“Make sure you pay your taxes, otherwise you can get in a lot of trouble.” -Richard Nixon

Hence, if your business is structured as a partnership or as an S corporation, then this article about Schedule K-1 and filling Form 1065 is for you. This is because this is the form which you should know as well as the back of your own hand. Along with you, even your partners should be this well-versed with Schedule K-1 and Form 1065.

The United States tax code allows certain types of entities to utilize pass-through taxation. By utilizing pass-through taxation, the income tax liability shifts from the income-earning entity to the people who have a beneficial interest in them. The Schedule K-1 is the form that reports all the amounts that are passed through to each of the parties who had a beneficial interest in the income-earning entity.

This article would hence be covering the following topics to become a complete guide on Schedule K-1 and Form 1065 for you:

- What is Schedule K-1?

- Who Needs to File Schedule K-1?

- What is a Pass-Through Business?

- How to File Schedule K-1 Based on Your Business Type?

- What is Form 1065?

- Who Needs to File Form 1065?

- Where to Find Form 1065?

- How to File Form 1065?

- Steps for Filing Form 1065

- When are Schedule K-1, Form 1065, and Form 1120S Due?

- How Can Deskera Help You With Accounting and Tax Filing?

- Key Takeaways

- Related Articles

What is Schedule K-1?

Schedule K-1 is also known as the IRS Schedule 1. It has two distinct forms for businesses:

- Schedule K-1 (Form 1120S), Shareholder’s Share of Income, Deductions, Credits, etc.

- Schedule K-1 (Form 1065), Partner’s Share of Income, Deduction, Credits, etc.

Hence, an S Corporation reports activity on Form 1120S, while a partnership reports transactions on Form 1065. S corporations are companies with under 100 stockholders that are taxed as partnerships. In fact, trusts and estates that have also distributed income to the beneficiaries will have to file Schedule K-1 forms.

On the other hand, while a partnership in itself is not subject to income tax, individual partners, including limited partners, are liable to be taxed on their share of the partnership income irrespective of whether it was distributed or not. Commonly, a Schedule K-1 form is issued to those taxpayers who have invested in limited partnerships and some to those who have exchange-traded funds (ETFs), for example, those that invest in commodities.

Therefore, depending upon the structure of your company’s business, which of these two forms would have to be distributed to all the owners, partners, or members gets determined. Typically though, taxpayers file Schedule K-1 with their individual tax returns.

In certain instances, the US federal tax code allows the implementation of a pass-through strategy, hence effectively shifting the tax liability from the income-earning entity like trusts and partnerships to the individuals who have a beneficial interest in it.

This means that while the entity itself is not required to pay any taxes on their incomes or earnings, or any other payouts with taxes due on them, the same is not true for its stakeholders as the tax liability is passed to them.

As an owner, partner, or member, you will use the information on the Schedule K-1 form to report your profits, losses, tax deductions, or tax credits on your personal income tax returns as per the tax bracket you are applicable for.

With Schedule K, businesses should track each partner’s or stakeholder’s ownership or stake in the business. This is because, based on the percentage of your ownership, the amount to be reported by you on each Schedule K-1 tax form gets determined.

Note, while Schedule K-1 is not filed with an individual partner’s tax return, the financial information posted on each partner’s Schedule K-1 is sent to the IRS along with Form 1065. Income generated from partnerships is added to the partner’s other sources of income and then entered on Form 1040.

Who Needs to File Schedule K-1?

While typically, Schedule K-1 is paired with the Forms 1120S or IRS Form 1065, some individuals might be required to file Schedule K-1 as well. Entities with individuals who are required to file Schedule K-1 are:

- Estate Beneficiaries

- Beneficiaries of Trust

However, remember that businesses that do not pass through taxes to the owner’s individual tax returns, like, for instance, in the case of a C corporation, they do not need to file Schedule K-1. Additionally, Schedule K-1 is not filed by all the pass-through businesses.

What is a Pass-Through Business?

Understanding pass-through businesses and taxation will help you better understand why individuals have to file IRS Schedule K-1 and not businesses.

When a business has pass-through taxation, it means that their tax liabilities will skip over (or pass-through) the business and to another entity who are its stakeholders. Such businesses hence do not directly pay the taxes. Instead, that another entity (usually a business owner, customer, or any other stakeholder) pays the taxes.

