Every business owner wants to save maximum when it comes to filling the income tax to IRS in America. He would do this by investing a lumsum amount in assets and liabilities. These assets are known to have a certain depreciation value. While tangible assets such as equipment, real property, vehicles and fixtures such as communication equipment and lighting can depreciate over a period of time, the intangible assets are amortized. Read on the understand Section 179 to understand in full detail.

What is Section 179?

As per the IRS tax code, section 179 deduction permits the business owner to deduct the full purchase price of qualifying equipment he has bought or financed under the company name during the tax year he would be filling the form for. The main goal of the section 179 deduction is to stimulate the US economy which is the main motto behind tax breaks.

When a company owner buys new equipment or other machinery for the production and workflow processes, its value will depreciate over time. However, section 179 permits the owner to dismiss the expenditure the year has bought it.

The section 179 deduction allows businesses to make an investment for themselves and this is used by most organisations to build up their infrastructure. In simple words, this deduction allows the taxpayers to deduct the cost of certain properties related to their office as eligible.

What assets qualify for Section 179 deduction?

The IRS in America has set up section 179 deduction to assist the businesses. It permits these businesses to take a depreciation deduction for their business assets. The prerequisite for this deduction is the equipment must be purchased within the year for which the entrepreneur would be filing tax. Moreover, it should have been between 1st January and 31st December. The businessman can take a deduction on the following assets -

- Machine equipment of business use

- A business vehicle whose gross vehicle weight must be greater than 6000 lbs

- Office Equipment

- Office furniture

- Tangible personal property put to use in business

- Printing press

- Large manufacturing tools

- Computers / Laptops

- Off the shelf software

- Equipment for partial business use

- Certain improvements to the commercial building where the work location is situated. This could include fire alarms, HVAC, roofing, alarms and security systems etc.

- Tangible personal property put to business use

An important point here note along with the above list is the equipment must be new to the businessman irrespective of whether it was purchased, leased or financed. Section 179 gives maximum purchasing power to small businesses and can change within the year. Hence, it is always advised to the entrepreneurs to use this tax rule to maximum advantage.

How do the deductions help in tax?

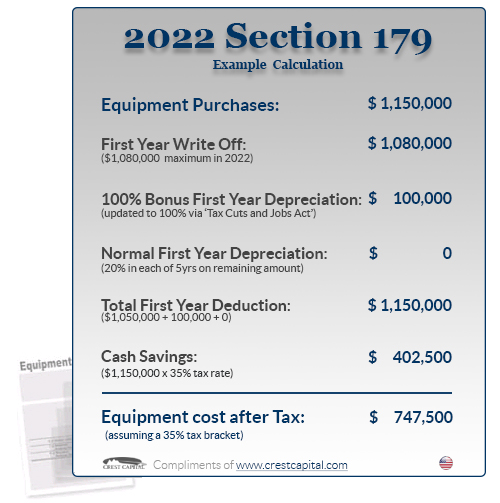

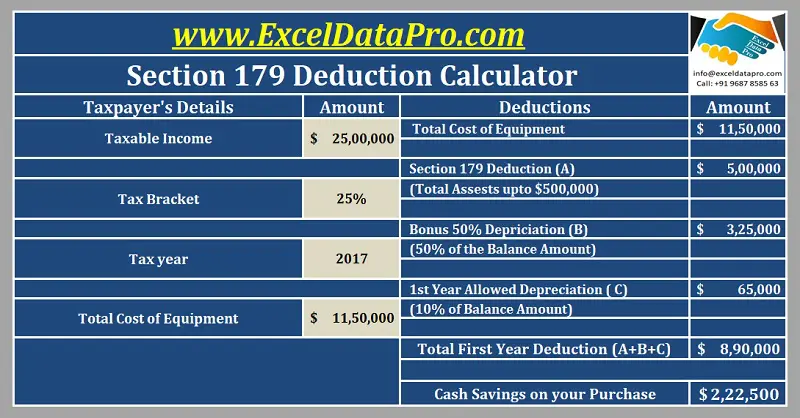

In the US, the section 179 deduction for a businessman takes the cost of deduction only in the first year of the purchase. Also, along with this deduction, the industrialist can an additional first-year bonus depreciation of a hundred per cent for the business property which has been just set up and is new for the business. According to the latest rule of IRS, the bonus depreciation shall remain at 100% till the next year that is till 1 January 2023.

A new entrepreneur before filing the tax for the ongoing financial year must check the limits of the different business assets that can be considered as expenses under section 179 deduction and also check the amount of these deductions. As this deduction process is found to be complicated by many business tycoons, they must allow the work to a qualified and experienced tax professional who is well-versed with the IRS laws if he is considering taking the deduction rule.

