As a small business owner, you look forward to the growth of your business. Your employees are an integral part of your business and have a crucial role in your expansion. Moreover, all companies must take care of their employees’ needs.

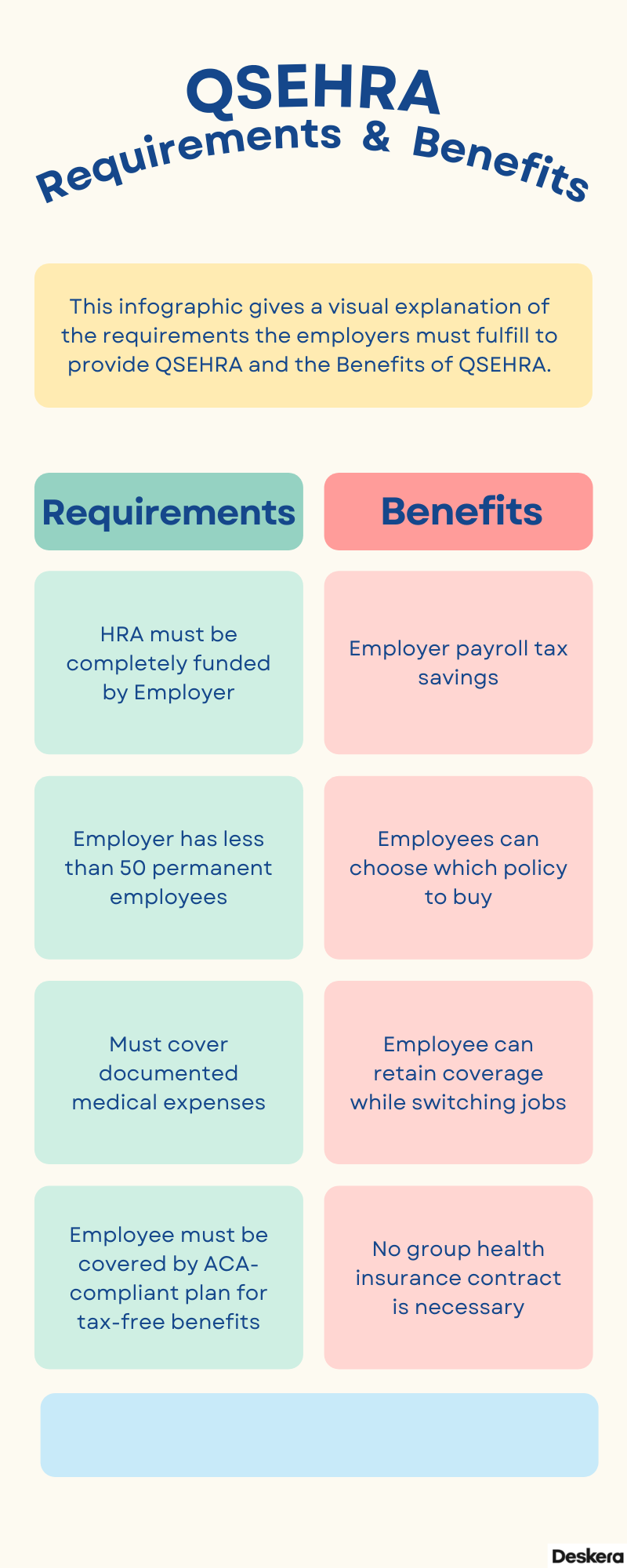

Providing them with a qualified health reimbursement plan comes well within the scope of catering to their needs. If you have been thinking about which could be the best arrangement in this framework, then QSEHRA might as well be the most adept option. Two important factors you must know of before you begin with QSEHRA are the prerequisites (or requirements) and the benefits.

What is QSEHRA, how it works, and how it benefits your employees are some of the questions we will find answers to in this post. Here is what more we shall learn:

- What is a QSEHRA?

- How does a QSEHRA work?

