The new Goods and Services Tax (GST) regime has brought about a slew of reforms to the indirect tax system, affecting firms doing business in India.

One such change pertains to introducing a reverse charge mechanism (RCM) and the taxation of import of services via RCM.

What is the Reverse Charge Mechanism under GST?

Reverse Charge is a mechanism in which the recipient of the goods/services can pay the tax instead of the goods and service provider.

Under the normal tax regime, the buyer's supplier collects the tax collection and deposits the same after adjusting the output tax liability with the available input tax credit. But under the reverse charge mechanism, liability to pay tax shifts from supplier to recipient.

When Is Reverse Charge Applicable?

Under GST law, the following are the scenarios of the reverse charge mechanism.

Supply of specific goods and services specified by the CBIC

Under section 9(3) of the CGST Act, 2017, this scenario is covered. According to this section, the GST council's categories of goods and services will come under the RCM in GST. In simple words, the recipient receiving any specific type of goods/services will be liable to pay GST instead of the supplier.

- List of Goods under RCM in GST

There are a total of 8 categories of goods in the supply of goods, subject to RCM as per section 9(3) of the CGST Act.

Following is the list of goods under RCM in GST,

- List of Services under RCM in GST

In the case of a supply of services, under section 9(3) of the CGST Act, there are specific categories of services and certain types of services as per the IGST Act, subject to RCM. Following is the list of RCM services under GST.

Supply from an unregistered dealer to a registered dealer

Section 9(4) of the CGST Act, 2017 declares that the supplies made taxable by an unregistered supplier to a registered recipient under GST will be subject to an RCM. In short, in such a case, the registered person will be liable to pay GST on a reverse charge basis. Thus, all GST provisions will apply to the registered recipient so that he is liable yo pay GST with the supply of goods and services he received.

Hence, every time the registered person buys supplies from an unregistered supplier, he must pay GST on a reverse charge basis. However, if the value of these supplies is less than Rs 5,000, then the registered person under the RCM is exempted from paying GST on such goods and services.

Further, section 9(4) of the CGST Act will not apply to an unregistered supplier if he makes supplies to a TDS deductor. In other words, as per section 51 under CGST Act, and who deducts TDS, the government companies will not be liable to pay GST under Reverse Charge.

Supply of Services By E-Commerce Operator

Section 9(5) of the CSGT Act, 2017 declares that supplied services by an e-commerce operator are subject to the RCM. In short, if an e-commerce operator supplies services, he will be liable to pay and collect GST for the supplied services.

Therefore, the GST Act shall apply to the e-commerce operator as if he is the supplier who is liable to pay GST with regard to the supply of services.

However, suppose the electronic commerce operator does not have a physical presence in the taxable territory. In that case, the person who is representing an e-commerce operator will be responsible for tax payment.

If in the taxable territory, if these e-commerce operator does not have a representative, then he needs to appoint a person liable to pay GST for the services supplied.

Time of supply under RCM

In the case of Goods:

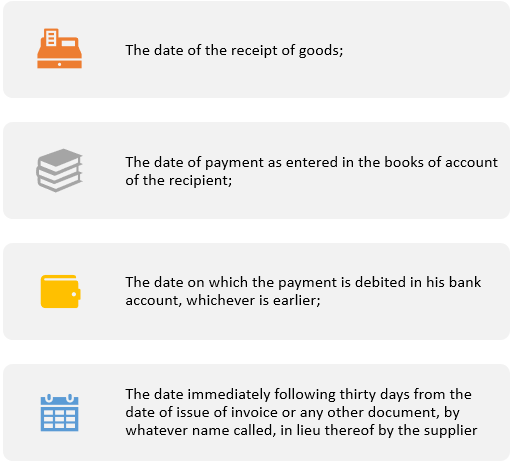

The time of supply for goods, in case of reverse charge, shall be the earliest of the following dates:

Note: However, if it is not possible to find out the time of supply in mentioned above cases than the time of supply will be considered the date of entry in the books of account of the recipient of the supply.

With the following example, let us understand in detail:-

- Payment Date – June 18th, 2019

- Invoice Date – July 1st, 2019

- Entry date in books by the recipient – June 19th, 2019

Here the time of supply will be June 18th, 2019. In case the supplier is located outside India, then the time of supply will be earlier of, " When the amount is paid (The payment date) OR When the recipient records the payment in his accounting books.

In the case of services

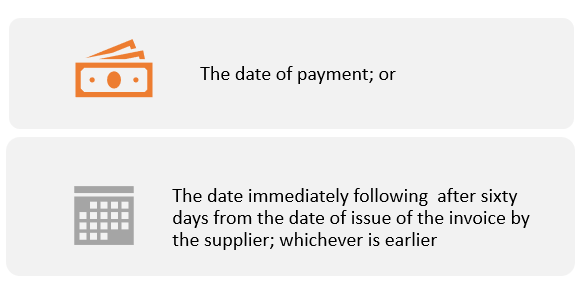

The time of supply for services, in case of reverse change, shall be the earliest of the following dates:

With the following example given below, let us understand in detail:-

- Payment Date – August 18th, 2019

- Invoice Date – September 1st, 2019

- Entry date in books by the recipient – August 19th, 2019

Note: In this case, the time of supply will be 18th August 2017, Due to some reasons if the time of supply can’t be ascertained under 1 or 2 heads, in this case, it will be August 19th i.e., date of entry in books by the recipient.

