Employees are the backbone of any company. An entrepreneur's main priority must be to thank them for their work and ensure they are well compensated.

Now, what better than an employee equity programme?

Equity is an excellent instrument for rewarding early employees for taking the risk of working for you (recruiting) and encouraging them regularly (retention). Startups often construct employee equity plans that account for 10–20 percent of the company's total equity, and the plan size within that range depends on your hiring needs.

However, hires and exits are unavoidable in a growing company, and keeping track of equity allocations for each case becomes complicated.

Furthermore, investor participation includes equity distribution. So, it is advisable to keep things automated with the help of software solutions.

This guide will discuss startup founders' employee equity, its types, and why it is beneficial? Read on.

- Is equity your best option?

- What is employee equity?

- What is Startup Equity?

- What types of equity?

- Performance Shares

- Employee Stock Options

- Why should a startup business give you equity?

- How much equity should be kept for startup employees?

- The company's valuation

- Type and Reason for Compensation

- Innovation and development accomplished by the founders

- How Can Deskera Assist You?

- Key Takeaways

Is equity your best option?

Before we read about employee equity, we must analyze your motivation here.

Yes, if you have an excellent company idea but don't have enough money to implement it. Small business equity, on the other hand, isn't appropriate in every circumstance. In reality, we're a self-funded business that hasn't taken any outside funding, but that doesn't mean it's not good for you.

Selling shares of your company to strangers can be difficult, and forking out a chunk of your profits to someone who did nothing except open their wallet can be much more difficult. You risk losing a lot of control, so proceed with caution.

The two most prevalent types of equity, and the ones you'll most likely employ, are:

● Equity financing asks you to see "shares" of your company to outside investors to fund your business. Your investors are entitled to a percentage of your profits if you make money. This sort of equity is ideal for sole proprietors who want a small amount of capital to start.

● In contrast, equity compensation offers you to provide your employees with a share of the company's profits as part of their compensation package, usually in exchange for a lower-than-average wage or occasionally instead of a salary. This sort of equity is best suited to companies that require more human capital than physical capital. This might be your best bet if you already have an office, a coffee maker, and a copier but need a new software developer.

Let's help you further with a headstart on the significance of employee equity as a business.

What is employee equity?

Cash flow can be a scarce resource in a startup business that requires time and space to grow into a successful organization. They need dynamic, determined, and diligent employees willing to work towards the vision and goal in the firm's best interests.

Employee Equity is a calibrated incentive given to the employee at the time of recruitment as an optional compensation on top of salary. Startup businesses are not at liberty to hire employees at a high salary, so an employee can choose between the alternative and make the appropriate decision.

The crux of this idea- offering a more upfront and inclusive role in the firm is two-fold. It balances its functioning and the markets by maintaining an efficient cost analysis structure to stay afloat as a startup until it starts bringing in exponential profits while retaining employees for a longer duration as they hold a stake in its valuation.

Vesting schedules are part of an employee equity programme. They serve as a safety net, granting equity only if specific requirements are met.

However, it's worth noting that delivering equity pay packages with underlying criteria like time in the company, performance milestones, and so on can also be an excellent incentive strategy.

Apart from startups, this type of incentive works well in large corporations where people chase gigantic goals and are compensated in firm shares, entitling them to significant earnings and ownership.

What is Startup Equity?

In simple terms, Startup Equity is the value of ownership of any organizational stakeholder. It directly refers to offering early investors and employees a particular percentage share within the spread of the firm.

The amount of equity depends on a couple of variables, such as-

● Time to join the startup company.

● Importance of their role in the company.

● The level of dedication and commitment is shown in the development of the startup.

● The standing of the company at the time of equity disbursement.

This scenario is also portrayed during the liquidity and clearing all assets and debts, respectively. So, equity can also be put as the company's amount to pay you back if liquidated. It also acts as a bill of receipt for the ownership of a firm.

The startup founders usually get the more significant chunk of the starting equity and the early investors. They also risk investing a large share of money into the business compared to the company's initial valuation, which increases the risk and the percentage stake.

