Nashville, good old' twang, and the city that strums guitars and heartstrings into the early hours of the morning come to mind when people think of Tennessee.

However, as all Tennessee residents are aware, the state encompasses much more than Music City. Similarly, operating a small business entails far more than meets the eye. You're in charge of everything as the owner of your own small business, from starting a store to dealing with any problem to paying your staff. You should also be aware of Tennessee payroll taxes; even though the state does not have a state income tax, you must still pay federal income tax and unemployment insurance.

Let’s have an overview of the Payroll Taxes in Tennessee.

Table of Contents

- List of Forms You Need Before Calculating Payroll Tax

- Form W-4: Employee’s Withholding Certificate

- State W-4 (as applicable)

- Direct Deposit Authorization Form

- Form I-9: Employment Eligibility Verification

- Step 1: Calculate your gross compensation

- Step 2: Determine the amount of tax withheld from employees

- Step 3: Pay Attention to Deductions

- Step 4: Include any refunds for expenses

- Step 5: Add everything up

- Calculating Payroll Taxes for Employers

- Income Tax in Tennessee

- Taxpayers in Tennessee

- Tennessee's Income Tax Rate

- What Is The Best Way To Pay Tennessee State Taxes?

- When Do Tennessee Tax Returns Have To Be Filed?

- How can you tell whether you've paid your Tennessee state income tax?

- Tennessee Taxes Can Be Deducted

- Final Words

List of Forms You Need Before Calculating Payroll Tax

Your workers must complete the following new worker documentation before you may begin computing payroll taxes.

- Form W-4: Employee’s Withholding Certificate

- State W-4 (as applicable)

- Direct Deposit Authorization Form

- Form I-9: Employment Eligibility Verification

Form W-4: Employee’s Withholding Certificate

Each new employee must fill out IRS Form W-4, which provides you with important information about how much federal income tax (FIT) you should deduct from their pay. The employee's name, address, and social security number will be entered.

In 2020, the W-4 was updated. The new form includes a five-step technique for assessing employee withholding as well as a new Publication 15-T (Federal Income Tax Withholding Methods). Withholding allowances are no longer used.

You can continue to utilise the information given on the previous form W-4 for workers recruited in 2019 or before. It includes a worksheet for your employees to use in calculating withholding allowances for dependents and children. If an employee works a second job, gets married, has a kid, or gets divorced, they may wish to fill out a new W-4, but you cannot force current workers to do so.

Employees can also elect to have more tax withheld or request to be exempt from federal income tax withholding. The new W-4 form includes comprehensive instructions.

Make sure the employee signed the W-4, but only send it to the IRS if they ask. Keep it in the personnel file of your employee for at least four years after the worker's most recent tax return.

State W-4 (as applicable)

Some states have their own forms for withholding. Form W-4 is frequently used as the basis for computing state and/or local income tax withholding in states that don't. The Federation of Tax Administrators has a complete list of state tax forms that are qualified.

Direct Deposit Authorization Form

You have various options for paying your employees as an employer: paper checks, direct deposits, prepaid debit cards, or cash. Because it is typically the easiest and most secure form of receiving paychecks, direct deposit is by far the most common. In fact, direct deposit is currently used by more than 82% of US workers.

If an employee wants to be paid by direct deposit, he or she must fill out a direct deposit consent form with bank routing and account information. The paper can be used as a permission form for depositing the employee's net income into their bank account online.

Many businesses will require a voided blank check as part of the verification process to guarantee that the employee's bank account information is valid.

Form I-9: Employment Eligibility Verification

A Form I-9 is completed by new workers to prove that they are legally authorised to work in the United States (For example, as a resident, permanent resident, or holder of a work visa). To prove their job status, they can show you their US passport or both their driver's licence and Social Security card.

You must get a signed Form I-9 from your employee before they begin working for you. The completed form, together with any accompanying evidence, should be stored in the personnel file of your employee.

Calculating Payroll Taxes for Employees (For All States)

Once your workers (and your business) are set up, you can calculate the salaries earned by each person as well as the amount of taxes that must be withheld. Making deductions for health insurance, retirement benefits, or garnishments, as well as adding back expenditure reimbursements, if required.

If you're having trouble figuring out a certain step, feel free to jump ahead to it:

Step 1: Calculate your gross compensation.

Step 2: Determine the amount of tax withheld from employees.

Step 3: Pay Attention to Deductions

Step 4: Include any refunds for expenses.

