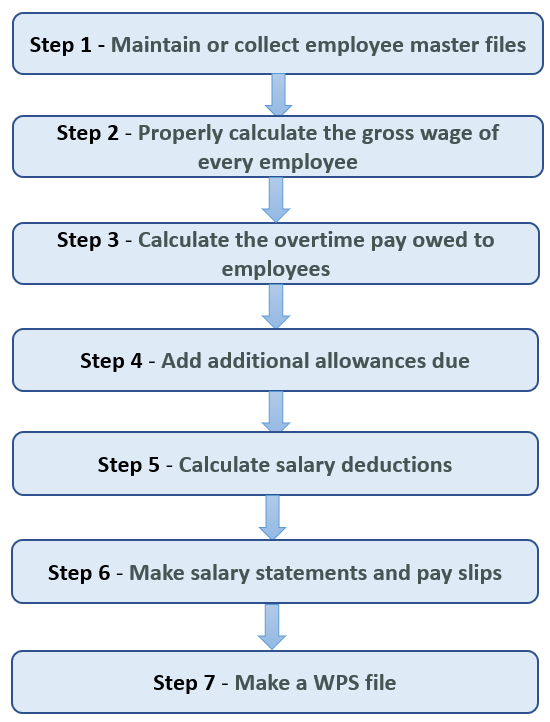

The actual payroll calculation can vary from what we will mention below, as there may be differences in the system used. For example, some businesses choose automated or software payroll solutions, others do the manual computation, while most businesses in UAE choose outsourced payroll processing. The most likely responsibilities and procedures in the management of payroll are as follows:

Step 1 - Maintain or collect employee master files

An employee needs to maintain all essential details of employees such as basic salary, designation, allowance amount, contact number, and payable allowance types.

This information is necessary for processing payroll and has to be updated regularly, significantly when the employees' wages change or increase. Therefore, the employees have to take care of and maintain the records properly.

Step 2 - Properly calculate the gross wage of every employee

Proper computation for the gross wages owed by the business to all employees has to be done before the end of every pay period. Therefore, when calculating the employee's gross salary, the basic salary is taken and added with the allowance amount, and then the sum is updated in the payroll records.

Step 3 - Calculate the overtime pay owed to employee’s

It would help if you calculated the overtime hours for your employees who have worked every pay period. The overtime hours are divided into the following categories,

- The normal overtime, and

- The Friday Overtime

For Normal calculation overtime the formula is:

- Salary/30 days /8 hours x 1.25.

- For weekend over time - it is salary/30 days/8 hours x 1.5.

Step 4 - Add additional allowances due

In the UAE, for many employees, an extra allowance is paid every single month, such as sales commission, bonus, car expenses and, more. So, every employer must add allowance to the employee salary for the pay period.

Step 5 - Calculate salary deductions

There are many different deductions to be taken out from the employee's salary, such as violations, absences, fines, etc. These deductions need to be taken from the basic wages or the gross wages. By adding all necessary deductibles, you can calculate the deductions. Then the total deductions need to be deducted from the total gross salary and employee's allowances.

Step 6 - Make salary statements and payslips

After every pay period, it is required to prepare a summary report or salary statements that will contain all salary components. It will include,

- Basic Salary

- Payroll Deductions

- Absences

- Overtime

- Allowances

These payslips for each employee will help to maintain the records of the paid salary each month. In addition, these payslips are prepared for the employees, which contains their salary calculations.