The company's role is to get the employees on board with the motto, goals, ideas, and most importantly, the prospects of the company that will help them weigh their alternatives. Over time, as the startup grows and its valuation builds over time, having a stake within a startup from the beginning can be a progressive financial bracket for an employee.

The biggest challenge companies face in granting equity to their employees is separating the accepting employee from the conservative employees. An employee who is more open to options and potentially strong ways of raising money would be more receptive to the equity offer and value it than an employee with a conservative outlook who prefers an overall increased salary over equity fluctuations. It is valid for anyone to question the integrity and future of a business.

Many startups fail in America, and only some rise up to be a substantial financial success. The company is responsible for taking care of its employees by providing the proper guidance. This is a reasonable way for a startup to save cash while offering a prosperous loop of benefits.

What types of equity?

The two aims of employee equity are recruitment and retention, and they should always be kept in mind while choosing an employee's equity. Let's find out what are the types of equity offered:

Performance Shares

Employees receive rewards to appreciate their hard work and benefit the company in completing specific targets. When an employee holds a stake in the same company he works for, it gives him a sense of motivation to put in more effort towards the company's objective, increase productivity and ensure peak performance.

The incentives motivate an employee, which turns into profits. Eventually, both are satisfied, creating a better role and a collateral impression of the firm in the market and public opinion. Compensation is essential in every organization and its attitude towards its employees as it helps attract more candidates while being a proven method to retain precious employees. It may be received by the employee in the form of bonus or stock options.

Rewarding employees for their performance and achieving target goals goes a long way in retaining a model employee. Praise, prospects of more significant opportunities or advanced skill training in a better location for the internal skill development of the employee gives him the impression that the company takes care of its employees and, rightly so, is the appropriate environment for him.

Performance shares are allotted to employees to achieve the desired target, complete projects, improvise in performance and service division, etc. The company allows performance shares on the event of a chief event. The urge to receive more money-generating options helps motivate employees. It also includes some restrictions from the company that helps safeguard the value of the shares and help retain an employee.

The number of performance shares floated can vary depending on the 409A valuation of the company in light of the shares issued or outside forces such as market fluctuations that hamper the value of the stock, fulfilment of goals needed to be fulfilled that affect the valuation of performance shares.

So, the company retains a model employee by including his voting rights or ownership up until a specific period. By adding a vesting period in performance stocks, the company can help increase its returns by holding a temporary license while ascertaining the employee's commitment to the company. An employee will work for a longer duration until he receives his voting rights.

Employee Stock Options

These are a veritable money generator for employees granted by a company to increase its shareholders while the employee receives dividends. ESOs help formulate the interests of their employees along with the shareholders.

Unlike performance-based shares, ESOs are optional to employees willing to purchase the company's stocks. The company realizes that if an employee decides to buy the stock options, he is ready to invest efforts in the company's circulation and generate a reasonable profit.

The ESO options are elaborately laid out in complete clarity, employee. When an employee purchases a certain number of stocks, he buys them at a price predetermined by the board of directors, known as the exercise price or strike price. But does not receive the voting right or ownership of the stocks right then.

Over time as the company increases in value, the cost of the stock increases over the exercise price. Only when the stock's market price increases over the exercise price are the employees given the acquisition right to their reserves.

No company stands to incur losses which is why most stocks are subjected to a cliff of 1 year in which the employee is given no right to overstock. He should be associated with the company for more than a year if he wishes to use his ESOP privileges. And, there's a vesting period of likely four years. Here, the ownership is given in parts because it requires assurance of withholding the company's position and its employee output.

By doing this, the company gets the desired output and enough time to rectify mistakes, but it is also obligated to return more than the strike price to the employee.

Under the ESO, he need not pay the entire amount of his shares while purchasing them but later collect the profit as a part of the acquisition. His profit is vested in the company's valuation hike and the stock's value. And the margin between the market price and the exercise price is his profit.

Only after the company owns stock can the employee decide to hold on to the supply or liquidate it.

Why should a startup business give you equity?

