Have you been a recipient of a work visa to work in the USA? Or are you a student looking forward to obtaining a work visa and maybe even settling down in the country? Or are you an immigrant wanting to fulfill all the legal requirements while also being able to stay and work in the country?

Whichever of these scenarios matches you, or even if you are a participant of a different scenario, you know Social Security Number is the key to several of your problems and solutions as well as a crucial legal requirement of the USA. If you want to know more about Social Security Number, its purpose as well as its application process, this article will be your guide for it all.

Since its inception in 1936, the use of Social Security Number has expanded significantly. While earlier it was used more for keeping track of the earnings history of US workers for Social Security entitlement and benefit computation purposes, today it has become more of a universal identifier.

The Social Security Number (SSN) is a nine-digit number that is issued by the US government to all its citizens at their birth. This number is also issued to eligible US residents who apply for it. The Social Security Number is used by the US government to keep track of your lifetime earnings, as well as the number of years that you have worked for.

When it's time for you to retire, or if you are in need of social security disability income, the government will use your information about your contributions to the social security to determine whether you are eligible or not, and if you are, then what benefit payment you would receive.

Usually, the same social security number is used by most people; however, in case you are a victim of identity theft, then you might need to apply for a replacement number.

The topics covered in this article are:

- What is a Social Security Number?

- Types of Social Security Cards

- Structure of the Social Security Number Cards

- Purposes of Social Security Number

- Non-Citizens and Social Security Number

- When to Not Use Your Social Security Number?

- Application Process to Get a Social Security Number

- When Can You Get Your Social Security Number Replaced?

- Tips for Safeguarding Your Social Security Number

- How Can Deskera Help?

- Key Takeaways

- Related Articles

What is a Social Security Number?

In the USA, the Social Security Number (SSN) is the nine-digit number issued to US citizens, permanent residents, and temporary (working) residents under section 205(c)(2) of the Social Security Act.

The social security number is issued to each individual by the Social Security Administration, which is an independent agency of the US government. While originally, the purpose of the social security number was limited to tracking individuals and their work history as well eligibility for benefits and its calculation, today, it has become the de facto national identification number for taxation and other purposes.

Types of Social Security Cards

There are four different types of social security cards issues based on their geographic location (SSN area number):

- Persons of natural birth within the territorial boundaries of any one of the member states of the USA.

- Persons who become US citizens by oath or birth within the exclusive legislative or territorial jurisdiction of the USA government.

- Persons who become US permanent residents.

- Persons with certain restrictions.

The two restricted types of Social Security cards are:

- One reads, “not valid for employment.” Such social security cards cannot be used as proof of work authorization. Additionally, they are also not acceptable as a List C document on the I-9 form.

- The other reads, “valid for work only with DHS authorization,” or if it is an older card, then it reads “valid for work only with INS authorization.” These cards are issued to those people who have temporary work authorization in the US from the Department of Homeland Security which is the nation’s border agency. If accompanied by a work authorization card, they can satisfy the I-9 requirement.

Usually, the Social Security Cards display the cardholder’s name and number. In fact, the new social security number card design also comes with covert and overt security features as created by the SSA and GPO design teams to prevent forgery of the social security cards.

Structure of the Social Security Number Cards

The structure of the social security number cards is in the format of a nine-digit number as: “AAA-GG-SSSS.” Here, A stands for area number as formerly they were assigned by geographical region, the G stands for group number, and the final four digits S stands for serial number.

The Social Security Administration changed the SSN assignment process to SSN randomization on June 25, 2011. This affected the SSN assignment process as follows:

- The geographical significance of the first three digits of the SSN referred to as the area number, was eliminated as the first three digits of the social security number were no longer assigned as by the individual’s resident state or by the location of their company’s headquarters.

- The SSN randomization also eliminates the significance of the highest group number assigned for each area number. This thus means that the High Group List is frozen in time and can be used for the validation of only those SSNs that were issued before SSN randomization was implemented.

- Through SSN randomization, previously unassigned area numbers have been introduced for assignment. This is, however, excluding the numbers 000, 666, and 900-999. This thus means that after the implementation of SSN randomization, the assignment of area numbers between 734 and 749 and above 772 through the 800s became valid.

Note: The Social Security Administration does not reuse any social security numbers and, in fact, says that it has enough unique social security numbers to last generations without having to reuse the assigned social security numbers or changing the number of digits in the social security number.

