If you are starting your business in Singapore, or expanding your headcount, or just want to understand how payroll works in Singapore, this article is for you.

Geographically Singapore is one of the best locations on the planet. Singapore is one of the world's most formidable business regions due to its central position that has helped it build a stellar reputation. From a business perspective, Singapore has become one of the world's busiest business hubs and is seen as a gateway to the rest of Asia.

According to the World Bank, Singapore is the most accessible globally to do business with a highly developed and free-market economy. However, Singapore is known for its reliability, quality, integrity, and productivity and has also ranked as the most open and one of the least corrupt countries globally. This makes the prospects of doing business in Singapore very engaging to companies from all over the world.

The key competitive advantages for companies offered by Singapore are are follows,

- Low taxes and business-friendly regulatory structure

- Stable and corruption-free political system

- Excellent strategic location

- World-class infrastructure

- Low trade barriers and a welcoming attitude to foreign investments

- Economic focus on knowledge-based industry

Doing Business in Singapore

Singapore has different business and cultural considerations that grow a company's experience, like all markets in Asia. For making the business expansion easier, the following are the aspects of doing a business in Singapore:

Check this video below to understand about different business entities in Singapore,

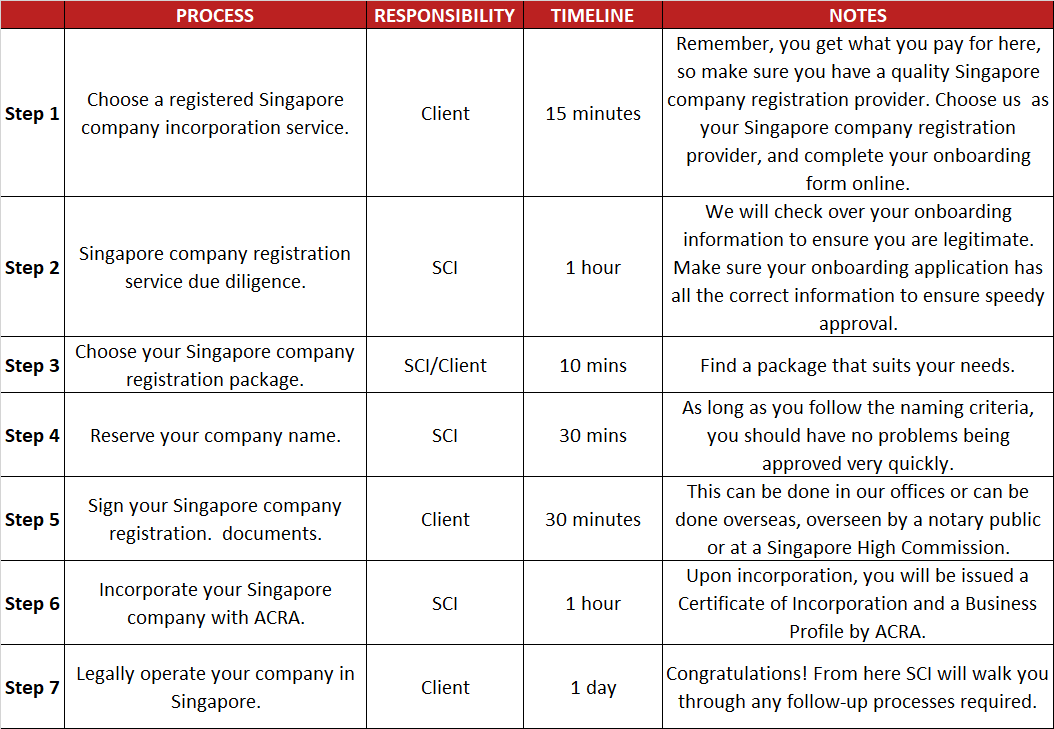

Company Registration Process in Singapore

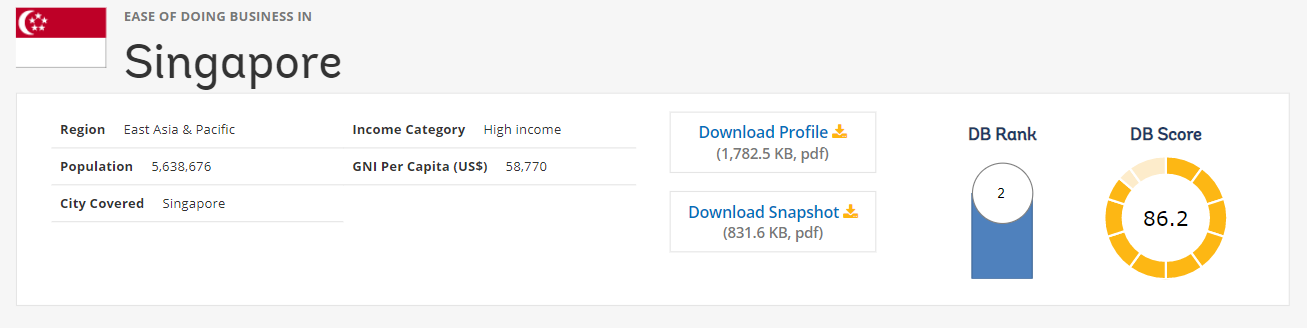

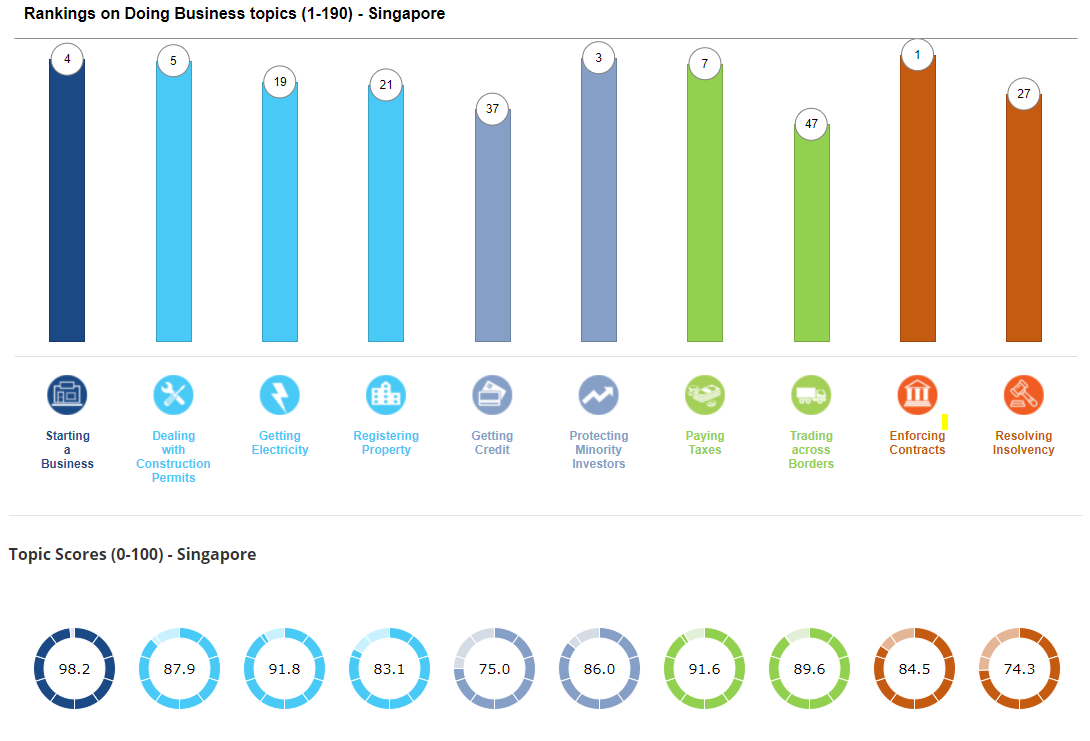

Singapore is one of the most convenient locations to start a business and ranks 2nd according to the World Bank to ease doing a business.

ACRA fully computerized the procedure of company registration in Singapore. Generally, the company can be incorporated in 1 -2 days.

3 steps for business Set-up

Step 1

You start registering a new business by getting its name accepted from ACRA( Accounting and Corporate Regulatory Authority). The chances of quick approval will be higher if you keep a few things in mind, such as the name must be unique, meaningful, easy to read and devoid of bad-mannered or indecent words, and free of copyright issues. No infringe trademark should be there.

Step 2

Prepare documents as below,

Step 3

Submit the application to ACRA. After the approval of the company name, you can apply for the company registration. It should not take much time to accomplish the process, assuming documents are in order, ACRA will notify upon the successful formation of the company.

In detail business registration process in Singapore,

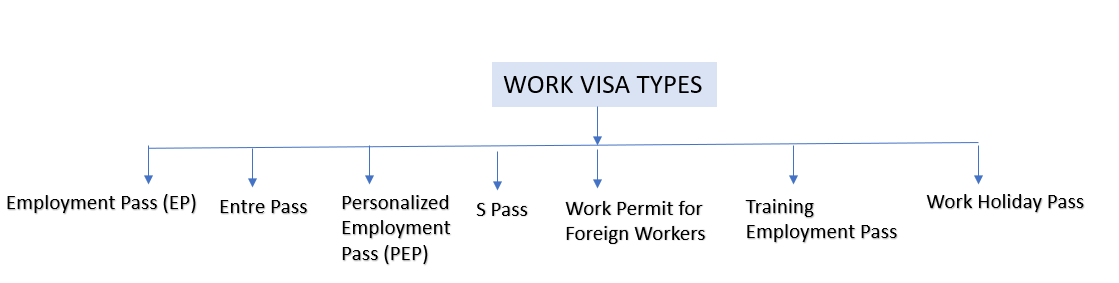

Types of Work Passes in Singapore

Employment Pass (EP)

Employment pass is issued to the professionals earning at least 4500 per month(Mostly at the executive or managerial level). On behalf of the visa-seeker, an employer must apply for EP's. The validity of the visa is for two years and can be renewed for up to three more years.

EntrePass

In Singapore, if any foreign entrepreneurs wish to open a business, they can directly apply for the entry pass. This pass is valid for 1 year, and the renewal for the first time is for 1 year. After that, the renewal can be done for 2 years.

Personalized Employment Pass (PEP)

This pass is issued for the highest-skilled workers earning at least SGD 18,000 per month or EP holders earning at least SGD 12,000 per month. Candidates can apply for this pass on their own and can stay in Singapore for 3 years, and cannot renew the pass.

S Pass

S Pass is an issue for mid-level skilled workers with a degree from a renowned institution and earning SGD 2,500 per month at least. On behalf of the candidate, an employer needs to apply for this pass. In case an employer changes jobs, the new employer will need to apply for a new S Pass. The validity of this pass is 2 years.