In such a taxation system, the business income is taxed only once through passed-through taxation. It is the business owners who would then be paying taxes on their Form 1040 at their personal tax rate rather than a business tax rate.

Following are the entities who are a part of pass-through taxation:

- Sole Proprietorships

- S Corporations

- Partnerships

- LLCs

However, out of all these pass-through entities, it is sole proprietors who do not file Schedule K-1.

How to File Schedule K-1 Based on Your Business Type?

The three business entities that are required to file Schedule K-1 are S corporations, partnerships, and LLCs filing as partnerships. This section of the article will take you through how each business type would be filing Schedule K-1.

S Corporations

Business owners part of this business type will have to file Form 1120S every year to report their income. Each shareholder in an S corporation would hence have to receive a Schedule K-1 Form 1120S. The shareholders would use the same information as that reported in Schedule K-1 during reporting for their individual returns.

The K-1 tax form for S corporations should also show how the businesses are distributing income among their shareholders, based on their stakes in the business. The main sections of the Schedule K-1, Form 1120S are:

- Information about the corporation

- Information about the shareholder

- Shareholder’s share of income, deductions, etc.

For example, you have a 25% stake in a particular S corporation. In one of the tax years, the profit earned by the business is equal to $100,000. Your Schedule K-1 form will therefore show $25,000 as your earnings or funds from the S corporation for the year.

Partnerships

If you are part of a partnership, then as a partner, you would be required to report your share of income, losses, deductions, and credits as filed on Form 1065. It is based on the informational Form 1065 that the business would have distributed Schedule K to each partner so that they can show their individual shares.

What needs to be remembered is that all Schedule K-1 should be filed with the business’s tax return. Simultaneously, each partner will also have to file its copy with their Form 1040 while they are filing their own taxes. Similar to S corporations, even in partnership, the business determines the amount listed on Schedule K-1 based on the partner’s number of shares.

The three main sections of the IRS Schedule K-1 Form 1065 are:

- Information about the partnership

- Information about the partner

- Partner’s share of income, deductions, etc.

For example, a business partnership is formed of 3 partners. One partner who owns a 50% stake in the business, and the other two partners own a 25% stake each. If now the business has earned a profit of $100,000 in one of the tax years, then the respective funds the partners would have to report are $50,000, $25,000, and $25,000.

If, however, yours is a partnership business wherein the partners have an equal stake in the business, in that case, the business profits would be divided equally among the partners.

LLCs

If you have a Limited Liability Company (LLC) filing as a partnership, you would be required to file Form 1065 and distribute Schedule K-1 to all the members, similarly to how it is done for partnership business. In the case of LLCs, owners and members are the same.

Considering that LLCs do not restrict members, multi-member LLCs would include:

- Individuals

- Other LLCs

- Corporations

- Partnerships

Irrespective of their structure, every member of the LLC must receive a Schedule K-1. Under the US federal taxation rules, most of the LLCs with multiple members receive the same tax treatment as partnerships. However, this is by default and hence applicable only when you have not filed to be taxed as a corporation. The LLC itself does not send the Schedule K-1 tax form to the IRS.

What is Form 1065?

The tax Form 1065 is alternatively known as the “Partnership Tax Return” because this is how partnership businesses report their financial information to the IRS. However, no taxes are paid from Form 1065. The two most important steps involved in reporting taxes as pass-through taxes through Form 1065 are:

- Using Form 1065, the partnership will report total net income and all the other relevant financial information for the partnership.

- Each individual partner will have to prepare their own Schedule K-1, which will identify each of the partner’s allocated profits and losses over the reporting period. This hence means that Schedule K-1 will become part of each of the partner’s personal tax returns.

Who Needs to File Form 1065?

All the partnerships in the USA are required to file the IRS Form 1065.

IRS has defined partnership as “any relationship existing between two or more persons who join to carry on a trade or business. A partnership is not a corporation. Unlike a corporation, a partnership is not a separate legal entity from the individual owners.”

Usually, most of the partnerships are specified as such through a formal written agreement known as the partnership agreement, which is registered with the state in which they are doing business. The partnership agreement also specifies whether you are a part of the general partnership, limited partnership, or a limited liability partnership.

