Index

- Understanding Trial balance

- What are the Uses of a Trial Balance?

- How to Prepare A Trial Balance: The Methods

- Types of Trial balance

- What is Trial balance Error-Are There Any Limitations of a Trial Balance?

- Trial Balance Vs. balance sheet

Understanding Trial Balance

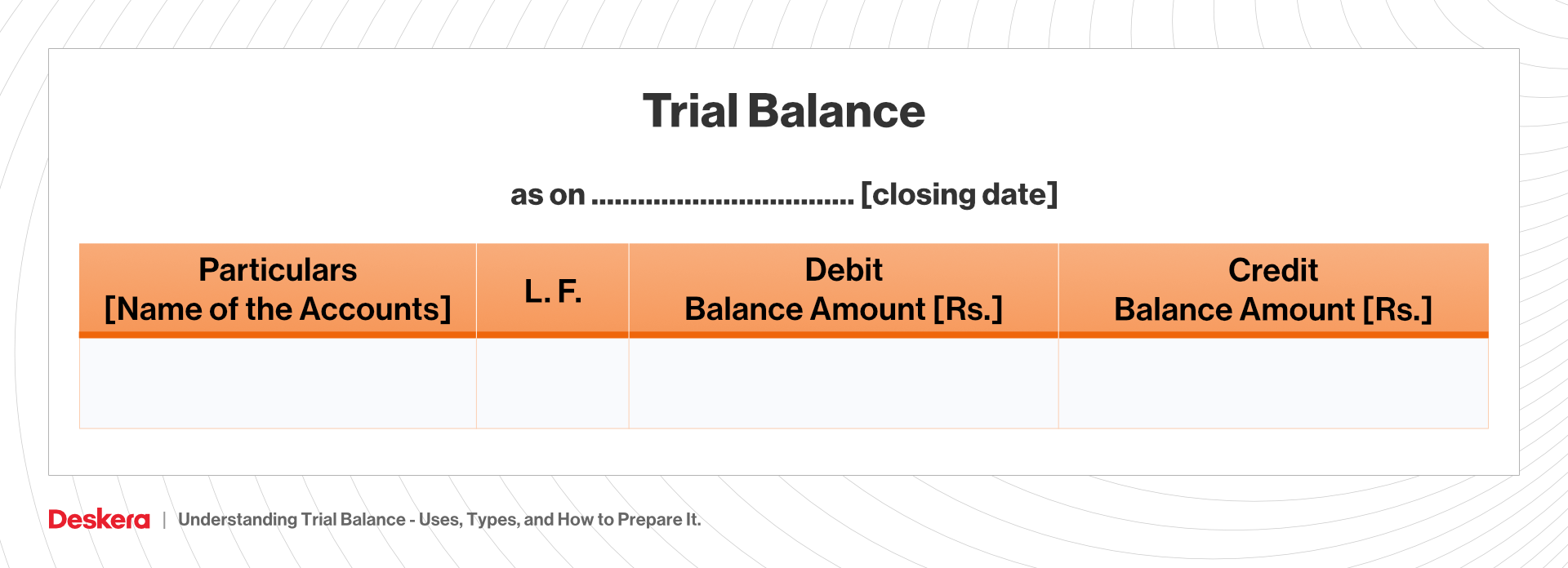

The trial balance is a bookkeeping or accounting report in which the balances of all the general ledger accounts of the organization are listed in separate credit and debit account columns. The balances are usually listed to achieve equal values in the credit and debit account totals. Any deviation from expected values helps to detect errors in the accounting exercise.

