Have you ever wondered how efficiently a company utilizes its assets to generate profits? The answer lies in Return on Assets (ROA)—a key financial metric that helps businesses and investors assess how well a company converts its assets into earnings.

A high ROA indicates strong financial performance, while a low ROA may suggest inefficiencies in asset utilization. Understanding and optimizing ROA is crucial for sustainable business growth and long-term profitability.

Return on Assets (ROA) is widely used in financial analysis to measure a company’s profitability relative to its total assets. It provides a clear picture of operational efficiency and financial health, making it a valuable metric for business owners, investors, and financial analysts.

Whether you are evaluating investment opportunities or seeking ways to enhance your company’s financial performance, ROA serves as a critical indicator of success.

Various factors influence ROA, including asset management, revenue generation, and industry-specific conditions. Companies that effectively manage their assets while maximizing profits tend to have a higher ROA.

This is why businesses must adopt strategic financial management practices, such as optimizing resource allocation, reducing unnecessary costs, and leveraging technology to improve efficiency.

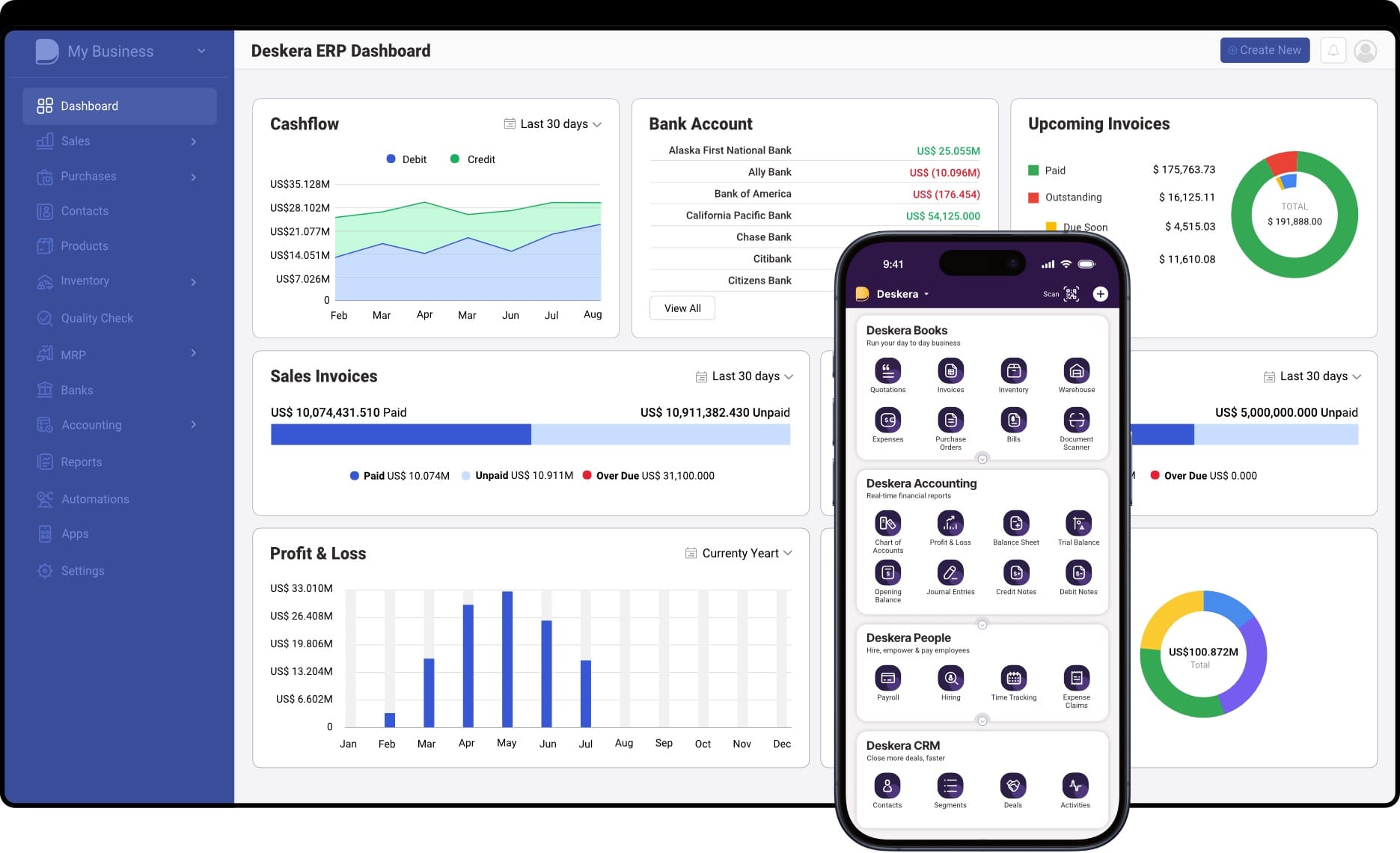

Deskera ERP plays a crucial role in improving ROA by streamlining financial management, inventory control, and operational processes. With features like real-time accounting, automated reporting, and data-driven decision-making, Deskera helps businesses enhance profitability and asset utilization.

