If you are a supplier of goods and services, then you are liable to pay GST. This applies to all the sellers or service providers. So far, we have seen only this aspect where the service providers are charged with the tax under the GST of India.

However, there are cases when the receiver or the recipient of these goods or services will be charged with tax under the reverse charge mechanism instead of the supplier. The cases could be some notified supplies and imports where the reverse charge mechanism comes into play.

This article aims at making us understand the concept of RCM- Reverse Charge Mechanism in detail.

We shall have a clear understanding of the following topics:

- What is Reverse Charge Mechanism?

- What is Reverse Charge Mechanism in GST?

- RCM in case of an Unregistered person

- GST registration under RCM

- Input Tax credit under RCM

- Time of Supply of Goods under reverse charge

- Time of Supply of Services under reverse charge

- Compliances for Services under RCM

- Reverse Charge on Specified Services

- Reverse Charge on Specified Goods

- Exemptions in RCM

- What is Self Invoicing?

What is Reverse Charge Mechanism?

Reverse Charge Mechanism refers to the paying of tax by the recipient instead of the supplier of goods and services, in some specified cases of goods and supplies.

There are 2 kinds of reverse charge mechanisms as observed in the law:

- Dependent on the nature of supply or the nature of supplier. This falls under and is covered by Section 9 (3) of the CGST/SGST (UTGST) Act and section 5 (3) of the IGST Act.

- The second scenario is where taxable supplies are made by an unregistered person to a registered person. This is covered under Section n 9 (4) of the CGST/SGST (UTGST) Act and section 5 (4) of the IGST Act.

By implementing Reverse Charge Mechanism, the tax will be levied on unorganized sectors as well as certain classes of suppliers.

What is Reverse Charge Mechanism in GST?

The Reverse Charge Mechanism in GST refers to the amount of GST that a recipient of goods has to pay directly to the Government because the supplier is an unregistered person. The government has specified that the goods or services, in such situations, should be subject to Reverse Charge Mechanism.