In the law, there are two types of reverse charge scenarios.

- Depends on the nature of supply and nature of supplier, under section 9 (3) of CGST/ SGST (UTGST) Act and section 5 (3) of the IGST Act

- Taxable supply made by the unregistered person to a registered person covered under section 9 (4) of the CGST/SGST (UTGST) Act and section 5 (4) of the IGST Act.

What Are the Exemptions to RCM?

Following are a few cases that are exempted from Reverse Charge under GST-

- Exempted goods or services- The Reverse Charge will not be applicable if the goods and services are exempted from GST,

- If the aggregate value of the goods & services does not exceed the amount of Rs. 5000 a day, then such transactions will be exempted from the provisions of reverse charges.

Invoicing Rules under RCM

The recipient/buyer of goods or services, under RCM, issues an invoice on receipt of goods or services from the supplier. Further, at the time of making payment to the supplier, they shall issue a payment voucher.

At the month-end, if the aggregate value of such supplies exceeds Rs 5,000 in a day, then a registered recipient or buyer can issue a consolidated invoice.

Manner of GST Payment under Reverse Charge Mechanism

As per the GST provision law, the person supplying goods needs to mention in the tax invoice whether the tax is payable under the RCM.

Below mentioned are some points to remember while making GST payment under reverse charge:

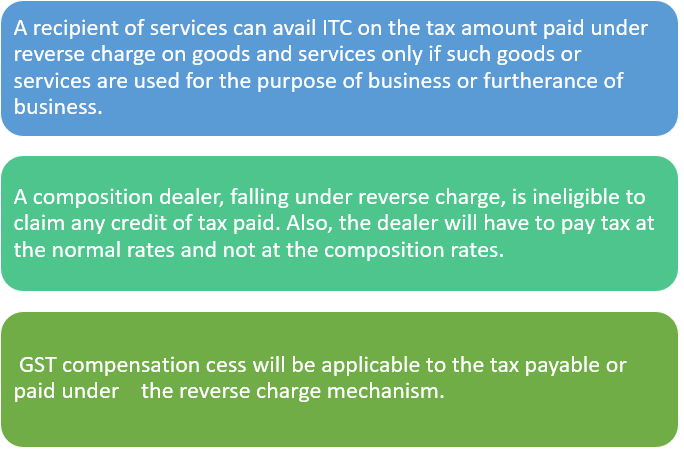

Input Tax Credit under RCM

Under the RCM, a supplier/seller cannot take an ITC of GST paid on goods and services supplied.

Under reverse charge on the receipt of goods and services, the buyer/seller can avail of ITC on GST paid if such goods and services are used or used for business purposes.

The recipients cannot use ITC to pay output GST on goods and services under the reverse charge. Hence the GST payment under reverse charge shall be paid only in cash.

Impact of RCM on Doing Business in India

Under the GST framework, the RCM acts as a self-policing tool and aims to restrain tax evasion by firms to motivate to register themselves under GST and pay taxes.

As the customers are opposed to directly paying taxes to the government and undertaking all the related paperwork and compliances, they will deal directly with suppliers who are registered under GST.

Hence, due to eroding customer base, the unregistered firms are likely to experience fewer revenues. Thus, this mechanism is designed to force such unregistered firms to get registered and become GST compliant.

How to Check GST Paid by Supplier in RCM under GST?

If the supplier pays the GST, then under RCM, it will not be considered a supply.

If you need to check that your supplier has declared supplies and paid GST, you can do so with the help of your GSTR-2A Form.

Also, if you wish to see if your recipient has declared the sales under RCM and if you are a registered supplier, you will have to follow up with your recipient.

How to Pay Reverse Charge in GST Portal?

Recipients liable to RCM need to pay GST for goods, services, and supplies as per the normal tax rates, directly to the government via GSTR-3B Form.

To pay GST liable to RCM, recipients need to furnish Table 3.1 D of GSTR-3B. Monthly, the GSTR-3B needs to be filed on the GST portal along with the RCM transactions details, and RCM taxes need to be paid using the Electronic Cash ledger only.

Taxpayers can later claim the ITC on such transactions in table-4A of GSTR-3B of the same month.

Frequently Asked Questions

What will happen if the receiver of goods/ services is required to pay tax under reverse charge but is not a registered dealer?

All taxpayers have to register for GST, and are required to pay tax under reverse charge, and as the case may be the threshold of Rs. 20 lakh or Rs.40 lakhs does not apply to them.

Under reverse charge, is ITC allowed?

For ITC, the tax paid on a reverse charge basis will be available if goods/services are used or used for businesses. Therefore, the recipient, who pays the reverse tax, can avail of it as ITC.

What if an Input Service Distributor receives liable supplies to reverse charge?

To the reverse charge, an ISD cannot make purchases liable. The ISD will need to register as a regular taxpayer if he wants to procure such supplies and tale the reverse charge paid as ITC.

Under RCM when can one claim ITC of tax paid?

The person who paid tax under RCM in a month can claim it as ITC in the subsequent month.

Refer the below article to know how does Reverse Charge Mechanism(RCM) work in Deskera Books?

Refer to the video tutorial for RCM with India GST in Deskera Books

Related Articles