How does Section 179 deduction work?

If the industrialist is new to the business and is still understanding the market rules of the business, he can clearly get confused when it comes to filling the form for deductions during filing tax. The Internal Revenue Service has the following general requirements for business property to qualify for section 179 deduction. The property must

- Tangible

- Depreciable

- Personal

Furthermore, it must be acquired for business use and should be active for business purposes. The entrepreneur can use section 179 deduction for the property only if the property has more than 50 per cent of use for business. Also, the deduction is possible only for the percentage of use and not entirely. In simple words, if an employer makes 70% use of his personal car for business travel and other purposes, then he can claim the deduction for only 70% of the car’s expense.

Another important point here to note is the deduction is applicable only if the equipment or other product is put in use by the tycoon for which he is going to claim the deduction. It implies if the employer has bought an asset that he claims under the company’s expenses but is not used for any employee then the asset would not be considered as an expense by the IRS. As a result, he cannot claim any deduction for it if it simply lies unused in the office.

What is Bonus Depreciation?

A business tycoon can make use of bonus depreciation to dismiss the cost of qualified property for the year of its purchase. This does not come under the deductions but can be used with it when he feels necessary. Let us take an example to understand it. Suppose an entrepreneur has purchased a qualified property that comes under section 179 deduction in 2019.

Hence, his full deductible cost would be a hundred per cent in 2019 unless he opts out of bonus depreciation. The percentage for this expense would start declining in 2023. The bonus depreciation happens automatically after a certain period of time for the company’s assets unless the businessman chooses to not use it.

The properties qualifying for bonus depreciation, irrespective of new or used are -

- Tangible personal property of the business like heavy machinery and office furniture

- Film and television productions

- Live theatrical productions

An employer can use bonus depreciation along with the section 179 deduction. According to available data, the bonus depreciation for vehicles is around 8000$ the year they have been placed in service and this is applicable until 2023. Also, this bonus depreciation is applicable for the employer irrespective of how much of its percentage is in use - partial or whole.

However, if the business manufacturer has incurred an expense related to floor plan financing or other inventory from a retailer or third party, it would not be considered under bonus depreciation. After the first year for 2022, the bonus depreciation for property placed in service for upcoming years would work as -

How to apply for Section 179 deduction?

If an entrepreneur is just setting up his start-up and establishing the business, he must follow the steps given below to apply for a section 179 deduction -

- Purchase the required and qualified property as per the business requirements. Start using the property immediately after purchase once all the settings have been completed. ‘

- He should consult a tax professional when has to file income tax for the ongoing financial year. The industrialist must meet the tax professional with a complete list of qualified assets has purchased for business use in the year. He needs to carry multiple purchase records for the different assets such as -

- Date of purchase

- Date when the property/asset was put in use

- All other expenses associated with its setup and/ or transport to the company location

c) The tax professional then does a summation of all the qualified purchases

d) The next step is to fill out the section 179 deduction form on the IRS website by electing it. The duly filled form must be then included by the employer when he is filing the business tax return.

The businessman has to report section 179 deduction using the IRS form 4562 which has been designed to collect information about the business properties acquired and put in use. In addition to this, he can claim a depreciation deduction by selecting section 179 and even have a bonus depreciation deduction.

Who qualifies for the Section 179 deduction in 2022?

All businessmen who purchase, finance or even lease new business equipment during the current financial year 2022 shall qualify for section 179 deduction with the limit that their expenditure should not be more than 3,78,000 dollars. According to available data, most tangible goods that are used by American employers, inclusive of ‘off-the-shelf’ software and in-use business vehicles along with certain restrictions will qualify for section 179 deduction.

To have a clear idea and in-depth understanding of what property would be covered under this deduction, the employer must check the list of qualifying equipment. Even more, the equipment, software and property should be purchased and placed into services between 1st January 2022 and 31st December 2022.