If your company is an LLC with two or more members and it has not decided to be taxed as a corporation this year, then you will be filing taxes as a partnership and therefore also filing Form 1065.

Additionally, foreign partnerships in the USA with an annual income of more than $20,000 or those who are earning more than 1% of their income in the United States will also have to file Form 1065. Also, nonprofit religious or apostolic organizations will also have to file Form 1065.

However, a partnership with no revenue or expenses in a particular year will not be required to file Form 1065 for the same year.

Where to Find Form 1065?

If your business falls into any one of the above categories, then you will need to fill and file Form 1065. You can find this form on the IRS website. From there, you can complete the form either online or download the form, print it, and fill it by hand.

You can even go to the IRS order form site and place an order for Form 1065 to get it mailed to you.

How to File Form 1065?

In order to file your Form 1065, you will need all the important financial statements of your partnership at the year-end. This includes:

- Profit and loss statements that will show the net income and revenue

- A list of partnership’s deductible expenses

- Balance sheet for the beginning and end of the year

- Providing information for calculating the cost of goods sold if your partnership deals in physical goods

In addition to this, you will also have the provide the following details:

- Employer identification number (i.e., your Tax ID)

- Business code number

- Number of partners in your business

- Stating date of the business

- Specifying whether your business is using the cash method of accounting or accrual method of accounting

In fact, if your business has paid a portion of profit to owners which was beyond their standard guaranteed payment or if you have paid more than $600 to anyone outside the partnership to do some contract work and filed Form 1099 for the same, you would also have to report the same information on your Form 1065 as well.

The easiest way to file your Form 1065 is by using an online service that supports the said form while also taking the help of bookkeepers and their bookkeeping services. This will ensure that you are complying with the taxation regimes of the USA correctly.

However, if you choose to file Form 1065 by mail, you will have to make sure that you mail it to the correct IRS center address of your state. You can even use the IRS e-file system to file your Form 1065. But, if yours is a partnership with more than 100 partners, then it is mandatory for you to file Form 1065 online.

Steps for Filing Form 1065

The tax Form 1065 is a five-page long document that will require information from a variety of business financial documents and sometimes even from other IRS forms. The steps for filing Form 1065 are:

Step 1: Gather Relevant Financial Documents and IRS Forms

In order to complete filling your IRS Form 1065, you will require pieces of information from several different sources. This hence means that if you want to complete the form on time, you should gather all these documents in advance.

While which documents you will need is dependent on your operations, some of the documents, information, and IRS forms that you might need to fill your Form 1065 are:

- Profit and loss statement

- Balance sheet

- Deductible expenses and total gross receipts

- Basic information about the partnership and the partners

- Cost of goods sold (if your business sells physical goods)

- W-2 and W3 forms

- Form 114

- Form 720

- Form 940

- Form 941

- Form 943

- Form 944

- Form 945

- Form 965

- Form 1042 and 1042-S

- Form 1042-T

- Form 1065X

- Form 1095-B and 1094-B

- Form 1095-C and 1094-C

- Form 1096

- Form 1097-BTC

- Form 1098

- Form 1099

- Form 1125-A

- Form 3520

- Form 4562

- Form 4797

- Form 5471

- Form 5713

- Form 8275

- Form 8275-R

- Form 8288 and 8288-A

- Form 8300

- Form 8308

- Form 8594

- Form 8621

- Form 8697

- Form 8804, 8805, 8813

- Form 8832

- Form 8865

- Form 8866

- Form 8876

- Form 8886

- Form 8918

- Form 8925

- Form 8990

- Form 8992

- Form 8993

- Form 8994

- Form 8999

Hence, as would be evident from this list, the most important documents that you will need would be related to your business’s finances.

