If you are a small business, you must have thought of taking a loan in order to expand your business or purchase some long-term assets. If this has been the case with you, you must have come across the term “small business administration loan”.

Have you? No? Then read this blog for a deep understanding of the blog.

What is the SBA loan?

What is the SBA community advantage program?

How can you apply it?

SBA Community Advantage Program: An Overview

As a small business, you've probably come across SBA loans when researching for appropriate lending choices. These partially government-guaranteed loans, which range from the classic 7(a) loan to the CDC/504 loan, provide some of the finest conditions and rates on the market. The severe conditions required to qualify for many SBA loan programmes may alienate you if you're a startup or business owner with mediocre credit.

Fortunately, SBA Community Advantage loans are a form of SBA loan developed exclusively for businesses in disadvantaged communities. This pilot loan programme, which is part of the broader 7(a) programme, is an excellent choice for young firms, those in historically "risky" industries, and those businesses which are owned by women, minorities, and veterans.

SBA Community Advantage loans, as previously stated, are a form of SBA loan that falls under the 7(a) lending programme. The SBA Community Advantage loan programme, unlike other forms of SBA 7(a) loans, is a new initiative, which means it will only be available for a short time until it is extended or made a fixed element of the SBA lending programmes.

The SBA Community Advantage loan programme, on the other hand, was established in 2011 to "address the credit, management, and technical support needs of small companies in underserved regions." The new initiative has been extended until September 30, 2022, despite the fact that it was supposed to finish on March 31, 2020.

With this in mind, while the SBA Community Advantage loan programme is legally part of the 7(a) programme and shares some application criteria, it varies from other SBA loans in a number of respects.

To begin with, unlike conventional SBA 7(a) loans, which are granted by SBA lenders such as national, regional, and local banks, SBA Community Advantage loans are issued by special lenders that are registered in this programme, also known as CA lenders.

What type of organizations are known as CA Lenders?

- SBA-Authorized Certified Development Companies (CDCs);

- SBA-Authorized Microloan Program Intermediaries

- SBA-Authorized Intermediary Lending Pilot (ILP) Program Intermediaries; and

- Non-federally regulated Community Development Financial Institutions (CDFIs) certified by the U.S. Treasury Department.

Special Lending Requirements for CA Lenders

Organizations that have been allowed to participate as CA Lenders must make at least 60% of their CA loans in underserved markets. Underserved markets are defined as follows for the goals of CA:

- Communities with a Low-to-Moderate Income (LMI) (CA Lenders are encouraged to serve poor and very-low-income communities);

- Businesses with more than 50% of full-time employees that are low-income or live in LMI census areas;

- Enterprise Communities and Empowerment Zones;

- HUBZones (High-Tech Business Zones);

- New enterprises (those that have been in operation for less than two years);

- Businesses run by veterans;

- Zones of Opportunity;

- Promise Zones; and/or

- Rural settings

How Does The SBA Community Advantage Program Work?

Small companies can obtain more inexpensive loans from partnering lenders with an SBA Community Advantage loan. In the unusual event that your firm fails, the SBA guarantees the lender that it will return 75-85% of your loan. Lenders can then give firms with up to $250,000 in loans, with durations up to 25 years and prices no higher than the current prime rate plus 6%, that they might not otherwise qualify for.

To be eligible for SBA Community Advantage loans, lenders must commit to providing at least 60% of the program's funding to disadvantaged markets. This category covers firms that are veteran-owned, have been in existence for less than two years, are situated in rural regions, or are in low- to moderate-income neighbourhoods. Lenders can also supply or connect enterprises to organisations that provide management and technical skills.

The Small Business Administration's Community Advantage loan is part of the wider SBA 7(a) lending programme. The maximum loan amount differs significantly between the two programmes, with SBA 7(a) loans having a cap of $5 million compared to Community Advantage's limit of $250,000. In addition, SBA Community Advantage loans have a significantly higher interest rate ceiling of 6% over prime, compared to a maximum of 4.75 % over prime for 7(a) loans. Both loans, however, have equal payback conditions.

A Quick Synopsis of The SBA Community Advantage Loans

A Detailed Synopsis of The SBA Community Advantage Loans

Let's talk about what these loans look like now that you have a better understanding of how the SBA Community Advantage lending programme operates. When it comes down to it, the following terms and conditions apply to SBA loans:

- Loan Amount: SBA Community Advantage loans are smaller SBA loans with loan amounts ranging from $50,000 to $250,000.