Work Permit for Foreign Workers

This pass is issued to semi-skilled workers working in manufacturing, construction, marine shipyard, process, or service sector. On behalf of the candidate, an employer needs to apply for this pass. The validity of this pass is 2 years.

Training Employment Pass

This pass is issued to foreigners in professional, executive or specialist, managerial jobs in Singapore and earning SGD 3,000 per month. By a local institution, this pass requires sponsorship, and validity is for 3 months.

Work Holiday Pass

This pass is issued to students and graduates aged between 1o8-25 years who want to work in Singapore. Validity for this pass is 6 months except for people from Australia, who can get a 1 year pass validity.

Minimum Wage in Singapore

For expats and foreign workers, Singapore is one of the most attractive countries globally, making the country's economy so productive. In addition, Singapore does not have any minimum wages/salary requirement for all local and foreign workers in Singapore, unlike many highly developed countries.

Few key points to be noted:

- As per the Employment Act, it does not standardize the minimum salary, and each employee shall be paid.

- Thus, there is no minimum salary requirement in Singapore and is subject to negotiation between the employee and the employer.

- In Singapore, local or foreign workers are paid based on their capabilities, skills, and competencies. It helps the companies to motivate their staff and retain their valuable workers.

- As per the Employment Act, salary needs to be paid at least once a month within 7 days after the salary.

- If applicable, overtime pay needs to be paid within 14 days of the stipulated salary period.

- There is no requirement for bonus payment under the Employment Act of Singapore.

Singapore Payroll Regulations

As the company headcount grows, managing payroll needs to be done with proper care. Calculating, processing, and reporting payroll components such as benefits, allowances, government remittance, and deductions are essential considerations.

As there is no minimum wage law in Singapore, listed below are the key regulations associated with payroll.

Salary

The payments agreed upon between employee and employer as specified in the employment contract is known as a salary.

It includes:

- Basic pay;

- Allowances;

- Bonuses;

- Commissions; and

- Incentives.

It does not include benefits provided by the employer, such as:

- Housing;

- Medical;

- Traveling;

- Utilities, etc

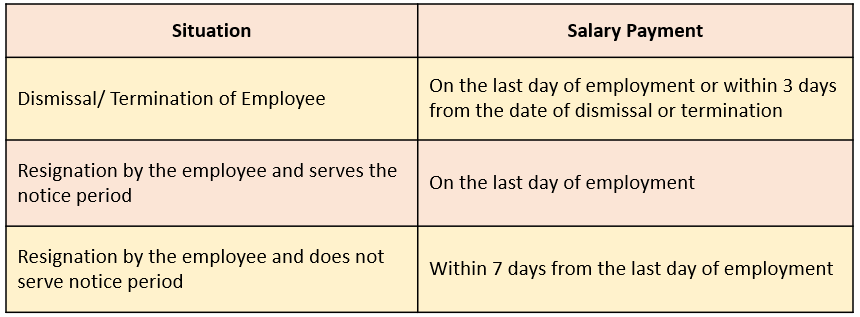

Frequency of Payment

In Singapore, the employee needs to be paid once a month and must be paid within 7 days from the salary period end date. Within 14 days, payments for overtime work need to be made from the end of the salary period.

Below are the few exceptions:

Payment Method

Salary must be paid on a working day and during working hours at work or any other mutually agreed place. Payment can be paid into an employee's personal/joint bank account.

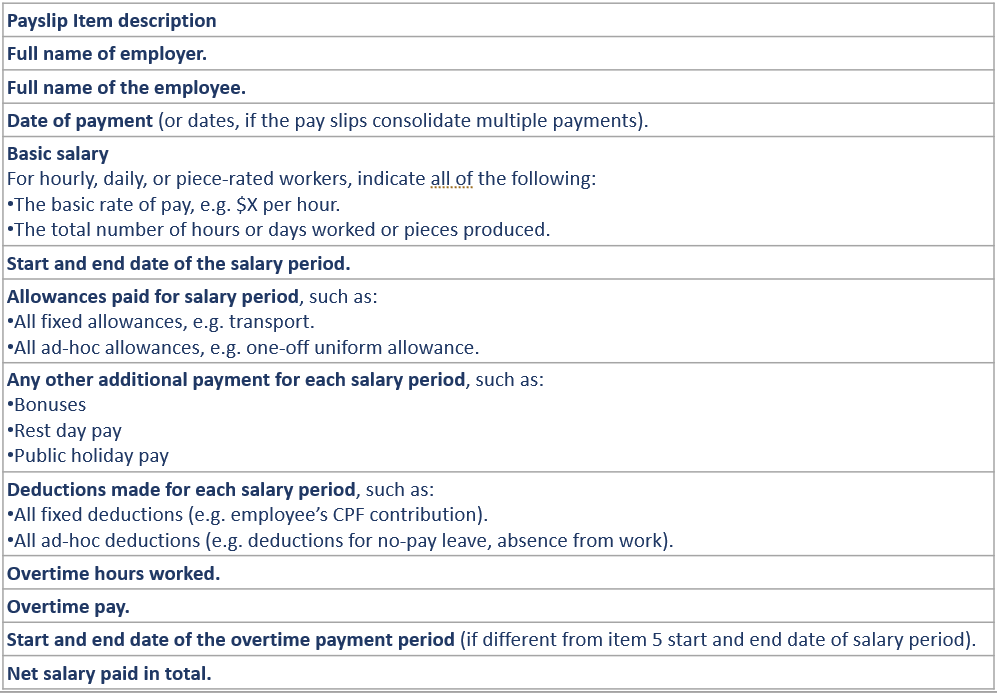

Itemized Payslips

Employers covered under the Employment Act need to provide itemized payslips to all the employees from 1 April 2016. These payslips need to be given along with the salary payment or within 3 days from salary payment.

If the employee is terminated or dismissed, the payslip needs to be given and the outstanding salary payment. Payslips may be a hard copy or a soft copy. Handwritten payslips are also permissible.

Payslips may be in a hard or soft copy, though handwritten payslips are also permissible.

Below list shows the items to be described in payslip:

Record Keeping

The payslip records need to be kept by the employers in either soft or hard copy. For current employees, documents can be kept for the latest 2 years. For former employees, after the employees leave the employment, a record for the last 2 years must be maintained for 1 year. Apart from the salary records, employers must also keep records of employees. The Employee Records must contain the below information,

- Employee Address

- Employee NRIC / Work Pass number and date of expiry

- Gender

- Date of joining of employment

- Employment date of leaving

- Working hours (including breaks duration)

- public holidays and dates of leave taken

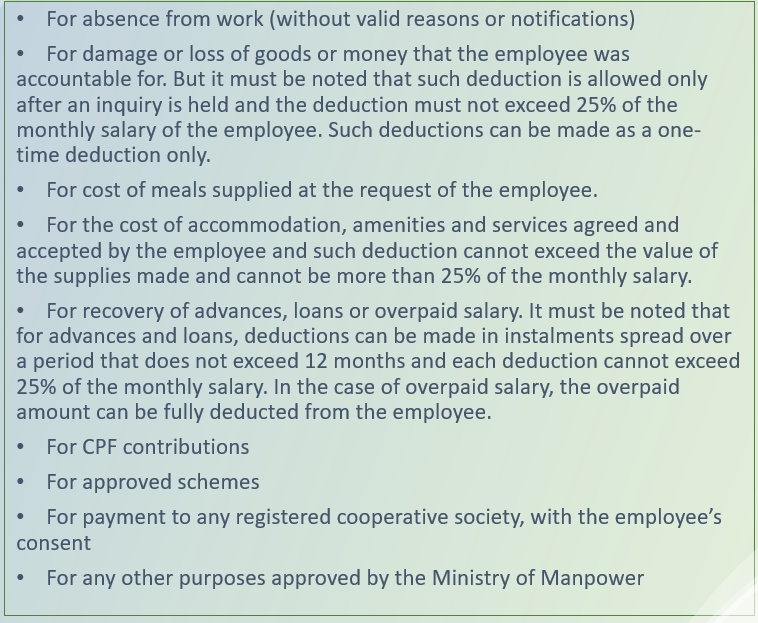

Authorized Deductions

Under the Employment Act, employers are allowed to deduct salary only for a reason or court orders. Following are such authorized deductions to be made,

For the salary period, the maximum deduction amount is limited to 50% of the total salary. It does not include deductions made for work absence, advances/loan recoveries, and registered societies payments that the employee has been allowed.

However, if the employee is terminated, the cap on the deduction is not applicable, and the employer will be allowed to deduct for all amounts outstanding owned by the employee.

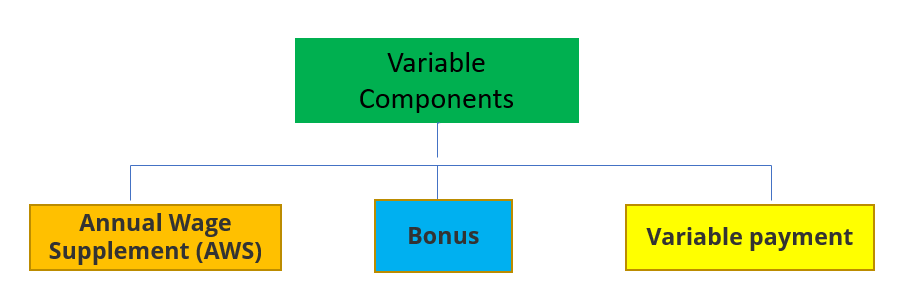

Variable Components

The variable portion of your wages can include the 13th-month bonus or Annual Wage Supplement (AWS), bonus, and variable payments. These payments are not compulsory unless they are in your contract.

Annual Wage Supplement (AWS)

AWS is popularly known as the "13th-month payment". Apart from an employee's total annual wage, it is a single annual payment.

It is not a compulsory payment. Depending on your employment contract or collective agreement, payment is made accordingly. As a reward, employers are encouraged to give their employees AWS for contributing to the company's performance.

If business results are poor for the year, your employer can negotiate a lower AWS amount.

Limits on AWS

AWS paid by the employer cannot be paid for more than 1 month's salary, and if they do not pay any AWS before 26 August 1988.

Bonus

The reward given to the employees for the contributions made toward the company, a bonus is paid one-time. It is given at the end of the year.

Giving bonus payments are not compulsory unless it is specified in the employment contract or collective agreement.

Variable payment

An incentive paid to the employees to increase productivity or a reward for their contributions is a variable payment.

It is not a compulsory payment; unless it is specified in the employment contract/collective agreement.

