31% of the USA’s working population is self-employed. That makes it more than 35 million people. If you think that the government is not going to charge taxes from such a huge number of working individuals, you are mistaken.

You may get away with not paying for a burger you had at a restaurant, but getting away with tax charges is not possible unless you are willing to pay for the consequences later. Don’t worry, we are not here to scare you but to provide you with the right information to help you understand why and how you need to pay your taxes if you are self-employed.

This article has complete information starting from who is considered to be self-employed to how you can file your taxes. Let's not waste much time and your energy and dive into the information directly. Yes, you can thank us when you are done reading this article.

What will you find in this article –

- What is Self-Employment?

- What is Self-Employment Tax?

- How much is Self-Employment Tax?

- Example of Self Employment Tax

- How to File Self Employment Tax?

- How Can I Save on My Taxes?

- Self-Employment Tax FAQs

- Conclusion

- How can Deskera Help You?

- Key Takeaways

- Related Articles

What is Self-Employment?

To understand how self-employment taxes work, you need to understand who falls in the category of self-employment as per the government. Per say everyone who is working for themselves is self-employed. A freelancer, a small business owner, an individual contractor, etc.

You are meant to pay self-employment taxes if you are an individual proprietor, an agent working alone, a solo dealer, a real estate agent if working alone, a freelancer, or a small business owner if you are running the show on your own. You are also eligible to pay self employment taxes if you are a partner in a company and still have a side business of your own. If you fall into these categories you will be considered self-employed as per Internal Revenue Service.

Self-employment and self-employment taxes are different for people employed by companies and other individuals. Employed income makers receive their income after the tax amount is deducted by their employers. Since self-employed income makers are their own employers, they have to deal with the taxes themselves too.

What is Self-Employment Tax?

Filling self-employment Taxes can be mind-boggling. You can do it in two ways. One, you can hire an accountant who can do it for you, or learn how to file taxes as a self-employed income maker. Either way, learning about self-employment taxes is a must.

The Internal Revenue System (IRS) of the USA makes it mandatory for the company as well as the employees to pay social welfare taxes for Medicare and Social Security. When a person is self-employed, in the eye of the IRS they are treated as the company as well as the employee. This means they have to pay both the shares of taxes.

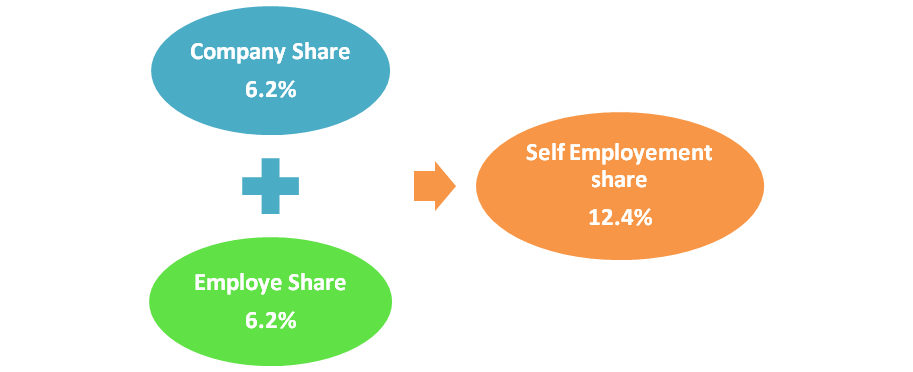

Social Security Tax

Internal Revenue Service has set social security tax in two shares. 6.2% from the employee and 6.2% from the employer company. Since a self-employed individual has to pay both the shares the calculation looks like this.

Company share – 6.2%

Social Security tax is only applied to a certain amount of your earnings each year. IRS decides this amount each year. For the year 2021, the amount was first $142,800 of your income. For the year 2022, it is the first $147,000 of your income. Remember, this calculation is only for self-employed individuals and not for employees.

