Businesses in any part of the country need to abide by the rules and regulations of the central government of India as well as the state government. If you are an employer who is planning to extend a branch of your business in the Southern zone, particularly Tamil Nadu in this nation, then you must know about the form 21 half while filing returns from the state government. We are going to cover about the same form 21 in this article. Furthermore, we would be discussing the following points in this article -

- What is the half-yearly return?

- Tamil Nadu Factories Act, 1950

- Tamil Nadu Half Yearly Returns - Industrial Establishment Rules

- What questions are asked in the Tamil Nadu Factories Act, 1950?

- How to fill the form 21 half as per the Factories Act 1950?

- Conclusion

- How can Deskera Assist you?

- Key Takeaways

What is the half-yearly return?

Every manager of the factory is expected to submit a half-yearly return form if he has his factory or business in Tamil Nadu. According to the rules of the state, the business owner must submit a 21 half form twice a year to the government to file their half-yearly returns. It is expected that the manager of the factory must furnish this form 21 before an inspector in the stipulated format before the expiry date. According to the rule, any manager who fails to submit it before the deadline or contravenes with the provisions of the Act or rules can be punished for one lakh rupees or face imprisonment of two years or even both.

Tamil Nadu Factories Act, 1950

The state government of Tamil Nadu passed the Tamil Nadu Factories Act in the year 1950. It is social legislation enacted by the state government for the occupational safety, health and welfare of the employees or workers at the workplace - factory or business. According to available information, the state of Tamil Nadu has formulated the rules that are contemplated under this act. These are known as the Tamil Nadu Factories Rules,1950.

The document for amendment to the Tamil Nadu Factories Rules can be found on the page -

Tamil Nadu Half Yearly Returns - Industrial Establishment Rules

As per the Tamil Nadu Factories Act, while filing Form 21, the employer needs to follow the government gazette published for the financial year to follow the rules. As per the available data for the year 2018, the government gazette had set the rules given below -

- In rule 6, the sub-rule (2) and (3), the following shall be substituted namely -

- Every employer is expected to compile an up-to-date list in Form 1 except column 9 at the end of the year. He should exhibit this list prominently in any part of the industrial establishment. It will help for the employees or workers' perusal at any time of the day during working hours as needed.

- As per the Factories Act of the state, every employer is required to send a copy of the updated list that is compiled under sub-rule (2) to the Inspector who is in charge of the area for the fortnight. He should also give a declaration that the list has been exhibited for the perusal of the workmen of the factory or industrial establishment and is required under the sub-section (2). In addition to this, the employer must send particulars for the year in Form 2 along with the particulars in Form 1 as necessary under the sub-rule to the concerned inspector.

It means when the employer is filling the form 21 half for half-yearly returns, he must obtain an acknowledgement from the inspector for furnishing the particulars in Form 2 and Form 1 by doing a registered post or any other suitable method. Furthermore, the employer must keep in mind while filing the Form 21 half that no other annual return form is sent to the inspector by the business owner of the industrial establishment or employer or if he filing a combined Form 22 as required in the sub-rule (2) of rule 100 of the Tamil Nadu Factories Rules, 1950.

4. In form 2, for half-yearly return, the heading annual return for the year ending with 31st December 20XX shall be substituted with half-year ending with 30th June or 31st December. Furthermore, in Item Nos. (6) and (7), for the expression year ending 31st December, shall be substituted by half-year ending 30th June/ 31st December. Also, in item (8), for the expression 1st July/1st January, the expression 1st January should be substituted by the employer or businessman filling the form 21.

What questions are asked in the Tamil Nadu Factories Act, 1950?

Every employer has to answer a few questions related to his business under the Factories Act, 1950 before filing a return using the 21 half Form. These are usually yes/ no types of questions that an employer must inform the inspector. In addition to the answer, the business owner can write specific remarks for the question he wants to give more details about. A few of the questions to be filled under the Tamil Nadu Factories Act for the inspector are listed below -

- Are all the building plans of the factory approved and if they are constructed according to the approval?

- Has the factory been registered and is the license fee of the business been paid correctly?

- Is the factory clean? Is the washroom of the factory outlet in every building washed once per week?

- Are all the drains at the business centre properly constructed and cleaned regularly?

- Is there a provision for adequate windows for the circulation of fresh air in the working rooms for the employees or workers?

- Is any working room overcrowded? Are sufficient floor-built areas, and air space provided for each worker?

- Is dust or fume given off in the manufacturing process? If so, are the exhaust arrangements satisfactory?

- Is the lighting in all the rooms and passages sufficient and suitable?

- What is the source of supply? If it is not from the public water-supply system, has it been approved in writing by the health officer?

- Is a sufficient quantity of drinking water provided for the use of the workers?