Calculating Salary

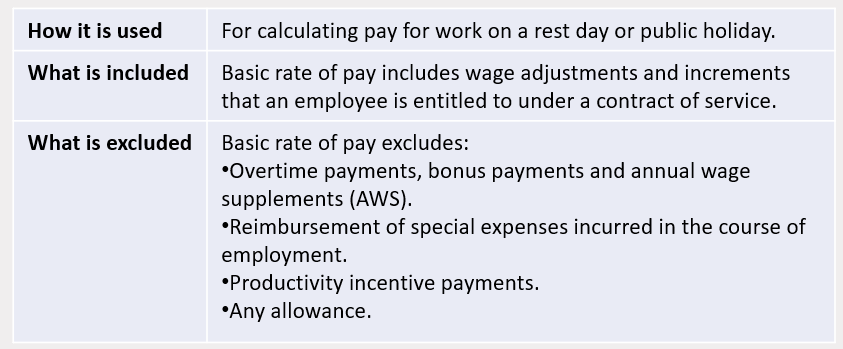

Monthly Basic Rate

According to the employment contract, this is the basic wage that an employee is entitled to according to the employment contract and does not include allowances, bonuses, incentives, or reimbursements paid. The basic pay rate is used to compute the pay for working on a rest day or public holiday and overtime pay.

How it is calculated

12 x monthly basic rate of pay

————————————

52 x average number of days an employee is required to work in a week

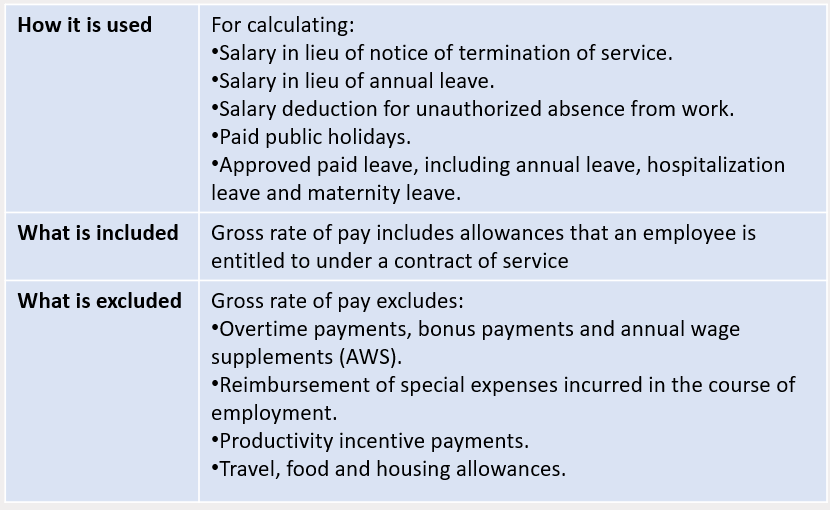

Monthly Gross Rate

For one month, it is the money payable, including allowances, to an employee. However, this does not include bonuses, reimbursements, incentives, and allowances paid for food, traveling, and housing. It is used to compute payment for paid leave/holiday, absence from work, salary instead of notice of termination.

How it is calculated

For a monthly-rated employee, for 1 day the gross rate of pay is calculated as follows:

12 × monthly gross rate of pay

------------------------------------

52 × average number of days an employee is required to work in a week

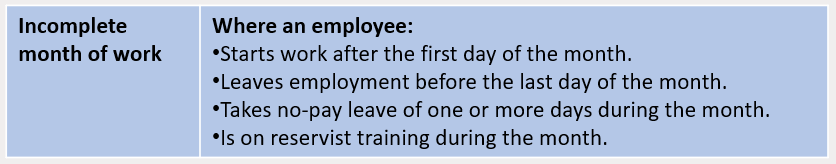

Incomplete Month and wages

A ‘complete month’ for salary is defined as any month of a calendar year. The working days of the Month exclude rest days and non-working days but include public holidays.

A situation to compute wages for an incomplete month may arise in the following scenarios, when an employee.

How it is calculated

Payment for Work done on Public Holidays (PH)

If all employees are covered under the Employment Act, then they are entitled to 11 days of public holidays(PH) a year, and for any other public holiday day, the employee and employer can mutually agree to the substitute. Employees are not entitled to the public holiday if they are on an unauthorized leave or an approved unpaid leave on the day before/after the PH.

For any urgent situations, the employer may request the employee to work on a public holiday. In this case, the employer will pay an extra day's salary at the rate of basic pay. If the employee works beyond the regular working hours on the PH, he must be paid 1.5 times his basic pay rate as overtime pay.

Click here to calculate the public holiday pay.

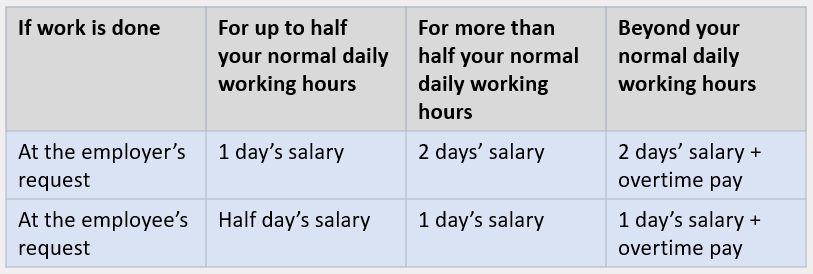

Payment for Rest Day Work

A rest day can be mutually agreed upon and can be a Sunday or any other day. Rest day is an unpaid day—the maximum number of working days is12 days between the two rest days.

How pay for work on a rest day is calculated?

Overtime on a rest day or public holiday is calculated as follows:

(Hourly basic rate of pay × 1.5 × Number of hours worked overtime) + (Rest day or public holiday pay)

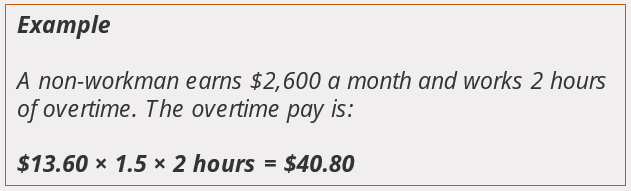

Overtime Payment

If an employee is covered under the Employment Act, then they are not required to work more than 8 hours a day/44 hours a week. Also, they are not required to work more than 6 continuous hours without a break, and the break cannot be less than 45 minutes.

Overtime can be claimed if you are:

- A non-workman earning up to SGD $2,600.

- A workman earning up to SGD $4,500

For non-workmen the overtime is capped at the salary level of $2,600/ an hourly rate of $13.60.

How overtime pay is calculated

Hourly basic rate of pay × 1.5 × number of hours worked overtime

Click here to get the correct overtime pay on time

Read more about Employment Practices in Singapore

Paid Leaves

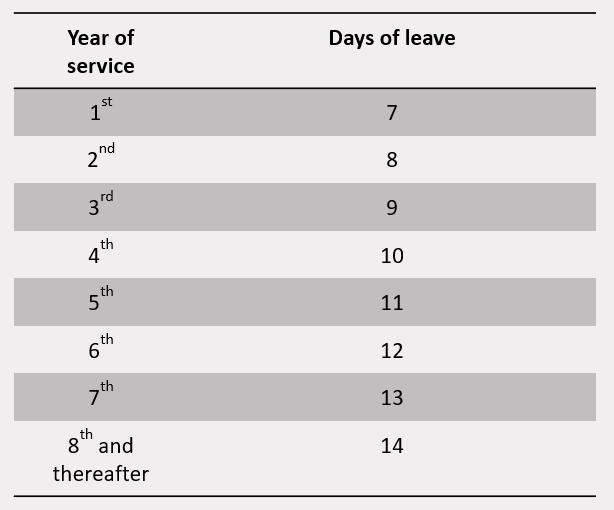

Paid Annual Leave

Depending on the employer's period of service, an employee is entitled to paid annual leave, which is 7 days for employees with a period of one year of service.

Entitlement

By one day per year additional year of service, the annual leave entitlement increases. At a maximum of 14 days, it is capped for employees whose service exceeds 8 years and above. The employer may allow employees to avail of unpaid leaves if the employee does not have adequate annual leaves.

In the event of resignation, termination, or at the employer's discretion or as per the contract terms, then the annual leaves can be encashed.

Click here to understand more about Annual leaves

Paid Sick Leave

Depending on the situation, the employee is entitled to paid sick leave if they worked for a minimum 3 months with the employer. Depending on the employee's service period, they are entitled to a number of days of paid sick leaves. The number of paid sick leaves is 14 days for employees who have worked for a minimum of 6 months.

An employee who has worked for three months at least is legally obliged to bear the medical consultation fees.

Click here to understand more about Sick leaves

Government Paid Leave Schemes

The government has introduced several paid leave schemes to conjure a pro-family system and to support young families, apart from the maternity leave of 16 weeks. This scheme consists of schemes such as,

- childcare leave

- extended childcare leave

- paternity leave

- shared parental leave

- adoption leave

Click here to understand more in detail regarding different leave types, eligibility, and more

Income Tax and Social Security Contributions in Singapore

In Singapore, the income tax system is progressive, meaning earners with higher income will pay a proportionately higher tax. Currently, the taxes rates range from 0-22 %. On an annual basis, the individual income tax in Singapore is payable and is only imposed on the income that is sourced within the country. The income that is earned outside Singapore is exempt from taxation.

In Singapore, employers are not responsible for withholding taxes on employees' monthly pay; therefore, it is employees' responsibility for filing their taxes and paying it directly to the local tax authority, 'Inland Revenue Department(IRD).'

On the other hand, statutory benefits refer to all the advantages the Singapore government provides to its residents, promoting population welfare through different schemes/insurances.

In Singapore, the Social Security system has mainly three aspects,

- Social welfare where Central Provident Fund(CPF), plays the key role in Singapore's comprehensive social security system

- Retirement

- Healthcare

Below, we will cover in detail regarding the Income tax and Social Security Contribution in Singapore.

Individual Income Tax In Singapore

In Singapore, the personal income tax is one of the world's most competitive and friendliest structures. The tax year in Singapore begins from 1 January till 31 December in each calendar year, and income is assessed on the preceding year basis.

In Singapore, the personal income tax rate is one of the lowest in the world. For an individual in order to determine the Singapore income tax liability, you need first to determine the tax residency and chargeable income amount and then apply the progressive resident rate to it.

Mentioned below are the key points of income tax in Singapore for individuals,

Who Is Eligible to Pay Singapore Personal Income Tax?

In Singapore, if anyone earns, receives, or derives income, will need to pay income tax every year, except if exempted under the Income Tax Act or by an Administrative concession.

