Are you an employer in the State of Tamil Nadu? Or are you planning on being one? Do you want to ensure that you are complying with all the provisions and obligations as laid down in the Tamil Nadu Labour Welfare Fund Act? Or are you planning to be an employee in the State of Tamil Nadu and want to ensure that you are availing all the welfare benefits that you can avail?

If your answer to the above questions is a yes, then this article will be your perfect reference to get to know all about the Tamil Nadu Labour Welfare Fund Act of 1972 and its Rules 1973, including its most recent Amendment. This will help in ensuring that you have a good standing in the eyes of the law, as well as amidst the labor groups.

The main purpose of the Tamil Nadu Labour Welfare Fund Act was to provide a constitution that promotes, supports, and ensures the welfare of labor and for certain other matters connected therewith in the State of Tamil Nadu. This Act applies to the whole of the State of Tamil Nadu.

To get a clearer as well as more detailed understanding of the Tamil Nadu Labour Welfare Fund Act, this article covers the following topics:

- What is the Labour Welfare Fund Act and Labour Welfare Fund?

- Some of the Important Definitions as per the Tamil Nadu Labour Welfare Fund Act

- Tamil Nadu Labour Welfare Fund

- Tamil Nadu Labour Welfare Board

- Unpaid Accumulation and Claims Thereto

- Interest on Unpaid Accumulation or Fines After Notice of Demand

- Remission of Penalty

- Contribution to the Fund by Employee and Employer

- Grants and Advances by the Government

- Vesting and Application of Fund

- Budget of the Board

- Power of Board to Borrow

- Deposit of Fund and Placing of Accounts and Audit Report Before the State Legislature

- Power of Government to Give Directions to the Board

- Appointment and Powers of Secretary

- Inspectors

- Constitution of the Board

- Allotment of Certain Officers and Staff to the Board

- Appointment of Clerical and Other Staff by the Board

- Transfer of Provident Fund to the Board

- The Credit of Leave Salary and Pensionary Contribution to the Board

- Meetings of the Board

- Powers of Government to Call for Records

- Mode of Recovery of Sums Payable to the Board

- Maintenance of Registers by the Employers

- Penalty for Obstructing Inspection or for Failure to Produce Documents, etc.

- Offenses by Companies

- Power to Supervise the Welfare Activities of an Establishment

- Penalty for Non-Compliance with the Direction of the Board

- Annual Report

- Supersession of the Board

- Members of Board, Secretary, Inspectors, and All Officers and Servants of the Board to be Public Servants

- Protection of Action Taken in Good Faith

- Exemption

- Power to Make Rules

- Power to Make Regulations

- Amendment of Section 8, Central Act IV of 1936

- Change in the Contribution by Employee, Employer, and the Government to the Fund

- Benefits of the Tamil Nadu Labour Welfare Fund

- How Can Deskera Help?

- Key Takeaways

- Related Articles

What is the Labour Welfare Fund Act and Labour Welfare Fund?

Adopted in 1953, the Labour Welfare Fund Act was constituted for financing activities to promote the welfare of the employees and their dependents in the respective states. This Act is applicable to all the companies that have at least five or more than five employees, however, this may differ depending upon the state-specific Act. This includes all the employees, including employees through a contractor, except those working in the managerial or supervisory position and drawing wages of more than Rs. 3,500 per month.

The scope of this Act extends to housing, family care, and worker’s health service by providing medical examination, a clinic for general treatment, women’s general education, infant welfare, workers' activity facilities, education, marriage, etc.

The State specific Labour Welfare Funds are funded by contributions from the employer, employee, and in a few states, by the Government as well. Thus, a labor welfare fund is a statutory contribution managed by the individual state authorities, which also means that they would be determining the amount and frequency of the contributions.

It is because of this reason that the contribution and periodicity of remittance differ with every state, with some of the states (e.g., Tamil Nadu, Andhra Pradesh, Karnataka, Haryana, etc.) having an annual periodicity, while some states (e.g., Madhya Pradesh, Gujarat, Maharashtra) requiring contributions during the month of June and December.

Labour Welfare Fund is an aid in the form of money or necessities for those in need and provides facilities to laborers in order to provide them with social security, improve their working conditions, and raise their standard of living.

In order to justify this purpose of the labor welfare fund, various state legislatures have enacted an Act exclusively focusing on the workers, known as the Labour Welfare Fund Act.

Therefore, the Labour Welfare Fund Act incorporates various benefits, facilities, and services offered to the employee by employers like you. Such facilities are offered by means of contribution from the employer and the employee.

Remember, in addition to the Labour Welfare Fund, other payroll compliances to consider are TDS, Employee Provident Fund, Gratuity, Employee State Insurance, and Professional Tax, to mention a few of the most important compliances.

Some of the Important Definitions as per the Tamil Nadu Labour Welfare Fund Act

Under the Tamil Nadu Labour Welfare Fund Act, some of the important definitions are:

- Board- This refers to the Tamil Nadu Labour Welfare Board

- Employee- This refers to any person who is employed for reward or hire to do any work, unskilled to skilled, manual, clerical, supervisory, or technical in an establishment for a period of 30 days during the period of the preceding twelve months. However, it does not include anyone who is employed mainly in a managerial capacity, or in a supervisory capacity, or as an apprentice, or on a part-time basis. It can, however, include any other person employed in your establishment whom the Government may by notification declare to be an employee for the purposes of this Act.

- Employer- It refers to the person who has the ultimate control over the affairs of the establishment and where the said affairs are entrusted to any other person, whether called a managing director, manager, managing agent, superintendent, or by any other name, such other person.

- Establishment- It refers to,

- A factory as defined in the clause (m) of section 2 of the Factories Act, 1948 (Central Act LXIII of 1948) or any place which is deemed to be a factory under sub-section (2) of section 85 of that Act.

- A motor transport undertaking as defined in clause (g) of section 2 of the Motor Transport Workers Act, 1961 (Central Act 27 of 1961).

- A plantation as defined in the clause (f) of section 2 of the Plantations Labour Act, 1951 (Central Act LXIX of 1951).

- A catering establishment, as defined in section 2 (1) of the Tamil Nadu Catering Establishments Act, 1958 (Tamil Nadu Act XIII of 1958), and which employs or on any working day during the preceding twelve months employed five or more than five persons.

- An establishment, including society as registered or deemed to be registered under the Tamil Nadu Societies Registration Act, 1975 (Tamil Nadu Act 27 of 1975) and a charitable or other trust, whether registered under any law applicable to such charitable or other trust or not, which carries on any business or trade or any work in connection therewith or ancillary thereto and which employs, or on any working day during the preceding twelve months employed five or more persons, but does not include an establishment (not being a factory) of any State or the Central Government.

- Any other establishment which the Government may, by notification, declare to be an establishment for the purposes of this Act.

- Fund- It refers to the Labour Welfare Fund constituted under section 3.

- Government- It refers to the Tamil Nadu State Government.

- Unpaid Accumulation- It refers to all the payments other than gratuity due to an employee but not paid to him within a period of three years from the date on which the payments became due, whether before or after the commencement of this Act, and the gratuity accrued to an employee after the commencement of this Act but not paid within a period of three years from the date of such accrual, but does not include the amount of contribution, if any, paid by an employer to a provident fund established under the Employees’ Provident Funds Act, 1952 (Central Act XIX of 1952).

- Wages- It refers to all the remunerations capable of being expressed in terms of money which would, if the terms of the contract of employment, expressed or implied, were fulfilled, be payable to an employee in respect of his employment or of work done in such employment, but does not include:

- The value of any house accommodation or of the supply of water, light, medical attendance, or other amenities or of any service is excluded from the computation of wages by general or special order of the Government.

- Any contribution paid by the employer to any pension or provident fund or under any scheme of social insurance.

- Any traveling allowance or the value of any traveling concession

- Any sum paid to the employee to defray special expenses entailed on him by the nature of his employment

- Any gratuity payable on the termination of employment

Tamil Nadu Labour Welfare Fund

Under the Tamil Nadu Labour Welfare Fund Act, the Government shall constitute a fund called the Labour Welfare Fund. Notwithstanding anything contained in any other law for the time being in force or in any contract or instrument, all unpaid accumulations shall be paid, at such intervals as may be prescribed, to the Board and be credited to the Fund, and the Board shall keep a separate account thereof until claims thereto have been decided in the manner provided for in section 13 of this Act.