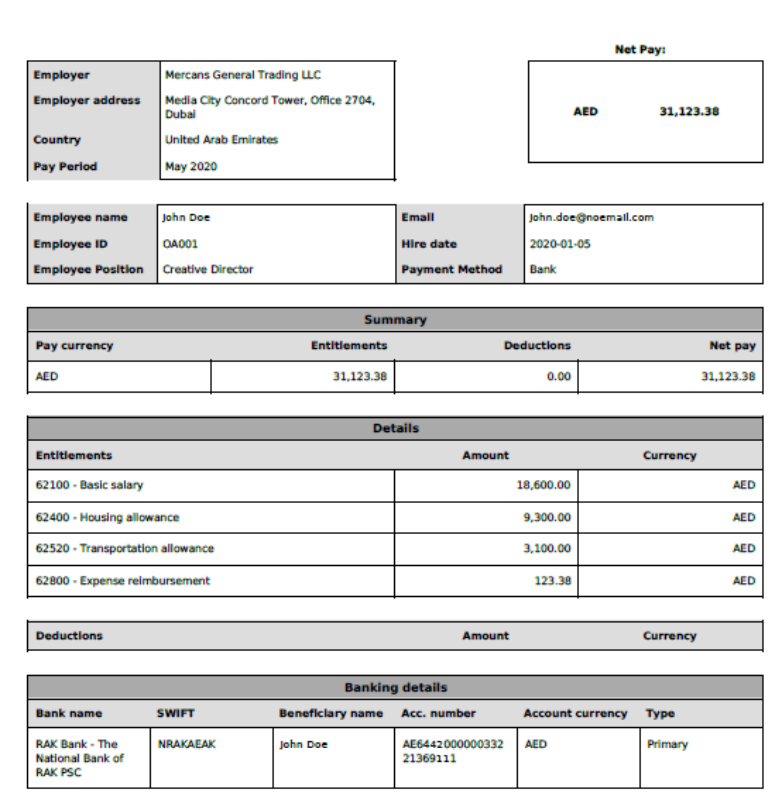

Sample Payslip -UAE

Step 7 - Make a WPS sif file

From the steps mentioned above, now the payroll process is almost done. Now, the last part is creating a sif or salary transfer file.

After that, the Ministry of Labor will define the file format. After that, all exchanges and banks also follow it in the country. Please take note: this is one of the most crucial steps to payroll processing in UAE as the government mandates it.

Read More about - Everything You Need to Know About Wage Protection System (WPS) in the UAE

Mandatory and Voluntary Payroll Deductions in UAE

In the United Arab Emirates, these deductions are made to the wage of staff members employed, and they fall into these categories: Mandatory Deductions and Voluntary Deductions.

Mandatory Deductions are wages that are withheld from an employee's paycheck to meet the necessary obligations.

Voluntary Deductions are the payments that are made for health insurance contributions and advances, among others.

By the UAE legislation, mandatory payroll deductions, as you may have presumed, are required. On the other hand, the voluntary deductions on the employee payroll are choices that an employee makes and is agreed upon by both employers and employees.

Mandatory Deductions on Employee Payroll

In the UAE, mandatory employee payroll deductions may include contributions for health insurance. The deduction can also include:

- Garnishments.

- Court orders for payments to courts who have won the judgment against particular employees.

- Payments for child support.

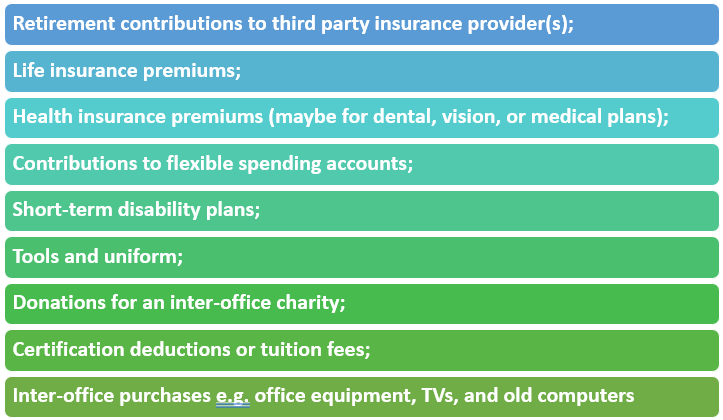

Voluntary Deductions on Employee Payroll

Unless the concerned employee gives authorization on the payroll deductions, an employer can not withhold voluntary deductions on employee payroll from the payroll cheque of an employee. Examples for this include:

In each voluntary payroll deduction, a written authorization needs to be provided by the employee before the payroll processing team makes the deduction.

In addition, the details such as name, date, and reason behind the voluntary payroll deduction need to be provided. It is because they have already been considered a standard for many businesses in the region.

Main types of deductions made to the employee wages in the UAE

In the UAE, there are three types of main deductions for wages,

- By the UAE legislation deductions that are required or those that proper courts order;

- Deductions for the convenience of the employee;

- Deductions that are for contributions on interoffice matters

Can an employer deduct from paycheque during every pay period?

In the UAE, an employer can deduct certain payroll items in the employee wages. Thus, an employer can deduct money if it is legally authorized or if the employee has agreed to it voluntarily. For the latter, there has to be consent for the deduction.

What is included in a payslip?

