Most businesses, large and small, offer health insurance to their employees. Then why do some employees want to go for a second coverage?

Some employees could also be covered under their spouse’s or parent's health insurance. Despite primary health insurance or coverage, there are times they experience a predicament to have another one. Some feel it might be an added advantage; as having an extra is always better than one!

But, come to think of it, how far do you think it is true? Can they really reap the benefits of double coverage, and what does that mean for the employers?

With all these questions answered and more information on the topic is what this post aims at. Here is what more we shall learn about the two health insurance plans.

- Can employees have two Health Insurance Plans?

- When can employees need two health plans?

- How do multiple Health Insurance Work?

- Primary Vs. Secondary Insurance Plans

- When Does a Health Insurance Policy become Primary Insurance?

- In what circumstances does a health plan become Secondary insurance?

- What Health Insurance Is the First to Pay?

- How Much will Two Health Plans Cost You?

- What Benefits and Drawbacks Come with Having Double Coverage?

- Two Health Insurance FAQs

- Conclusion

- How can Deskera Help You?

- Key Takeaways

Can employees have two health insurance Plans?

Your employees can certainly have two different health insurance plans. It is completely acceptable to have two different health insurance plans, and many people do so in particular situations.

There could be reasons such as being covered in parents’ plans or spouse’s plans. Moreover, people have a general tendency of thinking that having two plans would be better than one. Yet, at this point, isn’t it important to consider that having two plans would imply paying twice the premiums?

There are many points like these that are often easily skipped or missed by the employees when they are looking at enrolling in two insurance plans. It is always recommended to gather complete information about all the plans available and draw a comparison to arrive at a clear winner.

When can employees need two health plans?

Apart from the thought that the two plans instead of one could make medical expenses more bearable, there are different scenarios in which an employee could be subject to two insurance plans. There could be a variety of factors. Let’s discuss some more scenarios in the points to follow:

Health Plan + Medicaid

If you receive Medicaid along with a health plan, then your primary insurance would be your health insurance and Medicaid would be the secondary.

Married Parents Plan + Spouse’s Plan

If you are under 26 years of age and married, and covered by your parent's plan and the plan of your spouse, then your spouse’s coverage will be your primary plan and your parent’s plan is going to be your secondary plan.

Divorced Parents Plan

If you are under 26 years of age and are covered under the separate policies of each of your parents, then the parent who owns custody of the child will be the primary insurance plan. In the case of joint custody, the birthday rule applies. The secondary plan would be of the parent who does not have the child’s custody.

Married Parents with separate policies

If your parents are married but have different sets of policies to cover you, then the parent whose birthday occurs first in the calendar year will have their plan as the primary plan. On the other hand, the parent whose birthday appears second in the calendar year will have the secondary plan.

Married with separate coverages from respective employers

In the case where you are married and both you and your spouse have individual coverages provided by your respective employers, then your employer’s plan becomes your primary coverage. The coverage of your spouse will be your secondary plan.

How do multiple Health Insurance Work?

If you have many plans, the sum total of what they all cover would not ever go above 100% of the price. Having several health insurance plans does not entitle you to a double reimbursement for a doctor's appointment or two prescriptions. Understanding the distinction between primary and secondary insurance is crucial in this situation (which we shall learn in the subsequent section).

When there are two different types of insurance plans, a COB or the Coordination of Benefits aids in getting carriers and participants on the same page. While preventing carriers from overpaying on medical claims, it enables customers to receive complete coverage for their medical expenses.

Coordination of benefits is the process that determines which insurer pays a claim first if you have more than one health plan. To understand this clearly, we must first get a grip over what are primary and secondary plans and the difference between the two.

One plan is designated by the COB as the primary insurance option, and the other as the backup. Most benefits are paid for by the first plan, and any that the primary plan does not cover is covered by the secondary plan.

After their deductibles are satisfied, a person with dual insurance plans occasionally pays almost nothing. However, this would rather be determined by the circumstances.

You still need to choose the correct plans and recognize your coverage. You will also need to be prepared to deal with a mountain of paperwork, despite a strong COB by your side.