Conclusion

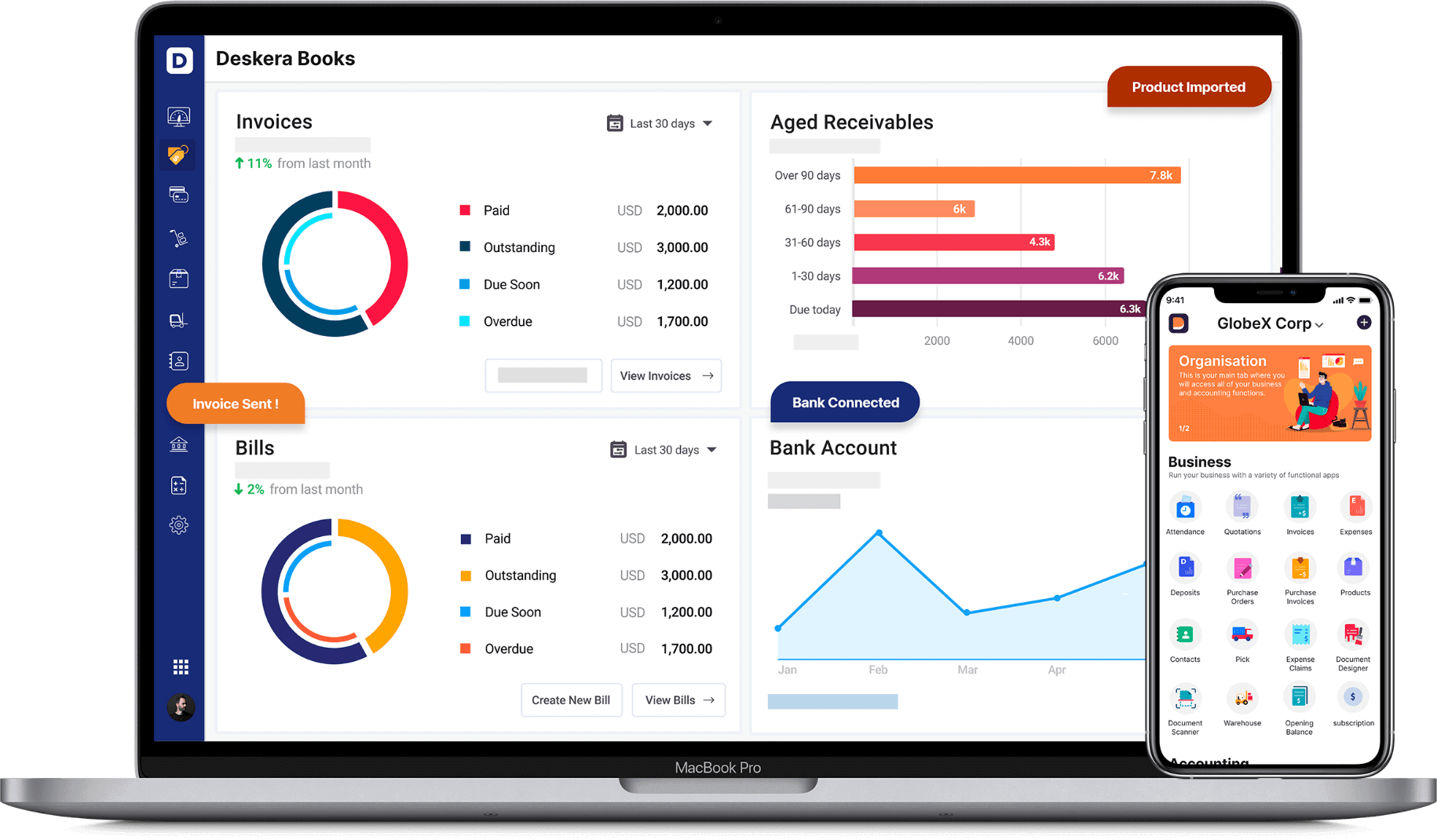

An employer in the US can get section 179 deductions only on the permitted property by the government in the year he has started a business if he wants a full hundred per cent return. He must connect with an experienced and professional tax consultant to nullify his doubts regarding this report while filling the income tax for the year. At Deskera, you can have a one-stop solution for integrated accounting and also read blogs related to assets, balance sheets and other business articles.

How Can Deskera Assist You?

Deskera Books can help you automate your accounting and mitigate your business risks. Creating invoices becomes easier with Deskera, which automates a lot of other procedures, reducing your team's administrative workload.

Key Takeaways

- A businessman or a leader of a start-up in the USA must mention his assets and expenditure to the IRS by filing a section 179 deduction report.

- This report must be attached when he is filing his annual income tax form.

- The list of allowed property under this deduction for tangible assets must be checked on the IRS website or he should consult a professional tax consultant. It is important to note that only the property between 1 January and 31 December would be included under the deduction.

- To qualify for this deduction, the entrepreneur has to check the rules and permitted expenditure by the IRS for the financial year before filing a claim.

- The assets allowed in deduction should be tangible, personal and depreciable. The list of permitted assets includes an office building, laptop or other computerized equipment, software, business vehicle, office furniture, off the shelf equipment and other equipment used in office space

Related Articles