The tax residency determines the Income Tax Liability in Singapore, the taxable amount of income, and then will apply the progressive tax rate to it. Therefore, all individuals who earn an annual income of SGD 22,000 or more will need to file their income tax with IRAS.

Personal Income Tax Rates for Residents

Individual tax liability will depend on the individual's tax residency status and tax rates in Singapore. For a particular Year of Assessment (YA), they will be treated as a tax resident if they are a:

- Singapore Citizen

- Singapore Permanent Resident(SPR), who lives in Singapore with a permanent home, or

- A foreigner who has resided or worked in Singapore for 183 days or more in the previous year, i.e., the year before YA.

Otherwise, for tax purposes, they will be treated as a non-resident of Singapore.

Here’re the personal income tax rates for residents:

Personal Income Tax Rates for Non-Residents 2021

In Singapore, for Foreigners(Non-Resident) working, the following conditions are applicable for their income taxability :

- In a calendar year, if you are working in Singapore for 60 days or less, on your earnings, you will be exempt from tax. This exemption will not apply to non-resident company directors, public entertainers, professionals that include speakers, foreign experts, trainers, coaches, etc.

- If you reside or work in Singapore for 61 to 182 days, your income is taxed at 15% or resident rates for individuals, whichever gives the higher tax

- If you stay in Singapore for 183 days or more in a calendar year, your income is taxed at resident rates for individuals.

- For a straight year, if you stay in Singapore for at least 183 days over 2 years, your income is taxed at the individual's resident rates.

- If you stay in Singapore, your income for all these years is taxed at resident rates.

Here’re the personal income tax rates for non-residents:

For more information, refer to the IRAS site for tax rates for resident and non-residents.

Difference in the Tax Treatments of a Resident and Non-resident

Components for Filing Your Personal Income Tax in Singapore

For filing your Personal Income Tax, there are three components,

Income

There are two types of income, taxable and non-taxable incomes,

Following are the example of taxable income,

- Employment Income

- Salaries

- Bonuses

- Director’s Fee

- Self-employment income from Trade, Business, Profession or Vocation

- Rental Income

- Withdrawal from SRS

Listed below are the examples of non-taxable income,

- Pensions

- Capital gains from stocks and property investments

- Winnings from 4D, TOTO, horse betting and soccer betting.

- CPF Life Payouts

For more information, refer to this IRAS site for a full list of taxable and non-taxable incomes.

Deductions

Deductions refer to any allowable expenses you incurred or approved donations you made during the year.

Listed below are the example of deductions,

Tax Reliefs

By the government, tax reliefs are given to recognize your contributions towards Singapore's most important social objectives like family planning, retirement, health. From your chargeable assessable income, they are deducted, which means you can pay less income tax. To the total tax reliefs amount, do note that a personal income tax relief cap of $80,000 applies and is claimed for each YA.

Most common ones which you might qualify for, includes:

- Staying with your parents

- Having Children

- Through National Service serving the country

- Planning for your retirement, means topping your CPF account.

For more information refer to the full list of qualifying reliefs, expenses, donations on IRAS site.

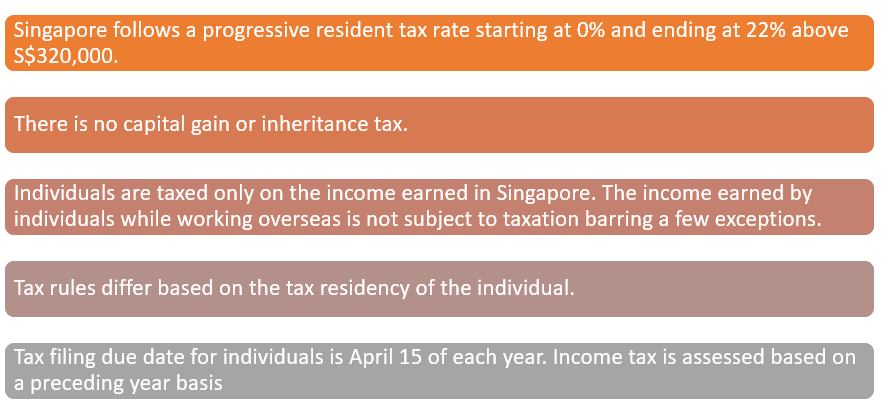

Sample personal income tax calculation

Step-by-step Process for Filing Personal Income Tax in Singapore

Step 1 - Log in to IRAS Tax Portal

Log in to IRAS Tax Portal using your SingPass, to file your taxes. Now, 2FA log-in is required, so you will need to enter a passcode sent to your mobile phone via SMS.

Alternatively, you can download the SingPass Mobile App. Then, log in by scanning a QR code. It is faster than trying to recall your password. Furthermore, if you forgot your password, you can head to the nearest community center during operating hours to reset it in person.

Below is a screenshots of myTax Portal when you e-File via mobile phone.

Step 2 - Check your total income

After you log in, go to Individuals>> Filing Matter and File Income Tax Return.

Here, you can check your total income for the year, in case you are a salaried employee. Based on your CPF contribution, this shall already be displayed.

You will need to manually enter your income, in case you are partially or fully self-employed. For more information refer to the IRAS guide for the self-employed.

Step 3 - Declare any additional income

Here, you need to declare any other income that you have earned outside of your job. This includes,

- Trade or business income earned.

- Income from Government Grants (COVID-19-related payouts, Jobs Support Scheme, Special Employment Credit or Wage Credit Payouts)

- Rent from Property

- Gains, dividends and interests from certain investment types.

- Annuities payouts

- Maintenance and alimony payments

- Trust or estate income

Step 4 - Check tax reliefs & deductions

In the next part, you can try and reduce the tax payable amount through tax relief and deductions such as,

- Course Fees Relief

- CPF Cash Top Up Relief

- CPF Relief

- Earned Income Relief

- Handicapped Brother/Sister Relief

- Life Insurance Relief

- NSman (Self) Relief

- Parent/Handicapped Parent Relief

- Supplementary Retirement Scheme (SRS) Relief

After these details are entered, the system will auto-calculate the tax relief amount you are entitled to. The tax relief amount will be deducted from your total taxable income.

Step 5 - File away

After the above details are filled, you need to check that the tax return is accurate, submit the form online and you are done.

You can file the tax from 1 Mar 2021 to 18 Apr 2021. To avoid the penalties, make sure you file your taxes on or before the deadline.

Step 6 - Check your Notice of Assessment

After you file your taxes, a few weeks later, you will receive a Notice of Assessment(NOA), that is your income tax bill. The NOA will let you know how much amount you pay in taxes and the deadline.

NOA will be sent to you home by post. By logging into the IRAS MyTax portal, you can access your digital copy of your NOA.

You need to check if the NOA received is correct, and in case you have any concerns, within 30 days of receiving your NOA, you can log in to IRAS myTaxPortal and select “Object to Assessment”. Supporting evidence needs to be provided and IRAS will review your objection.

For more information refer to IRAS’ guide on objecting to your NOA

What Is the Personal Tax Filing Due Date?

Under the law, it is compulsory to file your annual personal tax returns to IRAS by 15 April (Paper Filing) and 18 April (E-filing) every year. To avoid paying fines and court prosecution, IRAS diligently enforces the requirements relating to filing personal tax.

On a preceding calendar year basis, income is taxed, ending 31 December. You need to file your annual Tax form by 15/18 April of the following year. IRAS may raise the estimated assessment if the tax return is not filed by the 18 April deadline. The income tax bill is expected to be received from May to August.

What Happens If You File Your Taxes Late or If You Do Not File Your Tax?

If you fail to file your taxes by the deadline, IRAS will do the following,

- A late filing fee will be imposed, not exceeding $1,000;

- IRAS will issue an estimated Notice of Assessment (NOA); and

- Summon you to Court.

If IRAS issues an estimated NOA based on your past years' income or information available to IRAS, you must:

- Pay the estimated tax within one month from the date of the NOA.

- File your Tax Return. You should file your tax return immediately. Upon revision of the estimated assessment, any excess tax paid will be refunded.

Methods to Pay Income Tax in Singapore

There are several methods you use to pay your taxes:

GIRO

Majority of the Taxpayers use this method for paying taxes

Electronic Payment Modes

- PayNow QR

- Internet Banking Bill Payment

Internet Banking for tax payment is made available by the following banks: BOC CIMB Citibank DBS/POSB HSBC ICBC MayBank OCBC RHB Standard Chartered Bank State Bank of India UOB

(BOC, CIMB, Citibank, ICBC, MayBank, RHB and State Bank of India are applicable for individual account holders only). - DBS PayLah! Mobile App

Pay your tax via DBS PayLah! - Phone Banking

Phone Banking service for DBS/POSB, OCBC and UOB account holders who have subscribed to this service. (DBS/POSB and OCBC are applicable for individual account holders only.) - ATM

Only available at DBS/POSB or OCBC Automated Teller Machines. - AXS

- SAM Kiosk

- SAM Web / SAMMobile

- NETS

Only available over the counter at the post office. - Internet Banking Fund Transfer

Telegraphic Transfer

Telegraphic Transfer is used only for payments from overseas.

What Is the Penalty for Paying Your Tax Late?

You will incur late charges if you miss your payment due date.

Following are the late payment penalties

- For every month, 5% and subsequently an additional 1% (up to a 12 % maximum of the outstanding tax)

- Regarding this 5% late payment penalty, a letter will be sent to you.

- To avoid further penalties, you need to make payment before the due date stated in the letter.

Social Security - Central Provident Fund (CPF) Singapore

Studying how CPF contribution works may be a hassle; however, it is not rocket science. In Singapore, as an employer, you play an essential role in building an employee's safety net for their retirement years.

Further, you will read everything you need to understand regarding CPF contributions that employers need to pay for full-time, part-time, temporary, casual employees who are,

- Singaporean Citizens or Permanent Residents

- Earning more than $50 in a month

- Employed under a contract of service

What Is the Central Provident Fund (CPF)?

In Singapore, the Central Provident Fund(CPF) is an extensive social security savings plan. It gives many working Singaporeans financial security for their retirement years, including lifelong income, healthcare financing, and home financing.

You need to make the CPF contributions for staff who are,

- Singapore Citizens

- 3rd Year and Onwards Singapore Permanent Residents (SPRs)

- 1st and 2nd Year SPRs jointly applied with their employer(s) to contribute at total employer-full employee rates.

What Type of Allowances and Payments Attract CPF Contributions?

You may remunerate your employees with other payment types for their Work, apart from the monthly salary and annual bonus. For following payment types will be part of your employees CPF contribution as well,

- Basic Wages

- Overtime Pay for employees with basic monthly salaries not exceeding SGD 4500 and SGD 2600, respectively.

