If your business is registered as an S Corp, you could expect to save a considerable amount on your taxes. Sounds too good to be true?

Well, that is true! S corps as a business entity offers you opportunities to save on those valuable dollars; yet, there is so much more that you should know about the S corps. The 2018 tax reform has been the driving force behind the companies diving in to convert to S corps. The primary reason, the businesses are looking to register themselves as an S corp is the amount of tax one can save. Furthermore, converting to an S corp is much simpler now. However, there are other advantages that are discussed in this article.

As a business owner, you may have questions concerning the business structure, its advantages, disadvantages, and so on; which we have attempted to answer through this post.

We shall be taking a long look at the fundamentals of the S corporations and the tax-saving mechanism they offer.

Here is what the post entails:

- What are S corps?

- How do S corps help you save money on taxes?

- Example of S corp tax savings calculation

- Advantages of starting an S corp

- Drawbacks of S corps

- S corp FAQs

- How can Deskera Help You?

- Key Takeaways

What are S corps?

Businesses that are incorporated, such as LLCs and corporations, can choose the IRS tax status known as an S corporation or the S corp. In essence, only an LLC or company can choose the S corp tax classification. Therefore, just like any other LLC or corporation, any business that conducts business as an S corporation also provides limited liability protection.

An S corporation is distinguished primarily by the tax benefits it provides. You get something known as limited liability protection as an S corp owner. Since the business is independent of you personally, you are not liable for any obligations or liabilities incurred by it. In the event your business is ever sued, this safeguards your personal assets.

Because it chose to be taxed under Subchapter S of the Internal Revenue Code, a "pass-through" company for taxation, it is known as an S corporation. The advantages an S corp offers are similar to those of a C corporation. These include ownership, administration, and liability protection that a C corporation affords are also available to S corporations.

You may wonder, though, if there is anything that may catch you off guard. Well, the only hitch is that an S corp owner must pay a salary to themselves, much like they would pay to their employees, which is a reasonable amount. Additionally, the S corp owners should pay taxes on the profits the company makes.

What is a ‘reasonable salary’ and why is it important?

A fair wage or a reasonable amount must be paid as a salary. It must be remembered that a salary is different from distribution. Other than fair remuneration for the services rendered to the corporation, the IRS has not specified what a "reasonable salary" is. It is a good idea to pay the "reasonable" income for the position as compensation, with any extra money going to distributions.

It is important to take cognizance of the reasonable salary, because if a company fails to do so, it may expose itself to the risk of an audit by the IRS.

How do S corps help you save money on taxes?

This section will share detailed insights about S corps with an owner and/or spouse. The laws are a bit more intricate when you have more employees or have employees other than your spouse or children.

Let’s start learning how you can save taxes being an S corp.

- Lowering Owner’s Salary

- Employing your child

- Covering Owner’s Health Insurance Premiums

- Deducting Home-Office Expenditure

- Renting out your home to your S corp

- Implementing a plan to reimburse cell phone and travel expenses

- Utilizing Section 179 – Depreciation for vehicles

Lowering Owner’s Salary

By reducing their exorbitant wages by $10,000 to $20,000 each year can help the S corp owners lower their personal payroll taxes. The owner can take their residual S corp revenues as distributions that are exempt from self-employment tax by reducing their pay.

However, you must be careful not to reduce the wage below the amounts the IRS deems "reasonable salary," as an annual income. Another crucial rule is to never accept a distribution unless you are earning a wage.

Once you have decided to take this step, you can start by collecting the accurate numbers from the IRS laws in your state. Know what is the reasonable salary range and keep yourself in the same range to avoid being audited.

Employing your children

When you employ your children, although you must pay the payroll taxes, the best part is that you can move from a higher tax bracket to a lower tax bracket. This can help you save for their future and also cover the existing expenses, for example, their education, tuition fees, and so on.

Although creating a retirement account early enables tax-free growth of those contributions, as an S corp, your child's salaries are still subject to social security and Medicare tax. However, It is crucial to remember that in order for your child to earn money and have the right documentation, they must be engaged in a genuine job. If not, the wage deduction for your child could be rejected during an audit.

