Companies purchase physical assets, also known as tangible assets as they add value to their business. Examples of these are vehicles, machines, equipment, cash, inventory, land.

All these assets have an estimated useful life across which they deteriorate. The companies need to measure this deterioration and calculate the values of the assets as it affects their business. This measurement is called depreciation. This post targets the Sum of The Year’s Digits method of depreciation.

Leveraging AI-powered solutions like ERP.AI can help businesses automate and optimize depreciation calculations, ensuring accuracy and real-time asset value tracking, which improves financial reporting and asset management.

What is Depreciation and What are its Types?

Depreciation is described as the mechanism to calculate the drop in value of an asset through its useful life. When assets are used across their estimated valuable life, they tend to undergo a level of degradation owing to various reasons. The reasons could be continual usage or the asset going obsolete.

Depreciation is carried out for tangible assets which are the physical assets. A company acquires these assets to increase productivity and raise the overall performance of the business. Intangible assets are amortized which is a concept similar to depreciation but the type of assets differ in both cases.

Depreciation expenses are recorded for accounting purposes and its calculation is, therefore, important to a business.

The following list gives us a brief insight into the most commonly adopted methods to calculate depreciation:

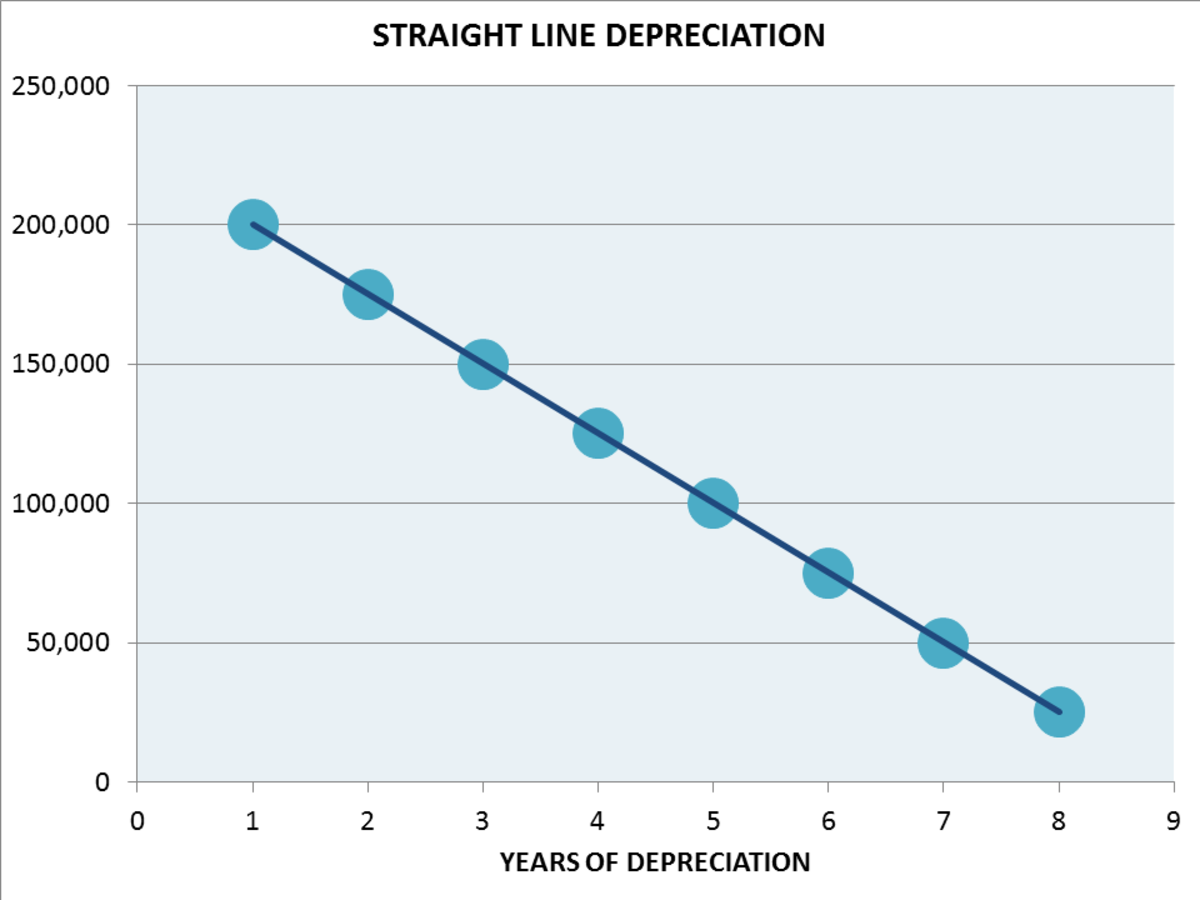

Straight-Line Method

The method has found vast acceptance due to its simple application. It considers an even amount for depreciation across the fruitful life of an asset. The straight-line method carries out the cost of the asset minus the salvage value, which is then divided by the useful life of the asset.

Double Declining Balance Method

An accelerated depreciation method, the double-declining method calculates depreciation twice as fast as that in the declining balance method. It records a larger depreciation in the earlier years of the asset’s useful life.

Units of Production Method

Unit of production method calculates depreciation when the asset starts producing units and the cycle ends when the asset stops producing. This method is based on the units produced by assets rather than the time for which the asset is used.

Sum-of-the-year digits Method

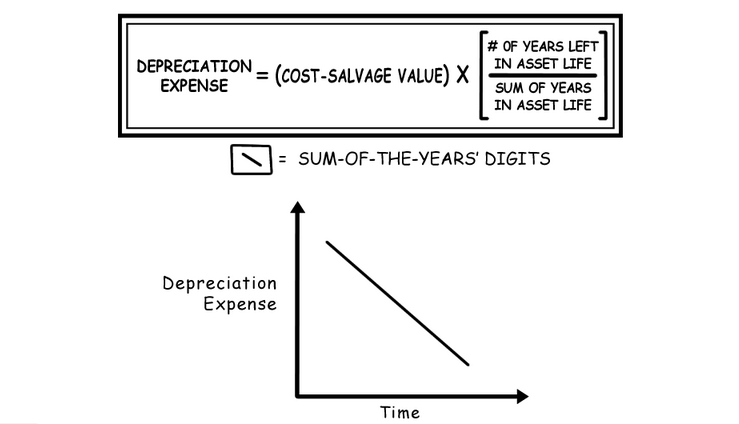