As per the provisions of this Act regarding the same, there shall also be credited to the Fund:

- Unpaid accumulations paid to the Board under sub-section (2) of section 13.

- All fines, including the amount realized under the Standing Order 20 of the Model Standing Orders issued under the Tamil Nadu Industrial Employment (Standing Orders) Rules, 1947 (and under the certified standing orders of the establishment) from the employees by the employers, notwithstanding anything contained in any agreement between the employer and the employee.

- Deductions made under the proviso to sub-section (2) of section 9 of the Payment of Wages Act, 1936 (Central Act IV of 1936) and under the proviso to sub-section (2) of section 36 of the Tamil Nadu Shops and Establishments Act, 1947 (Tamil Nadu Act XXXVI of 1947)

- Contribution by employers and employees

- Any interest by way of the penalty paid under section 14

- Any voluntary donations

- Any amount raised by the Board from other sources to augment the resources of the Board

- Any fund transferred under sub-section (5) of section 17

- Any sum borrowed under section 18

- Any unclaimed amount credited to the Government in accordance with the rules made under the Payment of Wages Act, 1936 (Central Act IV of 1936) and the Minimum Wages Act, 1948 (Central Act XI of 1948)

- Grants or advances made by the Government

- All fines imposed and realized from employers by courts for violation of labor laws less the deduction made by the court towards administrative expenses.

All of these sums shall be collected by or paid to such agencies at such intervals and in such manners as may be prescribed. In fact, the accounts of the Fund shall be maintained and audited in such a manner as may be prescribed.

Tamil Nadu Labour Welfare Board

In order to fulfill the provisions of the Tamil Nadu Labour Welfare Act, the Government will appoint the Tamil Nadu Labour Welfare Board, which shall be a body corporate having perpetual succession and a common seal, and shall, by the said name, sue and be sued.

The constitution of the Tamil Nadu Labour Welfare Board is:

- It will consist of a Chairman who shall be the Minister-in-Charge of Labour and of the following members appointed by the Government-

- Such number of representatives of employees and employers as may be prescribed. Remember, there shall be equal representation of the employees and the employers on the Board.

- Such numbers of members of the State Legislature as may be prescribed.

- Such number of officials and non-officials as may be prescribed.

- The term of office of the members of the Board other than the official members shall be three years from the date of their appointment, and they shall be eligible for reappointment. Also, they shall continue as members of the Tamil Nadu Labour Welfare Board until their successors are appointed. However, in the case of a member of the State Legislature, he or she shall cease to be a member of the Board from the date on which he or she ceases to be a member of the State Legislature.

Note: The appointment of the Chairman and the members of the Tamil Nadu Labour Welfare Board shall be notified in the Tamil Nadu Government Gazette.

The provisions of the Tamil Nadu Labour Welfare Fund Act, also allows the disqualification or removal of the members of the Tamil Nadu Labour Welfare Board.

This means that no person shall be chosen as, or continue to be, a member of the Board, if he or she:

- Is an officer or servant under the Board

- Is an undischarged insolvent

- Is of unsound mind

- Has been convicted by a criminal court for an offense involving moral turpitude, unless such conviction has been set aside

- In arrears of any sum due to the Board

On the other hand, the Government may remove from office any member who:

- Is or has become subject to any of the disqualifications mentioned above

- Is absent without leave of the Board for more than three consecutive meetings of the Board.

As per the provisions of the Tamil Nadu Labour Welfare Fund Act, any representative of an employee or employer or Member of the State Legislature, or non-official member may resign his or her office by giving notice thereof in writing, to the Government. Once such a resignation is accepted, it will be deemed that his or her office has been vacated.

In case of a casual vacancy in the office of a member, it may be filled up as soon as possible. Remember, a member so appointed to fill such vacancy shall hold office for the remainder of the term.

The Tamil Nadu Labour Welfare Board may constitute one or more committees consisting of at least one member of the Board and an equal number of representatives of employees and employers for the purpose of advising the Board in the discharge of its functions and, in particular, for carrying into effect any of the matters specified in the sub-section (2) of section 17 of this Act.

What needs to especially be kept in mind is that no act done or proceeding taken under the Tamil Nadu Labour Welfare Fund Act by the Board or any committee cannot be invalidated merely on the grounds of:

- Any vacancy or defect in the constitution of the Board or the committee

- Any defect or irregularity in the appointment of a person acting as a member thereof

- Any defect or irregularity in such an act or proceeding not affecting the merits of the case.

In fact, the functions of the Board shall be the administration of the Fund and such other functions as may be assigned to it by or under this Act.

Unpaid Accumulation and Claims Thereto

Under the Tamil Nadu Labour Welfare Fund Act, the provisions related to unpaid accumulations and claims thereto are:

- All unpaid accumulations shall be deemed to be abandoned property.

- Any unpaid accumulation paid to the Board in accordance with the provisions in the section ‘Tamil Nadu Labour Welfare Fund’ shall, on such payment, discharge an employer of his liability to make payment to an employee in respect thereof, but to the extent only of the amount paid to the Board, and the liability to make payment to the employee to the extent aforesaid shall, subject to the succeeding provisions of this section, be deemed to be transferred to the Board.

- After the payment of unpaid accumulation is made to the Board, as soon as possible in order to invite the claims by employees, their heirs, legal representatives, or assigns for any payment due to them, the Board shall-

- Exhibit on the notice-board of the establishment in which the unpaid accumulation was earned

- Publish in the Tamil Nadu Government Gazette and in such other manner as may be prescribed

Note: The particulars to be contained by this notice are-

A. Name and address of the establishment in which the unpaid accumulation was earned.

B. Wage period during which the unpaid accumulation was earned.

C. Amount of the unpaid accumulations.

D. A declaration that a list containing the name of employees and the amount due to them and paid to the Board has been posted on the notice of the factory or establishment in which the unpaid accumulation was earned.

- If any question arises whether the notice referred to above was given as required by that subsection, a certificate of the Board that it was so given shall be conclusive.

- If within a period of six months from the date of the publication of the notice in the Tamil Nadu Government Gazette, a claim is received either in response to the notice or otherwise, then the Board shall be responsible for transferring such a claim to the Authority as appointed under section 15 of the Payment of Wages Act, 1936 (Central Act IV of 1936). The Authority to which the claims should be transferred is one that should have jurisdiction over the area in which the establishment is situated. The Authority shall then proceed to adjudicate upon and decide such claims. In hearing such a claim, such Authority shall have the powers conferred by that Act and follow the procedure (in so far as it is applicable) specified therein.

- If the Authority, as discussed above, is satisfied that any such claim is valid, the right to receive payment will be established, and it shall then decide that the unpaid accumulation in relation to which the claim is made shall cease to be deemed to be abandoned property. It will then order the Board to pay the whole of the dues claimed, or such part thereof as the Authority decides is properly due to the employee, and the Board will make the payment accordingly. Remember, the Board shall not be liable to pay any sum in excess of that paid in Tamil Nadu’s Labour Welfare Fund in the section titled the same, as unpaid accumulations, in respect of the claim.

- If a claim for payment is refused, then the employee or his legal representatives or his or her heirs or assigns, as the case may be, may prefer an appeal in the City of Madras to the Madras City Civil Court and elsewhere to the District Court within sixty days from the date of receiving the order of the Authority regarding the same.

- In respect to the aforesaid appeal, the decision of the Authority, and the decision in appeal of the Madras City Civil Court, or as the case may be, the District Court shall be final and conclusive as to the right to receive payment, and the liability of the Board to pay, and also the amount to be paid, if any.

- If no claim is received within the period specified in the fifth bullet-point, or a claim has been refused by the Authority or on appeal by the Madras City Civil Court or the District Court, then the unpaid accumulations in respect of such a claim shall accrue to, and vest in, the State as “bona vacantia.” This will then be deemed to have been transferred to and form a part of the Tamil Nadu Labour Welfare Fund.