- Are sufficient latrine and urinal accommodations provided to the workers separately for men and women?

- Are the latrines and urinals of a type approved by the health officer?

- Are the walls of the latrines and urinal white-washed or colour washed at least once every four months?

- Are excessive weights carried by the Workers?

- Are all the tanks, pits, etc., securely covered?

- Are proper precautions taken for the protection of the eyes?

- Are Necessary precautions taken against explosions?

- Are staircases constructed following Section 38(6) and Rule 1(c) (d) and (e)?

- Is any building or part of a building in a dangerous condition involving imminent danger to human life or safety? If so what is the action to be taken?

- Are rest sheds provided when were they constructed?

- What is the maximum number of workers that take a rest in the factory at any particular time in the day?

- Are schools provided for workers or their children? When were they started?

- What are the other measures are taken exclusively for the benefit of the workers?

- Special features, if any, for Administration Report- Strikes, fires, epidemics, etc.

- What is the lowest wage paid to full adult workers?

- Dearness allowance in cash with scale, if any

- Are Suitable devices for cutting off power in emergencies in every workroom provided? [Section 24(2).]

- Are young persons without sufficient training and supervision employed on dangerous machinery?

- Does any child or adolescent not certified to work as an adult work for more than 4.1/2 hours on any day, or on the nights between 7 pm and 6 am?

- Are any women employed the nights between 10 p.m and 6 a.m?

- Is any worker required to work otherwise than by the notice of period of work?

- Is notice of the period of work framed in Form No.11 and exhibited in the factory in English and the Local language by Section 108(2)? Are copies of it sent in duplicate to the inspector?

- If exempt, is the overtime work muster roll maintained in Form No.10?

- Is any adult worker employed for more than nine hours on any day?

- Is a register maintained in Form No.9?

- Was a notice delivered to the Inspector by section 52 (1) (b) (i)?

- Is a crèche constructed according to plans approved and is the accommodation sufficient?

- Is the Lunchroom/restroom constructed according to the plans approved? Is the accommodation sufficient?

- Is there a managing committee for the canteen?

- Is the factory ordinarily employing more than 150?

- Is the first-aid equipment in charge of trained persons?

- Is any building or part of a building in a dangerous condition involving imminent danger to human life or safety? If so what is the action to be taken?

- Are adequate precautions taken against the danger of fire?

- Are exit doors of not less than 6.5 feet x 4 feet Size fitted to slide or open outwards?

- Are Necessary precautions taken against explosions?

- Is drinking water stored in suitable vessels with water and taps and dust-proof covers placed on the raised platforms in shade? Is the surrounding of the platform on which the vessels are placed kept dry and clean?

- Is a notice giving the particulars of each room in form 29 exhibited prominently in each working room?

- Is any working room overcrowded? Are sufficient floor-built areas, and air space provided for each worker?

- Is dust or fume given off in the manufacturing process? If so, are the exhaust arrangements satisfactory?

- Is the temperature in the working rooms high? If so, what are the measures to be taken to reduce it?

The list of all questions related to the factories while filling the form 21 half can be found on the link - https://dish.tn.gov.in/assets/pdf/FactoriesAct1948andTamilNaduFactoriesRules.pdf

How to fill the form 21 half as per the Factories Act 1950?