By leveraging an integrated ERP solution, companies can gain better visibility into their financial performance and take proactive steps to improve their ROA.

In this article, we will help you understand everything about return on assets (ROA).

What is Return on Assets (ROA)?

Return on Assets (ROA) is a profitability ratio that measures how efficiently a company utilizes its assets to generate net income. It provides valuable insight into a company's ability to turn investments in assets—such as machinery, equipment, and inventory—into profits. Corporate management, analysts, and investors rely on ROA to evaluate financial performance, compare companies within the same industry, and identify areas for operational improvement.

The formula for ROA is:

ROA = Net Income / Total Assets

Typically expressed as a percentage, a higher ROA indicates that a company is generating more profit per dollar of assets, reflecting strong efficiency and financial health. Conversely, a lower ROA suggests that a company may need to optimize its resource utilization.

However, it’s important to compare ROA within the same industry since asset structures and capital intensities vary significantly. For example, technology firms tend to have higher ROAs than manufacturing or utility companies, which require more fixed assets.

To accurately assess ROA, businesses often use average total assets rather than a single-period total. This method accounts for asset fluctuations due to seasonal trends, investments, or depreciation, providing a more accurate measure of performance over time. Additionally, some industries, like banking, refer to ROA as Return on Average Assets (ROAA) to standardize comparisons.

Leveraging an ERP solution like Deskera ERP can help businesses improve their ROA by optimizing financial management, asset tracking, and resource allocation. With features like real-time accounting, automated reporting, and AI-driven insights, Deskera enables businesses to maximize asset efficiency and profitability. By integrating smart financial tools, companies can make data-driven decisions that enhance their ROA and overall business growth.

Return on Assets (ROA) vs. Return on Equity (ROE): Key Differences

Both Return on Assets (ROA) and Return on Equity (ROE) are crucial profitability metrics used to assess a company's financial efficiency. While they may seem similar, they serve distinct purposes and offer different insights into a company’s performance. The key difference lies in how they treat a company’s debt and financial leverage.

ROA measures how efficiently a company utilizes its total assets—including both equity and borrowed capital—to generate profits. It accounts for all resources a company employs in its operations. The formula for ROA is:

ROA = Net Income / Total Assets

ROE, on the other hand, focuses solely on the returns generated for shareholders, excluding liabilities. It measures the profitability of a company relative to its shareholder equity and is calculated as:

ROE = Net Income / Shareholder Equity

Since total assets include both debt and equity, a company with higher leverage (more debt) will typically have a higher ROE relative to ROA. As a company borrows more, its assets increase, leading to a lower ROA, while ROE remains high. This is because equity remains constant, but the company is generating more profit relative to shareholder investment.

In general, investors and analysts use ROA to assess overall operational efficiency, while ROE is more relevant for shareholders evaluating their return on investment. Both metrics are useful but should be analyzed together to get a clearer picture of a company’s financial health. A balanced approach to debt management ensures that increasing ROE doesn’t come at the cost of excessive risk.

Why is Return on Assets (ROA) Important?

Return on Assets (ROA) is a crucial financial metric that helps businesses measure how efficiently they convert their assets into profits. It provides valuable insights into a company’s operational efficiency, financial health, and overall profitability. Understanding why ROA is important can help businesses, investors, and lenders make informed decisions about growth, investments, and resource allocation.

1. Measures Operational Efficiency

ROA is a key indicator of how effectively a company utilizes its assets to generate profit. A higher ROA means the company is efficiently managing its resources, while a lower ROA suggests there may be inefficiencies or underutilized assets. This makes it a valuable metric for management to assess performance and make strategic improvements.

2. Helps in Comparing Companies Across Industries

Since different industries have varying capital requirements, ROA allows investors and analysts to compare companies within the same sector. For example, asset-heavy industries like manufacturing typically have lower ROAs compared to service-based businesses. By benchmarking ROA against industry peers, stakeholders can gauge a company's competitive efficiency.