However, there have been some cases where multiple individuals have been mistakenly assigned the same social security number.

Remember, the last four digits of your social security number are most important to be protected as by using them, someone else can get credit, steal your money, etc. Before the implementation of SSN randomization, these represented a straight numerical sequence of digits from 0001 to 9999 within the group.

Purposes of Social Security Number

Social security number has become the key functioning as well as verification element across various crucial functions. Its purposes have hence become far-reaching and include:

Getting Hired for a New Job

A social security number is a must when you are getting hired for a new job. You would be required to provide your social security number to your employer so that his or her accounting department can use this number to report your income to the Internal Revenue Service (IRS). The accounting department also uses your social security number to report your social security wages to the social security administration.

Additionally, your social security number is also used for state income tax reporting unless your state does not have any income taxes. Other than for these reporting and tax and compliance purposes, some employers need social security numbers also to verify whether you are allowed to work legally in the United States or not. They do this by using a program named E-Verify.

Opening an Account with Any US Financial Institution

Social security numbers of the customers have been required by the banks as per the Federal Government guidelines since 1970. The banks can use either the social security number of their customer or their Individual Taxpayer Identification Number (ITIN).

The federal government has asked the financial institutions to collect your social security number so that by using it, they can:

- Check your credit

- Report your investment income or losses to the IRS

- Report your tax-deductible mortgage interest to the IRS

- To manage your account

Some of the institutions do accept the taxpayer identification number, also known as Employer Identification Number or EIN, on some forms as an alternative to your social security number.

Applying for a Federal Loan

When you are applying for a federal loan, like a federal student loan, the government will use your social security number to ensure that you are eligible for it.

For example, if you want to be eligible for a federal student loan, then you must not have defaulted another federal loan, have eligible citizenship or visitor status, and most male applicants must have registered with the Selective Service.

Applying for Certain Types of Public Assistance

Usually, public assistance programs like unemployment benefits or social security disability income are managed by the federal or state government agencies. These agencies use your social security numbers to ensure that you aren’t asking for a benefit that you are not entitled to.

Enrollment in Medicare

Considering that the Social Security Administration works with the Centers for Medicare and Medicaid Services to enroll people in Medicare, your social security number would be required during the same.

Applying for a Passport

As per federal law, if you have a social security number, you are obliged to provide it when applying for a US passport. However, in case you do not have your social security number, then you would be required to provide a sworn statement that you have never been issued a social security number.

Tax Returns

Your social security number is required for your tax returns because this would be used by the IRS to match your reported income on your tax return with the income your employer and financial institutions have reported as having paid to you.

Additionally, you would be required to provide your child’s social security number in order to claim him or her as a dependent on your tax return.

To Get a Driver’s License

Many states of the USA require that you provide your social security number if you have it when you are applying for a driver’s license.

Non-Citizens and Social Security Number

In the USA, non-citizens are exempted from providing their social security numbers in several situations like:

- Getting a driver’s license

- Registering for school

- Applying for public assistance like subsidized housing

- Getting private health insurance

And so on.

This is because the USA government does not like issuing social security numbers to non-citizens who are not authorized to work in the United States. In fact, for non-citizens, even banks and credit companies cannot make it mandatory to provide a social security number if you do not have one.

However, this does mean that the financial institutions would not be able to run a credit check on you, and without that check, it will become impossible for you to get a credit card or loan.

When to Not Use Your Social Security Number?

While the USA federal law does allow anyone to ask you for your social security number, it does not mean that you have to share it each time.

Social security number is such vital and sensitive information related to you that you should share it as infrequently as possible. In fact, when asked for your social security number, it is important to remember that they might not always need it, and if it is not needed, then you should not share it.

For example, though medical providers will ask for your social security number, you can leave it blank when filling out the medical paperwork. Most often, this would not be questioned by them as the doctor's office and other such businesses can use your other information to identify you and keep track of your records. However, this also brings the possibility that with your refusal to provide your social security number, the opposite party can refuse to do business with you.

It is easy for your social security number to be misused, and it is therefore important that you take all measures to ensure that does not happen. One of those measures involves not carrying your social security number card around with you until and unless you require it for a specific purpose on a certain day.