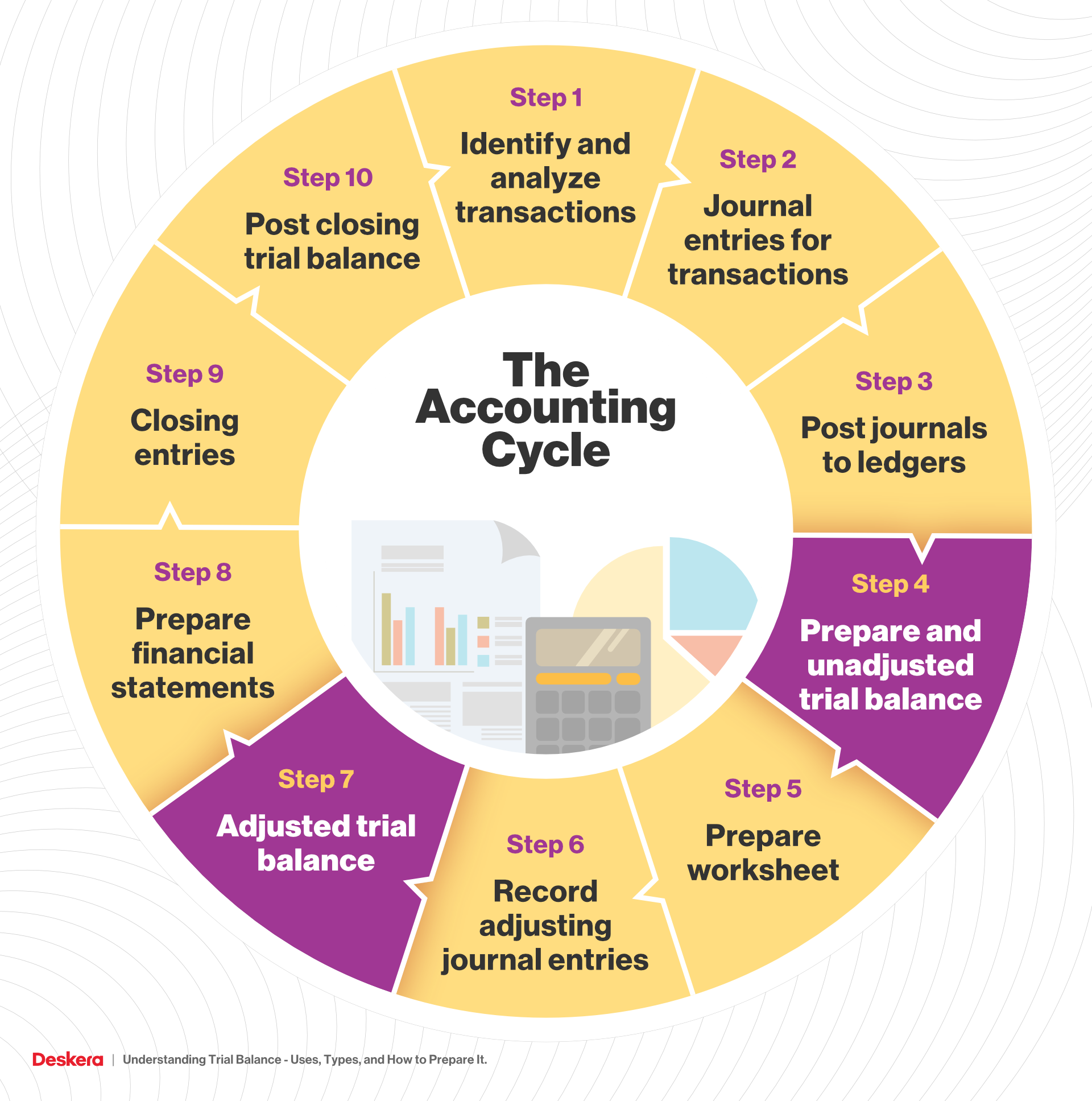

Trial balance is an important Step of the accounting cycle - which is a series of steps performed during an accounting period to analyze, record, classify, summarize, and report financial information for generating financial statements. The trial balance itself is not a financial statement, but comprises all the information required for creating the three main financial statements—the cash flow statement, the balance sheet, and the income statement. In the accounting cycle, preparing the trial balance comes right after posting journal entries to the ledger’s accounts, and just before preparing the financial statements.

Businesses prepare trial balance reports, usually at the end of every reporting period. Here’s all you need to know:

What are the Uses of a Trial Balance?

It is important to note that the trial balance is not a financial statement. For the most part, it is only an internal report. But why does a company need a trial balance? What are the objectives of a trial balance? Let us try to understand its purpose.

- While it is not a financial statement, a trial balance acts as the first step in preparing one. Accountants use the trial balance spreadsheet as the basis while preparing a financial statement.