This is a method that allocates higher depreciation expense in the initial years of asset use. It also falls under the category of accelerated depreciation methods. The method adds up the number of years across which the asset was utilized. We shall learn in-depth about it in the upcoming sections.

What is the Sum of The Years’ Digits Depreciation Model?

It is also called the sum of the years’ method which decreases the value of an asset at a rapid rate. This allows greater deductions at the beginning of the useful life of the asset and lesser in the subsequent years. It lays importance on the economic usefulness of the asset instead of the time span for which the asset is used

It calculates depreciation expenses based on the number of years of the useful life of an asset.

Considering the Economic Usefulness

The sum of years’ method matches the cost of utilizing an asset and the overall utility of the asset across the economic or useful life of the asset. A major benefit of using this method is that it considers the fact that the asset performance will decline over the years; i.e. the asset is more productive in the early years. Therefore, it is only apt to charge a higher depreciation in the early years and decrease it in later years. This depicts the changing economic usefulness of the asset for that time.

Repair and Maintenance Charges

An older deteriorated asset demands more repairs and maintenance charges. Therefore, a decreasing depreciation charge will help balance the cost of maintenance of the asset.

Without this accelerated calculation offered by the sum of the years’ method, the earnings may get distorted. In the later years, when depreciation expenses may not be able to offset the cost of the maintenance and repair.

How it works:

The sum of years method uses the expected life and adds the digits for every year to give the final depreciation expense amount.

Say, the useful life of the asset is 5 years. So, the sum of the years is obtained by adding up the year’s digits as 5+4+3+2+1 = 15. Every digit is then divided by this total to get the percentage depreciation for every year.

Under this method, the percentage of depreciation rate for each year is calculated by the years remaining in the useful life divided by the sum of remaining life every year throughout the asset’s life.

Formula of Sum of The Years’ Digits Depreciation Model

The sum of the years method assumes that the productivity of the asset is the highest in the initial years and goes on decreasing in the subsequent years. Therefore, the method charges a higher depreciation in the early years.