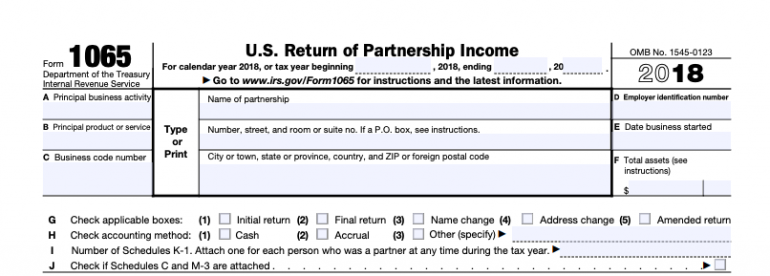

Step 2: Fill in IRS Form 1065 A-J

After you have gathered all the documents and the information you will need to fill the Form 1065, you should start with the first section of the form, which is a general information section. It has boxes from letter A to J and is found on the 1st page at the very top in Form 1065.

In this section of Form 1065, you will be filling in:

- The tax year you are filing for

- The name of your partnership and mailing address

- A-C: Mention your principal business activity and, therefore, your principal product or service, along with your business code. For example, if you are part of the category of “paper and paper products” under “merchant wholesalers, non-durable goods,” then you will be writing, “merchant wholesalers, non-durable goods” in box A, “paper and paper products” in box B and the corresponding code 424100 in box C.

- D: Here, you will enter your business tax ID number. It is also known as the employer identification number (EIN)

- E: Write the date on which your business started

- F: Enter the total assets of your partnership at the end of the year, as calculated by the accounting method that you follow in your books too.

- G and H: Indicate the type of return this is and the accounting method used by you.

- I: Every partner or LLC member must complete Schedule K-1, and in this box, you will be writing how many Schedule K-1 forms you would be attaching with Form 1065.

- J: If yours is a business that requires you to complete Schedule C or M-3, then in this box, you will be mentioning how many of those forms you have attached with the current Form 1065.

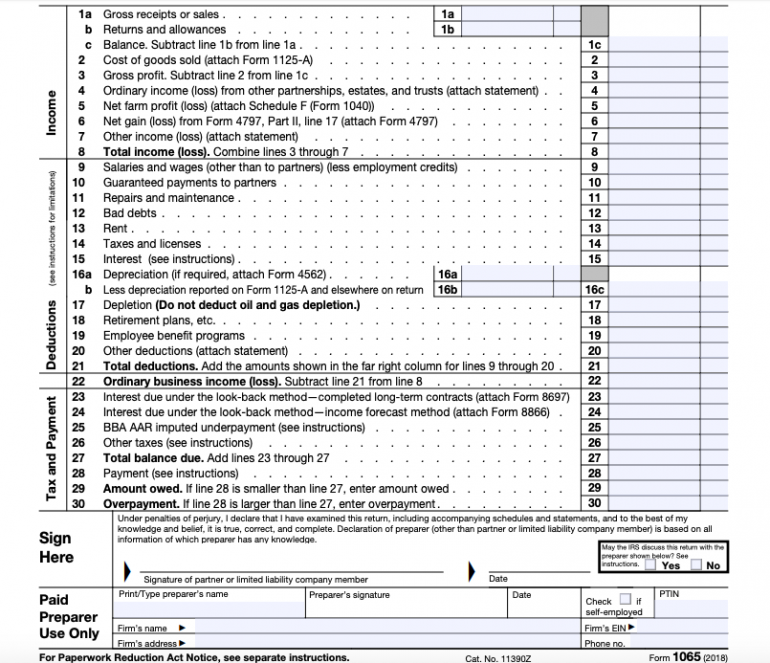

Step 3: Complete Filling the Remaining IRS Form 1065’s Page 1

The rest of page 1 of form 1065 will have boxes from 1 to 30, which are broken into three categories- Income, deductions, tax, and payment. To fill these sections, you will need to refer to your financial and tax documents to get the exact numbers to be filled in in some of the boxes. The line item will help you by referring to a specific form or document where you will find the information needed.

However, you will have to complete the following:

- Boxes 1-7: To record total income in box 8

- Boxes 9-20: To record your total deductions in box 21

- Boxes 22: Subtract box 21 from box 8 to fill in your ordinary business income loss

- Box 23-26: To record your total due balance in box 27

- Box 28: To record any prepayments that you have made for taxes applicable to boxes 23-26

- Box 29: To record the amount owed, in case your box 28 is smaller than box 27.

- Box 30: Over-payment, in case your box 28 is larger than box 27.