Note: The unpaid accumulations shall be paid by money order, cheque, or cash to the Secretary, Tamil Nadu Labour Welfare Board, by the employer. Along with such a payment, as an employer, you will also have to submit a statement to the Secretary of the Board giving full particulars of the amounts so paid.

After this, all fines realized and deductions made from the wages of the employees and all unpaid accumulation during the quarters ending 31st March, 30th June, 30th September, and 31st December, shall be paid by you as the employer in the same manner as before, to the Secretary of the Board on or before 15th April, 15th July, 15th October, and 15th January, succeeding such quarter and in a statement giving particulars of the accounts so paid shall be submitted by him along with such payment to the Secretary of the Board.

Interest on Unpaid Accumulation or Fines After Notice of Demand

Under the Tamil Nadu Labour Welfare Fund Act, the provisions related to interest on unpaid accumulation or fines after notice of demand are:

- If, as an employer, you do not pay to the Board any amount of unpaid accumulations or fines realized from the employees within the time specified by or under this Act, then the Secretary may serve or cause to be served a notice on you to pay the amount within the period specified therein. This period shall be of at least thirty days from the date of service of such notice.

- If, however, as an employer, you fail to pay any such amount within the period specified in the notice without any sufficient cause, then in addition to that amount, you will have to pay by way of penalty to the Board simple interest,

- The rate of simple interest for the first three months will be one percent of the said amount for each complete month, or part thereof after the last date by which you should have paid it according to the notice; and

- After the first three months, the rate of simple interest will be one and a half percent for each complete month or part thereof of that amount during the time you continue to default on the payment of that amount.

Note: Subject to such conditions as may be prescribed, the Secretary may remit the whole or any part of the penalty in respect of any period.

Remission of Penalty

The rules as per the Tamil Nadu Labour Welfare Fund Rules for the same are:

- Applications for the remission of penalty shall be made to the Secretary within thirty days from the date of payment of penalty. It should clearly state the grounds on which the remission is claimed.

- If the Secretary is satisfied that the imposed penalty is likely to cause undue hardship to you as an employer, or that you have suffered financially due to riots or natural calamities, or that the delay caused in the payment of unpaid accumulations fines was due to circumstances beyond his control, then the Secretary may remit in part or whole the penalty payable as per second bullet-point in the section titled as- ‘Interest on Unpaid Accumulation, or Fines After Notice of Demand.’

Contribution to the Fund by Employee and Employer

Under the Tamil Nadu Labour Welfare Fund Act, the provisions for the same are:

- As may be prescribed from time to time, each employee can contribute a maximum of ten rupees per year to the Tamil Nadu Labour Welfare Fund. However, as an employer, you can contribute a maximum of twenty rupees per year to the Tamil Nadu Labour Welfare Fund for each such employee as may be prescribed from time to time. On the other hand, the Government shall contribute a maximum of ten rupees per year to the Tamil Nadu Labour Welfare Fund for each such employee, and as may be prescribed from time to time.

- Notwithstanding anything contained in any other law for the time being in force, as an employer, you shall be entitled to recover from the employee their contribution for the Tamil Nadu Labour Welfare Fund by deduction from his or her wages in such a manner as may be prescribed. Such a deduction shall be deemed to be a deduction authorized by or under the Payment of Wages Act, 1936 (Central Act IV of 1936) or the Tamil Nadu Shops and Establishments Act, 1947 (Tamil Nadu Act XXXVI of 1947).

Payment of Contribution

According to the Tamil Nadu Labour Welfare Fund Rules, the rules regarding the payment of contribution are:

- As an employer, you shall have to pay to the Board both the employer’s contribution and the employees’ contribution payable as per this section of this Act for every year before the 31st July of that year. You shall recover the contributions from the employees whose names are borne on the registers of your establishment on the 30th of June of the year. These contributions should also include those made from the employees’ wages for the month of June. Such deductions shall be deemed to be deductions authorized by or under the Payment of Wages Act, 1936 (Central Act I of 1936).

- Notwithstanding any contract to the contrary, as an employer, you shall not deduct your contribution from any wages payable to an employee or otherwise recover it from the employee.

- You shall have to pay the employer’s and the employees’ contribution to the Board by cheque, money order, or in cash, and you shall bear the expenses of remitting to the Board such contributions. Along with such a payment, you shall also have to submit Form A to the Secretary, giving full particulars of the amounts so paid.

- The Secretary of the Board shall submit to the State Government as soon as possible after the end of January every year, in the prescribed form, a statement showing the total amount of the employers’ contribution in respect of each establishment.

Note: No such deduction shall be made in excess of the amount of the contribution payable by such employee, or shall it be made from any wages other than the wages for the month of June. Also, if, through inadvertence or otherwise, no deduction has been made from the wages of an employee for the month aforesaid, such deduction may be made from the wages of such employee for any subsequent month or months with the permission in writing of the Inspector appointed under this Act.

Grants and Advances by the Government

Under the Tamil Nadu Labour Welfare Fund Act, the Government may, from time to time, make grants or advance loans to the Board for the purposes of this Act, on such terms and conditions as the Government may, in each case, determine.

Vesting and Application of Fund

The provisions under the Tamil Nadu Labour Welfare Fund Act for the same are:

- The Tamil Nadu Labour Welfare Fund shall vest in, and be held and applied by, the Board as trustees subject to the provisions, and for the purposes, of this Act. In order to promote the welfare of the employees and their dependents as may be specified by the Government from time to time, the money therein shall be utilized by the Board to defray the cost of carrying out such measures.

- Without prejudice to the generality of the provisions of the previous subsection, the money in the Fund may be utilized by the Board to defray expenditure on the following:

- Vocational training

- Community and social education centers

- Entertainment and other forms of recreation

- Community necessities

- Holiday homes in health resorts

- Convalescent homes for tuberculosis patients

- Pre-schools

- Part-time employment for housewives of employees

- Nutritious food for children of employees

- Employment opportunities for the disabled employees or the widows of the deceased employees

- Cost of administering this Act, including the salaries and allowances of the staff appointed for the purposes of this Act

- Such other objects as would, in the opinion of the Board, improve the standard of living and education and ameliorate the social conditions of labor.

Note: The fund shall not be utilized in financing any measure which, as an employer, you are required under any law for the time being in force to carry out. Also, the unpaid accumulations and fines shall be expended by the Board under this Act, notwithstanding anything contained in the Payment of Wages Act, 1936 (Central Act IV of 1936) or any other law or agreement for the time being in force.

- With the approval of the Government, the Board may make grants from the Fund to any local authority or any other body in aid of any activity for the welfare of employees.

- If any question arises whether any particular expenditure is or is not debitable to the Fund, the matter shall be referred to the Government, whose decision regarding the same will be considered final.

- The Board may accept the transfer of Labour Welfare Fund of any establishment and may continue any activity financed from such Labour Welfare Fund if the said Fund is duly transferred to the Board.

Budget of the Board

As per the Tamil Nadu Labour Welfare Fund Rules, the rules regarding the budget of the Board are:

- For each financial year, the budget estimates shall be prepared and laid down before the Board on or before the 1st day of December of the previous financial year. After it is approved by the Board, it shall be forwarded to the State Government for its approval on or before the 15th of December. The State Government shall approve the budget before the 15th of January, after making such Amendments and alterations as it considers necessary.

- Such an amended or altered and then approved budget shall constitute the budget of the Board for the ensuing financial year and shall be issued under the seal of the Board and signed by the officer or officers of the Board duly authorized in this behalf. An authenticated copy of the budget shall be forwarded to the State Government before the 28th of February.

Additional Expenditure

If, during the course of the financial year, it becomes necessary to incur expenditure over and above the provision made in the budget, then the Board will have to immediately submit the details of the proposed expenditure to the State Government. With this, it will also have to state the manner in which it is planning to meet the additional expenditure.

The State Government can then either approve the proposed expenditure after making such modifications as it considers necessary, or it may reject it. Remember, a copy of the order passed by the State Government on every such proposal to incur additional expenditure shall be communicated to the Board and to the Examiner of Local Fund Accounts.

Power of Board to Borrow

Under the Tamil Nadu Labour Welfare Fund Act and its provisions, the Board may, from time to time, with the approval of the Government and subject to the provisions of this Act and to such conditions as may be prescribed in this behalf, borrow any sum required for the purposes of this Act.