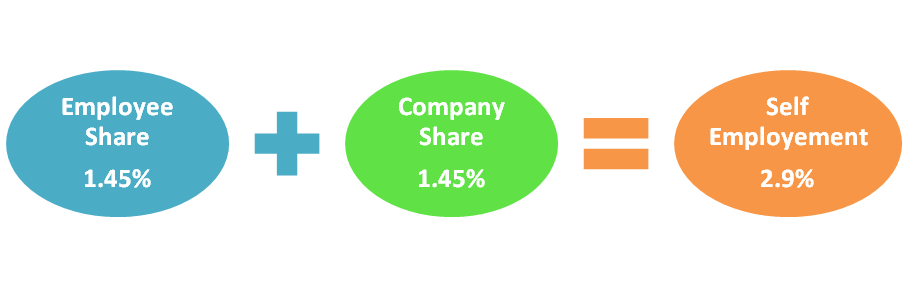

Medicare Tax

Medicare taxes again is a very important tax that covers a person’s medical insurance. IRS demands the employer company to pay a share of 1.45% of the tax and the employee to pay 1.45% of their income. In the case of self-employment, the individual has to pay both shares on their own. The calculation for the same will be as follows:

Medicare tax is applied on whatever amount of income you make since you are both the employee as well as the employer.

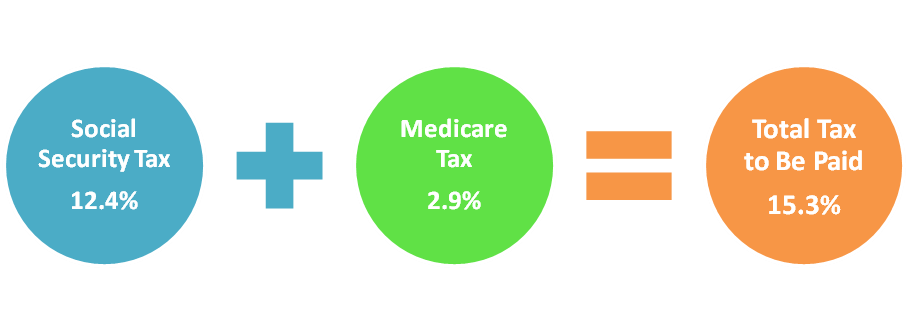

Total Tax

A self-employed individual has to pay Social Security tax as well as Medicare tax. The calculation for the same combined will be as depicted below:

Your net income will not make a lot of difference here. Both the taxes are to be paid separately. In total, the tax amount would make 15.3%.

How much is Self-Employment Tax?

The rate of self-employment taxation is 15.3%. The rate is divided into two components: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance).

Example of Self-Employment Tax

We have discussed enough about the percentage of tax you have to pay as a self-employed person. Here is an example of how it works in real.

Self-employment tax is paid on 92.35% of the net income and not on 100% of the income. Larisa is a marketing consultant. A business has multiple expenses like paying for client meetings, rent for office space, stationery supplies, SaaS purchases, etc. After deducting all the expenses her net income for the year 2020 is $200,000.

The tax will be applied to her net income. The calculation will be as follows:

92.35% * $200,000 = $184,700

Now, Larisa has to pay Medicare and Social Security taxes. These taxes will be paid from $184,700. The amount of money Larisa will be paying in her Social Security tax will be as follows:

12.4% * $142,800 = $17,707.2

For Medicare tax, Larisa will be paying the amount calculated here:

2.9% * $184,700 = $5,356.30

In total, the tax amount to be paid by Larisa is Social Security tax + Medicare Tax

$17,707.2 + $5,356.30 = $23 063.5

Yes, the final tax amount as a self-employed individual to be paid by Larisa is $23 063.5.

How to File Self-Employment Tax?

Self-employment taxes are filed in a pre-decided way like any other tax is. Here are two ways in which you can file your self-employment taxes.

Annual Return

The annual return is filed on the basis of the losses and profits you made out of your businesses or self-proprietorship. For filing the annual report you have to report your Medicare and Social Security Tax. You can file your Medicare and Social Security Tax through Schedule SE (Form 1040), Self-Employment Tax.

