One of the fundamental principles of financial accounting is the T account.

A T account resembles the letter T and visually represents the debit and credit entries of financial transactions.

Because T accounts are posted into the General Ledger of a business, they’re also commonly recognized as ledger accounts.

In this guide, we’ll be going through all the basics of T accounts, their uses in accounting, how to record them, and so much more.

What Is a T Account?

A T account (or general ledger account) is a graphical representation of a general ledger account. The general ledger is an accounting report that sorts and records a business’ financial transactions, by account.

A T account is identified as a T account, simply because it visually resembles the letter T.

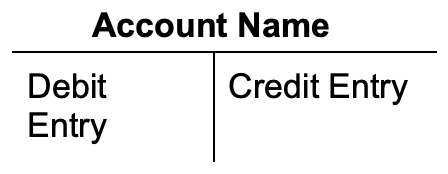

The name of the account is placed above the letter T. Then debit entries are entered on the left side of the T, and credits on the right, as displayed below:

How Are T Accounts Used in Accounting?

Before diving into why T accounts are used in accounting, let’s kick things off with some basic accounting definitions you’ll need to knw to properly understand how T accounts work.

T accounts are used in a bookkeeping method known as double-entry bookkeeping.

In double-entry bookkeeping, every transaction affects two accounts at the same time (hence the word double). One of these accounts is always debited, while the other always credited.

The main thing you need to know about debit and credit entries is that they are the equal and opposite sides of a financial transaction. They’re simply words representing where cash is coming from, and where it’s flowing to, within a business.

First, these debit and credit entries are posted into the journal, as a journal entry.

Then, the journal entry is moved into the ledger, in the form of a T account.

Each T account carries the debit and credit entries for a different type of account, such as accounts receivable, cash, sales revenue, and so on.

The use and purpose of a T account is to help business owners visualize the amounts on each individual account. Splitting out debits and credits makes it easier to quickly spot things when looking at the ledger.

And if you’re new to the accounting world and have little knowledge in finance, T accounts can be especially useful in working through complex financial transactions.

Recording T Accounts

To create and record a T account, you have to know how debit and credit rules apply to the different types of accounts.

Now, every business has its own chart of accounts that depends on the industry they are a part of and the financial activities they lead.