- A trial balance is made in accordance with the double-entry concept of bookkeeping. This means that for every entry recorded in the debit column, a corresponding credit entry will also be recorded in the credit column. Since it involves recording all the entries from the ledgers of the organization in this manner, it also helps to identify and rectify errors.

For example, if there is a mismatch between the debit and credit account totals at any point, it indicates an error. However, since most companies use software tools, their system may not allow new entries to be added if there is a mismatch between the values, leaving no room for error. This helps to achieve mathematical accuracy.

- With the help of the trial balance, one can also ensure that the account balances are accurately extracted from accounting ledgers.

- Being a summary sheet, it helps to give a bird’s eye view of the accounting transactions of the company.

- A trial balance can be an important tool for auditors as they can analyze the trial balance prior to scrutinizing the ledgers.

- Adjustments can be made easily even after a trial balance has already been prepared because it provides the accountants with tallied columns.

How to Prepare A Trial Balance: The Methods

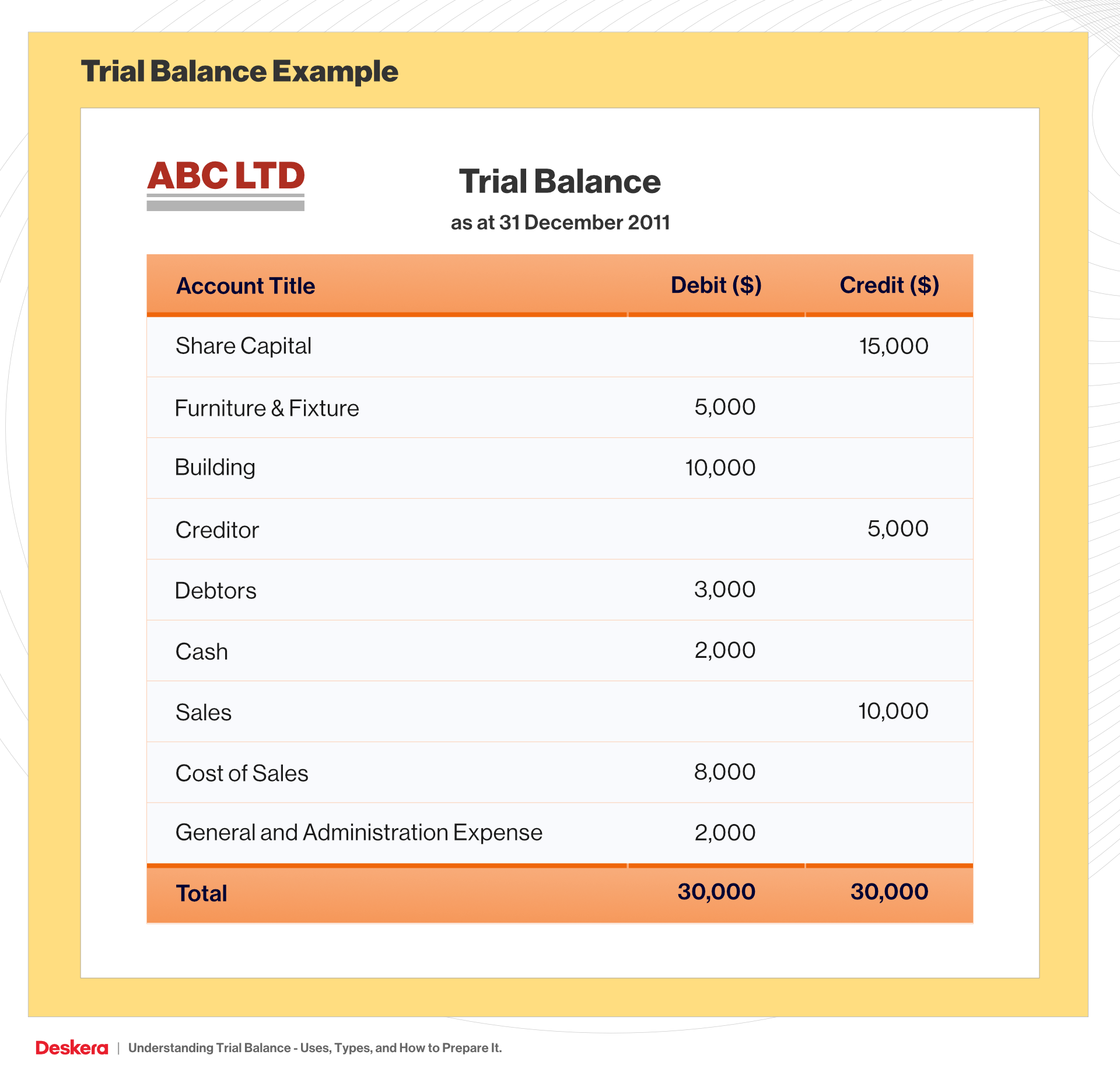

To prepare a trial balance, the initially recorded transactions of a company in its ledgers are added. The ending balance of each ledger account is then reflected in the trial balance sheet. It is the sum of all debit and credit transactions. Therefore, the end of an accounting period reflects a debit balance for the accounts of asset, loss or expense, and a credit balance for the accounts of liability, equity, revenue, or profit.

There are various methods of preparing a trial balance.

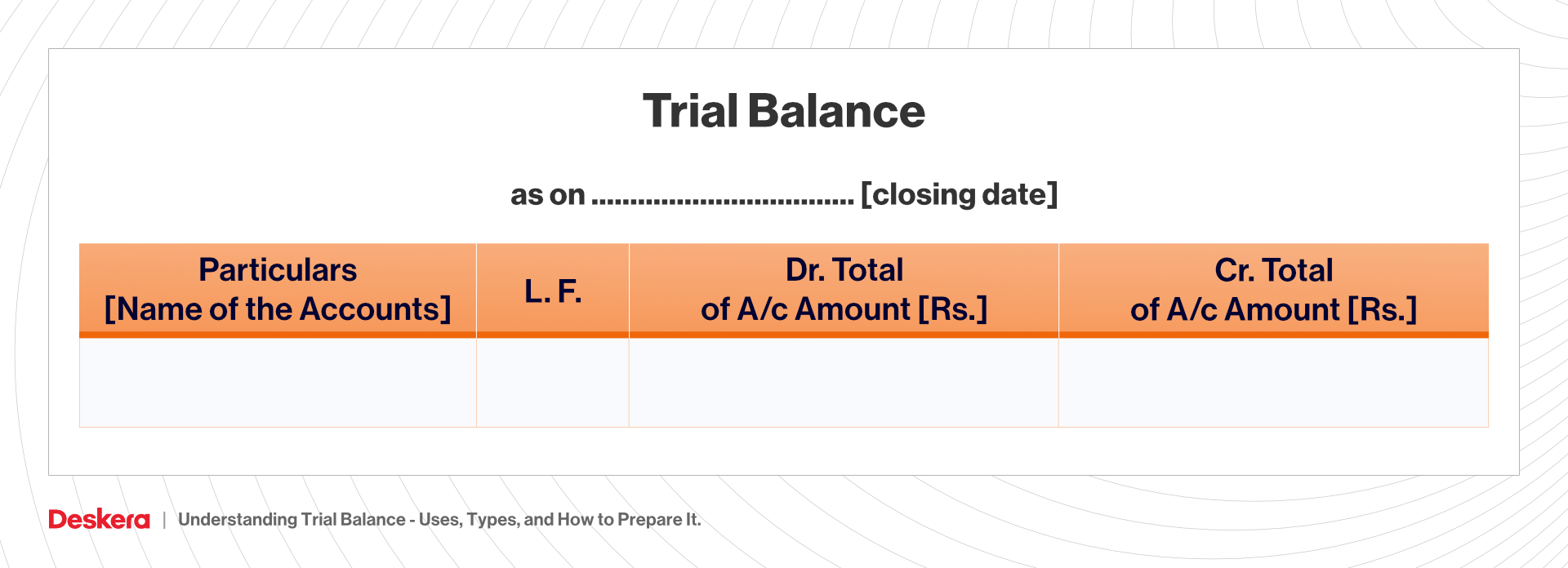

- Total Method or the Gross Trial Balance Method with Template

In this method, the total value at the end of the debit and credit columns of a company’s ledger is recorded in the trial balance sheet. This method consumes less time, but is not useful in the preparation of the final accounts; therefore, it is not generally used.