Deposit of Fund and Placing of Accounts and Audit Report Before the State Legislature

Under the Tamil Nadu Labour Welfare Fund, the provisions related to the same are:

- All money and receipts forming part of the Fund shall be deposited in the Reserve Bank of India constituted under the Reserve Bank of India Act, 1934 (Central Act 11 of 1934), or in the State Bank of India constituted under the State Bank of India Act, 1955 (Central Act 23 of 1955), or in any corresponding new bank as defined in the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970 (Central Act 5 of 1970), or in the State Co-operative Bank or in Central Co-operative Bank as defined in section 73-A of the Tamil Nadu Co-operative Societies Act, 1961 (Tamil Nadu Act 53 of 1961) or in any corporation owned or controlled by any State Government or by the Central Government. Such accounts shall be operated upon by such officers of the Board as may be authorized by the Board and in such manner as they may be prescribed.

- The Accounts of the Board, as certified by the auditor, together with the audit report thereon, shall be forwarded yearly to the Government, and the Government may issue such instructions to the Board in respect thereof as they deem fit, and the Board shall comply with such instructions.

- The Government shall:

- Cause the accounts of the Board together with the audit report thereon forwarded to them under the previous subsection to be laid yearly before the State Legislature; and

- Cause the accounts of the Board to be published in the prescribed manner and make available copies thereof on sale at a reasonable price.

Power of Government to Give Directions to the Board

As per the Tamil Nadu Labour Welfare Fund Act and its provisions, the Government may give the Board such directions as, in their opinion, are necessary or expedient in connection with expenditure from the Fund or for carrying out the purposes of the Act, and it shall be the duty of the Board to comply with such directions.

Appointment and Powers of Secretary

Under the Tamil Nadu Labour Welfare Fund Act and Rules, the provisions related to the appointment and powers of the Secretary are:

- With the previous approval of the Government, the Board may appoint a Secretary. The Secretary shall be the Chief Executive Officer of the Board.

- The Secretary shall be responsible for ensuring that the provisions of the Tamil Nadu Labour Welfare Fund Act and the Rules made thereunder are duly carried out. In order to fulfill this responsibility, he or she shall have the power to issue such orders as he or she may deem fit. However, these should not be inconsistent with the provisions of this Act and the Rules made thereunder. The orders issued will thus be implementing the decisions taken by the Board under this Act or the rules made thereunder.

- The Secretary may, without reference to the Board, sanction expenditure on contingencies, supplies, and services, and purchase of articles required, subject to the financial provision in the budget and subject to the limits up to which the Secretary may be authorized to sanction expenditure on any single item, from time to time, by the Board with the approval of the Government.

- The Secretary may also exercise such administrative and financial powers other than those discussed in the preceding bullet point, as may be delegated to him or her, from time to time, by the Board, with the approval of the Government.

- The Secretary may delegate, from time to time, the administrative and financial powers delegated to him or her by the Board to any officer under his or her control or Superintendent to the extent considered suitable by him or her for the administration of the Fund. A statement of such delegation shall be placed before the next meeting of the Board for information.

Note: As per the Tamil Nadu Labour Welfare Fund Rules, the Secretary shall receive such salary and allowances as may be fixed by the Board with the approval of the Government.

Inspectors

Under the Tamil Nadu Labour Welfare Fund Act, the provisions related to Inspectors are:

- An Inspector of Factories appointed under sub-section (1) of section 8 of the Factories Act, 1948 (Central Act LXIII of 1948) shall be an Inspector for the purposes of this Act in respect of all factories within the local limits assigned to him or her.

- Another person can be appointed as the Inspector for the purposes of this Act if the Government finds him or her fit and has given a notification for the same. Such a person may also be given the local limits within which and the class of establishments in respect of which they shall exercise their functions.

- Subject to any rules made in this behalf, an Inspector shall have the power to do all or any of the following matters within the local limits for which he or she is appointed:

- In order to ascertain whether the provisions of this Act have been and are being complied with, he or she is to make such examination and hold such inquiry as may be necessary.

- In connection with the sums payable to the Tamil Nadu Labour Welfare Fund, they can ask for the production of any prescribed register and any other document in possession of the employer.

- To enter at all reasonable times any premises with such assistance as he or she may think appropriate.

- To exercise such other powers as may be prescribed.

In addition to these powers of the Secretary, as per the Tamil Nadu Labour Welfare Fund Rules, for the purposes of giving effect to the provisions of the Tamil Nadu Labour Welfare Fund Act, his or her powers also include:

- To prosecute, conductors defend before a Court any complaint or other proceeding arising under the Act.

- To require any employer to supply or send any return or true copy of any document or information relating to the provisions of the Act.

- To satisfy himself or herself at each inspection that-

- The provisions of the Act and the rules regarding the payment of contributions and unpaid accumulations and fines are observed.

- The prescribed registers are properly maintained.

- The returns required under the rules are sent to the Secretary of the Board.

- To note how far the defects pointed out at previous inspections have been removed and how far orders previously issued have been complied with.

- To point out all such defects or irregularities as he or she may have observed and to give orders for their rectification, and to record and furnish to the employer a summary of the irregularities or defects and of his or her orders.

Constitution of the Board

As per the Tamil Nadu Labour Welfare Fund Rules, the constitution of the Board shall be as follows:

- The Board shall consist of twenty members, including the Chairman, who shall be the Minister in charge of Labour, and the following members appointed by the Government:

- Five representatives of employers as appointed by the State Government in consultation with such organizations of employers in the State.

- Five employee representatives are to be appointed by the State Government in consultation with such organizations of employees in the State.

- Three members of the State Legislature

- Four Government Officials

- Two independent members

- The Board shall also elect a Vice-Chairman to perform the duties of the Chairman in his absence.

Note: If there is no other women representative on the Board, then the question of including women representatives as independent members would be considered by the Government. Also, the members of the Board, other than Government Officers, shall receive traveling allowance and dearness allowance at the rates admissible to members of the 1st Class Committee whenever they attend the meetings of the Board.

Allotment of Certain Officers and Staff to the Board

Under the Tamil Nadu Labour Welfare Fund Act, the provisions related to the allotment of certain officers and staff to the Board are:

- As soon as may be after the commencement of this Act, the Government may, after consulting the Board directly by general or special order, that such of the Officers and other servants serving immediately before the notified date in connection with the affairs of the State as are specified in such order shall be allotted to serve in connection with the affairs of the Board with effect on and from such date as may be specified in such order. Remember, no such direction shall be issued in respect of such officer or other servants without his or her consent for such allotment. Also, the conditions of service applicable immediately before the notified date to any such person shall not be varied to his or her disadvantage except with the previous approval of the Government.

- With effect on and from the notified date, the Officers and other servants specified in such order shall become employees of the Board and shall cease to be officers or servants of the Government.

Appointment of Clerical and Other Staff by the Board

As per the provisions of the Tamil Nadu Labour Welfare Fund Act, the Board may, subject to the provisions of the section titled as- ‘Allotment of Certain Officers and Staff to the Board,’ appoint such other officers and servants as it considers necessary for the efficient performance of its functions. However, while doing so, it will have to ensure that the expenses of this appointed staff, as well as other administrative expenses, do not exceed such a percentage of the annual income of the Fund as may be prescribed.

Transfer of Provident Fund to the Board

The provisions for transferring of provident fund to the Board under the Tamil Nadu Labour Welfare Fund Act are:

- For any of the money standing to the credit under the Provident Fund Account of any servant or officer allowed from the service of the Government to the Board’s service on the date specified in the order as per the first bullet point of the preceding section shall stand transferred to and vest in the Board with effect on and from such date.

- The Board shall, as soon as may be, after such date, constitute in respect of the money and other assets which are transferred to and vested in it as per the preceding subsection of this section of this Act, a similar fund and may invest the accumulations under the Fund in such securities and subject to such conditions as may be specified by the Board with the approval of the Government.

