Filing income tax returns can be a dreaded task. If you have filed your federal tax return with the IRS and are entitled to a tax refund, you may be anxiously waiting to get it or would want to get an idea of when you may receive the tax refund.

This blog is for all taxpayers waiting eagerly for their tax refund and will cover the following topics:

- When you can expect your Tax Refund

- Tax Refund Process

- Timeline for Tax Refund

- 10 Factors that may delay your Tax Refund

- Tracking your Tax Refund progress

- What to do if you get topic 152 when checking your Tax Refund status

- Top 5 tips for a Faster Tax Refund

- What are State Tax Refunds and how to check them?

- What to do if I get a Reduced Tax Refund?

When Can You Expect Your Tax Refund?

As a rule of thumb, the Internal Revenue Service (IRS), which is a limb of the U.S. Department of Treasury, processes tax refunds within 21 days when the tax return is filed electronically. If you have filed paper returns, you can expect your tax refund within 42 days.

However, there may be several factors that may delay your tax refund, including incorrect or incomplete information and further review. One of which is choosing the mode for receiving the tax refund from the IRS.

Modes of Receiving the Tax Refund

At the time of preparing your tax return, you would be required to pick a mode for the IRS to credit your tax refund after processing your return. The following methods are available:

- Direct deposit in the bank account

- Refund check via Postal mail

- A debit card that holds the value of the refund

- Purchases up to $5000 in U.S. Savings Bond

- Split the refund into IRA accounts by filing Form 8888

Timeline for Tax Refund

If you opt for electronic filing of tax returns and choose to receive your tax refund via direct deposit in a bank account, you can expect your tax refund in 1-3 weeks as opposed to an electronic filing with a paper check via postal mail which may delay the tax refund by over 5 weeks!

If you opt for paper filing of tax return and choose to receive your tax refund via direct bank deposit, your tax refund would be processed in 3 weeks as opposed to the paper filing of tax return with a paper check via postal mail which may take up to 6-8 weeks.

10 Factors that might delay your tax refund

In some extraordinary circumstances, the IRS might take longer than the usual 21 or 42 days time period to credit your tax refund. Apart from the technical delays, there may be other factors hindering your tax refund such as:

1. Tax Return Errors

When tracking your tax refund status, you may see a “Tax Topic 303” pop-up being displayed. Shoddy, rushed handwriting can lead to the IRS flagging your tax return as having typos. Spelling errors in your name or social security number (SSN) would also be an issue. IRS has listed these as one of the common taxpayer mistakes that can lead to a delay in returns.

Mistakes in the calculation of your returns would also cause a delay. This is especially difficult to rectify due to the trickle-down effect it would have on your statement. To avoid this, it is better to e-file your return and leave the calculations to the software.

2. Incomplete Tax Return Form

If you do not give the complete information required for the tax return form, then the IRS will consider it defective and will not provide the returns. You will need to file an amended return with the IRS, or risk getting penalized for the mistake.

3. Amended Returns

It is a rule of thumb that if you have filed amended tax returns for correcting errors and omissions from your return, your tax refund may be significantly held up and may take up to 16 weeks to be received.

4. Identity Theft or Fraud

Identity theft occurs when someone uses your personal information and SSN to falsely claim your return. The IRS will rectify this and take measures to prevent future thefts. However, this may delay your returns and tax refunds as the process could take anywhere from three months to a year to complete.

5. Claiming Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC)

When you file for EITC and ACTC, the law mandates that returns will be withheld until February 15th. This includes returns outside of your EITC and ACTC claims. There are no exceptions to this rule. And in these cases, your tax refund may get held up.

6. Filed Form 8379

Filing for the injured spouse refund could delay your refund significantly. If you filed form 8379 electronically with a joint return, it would take 11 weeks to process the refund. 14 weeks if it is done on paper. 8 weeks if the form is filed after the joint return has already been processed.

7. Requires Further Review

The IRS could delay your returns if your refund requires additional review. Several factors could trigger this process. This includes verifying your income, tax withholding amounts, and right to claim returns.