For example, you will need your social security number card when you are going to start a new job, and you have to show proof of citizenship to your employer. However, here as well, you can provide your passport as proof, rather than your social security number card.

Your social security number card, however, will be mandatory for reporting your income to the IRS and social security administration, making it mandatory for your employer to have your social security card number.

Make sure that you do not lose your social security number card, as this number, along with your other personal data, can be used by thieves to apply for credit, take out loans, get a job, get health care, etc. Such an incident, known as identity theft, will then become a huge mess that you would have to clean up.

It is therefore recommended to keep your social security number card safely at home or in a safe deposit bank at the bank. If your social security number card is stolen or lost, then you will be required to apply for a new one.

Additionally, other documents like your tax reports, for example, or even electronic documents like an unencrypted pdf of your tax reports which contain your social security number, should be kept in an equally safe and secure place as well.

Application Process to Get a Social Security Number

To get your social security number, you will have to complete an application for the same. This application will let you get an original social security number or replacement social security number or let you change the information in the SSA’s Numident records.

The steps for the same are:

- Filling the application SS-5, which is available online or in any SSA field office. The information that is requested on the SS-5 is:

- Name to be shown on the card.

- Full name at birth, if different

- Other names used

- Mailing address

- Citizenship or alien status

- Sex

- Race/ethnic description (SSA does not receive this information under EAB)

- Date of birth

- Place of birth

- Mother’s name at birth

- Mother’s SSN (SSA collects this information for the IRS on an original application for a child under age 18. SSA does not retain this data.)

- Father’s name

- Father’s SSN (SSA collects this information for the IRS on an original application for a child under age 18. SSA does not retain this data.)

- Whether the applicant ever filed for an SSN before

- Prior SSNs assigned

- Name on most recent social security card.

- Different date of birth if used on an earlier SSN application

- Date application completed

- Phone number

- Signature

- Applicant’s relationship to the social security number holder

- The application and required evidence can be taken or mailed to any social security office for processing.

- If the applicant is 12 years of age or older and applying for an original social security number, then an in-person interview would be required.

- SSA employees key the SS-5 application data and evidence into the SSA computer system, which uses the information to create or update the Numident.

- The signed SS-5 application is retained for a short period in the field office and then is sent to a records center in Pennsylvania for microfilming. Once microfilmed, the original SS-5 is destroyed.

Note: The Veterans Affairs Regional Office (VARO) in Manila also accepts SS-5 applications for an original social security number or a replacement card. Additionally, this is accepted by all the US Foreign Service posts as well as all military posts outside the United States.

To find a Social Security Administration Office closest to you, the steps that you should follow are:

- Visit the website- https://secure.ssa.gov/ICON/main.jsp

- Type your zip code or look up the zip code for your city

- Get address, timings, and directions to the office location

Application Process for Immigrants Getting Social Security Number

- You should go to the nearest Social Security Administration (SSA) office.

- Fill up an application, i.e., Form SS-5, which is for getting a social security number card.

- Show your original documents or copies certified by the issuing agency to prove your immigration status. This should also include a work permit as issued by the Department of Homeland Security, your passport, and your identity card.

- Get a receipt

- You will receive your social security number in 2-3 weeks via mail on your residence address.

Note: If you have the H1B visa, that means that you are an immigrant to the United States and not a citizen. Hence, to get your social security number, you will be asked for the following papers by the Social Security:

- Form I-551 (this includes machine-readable immigrant visa with your unexpired foreign passport)

- I-94 with your unexpired foreign passport, or,

- Work permit card from the Department of Homeland Security (I-766 or I-688B)

Application Process for Green Card Holders Getting Social Security Number

The two ways for getting social security number by all those who have come to the United States as permanent residents or green card holders are:

- Before coming to the USA, you can apply for a green card along with the Visa application. To do so, you will have to fill the Form DS 230 (Application for Immigrant Visa and Alien Registration) or the electronic Form DS 260 (Immigrant Visa Electronic Application) of the US Department of State (DoS). You would not have to go to the SSN office or fill out a separate SSN application form to get your social security number.

This is because the DoS and the Department of Homeland Security will coordinate to issue you the social security number card. This will be issued to you after you come to the USA, and you will receive it via mail three weeks after you arrive in the United States. In case you do not receive your social security number card within the given time period, or you change your address, you should contact the SSN office.

