From acquiring working capital to purchasing equipment for the business, SBA loans can help the businesses with every initial necessity. For any small business that requires making those initial expenses, SBA can offer a lot of respites as far as the financial arrangements are concerned.

Furthermore, the SBA loans are very flexible, which is another advantage. Additionally, these funds can be utilized for a variety of business purposes. This article examines the diverse parameters associated with the SBA 7(a) loan.

Here is all that we shall learn:

- What is the SBA?

- What is an SBA 7(a) Loan?

- Types of SBA 7(a) Loan

- Benefits of an SBA 7(a) Loan for Small businesses

- Benefits of an SBA 7(a) Loan for the Banks

- Disadvantages of an SBA 7(a) Loan

- How do SBA 7(a) loans work?

- Eligibility for an SBA 7(a) Loan

- How long does it take to acquire an SBA 7(a) Loan?

- Documents required to apply for an SBA 7(a) Loan

- What happens when you default on your Loan?

- How can I pay back my SBA 7(a) Loan?

- FAQs

- How can Deskera Help You?

- Key Takeaways

What is the SBA?

SBA stands for Small Business Administration and is a federal agency that provides counseling and capital to small businesses. One of the primary agendas of the SBA is to oversee and catalyze the growth of small businesses in America. The SBA loan program aims to achieve this through the easy and flexible loan program through guaranteed funding to small businesses.

SBA loans are a great way for small business owners to obtain cheap interest rates and long periods. Learn about the many types of SBA loans and how to apply through the steps described in this post.

What is an SBA 7(a) Loan?

The 7(a) loan program offers help to grow and expand small businesses. Businesses can take a loan of a maximum of $5 million. Before granting the loan, businesses may be evaluated for their credit history, the key operations of the business, and the location of the business operations. The lender usually organizes and helps find the best-suited type of loan for the businesses.

The SBA does not involve in any direct loans to small businesses. Instead, it establishes lending rules for its partners. The partners can be banks, credit unions, community development groups, or conventional microfinance institutions. The SBA ensures that a percentage of the loans made to these organizations will be repaid. This is done to bring down the risk for lenders.

The SBA restricts the amount of money you can borrow and guarantees specific interest rates that are lower than what a bank would normally give. Moreover, there are times when the lenders completely refuse the borrowers a loan. While the government backs a large percentage of the loan, the lender may determine if the risk is acceptable.

The following list presents some of the peculiarities of the SBA loan:

- SBA loans often have lower interest rates along with longer periods as compared to traditional loans.

- Small businesses can be eligible for an SBA loan more easily than a conventional loan. However, the application needs you to produce significant financial documents.

- The amount you can take is determined by the sort of SBA loan you apply for. You must understand the caps or limits of the different loan programs at this juncture. An SBA microloan is limited to $50,000, whereas a 7(a) loan is limited to $5 million.

Types of SBA 7(a) Loan

There are multiple types of loans under the SBA program of loans, and you can access the entire list here.

The different types of 7(a) loans aim to address diverse business needs. Let’s dive in:

Standard 7(a) Loan

With a maximum limit of $5 million, the standard 7(a) loan is suitable for the majority of small businesses. The SBA guarantees 85 percent of loans for the amount up to $150,000 and 75 percent of loans over $150,000.

7(a) Small Loan

This kind of loan is very similar to standard 7(a) and offers quite identical facilities. However, the difference is that this loan max out at $350,000.

SBA Express

The SBA Express is a fast-track loan for companies that require a quick response. According to their website, your application will receive a response from the SBA within 36 hours. The maximum loan amount is $350,000, with the SBA guaranteeing up to 50% of the loan amount. It can be utilized as a revolving line of credit for up to seven years.

Export Working Capital

This loan is for companies that require extra working capital to support their export sales. Export Assistance Center loans of up to $5 million are offered. Irrespective of the loan amount, the SBA can guarantee up to 90% of the loan. These credit lines are usually only good for a year.

Export Express

This program is for exporters who require up to $500k in loans or lines of credit. The Small Business Administration (SBA) will guarantee up to 90% of loans under $350,000 and 75% of loans over that amount. There is also a 24-hour response time on this. The credit lines might last up to seven years.

International Trade

These are long-term loans for the fastest-emerging enterprises. These enterprises experience an expansion as a result of export sales. Alternatively, these could be the companies that need to modernize to combat the negative effects of imports from overseas competitors.