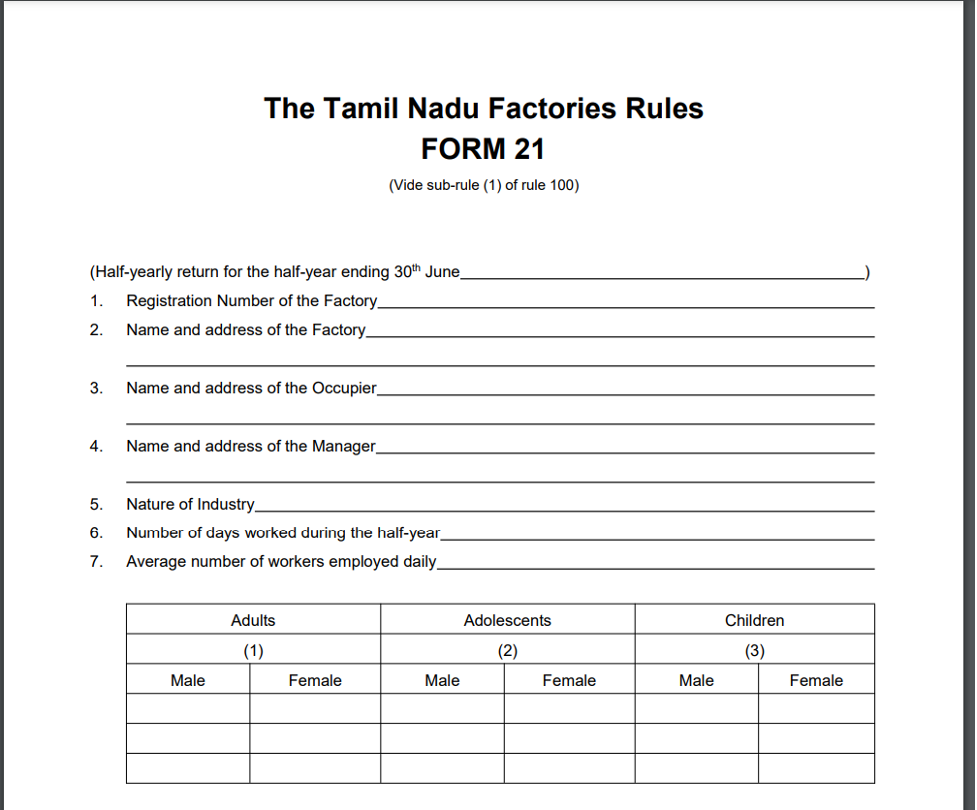

If you are an employer who has just established a business in Tamil Nadu and have no idea about what to fill in the form 21 half while filing half-yearly returns, then this is the perfect article for you. We will explain what is included in this form in this section. Form 21 half is under the Tamil Nadu Factories Rules. Let us know how to fill this form properly through the points given below -

This form 21 half is for the employers who consider their half year ending on 30th June of the financial year. The steps to fill this form are as follows -

- Registration Number: Here on the first line, the business owner must mention the registration number of the factory

- Name and Address: The employer must specify the name of the factory as per the registration. In addition to this, it is expected that he gives proper address of the factory along with the pin code. It will be helpful for location in Tamil Nadu

- Name and Address of the Occupier: In this line, the employer or businessman must mention his correct details. He should give his personal address properly along with the pincode

- Name and Address of the Manager: In the form 21 half yearly return, it is expected that the employer gives details of the manager who handles the factory. Hence, proper name of the manager along with his address is expected on this line of the form

- Nature of Industry: On this line, the state government asks the business owner or factory owner to specify the nature of the industry which is useful for classification in the government dataset of companies

- Number of days worked during the half year: The employer must specify the number of days his factory was working in the half year that is until June 30 of the financial year

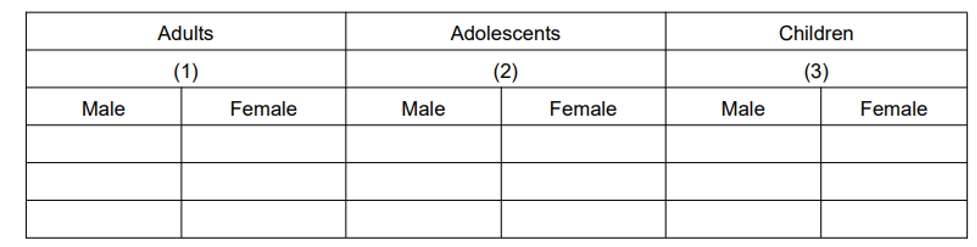

- Average number of employees daily: In this line, the employer must specify the average number of workers or employees working daily in the factory outlet. He should give proper details by giving count of number of adult men and adult women employed in the factory, number of adolescents - both, men and women working in the factory as well as the number of children (if any) - boys and girls in the factory in the table format as present in the form 21 half yearly returns. This can be better understood from the image given below -

