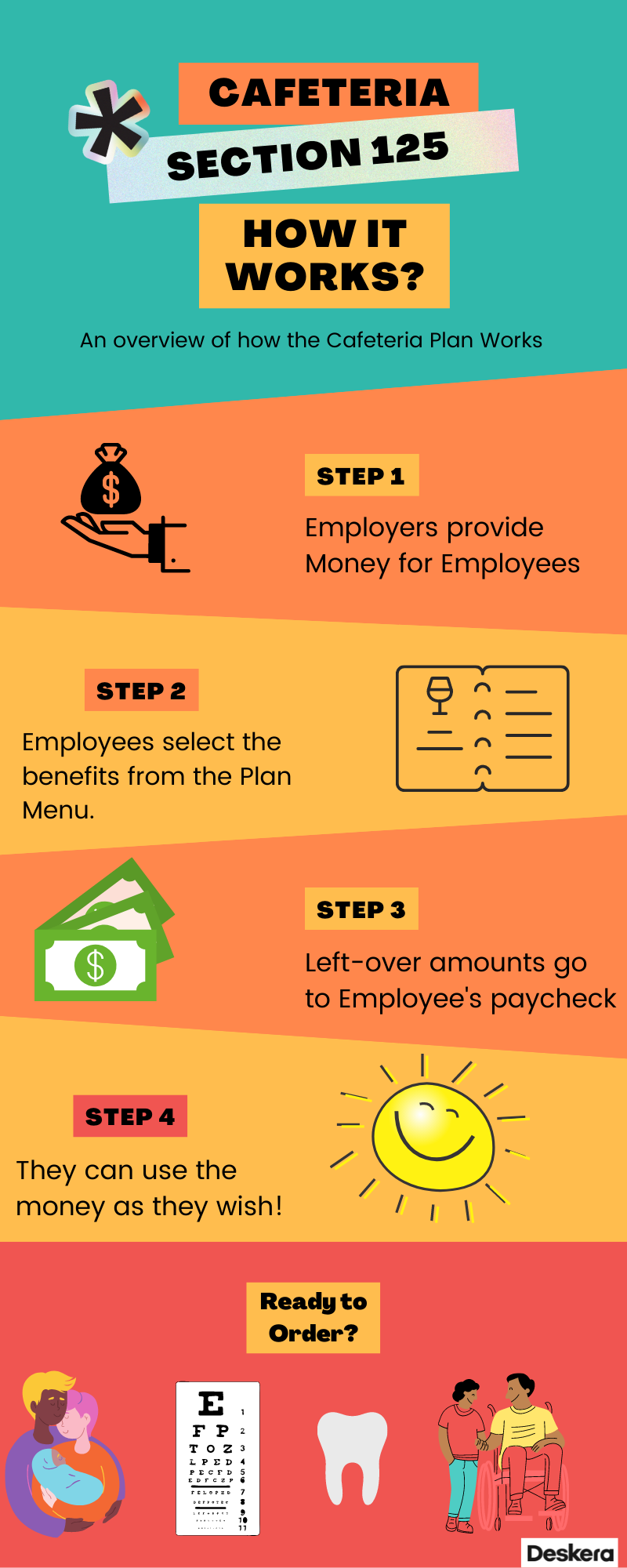

If you are an employer looking to offer non-taxable pre-tax benefits to employees, then Section 125 or Cafeteria plan might be the right option for you. A part of the IRS- Internal Revenue Service, the plan came into effect in 1978 and has been a preferred choice for numerous employers across the U.S.

As a part of the IRS code, a Section 125 plan allows employees to take taxable benefits, such as a cash salary, and convert them to nontaxable benefits. The deduction of these benefits may occur before taxes are paid by the employee. Plan participants whose regular expenses are related to medical issues or child care may benefit from cafeteria plans.

Modern tools like ERP.AI help streamline Section 125 plan administration by automating benefit tracking, eligibility verification, and compliance reporting—ensuring error-free and efficient operations.

This article comprehensively takes us through how the Section 125 plan works and many other components associated with it.

What is a Section 125 Health Insurance Plan?

A Section 125 (or cafeteria) plan is offered by employers that provide employees with taxable and nontaxable benefits before tax. Section 125 plans offer employees the option of receiving cash payments or employee benefits.