- SBA-Guarantee: For loans of $150,000 or less, the SBA will guarantee up to 85% of the loan amount, and up to 75% for loans of $150,001 or more.

- Interest Rates: Though CA lenders have significant flexibility in terms of interest rates, the SBA sets a maximum rate for these loans of prime + 6%. The rates for SBA Community Advantage loans typically vary from 7% to 9%.

- Repayment Terms: Vary according to the borrower's credentials and the loan's purpose; maximum of 10 years or the equipment's usable life, 10 years for working capital, and 25 years for real estate.

- Fees: An upfront SBA guarantee fee of 0.25-3.0% will be required for SBA Community Advantage loans, depending on the loan amount and repayment conditions. The CA lender has some flexibility in imposing additional costs. According to SBA standards, they are limited to a maximum processing or application cost of $2,500.

- Eligible Loan Purposes: SBA Community Advantage loans, like other SBA 7(a) loans, can be utilised for almost any company purpose, including working capital, real estate purchases, renovations, equipment purchases, debt refinancing, and more. These loans, on the other hand, cannot be utilised as revolving lines of credit.

- Collateral and Personal Guarantees: For loans less than $25,000, there is no need to take collateral from the CA lenders. SBA rules for loans over $25,000, on the other hand, specify that the lender should use the same collateral procedures as they use for other, similarly-sized non-SBA loans. A personal guarantee will be required for SBA Community Advantage loans, regardless of collateral.

What Can You Finance Through SBA Community Advantage Loans?

You may use your Community Advantage loan to benefit your small company in a variety of ways. Here's a list of things you can do with your funds:

- Purchase a company

- Start your own company.

- Increase the size of your company

- Purchase necessary equipment.

- Employ people.

- Invest in inventory

- Purchase supplies.

- Debt consolidation

- Payroll should be covered.

- Increase your marketing efforts.

- Relocate

- Optimize cash flow

- Enhance your structure.

- Make your rent payments.

- Repay a debt

Pros & Cons of SBA Community Advantage Loans

Pros:

- Repayment terms are long and interest rates are low.

- In comparison to other SBA loans, the conditions are more flexible.

- The loan may be utilised for almost anything.

- Startups, firms with ordinary credit, and enterprises in traditionally "risky" industries, such as food and beverage, will benefit greatly.

- It's ideal for firms who have been turned down for other types of funding.

- This is ideal for women-owned, minority-owned, and veteran-owned enterprises.

Cons:

- Lower loan amounts as compared to other SBA loan programmes and other lending choices available.

- It takes a long time to fund and requires a lengthy application.

- It can't be utilised as a revolving credit line.

- There will be a personal guarantee (and maybe collateral) required.

General & Specific Requirements of an SBA Community Advantage Program

SBA Community Advantage loans are similar to SBA 7(a) loans in certain respects and distinct in others, and firms must meet both general and specific standards to be eligible.

It's worth noting at this point that, while the SBA has some loan qualifying standards, others will differ according to the CA lender you're working with. Let's go down both the general SBA loan criteria and those specific to the SBA Community Advantage programme with this in mind.

General Requirements

To be eligible for the SBA Community Advantage loan programme, you must fulfil the following general requirements:

- It must be a for-profit company operating in a qualified industry in the United States.

- According to the SBA criteria, it must be a "small business."

- Other usual funding sources must have been exhausted.

- You must have put some of your own money and time into the company.

- Must be able to demonstrate "good character" as well as the ability to pay back the loan.

- Have not defaulted on any government-guaranteed company loans in the past.

Specific Requirements

Most SBA loan programmes enable the individual lender to evaluate your business's capacity to repay the loan on their own when it comes to showing your ability to repay the loan. The SBA, however, lays forth more detailed instructions for satisfying these sorts of standards because of the nature of the SBA Community Advantage loan programme.

To this point, SBA Community Advantage lending requirements are far more flexible than typical 7(a) loan requirements:

- Minimum credit score: To qualify for an SBA loan, most firms must have great credit. However, under this programme, CA lenders can submit applications with credit scores as low as 140, according to SBA standards. Of course, the lender has the authority to set some of their own credit criteria.