Covering Owner’s Health Insurance Premiums

S corporations allow you to deduct your health insurance amount and if you are into healthcare businesses, it is crucial for you to know how that is done. Most healthcare business owners are unaware that in order to deduct your health insurance, you must do so through your S corp. Next, an S corp can set up a health insurance plan in one of the following two ways for an owner or employee who owns more than 2% of the business:

- the S corp pays the premium for the owner or family OR

- the S corp reimburses the owner for the payments.

Your spouse and other dependents who are under the age of 27 are all eligible for coverage under the health insurance plan offered by your S corp provided you follow these IRS-mandated procedures. The procedures are as mentioned in the following points:

- Ensure that the S corp covers your insurance premiums outright or via reimbursement

- The cost of the premiums must be deducted from your Form 1040's self-employed health insurance deduction

- The S corp must report the health insurance as salaries reported by the S corp on your W-2

Note: It is vital to keep in mind that your insurance premiums must be lesser than your S corp pay in dollars. Also, if you and your spouse qualify for health insurance through your spouse's employment, you cannot claim this deduction.

Deducting through Home-Office Expenditure

Finding personal expenses that can be offset against corporate earnings is always a part of traditional tax deduction methods. As an S corp, your business is subject to the same rules. When the S corp pays the owner's home or office expenses, the S corp can deduct those costs due to which the owner's living expenses partially become tax-free.

Ensure appropriate reimbursement

To understand this completely, we must know how and when to utilize Form 2106 to subtract the expenses that are not yet reimbursed.

You will receive no profit from renting the office to your S corp. The rent you received is subtracted by the S corp. The existing tax rule prohibits deducting taxes from rental income if you include the rent in your taxable income on your personal tax return. Also, presuming you qualified over the 2 percent AGI maximum in the first place, you are no longer able to use Form 2106 to deduct unreimbursed costs from your Schedule A.

To ensure the appropriate reimbursement, you must adhere to the following instructions provided by the IRS in IRS Regulation Section 1.62-2(c):

- As an employee, you must submit expense reports to your employer that detail your home office costs.

- Your firm will compensate you for the home office under the S corp's accountable plan, deducting the full cost of the area as an office space.

- The reimbursement will be given to you as an employee business cost that is not taxable.

Besides these points, there are certain other key factors you must remember. When you use the space of your home office to perform activities and operations for earning your income, you can get it qualified as your main site of work. Also, do not forget to calculate and write down each of your expenses correctly. This documentation is essential to making the process free from undergoing an audit.

What is an Accountable Plan?

Employee expense reimbursement is handled through an accountable plan. Accountable plans are not seen as a type of workers' compensation, hence they are not taxed. Costs must be business-related, fully recorded, and have any excess reimbursements repaid in order to be included in an accountable plan.

A reimbursed expense is taxable by the IRS if it is determined to be non-accountable. Usually, excess monies must be refunded within 120 days.

Preparing your Tax return

In your S corp tax return, give a line item named – office space. Then, report the entire reimbursement for the home office in the other deductions section on the S corp tax return. On your personal return, subtract the sums you got from the S corp for the office mortgage interest and property taxes from your itemized deductions.

Last but not least, you must remember to record the depreciation that the company offers you for your home office in the permanent file that you use for your individual taxes.

Renting out your home to your S corp

This step can be instrumental in helping you save some dollars on your tax amount. As an S corp owner, you are not required to disclose the income from renting out your full residence to the S corp for up to 14 days per year. The whole rent will then be deducted by the S corp, resulting in a completely tax-free accrual of income for you.

Points for consideration

Don't let the S corp rent your house to host events or visitors. The entertainment facility rule forbids any kind of entertainment deductions. Therefore, only allow your company to utilize your house for employee gatherings and staff retreats and not for any other entertainment purposes. Additionally, you might lease your house to a business for conducting business meetings.

Implementing a plan to reimburse travel and cell phone expenses

If you are an S corp owner who travels for business purposes, submitting an expense report to the S corp is the first step in order to initiate a reimbursement. Your airfare, a rental car, luggage fees, hotel, and meals are all considered travel costs and therefore, you must send a monthly cost report and associated receipts through your accountable plan.

