Certain enterprises may now apply for "second draw" PPP loans, which is a major aspect of the 2021 PPP loan modifications. For example, struggling small firms that obtained a PPP loan in 2020 would be eligible to get another PPP credit in 2021.

Here’s a guide to finding your PPP loan number. Following are the topics covered:

- Paycheck Protection Program (PPP)

- Loan types

- How do I find my PPP First Draw SBA Loan Number?

- PPP Loan Forgiveness

- Key takeaways

Paycheck Protection Program (PPP)

For 2021, the Paycheck Protection Program (PPP) is resuming. The program, which was revived as a component of the $900 billion stimulus package passed by Congress at the end of December 2020, provides small companies all throughout the US with desperately needed financial help.

Similar to the first round of PPP, the program's specifics weren't finalized until after the bill had been approved. As a result, a lot of small business owners were perplexed as to how PPP functions. We are aware of the significance of this financial safety net for many small business owners.

Here are some of the most typical PPP-related questions that small businesses have asked us. On our PPP website, you can also find the essential information about the loan (such as how to figure out your payroll costs and what the loan may be used for).

How much of a loan can a business get under PPP?

As was the case with the initial round of PPP, small firms can be eligible for a potentially forgiven loan worth up to 2.5 times the company's monthly payroll expenses. Businesses that meet the requirements (i.e., hospitality or food service companies with an NAICS code beginning with "72") may be eligible for a second draw worth up to 3.5 times their monthly payroll expenses.

The following caps are also part of the program:

- Maximum loan total for businesses within a corporate group: $20 million

- Maximum total loan amount: $10 million (aggregate total for First and Second Draws)

- Maximum loan amount for a Second Draw: $2 million

What protections have been included in PPP?

Three crucial provisions put forth by Congress are intended to aid companies that have been the most severely impacted by the corona virus outbreak. What we know right now is this:

On their Second Draw, restaurants, lodging facilities, or live entertainment establishments that fall under an NAICS code beginning with "72" may request 3.5 times their monthly payroll expenditures.

Live event and production businesses that had to shut down might be qualified for a special grant.

BIPOC-owned enterprises will receive $12 billion particularly.

How soon will the lender begin funding the loan?

Starting on the day the borrower is given an SBA loan number, the lender has ten calendar days to distribute the money. The loan must be disbursed in full in compliance with SBA regulations. The day the monies are disbursed by the bank marks the start of the 24-week loan forgiveness period.

The SBA gives lenders 20 days to disburse payments if a borrower-caused holdup, such as a lack of paperwork, prevents them from issuing funds. At the conclusion of that 20-day window, the lender must terminate the loan if it still hasn't gotten the appropriate documents.

What new companies are now qualified for a PPP loan?

The following company categories are now eligible for PPP funding under the new stimulus package:

- News organizations

- Electric, telephone, and housing cooperatives Destination marketing organizations (if they meet applicable requirements)

- Some hospitals owned by government entities

- Tribal businesses

- Businesses that receive legal gaming revenue (if they meet applicable requirements)

- 501(c)(6) organizations and 501(c)(19) tax-exempt veterans organizations

- Certain faith-based organizations

Are PPP loans taxable?

It varies. They're not at the federal level. According to the CARES Act, PPP loan monies themselves are not considered to constitute taxable income (this differs from other forms of business financing that may be counted as taxable business income).

At first, it wasn't clear whether a company or organization could write off costs incurred with PPP loan money. These costs are now tax deductible because to the Economic Aid Act's clarification. The IRS has to be more specific about how this procedure would operate.

You should speak to your local accountant about how your state is managing this issue because some states are currently taxing these monies.

What is the lender’s role with PPP?

Each lender makes their preferred consumer criteria (state, loan size, etc.) available to the marketplace. Additionally, they are completely in charge of how many applications they choose to pull from the market. When a lender and a small business are matched, the lender verifies payroll, submits to E-Tran, runs the required fraud checks (KYC/KYB, etc.), pushes out closing paperwork, and finally finances the deal.

Loan types

Economic Injury Disaster Loans (EIDL) under COVID-19: Each EIDL loan has a unique 10-digit loan number. The process for applying for EIDL loans was done online at the SBA website. With this kind of loan, the borrower deals directly with the SBA. Loans made under the COVID EIDL program cannot be forgiven.

- Instructions for partial payments: Use the 1201 Borrower Payment form to make any partial or installment payments. In the SBA Loan Number section, enter your 10-digit EIDL loan number along with the payment amount you wish to send.