Understanding RCM under GST

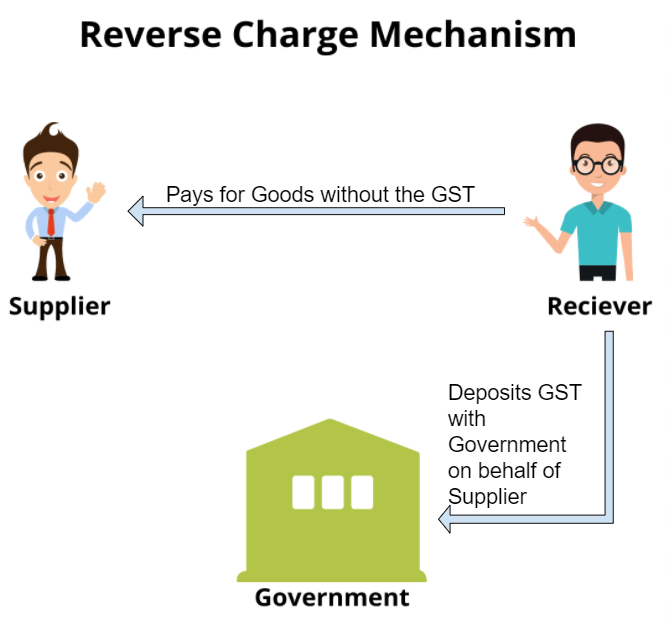

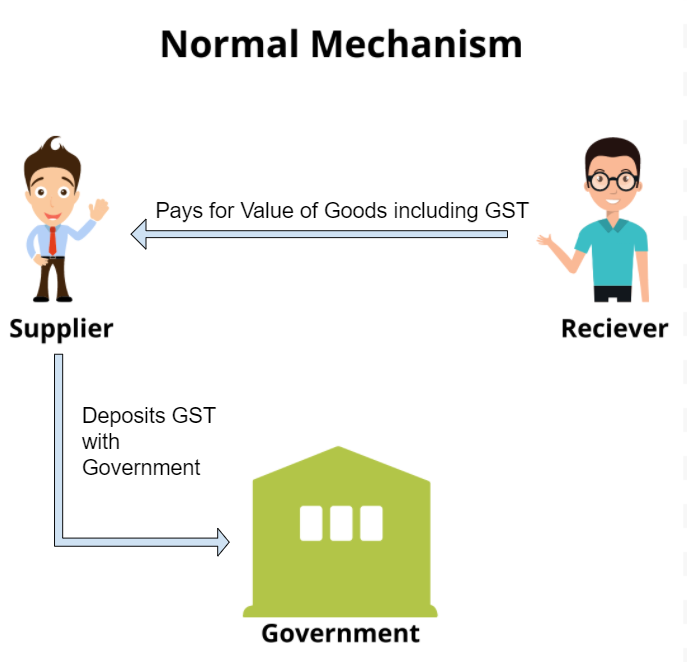

In a normal scenario, when a purchaser purchases goods from a registered supplier, then the GST will be paid by the supplier. However, in the Reverse Charge mechanism, this process is reversed.

If the purchaser purchases goods/services from an unregistered supplier, then the purchaser pays for the goods to the supplier excluding the GST on the goods; then this GST will be paid by the purchaser to the government directly.

This complicated process is applicable only in a few scenarios identified and instructed by the government.

RCM In case of an Unregistered Person

Based on Section 9(4) of the CGST Act, 2017, the provisions for the reverse charge mention that:

As a recipient of taxable goods or services or both supplied by a non-registered supplier, all the provisions of this Act shall apply to such recipient as if he were the person liable for paying the tax on such supplies.

Understanding RCM on Unregistered Supplier/Dealer

When a person purchases from an unregistered supplier, then this transaction is categorized under reverse charge. Here, the purchaser will pay to the supplier only the value of goods without the taxes.

These taxes will be paid by the purchaser directly to the government through his monthly return filings.

However, as these goods purchased by the purchaser are for furthering his business, he can claim an ITC while filing the returns for the finished goods.

GST Registration Under RCM

Taxpayers who are required to pay reverse charge tax have to mandatorily register under GST and the threshold limit of Rs. 20 lakh (Rs. 10 lakh for special category states) does not apply to them.

Input Tax Credit Under RCM

If a registered person uses the goods or services supplied under the reverse charge mechanism in the course of doing business, GST paid on those items is an Input Tax Credit (ITC).

When goods or services are received by the recipient, he may claim Input Tax Credit for the GST amount paid under reverse charge. Goods or services purchased by a supplier for use in making supplies for which a recipient is liable to pay tax under reverse charge cannot be claimed as input tax credits

Time of Supply of Goods Under Reverse Charge

During the time of supply, the supply is subject to GST. The person who needs to pay tax is one of the key factors to consider when determining the time of supply. In the case of the reverse charge, the recipient is responsible for paying GST. Thus the time of supply for goods under reverse charge differs from the supplies that come under the forward charge.

As regards the supply of goods, the time of supply is based on whichever is earliest of the following:

- the date when the goods were received; or

- date of payment as shown on the books of account or the date of debit in the bank account, whichever occurs first; or

- The date immediately following thirty days from the invoice date or a similar document.

Time of Supply of Services Under Reverse Charge

In this case of supply for services, the time of supply is based on whichever is earliest of the following:

- The date of payment on the books of account or date of debit on the bank account, whichever is earlier;

- Sixty days after the invoice or similar other document was issued.

In the case of incomplete estimation of the time of supply using the above-mentioned methods, the purchaser's books of account would serve as the time of supply determination.

Compliances for Services under RCM

- Every tax invoice must mention whether the tax is payable on reverse charge in accordance with section 31 of the CGST Act, 2017 and Rule 46 of the CGST Rules, 2017. Similarly, you also need to mention in the receipt voucher and refund voucher if the tax is payable of the reverse charge.

- Any reverse charge amount payable will be debited from the electronic cash ledger. Therefore, reverse charge liability cannot be discharged with input tax credits. If the recipient is otherwise eligible, the reverse charge liability can be discharged and a credit can be taken.

- Maintenance of accounts by registered persons: All registered persons must maintain records of all supplies that attract payment of tax on reverse charge

- Taxes must be paid on a reverse charge basis by the person who makes advance payments. Advance payments for reverse charge supplies are also subject to GST.

- If the supply attracts a reverse charge, the invoice level information for all such supplies should be furnished in a separate GSTR 1 table 4B.

Who Should Pay GST in RCM?