An employee who takes the benefit generally enjoys two tax advantages:

- A cafeteria plan's employee contributions are pre-tax

- Contributions by an employer to a cafeteria plan are not taxed

The company requires employees to contribute a portion of their salary to cover qualified benefits on a pretax basis, which does not count as wages for federal income tax purposes.

Employers, their spouses, and their dependents can participate in the plan. Employees must be given the option of selecting at least one taxable benefit, such as cash, and one qualified benefit, such as a Health Savings Account.

The contributions to cafeteria plans are typically not subject to FICA taxes or FUTA taxes. (FICA taxes help pay for Social Security and Medicare and FUTA taxes help pay for unemployment insurance.)

Types of Section 125 Insurance Plan

There are 4 common types of plans that Section 125 includes:

- Simple cafeteria plans: These plans protect employers with 100 or fewer employees from nondiscrimination requirements in exchange for contributing to employee benefits

- Premium-only plans (POPs): These plans allow employees to choose to receive their entire salary in cash or pay for their group health insurance premiums on a pretax basis. Among the products which the Section 125 plan can cover are medical, vision, dental, disability (in case of taxed benefits), and term life insurance within $50,000 (in case of taxed benefits)

- Full flex plans: Under these plans, employers contribute to all eligible employees' plans, and employees use their contributions to purchase various benefits. A portion of any benefit not covered by employer contributions can be paid by employees pre-tax

- Flexible spending arrangements (FSAs): These plans allow employees to contribute pre-tax funds to cover health care expenses and dependent care expenses

What Benefits are included in Section 125 for Employer and Employee?

Here’s a description of the benefits the Section 125 Plan holds for employers and employees:

Benefits for the Employer

Employers enjoy a lot of tax-saving benefits. For every participant of the plan, employers save a considerable amount on the following taxes:

- FICA- Federal Insurance Contributions Act

- FUTA - Federal Unemployment Tax Act

- SUTA - State Unemployment Tax Act

Additionally, employers can also save some dollars as they do not have to pay anything extra from their pocket even when the employees receive an effective raise under the plan. Effectively, the more the number of participants in the plan, the higher the employer's tax savings.

This leads to the employer making contributions to an increasing number of employees, which equates to more tax savings.

Benefits for the Employee

Section 125 plan offers immense benefits to the employees and like for employers, there are multiple tax benefits. Roughly, an employee who has participated in the plan can expect to save anywhere between 20% to 40% for each dollar that they invest in the plan. They can select this amount at the onset of every year which is deducted from their paycheck for each payroll period automatically.

