Did you know that 91.4% of U.S. citizens are covered under Health Insurance?

Out of the numerous employee benefits, health coverage is one of the most popular benefits you can offer to employees that can help to improve their morale and quality candidates.

As a business owner, Health Insurance coverage is critical for your employees.

Around 49% of the American population receive employer-sponsored Health Insurance, also known as group Health Insurance.

Group Health Insurance is a type of plan that provides insurance coverage to employees working under a company.

The group Health Insurance can be further categorized into two categories, i.e., small group and large group.

Well, the definition of both these categories mainly sound the same, but depending upon the size of the business, the definitions are entirely different.

This article will discuss these two categories and the points that make both the terms entirely different from each other.

The article covers the following:

• What is small group insurance?

• What are the requirements and benefits of small group health insurance?

• What is large group insurance?

• What are the requirements and benefits of large group health insurance?

• What is the difference between small group insurance and large group health insurance?

What is Small Group Health Insurance?

A small group health insurance gives coverage to less than 50 employees working in the organization.

If you are a business owner who employs less than 50 full-time employees in the organization, you cannot provide this affordable coverage to them.

What are the requirements and benefits of Small Group Health Insurance?

The requirements for small group health insurance are as follows:

- The small business should be approved by the Small Business Health Care Tax Credit

- The taxation be equal to 50% of premiums that you will pay for the employee Health Insurance

- The annual wages of employees should not exceed $52000

- The business owner is not required to meet any minimum requirement under a small group Health Insurance.

The benefits of the small group Health Insurance are as follows:

- The expenses related to small group Health Insurance are 100% tax-deductible.

- The business will also be provided with health care tax credit that they can use to offset the costs of Health Insurance

- By purchasing small group Health Insurance, the business owner can maximize their investment at a large scale

What is Large Group Health Insurance?

A large group of Health Insurance gives coverage to up to 100 employees or more than a hundred working in the organization.

Companies operating in States like California, Colorado, New York, and Vermont follow large group health insurance.

What are the requirements and benefits of Large Group Health Insurance?

The requirements for large group health insurance:

The only requirement for large group Health Insurance is subject to the Affordable Care Act.

It says that all full-time employees should be provided full health coverage. Otherwise, it will be subject to penalty.

This particular requirement is also called the play or pay rule, which was formed as a result of 2016.

The benefits of large group health insurance are as follows:

- The reason to choose a large group health insurance plan is the comparatively lower rate on health plans.

- The plans can be designed as per the need of the employees, which makes it most affordable for the company's

- The company can enjoy certain business tax breaks

What is the difference between Small Group Insurance and Large Group Health Insurance?

The large and small group Health Insurance are entirely different, the first reason being the size of the coverage.

Further, the differences between large group health insurance and small group Health Insurance can be divided into two main categories:

- Regulations

- Price

Let's discuss both of these aspects briefly:

1. Regulations

For the small group Health Insurance, the Affordable Care Act (ACA) states the factors that can and cannot impact the rates.

The rates of small group health insurance entirely depend upon the location of the business and the age of enrollees.

In contrast, for the large group Health Insurance, there are a lot of factors that need to be considered in calculating the large group insurance rates. In addition to the above factors, other factors include the participation rate of employees and the percentage rate of declining acceptance of the coverage.

2. Price

For the small group coverages, every employer's purchase price remains the same.

The business owner has the opportunity to choose any broker who will share the same price and the same plans.

It means that the price of purchase is the same.

Compared to the large group coverages, the purchase price is not set, and your broker can assist in negotiating the prices for you.

Here, the business owner needs to join hands with a good broker who can make the difference between your payment amount and the plan you select.

Since the prices differ, it is always recommended for a business owner to understand the United States laws from the broker. The broker will also assist you in choosing the right health insurance plan for a business.

So in major, the prices and regulations play a vital role in understanding the differences between small group health insurance and large group Health Insurance.

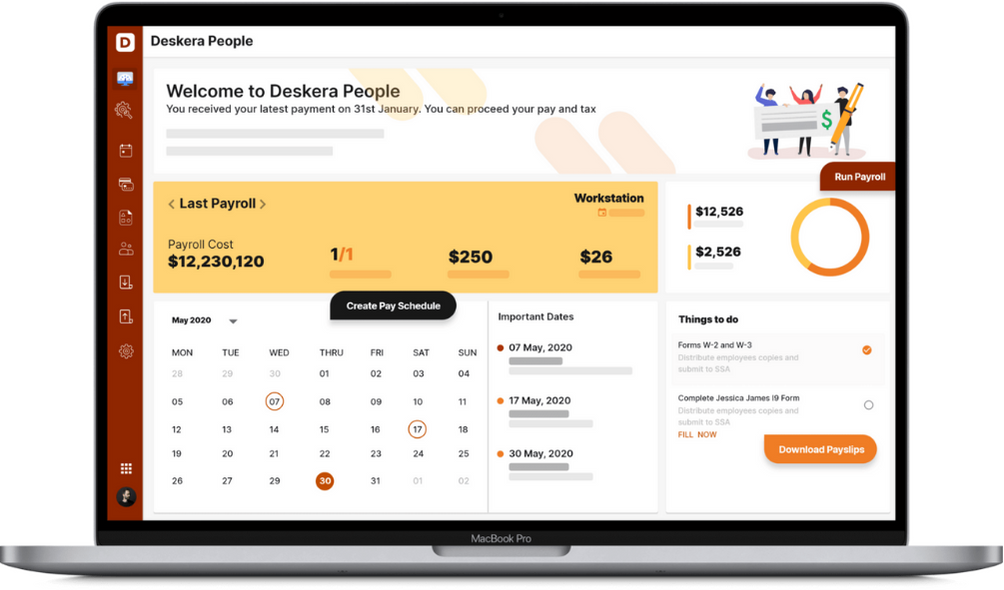

How can Deskera Help You?

Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

As a business owner, incurring Health Insurance may cost you one of the largest expenses. Still, it is very critical for you to maintain the health and safety of their employees working in your organization.

Whatever health insurance plan you choose, be it a small group or large group, the result is to boost employee satisfaction.

After all, it's a win-win situation for both the employer and the employee.

Following are the key takeaways of the article:

- Small-Group Health Insurance gives coverage to less than 50 employees working in the organization.

- There are four sets of requirements under the small group Health Insurance.

- The significant benefits of the small group Health Insurance are 100% tax deductibility, healthcare tax credits, and investment opportunities at a large scale.

- The large group Health Insurance gives 200 employees of more than a hundred working in the organization.

- The only set of requirements for large group Health Insurance is subject to the Affordable Care Act.

- The significant benefits of the large group Health Insurance are the lower rates of plan and business tax break.

- The first and the foremost difference between large group insurance and small group insurance is the coverage size.

- The other two significant points that highlight the differences between the large group Health Insurance in the small group Health Insurance are regulations and price.

- For small group Health Insurance, the factors in determining the rates are less than the large group Health Insurance.

- For small group Health Insurance, the prices of purchase remain the same compared to large group Health Insurance where the amount differs based on States.

Related Articles