Here are the essential facts while making GST payments under Reverse Charge Mechanism:

- Under RCM, a recipient of goods or services is eligible for an ITC only if those goods or services are used for business purposes.

- The tax paid under RCM can be subject to the GST compensation cess.

- Composition dealers should pay tax at the normal rate rather than the composition rate when releasing their liability under RCM. Additionally, they are ineligible to claim any input tax credit for the tax paid.

Reverse Charge on Specified Services

The following table presents the reverse charge levied in specified services:

Reverse Charge on Specified Goods

Exemptions in RCM

The cases that are exempted from the reverse charge:

- Goods exempted from GST: The goods that are exempted from GST are not subject to reverse charge.

- Aggregate value up to Rs. 5000 per day: If the aggregate value of the goods and services is up to Rs. 5000 per day, these transactions will also be exempted from the reverse charge.

What is Self Invoicing in RCM?

A self-invoice is required when goods or services are purchased from an unregistered supplier, and such a purchase falls under the reverse charge category. In this case, your supplier cannot provide you with a GST-compliant invoice. So, here you will be responsible for paying their taxes. As a result, self-invoicing is needed in this situation.

In addition, Section 31(3)(g) requires recipients who are required to pay tax under sections 9(3) or 9(4) to issue a voucher to the supplier at the time of payment.

How Can Deskera Help You?

Deskera Books provides accounting, financial management, inventory management, and much more.

GST and its related processes such as the GST registration process tend to intimidate businesses: calculating GST, what is GSTIN, what is a GST Return, checking the registration status, and so on, require a complete knowledge before proceeding with the next steps.

Choosing the correct GST form can be confusing in many instances. Therefore, it would be helpful in the long run if you grasp the topics such as GSTR1, GSTR 2A, GSTR 2B, and making invoice amendments. Once registered, you may have to file one of the GST forms applicable to your business.

With Deskera, you can now manage your Journal entries easily. With one single interface, all remarkable features, such as adding products, services, and inventory, are at your fingertips.

Try out the tool to learn about your accounting system in a new light and see how easy it is to use.

Taking the time to familiarize yourself with the process of managing and setting up India GST by viewing the below videos is highly recommended.

Managing your business contacts, invoicing, bills and expenses is easier with Deskera Books. Moreover, Accounting for Startups is also one of the concepts you can learn about, as well as KPIs that Startups ought to measure. You can also import opening balances and create chart accounts through it.

With Deskera Books, you can handle all aspects of your organization, including inviting colleagues and accountants.

Key Takeaways

Here’s a recap of the important observations from the post:

- Sometimes, when the recipient of these goods or services will be charged with tax under the reverse charge mechanism instead of the supplier. The cases could be some notified supplies and imports where the reverse charge mechanism comes into play.

- Reverse Charge Mechanism refers to the paying of tax by the recipient instead of the supplier of goods and services, in some specified cases of goods and supplies.

- There are 2 kinds of reverse charge mechanisms, one of which is dependent on the nature of the supplier and the other is where taxable supplies are made by an unregistered person to a registered person.

- In a normal scenario, when a purchaser purchases goods from a registered supplier, then the GST will be paid by the supplier.

- If the purchaser purchases goods/services from an unregistered supplier, then the purchaser pays for the goods to the supplier excluding the GST on the goods; then this GST will be paid by the purchaser to the government directly.

- Taxpayers who are required to pay reverse charge tax have to mandatorily register under GST and the threshold limit of Rs. 20 lakh (Rs. 10 lakh for special category states) does not apply to them.

- If a registered person uses the goods or services supplied under the reverse charge mechanism in the course of doing business, GST paid on those items is an Input Tax Credit (ITC).

- The time of supply of goods is based on whichever is earliest of these: the date when the goods were received, or date of payment as shown on the books of account or the date of debit in the bank account, whichever occurs first, or The date immediately following thirty days from the invoice date.

- The time of supply of services is based on either the date of payment on the books of account or the date of debit on the bank account or sixty days from the issued invoice.

- Goods exempted from GST and goods and services with an aggregate value up to Rs. 5000 per day are exempt from reverse charge.

- A self-invoice is required when goods or services are purchased from an unregistered supplier, and such a purchase falls under the reverse charge category.

Related Articles