- If, however, you have not applied for the SSN along with your visa, then you will have to go to the SSN office to apply for it. This procedure will take a minimum of two weeks before you get your SSN card. The documents that you would require for this procedure are:

- Your passport with the Machine-Readable Immigrant Visa (MRIV) or Permanent Resident Card (Form I-551).

- Your birth certificate as well as the birth certificate for each member of your family who is applying for the social security number.

Application Process for Non-Immigrants Getting Social Security Number

For non-immigrant visa holders like students, H1B, etc., the documents that would be required to get the social security number are:

- Application form SS-5. This can be found online or in any of the SSA offices.

- Valid passport

- Original SEVIS I-20 (for F-1 visa holders) or DS-2019 (for J-1/J-2 visa holders)

- A printout of your I-94 Arrival/Departure record

- Proof of employment eligibility. This can be a job offer letter, I-20 endorsed for CPT, or Employment Authorization Document (EAD) card.

- Social Security letter from the OIS.

When Can You Get Your Social Security Number Replaced?

The conditions under which an individual would be able to justify his or her’s request to get assigned with a new social security number are:

- Where sequential numbers assigned to members of the same family are causing problems.

- In the event of duplicates having been issued.

- In cases where an individual has been a victim of domestic violence and harassment after which, having a new social security number will ensure his or her personal safety.

- When an individual has been a victim of identity theft, and his or her social security number continues to be problematic.

- When an individual has a demonstrable religious objection to a number (for example, certain Christians are aversive to the number 666).

Note: To prove the existence of all these conditions, credible third-party evidence like a police report or a restraining order is a must.

In case you have lost your SSN card or it has been stolen, then it needs to be reported immediately to the SSA.

You can get your SSN card replaced only three times a year and up to ten times in your entire lifetime. However, these limits are not applicable when your SSN is replaced due to legal name changes or other such updates.

For example, if you get a green card and therefore want to change your non-citizen status in your SSN card, then it would not be counted in those limited replacements. What you should also remember here is that, in case of a replacement card, they will have the same details and number as your previous card.

Tips for Safeguarding Your Social Security Number

The social security number has become a piece of confidential and sensitive information due to its widespread use and eligibility, making it a target of malpractices. Hence, you should take utmost care before sharing this information with anyone- either purposefully or mistakenly. Some of the tips for safeguarding your social security number are:

- Until and unless you are entirely convinced, do not share your social security number with anyone.

- Mostly, you will be asked to share the last four digits of your social security number. For example, if you call the customer service number for your cable account, the associate will definitely ask for this number.

- Remember: Even when you are asked for your social security number directly, you do have a choice in the matter.

- When asked for your social security number, you should verify the following:

- Why is your number needed?

- Instead of your social security number, can you give some alternative information?

- What happens if you do not share your social security number?

- According to which law is your social security number required?

Based on the answers to these questions, you would be able to determine whether you should and want to share your social security number or not.

- Your social security number should never be printed on your checks, business cards, address labels, etc.

- You should not carry your social security number card in your wallet or bag.

- You should never simply throw away any paper that has your social security number. Rather, you should always use a shredder and then dispose of it. This will help you in protecting yourself from identity theft which is a big problem in the United States.

Note: The local security office is listed under the US Government agencies in your telephone directory, or you may call Social Security at 1-800-772-1213. If, however, you do not have a telephone directory and you need to locate the nearest Social Security Office, then visit http://www.socialsecurity.gov.

How Can Deskera Help?

