It is painful to sacrifice a portion of the hard-earned money for tax deductions. Almost every taxpayer wishes to keep as much of their earnings as possible. There IRS makes it possible for certain individuals, organizations to avail of tax exemptions under specific conditions. Tax exemptions could be the way to achieve this.

This article will take you through the following points:

- What are Tax Exemptions?

- Difference Between Tax Exemptions, Tax Deductions, and Tax Credits

- Types of Tax Exemptions

- Tax-Exempt Organizations

What are Tax Exemptions?

Tax exemption is a process that allows taxpayers to exclude all or some of their income from federal and state taxes. While this may sound similar to the tax deduction, the two are different.

There is a relationship between tax exemptions and tax deductions, but they are not the same thing. We shall be learning about the difference between the terms in the oncoming sections.

While some individuals fulfill the conditions to be eligible for tax exemption for a particular amount of their income, there are some organizations that could be completely exempted from paying taxes.

Difference Between Tax Exemptions, Tax Deductions, and Tax Credits

People often confuse between tax exemptions, tax deductions, and tax credits. However, it’s essential to note that the three are different from each other. This section highlights the differences between these terms. Let’s look at the individual definitions to understand more clearly:

Types of Tax Exemptions

There are various kinds of tax exemptions. They have mentioned as follows:

Common Tax Exempt Earnings

The interest earned by an individual on the municipal bonds can sometimes be eligible for tax exemption. The state or the cities raise these bonds to complete projects or general operations. Whenever the individual receives interest on these bonds, which are issued in the state or city of their residence, the profit earned is exempted from federal as well as state taxes.

The taxpayers must mention and fill up the required information in box 8 of the 1099-INT form to report any interest income for the particular, fiscal year.

Capital Gains Tax Exemption

When a taxpayer sells an asset for a profit, the profit earned becomes the capital gain. The capital gains are taxable. Yet, it is important to note that there are different types of capital gains that are tax exempted.

Tax-Exempt Organizations

The following are the institutions/ organizations that are exempted from tax:

Charity Organizations

These are organizations that operate exclusively for religious, humanitarian, scientific testing for public safety, literary, educational, or other specified purposes. They must fulfill certain criteria after which they are termed tax-exempt under Internal Revenue Code Section 501(c)(3).

Churches and Religious Organizations

Religious organizations such as churches are eligible to qualify for tax exemptions under Section 501(c)(3)).

Political Organizations

The organization's primary purpose is to accept contributions or make expenditures for an exempt purpose, directly or indirectly. Under certain conditions, the political parties can be tax-exempted.

Private Foundations

Except for those organizations that meet one of the exceptions listed in Section 509(a), all organizations that qualify for tax-exempt status are classified as private foundations. Private foundations typically have a single major source of funding which generally comes from gifts from one family or corporation. Most nonprofit organizations make grants to other charities and to individuals rather than operating programs directly.

Other Nonprofits

If an organization meets certain criteria, it may qualify for exemption under a subsection other than 501(c)(3). Societies that offer these services are civic leagues, social clubs, labor unions, and business leagues.

How can Deskera Help You?

Filing taxes and calculating the deductions is a tough task and requires you to keep all your documents handy. Let an automated accounting system take care of it.