Note: It is vital to remember that if you own more than 10% of the company, you cannot pay lodging charges using the per-diem allowance system. Instead of this, you must utilize actual travel expenses.

Your organization may repay you under the accountable-plan regulations if you pay a business expense directly out of your own pocket rather than via your company. According to these regulations, you as the owner are required to incur these costs while carrying out your responsibilities for the corporation and substantiating the costs to the corporation in accordance with the requirements outlined by the IRS.

The reimbursement is no longer included in your gross income and is not reported as compensation on your Form W-2. Furthermore, it is not even subject to withholding or payment of employment taxes like FICA if you satisfy the relevant conditions or incur the related expenses.

Cell phone reimbursement

Companies usually provide their employees with a phone for better approachability. An employee may be eligible for an income exclusion when an S corp supplies them with a smartphone or other gadget that is largely needed for non-compensatory business purposes.

The S corp can deduct the whole cost of the phone and monthly services from the employee's pay and repay them for it. As a result, the employee receives the reimbursement as tax-free income. All you need to do is remember to preserve and present your monthly cell phone bills to include them in your monthly expense reports.

Utilizing Section 179 – Depreciation for vehicles

A heavy vehicle is one that weighs at least 6K pounds. Such a qualifying heavy vehicle can generate a Section 179 first-year depreciation credit if it is operated at least 50% for commercial reasons. You can write off a considerably huge amount (over $500,000) of qualified new or used equipment that is put into service according to Section 179.

It is crucial to be aware that the Section 179 deduction cannot be greater than the total net business taxable income from all sources for the tax year before you write off Section 179. Moreover, if your home office qualifies as a principal place of business, all business trips to and from your place of employment can accrue business miles that can be repaid through the standard business mileage deduction or actual expenses.

You can add all your trips here including the ones to the hospitals or for any other office-related work. You will easily be able to overcome the "over 50% commercial use hurdle" with this additional mileage.

It goes without saying that you will need to preserve and produce all the receipts and records of these trips to claim reimbursement for them.

Example of S corp tax savings calculation

When you operate an S Corp, the more money you pay yourself as a distribution, the more Social Security and Medicare tax you will save. In a similar vein, you will save more money the more money your business makes.

Here is an illustration that offers insights into a comparison drawn between the S corp and a sole proprietorship. We shall be looking at this comparison in terms of the taxes that can be saved in each case.

These graphs illustrate the tax savings for companies with profits of $40,000 and $100,000. As you can see, your savings will increase as your employee wages decrease. The graphs also demonstrate the financial savings that result from paying yourself 60% and 40% of your company's profit in salary, with the remaining 20% given as a shareholder payout.

Sole Proprietor vs. S Corp: $40,000 Profit

Sole Proprietor vs. S Corp: $100,000 Profit

When you operate an S Corp, the more money you pay yourself as a distribution, the more Social Security and Medicare tax you will save. In a similar vein, you will save more money the more money your business makes.

However, in order for an S Corp to be profitable, you must make at least $40,000 in profit. Otherwise, the expenses of starting and maintaining it outweigh the advantages.

Advantages of starting an S corp

Apart from offering some key tax advantages, having an S corp can benefit you in a number of other ways. Here are some of the benefits that an S company can provide its owners. However, you should be mindful of your short and long-term objectives as sometimes a benefit may turn out to be a disadvantage at the later stage for S corporations.

Security in terms of assets

Regardless of its tax status, an S corporation offers owners limited liability protection, which is a significant benefit. Limited liability protection protects the owners' personal assets from the demands of the company's creditors, whether those demands result from agreements or legal proceedings. This is true for all corporations; they all provide limited liability protection.

Paying salaries and dividends

An S corporation owner may choose to receive payments from the corporation in the form of a salary or dividends. This can be crucial to reducing the overall tax burden.

The reason for this is due to the fact that dividends are exempt from self-employment tax. Additionally, when calculating the amount of income that is passed through to the shareholders, the S company may deduct the cost of the wages paid.