- Cash Incentives

- Allowances

- Bonuses

- Commission

For more information, check out the entire list of allowances and payments that attract CPF contributions.

Alternatively, try a free Deskera People that automatically calculates CPF, taxes, and more in your payroll process.

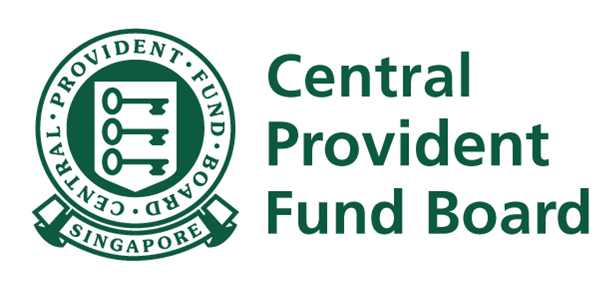

CPF Contribution Rates for Singaporean Employees/Employers?

When paying your employees every month, your employer needs to withhold the portion of your pay that goes into your CPF accounts.

As your employee's contribution, that portion will be paid into your CPF accounts.

Apart from the employee's CPF contribution, there is also an employer's CPF contribution. The employer needs to pay this amount into your CPF accounts out of their own pocket on your stipulated salary.

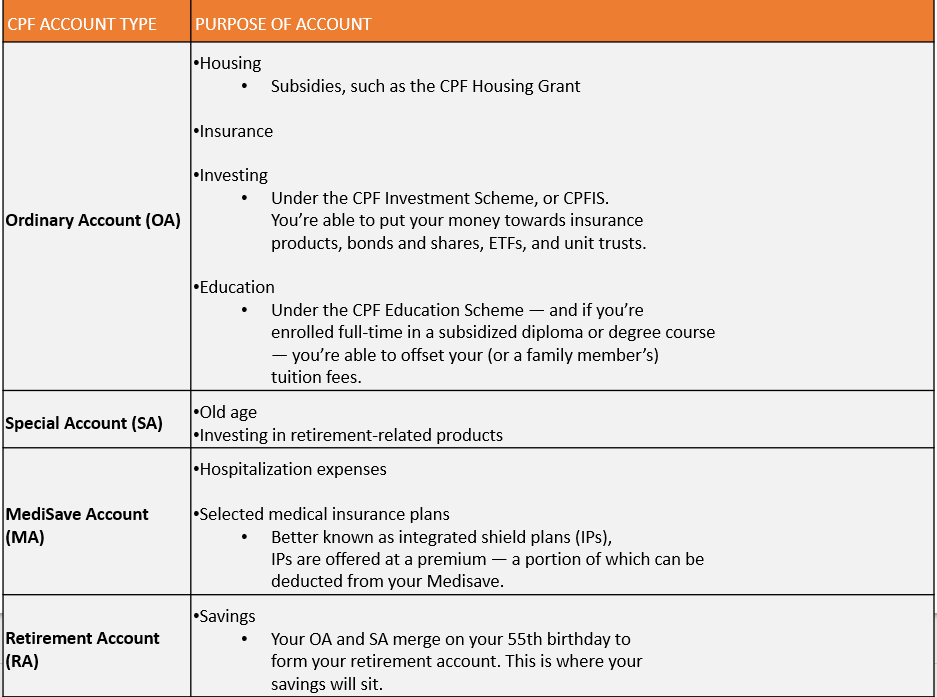

Here's how much (by the percentage of your wage) each person contributes:

Note on CPF contributions for 55 & above: CPF contributions for older workers will be gradually adjusted upwards, over the next 10 years to meet the full contribution rate of 37%(Employee + Employer). Only after the age of 60, the CPF contribution rate will drop.

In case you are self-employed, none of the above applies to you. Any CPF contributions are voluntary, except for the Medisave contributions, which you need to pay after filing the taxes each year.

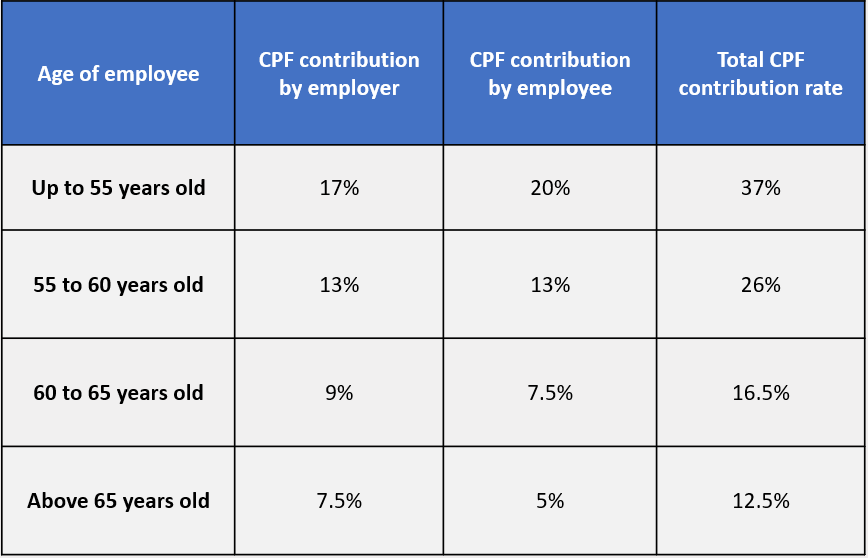

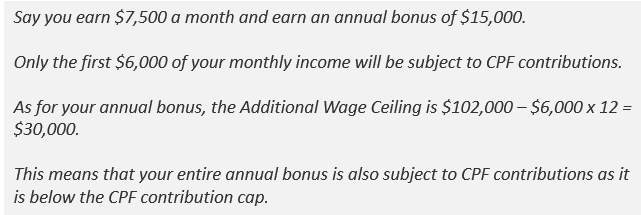

Example

What Is the CPF Contribution Cap For Employees?

There is a limit you can contribute to your CPF account each Month. It is called a CPF Wage Ceiling, which is a form of CPF contribution cap. There are two parts if this Wage Ceiling,

- Ordinary Wage Ceiling

- Additional Wage Ceiling

Ordinary Wage Ceiling

On your monthly salary, it is a CPF contribution cap and is currently capped at $6,000. So that means, of your monthly salary, the first $6,000 is subject to CPF contributions. For any above amount will not have a portion deducted for CPF. It means your employer will not contribute you your CPF account for amounts above $6,000.

Additional Wage Ceiling

It is a CPF contribution on your additional wages, such as bonuses. The formula is $102,000 – Ordinary Wages subject to CPF for the year for calculating wage ceiling.

Example

Different Types of CPF Contribution and Allocation Rates in Singapore

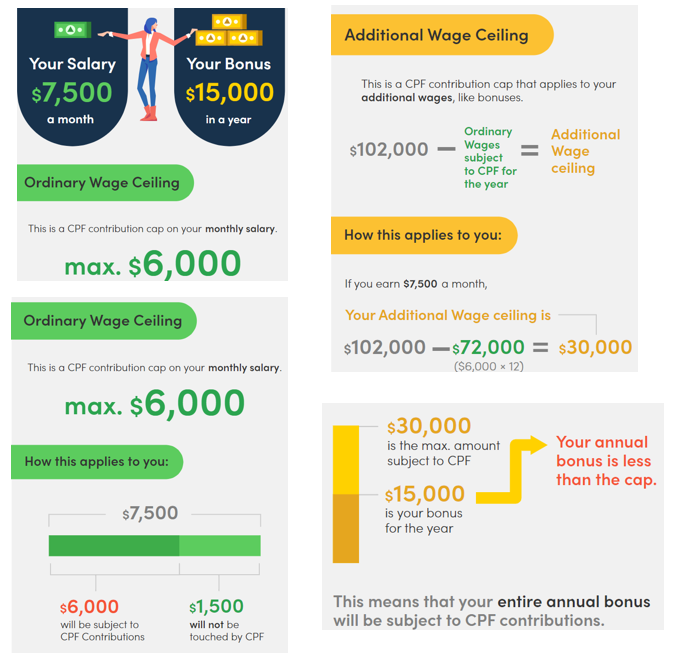

Your CPF contributions are divided into four CPF accounts.

- Ordinary Account (OA)

- Special Account (SA)

- MediSave Account (MA)

- Retirement Account (RA)

Later, at the age of 55, the account, which is automatically opened on your behalf, combines your OA and SA funds.

CPF Account Types and Allocation Rates

Mentioned below are the detailed functions of each account and their allocation rates.

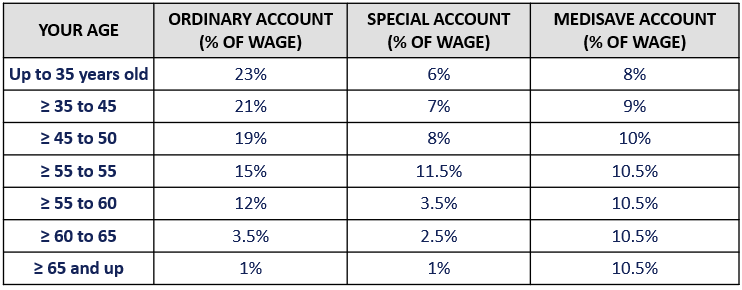

Your money isn’t equally allocated between each of your accounts. This overview shows how your salary contributions vary with age — and only applies to salaried employees drawing a monthly income of S$750 or more.

CPF Allocation Rates

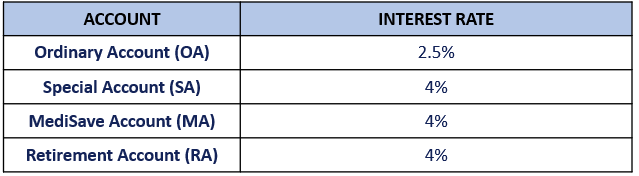

Interest rates

In addition to the above-listed interest rates per annum, you will get an extra 1% interest on the first $60,000 of your combined CPF balances — of which up to S$20,000 can come from the OA.

Older Singaporeans aged 55 and up also get an extra 1% interest per annum on the first S$20,000 of their combined CPF balances.

Permanent Residents’ (PR) CPF Contribution

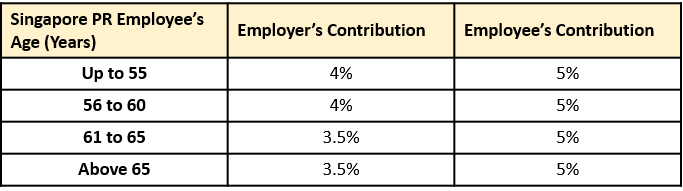

There is no difference in the Permanent Resident Employees CPF contribution from that of Singaporeans, except for the first 2 years when an employee gets their PR status. In the first 2 years, both the employees and employers pay a lower contribution.