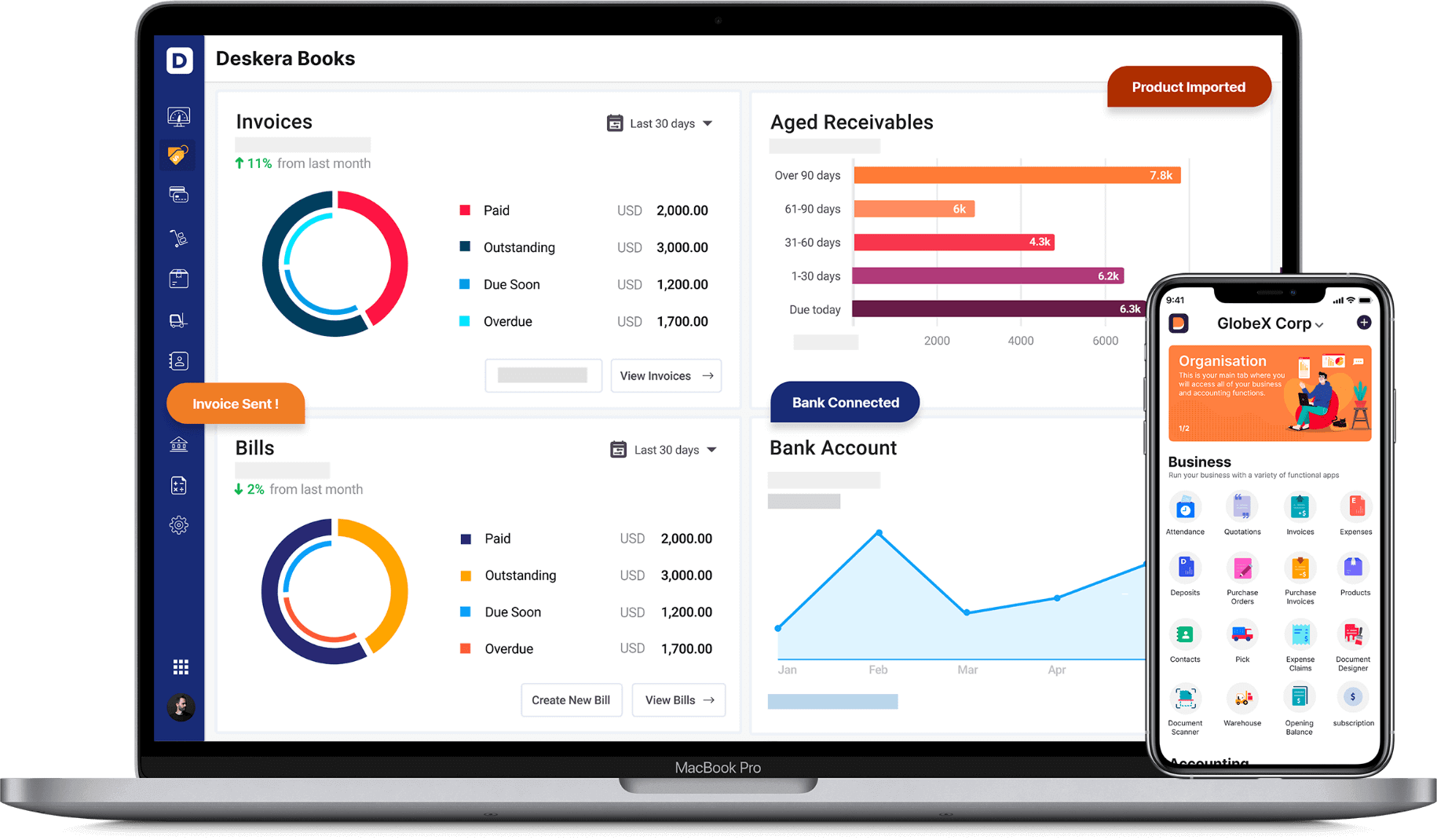

Deskera Books is comprehensive accounting software that can help you manage your finances.

It helps you manage your profit loss statement, work on invoicing, general ledger, balance sheets. It also helps you automate your financial records and keep track of them online.

Learn about the exceptional and all-in-one software here:

Key Takeaways

Here are the highlights of the article:

- Tax exemption is a process that allows taxpayers to exclude all or some of their income from federal and state taxes

- Your tax bill can be reduced through tax exemption depending on how you file your taxes and how many dependents you have

- Tax deduction is a process that allows you to deduct items on your tax returns indefinitely. Tax deductions include traveling, home offices and student loan interest

- Tax credit is an amount of money that can reduce tax liability, on a dollar-to-dollar basis

- Capital gains under certain conditions can be allowed for tax exemption

- Charity organizations, churches, political organizations, private foundations, and some other Non-profit institutions are eligible for tax exemption

Related Articles