Step 5: Add everything up.

Step 1: Calculate your gross compensation

The amount an employee makes before taxes is deducted is referred to as gross pay.

Gross pay for hourly employees is calculated by multiplying the number of hours worked during the pay period by the hourly rate. For instance, if your receptionist worked 40 hours per week at $20 per hour, his weekly gross salary would be 40 x $20, or $800.

Remember to include in any overtime compensation, which is usually 1.5 times the regular rate when an hourly employee works more than 8 hours per day or 40 hours per week. In this scenario, your receptionist would be paid $20 for the first 40 hours worked, plus $30 for the 41st and any additional hours done during the week.

Salaried personnel are free from overtime laws, therefore their gross compensation will normally stay the same from pay period to pay period. Simply multiply their annual compensation by the number of pay periods. For example, if a manager makes $50,000 per year and is paid twice a month, his gross income per pay period is $2,083.33 ($50,000/12 months/2 monthly pay periods).

Gross salary also includes any commissions, tips, or bonuses earned by the employee.

Step 2: Determine the amount of tax withheld from employees

You may start calculating how much you need to withhold to cover an employee's taxes after you know their gross salary and the number of allowances from their W-4. You'll need to withhold federal, state, and FICA taxes from each paycheck in most states.

Step 3: Pay Attention to Deductions

Calculating your employees' paychecks entails taking out any necessary deductions in addition to withholding for payroll taxes.

Health insurance premiums, 401(k) plan contributions, and health savings account contributions are all examples of optional pre-and post-tax deductions. Involuntary deductions may be necessary for items such as child support or wage garnishments (you'll know whether you need to withhold these things because you'll get an order from a judge, the IRS, or the state).

Step 4: Include any refunds for expenses

Your employee expects to be compensated for any company costs they paid out of pocket. Employers have the option of paying reimbursements individually or combining them with payroll.

It's important to remember that cost reimbursement isn't considered part of your gross pay, therefore it's not subject to tax withholding. Employee costs should be reimbursed in full and added to net pay at the conclusion of the calculation.

Step 5: Add everything up

- You'll have everything you need to compute the paycheck once you've done all the arithmetic to figure out gross pay, tax withholdings, deductions, and reimbursements:

- Begin with your gross compensation.

- Subtract employee withholdings from the total.

- Deductions are subtracted.

- Include any compensation for expenses.

- You also get net pay!

Calculating Payroll Taxes for Employers

You, as the employer, are responsible for paying various payroll taxes in addition to the taxes you take from an employee's pay:

- FICA Matching: You must match the FICA tax withholding of your employees, which means your firm will pay 6.2% in Social Security and 1.45% in Medicare taxes. You, as the employer, would pay a matching $129.17 in Social Security and $30.21 in Medicare for our hypothetical employee, resulting in a $159.38 FICA liability.

2. Unemployment Taxes: Both federal and state unemployment taxes must be paid. Employers, not employees, are responsible for paying unemployment taxes.

- The Federal Unemployment Tax (FUTA) is 6% of the first $7,000 in the salary paid to each employee in a given year. If your business is subject to state unemployment, you may be eligible for a federal tax rate credit of up to 5.4%, bringing your effective tax rate down to 0.6%. You stop paying FUTA for the employee in that tax year once they earn more than $7,000 in a calendar year. Unemployment in the United States: $2,083.33 x 0.6 percent = $12.50

- The State Unemployment Tax (SUTA) differs from state to state. For information on tax rates, wage bases, and filing procedures, contact your state's Department of Labor or Unemployment Revenue. For the sake of this example, we'll suppose that the employee has not yet been paid $7,000 for the year. We'll utilise Florida's 2.7% unemployment tax rate. Unemployment in the state: $2,083.33 x 2.7 percent = $56.25

As a result, your total liability as an employer for this pay period is $129.17 + $30.21 + $12.50 + $56.25, or $228.13.

For the most part, all cities follow the same laws when it comes to payroll taxes. Let's take a look at what's going on in Tennessee.

Income Tax in Tennessee

The money you generate during a tax year is normally taxed at the state level. Despite this, Tennessee is one of just a few states that does not charge a personal income tax at the state level. Tennessee levies business income and real estate taxes, as well as sales taxes.

Taxpayers in Tennessee

Do you have to pay Tennessee income taxes if you make money or live in Tennessee?