Calculate all the profits and losses that occurred trough out the year. Calculate the amount to be paid for Medicare and Social Security Tax. You can determine your taxes through Schedule C or Schedule C-EZ determine the amount. While filling out the form, make sure you go through all the rules and guidelines to file the right amount of tax.

Quarterly Payments

To file quarterly payments for your taxes you will need the prior year’s return Form 1040-ES. Use Form 1040-ES, Estimated Tax for Individuals. This form is similar to form 1040. It contains a worksheet filled with information and calculations on how to make an estimate and then the final amount of tax you need to file as a self-employed person.

If you are someone who is filing their self-employment taxes or any kind of income tax for the first time, you will have to take care of things a little differently. To file the tax for the first time, you need to make an estimate of the amount of income you or your business is going to make in that financial year. Your tax will be filed on the basis of this assumption. Read IRS’s guidelines to thoroughly understand how it works.

How Can I Save on My Taxes?

As important as it is to pay taxes, let's face it, it breaks our hearts a little when we have to give away our hard-earned money. Yes, the money is ultimately going to be used by the government to give us a better life and a better country but the fact that the money is being taken away hurts every single time.

It is fine to think of ways in which you can save some (if not all) of the money you have to pay in taxes. Until you find a legal way to cut down the amount of your tax, it is all workable. So here is the information that will make you happy.

Here are a few ways in which you can save the amount of tax to be paid. When you are changing your employment from a full-time employee to a self-employed person, you are eligible to show some write-offs.

Cost of Startup

Government supports new businesses and startups. If you have just launched a startup, the government gives you a tax rebate for legal fees, marketing costs, and other costs that may take place while you are setting up.

Home Office Setup

We are living in a new era of work from home. Even if that was not happening, most self employed people prefer working from home as it is convenient, cost-saving, and great for a lone worker. Even though working from home is convenient, most people chose to set up an office space inside their home rather than working from their bed.

Measure the area of your home office set up and use it as a commodity for business. You can use this space to determine the amount of rent or mortgage payments, property taxes, utilities, etc.

Vehicle

Businesses need an individual to run around the city. For the same, a business has to maintain a travel expenses account. The government understands the need for it and gives ease on travel expenses up to $25,000 yearly.

Office Supplies and Assets

Even if the office is set at home, there are supplies that you will need. These supplies can be as tiny as a pencil or a sharpener, and they can be expensive like ink for the printer, or software required for the business. All these costs can be eliminated from the amount you are paying tax on under office supply expenses.

Health Insurance Premium

Health insurance is a must for every individual. Most companies pay a health insurance premium for their employees. Since you are a self employed person you can get a tax rebate for paying a health insurance premium for you and your family.

Self-Employment Tax FAQs

Let's look at some of the frequently asked questions regarding self-employment tax.

Q: What is the tax rate for 2022-23?

A: The self-employment tax rate for 2022-23 in the USA is 15.3%. This rate is made up of 12.4% for Social Security and 2.9% for Medicare.

Q: Do you have to pay tax on passive self-employment income?

A: To give a direct answer, No, you do not have to pay tax on your passive self-employment income. IRS has guidelines to justify your income. If your passive self-employment income fall in the category justified b IRS then you are not supposed to pay any self-employment tax on it. But do not mix it up with your income. Passive income is still an income and it will be subjected to income tax.

As per IRS, there are two kinds of passive self-employment income. First, the income you make through a trade or a business that you are not actively a part of. If you have a business or are a part of a business that does not require you to actively participate in it then the income is considered passive. For example – your eBooks are listed on an eCommerce website and more similar in the same way.

The second kind of passive income is through your real estate investments. The rental income from your real estate investments is not subjected to your passive self-employment income. You can be active in these activities and still not be subjected to pay any self-employment tax here.

Q: Is my job exempted from self-employment tax?

A: This can be a question you get confused about. To answer this, jobs are exempted from self-employment tax on the basis of the amount of income the job makes. If the annual income from the job is less than $400, you are not supposed to pay tax.

Clergy who are hired by the congregation are exempted from paying taxes. In case the clergy is receiving their income through an organization or the church directly rather than from the congregation, the tax charges may apply to the income.