While checking your tax refund status, you may see a Tax Topic 152 alert popping up if the IRS needs to further review your tax return. In this case, there is no need to panic. The IRS will continue the tax refund process but may take a little longer.

8. Filed A Paper Return

Due to the Covid-19 pandemic, the IRS has been short-staffed in processing returns. Given the arduous task of manually going through tax returns, it is a given that tax refund would take longer than usual.

There are nearly 35 million tax returns currently backlogged and waiting to be processed. If your paper tax return has been filed accurately and completely, then it will take about 6 to 8 weeks to be processed.

9. Recovery Rebate Credit (RRC)

In cases that involve claims of RRC, if there is a mismatch of information between the RRC and IRS records or where an incorrect stimulus amount has been mentioned on your tax return, the IRS would need to manually adjust the same. This can cause significant delays in receiving your tax refund.

10. Form 1042-S

If you filed a Form 1040NR and requested a tax refund withheld on a Form 1042-S, the IRS will need more time to process your return. In such a case, the estimated time for receiving your tax refund is 6 months from the initial due date of the 1040NR return or the day of submission of Form 1040NR, whichever is later.

Tracking Your Tax Refund Progress

If you filed a tax return and are expecting a refund from the IRS, you may want to find out the status of the refund, or at least get an idea of when you might receive it. You can check the status of your refund with the “Where’s My Refund” tool or the IRS2Go mobile app.

You will require three key details when tracking your refund:

- Your SSN or Individual Taxpayer Identification Number (ITIN)

- Filing Status

- The exact whole dollar amount of refund filed

You can check the status of your tax refund 24 hours after e-filing the return, or 4 weeks after filing a paper return. Where’s My Refund will provide you with a personalized date to collect your refund once the return has been processed and approved.

When using the tracker, it will display one of three stages:

Return Received - This means that the IRS has received your tax return application and is currently processing it.

Refund Approved - The return has been processed and the IRS is arranging for the refund.

Refund Sent - The refund has been approved and sent to you. It could take up to 5 days for the amount to be credited to your bank account or several weeks if it is by a mailed check.

However, the Where’s My Refund tool will not be able to track the following applications:

- Amended Tax Returns

- Business Tax Return Information

- Prior Year Refund Information

How to Track an Amended Tax Return?

The IRS has a separate tool to track amended tax returns, Where’s My Amended Return. However, it should be noted that the IRS will receive the amended tax return after 3 weeks of it being mailed. It will take an additional 16 weeks to process it.

Top 5 tips for a Faster Tax Refund

1. Opt to E-file your Tax return

With an estimated processing time of 1-3 weeks, E-filing the tax return is the most time-effective way of receiving your tax refund. With E-filing, silly typos, math errors, and incorrect line entries, and other such taxpayer missteps can be avoided. This enables the IRS to seamlessly process the return and initiate your tax refund as soon as possible.

2. Opt for Direct Deposit

The Direct Deposit method of receiving your tax refund is the simplest and most secure way of receiving your tax refund. Combining Direct deposit mode with E-filing is the IRS recommended way to expedite your tax refund.

3. Where EITC or ACTC is claimed

In cases that involve EITC and ACTC, you will be contacted by the IRS for gathering more information or for verification. Make sure to respond to them as soon as practicable to avoid further delays in getting your refund.

4. Make use of Tax-related Software

Using tax software to file your taxes might be the most efficient and easy way for you. With this software, you can be assured that the filing has been done right no matter how simple or complex they are.

5. Review your Tax Return

Before filing your tax return, have a tax consultant review your return. For instance, incorrect information such as an incorrect dependent's Social Security numbers can cause a tax refund to be severely delayed. In this way, you can catch errors and prevent unnecessary amendments which can cause impediments in the otherwise smooth processing of your tax refund.

What are State Tax Refunds and how to check them?

As opposed to Federal income taxes, state income taxes are handled differently in each state. Depending on your state, it could take as little as a few days or as long as a few months for your state to process it.