Every startup begins with a great idea, but unfortunately, no board of directors or capital as such. Given that the company issues equity shares for its company to the public, its first startup employees are the most crucial batch for the company.

The first employees enrolled inside the firm decide the output and result of the opening fiscal year of the company. This includes employing co-founders, board of directors, significant positions, etc.

The company should always maximize their employees' equity and keep them satiated in work and remuneration. That is, the company needs to carve a bigger slice of the company for its employees; as a generous compensation and a special incentive for their prospects.

The company needs to establish an integral relationship with its first employees because they will put in the first work that will seed the company. The returns they receive decide their attitude and loyalty towards it, especially when things are not going well for the startup company for a long time.

When an employee receives a salary, it is the base pay and similar to the same income given in other companies for the same type of job with similar characteristics, which somewhat puts a tag on a particular designation but fails to acknowledge and reward employees for their skills and efforts.

Equity as an incentive gives them a piece of the action that decides the company's standing while giving them a sense of belonging to the company as potential shareholders.

The early employees should receive more equity than the latter employees as they work in an entirely unconstructed environment. They might have to work extremely hard to build the idea from scratch, for which they rightly deserved to be paid handsomely and in fairness with the overtly fluctuating changes within the company.

As a startup, a company's future is the most uncertain and likely to fail if it does not employ the right people to withhold a designation and work together to take the company forward. So, the employee is also taking a potential career risk by working for the firm.

The quality of the recruitment, their level of expertise, and value addition to the company decide his remuneration and additional benefits because the company is aware of its needs.

The employees hired later in the company's course when it is well funded, working smoothly and generating regular profits should be given less than the ones before them but most definitely more than those after them.

How much equity should be kept for startup employees?

Often seen in many cases, companies reserve between 10-20% of their equity to incentivize their employees on a predetermined basis.

Various factors depend on when considering the percentage. Let's look at some:

The company's valuation

While seniority of position or badge number is essential, it is still advised to be generous but not give away everything. Incentivizing the gains for maximization helps keep the employee motivated for a long time. The founders/ CEO of the business get a significant share of the company. Still, even then, it depends if the board of directors is more involved in the daily functioning of the firm, in which case employees may expect a lesser percentage of equity than the companies where the board is less active.

The management runs the firm more than the administration. As early employees receive more stock than salary, the amount of stock allotted to an employee will vary in the number of stores depending on the number of employees the company needs to bring to fulfil its requirement.

Type and Reason for Compensation

The equity distribution will also depend on the type and reason for compensation because it raises the question- of why the company needs to grant a certain percentage of the equity to a specific employee?

If the employee is recruited for a senior position in the company and is a very early employee, they will receive more stock than salary. When the seeding amount is received early in the business, the founders tend to have the majority stake in the equity distribution (up to 65%) as they need it to expand their business. Unless the startup is owned by a single founder, having a co-founder or partners could be challenging.

A multi-owned business requires a hierarchy of order among the board of directors based on a mutual or technical understanding. Having a ranking among the founders helps speed the decision-making process, including the split of equity among employees, along with several teams the company needs to hire for its various projects, expertise and contribution of the employee, etc. Founders need complete transparency of any changes within the organization.

Although the risk incurred is almost the same, any sacrifice or personal motive, attitude, and commitment towards venturing into the firm is equal. But, sometimes founders divide roles, and some take more responsibility in the firm and should also be given equal thought while dividing equity.

Innovation and development accomplished by the founders

Transformations ignited by the core committee around the main idea of the firm are also taken into account.

The investors get the following big chunk for the risk and time involved; whether they are known associates, angel investors, or an institution, every investor should receive a slice of the equity.

The third share of equity is distributed among the employees for their hard work and thorough cooperation throughout the building phase of the firm. When it doesn't have enough cash in deposit to offer high-paying salaries to its employees, it offers stock options as a commensurable compensation. It includes a vesting schedule that determines when employees can access their earnings.

But, can distribution equity become as simple as a checklist of factors given to you? No.