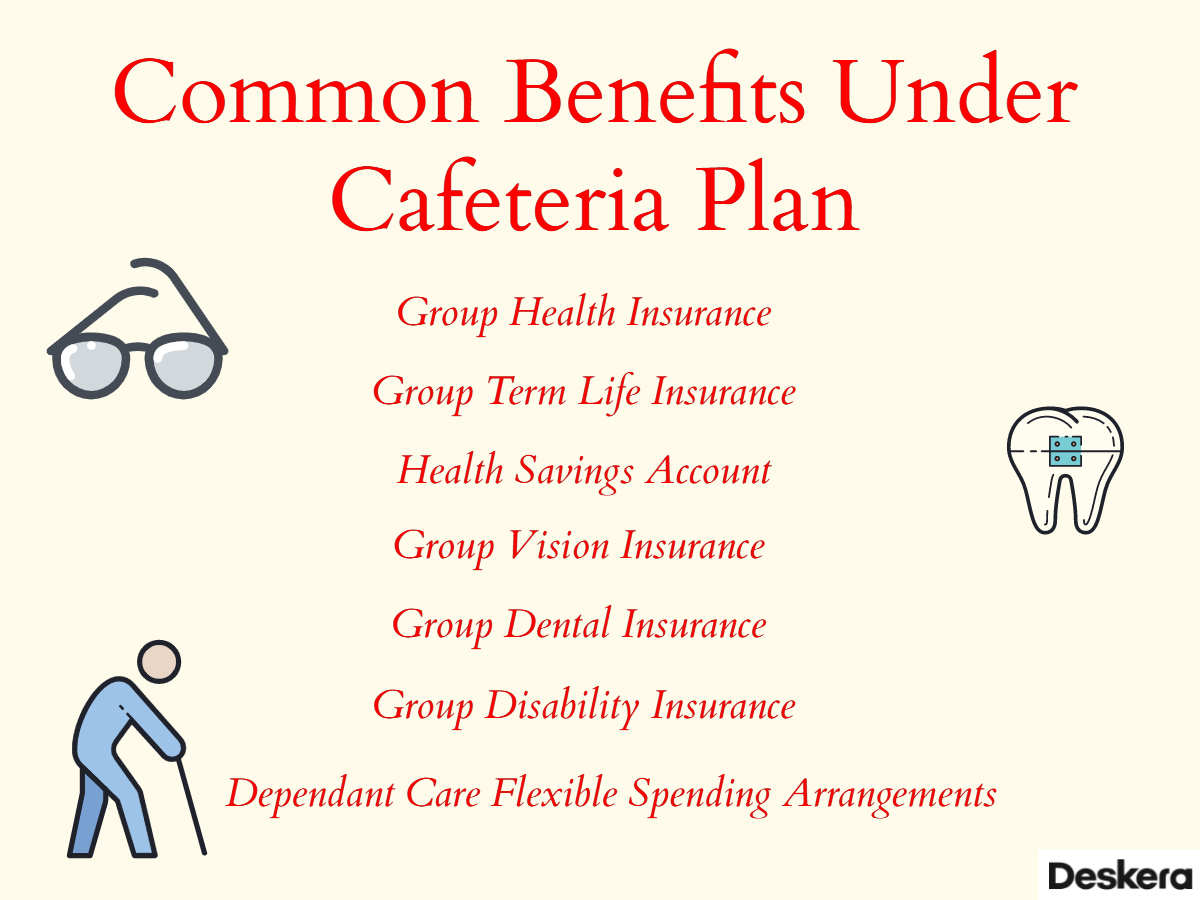

Common Benefits Under Section 125 Plan

The commonly offered benefits under the Cafeteria Plan are as depicted below. However, IRS Publication 15-B offers full insight into the list of benefits.

Example of Section 125 Plan

In this example, we shall estimate the amount that will be deducted tax-free from the employee's paycheck.

Imagine an employee elects an amount of $500 for deduction from their salary. This amount will go towards the Section 125 plan. Now if there are 24 pay periods, then the amount deducted is:

Amount Deducted = $500/ 24

= $20.8

Thus, the amount deducted every month from the employee’s salary is $20.8 (tax-free).

The third-party admin receives this amount and distributes it for reimbursement when requested (against valid and qualified expenses).

Who is not eligible for the Section 125 Plan?

Individuals with the following conditions cannot participate in plans:

- Self-employed individuals

- partners in a partnership

- Those who own more than 2% of a subchapter S corporation

Employee Participation Requirements for Section 125 Plans?

Generally, employers must offer a cafeteria plan to all employees with 1,000 hours of service or more over a plan year. Employers can exclude employees who fall into one of the following categories:

- Under the age of 21 when a plan year ends

- Less than one year of employment with the employer at any time during the plan year

What if an employer wants to provide a Cash-in-lieu option?

Before we begin to understand this section, we must remember that Cash-in-lieu is not mandatory for employers and is not available in all Section 125 plans. Therefore, before you take any action on this front, discuss your options with your broker.

What is a cash-in-lieu benefit?

When a business decides to provide employees with additional compensation in lieu of its share of health insurance premiums, it is called a cash-in-lieu benefit option. Thus, employees can either receive their compensation in cash or receive it as a benefit under the Section 125 plan.

When an employee elects to receive their compensation as a benefit, they enjoy the following tax advantages:

- Employee contributions toward cafeteria-plan benefits are considered pre-tax contributions

- Contributions an employer makes to an employee's cafeteria plan are tax-free

What are the prerequisites for employers to offer cash-in-lieu benefits?

The employers must fulfill the following criteria to be able to offer the cash-in-lieu benefit:

- Payments must be reported on the recipient's W-2 form

- For compliance with non-discrimination laws, the amount should be set at a level that is consistently offered to all eligible employees

- The choice between taxable and non-taxable benefits must be available to employees. Therefore, the cafeteria plan can't only offer cash-in-lieu

How can Employers set up a Section 125 plan?