It is calculated by this expression:

Steps to achieve depreciation through the sum of the years’ method

Step 1: Calculate the depreciable amount. This is achieved by the total cost of assets minus the salvage value. So, depreciable amount = cost of the asset - salvage value.

Step 2: Get the sum of the useful years.

Step 3: Multiply depreciation amount by the depreciation factor each year. Depreciation factor = useful life/ sum of useful years.

Step 4: Therefore, Sum of years depreciation = (Number of useful years/ total of useful years) multiplied by depreciable amount.

Step 5: Assuming the useful life to be 4 years. The sum of the useful years = 4+3+2+1= 10. So, the factors for each year will be 4/10, 3/10, 2/10, 1/10 respectively for the years from 1st to 4th.

Consider the example in the next section for better understanding.

Example and Calculation of Sum of The Years’ Digits Depreciation Model

Our example assumes ABC technologies that purchased computers for $4,000,000. Considering the useful life of the computers to be 5 years and a salvage value of $100,000. The company also incurred a transportation expense of $200,000.

With these values, we move on to applying the sum of the years’ formula in a step-wise manner.

Step 1: Calculating Depreciable amount

Total cost of asset = cost of asset + transportation cost

= 4,000,000 + 200,000

= 4,200,000

Salvage Value = 100,000

Useful life = 5 years

Therefore, Depreciable amount = Total Cost - Salvage Value

= $4,200,000 - $100,000

= $4,100,000

Step 2: Calculate the sum of useful life

Sum of useful life = 5+4+3+2+1 = 15

Step 3: Calculation of Depreciation Factors

The depreciation factors are:

Step 4: Calculating Depreciation for each year:

The depreciation expense of first year = $4,000,000 x 5/15

= $ 1,333,333

The remaining amount left to be depreciated is given by $4,100,000 - $1,333,333 = $2,766,667

Similarly, we can calculate the depreciation expense for year 2, year 3, and year 4.

Now, for the 5th year, as it is the last year, we shall depreciate all the remaining amount at this stage.

In this case, it is $366,668.

As observed from the example and calculations, the depreciation expense is the maximum in the initial years and decreases down the years until finally, it reaches obsolescence.

It must be noted that the final depreciation expense equals the salvage value of the asset.

Advantages of Sum of The Years’ Digits Depreciation Model

Here are the advantages of using the method:

- The method helps in aligning the asset cost with its use each year across its useful life. This way, it proves to be more pragmatic in its approach as the asset is most useful in its early years.

- The method balances the depreciation expense with the other surplus charges like maintenance and repairs. In the process, it keeps away the calculation glitches.

- Acts as a tax shield. As it reports higher depreciation in the initial years, the net income is lower, and therefore, the tax liability goes down as well.

- The sum of years is an accelerated method. If an accelerated method is not used in scenarios where the asset will be most used in its early years, then the earnings might get disturbed or distorted. They may fluctuate as the initial depreciation expense will be lesser; also, there would be an added expense of repairs and maintenance, leading to a drop in the earnings.

- The accounting standards including GAAP and IFRS accept and allow the use of the method for tax purposes.

Disadvantages:

Although the benefits of the sum of years method outnumber the disadvantages, it is important to take note of these.

- One major disadvantage of the method is that it charges a higher depreciation expense in the early years. This leads to lower profits in that time range.

- The other is that the method may indirectly affect the cash flows.

When to Use Sum of The Year’s Digits Depreciation

While all the methods of depreciation would lead to the same result, the only variation is the time taken for depreciation recognition. The straight-line method may take much longer to calculate the depreciation expense. It is therefore recommended to use the sum of years method. The method facilitates the calculation when the asset performance is at its highest.

The best examples or scenarios where applying this method is fruitful can be automobiles, computers, mobile phones. All these assets can become obsolete rapidly. A newer model of a car or the latest technological advent can lead to quick obsolescence of these assets.

Journal Entries for Sum of The Years’ Digits Depreciation

Let’s call back our example and see the journal entries made:

There will be 5 entries at the end of each year where the company debits the depreciation expense and credits the accumulated depreciation account.