Primary Vs. Secondary Insurance Plans

This part of the article dives into the fundamentals of having double insurance. When an individual is enrolled under two insurance plans, the COB helps in pointing out the primary and the secondary insurance plan from the two plans.

Your primary insurance may require you to share the cost (cost-sharing) and your secondary insurance may pay all or a portion of the balance.

It is extremely significant to note that the plan limits will be covered by both primary and secondary insurance. You can be liable for any sum that remains unpaid after the secondary insurance has paid its portion. Therefore, even if you have several health insurance plans, you could still have unpaid medical expenses.

When Does a Health Insurance Policy become Primary Insurance?

Your primary insurance is your main insurance if you have two plans. The health insurance you receive via your workplace is normally regarded as your primary health insurance plan, with the exception of corporate retirees who are eligible for Medicare. If a firm has less than 100 employees, Medicare is the primary plan for people who have both Medicare and a private company plan; if an employer has more than 100 employees, the private insurer would be the primary plan.

However, the employer often instructs the employee to first collect from Medicare when the employee retires with company insurance and receives Medicare.

In what circumstances does a health plan become Secondary insurance?

Secondary insurance refers to insurance that takes effect after your primary health insurance or main insurance has been used up.

What Health Insurance Is the First to Pay?

Who pays initially depends on the situation while deciding between primary and secondary insurance. When you file a claim with your health insurance, your primary insurance plan will take over and pay out your benefits as if you did not have a secondary plan. If it is necessary, your secondary insurance plan then kicks in and pays the remaining expense.

If we wish to understand which would be the plan that pays first, let’s consider an example of the The birthday rule. The rule determines which parent will serve as your primary insurer if you are a child with two parents who each provide coverage for you under their separate plans. The parent whose birthday occurs earliest in the calendar year will give the most coverage. It should be noted that the parent with the earlier birthday wins, not the parent with the older age.

How Much Will Two Health Plans Cost You?

As opposed to the commonly presumed notion, having two health plans does not necessarily simplify life; when employees have two health plans, they will always have to choose which one will eventually pay for their medical expenditure. Deciding which one pays is one part of the problem; the other is the two premiums that you will be required to pay.

Furthermore, you may have two different deductibles to satisfy annually if you have two health plans. In such a case, you will have to cover both deductibles before the health insurance starts to pay. Therefore, it is essential the individual weighs all the options clearly and accordingly, decide of they want to opt for two plans or just a single one.

What Benefits and Drawbacks Come with Having Double Coverage?

When your employees have two insurance plans, the out-of-pocket expenses might be modest if the two plans have completely distinct structures because they work well together. This is so that they have better overall coverage if one plan does not cover a certain service, but the other does.

Additionally, dealing with two health insurance providers could be an added overhead task, each of which may have quite distinct policies. This can be complex enough to cause costly errors like submitting for reimbursement improperly or late. Eventually, the drawbacks of having two annual deductibles and paying two monthly premiums can be substantial.

The advantages and disadvantages of the two health insurance plans have been summed up in the following table:

As is evident from the table, the employees are likely to face more disadvantages than advantages. Moreover, there would be a lot of paperwork to be taken care of.

Two Health Insurance FAQs

Q: Will there be a copay if you have two insurances?

A: If you have two health insurance plans, the second one might reimburse any copayments or extra expenses that your original policy did not cover. One should get a clear understanding of this part of insurance by connecting with the individual insurance companies.

Q: When I become eligible for Medicare, will I lose my Medicaid?

A. No. Medicaid and Medicare actually complement one other quite effectively. Between the two, the majority of your expenses ought to be fully covered. Medicaid-Medicare programs that provide more alternatives for coverage are available in some states.

Conclusion

Two insurance plans oftentimes translate into double the set of problems. Not only are the double coverage plans too expensive, but they are also too complicated to be truly beneficial because of the humongous paperwork.

As an employer, you can educate your employees and staff to learn about all the available plans appropriately before making a decision. After which, they can strive to select a single plan that provides the best coverage for their requirements.

However, remember that you should not influence the decisions made by your staff. If you have a broker, they can assist in busting the notion that signing up for two medical insurance policies is preferable to just one.

How can Deskera Help You?