With a monthly salary of $750 or more, for 1st year PRs their contribution (by % of Wage) differs by age, as below,

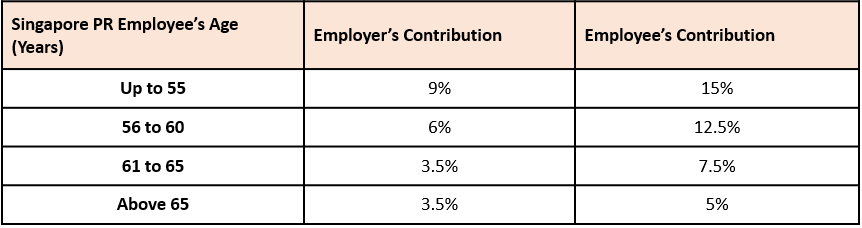

With a monthly salary of $750 or more, for 2nd year PRs their contribution (by % of Wage) differs by age, as below:

Like Singaporeans, PRs who earn less than $50 will not receive any CPF contributions. However, those who earn more than $50 to under $750 will receive the same employer's CPF contributions but lower employee CPF contributions.

For the PR employees, the employer will also have an option to make full CPF contributions. After the PR employee becomes a 3rd year PR, full CPF contributions, like Singaporeans, need to be paid.

How to Pay Employee CPF Contributions

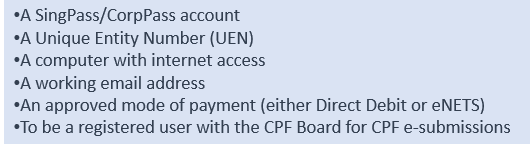

Employee CPF contributions can be paid online, via the CPF e-Submit@web portal

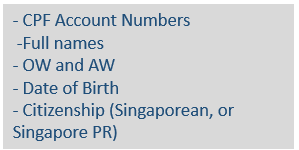

In order to use the CPF e-Submit@web portal, you will need:

If you have just started your company, or manually have been submitting the CPF contributions, and need to switch to the web portal, then in this case you, before accessing the web portal will need to submit an application.

After you get the access to the web portal, then you need the below details of your employees to pay their CPF contributions.

If you fill in the above listed details, the system will calculate the CPF contribution automatically that you will make for each employee, considering their wages, ages and citizenship. You can make the payments via Direct Debit/eNETS.

You do not need to pay the processing fee of $7 per employee per month, if you submit the CPF contributions online.

Incase, you do not have an access to a computer, you can also e-submit CPF contributions details via, any mobile device with the help of free “CPF e-Submission” mobile app, or via any AXS station using “CPF e-Submit@AXS” portal.

When Must I Pay My Employee CPF Contributions?

You need to pay CPF contributions on the last day of the calendar month. It means, if you forget to pay CPF contributions on the 31st January, then you will have up till 14th February to pay the contribution.

If you fail to pay the contributions, late payment interest will be charged at 1.5% per month from the due date.

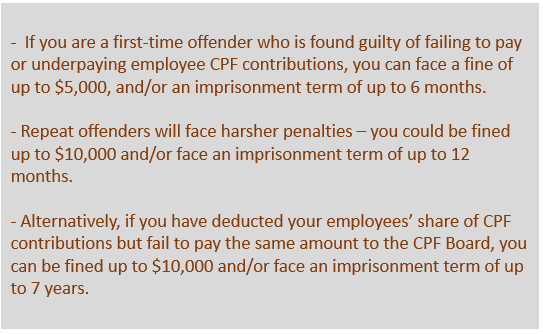

What Happens If I Fail to Submit My Employee’s CPF?

Incase, you fail to pay or underpaid employees CPF contributions, you will be imposed with below penalties,

How to Generate CPF E-Submission TXT File in Deskera People?

Self Help Group Funds (SHGs) CDAC, ECF, MBMF, SINDA

To the SHGs Fund, in the CPF contributions, there are also following contributions,

- CDAC

- ECF

- MBMF

- SINDA

These funds help to uplift the low income households and low privileged in the Chinese, Indians, Muslims and Eurasian communities.

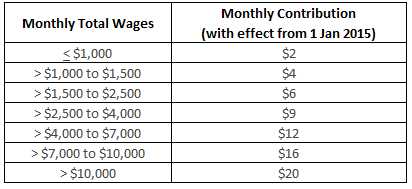

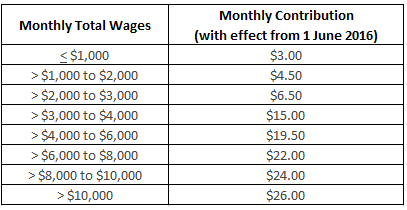

Chinese Development Assistance Council (CDAC) Fund

Each employee’s who belongs to the Chinese community and are Singapore Citizens and PR’s will need to contribute to the CDAC fund as per the wage levels below,

Eurasian Community Fund (ECF)

Employees who belongs to the Eurasian community and who are Singapore Citizens and PR’s will need to monthly contribute to the ECP as per the wage levels below,

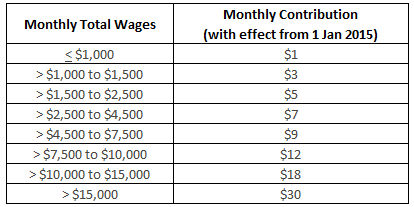

Mosque Building and Mendaki Fund (MBMF)

Employees who are Muslims, and who are Singapore Citizens, PR’s and foreign employees, will need to contribute to the MBMF as per the below wage levels,

Singapore Indian Development Association (SINDA) Fund

Employee’s who belongs to the Indian Community and who are Singapore Citizens, SPR, and Employment Pass holders will need to monthly contribute to the SINDA Fund as per the below wage levels,

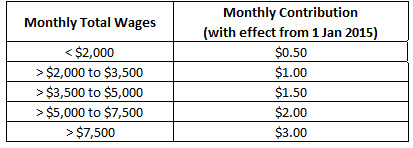

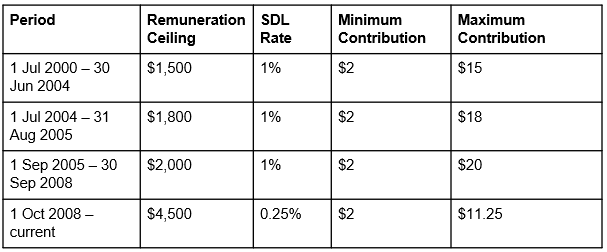

What Is The Skills Development Levy (SDL)?

All Singapore based companies will need to pay a Skill Development Levy(SDL) for all their employees (Local and Foreign) if they are hired on a permanent, part time, casual or temporary role. It is on the top of the employer CPF contribution for local employees and Foreign Worker Levy(FWL) for foreign employees.

Many employers will need to pay the SDL at the point of making the employer and employee CPF contributions for their employees each month. As the CPF board collects the SDL, it is actually on the behalf of Skills Future Singapore Agency (SSG).

SDL Contribution Table

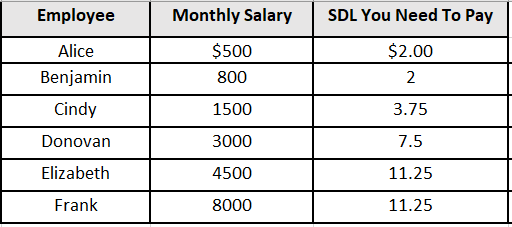

How Much Skills Development Levy (Sdl) Do I Have to Pay for Each Employee?

To calculate the SDL, on the SkillsFuture website you can use the Skills Development Levy Calculator to calculate how much you need to pay the SDL.

Of an employee’s total monthly wages, up to the first in general you need to pay 0.25%. For employees a minimum of $2 is payable, who arn under $800 each month, and maximum of $11.25 is payable for employees who earn more than $4,500.

Types of Employees Excluded from the Skills Development Levy (SDL)

Usually, companies will need to pay the SDL on all their employees. However there are few exceptions,

- Employees hired outside of Singapore

- Employees hired locally, but work outside of Singapore

- Fees paid to directors

- Self-Employed Persons

- Interns

- Employees hired by individuals

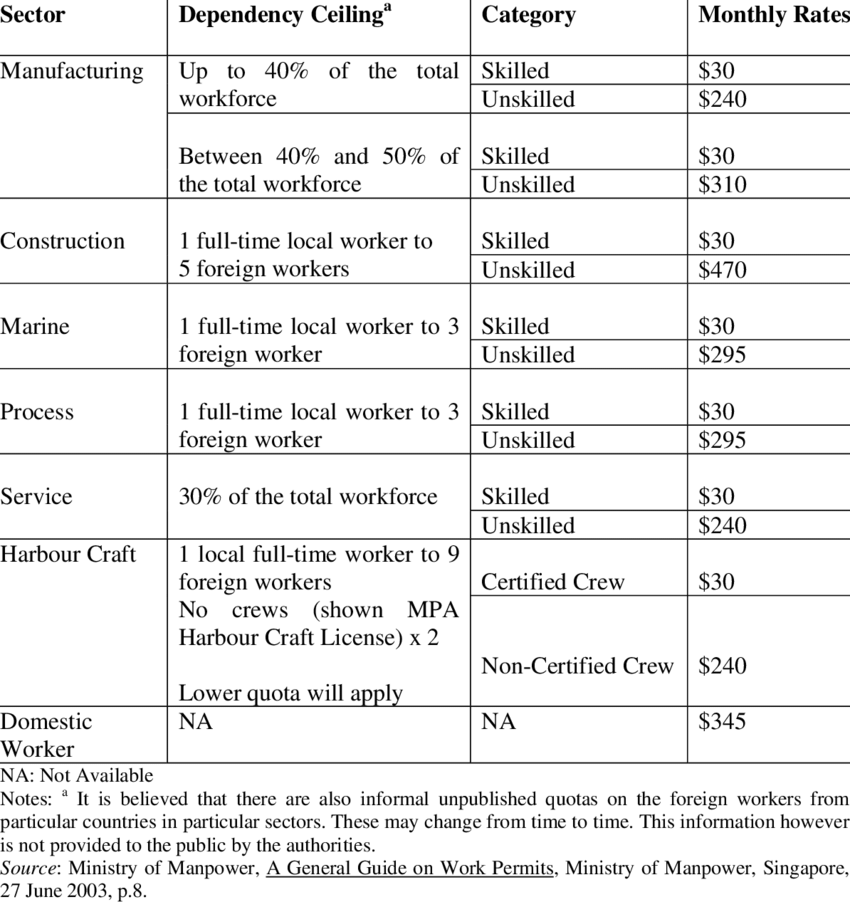

What is Foreign Worker Levy (FWL)

The Foreign Worker levy is a pricing mechanism to regulate the amount of foreign manpower in Singapore. It is not applicable to Singaporean Permanent Residents.