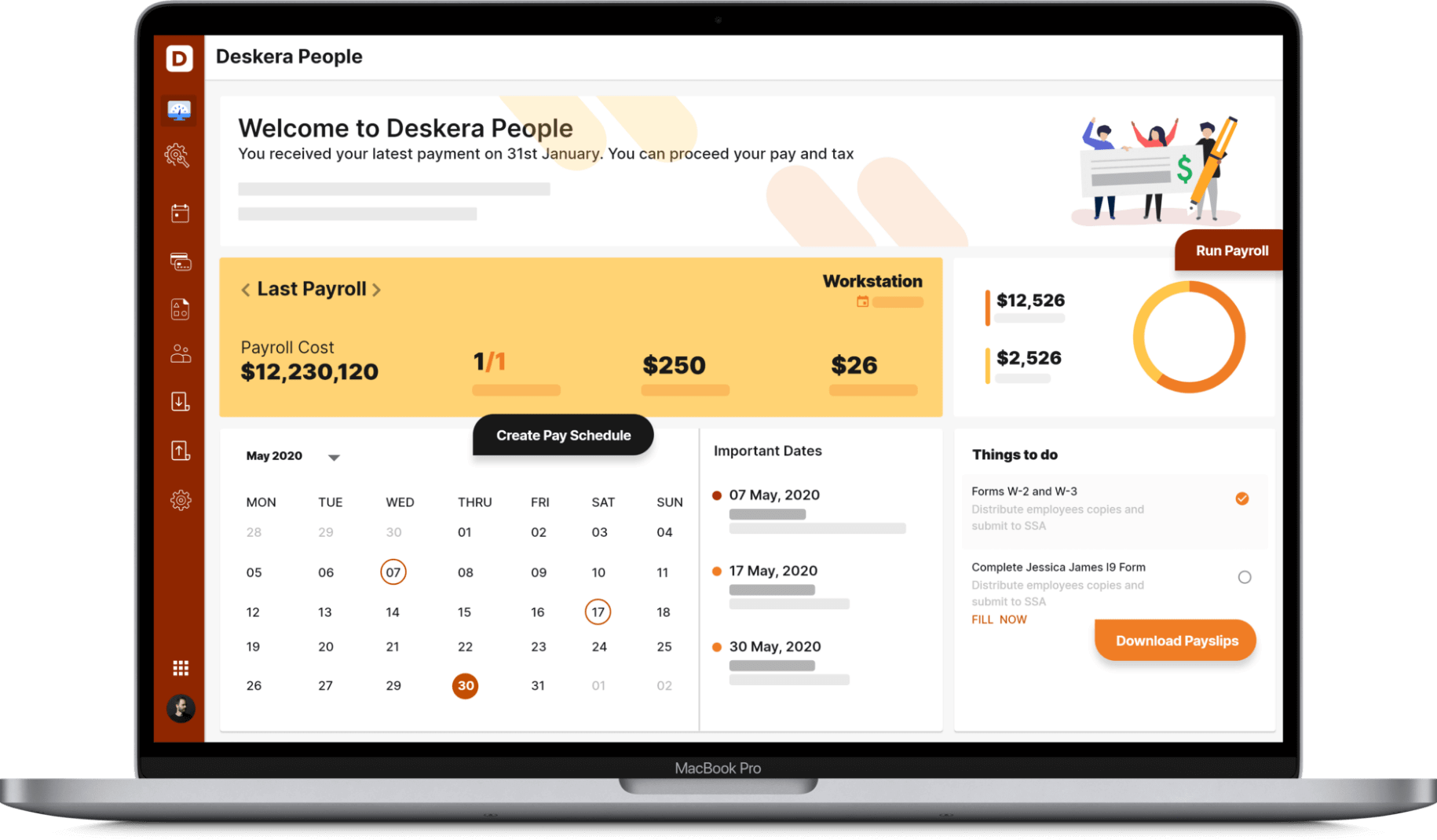

Deskera People is a cloud-based software that lets you keep all your employees’ personal data and information in one place but accessible from anywhere.

As an employer, you would be able to view your employees’ essential information through the employee grid, which can be further sorted, to make it easier for you to get the information that you need.

Additionally, you would also be able to maintain a centralized database of all your applicants, with custom fields and a well-rounded profile of the applicant, letting you store as well as access their information as and when it is required by you.

Key Takeaways

While earlier the use of social security numbers was limited, today it has become the unique identification number of each individual, based on which they are identified and tracked. Be it tracking of your lifetime earnings and calculating your social security benefits, or opening a checking account or applying for a federal loan or public assistance, or filling out a new patient form in the hospital, social security number has become the key functioning element for a wide range of functions.

Social security numbers are hence required by immigrants, non-immigrants, and green card holders in addition to the natural citizens of the United States. Without a social security number, getting a loan or social security benefits or even being able to work in a reputed firm becomes impossible.

However, along with its wide usage, there are also wider threats involving identity theft. This highlights why you should safeguard your social security number the best. This safeguarding also involves cross verifying your social security number is required by someone and whether it is mandated by the law or can you provide alternative information sources for the same.

Related Articles