3. Provides Insight for Investors and Lenders

Investors use ROA to evaluate how well a company is using its assets to generate returns, which can influence investment decisions. Lenders also assess ROA to determine a company’s ability to generate profits relative to its assets, which impacts creditworthiness and loan approvals.

4. Balances Growth and Financial Stability

A consistently strong ROA indicates a company is effectively reinvesting in its business without over-reliance on debt. Companies with declining ROA might be facing operational inefficiencies or excessive capital investments that aren’t yielding expected returns. By tracking ROA over time, businesses can ensure a balance between growth and financial stability.

Factors Affecting ROA

Several key factors influence a company's Return on Assets (ROA), impacting its profitability and efficiency. Understanding these factors can help businesses optimize their asset utilization and improve financial performance.

1. Asset Utilization Efficiency

The way a company manages and utilizes its assets directly affects its ROA. Efficient use of machinery, equipment, and inventory leads to higher productivity and profitability, boosting ROA. Conversely, underutilized or idle assets lower overall efficiency.

2. Profit Margins

Higher profit margins contribute to a stronger ROA since net income is a key component of the formula. Companies that maintain cost-effective operations and maximize revenue streams will generally have a higher ROA compared to those with shrinking profit margins.

3. Industry Type and Asset Intensity

Different industries have varying capital requirements, which influence ROA. Asset-heavy industries like manufacturing and utilities tend to have lower ROA due to large fixed assets, while service-based businesses often have higher ROA as they require fewer assets to generate revenue.

4. Debt and Leverage

Companies that rely heavily on debt financing may see fluctuations in ROA. While borrowing can fund growth, excessive debt increases interest expenses, reducing net income and lowering ROA. Businesses with balanced debt-to-equity ratios typically maintain more stable ROA levels.

5. Depreciation and Asset Aging

Over time, assets depreciate, reducing their book value. While this can sometimes artificially inflate ROA by lowering the denominator (total assets), older equipment may also lead to inefficiencies, repairs, and operational delays, negatively impacting profitability.

6. Revenue Growth and Sales Efficiency

A company’s ability to grow revenue without significantly increasing assets can improve ROA. Businesses that optimize production processes, reduce costs, and expand sales while maintaining efficient asset use tend to achieve higher ROA.

By monitoring and managing these factors, companies can work toward improving their ROA, enhancing profitability, and maintaining financial health.

How to Improve ROA?

Improving Return on Assets (ROA) requires businesses to optimize their asset utilization, increase profitability, and manage costs efficiently. Here are some key strategies to enhance ROA:

1. Optimize Asset Utilization

Ensuring that assets are fully utilized and not sitting idle can significantly boost ROA. Businesses can achieve this by implementing better asset tracking, scheduling regular maintenance, and reducing downtime for machinery and equipment.

2. Increase Profit Margins

Higher profit margins directly impact ROA. Companies can enhance margins by optimizing pricing strategies, reducing production costs, and eliminating unnecessary expenses. Investing in automation and process improvements can also help streamline operations and increase profitability.

3. Reduce Unnecessary Assets

Holding on to underperforming or non-essential assets can lower ROA. Businesses should regularly evaluate their asset base and sell or repurpose assets that are not contributing to revenue generation.

4. Improve Sales and Revenue Growth

A company can improve its ROA by increasing revenue without significantly adding new assets. Expanding product lines, entering new markets, and leveraging digital sales channels can drive revenue growth while maintaining a lean asset structure.

5. Manage Debt Efficiently

Since ROA considers both equity and debt, managing liabilities effectively is crucial. Companies should aim to balance borrowing and asset investments, ensuring that debt-financed assets generate sufficient returns to justify the additional cost.

6. Implement Technology and Automation

Leveraging technology, such as enterprise resource planning (ERP) systems, can help businesses streamline operations, reduce waste, and improve efficiency. Deskera ERP, for example, provides real-time asset tracking, inventory management, and financial analytics to optimize ROA.

By focusing on these strategies, businesses can enhance their ROA, improve operational efficiency, and drive long-term financial success.

Limitations of ROA

While Return on Assets (ROA) is a valuable metric for assessing how efficiently a company uses its assets to generate profits, it comes with certain limitations that may hinder its full applicability. Understanding these limitations is crucial for businesses and analysts to interpret ROA effectively.