Who Should Pay for Foreign Worker Levy?

For the Work Permit Holders(WPH), employers are required to pay Foreign Worker Levy. The levy liability begins from the day the Temporary Work Permit or Work Permit is issued, whichever is earlier. It will end when the permit is cancelled or has expired.

How Is the Levy Amount Calculated

There are 4 things that will affect the levy amount that is applicable for work permit holders.

- Dependency Ceiling

- Worker’s Qualification

- Workers on Man-Year Entitlement (MYE) or MYE-waiver scheme

- Company Sector

Foreign Worker Levy Rates

Additional Read:

Complete guide to CPF and CPF contribution in Singapore

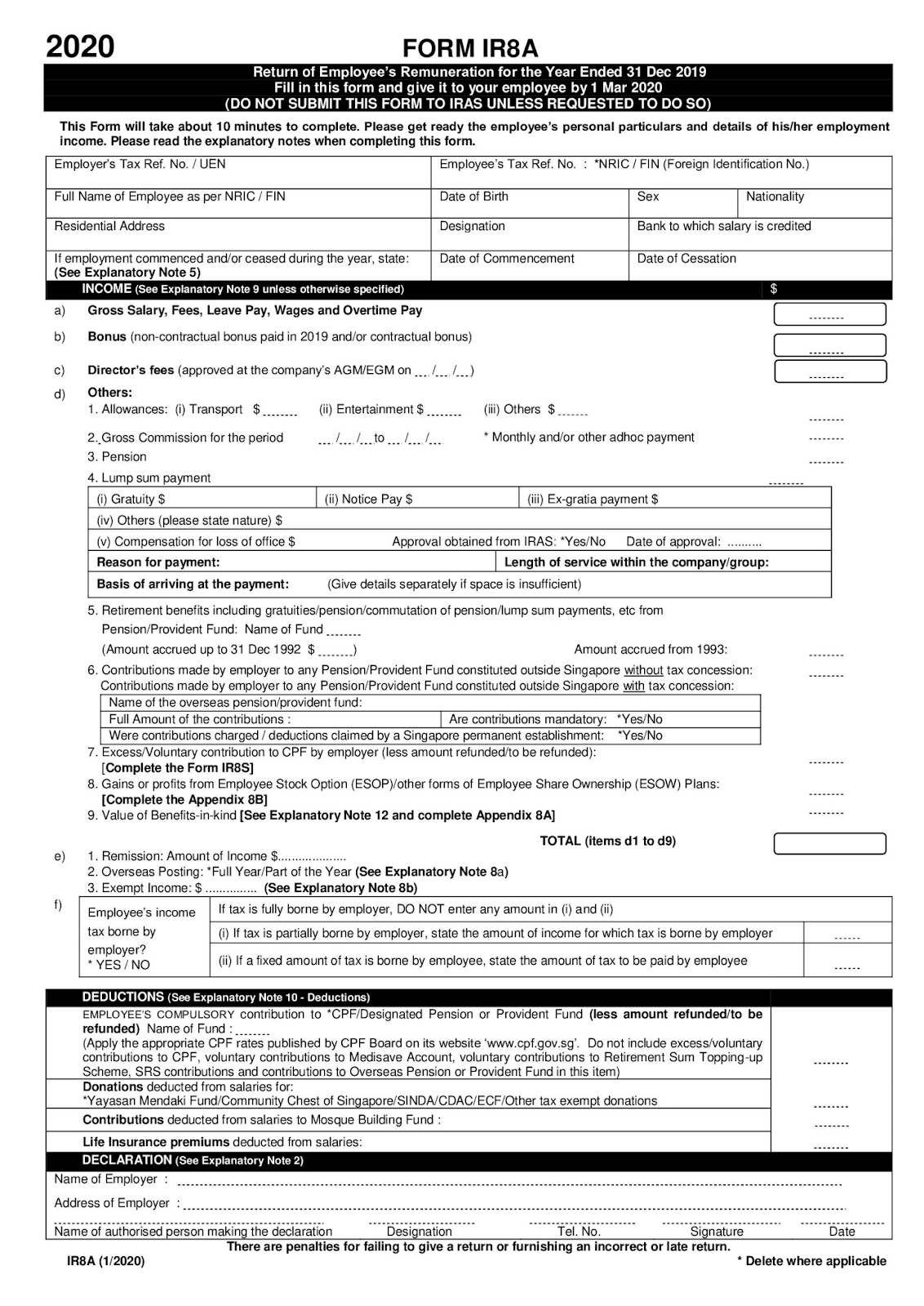

Reporting Employee Earnings (IR8A, Appendix 8A, Appendix 8B, IR8S)

Each year by 1 March, employers are required by the Income Tax Act to prepare Form IR8A, Appendix 8A, Appendix 8B or Form IR8S for employees who are employed in Singapore.

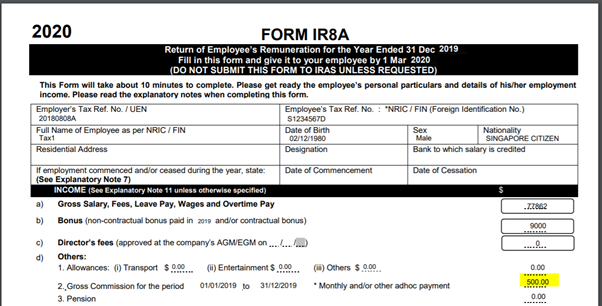

IR8A Form

Form IR8A is a mandatory document in Singapore that contains details on employee’s earnings.

Depending on the various working situations of your employees, you will need to prepare Appendix 8A, Appendix 8B and Form IR8S. For the preceding year, they are issued by the employer and relate to employee’s income.

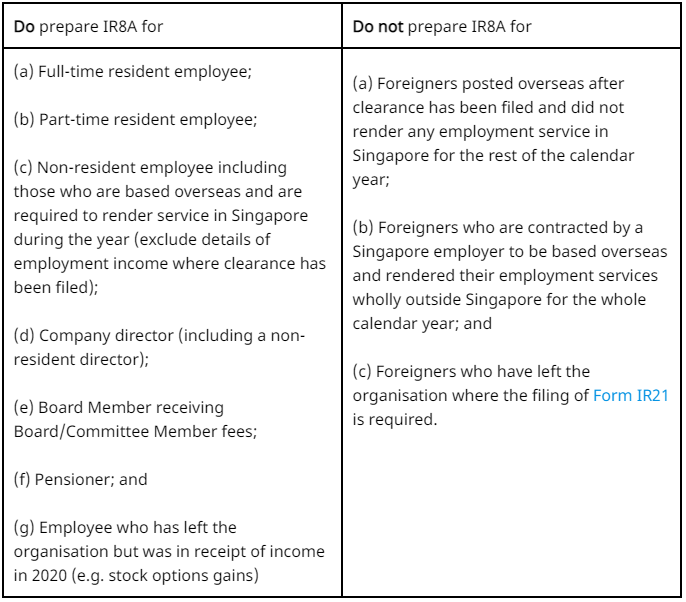

For Whom Does the Employer Prepare IR8A?

Tax residents refer to Singapore Citizens, Permanent Residents and foreigners who have worked for 183 days or more.

How Do You Submit Form IR8A in Singapore?

Submit Through AIS

For Singapore employers the Auto-Inclusion Scheme (AIS) for Employment Income allows the filing of the IR8A information electronically. Then the information submitted will be automatically included in the employees income tax assessment, that will make things easier for both employer and employee.

AIS participation is mandatory for all employees with 6 or more employees, and it is an option for employers with 5 or fewer employees.

For the records, you need to provide to your employees with individual IR8A copies.

Via IRAS service, you can double check if you have any doubts as to whether your company is registered for AIS.

Submit Manually

You can also submit your IR8A form manually on or before December 2022. Click here to download the offline application IR8A forms.

Also, to your local and foreign employees, you need to provide IR8A and related forms before 1 March so that they can fill by themselves.

Downloading IA8A Form Using Deskera People

Automate your payroll and submit your Form IR8A now for free. Just sign up for a 30-day Free Trial with Deskera People!

What Are Appendix 8A, Appendix 8B, and Form IR8S?

Along with IR8A form, these three documents are filed together for the same group of employees. If they do not then, you only need to file IR8A for them.