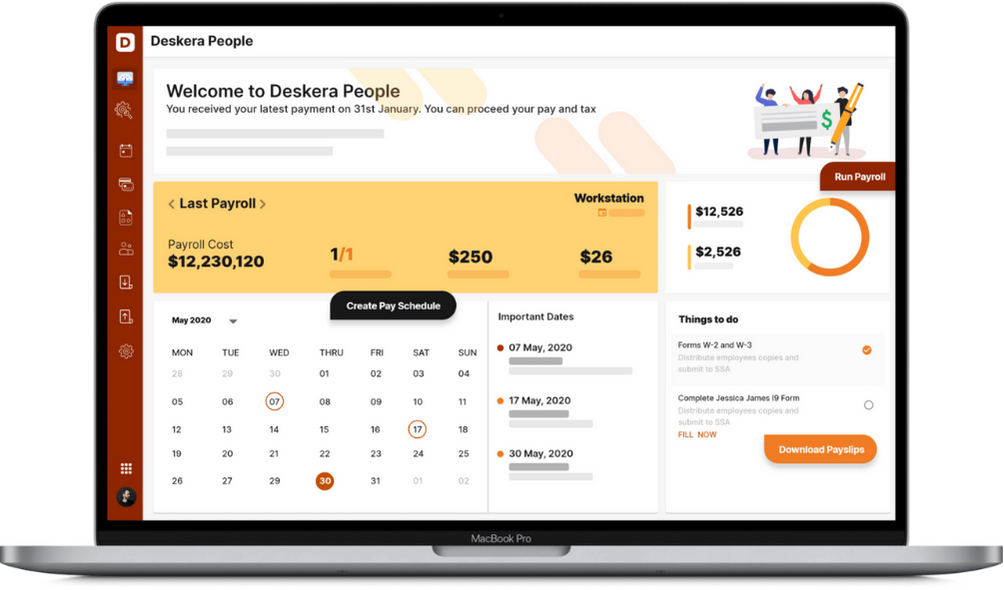

Employers may execute payroll more quickly and easily using Deskera People thanks to its integrated tax computations. Employers would also be able to designate and assign specific compensation components to a worker in accordance with their needs. Additionally, voluntary employee deductions for things like long-term disability insurance premiums will need to be set up.

Through your personalized dashboard, employees can examine all of their payroll information as well as the projections for the future one. The smooth transfer of employee data from other apps and built-in legislation and tax compliances for the USA are two further benefits.

Key Takeaways

Your employees can certainly have two different health insurance plans. It is completely acceptable to have two different health insurance plans, and many people do so in particular situations.

- Apart from the thought that the two plans instead of one could make medical expenses more bearable, there are different scenarios in which an employee could be subject to two insurance plans.

- If you receive Medicaid along with a health plan, then your primary insurance would be your health insurance, and Medicaid would be the secondary.

- If you are under 26 years of age and married, and covered by your parent's plan and the plan of your spouse, then your spouse’s coverage will be your primary plan, and your parent’s plan is going to be your secondary plan.

- If you are under 26 years of age and are covered under the separate policies of each of your parents, then the parent who owns custody of the child will be the primary insurance plan. In the case of joint custody, the birthday rule applies.

- If your parents are married but have different sets of policies to cover you, then the parent whose birthday occurs first in the calendar year will have their plan as the primary plan.

- In the case where you are married, and both you and your spouse have individual coverages provided by your respective employers, then your employer’s plan becomes your primary coverage. The coverage of your spouse will be your secondary plan.

- Having several health insurance plans does not entitle you to a double reimbursement for a doctor's appointment or two prescriptions.

- When there are two different types of insurance plans, a COB aids in getting carriers and participants on the same page. While preventing carriers from overpaying on medical claims, it enables customers to receive complete coverage for their medical expenses.

- One plan is designated by the COB as the primary insurance option, and the other as the backup.

- Most benefits are paid for by the first plan, and any that the primary plan does not cover is covered by the secondary plan.

- After their deductibles are satisfied, a person with dual insurance plans occasionally pays almost nothing.

- Your Primary insurance is the one that pays out first, and this plan will only pay out up to the limits of your coverage.

- If you have more than one health plan, the remaining cost is covered by your secondary insurance after your primary insurance has paid its portion.

Related Articles