- Full Repayment Instructions: If you choose to repay your EIDL loan in full, you are also responsible for paying back any Uniform Commercial Code (UCC) costs that were incurred. Contact the Service Office mentioned on your monthly 1201 Borrower Statement to obtain a payoff amount before completing payment on this 1201 Borrower Payment form.

Loans under the Paycheck Protection Program (PPP) The PPP loan program were created to give small businesses a clear incentive to keep their employees on the payroll. Loan numbers for PPPs are 10 digits long. These loans are made between the borrower and lender, not between the borrower and SBA, and were started by getting in touch with a lending institution and filling out their application. PPP loans are eligible to be forgiven.

How do I find my PPP First Draw SBA Loan Number?

Your approved PPP loan from 2020 will have a PPP First Draw SBA Loan Number. It might be printed in the loan documents you received after your PPP loan was authorized, depending on your lender.

You will need to get in touch with your first PPP lender and ask them to supply that number for you if you don't have access to these documents or your lender didn't include your PPP number on your documentation.

You will be requested to look for your SBA PPP loan number by filling in the Tax Identification Number (EIN, SSN, TIN or ITIN) you used to apply for your PPP loan and the amount of your loan after registering for the portal and starting your application. The "SBA Loan #" label and the SBA PPP loan number are located in the top left corner of your account home page. It differs from the application number you provided.

Please log into your RAPID Portal or create a CAFS portal account if you are an EIDL borrower. Your loan number can also be found on your original loan documentation.

The CAFS webpage requires all other borrowers to register before they may find their loan number. You may also call the SBA PPP Hotline at (877) 552-2692 or 833-853-5638, Monday through Friday, 8 am to 8 pm ET.

Your Promissory Note also includes your PPP loan number. To help you with your request for forgiveness, the SBA has produced a user guide for the Direct Forgiveness Portal.

How should I write down my PPP First Draw SBA Loan Number?

The SBA loan number of the First Draw PPP loan must be entered as part of the Second Draw Borrower application (i.e. the loan that was originated in 2020).

To make it easier for borrowers to recognize the SBA loan number of their first PPP loan, the SBA states that PPP First Draw Loan Numbers have the following format:

XXXXXXXX-XX (i.e. eight numbers followed by a dash and then two more numbers). Lenders also provide the PPP First Draw Loan Number as 10-digits (without a dash).

Your PPP First Draw SBA Loan Number is a ten digit number without any letters, in any case. Work with your lender to receive your ten-digit PPP First Draw Loan Number since the SBA has requested that all PPP lenders make SBA loan numbers readily available to their clients.

Is it same as your SBA customer ID number?

You should not use your SBA Customer Number on your application in place of your PPP First Draw SBA Loan Number because they are different. With email marketing, you may attract new customers and foster customer loyalty with your current clients.

For busy small business owners, independent contractors, and sole proprietors, email marketing can be completely automatic. With tailored emails that automatically sent once a consumer completes a transaction with you, it helps you turn customers into regulars and increase repeat business. With just a few clicks, increase repeat business and client loyalty while increasing revenue.

Can I check up my PPP First Draw SBA Loan Number in an SBA resource?

You cannot search for your PPP First Draw SBA Loan Number in a centralized database (e.g. from the SBA). For the time being, you must get in touch with the lender who provided you with your First Draw PPP loan and request your PPP First Draw SBA Loan Number.

When can I submit a request for forgiveness?

Once you have met all the requirements for forgiveness, you are free to apply whenever you like as long as it is done no later than six months following the end of your PPP period. Each Lender has 60 days to decide whether the application satisfies the entire conditions for forgiveness or not.

PPP Loan Forgiveness

The Paycheck Protection Program (PPP) was formed by the U.S. government at the beginning of the corona virus (COVID-19) pandemic to assist small firms with 500 or less employees in keeping their payrolls current during the emergency. If you diligently adhere to the debt forgiveness standards, the money are entirely forgiven.

Recent preliminary instructions for PPP loan forgiveness from the Small Business Association (SBA) explain the procedure as a whole. The lender has up to 60 days after you (the borrower) submit the loan forgiveness application to review it and confirm the data you provided. Before June 5, 2020, any unforgiven loan amount will be handled as a two-year loan; after June 5, 2020, it will be treated as a five-year loan. Both have a fixed interest rate of 1%.

How to calculate PPP Loan Forgiveness?

Make sure the dates for your 24-week "alternative payroll covered period" during which you used these money are accurate before attempting to calculate your potential forgiveness amount. Keep in mind that it begins the day your lender disburses your loan. Let's assume that on April 30, 2020, you received money. On October 15, 2020, your 24-week coverage period would come to an end.

