In India, on April 2000, the concept of Special Economic Zone(SEZ) was introduced to encourage foreign investments and provide a hassle-free and competitive environment for businesses to flourish.

In India, SEZs are the areas that offer incentives to resident businesses. SEZs generally offer duty-free exports, competitive infrastructures, tax incentives, and other measures to make it easier to conduct business.

Therefore, in India, SEZs are a popular investment destination for many multinationals, especially exporters.

What is SEZ or Special Economic Zone?

An SEZ (Special Economic Zone) is a special region with unique economic regulations compared with other areas in the same country. Therefore SEZ is considered to be foreign territory. These SEZ zones have easy tax and legal compliances and make them the most convenient regions for FDI(Foreign Direct Investment).

Hence, whenever you conduct business in the SEZ region, you will enjoy many benefits like paying lower tariffs, tax incentives, labor regulations, etc. In addition to the operational units in SEZ, a special tax holiday is also offered.

Following are the various objectives behind the implementation of SEZ;

Impact on SEZ under the GST regime?

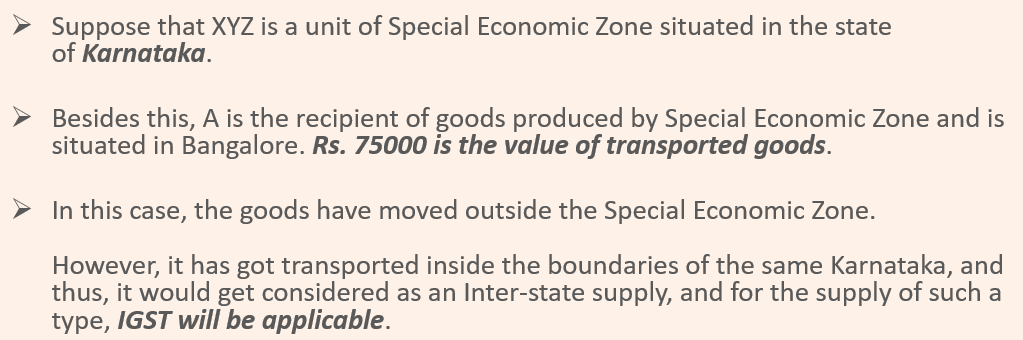

Any supply to or by an SEZ unit is an inter-state supply, as per the GST. It is because SEZ is considered to be a foreign territory and will attract IGST.

It is categorized into 2, Export and Import:

Export under SEZ in GST

- By any mode of transport of goods/services from SEZ to outside India.

- Goods/service supply from one SEZ unit to another or same unit.

Import under SEZ in GST

- By any transport mode, bringing goods and services into an SEZ from outside India.

- Goods and Services received from one SEZ unit by another unit located in the same or another SEZ unit.

Goods suppliers to SEZs can supply by the following:

- Under bond / LUT without paying IGST and claiming ITC.

- By IGST payment and claiming refund of taxes paid.

Note:

- (IGST) applies to the SEZ supply of goods/services.

- IGST exception when an SEZ supplies goods /services to a Domestic Tariff Area (DTA). So, it is exported to DTA (exempt for the SEZ). The person receiving these DTA supplies is liable to pay customs duties and other import duties.

- Any supply of goods /services to an SEZ developer/unit has a zero-rated supply ( ie, Zero tax rate under GST). In short, supplies into SEZ are exempted from GST and considered as exports.

E-way Bill in SEZ under GST

If the value of the goods is above Rs.50,000, the transporters need an E- way Bill to transport goods from one place to another under GST. As inter-state supplies, SEZ supplies are the same. Thus, SEZ units will have to follow the same E-Way Bill process as inter-supply goods.

Note: In case the supply of goods is from SEZ to a DTA, or any other place, then the person registered to do the movement of goods will also need to generate the e-way bill.

Example:

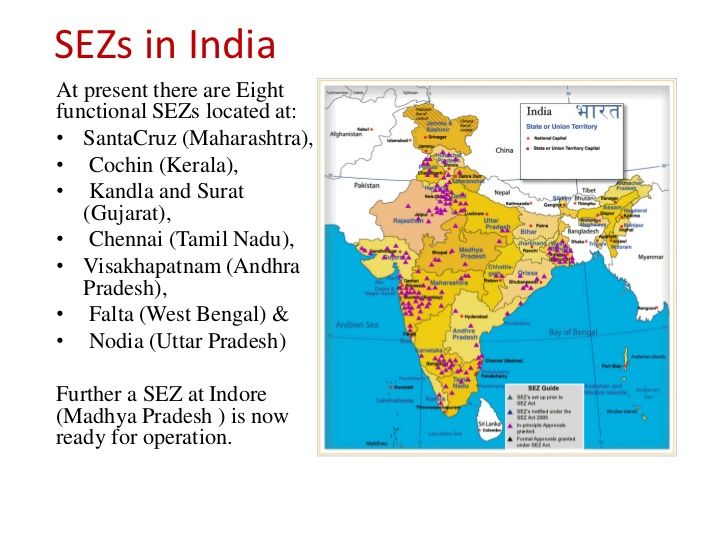

List of SEZ in India

Treatment of Supply to Special Economic Zone (SEZ) under GST

The trade between two SEZs is treated as Import or Export. Therefore, on such supply, IGST is leviable.

Under GST, the supply of goods/services to SEZ is treated as a Zero-rated supply.

The Goods or Services supply or both by SEZ to the Domestic Tariff Area (DTA) is treated as Import by DTA, and Customs Duty is to be paid by the recipient of the supply.

After so many advantages provided to SEZ, there are some serious issues faced by SEZ under GST.

Let us discuss this one by one:

ITC Refund on Inward Supplies

Following are the two ways where SEZ units can make inward supplies:

- Payment without IGST (With LUT)

- Payment with IGST (Without LUT) and claiming Input Tax Credit(ITC)

The SEZ unit suppliers need to issue LUT so that they do not need to collect GST.

Thus, for such ITC under GST, if they do not issue LUT, they will not collect IGST; the SEZ unit can avail of a refund.

Many suppliers do not issue LUT, and thus they need to collect IGST from SEZ. Then the SEZ unit/developer will be required to claim a GST refund.

Hence, there is an increase in compliance for SEZ units. And also, their working capital gets blocked.

Zero-Rated Supply for Regional Operations

Supply to SEZ is a Zero-Rated supply. However, this provision is only for authorized operations.

For non-authorized operations, the suppliers are under the confusion of whether to charge GST or not.

As per the IGST Act of section 16, all the supplies made to SEZ are Zero-rated, and GST is not chargeable.

However, as per various rulings and circulars issued in June-2018, it was clarified that for not authorized operations, they are subject to IGST.

Below listed are various supplies, which are out of the purview of authorized supplies to SEZ:

- Event Management and Banquet services,

- Accommodation service to SEZ employees

- Supply of goods for employee consumption, etc.

On these supplies, it is unclear if these are zero-rated supplies or not.

Any supplies made to SEZ are Zero-Rated as per the IGST Act, and as per rulings, these types of services are liable to GST.

So, the suppliers are still under confusion in case of such services.