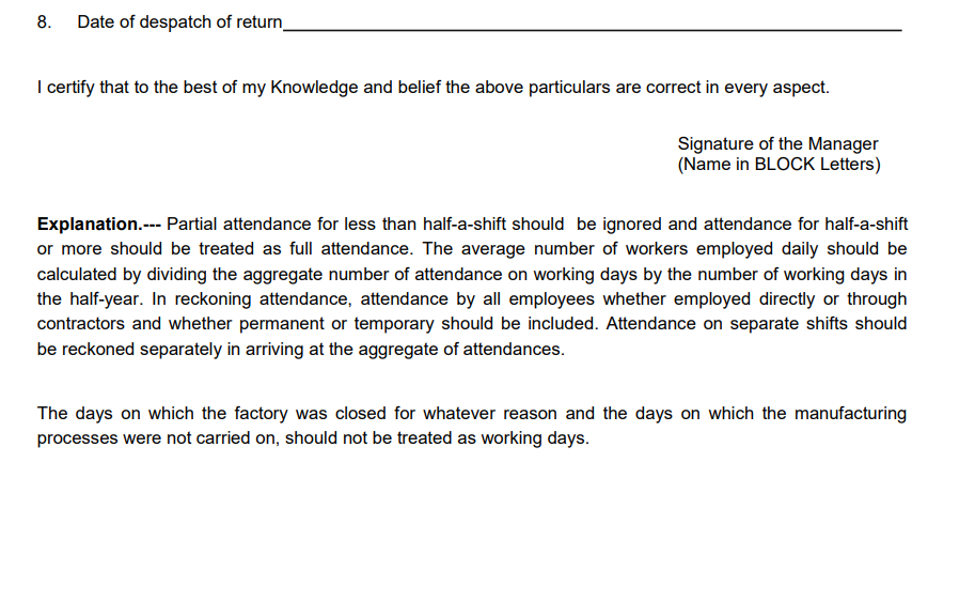

8. Date of despatch of return: The employer must specify the date when he is expecting the half yearly returns from the state government in the Form 21 half for the financial year. It will give an idea to the income tax department of the state and help them clear the returns easily

The form 21 half certifies that the information mentioned by the employer is in the truest sense which acts as the validation for the tax professional handling this section in the state government department.

This form should be filled by the manager of the employer and submitted before the deadline. The employer can make use of the website - https://dish.tn.gov.in/aboutdept.html to get all the information related to the Factories Act and allied labour laws observed in the Tamil Nadu state.

Conclusion

The form 21 half for half-yearly returns in Tamil Nadu can be filled by employers or businessmen who have established their factory or business in this state. Employers need to file income tax returns twice a year if they want to get the returns twice in a financial year. It will help the state government maintain an accurate count of the factories or business owners in the state and ensure that the employers have registered with the government which is important for their total count.

How can Deskera Assist you?

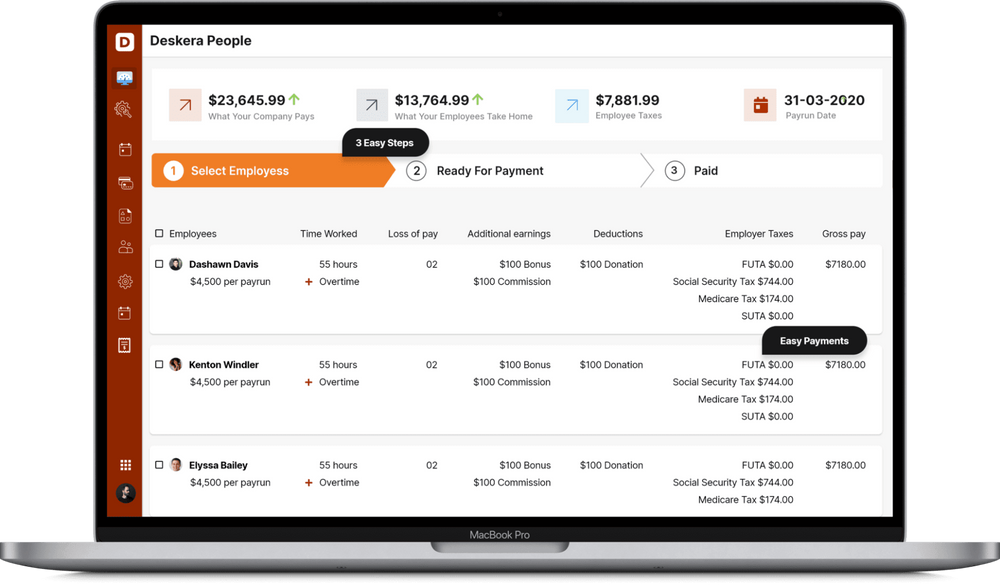

Deskera People helps digitize and automate HR processes like hiring, payroll,leave, attendance, expenses, and more. Simplify payroll management and generate payslips in minutes for your employees.

Key Takeaways

- An employer or entrepreneur who opts for half-yearly return in Tamil Nadu needs to fill the form 21 half twice in year to get income tax returns from the state government

- The Tamil Nadu Factories Act was established in the yeat 1950 and it laid the rules for the workers in the factory in the state. The same rules are applicable to the employees working in small, mid and big organizations.

- The Factories Act of Tamil Nadu was passed with a motto of occupational safety, health and welfare of the workers. It ensures proper sanitation and restroom requirements are in place at the factory outlet. This also compels the employer to provide restrooms, dining halls, creches and other facilities at the workplace

- According to the questions list in the Factories Act related to form 21 half, the employer must answer queries related to the ventilation, fire safety, emergency exits, explosion safety, construction model and various other factors related to the company premises in this questionnaire

- The Manager of the factory must fill the form 21 half to get half yearly returns from the state government. In this form, he must give proper details of the name and address of the company, name and address of the employer or business owner, name and address of the occupier etc.

- In addition to this, the form also asks for the number of employees or workers employed at the factory center as per their age and gender

- The employer must submit form to the inspector incharge of the area twice in a year - before 30th June and before 31st December

Related Articles