In the UAE, a payslip for an employee includes gross wage, payroll deductions (Mandatory/Voluntary), and net pay(paid to the employee after deductions are made from the gross wage).

Tax and Social Security in the UAE

The tax system in the UAE – or the lack of taxes paid – is one of the main that draws to the region for many ex-pats. For example, there is no income tax paid by employees and no system for corporate and inheritance taxes. Currently, there is no individual income tax in the UAE.

Where a UAE entity employs UAE citizens, it is required to make social security contributions. Still, there is no requirement for an expatriate or an expatriate employee to make any social security contributions.

Let us see more in detail about Social Security in the UAE.

Social Security in the UAE

For expatriates, there is no social security scheme available. Thus, there is no need for an expatriate to male social security contributions.

To obtain a UAE Resident Permit, appropriate health care insurance is required. Thus for all employers, it is mandatory to provide medical insurance to their employees.

After one month of hiring the employees, the employer must register for a UAE national/GCC Nationals with the (GPSSA) General Pension and Social Security.

Social Security Contributions

Contributions should be made by both the employer and employee:

Employer - Employer Payroll Contribution

Employee - Employee Payroll Contribution

The monthly social security contributions towards minimum salary are AED 1,000, and the maximum is AED 50,000.

The 5% employee contribution will be deducted from the employee's salary each month, and the GPSSA payment will be made on the 15th of the following month.

How to Make Social Security Payment?

For the UAE nationals/GCC Nationals, the social security payments need to be made and must be processed via, UAE Funds Transfer System(UAEFTS). UAEFTS payments are facilitated by the UAE commercial banks.

Pensions For the UAE and GCC Nationals

To benefit the UAE-employed citizens, the Government of the Gulf Corporation Council (GCC) member states - Kuwait, Qatar, Bahrain, Saudi Arabia, Oman, and United Arab Emirates-has implemented the state pension scheme.

The Pension Scheme in the UAE is governed by the Federal Pension and Social Security which the GPSSA enforces. Throughout the UAE, pension scheme applied equally to all employers, including different free zones, and mandates all eligible employees, UAE or GCC nationals, must be registered with the GPSSA within the first month following the beginning of their employment.

Eligibility

The employed UAE nationals who hold a family book are entitled to be enrolled in the GPSSA pension scheme and are consequently not eligible to receive an EoS gratuity when they leave an organization.

Based on the nationality, GCC nationals will qualify to register by default and are not required to submit any proof other than their passport. But, most important, registration is a mandatory requirement for GCC and eligible UAE nationals.

Emiratis aged between 18 and 60 years are eligible for the pension scheme and need to provide fitness and the medical report signed by GPSSA Centre.

Registration

An employer needs to first register with the GPSSA before registering eligible employees and get a registration number. The registration process generally takes 5 working days after submission of the required documents.

The employer needs to make sure that they register the eligible employees within one month of the commencement of their employment. This registration process can take up to 14 working days.

If registration is not done on time, late registration may be penalized in the form of late fees and fines. So, the employer needs to begin with the registration process with the GPSSA sooner, even if the company is not previously employed in GCC nationals or UAE.

In the UAE, every eligible individual has a single registration number that remains with them for the entire working life.

Pension Contribution

To the employee’s pension fund, both the employee and employer are responsible for making contributions.

- An eligible UAE national employee - Contribute 5% of their monthly salary

- The government employer - Contribute 15%

- In respect of private-sector employment - Employers Contribute - 12.5%, with an additional 2.5% being contributed by the government.

Fines and penalties

By the GPSSA, employers may be fined for late payment at a daily rate of 0.1% each day of the contribution. In addition, if you fail to register eligible employees, the GPSSA may also charge a fine of AED5,000 per case.

Key Takeaways

And it's a wrap.

By now you would have developed the understanding of how UAE payroll and compliance works, we covered the following topics in the article:

- Starting a Business in UAE

- Registrations and Establishing an Entity in UAE

- Banking

- Minimum Wage In UAE

- Immigration and Work Permit in UAE

- Employment Law in the UAE

- Steps For Processing Payroll In UAE

- Mandatory and Voluntary Payroll Deductions in UAE

- Tax and Social Security in the UAE

- Pensions For the UAE and GCC Nationals

Deskera provides an automated solution for all your payroll needs, just input your employee information, compliance details, select your pay schedule, and that is all.

Make payroll a breeze for your organization. Spend more time on your most valuable asset, people, not the administration work that comes along with it.