These loans are identical to Export Working Capital loans in terms of guarantees. However, they have a longer tenure: up to 25 years for real estate and ten years for working capital and equipment.

Veterans Advantage

Businesses that are at least 51 percent owned and controlled by veterans are eligible for these low-interest loans. The spouses of veterans count toward this requirement.

CAPLines

CAPLines loans are similar to Standard 7(a) loans but with a slight difference. They provide an ongoing line of credit instead of a lump-sum loan. This line of credit is drafted to help small firms fulfill their cyclical and short-term working capital requirements.

This program covers four lines of credit described as follows:

Let’s check out the four CAPLines here:

Contract CAPLines: This is intended to give businesses the flexibility they need to scale up wealth and resources in response to an increase in contract jobs.

Seasonal CAPLines: This is for companies that have seasonal peaks and valleys. A classic example would be a retail store that has to hire extra employees owing to holidays or the shopping season.

Working CAPLines: This applies to businesses that have cyclical growth or repeated short-term demands. The companies may borrow funds when they need to buy assets and then sell off the assets for repaying in cash.

Builders CAPLines: This is for small general contractors and builders who require assistance in meeting material and labor standards. Unlike the other three, the Builders CAPLines last only for up to 5 years.

Here’s a table that sums up the details of each of the loan programs:

Benefits of an SBA 7(a) Loan for Small businesses

The myriad benefits of the SBA 7(a) loan for the small business owners can be summed up as described in the following table:

In most circumstances, it provides the borrower with long-term funding. Furthermore, the businesses can use the funds from the SBA 7(a) loans to refinance high-interest loans. Borrowers can use loan proceeds for a range of business purposes. SBA loan also gives the borrower access to financing that they might not have otherwise.

Benefits of an SBA 7(a) Loan for the Banks

The benefits of an SBA 7(a) loan that the banks enjoy can be given as follows:

Just like the businesses, the banks enjoy a lot of perks owing to the SBA 7(a) loans. It provides the bank CRA credit for every trade and aids in the retention of clients and supplementary banking services.

The banks can obtain the authority to buy or sell the risk-free element of the loan. They may even refinance the borrowers in 3-5 years to a fixed rate.

Disadvantages of an SBA 7(a) Loan

The following table sums up the disadvantages of the SBA 7(a) loan:

- The loan may take significantly longer than loans from alternative lenders. The duration may be anywhere from 60 to 90 days.

- You must have a well-thought-out company plan as well as industry experience, without which you may not be able to apply for the loan.

- The portion of the loan that is guaranteed by the SBA is subject to a guarantee fee.

- All partners who possess 20% or more of the company must provide a personal guarantee.

- To be eligible, your company must have been in operation for at least two years.

How do SBA 7(a) loans work?

SBA 7(a) loans are intended to encourage lenders to make fair loans to enterprises that may not be able to otherwise secure capital on appropriate terms and conditions. Once a business owner has found an SBA-approved lender with whom they would like to coordinate, the process of securing and applying for an SBA loan can be worked out.

Fundamentally, the 4 key steps provide an insight into how the SBA 7(a) loans work:

- Search for an SBA 7(a) lender

- Collect the required documents

- Submit your application

- Wait for approval

Search for an SBA 7(a) lender

Bank of America, Wells Fargo are some of the names that can help you with applying and obtaining your 7(a) loan. Contacting one of the banks or such institutions that offer this loan has an advantage. They know the process well and therefore, can help you expedite the process.

Collect the required documents

Your SBA lender shall guide you with the checklist of the important documents that you shall need. From all the forms to credit history and income tax returns, you will need many such vital documents to apply for the loan.

Submit your application

Once your documents are in place, it is now time to submit them with your application.

Wait for approval

Having submitted your application, you will now have to wait for approval, which may come from the lender of the SBA directly. Your lender will begin the closing process once your loan has been accepted, which involves securing collateral, drafting loan documentation, and meeting any other authorization requirements. Your lender will subsequently distribute your funds, and you will return the loan over the length of the term in monthly payments.

You shall receive the approval within 5 to 10 working days.

Eligibility for an SBA 7(a) Loan

Enterprises must meet the following criteria to be eligible for 7(a) financial assistance:

- Demonstrate profitable operations

- Be classified as a small business by the Small Business Administration (SBA)

- Be able to show that you require a loan

- Consider other financial options (personal assets) before seeking financial aid

- Use the money towards a sustainable business venture

- Have reasonable investments

- You must not be in arrears on any existing debts to the US government

- Be doing business in the United States

How long does it take to acquire an SBA 7(a) Loan?

