Congress passed the most comprehensive tax reform bill in 2017, lowering tax rates for individuals and businesses while also changes to a number of tax regulations, including deductions.

The tax law under the measure had its most significant change since ‘The Tax Reform Act of 1986’, signed by President Reagan.

On December 22, 2017, President Donald Trump signed the "Tax Cuts and Jobs Act" (TCJA) into law. Due to the significant changes, the law will have an impact on smaller enterprises, organizations, estates, and people.

Although the goal of the final package was to streamline and simplify the tax code. However, it has really brought about a number of uncertainties that make proactive tax planning and flexibility increasingly important. The tax law has undergone few significant changes since the Reagan era.

In today’s guide, we’ll discuss each and every aspect of Tax Cuts and Jobs Act (TJCA). Let’s take a look on what we’ll cover ahead:

- What Significant Changes Does This Law Incorporate?

- How Important are the Modifications?

- What Impact Will the New Law Have on Financial Investments and the Economy?

- Private Equity & Hedge Funds

- Deductions: How are they Changing?

- How Can Taxpayers Access the Remainder of the Deductions?

- How do Divorcing Taxpayers become Affected by the New Law?

- How Has the Alternative Minimum Tax Changed?

- Do Taxpayers Need to Watch Out for any Changes in the Long Term?

- Seek a Professional Consultant

- How Deskera Can Assist You?

Let’s Start!

What Significant Changes Does This Law Incorporate?

The Tax Cuts and Jobs Act introduced significant changes for individuals and businesses organized as pass-through entities (e.g. partnerships and S corporations), as well as permanently reducing the corporate tax rate

The majority of these modifications are scheduled to sunset on December 31, 2025, though. This would imply that a number of provisions such as individual tax rates and the estate taxes exemption, will return to the current law in 2026 in the absence of new legislation. Here are the main elements and how they have changed (or not):

How Important are the Modifications?

In aggregate, personal tax cuts in 2018 are estimated at roughly $122 billion, with corporate tax cuts estimated at approximately $83 billion.

With the new effective company tax rate, the effective corporate tax rate will drop from around 22 percent to an estimated 9 percent in 2018.

What Impact Will the New Law Have on Financial Investments and the Economy?

The tax law did not substantially alter our investment outlook for 2018. Given the late stage of the U.S. economic upswing, we anticipate broad-based global growth in 2018, with the tax reform only having a moderate positive impact on economic activity.

We have therefore revised our prediction for the real gross domestic product in the United States to an annualized pace of 2.7 percent for 2018, up somewhat from 2017.

Corporate profits are anticipated to be more affected by the tax plan. In fact, we increased our 2018 prediction to a range of $150 to $155, estimating that the reduction in corporate tax rates should improve operating earnings for S&P 500 companies by about $10.

A tax-related uptick in economic growth has driven up the yield on the 10-year Treasury note in the United States, but rising concerns over an unexpected increase in inflation has also played a role.

Recent changes in the equities market have been triggered by the trend toward higher rates, but we still think that inflation will gradually increase and that interest rates will eventually settle in a new range.

While increasing interest rates and inflation may have an impact on equity market values, we think stronger earnings will boost equities. As a result, we still advocate investing in non-correlated assets and choosing stocks over bonds.

Private Equity & Hedge Funds

The amount of corporate interest expenses that can be deducted as a business expense has been capped for the first time at 30% of a company's earnings before interest, taxes, depreciation, and amortization.

Given that leveraged buyout opportunities usually include highly leveraged purchase prices, this could have an impact.

Future management of hedge funds is unlikely to be significantly impacted by the move from a one-year to a three-year holding period for carried interest.

Deductions: How are they Changing?

The subsequent deductions will be scaled back or changed:

- Individuals' deductions for state and local income taxes will be capped at $10,000.

- Up to $750,000 in mortgage interest will be deducted from acquisition debt.

- Only if the money is used to purchase, renovate, or build a primary or secondary dwelling may the interest on home equity loan (i.e., a HELOC) be written off.

The following won't be tax deductible anymore:

- work-related costs (such as tax preparation and investment management fees)

- Alimony payments (and income from alimony) are no longer required to be included in the recipient's gross income.

- Entertainment costs for work (50 percent of meals may still be deducted)

- loss due to theft

- Casualty Losses (unless they are from an area declared a disaster by the President of the United States)

There will be a couple more generous deductions:

- A public charity will be able to deduct up to 60% of your adjusted gross income in cash contributions (AGI)

- If your medical expenses surpass 7.5 percent of your AGI through 2019, you will be able to deduct them.

For pass-through entities, a new deduction has been introduced:

- Taxpayers will often get a deduction equivalent to 20% of their eligible business income from a pass-through corporation.

- Married individuals who file jointly and make more than $415,000 year are eligible for a small deduction.

- This deduction is not available to married individuals who file jointly, make more than $415,000 annually, and have pass-through income from a particular service firm.

How Can Taxpayers Access the Remainder of the Deductions?

Taxpayers who want to maximize their deductions and exceed the $12,000 or $24,000 standard deduction may consider grouping deductions from multiple years into one year.

For instance, a taxpayer could advance the deductions from year three so that they can all be claimed in year two, deferring the deductions from year one in an effort to exceed the standard deduction. This would be different from dividing deductible expenses equally throughout the next three years.

How do Divorcing Taxpayers become Affected by the New Law?

Important changes made by the new law must be considered when drafting divorce and separation agreements, and it may be necessary to revise existing ones.

While the repeal of Section 682, which allowed for alimony-like distributions from trusts to be taxed for the recipient rather than the payor, and the elimination of the alimony deduction only apply to divorce and separation agreements signed after December 31, 2018, the elimination of personal exemptions, which includes the right to claim an exemption for children, may also have an impact on existing agreements.