1. Industry Differences

One of the primary drawbacks of ROA is its inability to be effectively compared across different industries. Companies operating in industries like oil and gas tend to have significantly larger asset bases than those in retail or service industries. Therefore, comparing ROA between such industries may lead to skewed conclusions since the asset requirements and capital intensity vary drastically.

2. Inconsistent Accounting Practices

The accuracy of ROA can be affected by the varying accounting practices followed by different companies. For example, how a company records the cost of an asset can influence the ROA calculation.

Some companies may account for the full purchase price of an asset in the year it’s acquired, reducing net income and, consequently, ROA. Others might amortize this cost over time, spreading the expense and maintaining a steadier ROA.

These discrepancies can distort comparisons between companies, especially if their accounting methods differ.

3. Incomplete Picture of Profitability

ROA is a useful metric for understanding asset efficiency, but it doesn’t provide a complete view of a company's profitability. It does not directly factor in a company's debt, which can be a significant source of capital.

This limitation is particularly important because a company with substantial debt may appear more efficient with a high ROA, while its actual financial health could be more precarious.

This is why ROA is often used alongside other ratios, like Return on Equity (ROE), which takes debt into account and provides a fuller view of a company's financial position.

4. Variations in ROA Formula

The basic ROA formula can sometimes be inconsistent, especially for non-financial companies where debt and equity are treated separately. The formula compares net income to total assets, but this can lead to discrepancies because net income represents returns for equity investors, while total assets reflect both debt and equity.

To correct this, variations in the ROA formula have been introduced, such as adding interest expense back into the numerator to account for the impact of debt. These adjustments can provide a more accurate picture but complicate the calculation process.

The two variations of the ROA formula are as follows:

ROA Variation 1:

ROA = Net Income + (Interest Expense x (1 - Tax Rate)) / Total Assets

ROA Variation 2:

ROA = Operating Income x (1 - Tax Rate) / Total Assets

These variations help adjust for the impact of interest expenses and provide a clearer understanding of how debt affects the company's asset utilization.

5. Lack of Context for Changes in ROA

ROA can indicate how efficiently a company uses its assets, but it doesn’t provide insight into why changes in ROA have occurred. For instance, a decline in ROA might be due to broader economic factors, such as a downturn in the market, rather than any mismanagement by the company.

Therefore, while ROA is helpful for evaluating trends over time, it should be considered alongside other data to understand the underlying reasons for changes in performance.

In conclusion, while ROA is a crucial financial ratio for understanding a company’s operational efficiency, it has limitations that must be considered when evaluating a company’s overall financial health.

Using ROA in conjunction with other metrics, and accounting for industry-specific and company-specific factors, can provide a more comprehensive analysis of performance.

How to Analyze the Return on Assets (ROA) Ratio

Analyzing the Return on Assets (ROA) ratio involves assessing how effectively a company uses its assets to generate profits. ROA provides valuable insight into a company’s operational efficiency and profitability, but it needs to be interpreted in the right context.

Here's a step-by-step guide on how to analyze ROA:

1. Understand the ROA Formula

The basic formula for calculating ROA is:

ROA = Net Income / Total Assets

Where:

- Net Income is the profit the company has earned after all expenses, taxes, and interest have been deducted.

- Total Assets includes both current and non-current assets of the company, such as cash, inventory, machinery, and property.

2. Compare ROA Across Time

- Year-over-Year Comparison: Start by comparing a company’s ROA over multiple periods (e.g., annually or quarterly). If ROA is consistently improving, this suggests better asset utilization and increasing profitability. If it's declining, this could signal issues with asset management or operational inefficiencies.

- Identify Trends: A consistent upward trend in ROA suggests that the company is becoming more efficient in using its assets to generate profit. Conversely, a downward trend could indicate that the company is either over-investing in assets without commensurate profit growth or struggling with its current asset base.

3. Compare ROA with Industry Peers

- Industry Benchmarks: Since asset bases vary by industry, it’s essential to compare ROA with competitors in the same industry. For example, technology companies typically have fewer physical assets than manufacturing companies, leading to naturally higher ROAs in the tech sector.

- Industry Averages: Research the average ROA for companies in the same industry or sector. A company with a higher ROA compared to its industry peers is likely utilizing its assets more effectively, while a lower ROA could indicate inefficiency.

4. Assess ROA in the Context of the Company's Strategy

- Capital Intensity: Consider the capital intensity of the company. Industries like manufacturing or utilities have large, asset-heavy operations, which naturally lead to lower ROA compared to asset-light industries like software or consulting. For capital-intensive industries, a lower ROA doesn’t necessarily indicate inefficiency if the company is achieving reasonable returns relative to the size of its assets.