Individuals are not liable to income tax on earnings in Tennessee since personal income is not taxed.

Tennessee's Income Tax Rate

This state has no income tax on wages, making it one of the lowest taxed states in the US. As a result, the Tennessee income tax rate is 0%. It does, however, have a flat tax rate of 1 to 2% that applies to interest and dividend income.

Outside of income, Tennessee imposes a tax on a variety of products. This is how they raise funds for municipal services including first responder services, infrastructure, roads, and schools, among other things.

What Is The Best Way To Pay Tennessee State Taxes?

If you owe Tennessee state taxes other than income tax, visit the Tennessee Department of Revenue website to learn more about what is taxed. Business and sales taxes, as well as inheritance and gift taxes, are all levied by the state.

You may pay your taxes online at https://tntap.tn.gov/eservices/_/

When Do Tennessee Tax Returns Have To Be Filed?

State tax deadlines sometimes overlap with the federal tax deadline, which is usually April 15 unless it falls on a weekend or the IRS determines differently.

How can you tell whether you've paid your Tennessee state income tax?

You do not need to check to see if your Tennessee state income taxes have been paid. This is due to the fact that the state does not levy a personal income tax.

Tennessee Taxes Can Be Deducted

The IRS permits you to claim a deduction on your federal tax return if you pay certain Tennessee taxes as a corporation or person. If you itemise deductions on your federal tax return, you can claim a state income tax deduction.

Add up your calendar-year deductible costs to see if you should categorise your deductions. If the sum exceeds the standard deduction amount for your filing status, continue. You can claim a standard deduction of $12,400 if you are single. So, if your itemised deductions total more than that, itemising your taxes is a good idea.

State and local tax deductions, including state income taxes, are now restricted to $10,000 per year ($5,000 for married filing separately) under the Tax Cuts and Jobs Act.

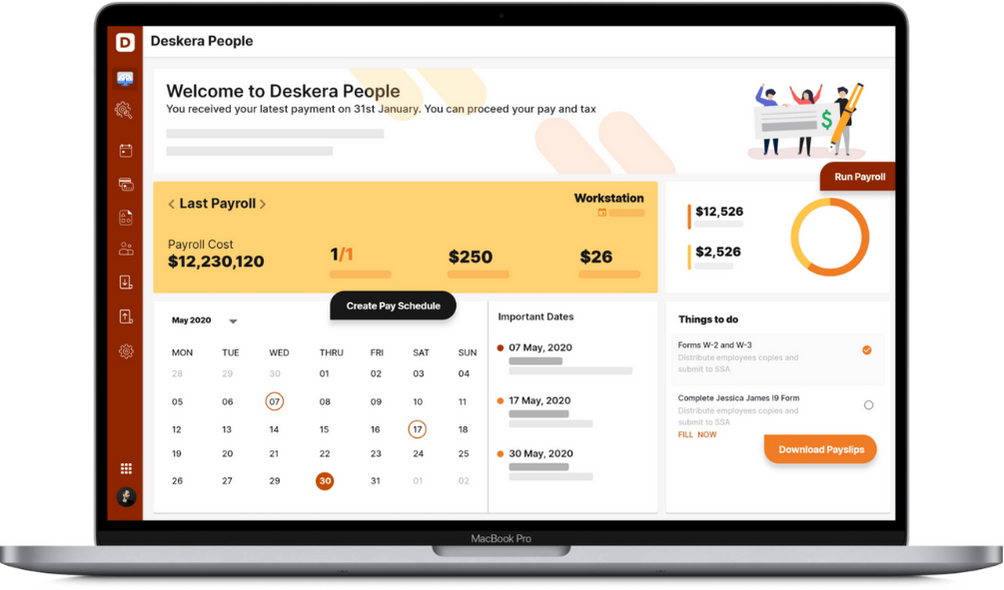

How Can Deskera Assist You?

As a business, you must be diligent with employee leave management. Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating payslips for your employees is now easy as the platform also digitizes and automates HR processes.

Final Words

Understanding your tax liability and the federal deductions you may be eligible for is critical since it influences the size of your entire tax return and refund.

When it comes to Tennessee, the state's income tax is straightforward, with a flat rate of 0%. Tennessee unemployment insurance rates for the calendar year 2022 vary from 0.01% to 10%, with a taxable pay base of up to $7,000 per employee per year. Only a flat rate of 2.7% is required of new employers.

Related Articles