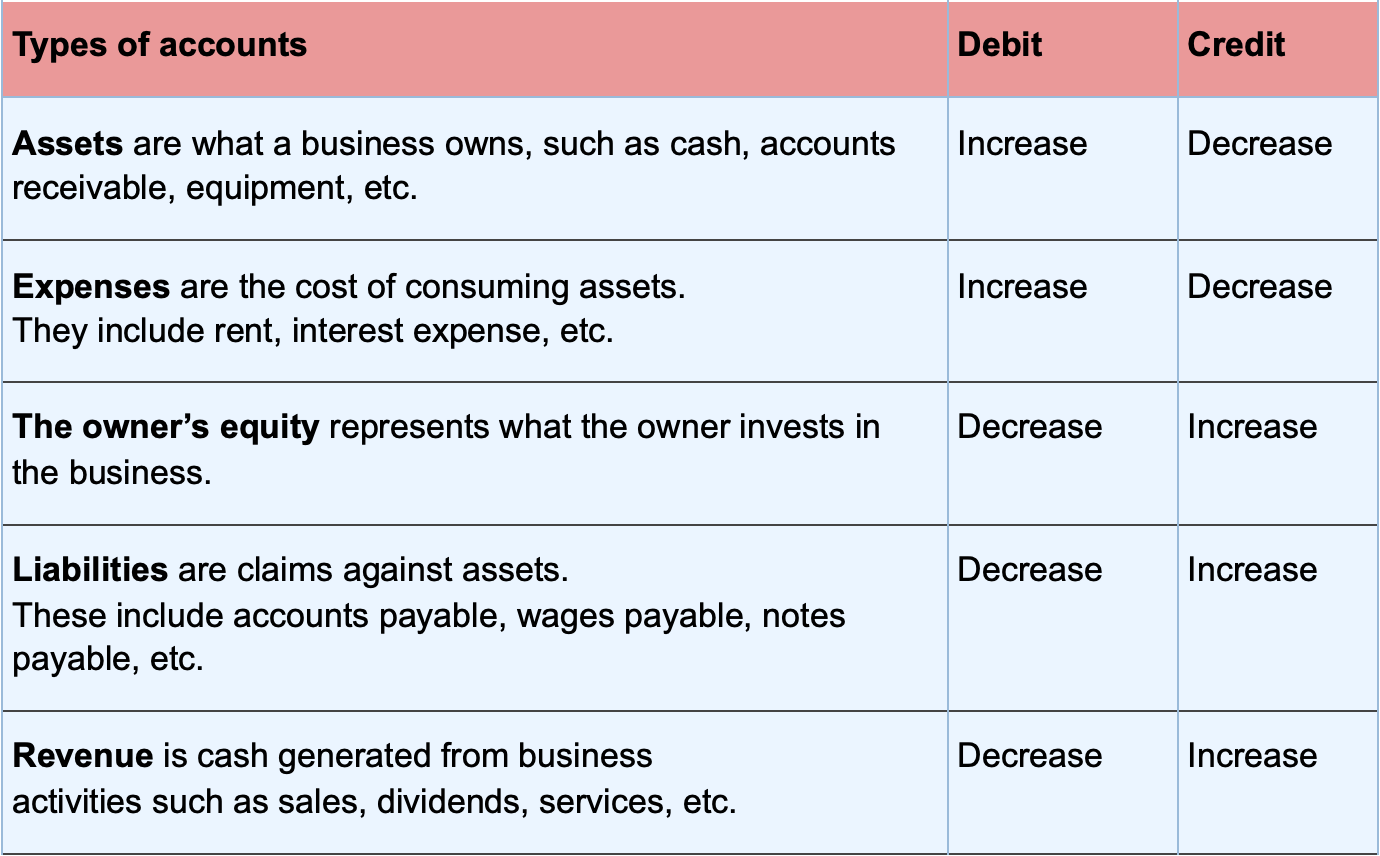

With that being said, the five most common types of accounts in financial accounting are assets, liabilities, expenses, revenue, and owner’s equity.

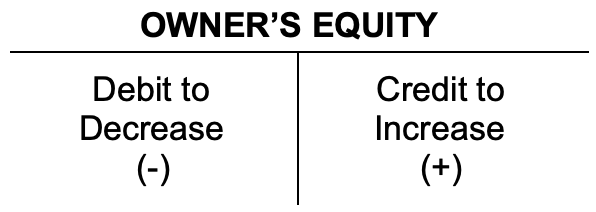

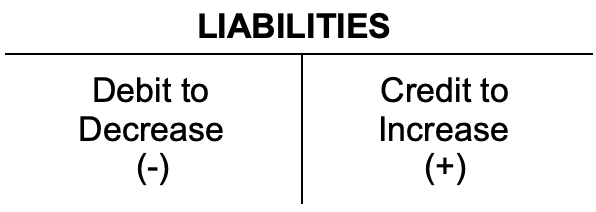

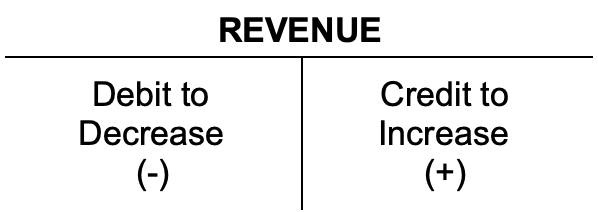

For easy access, we’ve made a cheat sheet with all of the corresponding debit and credit entries for these 5 main accounts:

After assessing what debit and credit entry applies to each specific account, T accounts can be created.

And again as previously mentioned, a T account always needs to have:

- The account name on top of the letter T

- The debit entry on the right side

- The credit entry on the left side

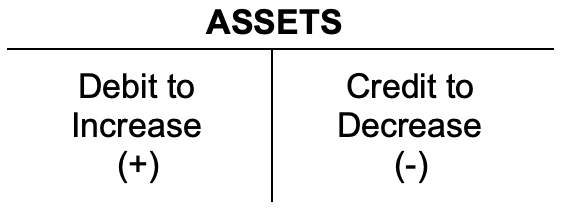

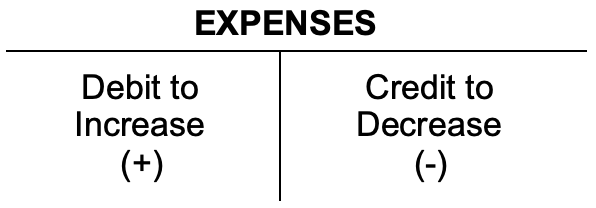

So, this is how the debit and credit rules would look like as T accounts:

Let’s check out some practical examples to put all of these accounting principles and T account rules into action.