- Growth Stage: Companies in the early growth stage might have lower ROAs as they invest heavily in assets, such as equipment or facilities, to scale operations. In contrast, mature companies are expected to achieve higher ROAs as their investment in assets stabilizes.

5. Investigate ROA and Profit Margins

- High ROA with Low Profit Margins: If a company has a high ROA but low profit margins, it might be using assets efficiently, but it could be facing challenges in controlling costs or generating substantial revenue from each unit sold.

- Low ROA with High Profit Margins: If a company has a low ROA but a high profit margin, it could be an indicator that the company isn't utilizing its assets optimally, even though it may be able to generate higher profits per sale.

6. Consider Debt Levels and Leverage

- Effect of Debt: The ROA metric considers both equity and debt in its denominator, as it includes total assets. High levels of debt can inflate ROA, making it look better than it actually is. To get a more accurate picture, you might also analyze the company’s Return on Equity (ROE), which excludes debt and focuses only on equity. If a company’s ROA is much lower than its ROE, it could be highly leveraged.

- Leverage and Asset Efficiency: A company with high leverage might show a higher ROE compared to ROA, reflecting that it's earning higher returns on its equity investment due to borrowed capital.

7. Review the Impact of Accounting Practices

- Accounting Methods: Differences in accounting practices can affect the calculation of ROA. For example, some companies may recognize revenue or expenses differently (e.g., revenue recognition policies or asset depreciation methods), which can impact net income and total assets. Always review the company’s financial statements and accounting notes to ensure that ROA is being calculated consistently across periods or with peers.

8. Use ROA in Conjunction with Other Ratios

- Complementary Ratios: To gain a more comprehensive understanding of a company’s financial performance, use ROA alongside other financial ratios:

- Return on Equity (ROE): To compare profitability and leverage.

- Asset Turnover Ratio: To understand how effectively a company generates sales from its assets.

- Profit Margin: To assess how well the company controls its costs.

- Current Ratio: To analyze liquidity and short-term financial health.

9. Monitor the Influence of Economic and Market Conditions

- External Factors: ROA can also be impacted by broader economic conditions, market trends, or regulatory changes. For instance, a recession may negatively affect a company’s ROA by reducing demand or limiting revenue potential, regardless of how effectively it manages assets.

What Is Considered a Good ROA?

Return on Assets (ROA) is an important metric used to evaluate how efficiently a company is utilizing its assets to generate profits. What constitutes a "good" ROA can vary depending on the industry, the company's financial structure, and its historical performance. However, certain general benchmarks can help define what a good ROA looks like.

Industry Considerations

A ROA of over 5% is generally considered good, while anything above 20% is deemed excellent. However, it's crucial to consider the industry in which the company operates. For instance, a software company typically has far fewer tangible assets than a manufacturing company like an automaker.

As a result, the software company may show a higher ROA due to fewer asset-intensive operations, making comparisons across industries less meaningful. Comparing ROA among firms within the same sector is essential to ensure you're getting an accurate assessment of efficiency.

Comparison to Industry Peers

A consistently high ROA compared to industry peers indicates that the company is efficiently utilizing its assets to generate profits.

Companies with a higher ROA are better at deriving profits from the same amount of assets as companies with a lower ROA, which could suggest that their assets are being used more effectively or near full capacity.

In contrast, lower ROA relative to industry averages might indicate inefficiency in asset utilization or the need for improved operational management.

Performance Trends Over Time

Another important factor to consider is the year-over-year trend of a company's ROA. An increasing ROA over time suggests that a company is improving its ability to generate profits from its assets.

This can indicate better asset management, operational improvements, or growth in profits. Conversely, a decreasing ROA may signal that the company has acquired too many assets, is underutilizing them, or faces inefficiencies in operations.

General ROA Benchmarks

- 10% ROA is generally considered a solid performance level.

- Above 15% ROA is considered excellent, signaling a highly efficient use of assets.

- Below 5% ROA is considered problematic, as it may suggest the company is struggling to generate returns on its assets.

- ROA below 1% can be alarming, indicating that the company is not generating enough profit to cover its asset base, which could lead to financial distress.

ROA Below the Cost of Capital

A particularly concerning scenario arises when the company's ROA is lower than its cost of capital. In such cases, the company is not generating enough return to cover the expenses associated with the funds invested in its assets, which could eventually lead to financial difficulties.