However, the IRS must deem the distribution of wages and profits to be valid and reasonable. It is vital to monitor the distribution as such transactions may attract intervention from the IRS; especially, in the case of large payments.

Pass-through taxation

S corporations have the advantage of passing through business income, as well as numerous tax deductions, credits, and losses, to the owners instead of being taxed at the corporate level. This reduces the possibility of double taxation, which happens with C corporations when dividend income is initially taxed at the corporate level before being taxed at the shareholder level. This is due to the fact that an S corp is a pass-through entity for the purposes of federal income tax.

Easy conversion

Simply filing the election with the IRS will result in S corporation stockholders being taxed as C corporations. A pass-through LLC that wants to be taxed as a C corporation can also do so by submitting a simple IRS form.

To convert their LLC into a C or S corporation, the LLC owners must abide by both their state's corporation and LLC regulations. They must also submit the necessary paperwork along with filings to the state that include formation filings and dissolution/withdrawal filings.

Drawbacks of S corps

For certain sorts of businesses and company ideas, some advantages can also serve as downsides.

Let’s go through some challenges you may face with being an S corporation as well as some problems with conducting business as a corporation.

Rigid qualifying standards

The corporation must adhere to stringent standards regarding the number, nature, and types of shareholders and share classes in order to be eligible to elect to be treated as an S corporation and to remain such. All these regulations are based on federal laws. In a nutshell, these guidelines consist of the following:

- Shareholders may only be persons, specific estates and trusts, and specific tax-exempt organizations.

- There can only be 100 shareholders total. However, there can be an inclusion of some family members as a single shareholder.

- There can be just one type of stock; it does permit differences in voting rights.

- Any entity that is a pass-through can be an LLC without being constrained by those rules. Even though an S corporation and an LLC are both pass-through companies, their taxation is not the same since they are taxed under distinct provisions of the Internal Revenue Code.

There can be just one type of stock, except the differences in voting rights are permitted.

Corporate protocol

S corporation is primarily a corporation that must adhere to all corporate formalities mandated by the company statute of its native state. The state LLC statutes, however, impose much fewer legislative requirements. To conduct business in a state other than one's home state, companies and LLCs must register.

Rigid allocation of profits and losses

An S company is mandated to divide profits and losses among its owners strictly according to ownership percentage or the number of shares held because it is a corporation. In contrast, an LLC's owners are free to divide its revenues and losses in any way they wish.

As a result, the original owner who transfers 50% of the business to a new member may be entitled to a disproportionate amount of the LLC's profits. The founders' allocation is lowered from 100% to 50% in an S corporation.

S corp FAQs

Q: How can I get an S corp tax status?

A: The process to apply for S Corp tax status is as follows:

- Create a company or LLC to own and run your business.

- You shall now become the owner of the corporation as an LLC member or a sole shareholder.

- Submit IRS Form 2553 to the IRS in order to make an S Corp election.

Q: Do I need a tax adviser as an S corp owner?

A: To analyze the potential tax advantages of choosing the S Corp form, based on the corporation's and its shareholders' characteristics, you are advised to consult with an accountant or tax attorney both during and after the incorporation process. Your tax advisor may provide you with information regarding how to obtain your company's tax identification number and use it to open a bank account, apart from a load of other things.

Your advisor can also provide guidance on how to effectively take advantage of these tax advantages once you have decided that filing taxes as an S Corp is the best option for you.

They can also offer you insights on what can be deducted for tax reasons as business costs and make recommendations for how long you should keep receipts.