7+ T Account Examples

It’s impossible to provide a complete collection of examples that addresses every financial transaction with the corresponding T account. That’s why we’ve only gathered some of the most frequent financial activities businesses deal with in their day-to-day operating cycle.

For the sake of our example, let’s assume Company XYZ carries the following transactions, for the month of February:

1. Owner’s Investment

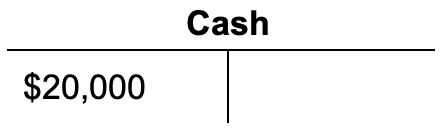

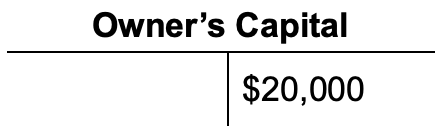

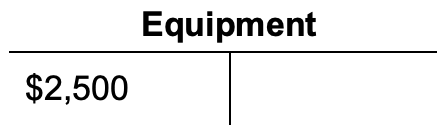

The owner of Company XYZ invests $20,000 in the business.

This transaction causes an increase in cash and capital. Because cash is an asset account, the Cash account will be debited for $20,000.

And since capital is an owner’s equity account, the Owner’s Capital account will be credited for that same amount.

T accounts would look as follows:

2. Service Revenue Earned and Collected

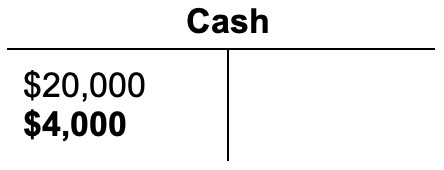

Company XYZ provides and collects $4,000 worth of repair services.

There’s an increase in the asset Cash and the revenue account, Service Revenue.

The changes in ledger accounts for this transaction would be:

3. Purchase of Equipment

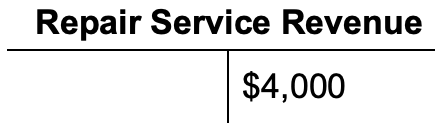

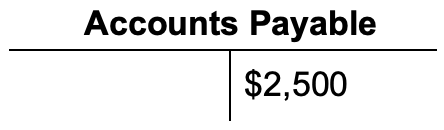

The company purchases $2,500 worth of equipment on account.

The asset Equipment increases by $2,500 and is recorded as a debit. The liability Accounts Payable also increases by $2,500 and gets credited for the amount, since increases in liability result in a credit entry.

The entries in T accounts would look like this:

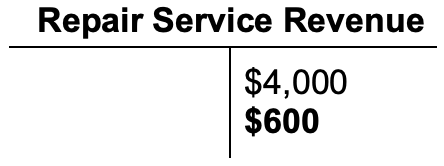

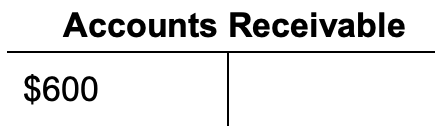

4. Service Revenue Earned but Uncollected

On February 15th, the company XYZ invoices a client for $600 worth of service. The payment terms of the invoice call for payment to be received in the following 20 days.

Since services are sold on credit, the accounts receivable account increases and gets debited for $600. Revenue also increases, so the Repair Service Revenue account gets credited for $600.

The entries in ledger T accounts would be:

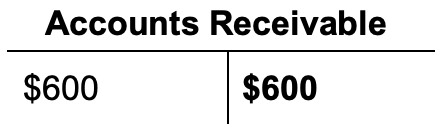

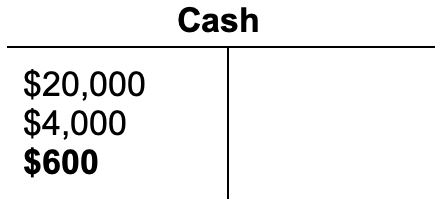

5. Received Payment for Billed Services

On February 18th, clients send the $600 worth of invoice payment billed on February 15th.