Most 7(a) loans take five to ten business days to process, but it depends on the case. The SBA Express loan has a 36-hour response time for people who are in a hurry.

Documents required to apply for an SBA 7(a) Loan

When you decide to apply for a 7(a) loan, you may begin the process by coordinating with your lender. The lender will then let you know about the essential documents for the processing of your loan. Once you have collected your documents, the lender shall then take them forward to the SBA. Here is the checklist of the important papers that you will need:

- Application for an SBA Loan: To get started, you'll need to fill out an SBA loan application form. Here's where you can get the most recent version of the form: SBA Form 1919 - Borrower Information Form

- Personal Background and Financial Statement: The SBA also requires you to fill out the following documents in order to determine your eligibility: SBA Form 912 - Statement of Personal History AND SBA Form 413 - Personal Financial Statement

- Business Financial Statements: Prepare and include the following financial statements to support your application and demonstrate your ability to repay the loan:

- P&L Statement: This must be the latest and updated document within 180 days of submitting your application. Include supplemental schedules from the previous three fiscal years as well.

- Projected Financial Statements: Include a one-year income and financial estimate, as well as a written explanation of how you plan to meet this goal.

- Ownership and Affiliations: Include a list of any subsidiaries and affiliates, as well as any concerns in which you have a controlling interest and any concerns that may be associated with you through stock ownership.

- Business License/Certificate: Your original business license or certificate of good standing. Use your corporate stamp for the SBA loan application form if your company is a corporation.

- Loan Application History: Keep track of any loans you've applied for previously to produce them as and when required.

- Income Tax Returns: Add signed personal and business federal income tax returns of the previous three years.

- Résumés: Personal résumés should be included for each principle.

- Business Overview and History: Give a brief overview of the company's history and issues. Include a rationale for why the SBA loan is required and how it will benefit the company.

- Business Lease: Add a copy of your business lease or a statement from your landlord outlining the suggested lease terms.

- If you're looking to buy an established business, you'll need the following information:

P&L statement and the current Balance Sheet of the business that is to be purchased.

Returns of the business's federal income tax for the previous two years

Terms of Sale and proposed Bill of Sale.

Inventory, machinery, and equipment, as well as furnishings and fixtures, as included in the asking price.

What happens when you Default on your Loan?

You should be aware of all stakeholders engaged in the SBA loan processing. The lender will be the one to mark you as a defaulted borrower and take the first steps to collect your unpaid debts.

Here's a quick rundown of the procedure:

- After you miss a payment, the lender designates your account as delinquent and attempts to contact you to collect the amount.

- A duration of 90 or more days is termed extreme lateness if you have missed your payments for so long. At this time, the lender labels your account as in default.

- ‘Extreme lateness’ gives the authority to the lender to capture your assets which were set as collateral for the loan. This will include both your personal as well as professional assets.

- If the outstanding debt is not covered after liquidating assets, the lender reports the loss to the SBA, who will pay out the guarantee.

- The Small Business Administration contacts you to request a repayment of the loan amount protected by its guarantee.

- If you don't finalize a repayment plan with the SBA, the SBA will transfer your debt to the US Treasury for collection.

- The US Treasury collects on past-due debts, using personal assets to make up for the difference.

- The US Treasury may take additional lawsuits against you, including filing a lawsuit in court.

Lenders are more likely to report delinquency after 30 days and default if you don't pay within 90 days. In the process of concluding the default, each lender's approach to the liquidation of collateral may be different. They may use other means to settle a loan's unpaid amount.

How can I pay back my SBA 7(a) loan?

Your repayment of the SBA loan will happen through the equated monthly installments, or simply called installments. The installments comprise the two components of the loan, which are the principle and the interest.

However, your loan repayment can take place as explained in the following:

- The majority of 7(a) term loans are repaid in monthly principal and interest payments.

- When the interest rate on a variable rate loan changes, the lender may need a different payment amount.

- Fixed-rate loans have the same payments because the interest rate is fixed.

FAQs

Let’s get through some of the commonly asked questions in this section.

Q: How can I tell if I have an SBA loan that has gone into default?

A: As your loan gets delinquent and you fall behind on payments, your lender will try to connect with you more frequently. They shall be informing you about the default.