You can get a rough idea of the amount using a debt forgiveness calculator or estimator, though lenders will work with each customer individually to compute loan forgiveness. Obtain the following data over the course of the 24-week coverage period:

• The amount of the loan

•The amount of the loan

• The cost of your rent, mortgage, and utility bills.

• Any FTE modifications, salary decreases, and EIDL adjustments

You can make an estimate of the expected acceptable payroll costs to submit in your loan forgiveness application even if you are still in your covered period.

Start with the sum of PPP loan funds you borrowed and used for payroll expenditures and other eligible expenses once you've obtained the necessary data (mortgage, mortgage interest, rent, and utility costs). That is the most you can get away with.

Subtract the percentage of lower wages from there. The same procedure should be followed for any decreases in the average number of full-time employees per month and the average full-time employee percentage. Finally, take any money you received out of the EIDL to determine how much of your debt is forgiven.

What do you need for your PPP Loan Forgiveness Application ?

Due to the length and detail of the PPP Loan Forgiveness Application, make sure you have the necessary materials on hand:

- The legal name, DBA, trading name, and business TIN of your company (EIN, SSN)

- The same information from your loan application, including your company's address, phone number, primary contact, and email address

- The SBA PPP loan number that your lender assigned.

- The lender’s PPP loan number

- Your PPP loan amount

- The amount of staff you had when you applied for the loan

- The number of employees at the time you applied for forgiveness

- When your lender disbursed your first PPP loan disbursement or when you received your PPP money from them.

- The amount of the EIDL advance, if you were given one.

- If you applied, your EIDL application number

- The payroll schedule for your company

- Your covered time period (either the 8-week or 24-week period after your loan was disbursed)

- If applicable, any alternative payroll covered period

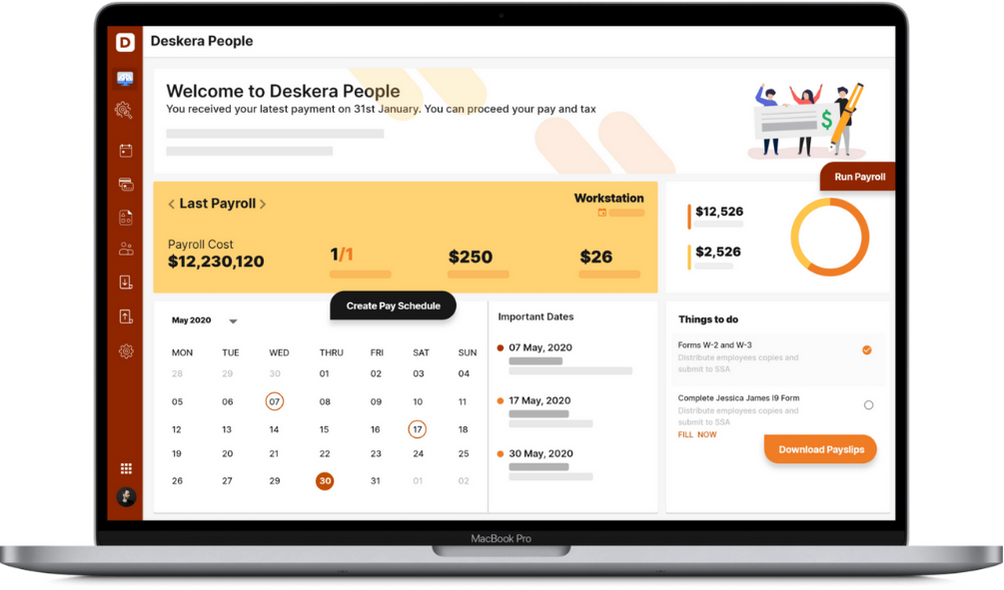

How Deskera Can help You?

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

To learn more about Deskera and how it works, take a look at this quick demo:

Key takeaways

- The SBA's judgment is usually made reasonably quickly when a lender files a PPP application through the SBA's system (E-Tran). The system received thousands of applications simultaneously from numerous banking and financial organizations, which are what caused the delay. As a result, the E-Tran system had to be temporarily shut down. An SBA loan number is given to the borrower if the loan is given preliminary approval, letting them know that money have been set aside for them.

- Your PPP First Draw SBA Loan Number is one of the things you'll need when submitting an application for a second draw PPP loan. This is a special 10-digit loan number that the lender that arranged your First Draw loan provided to your First Draw PPP loan.

- $2 million is the maximum loan amount for Second Draws. If you win $9 million in your first draw, you can only win $1 million in the second draw since the combined total for the first and second draws cannot exceed $10 million. A corporate group's enterprises are only permitted to borrow a total of $20 million.

Related articles