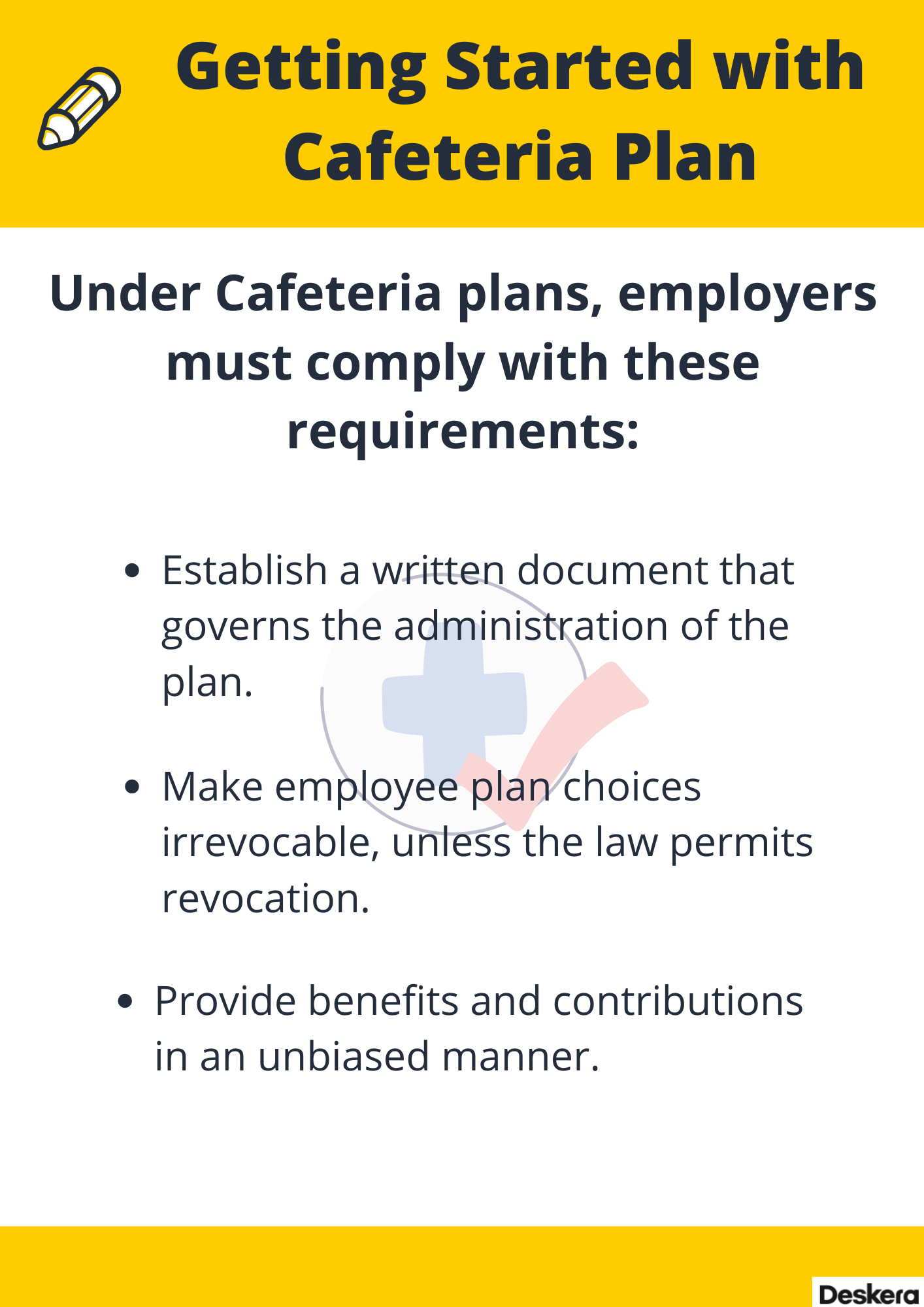

Section 125 plans are easy to set up. Documentation, notification, and nondiscrimination testing are the 3 key steps required of employers. To qualify for Section 125, a plan must pass three nondiscrimination tests: eligibility to participate, benefits and contributions, and concentration tests.