The Credit of Leave Salary and Pensionary Contribution to the Board

The provisions related to the Government crediting leave salaries and pensionary contributions in respect of the officers and servants allotted to the Board’s service as under the Tamil Nadu Labour Welfare Fund Act are:

- The Government shall credit to the account of the Board the leave salary and pensionary contributions such that it is in proportion to the leave at the credit of such officers and servants, or in proportion to the length of their service under the Government, as the case may be. This would be as per the terms and conditions applicable to them under the Government on the date specified in the order as per the first bullet-point of the section titled as- ‘Allotment of Certain Officers and Staff to the Board.’

Meetings of the Board

As per the Tamil Nadu Labour Welfare Fund Rules, the rules related to the meetings of the Board are:

- The Board shall meet at least once in every quarter and as often as may be necessary.

- The Secretary shall, in consultation with the Chairman, fix the date, time, and place of, and also draw up an agenda for every meeting. Notice of at least seven clear days should be given to each member for such a meeting. Also, no other matter, except for the one included in the agenda, shall be considered except with the permission of the Chairman.

Note: If the Chairman is of the opinion that the business of an emergent nature has to be transacted, then the notice of seven clear days is not necessary.

Quorum

As per the Tamil Nadu Labour Welfare Fund Rules, no business shall be transacted at any meetings of the Board unless there is a quorum of not less than one-third of the number of the members of the Board, including the Chairman.

Thus, if at any meeting there is less than one-third of the total number of members present, then the Chairman may adjourn the meeting to a later date which is not later than seven days from the date of the original meeting.

Thereupon, it shall be lawful to dispose of the business of such adjourned meetings irrespective of the number of members present.

Chairman to Preside

As per the Tamil Nadu Labour Welfare Fund Rules,

- The Chairman shall preside over the meetings of the Board.

- In the absence of the Chairman at any meeting, the Vice-Chairman shall preside. If, however, the Chairman and the Vice-Chairman both are absent from a meeting, then the present members shall elect one among them to preside over that meeting.

Disposal of Business

According to the Tamil Nadu Labour Welfare Fund Rules, all the matters at the meeting of the Board shall be decided by a majority of votes of the members present and voting. In case of tie-in votes, the Chairman shall have a casting vote or a second vote.

Method of Voting

The votes shall be taken by show of hands, and if requested so by the Chairman, the names of the persons voting in favor and against any proposition shall be recorded.

Proceedings of the Meeting and Minute Books

As per the Tamil Nadu Labour Welfare Fund Rules,

- The proceedings of each meeting showing, inter alia, the name of the members present thereat shall be forwarded to each member of the Board as soon after the meeting as possible.

- The minutes of proceedings of the meeting shall be kept in a separate box and shall be signed by the Chairman at the meeting in which the proceedings are confirmed.

Confirmation of the Proceedings

As per the Tamil Nadu Labour Welfare Fund Rules, the proceedings of each meeting shall be confirmed with such modifications, if any, as may be considered necessary at the next meeting of the Board, and a copy thereof shall be submitted by the Board to the Government after such confirmation.

Powers of Government to Call for Records

Under the provisions of the Tamil Nadu Labour Welfare Fund Act, any officer authorized by the Government or the Government may call for the records of the Board and inspect the same. They may even supervise the working of the Board.

Mode of Recovery of Sums Payable to the Board

Under the provisions of the Tamil Nadu Labour Welfare Fund Act, any fund payable to the Board or into the Fund under this Act shall, without prejudice to any other mode of recovery, be recoverable on behalf of the Board as an arrear of land revenue.

Maintenance of Registers by the Employers

As per the Tamil Nadu Labour Welfare Fund Rules, the rules related to the maintenance of registers by the employers are:

- As an employer of your establishment, you are obliged to maintain the following registers:

- A register of wages in Form B

- A consolidated register of unpaid accumulations and fines, and other deductions in Form C.

- A visit book in which the Inspector visiting the establishment may record his or her remarks regarding any defects that may come to light at the time of the inspection. It shall be produced whenever required to do so by the Inspector. Remember, no separate visit book needs to be maintained when you are maintaining such a book in compliance with any other labor legislation.

- The registers to be maintained under these rules shall be in English or Tamil.

- The registers shall be preserved for a period of ten years from the date of the last entry made therein.

- By the 31st of January, as an employer, you will have to forward a copy of the extract from the register in Form B pertaining to the previous year to the Secretary every year.

Forms to Be Filled by the Employer

FORM – A

[See Rule 12 (4)]

Statement showing the particulars of contribution Amount paid to the Secretary, Tamil nadu Labour Welfare Board, for the year ending 31stDecember.

|

Name and address of the

Establishment. |

|

|

1. Total No. of employees in the establishment: |

|

|

2. No. of persons who are excluded from the payment of

contribution. |

|

|

3. No. of persons from whom their recovery not made for any other reasons. |

|

|

4. No. of persons from whom employee’s contributions have been

recovered. |

|

|

5. Amount of employee’s contribution at Rs.5/- per head. |

|

|

6. Amount of employer’s contribution at Rs.10/- per head. |

|

|

7. Total amount remitted

(Cheque or Draft No. and date) |

|

|

|

Authorized signatory. |

Certificates:

1. Certified that the number of employee shown under Column (1) is correct as per the Muster Roll/Attendance Register.

2.* Certified that the contribution is paid in respect of all employees covered by the Act.

3.* Certified that the contribution in respect of employees covered by the Act has yet to be recovered and it will paid separately.

(Vide G.O.Ms.No.868, Labour and Employment Department, dt.30.10.1976.

* Strike out items not applicable.

FORM – B

(See Rule 29)

REGISTER OF WAGES

|

Name and

address of the establishment: |

|

|||||

|

Month and year |

Total No. of Employees |

Total emoluments payable during the month including basic Wages,

D.A., OT, Bonus. |

Amount deducted during the month |

Amount actually paid

during the month |

Balance due to the employees |

|

|

Fine |

Other deductions |

|||||

|

Jan |

|

|

|

|

|

|

|

Feb |

|

|

|

|

|

|

|

Mar |

|

|

|

|

|

|

|

Apr |

|

|

|

|

|

|

|

May |

|

|

|

|

|

|

|

June |

|

|

|

|

|

|

|

July |

|

|

|

|

|

|

|

Aug |

|

|

|

|

|

|

|

Sep |

|

|

|

|

|

|

|

Oct |

|

|

|

|

|

|

|

Nov |

|

|

|

|

|

|

|

Dec |

|

|

|

|

|

|

Authorized signatory____________

FORM – C

(See rule 29)

Register of Fines and Unpaid Accumulations for the year.................

Name of the Establishment:

|

Details of Fines and Unpaid Accumulations |

Quarter

ending 31st March |

Quarter ending 30th

Jun |

Quarter ending 30th

Sept. |

Quarter ending 31st

December |

|

1 |

2 |

3 |

4 |

5 |

|

1.Total Realisation under Fines |

|

|

|

|

|

2. Total amount being unpaid accumulations*

of ** (i) Basic

Wages |

|

|

|

|

|

(ii) Overtime |

|

|

|

|

|

(iii) Dearness allowance and other

allowance |

|

|

|

|

|

(iv) Bonus |

|

|

|

|

|

(v) Gratuity |

|

|

|

|

|

(vi) Any other item of unpaid accumulations |

|

|

|

|

|

3. Deductions under Standing Orders |

|

|

|

|

|

4. Deductions under Payment of Wages Act |

|

|

|

|

Signature of the employer.__________________

* See definition “Unpaid accumulation” under Section 2(i) of the Tamil nadu Labour Welfare Fund Act, 1972.

Penalty for Obstructing Inspection or for Failure to Produce Documents, etc.

The provisions under the Tamil Nadu Labour Welfare Fund Act for the same are:

- If the Inspector is wilfully obstructed in the exercise of his powers of discharge of his duties under this Act by any person, or if any person fails to produce for inspection any record, register, or other documents maintained in the pursuance of the provisions of this Act or the rules made thereunder when so demanded by an Inspector, or if any person fails in supplying true copies of any such document as demanded, then on conviction, such a person shall be punished.

- For the first offense, that person will be punished with imprisonment for a maximum of three months or with a fine of a maximum of five hundred rupees, or with both; and

- For the second and subsequent offenses, that person shall be punished with imprisonment of a maximum of six months, or with a fine of a maximum of one thousand rupees, or with both.