Although there is no hard and fast rule, like federal tax returns, manual paper returns will take much longer to process than E-filed taxes. Fortunately, every state that levies an income tax provides an online method for checking the status of your state tax refund.

What To Do If I Get a Reduced Tax Refund?

Sometimes you may receive a tax refund that is much lesser than what you would expect. This is because the Bureau of the Fiscal Service (BFS) of the Department of Treasury, which is in charge of issuing IRS tax refunds, has the authority to run the Treasury Offset Program (TOP).

The BFS can minimize your tax refund through the TOP program and use it to pay one of the following.

- Past-due child support

- Non-tax bills owed to federal agencies

- State income tax obligations

- Unemployment compensation obligations owed to the state

To check if your tax refund has been offset against one of the above, you may contact the concerned agency with which you hold a debt. If you have a reason to believe that an erroneous deduction was made from your tax refund, you may call the TOP Program on 1-800-304-3107 to locate the agency you need to contact.

Conclusion

The majority of taxpayers receive their tax refund within 21 days of filing, however for a few, it may not arrive in the mail or be credited to your bank account as soon as you would like. Delays in collecting tax refunds are frequently caused by circumstances beyond your control.

How Can Deskera Help You Comply with Your Income Tax Regimes?

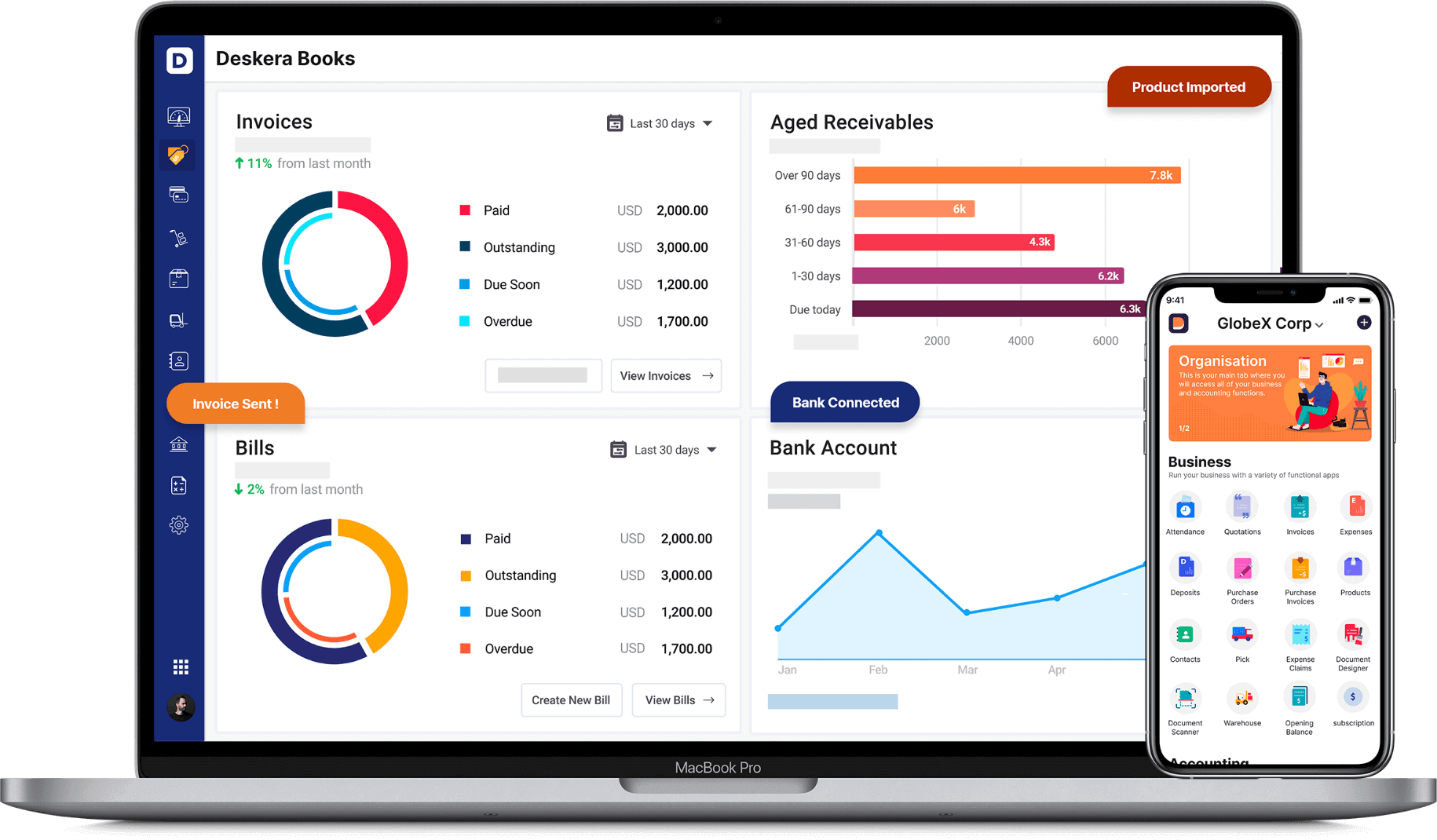

Deskera is a software that specializes in meeting all of your needs. Deskera Books is one that is devoted to meeting all your financial needs, including complying with your income tax regimes.

One of the ways to comply with your tax regimes is by having an efficient accounting system in place. Through Deskera Books, your accounting would be handled by it, with all that you would need to do is update your invoices, your account receivables, and accounts payable, and the operating expenses incurred as well as operating income earned on the software. In fact, you can even delete or edit the existing debit notes and credit notes, as is applicable.

Following the US accounting rules, it will process all these financial transactions and make financial statements like balance sheets, profit and loss statements, cash flow statements, income statements, and so on.