These documents explain the legal and employer-specific aspects of an employer's benefit plan, which are required under the Internal Revenue Code (IRC) as well as ERISA - Employee Retirement Income Security Act.

The employers must create a summary plan description of the SPD which they must furnish to all the eligible employees. Through this document, the employees come to know about the various benefits they shall receive.

The SPD comprises of the following:

- All the benefits listed in the plan

- Participation rules and eligibility criteria

- Pre-tax contributions limit

- The plan year

- Details including information about if the contributions from the employer will be included

- The plan requires that elections be made during open enrollment (unless a change in status allows for changes to the benefits election)

Employers must engage and partner with a Section 125 third-party administrator to provide them with the most current documentation. The administrators can also inform employers of any compliance requirements.

What are Non-discrimination Testing Requirements?

The IRS requires nondiscrimination testing for many Section 125 plans, such as POPs. Section 125 is subject to 3 tests which are given as follows:

- Cafeteria Plan Eligibility Test

- Cafeteria Contributions & Benefits Test

- Cafeteria Plan Key Employee Concentration Test

Cafeteria Plan Eligibility Test

The employer shall offer the plan to all eligible employees to pass this test; however, union employees may be excluded.

- Under this test, the employers must ensure the same requirements for all the employees in order to join the plan

- This also applies to the premium paid through the plan, which should be the same for everyone

- The waiting period must not exceed three years

Cafeteria Contributions and Benefits Test

According to this test, plans cannot discriminate against highly compensated participants with regard to contributions and benefits. Among highly paid employees, there are:

- Company officers

- Shareholders who own more than 5 percent of the employer's stock or voting power

- An employee who receives about $130,000

- A spouse or dependent of an employee in any of the above categories

Cafeteria Plan Key Employee Concentration Test

This test compares the number of benefits provided to key employees to the amount provided to all employees. A key employee is someone who:

- Earns a salary of at least $185,000 per year

- Is an employee who owns 5% of the business or earns more than $150,000 as a 1% owner

How is Section 125 reported on a W-2 form?

The employer deducts an employee's contributions before withholding certain taxes from a Section 125 plan. Employers may want to report the deductions as W-2 items in Box 14 even though the payments are not included in taxable wages.

When must Employees make Elections under a Section 125 Plan?

Section 125 plan employees must make their election before the first day of the plan year, or the date taxable benefits would become available. The majority of employees will elect their plans during a period of annual open enrollment, with their choices taking effect on the first day of the plan year. When new employees become eligible for benefits during a plan year, such as when they are hired, they typically elect their benefits during the initial enrollment period.

What are the Advantages and Disadvantages of Section 125 Plans?

The section 125 plan offers many benefits to employees, including tax savings. These plans allow employees to reduce their taxes like the federal, state, and local taxes while also covering part of their out-of-pocket expenses. Furthermore, because these funds are placed into this account pre-tax, their taxable income is reduced on the W-2. To summarize, an employer can reduce their payroll and tax liabilities by implementing a Section 125 plan.

Having learned about the advantages, we must take a look at the disadvantages the plan holds for both employers and employees.

For employers:

- A fee may be required by brokers or third-party administrators from employers in order to set up a Section 125 plan. Due to long-term savings, the fee is minimized

- In addition, Section 125 plans have maintenance costs

- There is a risk for employers offering FSAs. Employers are required to offer the full amount selected by an employee at any time during the plan year under the uniform coverage rule

For employees:

- Funds are available to employees for a limited period of time. During the plan year, participants of Section 125 plans must use the funds; otherwise, they will lose the funds

- The employee can't change their elections throughout the year without some qualifying life event (QLE)

- Under Section 125 plans, employees have to pay expenses up front. Depending on the benefit, out-of-pocket expenses must be paid first and then reimbursed once a claim is filed

- Considering that Section 125 plans reduce taxable income, they may also reduce employee benefits such as Social Security

How AI Enhances HR Compliance and Efficiency

AI can automate eligibility checks, ensure timely documentation, and monitor regulatory changes—reducing the risk of human error and non-compliance. By analyzing employee data in real time, AI systems identify inconsistencies, track enrollment patterns, and flag potential issues before they escalate.