Note: In the absence of special and adequate reasons to the contrary to be mentioned in the judgment of the court, in any case where the offender is sentenced to a fine only, the amount of the fine should be of minimum fifty rupees.

Offenses by Companies

Under the Tamil Nadu Labour Welfare Fund Act, the provisions related to offenses by companies are:

- If an offense committed under this Act is a company, then every person, who, at the time the offense was committed, was in charge of and was responsible to the company for the conduct of the business of the company as well as the company, shall be deemed to be guilty of the offense. Thus, for each of these people, proceedings will be held against and punished accordingly.

Note: This provision will only be applicable provided that nothing contained in this subsection shall render any such person liable to any punishment provided in this Act if he proves that the offense was committed without his knowledge or that he exercises all due diligence to prevent the commission of the offense.

- Notwithstanding anything contained in the preceding provision of this section of this Act, where an offense under this Act has been committed by a company, and it is proved that the offense has been committed with the consent or connivance of, or is attributable to any neglect on the part of any manager, director, Secretary or other officer of the company, then such a manager, director, Secretary or other officer of the company shall also be deemed to be guilty of that offense, and shall be liable to proceeded against and punished accordingly.

Cognizance of Offenses

The provisions under the Tamil Nadu Labour Welfare Fund Act for the same are:

- Except on a complaint by, or with previous sanction in writing of the Secretary, no court shall take cognizance of any offense punishable under this Act.

- For the trial of any offense punishable by or under this Act, no court inferior to that of a Presidency Magistrate or a Magistrate of the First Class shall be allowed.

Limitation of Prosecution

As per the Tamil Nadu Labour Welfare Fund Act, no court shall take cognizance of an offense punishable by or under this Act unless a complaint thereof is made within six months of the date on which the offense is alleged to have been committed.

Power to Supervise the Welfare Activities of an Establishment

If, in any establishment, money is set apart specifically for the purpose of promoting the welfare of the employees, then in such establishments, the Tamil Nadu Labour Welfare Board shall have the power to:

- Ask for the production of any document in connection with such money in possession of the employers like you so that it can ensure whether such money is being applied for such a purpose or not.

- Call for any information from you as the employer of the establishment, as it may deem fit; and

- Issue such directions to you as the employer of the establishment as it may deem fit for the purpose of utilizing the Tamil Nadu Labour Welfare Fund for promoting the welfare of the employees.

Penalty for Non-Compliance with the Direction of the Board

As per the provisions of the Tamil Nadu Labour Welfare Fund Act, any person who willfully fails to produce any document required by the Board, or to furnish any information called for by the Board, or willfully fails to comply with any directions issued by the Board as per the provisions of the section titled as- ‘Power to Supervise the Welfare Activities of an Establishment,’ then on conviction shall be punished with:

- If it is the first offense, then that individual will be punished with an imprisonment of a maximum of three months or with a fine of a maximum of five hundred rupees, or with both.

- However, if it is a second offense or subsequent offenses, then that individual will be punished with an imprisonment of a maximum of six months or with a fine of a maximum of one thousand rupees, or with both.

Note: In the absence of special and adequate reasons to the contrary to be mentioned in the judgment of the court, in any case where the offender is sentenced to a fine only, then the amount of the fine shall be of at least fifty rupees.

Annual Report

Under the Tamil Nadu Labour Welfare Fund Act, the Board will prepare and submit to the Government a report giving an account of its activities during the previous year, as well as an account of the activities, if any, which are likely to be undertaken by the Board in the next year. This report will have to be submitted in the form as may be prescribed and after the end of each year. As soon as the Government receives this report, it will ensure that it is laid before the State Legislature.

Supersession of the Board

The provisions under the Tamil Nadu Labour Welfare Fund Act related to the supersession of the Board are:

- If the Government are of the opinion that the Board is unable to perform, or has persistently made default in the performance of the duty imposed on it by or under this Act, or has exceeded or abused its powers, they may, by notification, supersede the Board for a period of maximum six months, as may be specified in the notification. However, before issuing such notification, the Government shall give a notice to the Board, requiring it to show cause within such period as may be specified in the notice as to why it should not be superseded. Before making any decisions, it will thus consider any explanations and objections, if any, as provided by the Board.

- Once the above-mentioned notification that will supersede the Board is published,

- The Chairman, as well as all the members of the Board, shall, as from the date of supersession, vacate their offices.

- During the period of supersession, all the powers and duties, which may, by or under the provisions of this Act, were exercised or performed by or on behalf of the Board and the Chairman, will now be exercised and performed by any such authority or person as the Government may direct.

- During the period of supersession, all the funds and other property vested in the Board shall be vested in the authority or person referred to in the clause (2).

- This means that all the liabilities, legally subsisting and enforceable against the Board shall be enforceable against the authority or person referred to in the clause (2) to the extent the funds and properties vested in it or him or her.

- When the period of supersession expires as specified in the notification issued for the same, the Government may:

- Extend the period of supersession for such further periods as they may consider necessary. However, this extension period cannot exceed six months.

- Reconstitute the Board in the manner as provided in the section titled as- ‘Tamil Nadu Labour Welfare Board (Subtopic- Constitution of the Board).’

Delegation of Powers

Under the Tamil Nadu Labour Welfare Fund Act, the provisions related to the delegation of powers are:

- Through a notification, the Government may authorize any authority or officer to exercise any of the powers vested in them by or under this Act. This, however, will not include the ‘power to make rules, as will be discussed in the section titled so below. Thus, the Government will be withdrawing such authority from such authority or officers.

- Through a special or general order in writing, the Board may delegate to the Secretary or other officer of the Board such of its powers and functions under this Act. Here too, the ‘power to make rules as will be discussed in the section titled so below will not be included and can, in fact, withdraw such authority from the concerned person.

- The exercise of any power delegated as per the preceding provisions of this section of this Act shall be subject to such restrictions and conditions as may be specified in the order and also to control revisions by the Government or by such officer as may be empowered by the Government in this behalf, or, as the case may be, by the Board or such officer as may be empowered by the Board in this behalf.

- The Government or the Boar, as the case may be, shall also have the power to control and revise the acts and proceedings of any officer so empowered.

Members of Board, Secretary, Inspectors, and All Officers and Servants of the Board to be Public Servants

Remembers, all the members of the Board, the Secretary, the Inspectors, and all officers and servants of the Board, and thus, any person entrusted with the execution of any function under this Act shall be deemed to be a public servant within the meaning of Section 21 of the Indian Penal Code (Central Act XLV of 1860).

Protection of Action Taken in Good Faith

Under the Tamil Nadu Labour Welfare Fund Act, the provisions for the protection of action taken in good faith are:

- No prosecution, suit, or other legal proceedings shall lie against any person for anything which is, in good faith, done or intended to be done in pursuance of this Act or any order or rule made thereunder.

- No suit or other legal proceeding shall lie against the Government or the Board for any damage caused or likely to be caused by anything which is in good faith done or intended to be done in pursuance of this Act or any rule or order made thereunder.

Exemption

As per the Tamil Nadu Labour Welfare Fund Act, the Government may, by notification, exempt any establishment or class of establishments from all or any of the provisions of this Act or of any rules made thereunder, subject to such conditions as may be specified in the notification.

Power to Make Rules

Under the Tamil Nadu Labour Welfare Fund Act, the provisions relating to the power to make rules are:

- For the purpose of carrying into effect the provisions of this Act, the Government may make rules.

- In particular and without prejudice to the generality of the foregoing power, such rules may provide for:

- All matters expressly required or allowed by this Act to be prescribed.

- The intervals at which or the period within which any of the sums referred to in the section titled as- ‘Tamil Nadu Labour Welfare Fund’ shall be paid to the Board or into the Fund, the manner of making such payment, and the agency for, and manner of, collection of any such sum.

- The manner in which the accounts of the Fund shall be maintained and audited.

- The allowance, if any, payable to the members of the Board.

- The manner in which the employee’s contribution may be deducted from his wages.

- The form of notice regarding unpaid accumulations.

- The procedure for making grants from the Fund.

- The procedure for defraying the expenditure incurred in administering the Fund.

- The manner in which the Board shall conduct its business.