Balance Method or the Net Trial Balance Method with Template

In this method, the process of totalling the ledger accounts on both sides is followed by balancing the accounts. Account balancing is a process where both sides are tallied by placing the balance on the side where the amount falls short.

- Compound Method

The compound method uses both the practices described above. It has tables for totals as well as balances.

Types of Trial balance

Unadjusted Trial Balance

The Unadjusted Trial balance is defined by the the accounting coach as "an internal accounting report that is prepared prior to recording the adjusting entries. Its purpose is to verify that the total amount of debit balances in the general ledger accounts is equal to the total amount of credit balance”.

Adjusted Trial Balance

Once a trial balance is prepared, an unadjusted version is used by an accountant to indicate the necessary adjusting entries and the resulting adjusted balances. An adjusted trial balance example might be where a company received some products from a vendor but the invoice was not processed as of the end of the accounting period.

Once the adjusted trial balance is made, it is used to prepare financial statements.

What is Trial balance Error-Are There Any Limitations of a Trial Balance?

There are essentially two primary limitations of a trial balance.

First, the detection of errors using a trial balance relies on any arising discrepancies in the totals of the credit and debit columns. However, there can be instances where these totals are equal despite the presence of errors. It may have occurred that certain transactions were not recorded at all, and hence both the credit and debit sides were not affected. Or that an incorrect debit entry was accompanied with an incorrect credit entry as well. Therefore, its scope in detecting errors is limited.

For example, an entry was recorded wrongly due to human error – such as Sales for $5000 is recorded as $50000 – the entry is incorrect but you will not be able to detect this error on the Trial balance because its the same mistake in both credit and debit accounts.

Secondly, Technology has changed how we do business.The trial balance was mainly used to prepare financial reports but the widespread adoption of accounting softwares like Deskera, which can perform this function automatically are effectively reducing the need of preparing a manual Trial balance

Trial Balance vs Balance Sheet

May be due to the similarity in nomenclature a lot of people get confused between the Trial balance and the balance sheet, but by now you surely know that both these are completely different. The information from the trial balance is used to prepare the balance sheet.

Some important distinctions here must be made between a trial balance vs balance sheet.

- The most important difference is that a balance sheet is a financial statement that is used to report a company's liabilities, assets, and stockholders' equity at a particular date. The trial balance, as stated earlier, is not a financial statement. It simply summarises all the transactions on the company's ledgers.

- A trial balance also does not form part of the final accounts, while a balance sheet is an essential part of those.

- Another important difference in trial balance vs balance sheet is their formats. The trial balance is recorded under debit and credit columns, while a balance sheet ideally displays total assets, liabilities, and stockholders' equity. Moreover, while the trial balance uses the company's ledgers as a source, a balance sheet uses the trial balance as a basis.

- The two also differ in the types of accounts that they display. The trial balance shows real, nominal, and personal accounts, while a balance sheet shows only real and personal accounts.

- Unlike a trial balance, a balance sheet requires the authorization of an auditor.

Conclusion

While the preparation of a trial balance is not a one-solution for detecting all accounting errors, it is undoubtedly an essential step in the accounting process since the remaining accounting exercises hinge on this process. It finds excellent use in real-life scenarios. For example, banks and lending agencies may use it to understand the borrowing capacity of a company and also its credibility. It is an essential procedure for the closure of books of accounts, but it is not error free. To make your accounting seamless, accurate and error free it is a good idea to move to a good accounting system like Deskera which is especially suitable for small businesses.

As a business owner, you can invest in accounting softwares that can help you keep track of your journal entries, balance sheet, inventory and production costs.A successful business needs an efficient financing process that meets its specific needs.

Deskera Books is an online accounting software that your business can use to automate the process of journal entry creation and save time. The double-entry record will be auto-populated for each sale and purchase business transaction in debit and credit terms. Deskera has the transaction data consolidate into each ledger account. Their values will automatically flow to respective financial reports.

You can have access to Deskera's ready-made Profit and Loss Statement, Balance Sheet, and other financial reports in an instant.

Related Articles