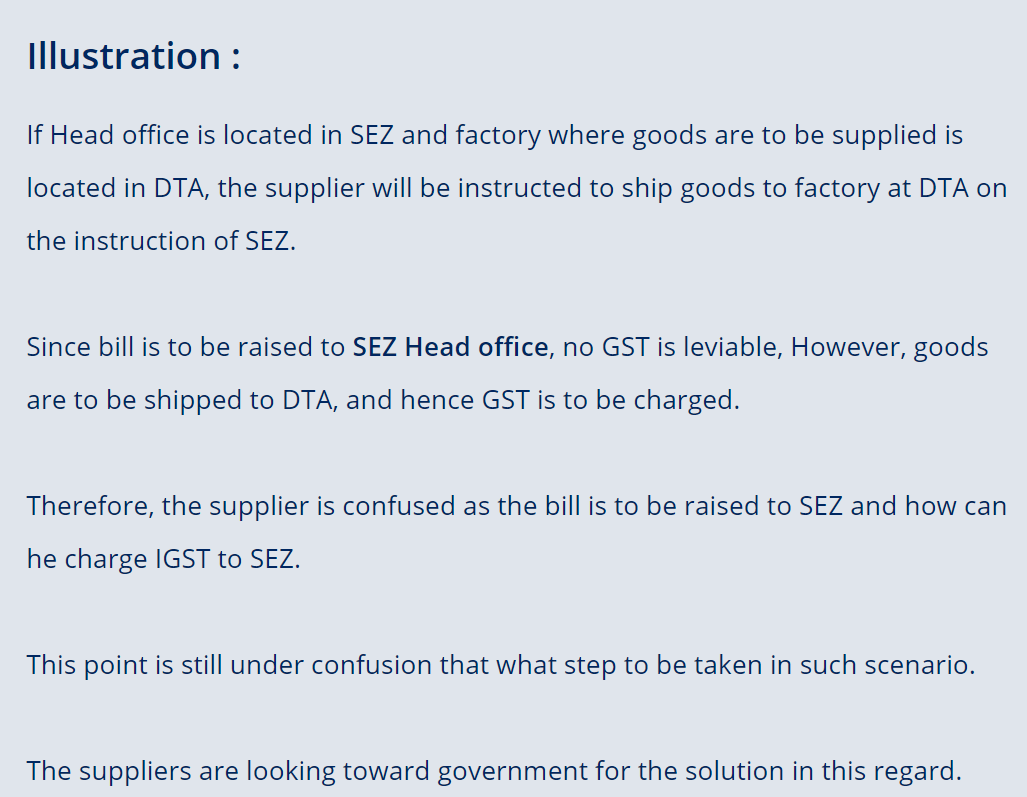

Supply of Goods to DTA on the Instruction of SEZ

A Bill-to-Ship-to transaction is when supplies are made at one place under the person's instruction, belonging to another place.

As per SEZ Act, of section 2(m) they supply goods to DTA as ‘export’ . If SEZ supplies goods to the DTA unit, the DTA unit must file a Bill of Entry and pay applicable customs duty, including IGST. DTA unit paying tax can be compared to reverse charge i.e, the tax is to be paid either by the recipient of goods and services.

Registration Obtained Under Incorrect Head

Many SEZ developers were selected as regular taxpayers rather than SEZ taxpayers. As a result, there are numerous benefits for SEZ under GST that others can not claim.

Hence, if you register yourself as a regular taxpayer, you will remain deprived of such benefits despite being eligible for them.

In this case, the GST department came with a solution to send an email to reset.sezflag@gst.gov.in for rectification, along with the scanned LOA to obtain SEZ unit registration.

SEZ unit/developer files many such applications to change their type, but the department took no action.

For such a type of rectification, the government shall add another field.

Otherwise, if it takes so much time to rectify it, then after rectification, all the benefits which were due will be demanded by SEZ units, and it will take more time.

The GST department may have to bear interest costs in case of refunds, if any, made to the SEZ unit/ developer.

Reverse Charge Liability

There are some supplies under which discharging compliances under GST and GST payment lies with the recipient. It is known as Reverse Charge.

For Example - Legal or GTA services, sponsorship services, etc.

There is confusion if GST is to be paid on such services or not.

For this, the GST council needs to clarify, as supply to the SEZ unit is Zero-Rated.

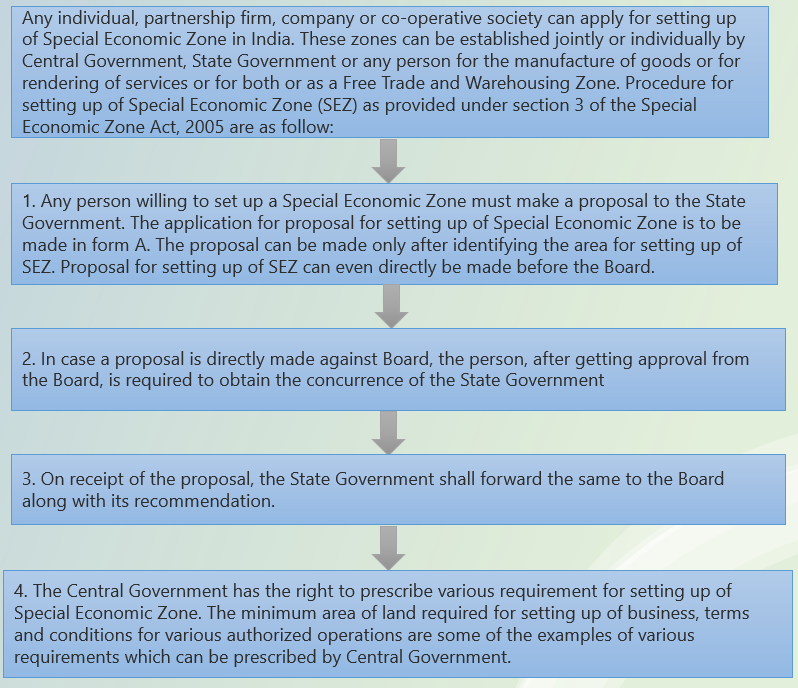

What is the Procedure to Set up an SEZ in India?