Once you have filled all these boxes and reached the end of Form 1065’s first-page end, you will have to sign and date the form. However, this needs to be done after you have completed the entire form and reviewed it as well. If, however, you have a preparer like a CPA or an enrolled agent who has filled the form on your behalf, they will have to sign in the box where it says, “paid preparer use only.” Also, if you authorize the IRS to contact that professional about this return, you will have to check “yes” in the box on the right. If not, you will need to check “no.”

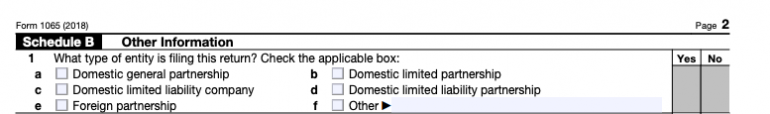

Step 4: Filling the Page 2 of the IRS Form 1065 Schedule B

This page of Form 1065 is divided into numbers 1 to 10 and continues till the third page of the form. Schedule B is part of the section that is titled “other information” and asks technical questions about your partnership, to which you have to answer in yes or no.

For example, question 1 asks you to indicate your business entity type. This is the simplest question of the section. The other questions are more detailed and specific, asking information like:

- Ownership percentages of the partnership

- Partnership debt

- Partnership involvement in foreign financial accounts

- Partnership investments

Considering that these questions are going to be specific to your business, having all your financial information available and organized, along with having a tax accountant or a CPA to consult, would make your tax a lot easier.

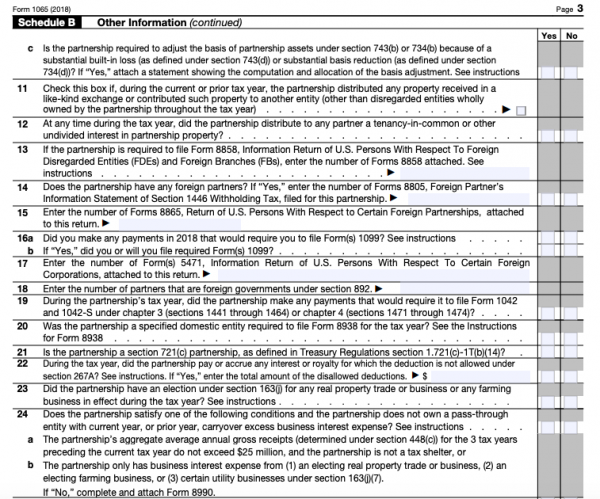

Step 5: Completing Schedule B of the IRS Form 1065 on Page 3

Similar to Schedule B on page 2, page 3 asks specific questions that require you to answer yes or no. Some of the wide range of topics covered by these questions are:

- Partnership property

- Foreign partners within the partnership

- Tax obligations with regard to forms like 1099, 1042, 5471, etc.

Now, question 25 asks “if the partnership is electing out of the centralized partnership audit regime under 6221 (b).” If the answer to this question is yes, then you will have to complete Schedule B-2. However, if the answer is no, you will need to fill in the “Designation of the Partnership Representative” below.

The last question of Schedule B asks “if you are attaching Form 8996 to certify as a Qualified Opportunity Fund.” If the answer to this is yes, you mention so while also adding the amount from that form in this section.