If the ROA is lower than the cost of debt, the company may be losing money on every dollar of debt owed, which can have long-term consequences like increased financial stress or even bankruptcy if it continues for a prolonged period.

In conclusion, a good ROA depends on the context in which it's measured. Companies should compare their ROA to industry standards and track changes over time to assess their financial health and operational efficiency.

If ROA trends downward or falls below the cost of capital, management should consider taking corrective actions to improve asset utilization and profitability.

How Deskera ERP Can Help You with Return on Assets (ROA)

Deskera ERP (Enterprise Resource Planning) system can significantly enhance a company's ability to manage and optimize its assets, which, in turn, can improve its Return on Assets (ROA).

By streamlining operations, improving asset utilization, and offering advanced insights, Deskera ERP helps businesses make more informed decisions, reduce inefficiencies, and boost profitability.

Here’s how Deskera ERP can contribute to improving ROA:

1. Enhanced Asset Tracking and Management

Deskera ERP provides a centralized platform for tracking both physical and intangible assets. By maintaining real-time visibility of asset usage, maintenance schedules, and lifecycle, businesses can avoid underutilized or overused assets, ensuring that every asset contributes optimally to profitability. This improved asset management can lead to more efficient use of resources and a higher ROA.

2. Streamlined Inventory Management

Efficient inventory management is crucial to improving asset utilization. Deskera ERP’s advanced inventory management features help businesses monitor inventory levels, reduce stockouts, and prevent overstocking. By ensuring that inventory is neither excessive nor insufficient, companies can make better use of their assets (e.g., warehouses, storage, and capital tied up in inventory), leading to improved asset turnover and ROA.

3. Demand Forecasting and Production Planning

Deskera’s demand forecasting and production planning features help companies predict future needs more accurately, ensuring that assets (like machinery and raw materials) are used optimally. By aligning production with forecasted demand, businesses can avoid underutilizing expensive equipment or over-investing in assets that are not required, improving overall asset efficiency and boosting ROA.

4. Real-Time Financial Reporting and Insights

Deskera ERP offers real-time financial reporting that allows businesses to track key financial metrics, including ROA. By providing detailed insights into net income, asset usage, and other critical financial data, the ERP system enables businesses to quickly identify areas where assets are underperforming and take corrective actions. This helps enhance asset performance and, consequently, improve ROA.

5. Optimized Capital Allocation

With Deskera ERP, companies gain better visibility into their asset utilization and financial performance. This allows for more strategic decision-making when it comes to capital allocation. By focusing investments on high-performing assets and divesting or reallocating underperforming ones, companies can improve their overall asset efficiency and return on investment, contributing to a higher ROA.

6. Integrated Analytics for Decision-Making

Deskera ERP’s business intelligence and analytics tools help businesses gain deeper insights into their asset performance and operational efficiency. By analyzing asset-related data, companies can identify underperforming assets, predict the best time for asset replacement, and implement cost-effective strategies, which can ultimately lead to more efficient asset management and a higher ROA.

Key Takeaways

- ROA is a financial metric that measures how efficiently a company uses its assets to generate profits. It is calculated by dividing net income by total assets, providing insights into asset efficiency.

- ROA is crucial for evaluating a company's efficiency in generating profit relative to its asset base. A higher ROA indicates better utilization of assets to drive profitability, which is key for long-term business growth.

- Various factors influence ROA, including asset management, industry type, financial leverage, and operational efficiency. These elements must be considered when evaluating ROA to gain a comprehensive understanding of performance.

- To improve ROA, businesses should focus on enhancing asset utilization, cutting unnecessary costs, optimizing inventory management, and maintaining efficient operations. Investments in technology and better decision-making can also boost ROA.

- ROA may not be directly comparable across industries due to differing asset structures. Additionally, it can be affected by accounting practices, and its formula may not fully capture the nuances of debt and equity capital, leading to potential inconsistencies.

- A good ROA typically exceeds 5%, with anything over 20% considered excellent. However, ROA should be evaluated in the context of industry norms, and changes over time are more informative than standalone figures.

- Analyzing ROA involves comparing it with industry averages, tracking it over time, and using it in conjunction with other financial metrics like ROE and ROI to gain a comprehensive view of a company’s asset efficiency.

- By providing robust tools for asset tracking, inventory management, production planning, financial reporting, and more, Deskera ERP enables businesses to optimize their asset base and improve operational efficiency. This results in better asset utilization, cost reductions, and ultimately a higher Return on Assets (ROA). For companies looking to enhance profitability through efficient asset management, Deskera ERP is a powerful solution.

Related Articles