This not only streamlines auditing but also ensures every deduction and pre-tax benefit aligns with IRS regulations. With AI, HR professionals can focus more on strategic decisions while maintaining accurate, up-to-date records with minimal effort.

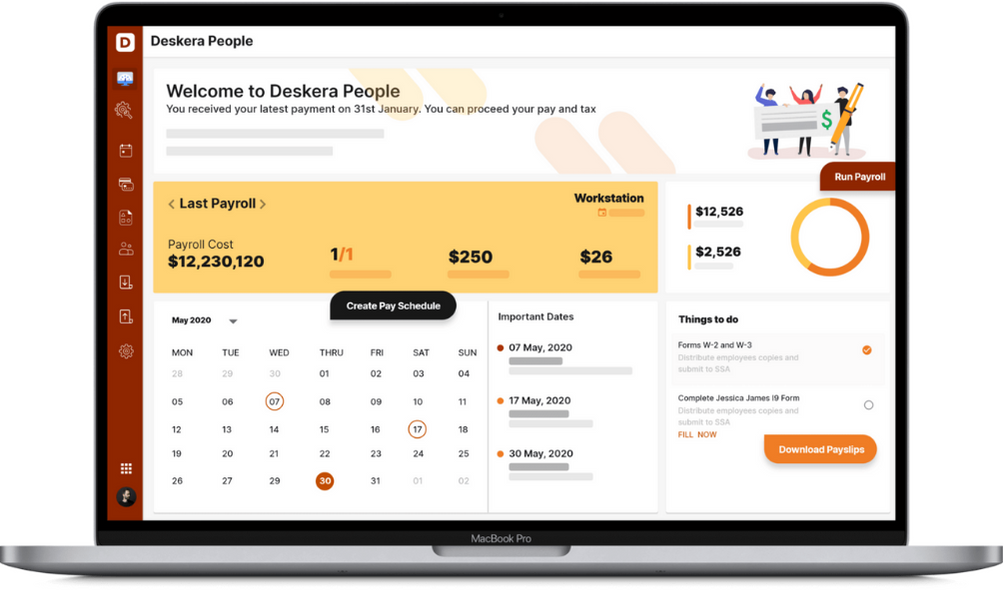

How can Deskera Assist You?

Deskera People is a platform that lets you manage payroll, leave, attendance, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

Small business owners can provide benefits to their employees through section 125 cafeteria plans, while saving tax dollars and keeping employees happy. To reap the benefits of this while remaining compliant, we recommend that you run through the process thoroughly, and even better, hire a professional service.

Key points from the article:

- As a part of the IRS code, a Section 125 plan allows employees to take taxable benefits, such as a cash salary, and convert them to nontaxable benefits

- Plan participants whose regular expenses are related to medical issues or child care may benefit from cafeteria plans

- A Section 125 (or cafeteria) plan is offered by employers that provide employees with taxable and nontaxable benefits before tax

- Simple cafeteria plans, Premium-only plans (POPs), Full flex plans, and Flexible spending arrangements (FSAs) are the four types of Cafeteria plans

- For every participant of the plan, employers save a considerable amount on the taxes including FICA- Federal Insurance Contributions Act, FUTA - Federal Unemployment Tax Act, and SUTA - State Unemployment Tax Act

- An employee who has participated in the plan can expect to save anywhere between 20% to 40% for each dollar that they invest in the plan

- Self-employed individuals, partners in a partnership, those who own more than 2% of a subchapter S corporation are some of the entities that are not eligible for the Section 125 plan

- Employers must offer a cafeteria plan to all employees with 1,000 hours of service or more over a plan year

- Documentation, notification, and nondiscrimination testing are the 3 key steps required of employers to set up a cafeteria plan in their organization

- To qualify for Section 125, a plan must pass three nondiscrimination tests: eligibility to participate, benefits and contributions, and concentration tests.

- The employers must create a summary plan description of the SPD which they must furnish to all the eligible employees to inform the employees about the benefits

- Employers report the deductions (from employee’s contributions) as W-2 items in Box 14 even though the payments are not included in taxable wages

- Section 125 plan employees must make their election before the first day of the plan year, or the date taxable benefits would become available

- An employer can reduce their payroll and tax liabilities by implementing a Section 125 plan

Related Articles