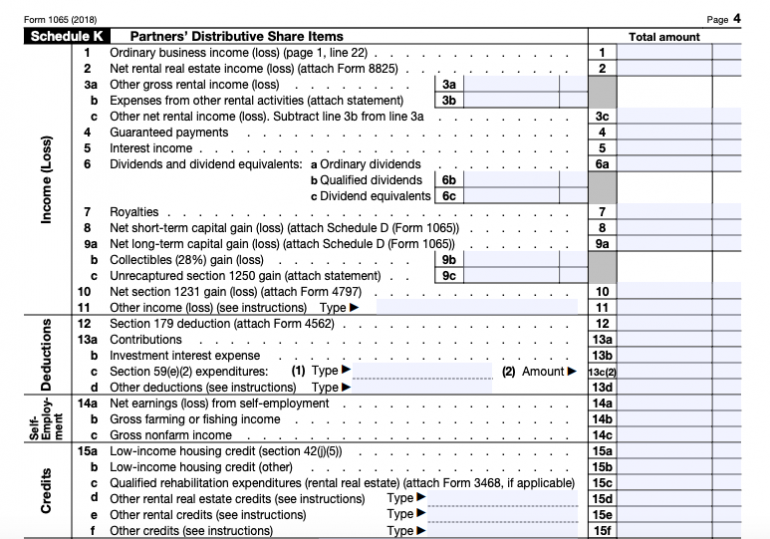

Step 6: Completing Page 4 of the IRS Form 1065’s Schedule K

Page 4 of the tax Form 1065 has Schedule K, and this is what you will have to complete after completing Schedule B. Schedule K is different from Schedule K-1. While Schedule K is found on page 4 of Form 1065 and is essentially a summary schedule of all the partners’ shares of the partnership’s income, credits, deductions, and more. Schedule K-1, on the other hand, shows each partner’s separate share. A copy of each partner’s Schedule K-1 needs to be submitted with Form 1065.

Schedule K has boxes numbered from 1 to 20, which are broken into the following sections:

- Boxes 1-11: These need to be completed to calculate your income loss

- Boxes 12-13: These need to be completed to calculate deductions

- Box 14: These need to be completed to record net earnings loss from self-employment

- Box 15: These need to be completed to record any applicable credits

- Box 16: These records foreign transactions

- Box 17: These need to be completed to record alternative minimum tax (AMT) items

- Boxes 18-20: These need to be completed to record additional income and expenses

In order to complete the 1st section on page 5, which is a part of Schedule K, you will need to use the information from Schedule K on page 4 to analyze the net income by partner type.

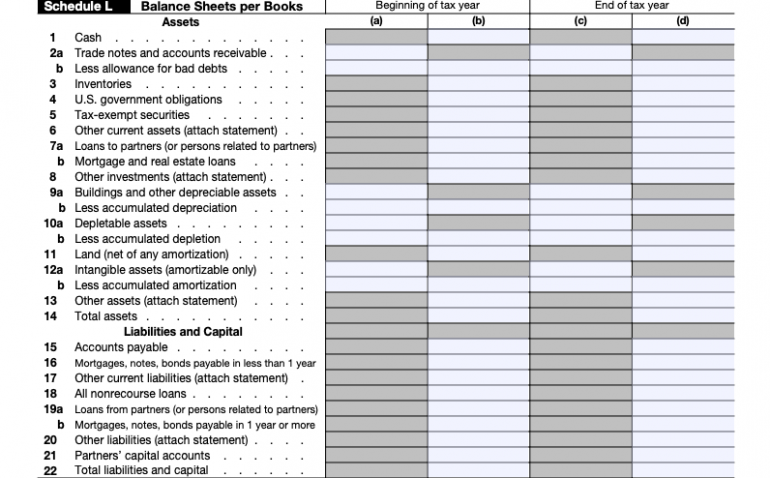

Step 7: Complete Schedule L on page 5 of IRS Form 1065

What needs to be noted here is that you need not complete Schedule L or even the remaining Schedules M-1 and M-2 of the IRS Form 1065 if you have answered “yes” to question 4 in Schedule B.

Schedule L, titled as the “Balance Sheets per Books,” is used to prove that the balance sheets agree with the partnership’s books and records. To do so, you will have to fill the questions from 1 to 22 and, through it, record your partnership’s assets, liabilities, and capital. If, however, there are discrepancies between your balance sheet and your books and records, then you will need to attach a statement explaining these discrepancies.

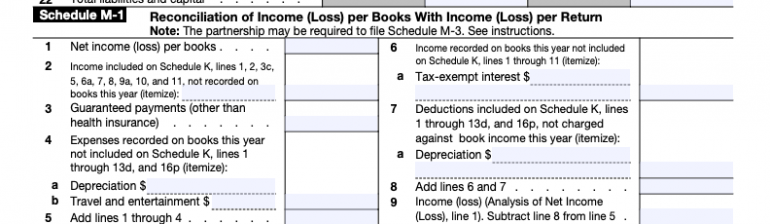

Step 8: Complete Schedule M-1 on Page 5 of IRS Form 1065

Through Schedule M-1, you will be explaining any differences that have occurred between the income recorded in your bookkeeping and the income as indicated in your tax returns. Some of the factors that might have led to this difference are:

- Tax-exempt interest

- Guaranteed payments and depreciation

Remember, if your partnership has responded “yes” to question 4 in Schedule B, then you do not need to fill this section of Form 1065.