- Time in business: To qualify for an SBA loan, most conventional SBA lenders will demand that you have been in the company for at least two years. The SBA Community Advantage lending programme, on the other hand, is designed specifically for small businesses. Businesses of all sizes are welcome to apply as long as they can demonstrate a vision for the future, including financial predictions, a complete business plan, and relevant industry expertise.

- Business financial record: Traditional SBA loan candidates should be able to prove excellent business financial records (preferably, showing they are profitable), similar to the time in business criteria. However, there is a lot more versatility with this programme.

How to Apply for an SBA Community Advantage Program?

If you're ready to apply for a CA loan, the first step is to locate a qualified lender. To locate CA lenders in your region, try the lender match tool. Many lenders start the application process by requiring you to submit financial statements as part of the prequalification procedure. After your potential lender gets your documents, the approval procedure might take two to four weeks.

Following is a list of documents that you need to submit:

- General personal and business information

- Business and personal tax returns

- Business financial statements

- Bank statements

- Business plan

- Business debt schedule

- Resumes of company management

- Collateral and personal guarantee

- Legal documents

You'll need to fill out and sign certain SBA documents in addition to the lender approval procedure. These are some of them:

- Form 1919: Borrower Information Form

- Form 2449: The Community Advantage Addendum, which collects data on any managerial or technical support provided to your company.

- Form 413: The Personal Financial Statement which evaluates repayment capacity and creditworthiness.

Bottom Line

Having said that, there's no denying that SBA Community Advantage loans offer a versatile and cost-effective source of capital for small businesses.

As a result, if you think this sort of loan will be beneficial to your company, it's well worth your time to check for CA lenders in your region, contact them, and discuss your company's financial needs.

How can Deskera Help You?

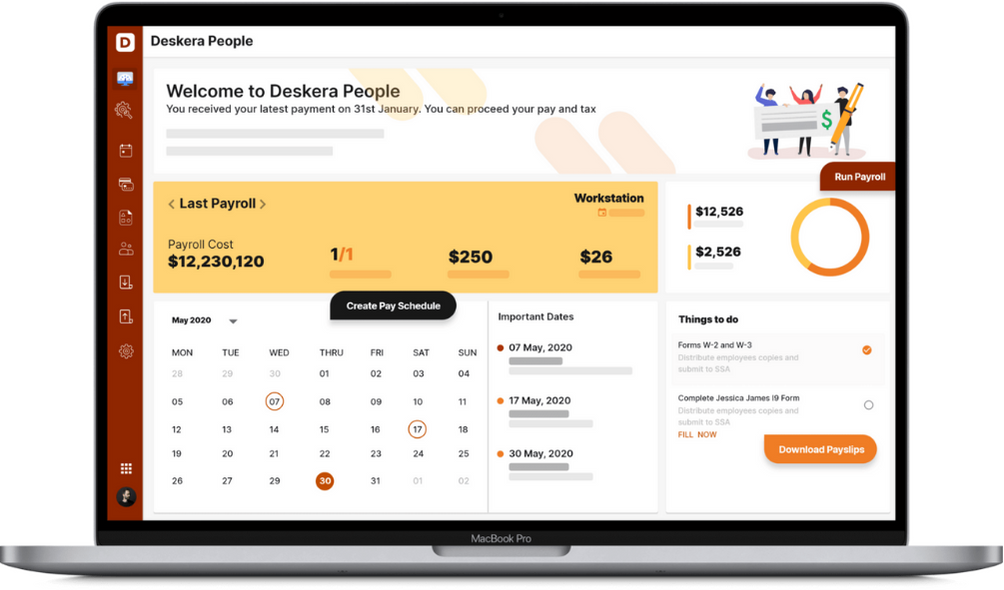

Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

- The SBA Community Advantage program is one of the most chosen options for small businesses when they consider taking loans, along with the finest conditions and rates on the market.

- This program is an excellent choice for young firms, those in historically "risky" industries, and those businesses which are owned by women, minorities, and veterans.

- To be eligible for SBA Community Advantage loans, lenders must commit to providing at least 60% of the program's funding to disadvantaged markets.

- Most SBA loan programmes enable the individual lender to evaluate your business's capacity to repay the loan on their own when it comes to showing your ability to repay the loan.

- When you’re ready to apply for the loan, find an appropriate CA lender to help you with the process and submit all the documents to them, along with filling 3 forms, i.e, Form 1919, Form 2449, Form 413.

Related Articles