The truth is- gradually, as the firm expands, the company attains the stage where it can afford to pay the necessary salary to its employees while also offering new shares to new investors.

After the seed funding is provided in full and the business has lifted off the ground, the company decides how much more funding it needs. And accordingly, the number of new shares it needs to issue and determine the dividend to be paid back to the investors further distribute the equity into various proportions.

Over time, the new investors raise the capital for the firm while the early investors and employees reap their contributions. Equity will also depend on the company's cash flow and cash reserves at that point, so paying less salary for a share of equity makes sense when the company is new and eventually changes in excess when the company starts moving smoothly.

From an employee's perspective, it may or may not be beneficial depending on the company he works in and the individual himself.

Lastly, a very nuanced yet crucial board of people who need to be given a share of the company is the board of Advisors. Every startup has an advisory board comprising literary market personnel, experienced business advisors, and tax advisors who provide a strategic edge to the company. And the team helps lay out viable options for the board of directors in light of the best course of action for the sustainability and future of the business.

How Can Deskera Assist You?

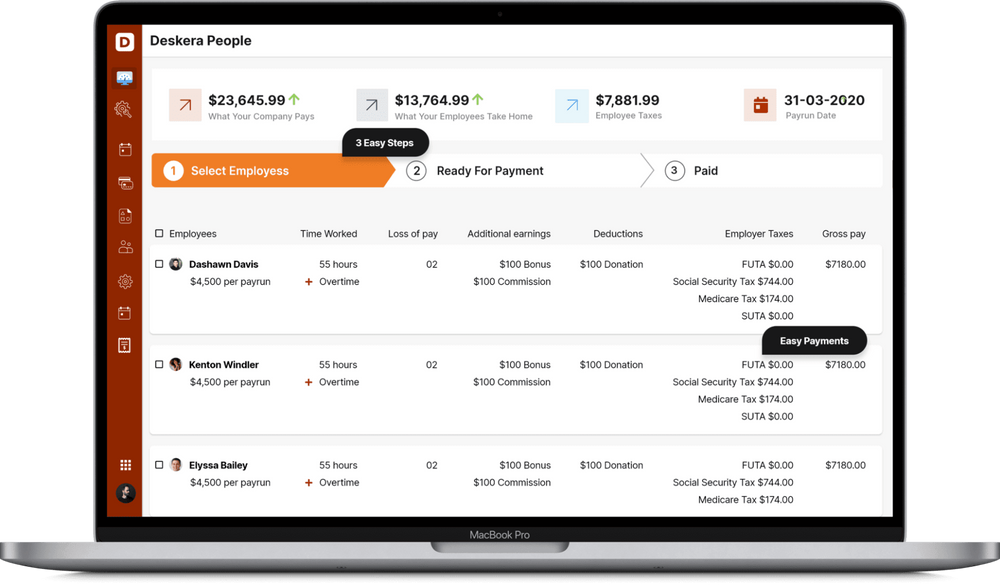

Deskera People helps digitize and automate HR processes like hiring, payroll,leave, attendance, expenses, and more. Simplify payroll management and generate payslips in minutes for your employees.

Key Takeaways

● Employee equity refers to the equity offered to an employee at the beginning of a startup as a compensation acknowledgement against a smaller salary. The offered equity is for their efforts that act as an instrument of exchange for liquidity. This includes a vesting period that does not allow employees to acquire rights until the board of directors determines a certain amount of time.

● Employee Equity is essential as it increases motivation and talent retention in the company.

● Different forms of Equity—ESOPs, stock warrants, Preferred Stock, Performance Stocks, etc. Stock options allow the employee to buy it directly from the company for the strike price.

● Every company needs to set aside a handsome percentage of the equity to distribute among the employees. It is a reserve set for future employees and is often refilled as it spreads over time.

● The vesting period is essential to the employee. It acts as an additional employment contract between the employee and the company to retain their service for a specific time if they wish to exercise their ownership rights.

● Building a healthy ESOP structure—a proven method of aligning the company's interests, investors, and employees, retaining employees and attracting dynamic new ones.

Related Articles