The accumulated depreciation is a contra asset. Therefore, the company deducts its balance from the balance of the equipment account in the balance sheet. In simple terms, the company reports the net asset value in the balance sheet.

How AI Can Improve Asset Management and Financial Reporting

AI platforms use intelligent automation to track asset lifecycles, apply appropriate depreciation methods, and ensure accurate valuation over time. Instead of manually updating spreadsheets, AI integrates real-time data—like usage, condition, and maintenance history—directly into your accounting system.

For financial reporting, AI eliminates errors by auto-generating depreciation schedules, journal entries, and compliance-ready reports. It also supports predictive analytics, helping businesses forecast asset obsolescence, replacement timelines, and financial impacts more effectively.

AI empowers businesses to stay compliant, reduce audit risks, and make informed decisions based on up-to-date, reliable data.

How can Deskera help your Accounting and Business?

As a business owner, you can invest in accounting softwares that can help you keep track of your journal entries, balance sheet, inventory and production costs.A successful business needs an efficient financing process that meets its specific needs.

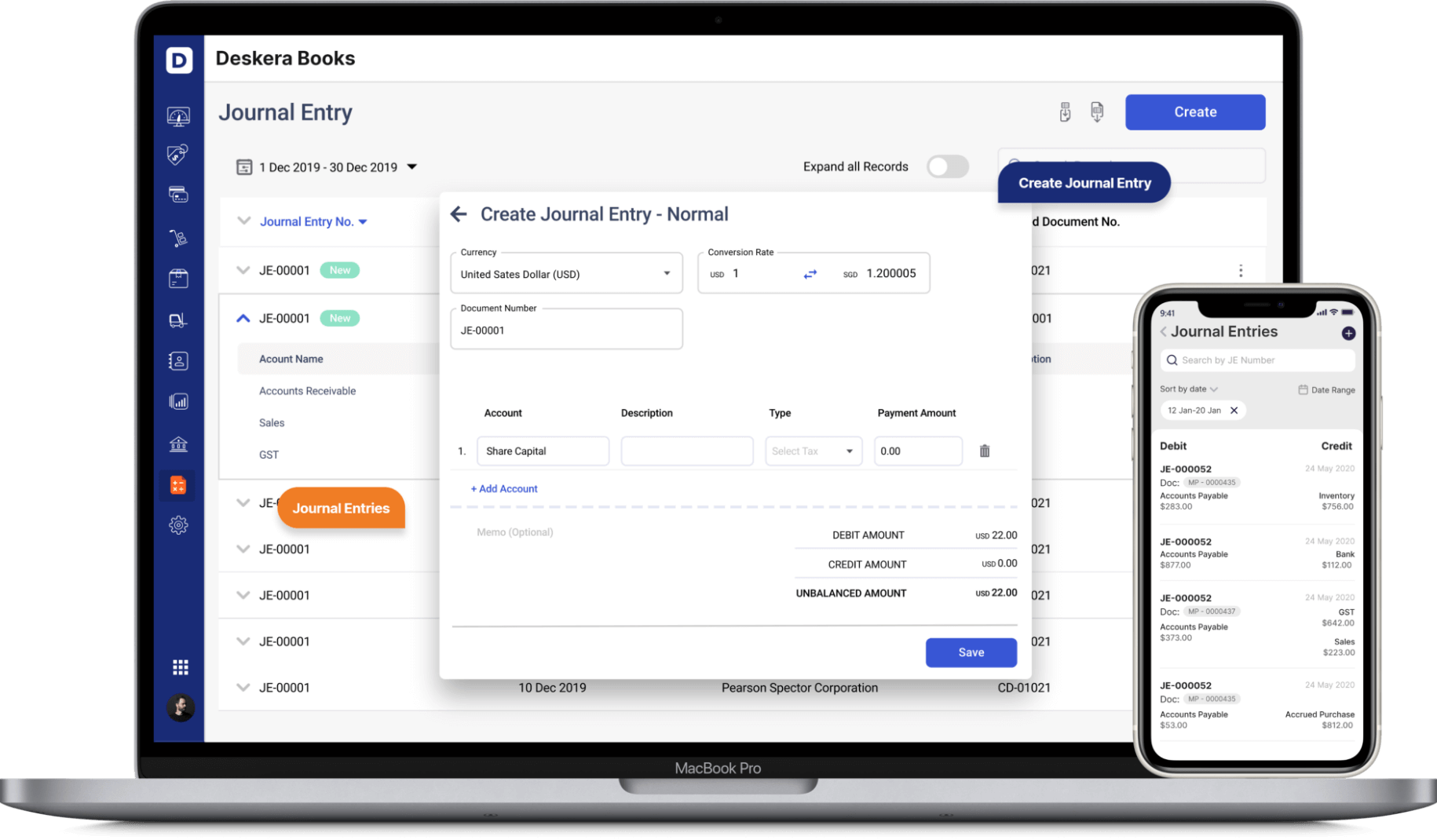

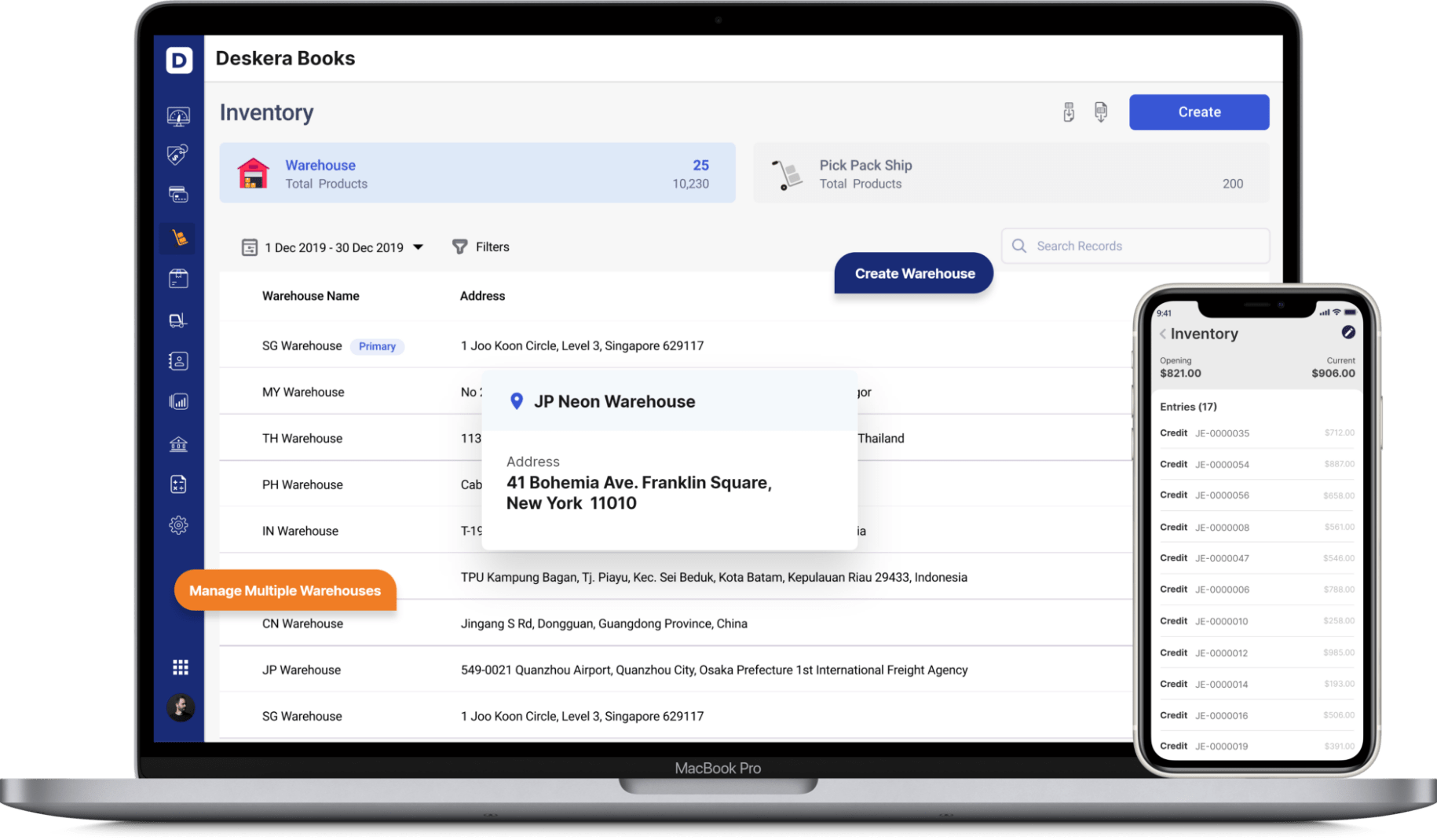

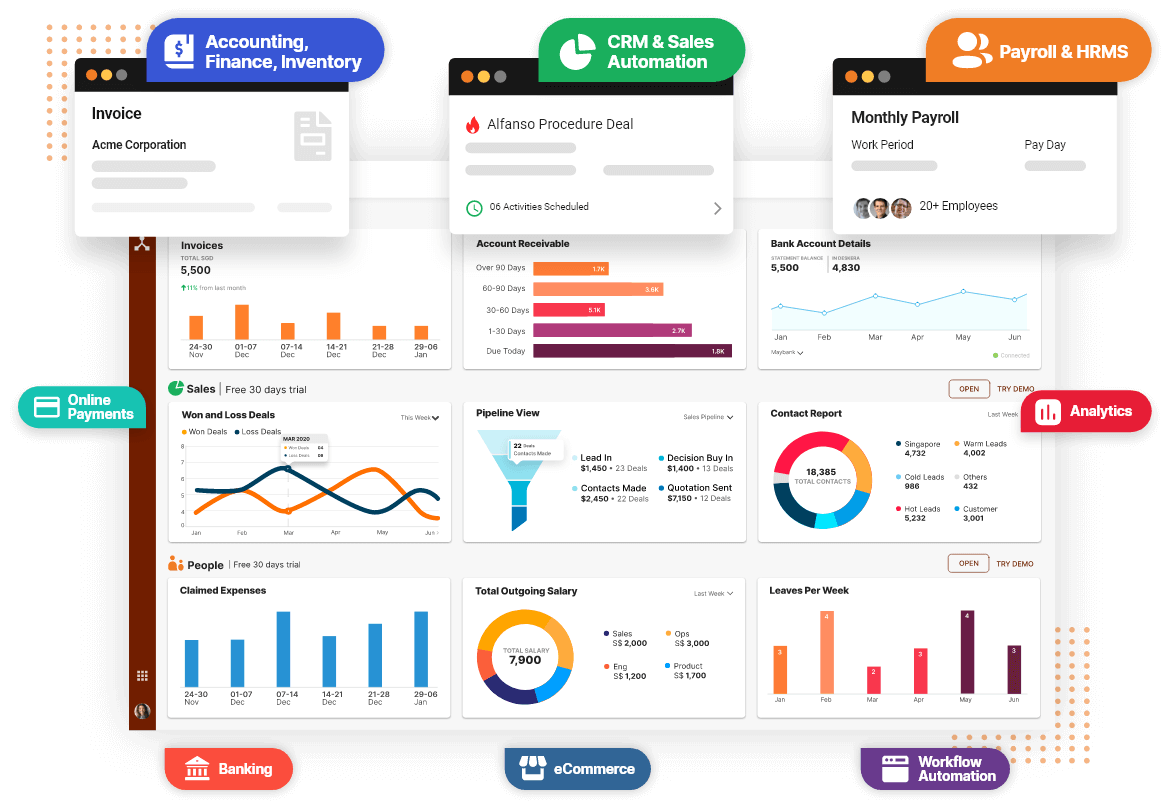

Deskera Books is an online accounting software that your business can use to automate the process of journal entry creation and save time. The double-entry record will be auto-populated for each sale and purchase business transaction in debit and credit terms. Deskera has the transaction data consolidate into each ledger account. Their values will automatically flow to respective financial reports.

You can have access to Deskera's ready-made Profit and Loss Statement, Balance Sheet, and other financial reports in an instant.