Q: If I default on my loan, will the SBA bring a lawsuit against me?

A: If you default on your loan, the SBA or your lenders may decide to bring a lawsuit against you. This is certainly relevant if your personal or corporate guarantees are insufficient to cover the outstanding loan balance. If the business owner appears untrustworthy, a lawsuit can be used to create a legally binding payback plan.

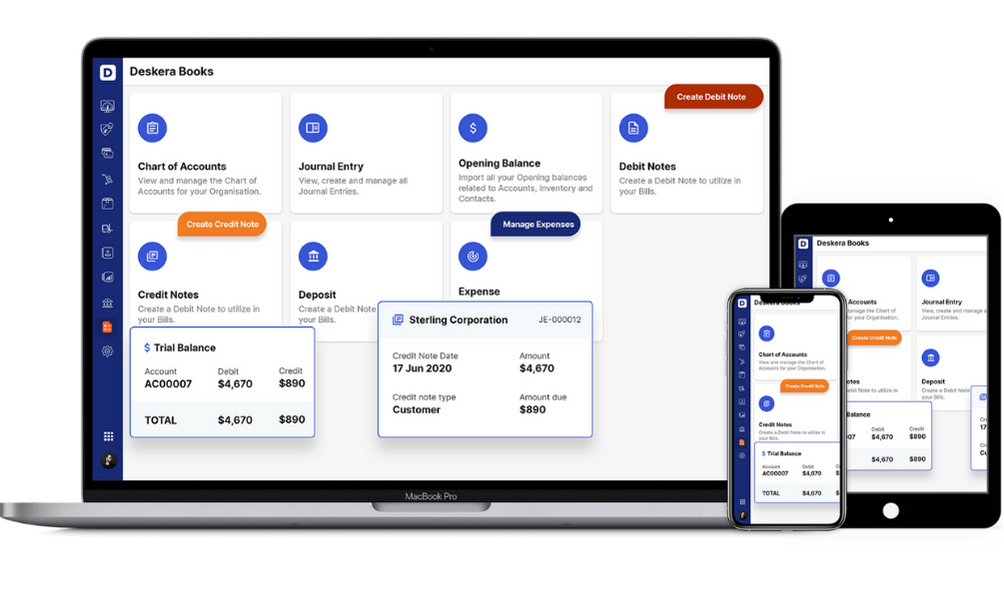

How can Deskera Help You?

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution, it caters to all your business needs, from creating invoices and tracking expenses to viewing all your financial documents whenever you need them.

Key Takeaways

SBA stands for Small Business Administration and is a federal agency that provides counseling and capital to small businesses. One of the primary agendas of the SBA is to oversee and catalyze the growth of small businesses in America.

- The 7(a) loan program offers help to grow and expand for small businesses. Businesses can take a loan of a maximum of $5 million

- There are multiple types of loans under the SBA program of loans and they are aimed at addressing diverse business needs

- With a maximum limit of $5 million, the standard 7(a) loan is suitable for the majority of small businesses. The SBA guarantees 85 percent of loans for the amount up to $150,000 and 75 percent of loans over $150,000

- 7(a) small loan is very similar to the standard 7(a) and offers quite identical facilities. However, the difference is that this loan max out at $350,000

- SBA Express is a fast-track loan for companies that require a quick response. Your application will receive a response from the SBA within 36 hours

- Export Working Capital loan is for companies who require extra working capital to support their export sales. Export Assistance Center loans of up to $5 million are offered

- Export Express program is for exporters who require up to $500k in loans or lines of credit

- International Trade are long-term loans for the fastest-emerging enterprises. These enterprises experience an expansion as a result of export sales

- Benefits for small businesses are getting long-term funding, refinancing high-interest loans, and many more

- Banks also have various benefits such as improving its risk-free loan portfolio, retain clients, providing alternative financing solution for the customers, and so on

- Once a business owner has found an SBA-approved lender with whom they would like to coordinate, the process of securing and applying for an SBA loan can be worked out

- Most 7(a) loans take five to ten business days to process, but it depends on the case. The SBA Express loan has a 36-hour response time for people who are in a hurry

- Applying for the loan requires you to gather documents such as personal background and financial statements, Ownership and affiliations, loan history, income tax returns, business overview and history

- In the case where a business defaults on repayment of the loan, there could be dire consequences such as lawsuits from the lender or the SBA

Related Articles