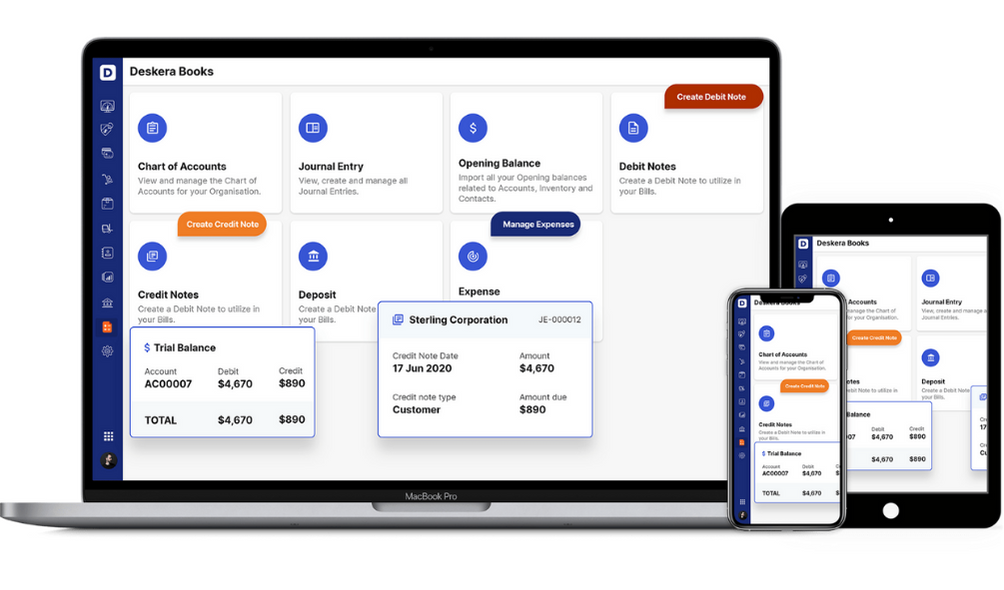

How can Deskera Help You?

Deskera Books can assist you in automating and reducing your company's risks. Deskera makes it simpler to create invoices by automating many additional tasks and lowering the administrative burden on your team. Register right away to receive further Deskera benefits.

Find out more about the outstanding and all-inclusive software here:

Key Takeaways

- Businesses that are incorporated, such as LLCs and corporations, can choose the IRS tax status known as an S corporation or the S corp.

- In essence, only an LLC or company can choose the S corp tax classification. Therefore, just like any other LLC or corporation, any business that conducts business as an S corporation also provides limited liability protection.

- Since the business is independent of you personally, you are not liable for any obligations or liabilities incurred by it. In the event your business is ever sued, this safeguards your personal assets.

- Because it chose to be taxed under Subchapter S of the Internal Revenue Code, a "pass-through" company for taxation, it is known as an S corporation.

- The advantages an S corp offers are similar to those of a C corporation. These include ownership, administration, and liability protection that a C corporation affords are also available to S corporations.

- Lowering the owner’s salary, employing children, deducting home-office expenditure, and renting out your home to your S corp are some of the ways in which you can lower your S corp taxes.

- By reducing their wages by $10,000 to $20,000 each year can help the S corp owners lower their personal payroll taxes. The owner can take their residual S corp revenues as distributions that are exempt from self-employment tax by reducing their pay.

- Once you have decided to take this step, you can start by collecting the accurate numbers from the IRS laws in your state. Know what is the reasonable salary range and keep yourself in the same range to avoid being audited.

- When you employ your children, although you must pay the payroll taxes, the best part is that you can move from a higher tax bracket to a lower tax bracket. This can help you save for their future and also cover the existing expenses.

- Most healthcare business owners are unaware that in order to deduct your health insurance, you must do so through your S corp.

- Your spouse and other dependents who are under the age of 27 are all eligible for coverage under the health insurance plan offered by your S corp provided you follow these IRS-mandated procedures

- When the S corp pays the owner's home or office expenses, the S corp can deduct those costs due to which the owner's living expenses partially become tax-free.

- As an S corp owner, you are not required to disclose the income from renting out your full residence to the S corp for up to 14 days per year. The whole rent will then be deducted by the S corp, resulting in a completely tax-free accrual of income for you.

- Implementing a plan to reimburse your travel and cell phone expenses can be another way to lower the taxes.

- You can write off a considerably huge amount of over $500,000 of qualified new or used equipment that is put into service according to Section 179.

- When you operate an S Corp, the more money you pay yourself as a distribution, the more Social Security and Medicare tax you will save. In a similar vein, you will save more money the more money your business makes.

Related Articles