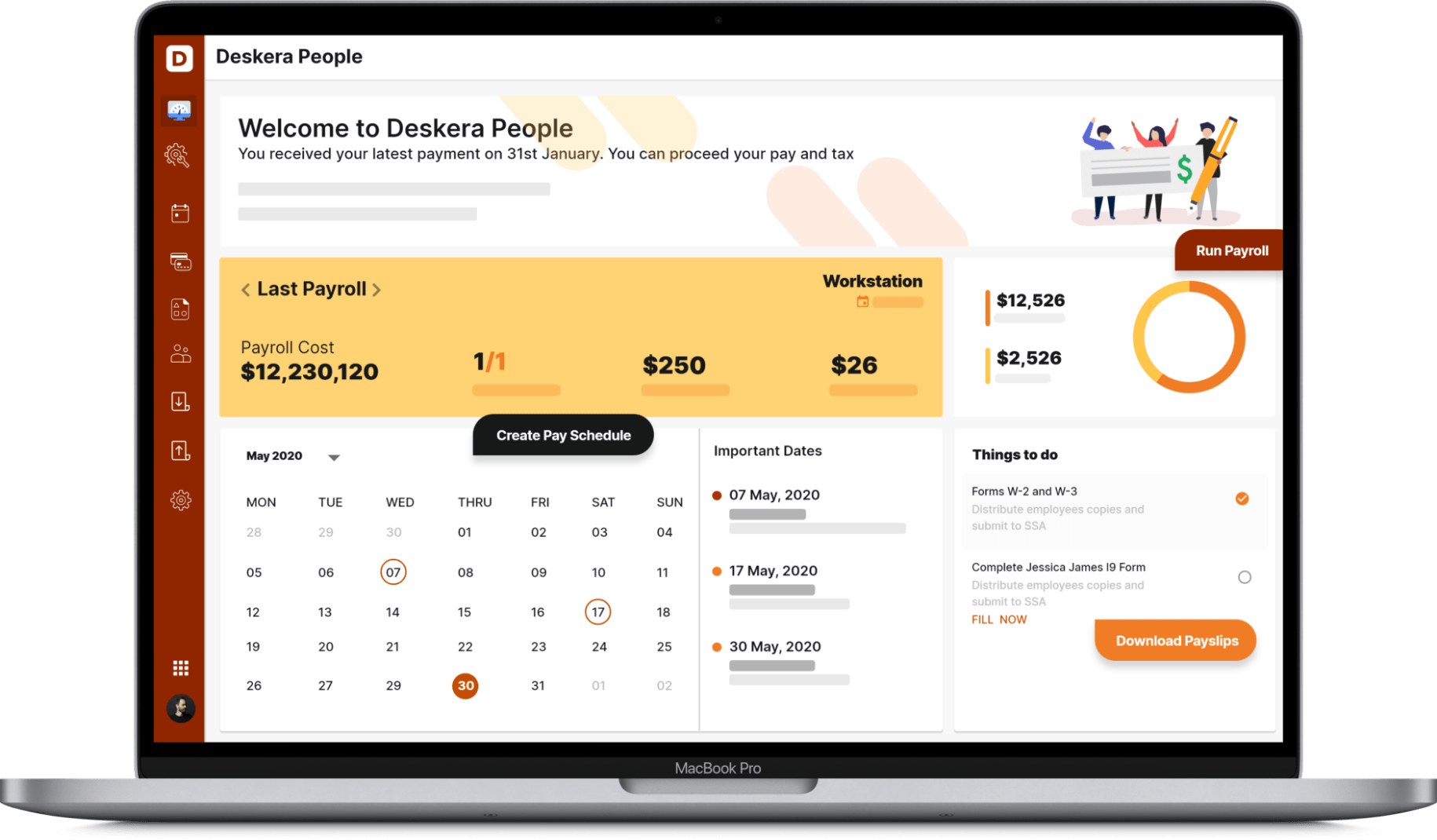

Deskera can also help with your inventory management, customer relationship management, HR, attendance and payroll management software. Deskera can help you generate payroll and payslips in minutes with Deskera People. Your employees can view their payslips, apply for time off, and file their claims and expenses online.