How Has the Alternative Minimum Tax Changed?

For corporations, there is no longer an Alternative Minimum Tax (AMT). Although the exemption and threshold amounts for individuals have increased, it still applies to individual taxpayers.

Do Taxpayers Need to Watch Out for any Changes in the Long Term?

The estate tax exemption's portability can raise some questions. It's unclear what will happen if one spouse dies before the law reverts and the other spouse dies later because the new estate tax exemption threshold of $11.18 million is scheduled to expire at the end of 2025.

Can the surviving spouse receive the greater, unused exemption amount and use it once the legislation changes? There will need to be regulations on the subject from the Treasury Department. While waiting for these circumstances to play out, it's crucial to include flexibility in estate planning contracts.

Every year, schedules of tax rates and other things are adjusted for inflation. They were connected to the consumer price index under the prior statute (CPI).

The chained CPI, on the other hand, will be used by the Tax Cuts and Jobs Act as a different way to measure inflation. Exemption amounts and tax rate schedules will increase more slowly when the CPI is chained than they would if it were just tied to the unchained CPI.

Seek a Professional Consultant

Given that most tax rules have undergone significant changes, individual investors and business owners may believe it is crucial to seek professional advice when analyzing financial strategies.

For instance, individuals who are accustomed to itemizing deductions may want to think about the implications of losing particular deductions and the best approaches to maximize tax efficiency.

Estate arrangements should be reviewed in light of the rise in the exclusion amount. Business owners will want to understand how to maximize the new 20% deduction for their qualifying business income.

In light of the new rules controlling the taxation of pass-through revenue, some business owners might want to carefully review their current organizational structure for potential revisions.

How Deskera Can Assist You?

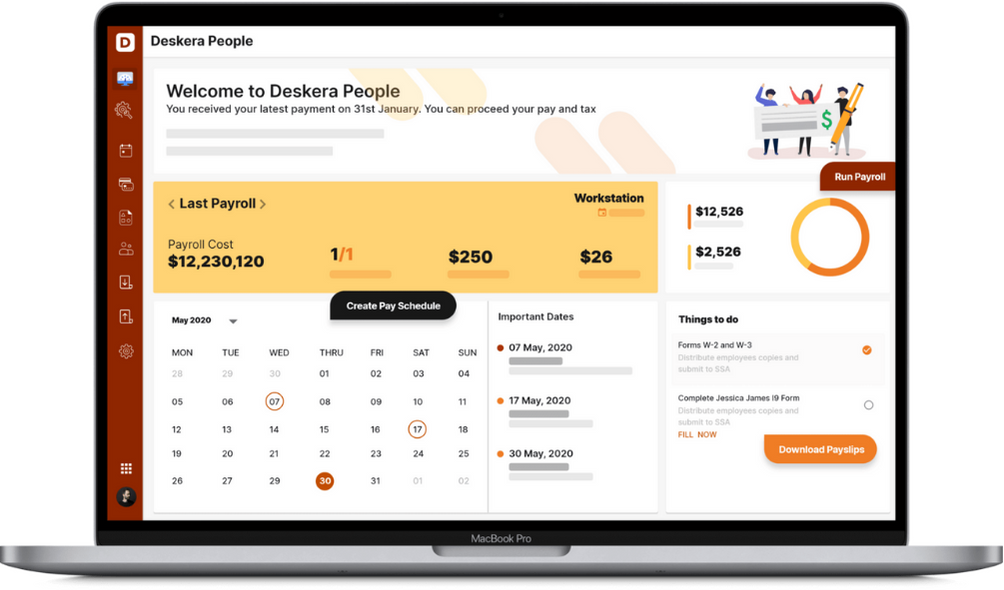

Deskera People has the tools to help you manage your payroll, leaves, employee onboarding process, and managing employee expenses, all in a single system. Features like a flexible payment schedule, custom payroll components, detailed reports, customizable pay slips, scanning, uploading expenses, and creating new leave types make your work simple.

Final Takeaways

We've arrived at the last section of this guide. Let's have a look at some of the most important points to remember:

- Congress passed the most comprehensive tax reform bill in 2017, lowering tax rates for individuals and businesses while also changes to a number of tax regulations, including deductions.

- On December 22, 2017, President Donald Trump signed the "Tax Cuts and Jobs Act" (TCJA) into law. Due to the significant changes, the law will have an impact on smaller enterprises, organizations, estates, and people.

- The Tax Cuts and Jobs Act introduced significant changes for individuals and businesses organized as pass-through entities (e.g. partnerships and S corporations), as well as permanently reducing the corporate tax rate

- The tax law did not substantially alter our investment outlook for 2018. Given the late stage of the U.S. economic upswing, we anticipate broad-based global growth in 2018, with the tax reform only having a moderate positive impact on economic activity

- While increasing interest rates and inflation may have an impact on equity market values, we think stronger earnings will boost equities. As a result, we still advocate investing in non-correlated assets and choosing stocks over bonds

- Future management of hedge funds is unlikely to be significantly impacted by the move from a one-year to a three-year holding period for carried interest

- Taxpayers who want to maximize their deductions and exceed the $12,000 or $24,000 standard deduction may consider grouping deductions from multiple years into one year

- For corporations, there is no longer an Alternative Minimum Tax (AMT). Although the exemption and threshold amounts for individuals have increased, it still applies to individual taxpayers.

- Every year, schedules of tax rates and other things are adjusted for inflation. They were connected to the consumer price index under the prior statute (CPI).

- The chained CPI, on the other hand, will be used by the Tax Cuts and Jobs Act as a different way to measure inflation.

- Given that most tax rules have undergone significant changes, individual investors and business owners may believe it is crucial to seek professional advice when analyzing financial strategies.

Related Articles