- The duties and powers of the Inspectors and the conditions of service of the Secretary and Inspectors and other staff appointed under this Act.

- The delegation of the powers and functions of the Board to the Secretary and the conditions and limitations subject to which the powers may be exercised or functions discharged.

- The percentage of the annual income of the Fund beyond which the Board may not spend on the staff and on other administrative expenses.

- The registers and records to be maintained under this Act.

- The publication of the report of the activities financed from the Fund together with a statement of receipts and expenditures of the Fund and a statement of accounts.

- All rules made under this Act shall be published in the Tamil Nadu Government Gazette, and unless they are expressed to come into force on a particular day, they shall come into force on the day on which they are so published.

- All notifications issued under this Act shall, unless they are expressed to, come into force on a particular day, come into force on the day on which they are published.

- Every rule made or notification issued under this Act shall, as soon as possible, after it is made or issued, be placed on the table of the Legislative Assembly, and if, before the expiry of the session in which it is so placed or the next session, the Legislative Assembly agrees in making any modification in any such rule or notification or the Legislative Assembly agrees that the rules or notification should not be made or issued, the rule or notification shall thereafter have effect only in such modified form or be of no effect, as the case may be, so, however, that any such modification or annulment shall be without prejudice to the validity of anything previously done under that rule or notification.

Power to Make Regulations

Under the Tamil Nadu Labour Welfare Fund Act, the provisions relating to the power to make regulations are:

- The Board may, by notification issued, whether prospectively or retrospectively, make regulations not inconsistent with this Act and the rules made thereunder for the purposes of giving effect to the provisions of this Act.

- In particular and without prejudice to the generality of the foregoing power, such regulations may provide for:

- All matters expressly required or allowed by this Act to be prescribed by regulations.

- The terms and conditions of appointment and service and the scales of pay of officers and servants of the Board, including the payment of traveling and daily allowances in respect of journeys undertaken by such officers and servants of the Board.

- The supervision and control over the acts and proceedings of the officers and servants of the Board and the maintenance of discipline and conduct among the officers and servants of the Board.

- The procedure in regard to the transaction of business at the meetings of the Board, including the quorum.

- The purposes for which and manner in which temporary association of persons may be made.

- The duties, the functions, the terms and conditions of service of the members of the committees.

- The manner and the form relating to the maintenance of the accounts of the Board.

- No regulation or its cancellation or modification shall have effect until the same shall have been approved by the Government.

- The Government may, by notification, rescind any regulation made under this section, and thereupon, the regulation shall cease to have an effect.

Amendment of Section 8, Central Act IV of 1936

In Section 8 of the Payment of Wages Act, 1936 (Central Act IV of 1936), in subsection (8), in the last sentence, the following shall be added at the end, namely:

“But in the case of any establishment to which the Tamil Nadu Labour Welfare Fund Act, 1972 applies, all such realizations shall be paid into the Fund constituted under the aforesaid Act.”

Change in the Contribution by Employee, Employer, and the Government to the Fund

In order to further amend the Tamil Nadu Labour Welfare Fund Act, 1972, the Tamil Nadu Labour Department has tabled a Bill for Tamil Nadu Labour Welfare Fund (Amendment) Act, 2021. This shall come into force on such date as the State Government may, by notification, appoint.

The extract of the Amendment in the Act is as follows:

In section 15 of the Tamil Nadu Labour Welfare Fund Act, 1972, for subsection 1, the following subsection shall be substituted, namely-

“Every employee shall contribute a sum not exceeding fifty rupees, per year, as may be prescribed, from time to time, to the Fund, and every employer shall, in respect of each such employee, contribute a sum not exceeding hundred rupees, per year, as may be prescribed, from time to time, to the Fund, and the Government shall, in respect of each such employee, contribute a sum not exceeding fifty rupees, per year, as may be prescribed, from time to time, to the Fund.”

There was a need for an amendment to take place because the last Amendment had been done in 2015 by a Bill that was tabled by the Minister of Labour Welfare and Skill Development C.V.Ganesan, due to which every employee had to contribute ten rupees per year, every employer in respect of each such employee had to contribute twenty rupees per year, and the Government had contribute ten rupees per year for each such employee.

Thus, the frequency of the contribution to the Tamil Nadu Labour Welfare Fund will be yearly, with the date of deduction being 31st December and the date of returns being 31st January of the immediately following year. The total contribution as per the 2021 amendment by the employee and employer would be INR 150, and the rules applicable are:

- Any establishment or employer employing five or more persons.

- All employees except those in part-time, apprentice, and managerial positions drawing wages more than INR 15,000 per month.

Benefits of the Tamil Nadu Labour Welfare Fund

The main purpose of the Tamil Nadu Labour Welfare Fund is to have a statutory contribution that will help the laborers improve their working conditions, provide them social security, and raise their standard of living. Some of the welfare benefits as given by and through the Tamil Nadu Labour Welfare Fund will now be discussed in this section.

Tamil Nadu aids with Natural and Accidental Death Assistance/ Funeral Expenses.

- In case of accidental death, the dependents are eligible for an Accidental Death Assistance of INR 1,00,000 and INR 5,000 towards Funeral Expenses. The eligibility criterias for the same are-

- The employee should have been contributing to the Labour Welfare Fund.

- Employee’s monthly salary should not exceed INR 25,000 (basic pay + dearness allowance)

- The claim will be given to the legal heir of the employee.

- The aid request should be applied for within one year from the date of death.

- In case of natural death, the dependents are eligible for an amount of INR 25,000 and INR 5,000 towards funeral expenses. The eligibility criterias for the same are-

- The employee should have been contributing to the Labour Welfare Fund.

- Employee’s monthly salary should not exceed INR 25,000 (basic pay + dearness allowance)

- The claim will be given to the legal heir of the employee.

- The aid request should be applied for within one year from the date of death.

- Tailoring Centers- It is developed as part of Tamil Nadu Labour Welfare Centers. Here, the wives and unmarried daughters/sisters of workmen who are contributors of the Tamil Nadu Labour Welfare Fund are eligible to undergo training in tailoring. The course will be of one year and will commence from January. The trainees will be paid INR 150 each month as a stipend. At the end of the course, the trainees will be sent to the examinations conducted by the Government, and the first rank holder in each center will be given a sewing machine as the prize.

- Pre-Schools- This is for the children of the workers who are in the age group of 2 to 5 years old. In the pre-schools, each day, the children would be given nutritious mid-day meals and 150 ml of milk in the evening. They would be given eggs thrice a week and plantain fruits twice a week. The children would be imparted education in Tamil, Maths, and English and will also be provided with two sets of teri-cotton uniforms. The pre-schools will function from June to April every year.

- Educational Scholarship- For the children of the workers who are pursuing higher education, they would be given scholarships at the following rates:

- Master Degree in Engineering- INR 12,000

- Master Degree in Medical- INR 12,000

- Master Degree in Law- INR 12,000

- Master Degree in Agriculture- INR 12,000

- Master Degree in Education- INR 12,000

- Master Degree in Physical Education- INR 12,000

- Bachelor Degree in Engineering- INR 8,000

- Bachelor Degree in Medical- INR 8,000

- Bachelor Degree in Law- INR 8,000

- Bachelor Degree in Agriculture- INR 8,000

- Bachelor Degree in Education- INR 8,000

- Bachelor Degree in Physical Education- INR 8,000

- Diploma in Engineering- INR 5,000

- Diploma in Medicine- INR 5,000

- Certificate Course in Physical Education- INR 5,000

- Diploma in Teacher Training Education- INR 5,000

- Higher Secondary- INR 4,000

- I.T.I.- INR 4,000

- Educational Incentive- For the children of the workers who secure the first ten places in the Government Public Examinations in each Educational District, a cash award of INR 2,000 will be given for the 10th standard and for the 12th standard, a cash award of INR 3,000 will be awarded.

- Book Allowance- Book allowances are given to the children of the workers for pursuing their studies at the rates as follows:

- Higher Secondary- INR 1,000

- Diploma Course- INR 1,500

- Bachelor Degree- INR 2,000

- Master Degree- INR 3,000

- Assistance of Basic Computer Training- A reimbursement of INR 1,000 will be given to five employees or dependants in each revenue district for basic computer training.