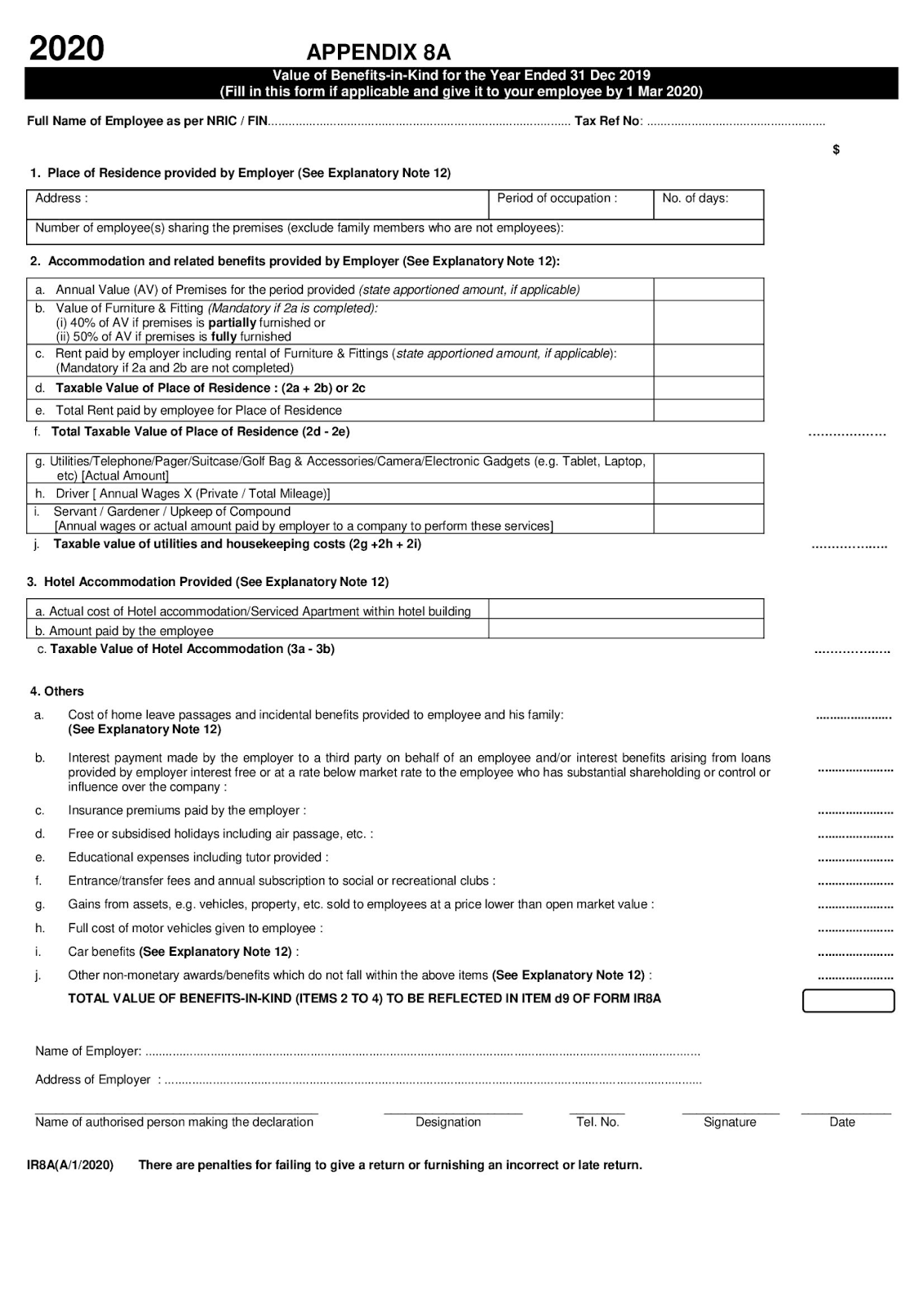

Appendix 8A

If you employee’s are provided with benefits-in-kind, all perks that you offer them, which does not include salary: Gym membership, a French class, a medical insurance, etc, then you must complete Appendix 8A form

In the Appendix 8A, employers need to declare the benefits-in-kind unless the benefits-in-kind are granted an administrative concession or exempted from Income Tax.

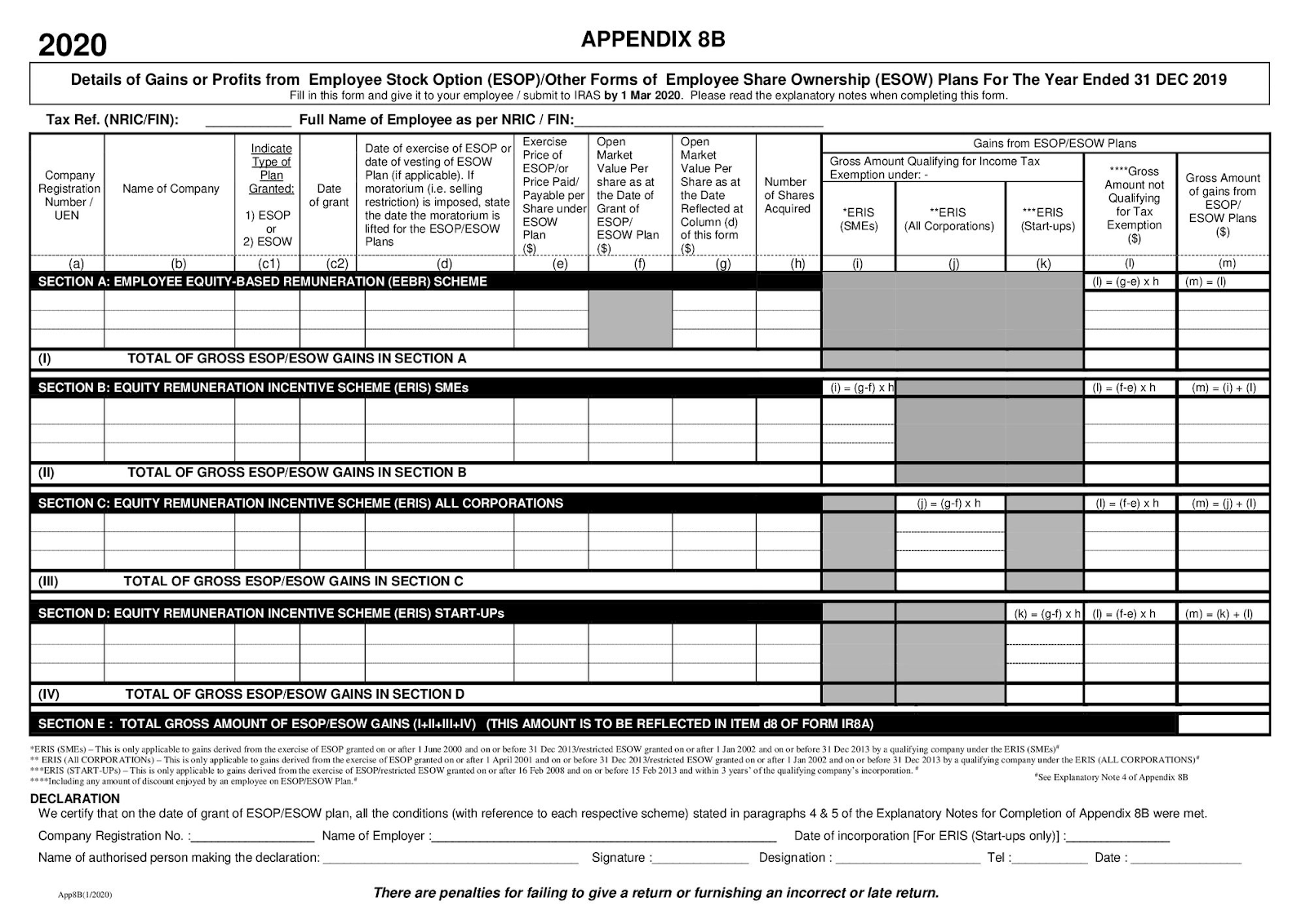

Appendix 8B

Appendix form must be completed if you are an employer who derives profits and gains from Employee Stock Option (ESOP) Plans or other forms of Employee Share Ownership (ESOW) Plans.

In case an employee has ESOP or ESOW plans, he can either buy or own shares in the company. Any gains and profits will be taxed from the share option.

Downloading Appendix A and Appendix B Form Using Deskera People

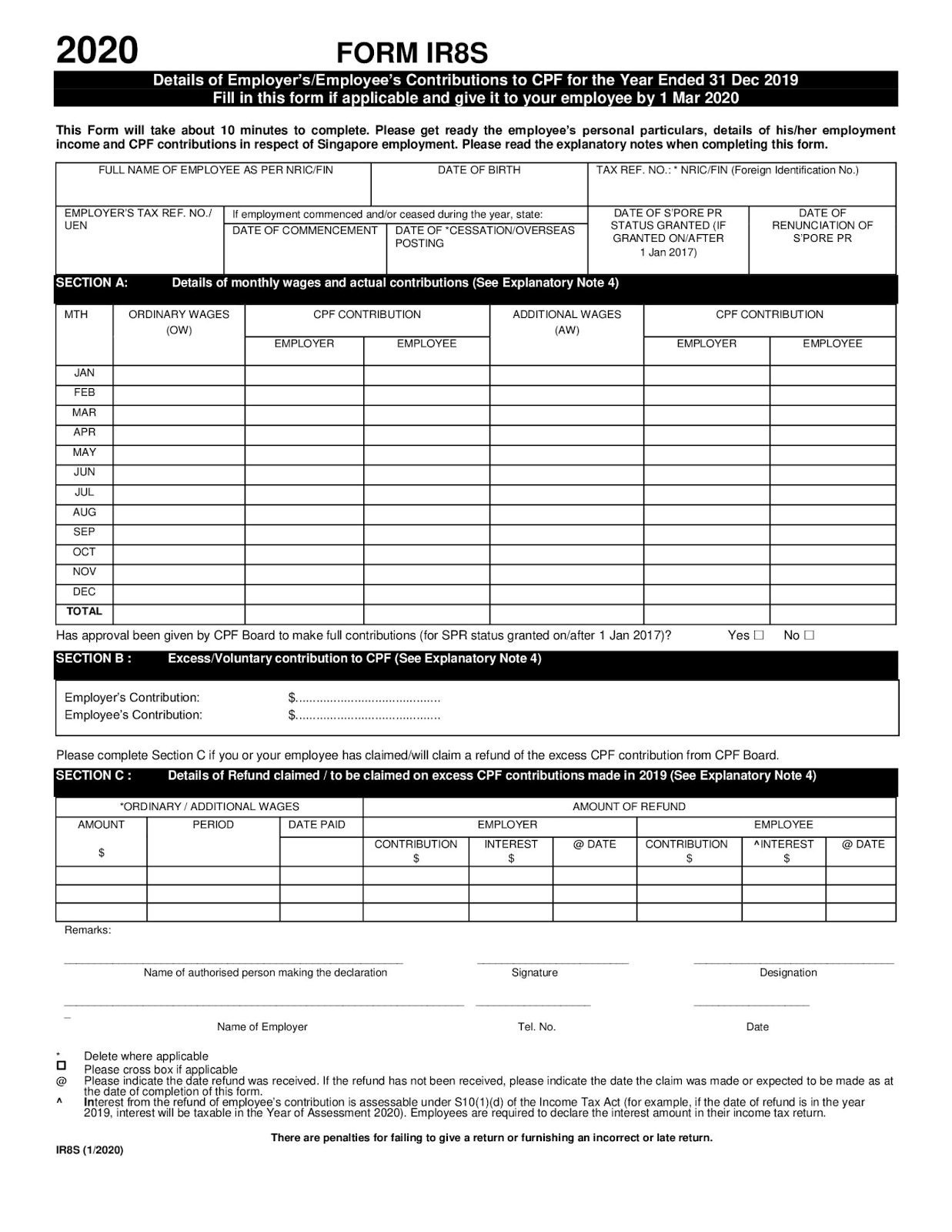

IR8S Form

If you are an employer, you need to complete an IR8S form incase has made an excess CPF contribution on your employee wages or have claimed a refund on excess CPF contributions.

Downloading IA8S Form Using Deskera People

Refer to the video tutorial for how to set up a Singapore Payroll in Deskera People

Selling in Singapore? Head over to our guide on GST in Singapore

Conclusion

Deskera People is a payroll software developed especially for small and medium enterprises (SME). Deskera People also supports auto computation for Income Tax and CPF contributions. All these taxes and contributions to IRAS are made easy with the readily available auto-generated reports from the system.

Sign up for a free trial of Deskera People now!

.