Q: Are self-employment taxes higher?

A: Self-employed people are subjected to pay more types of taxes and yes that means self-employment taxes are higher. The tax rate gets higher since there are self-employment taxes to be paid along with other taxes. It is better to understand how taxes work with self-employment income before jumping into self-employment.

Yes, there are ways to save or cut down the amount of tax to be paid as a self-employed person. Mostly, a solopreneur and a business owner are able to cut down on taxes in effective ways. If you are not one, read through the self-employment guidelines by IRS or hire an accountant to do your taxes and they will find ways to help you save some money.

Conclusion

In conclusion, the Self-Employment Tax for 2022-23 in the USA remains unchanged from 2021, with a net rate of 15.3% for self-employed individuals and businesses. It’s essential for all self-employed individuals and businesses to be aware of the self-employment tax rate and to plan for the upcoming tax year accordingly. B

y understanding the tax code and taking advantage of available tax deductions, self-employed individuals and businesses can reduce the amount of self-employment tax they owe and maximize their net income.

How can Deskera Help You?

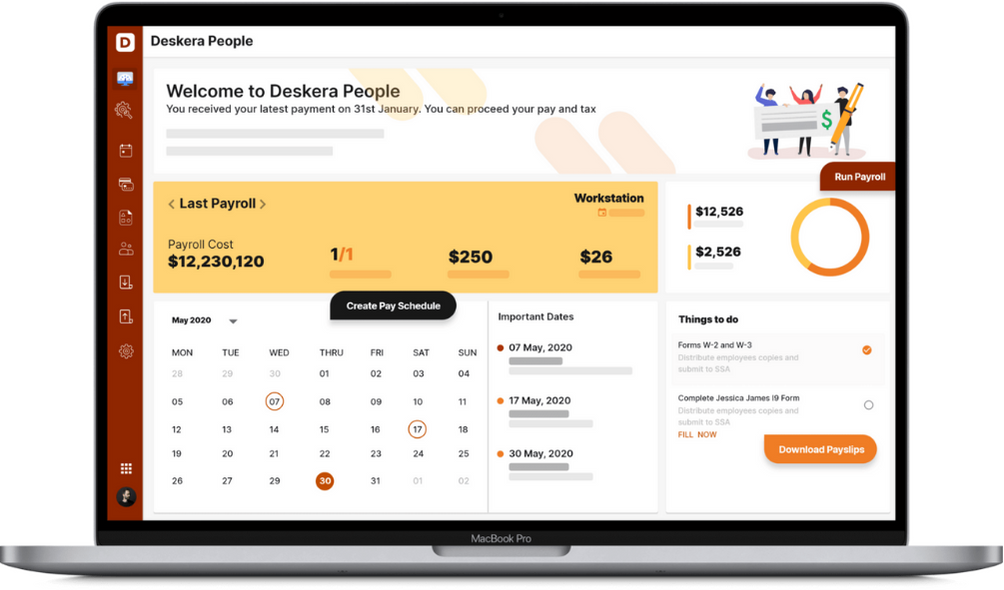

Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

The self-employment tax rate for 2022-23 in the USA is 15.3%. This rate is made up of 12.4% for Social Security and 2.9% for Medicare.

- Self employed people like freelancers, solopreneurs, small businesses owners, sole proprietors, contractors, etc, are supposed to pay their share of taxes.

- IRS counts it mandatory to pay Medicare and Social Security Tax as self employment tax.

- The rate of Medicare tax is 2.9% and the rate of Social Security Tax – is 12.4%

- The amount of tax is not paid on the complete income, it is paid on 92.35% of self employed income after deducting all the expenses made for business.

- You can file your taxes in an annual report or on quarterly payments. The guidelines for both differ.

- You don’t always have to pay a massive amount of tax. There are certain ways that can help you save some money from your taxes.

- If you make less than $400 a year, you are not required to pay self employment tax.

- Self employment tax is generally higher than general taxes. Make sure you understand it before you set out as a self employed individual.

Related Articles