It would be all of this data, updated in real-time, which will facilitate Deskera Books to complete filing for your income tax returns. Deskera Books has one more benefit that it also allows you to transfer your data from your previous accounting software by updating the details in the spreadsheet available on Deskera Books.

Additionally, the entire setting up process on Deskera Books is super easy, with you having to only sign-up using your email address or social authentication, and half of your work would be done. Once you have registered on Deskera Books, you would get pre-configured accounting rules, invoice templates, tax codes, and a chart of accounts, to mention a few vital features. Lastly, your accountants can be added to your Deskera Books account for free by just inviting them to use the system.

With so many features at your disposal, making your accounting, reporting, and compliance easier, what are you waiting for?

Key Takeaways

When you file your tax return electronically, you can expect the tax refund within 21 days. You can anticipate your tax refund in 42 days if you filed paper returns. The modes of receiving your tax refund are as follows:

- Direct deposit in a bank account

- Refund check via Postal mail

- Debit card which holds the value of the refund

- Purchases up to $5000 in U.S. Savings Bond

- Split the refund into IRA accounts by filing Form 8888

Remember to opt for E-filing your tax return and choose the direct deposit mode of receiving the tax refund to expedite the refund process.

Beyond this, there are possibilities for your tax refund to be held up such as:

- Tax Return Errors

- Incomplete Tax Return Form

- Amended Returns

- Identity Theft or Fraud

- Claiming Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC)

- Filed Form 8379

- Further Review of Tax Return

- Filed A Paper Return

- Recovery Rebate Credit

- Form 1042-S

You can check the status of your refund with the “Where’s My Refund” tool or the IRS2Go mobile app with the following details:

- Your SSN or ITIN

- Filing Status

- Exact whole dollar amount of refund filed

A few tips for a quicker tax refund are:

- Opt to E-file your Tax return

- Opt for Direct Deposit

- Where EITC or ACTC is claimed

- Make use of Tax-related Software

- Review your Tax Return

If you have received a reduced tax refund, it is possible that the BFS has offset it to pay one of the following through the TOP Programme:

- Past-due child support

- Non-tax bills owed to federal agencies

- State income tax obligations

- Unemployment compensation obligations owed to the state

Related Articles