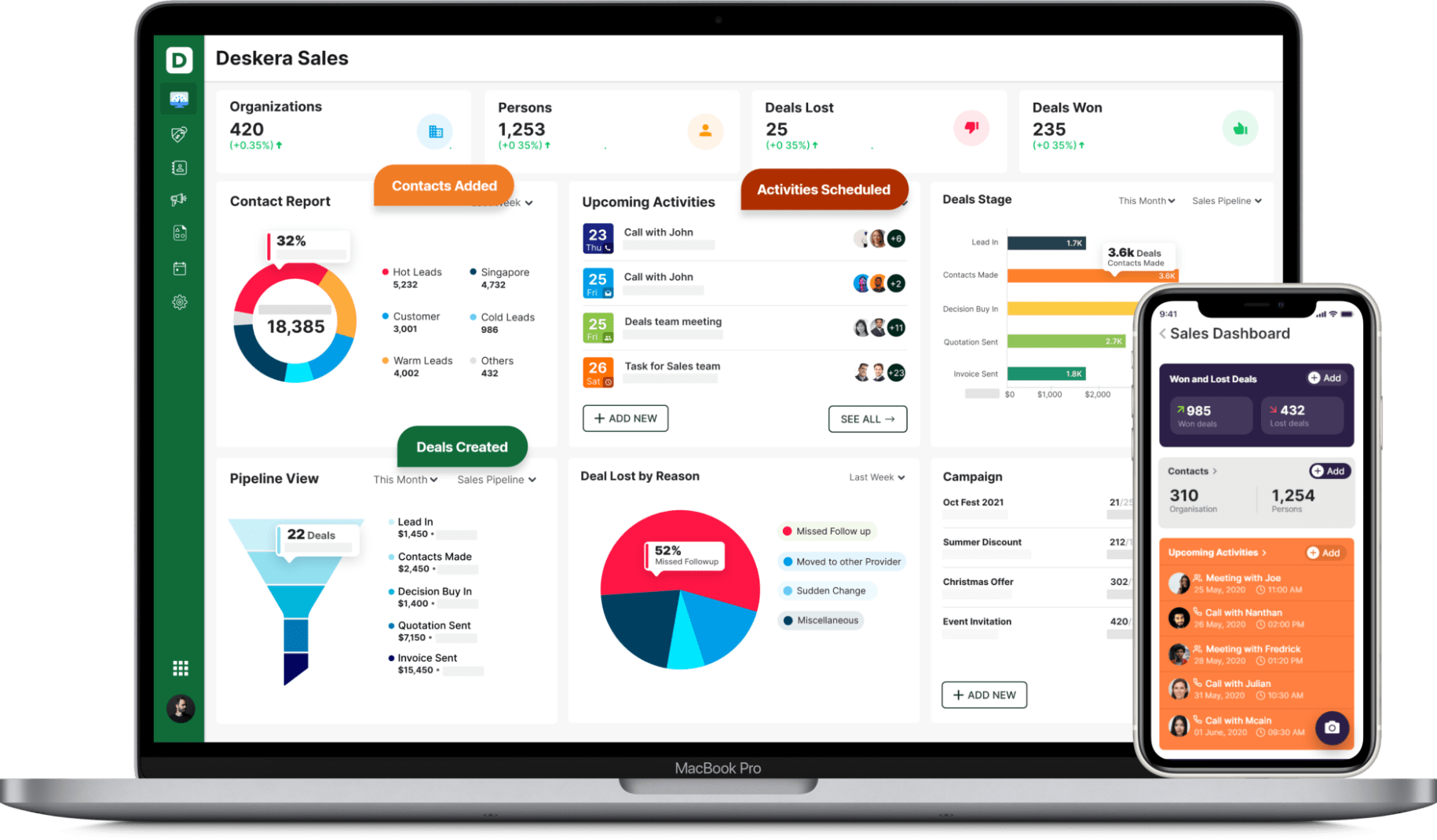

With Deskera CRM you can manage contact and deal management, sales pipelines, email campaigns, customer support, etc. You can manage both sales and support from one single platform. You can generate leads for your business by creating email campaigns and view performance with detailed analytics on open rates and click-through rates (CTR).

Deskera is an all-in-one software that can overall help with your business to bring in more leads, manage customers and generate more revenue.

Key Takeaways

Let’s get a quick recap of the major points discussed in the article:

- Depreciation is a technique in accounting that estimates the role of a tangible asset’s cost and its useful life in the asset’s deterioration.

- The sum of years method is best used when the asset would be most productive in its initial years of useful life.

- The sum of the years’ best application can be in scenarios involving assets like computers, cars, or objects that rapidly become obsolete.

Related Links