- Marriage Assistance Scheme- A sum of INR 10,000 is given as marriage assistance to employees or their son or daughter who legally attain the age of marriage.

- Spectacles Assistance- Reimbursement of the cost of spectacles of INR 1,000 is given to the workers on the production of the doctor’s prescription.

- Typewriting/Shorthand Assistance- The children of the workers who have passed the typewriting/shorthand Government examinations are paid INR 1,000 for typewriting lower, INR 600 for typewriting higher, and INR 1,500 for shorthand lower and higher.

- Hearing Aid, Artificial Limbs and Three Wheelers- A reimbursement of the cost of hearing aid up to INR 1,000 is given to the hearing impaired workers/dependants. Similarly, the cost of artificial limbs is also reimbursed, and three-wheelers are given free of cost to handicapped workers.

These welfare aids and activities leads to the following benefits:

- Offer better working conditions- When facilities are made available for the workers and employees like transport for commuting to work, reading rooms, libraries, vocational training programs, excursions and tours, recreational facilities at the workplace, etc., better working conditions will be secured for all the workers and employees.

- Improved industrial relations- These measures provide great satisfaction to the workers, which helps in maintaining industrial peace. In fact, a feeling of oneness is generated in the organization, which minimizes chaos, conflicts, unrest, etc.

- Increase in the general efficiency and income- The welfare facilities makes the worker happy and content at home as well as in the factory, which improves their general efficiency, as they will now be working with full zeal and enthusiasm.

- High morale- The welfare measures help in securing the cooperation of the workers, as once they are satisfied, the workers would be less tempted to engage in destructive and anti-social activities.

- Creation of permanent labor force- These facilities will attract the workers to stay longer in the undertaking while reducing the temptation to look for recreation or, in the case of efficient workers, better job opportunities with better facilities.

- Improvement in the mental and moral health- These facilities ensure that the outlook of the workers is changed and they become good citizens, rather than falling prey to social evils like gambling, drinking, etc.

- Change in the outlook of the employers- A change in the outlook and attitude of the employees along with their heart-felt cooperation will also change the outlook of employers like you, making you more sympathetic towards them. It will also encourage you to share the fruits of hard labor and follow-up successes with them.

- Social benefits- In addition to the various economic benefits to the employees and employer alike, the social benefits include the efficiency of the workers will ultimately lead to an increase in production, productivity, and the earnings of the undertakings. The increased earnings will lead to higher wages, hence enabling the workers to lead a richer and fuller life, thereby increasing the living standard of the society.

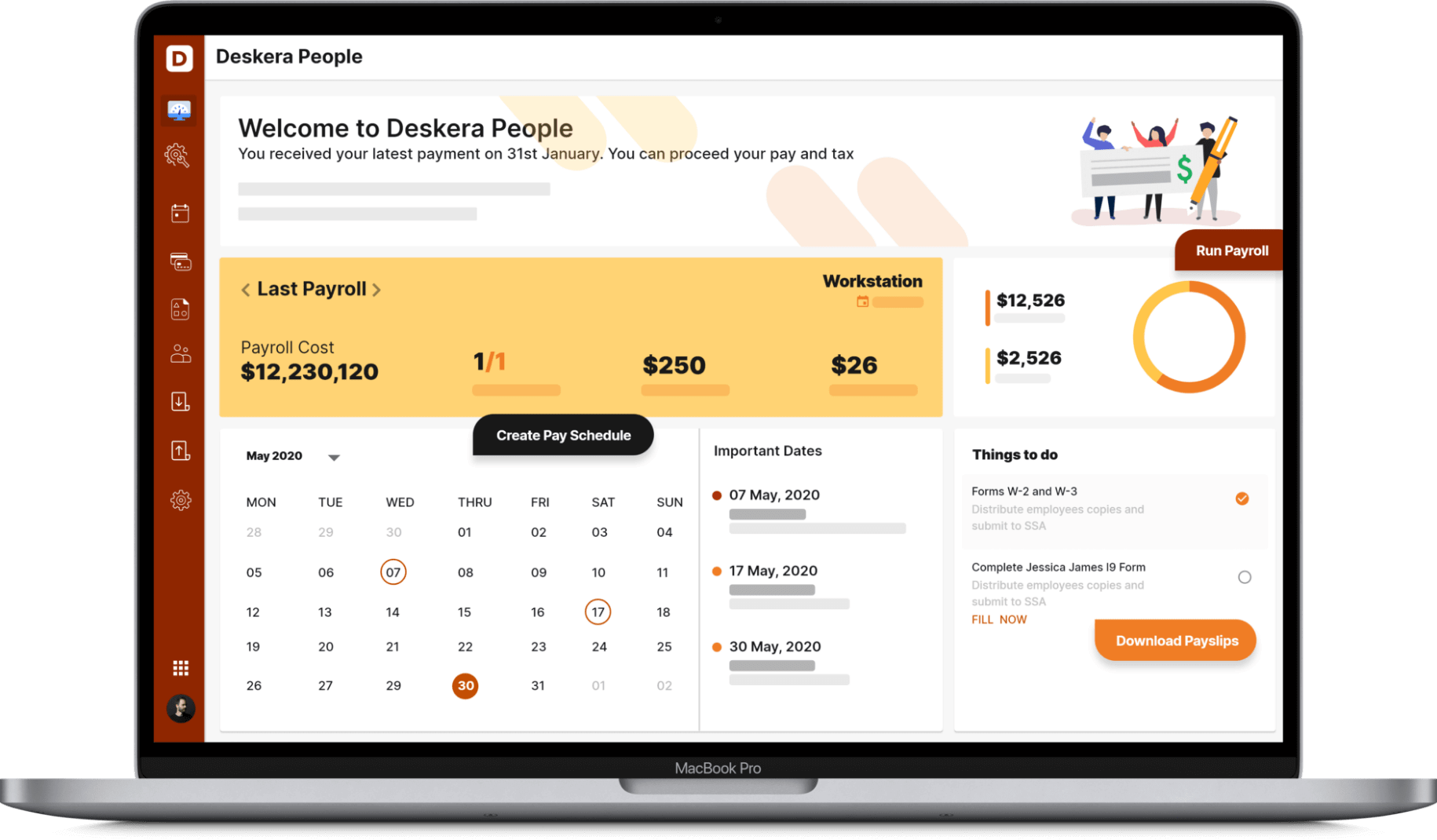

How Can Deskera Help?

Deskera People is the HR-based software that you should rely upon when you want automation as well as efficiency when processing payrolls, generating customizable pay slips, calculating wages of your employees after considering their own pay components, managing employee leaves, and their on-boarding processes, and even fulfill the pay schedules of different groups of employees as per the industry-specific requirements.

With Deskera People, all your HR-based tasks would be simplified while also ensuring that you are able to comply with the provisions of the Tamil Nadu Labour Welfare Fund Act. This will also involve the payment of unpaid accumulations, interest on the unpaid accumulations, and transfer of provident funds, to mention a few key functions. Additionally, it will also assist you in maintaining the records as prescribed by the Act.

Key Takeaways

The Tamil Nadu Labour Welfare Fund Act has been established to have a Fund through which the welfare of the labor in Tamil Nadu would be promoted, a Board that will ensure that the provisions of this Act and the rules thereunder are carried out, and the Government will have the overarching authority and say over it all. In fact, at certain times, along with the employees and employers, the Government might contribute to the Tamil Nadu Labour Welfare Fund as well.

The functions of the Tamil Nadu Labour Welfare Board are:

- The important provisions of this Act deal with-

- Collection of Labour Welfare Fund

- Vesting and Application of the Fund

- Constitution of the Board

- Term of Members

- Power to Appoint Committee

- Functions of the Board

- Unpaid Accumulations

- Deposit of Funds

- Placing of Accounts and Audit Report Before the State Legislature

- Power to Make Rules and Regulations

- The Tamil Nadu Labour Welfare Fund Rules 1973 deals with-

- Payment of Fines and Unpaid Accumulations by the Employer

- Maintenance and Audit of Accounts

- Budget of the Board

- Additional Expenditure

- Mode of Payment

- Payment of Contributions

- Meetings of the Board

- Quorum

- Administrative and Financial Powers of the Secretary