Step 9: Complete Schedule M-2 on Page 5 of IRS Form 1065

This is the last section of Form 1065 that some of you will have to fill out. Schedule M-2 is that schedule that shows the changes in the partners’ capital accounts, i.e., in the partnerships’ equity as shown on the business’s bookkeeping and records. These amounts should be equal to the total of the reported amounts in item L of all the partners’ Schedules K-1.

However, if your partnership has responded “yes” to question 4 in Schedule B, then you do not need to fill this section of Form 1065.

Step 10: Reviewing Form 1065 and Filing it With the IRS

After you have completed filling all the five pages of your IRS Form 1065, it is time for you to review it thoroughly, preferably with a certified public accountant, or an enrolled agent, or any other tax professional. They will help in ensuring that all the details filled in are complete and accurate.

Once you or a professional hired by you has confirmed that the form is completed correctly, you or them will need to go back to page 1 to sign and date the document. Post this, you will need to file your Form 1065 with the IRS, either online or by mail. This should be done by its deadline.

Remember, unlike several other business tax forms, IRS Form 1065 needs to have several other forms submitted along with it. These are:

- All 5 pages of the tax Form 1065

- Form 1040 Schedule F (if required)

- Form 8825 (if required)

- Form 1125-A (if required)

- Form 8941 (if required)

- Any other schedules or forms as indicated by your completed Form 1065.

In addition to these, you will also have to file each partner or LLC member’s Schedule K-1 with the overall 1065 tax form for the partnership.

When are Schedule K-1, Form 1065, and Form 1120S Due?

All of the individuals are required to file their tax returns by April 15 of each year for the previous tax year to the IRS. They would have to file their Schedule K-1 with their Form 1040. Considering that Schedule K is due by April 15 each year, businesses are liable to distribute the form to applicable individuals latest by March 15.

This is because Forms 1065 and 1120S are due by March 15 each year, and without these forms, individuals would not be able to receive their Schedule K-1. If, however, the due date- 15th March is on a Saturday, Sunday, or during a legal holiday, then you will have to file these forms by the next day, which is not a Saturday, Sunday, or a legal holiday.

However, if you file for a 6-month extension using Form 7004, then your deadline for filing Form 1065 and 1120S would get postponed to September 15 from the original March 15 deadline.

How Can Deskera Help You With Accounting and Tax Filing?

Deskera Books is online accounting software designed to meet all your accounting and tax filing needs. When it comes to the extent of financial reporting and data involved in the process of filling your Form 1065, taking the help of Deskera Books will save you lots of time and effort. This is because it comes with pre-configured tax codes and accounting rules, among many other things.

Additionally, your accountant can get access to Deskera Books as soon as you send them an invite link from your account. This will further help them and you in sorting through all the financial data and documents. In fact, Deskera Books will also make sure that your financial information is updated in real-time.

Key Takeaways

As discussed previously, Schedule K-1 (Form 1065) is a source document that is prepared by a Partnership as part of the filing of their tax return (Form 1065). It is only after Form 1065 is filed that each partner receives Schedule K-1. Schedule K-1 shows the partner’s share of income, deductions, credits, and other such items that the partner will need to report their individual tax return (Form 1040).

While there is only one Form 1065 that needs to be completed per partnership or LLC, it is required for each member of the entity to complete their own Schedule K-1 to file with the tax Form 1065 as well as their personal tax returns. However, in order to complete filling your Form 1065 and subsequently your Schedule K-1, you will require a variety of financial documents and additional tax forms.

Form 1065 is an informational tax form that is used to report the income, gains, losses, credits, deductions, etc., of a partnership or an LLC. This means that no taxes are calculated or paid through this form. Lastly, Form 1065 is a yearly form that can be filed online or through the mail, the deadline for which is 15th March of the following tax year, unless you have gotten a six months extension. In the case of Schedule K-1 however, its deadline is one month after that of Form 1065, i.e., on April 15.

Considering the complexities involved in the completion of the tax form 1065, using accounting software like Deskera Books as well as professional expertise becomes imperative.

Related Articles