Cash increases and is debited for $600. Accounts receivable decreases, and suffers a credit of $600.

The T account adjustments for the transaction would look like this:

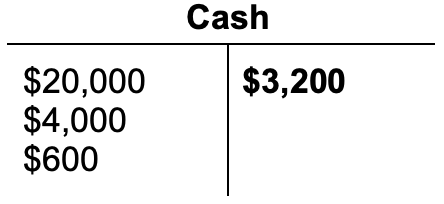

6. Payment of Employee Wages

Paid employee wages earned in February, $3,200.

Wages to employees are a business expense and decrease owner’s equity, so the Wages Expense account will be debited for $3,200. The asset Cash also decreases and gets a credit entry of $3,200.

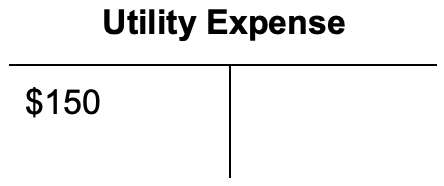

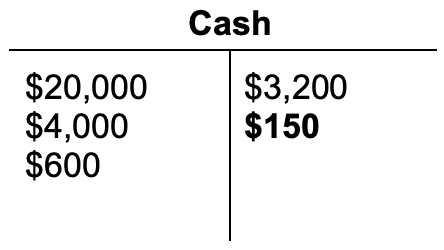

7. Payment of Utilities

Paid for February utilities worth $150.

Expenses decrease the owner’s equity and are recorded as debits, so the Utility Expense account will be debited for $150. Decreases in assets are recorded by credits, so Cash will be credited for $150.

And that’s how you manually record T accounts into the ledger.

If you want to learn more about what T accounts are and how they’re used to generate financial statements at the end of the financial year, we have a complete guide on the accounting cycle you can check out.

Automate T Accounts with Online Software

When you’re running your own business, you probably don’t have a ton of spare time to journalize transactions and write down T accounts into the ledger by hand.

Not only is the process tedious and time-consuming, but it requires a lot of accounting knowledge to be done perfectly and completely free of error.

That’s why most businesses prefer automating their finances with cloud accounting software, instead.

Now you may be thinking: what software should I choose for my small business accounting?

One of the best accounting software for small businesses today is Deskera.

We at Deskera have spent over 10 years working with small business owners from across 100+ countries, to build accounting software that suits any type of business.

With Deskera you can effortlessly manage and oversee your invoices, credit notes, business expenses, financial reports all in one place.

And as you’re issuing sales invoices, making payments, receiving revenue, Deskera automatically debits and credits the transaction values into the corresponding ledger accounts.

Without you having to lift a finger!

To top it off, you can filter the general ledger data any way you want, based on the predefined custom fields.

This feature allows you to focus on specific dimensions and gain insightful knowledge regarding the financial health of your business.

The best part: you can access Deskera at any time, anywhere, by simply downloading the Deskera mobile app.

Still not convinced Deskera is the right choice for your business? Well, don’t take our word for it - give the software a try out yourself.

Sign up for your free trial right away, no credit card details necessary!

T Account FAQ

#1. Are T Accounts Supposed to Balance?

Yes, similar to journal entries, T accounts should also always balance.

The debit entries entered on the left side of the T account should always balance with the right side, or credit side of the account.

If that’s not the case, make sure to double-check your books as you’ve probably made an accounting error along the way.

#2. What’s the Difference Between General Ledger and General Journal?

Every financial transaction is first recorded as a journal entry, into the general journal. So, the general journal is the original book of entries that contains the raw financial data of a business.

Then, these journal entries are transferred into the general ledger, in the form of T accounts. The ledger is more summarized and brief, in comparison to the journal.

Key Takeaways

And that’s a wrap! We hope our guide was clear and helpful in understanding how T accounts work.

For a quick recap, here are some of the main points we’ve covered today:

- A T account is a ledger account that visually represents debit and credit entries, for different types of accounts.

- Every T account has three main elements: the account name at the top of the T, a debit entry on the left side, and a credit entry on the right side.

- With online accounting software, you can automate T accounts, journal entries, and manage your entire accounting cycle, all in one place!

Related Articles