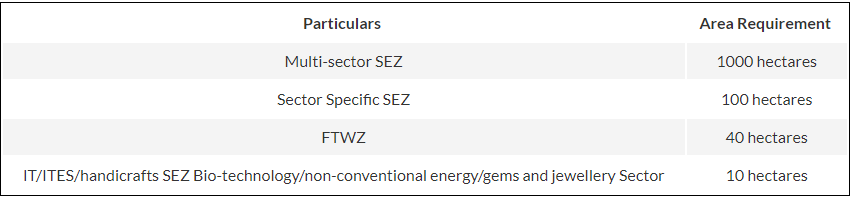

Currently, the minimum area requirement for setting up of Special Economic Zone are as follow:

Documents Required for Setting up an SEZ

\For an SEZ setup, the applicant must submit the below-required documents in Form A on the SEZ portal along with the required undertaking, affidavit, and project report.

- Name of the Applicant

- Proposed Area of Special Economic Zone

- Status of the recommendation of the proposal by the State Government, if available.

- Whether the proposal is for formal approval or in-principle approval?

- Whether it is a multi-product SEZ?

- Whether it is a sector-specific SEZ? If yes, the details of sector there on

- Projected investment in project

- Projected export from the project

- Projected employment generation from the project

- Source of fund of project

- Net worth of the Applicant

- Extent of FDI, if any

- Source of FDI.

GST Refund for Export And Supply To SEZ

To the special economic zones(SEZ), as per the IGST Act, 2017 exports and supplies are "zero" rated. It means that the entire supply chain of a particular “zero-rated supply” is free of GST. However, output alone is exempted in exempted supplies, and GST is applicable on the input side.

According to the provisions of the CGST Act, 2017, a person with GST registration making a zero-rated supply is eligible to claim a GST refund. Below mentioned are the two options:

- Goods or services supply under bond or Letter of Undertaking without integrated payment tax and claim refund of the unutilized ITC of SGST, CGST, UTGST and IGST; or

- Goods or services supplied with integrated payment of tax and claim of GST refund on tax paid.

GST Refund on Exports

Following are the conditions the taxable person must be satisfied to claim GST refund under GST:

- The person in charge of conveying exported goods needs to duly file an export report, covering the number and shipping bills date or bills of export.

- The applicant must provide a valid return in GSTR-3 Form or GSTR-3B Form after the shipping bill, and export reports are filed and a formal report is filed. Then the application for a refund will be granted ultimately, and the refund process will commence.

In case of service exporters, a statement containing the number and date of invoices and the relevant Bank Realisation Certificates or Foreign Inward Remittance Certificates along with the refund claim must be submitted

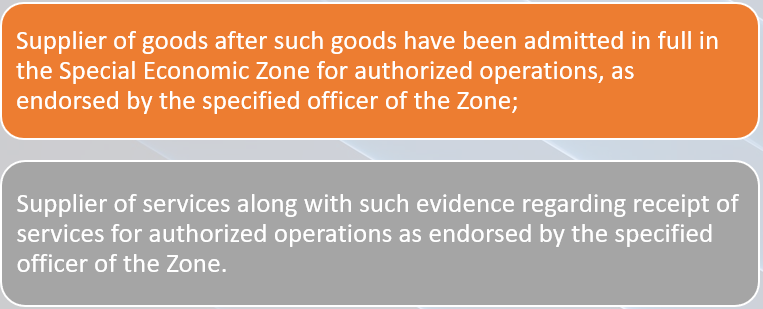

Refund Policy on Supply to SEZ

To the supplies to a Special Economic Zone unit, the taxpayer can apply by:

The following documents and information must be submitted to claim refund on supply to SEZ:

GST Provisional Refund

As per the CGST Act, 2017, the taxable person making zero-rated supplies is eligible for a 90% provisional refund claim. The CGST rules state that the provisional refund is granted within 7 days from the acknowledgment date of the refund claim.

In the claimant's name, an order for provisional refund will reflect in Form GST RFD 04 with payment advice. In addition, to the taxable person's bank account, the GST provisional refund amount will be electronically credited as mentioned on the GST Portal.

The provisional refunds are not granted of the person claiming refund has,

- During any five years of immediately preceding the tax period to which the claim for refund relates,

- Has been prosecuted for any offense under the Act or under an earlier law where the tax was evaded.

Key Takeaways

And, it’s a wrap!

With the points mentioned above, you have understood what SEZ under the GST regime.

Following are the topics we have covered in this article:

- What is SEZ or Special Economic Zone?

- Impact on SEZ under the GST regime?

- E-way Bill in SEZ under GST

- List of SEZ in India

- Treatment of Supply to Special Economic Zone (SEZ) under GST

- What is the Procedure to Set up an SEZ in India?

- Documents Required for Setting up an SEZ

- GST Refund for Export And Supply To SEZ

Refer to below article to know SEZ applicability under Deskera Books.

Related Articles