- How are QSEHRAs and bank accounts (HSA) different?

- Which businesses are eligible?

- Which employees are eligible?

- Reimbursement rules and procedures

- QSEHRA's advantages

- How does an employer set up a QSEHRA?

What is a QSEHRA?

QSEHRA stands for Qualified Small Employer Health Reimbursement Arrangement and is a kind of an HRA.

Businesses that do not offer a group health insurance plan can provide their employees with QSEHRA for covering their medical expenses. All small businesses (who have less than 50 permanent employees) can offer it to their staff. All eligible employees can benefit from a QSEHRA for their qualified medical expenditures.

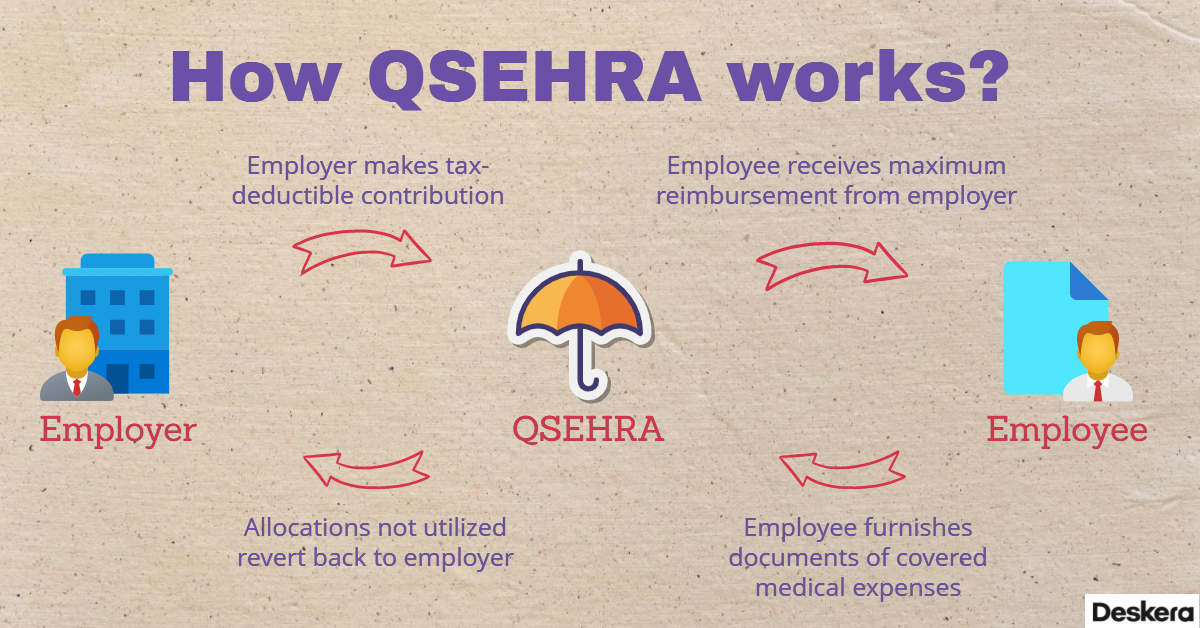

How does a QSEHRA work?

Simply put, when employees go through health care processes and incur expenses, they can produce the bills and receipts for the same. On confirming the authenticity of these bills, the employers reimburse the amounts. These reimbursement amounts are tax-free for both employers and employees.

Here, we must note that a QSEHRA is not considered as a replacement for health insurance. On the contrary, for qualifying to enroll for QSEHRA, the employees must get qualifying health insurance from the health insurance marketplace. Alternatively, they can also get it from the employer for participating in QSEHRA.

The IRS has set a ceiling to the amount employers can reimburse for each employee. Aligning with this, the employers also set a limit to the maximum allowance amount they will reimburse for employees. The reimbursement allowance provided by the employers must not exceed the one set by the IRS.

In 2022, employees can claim the following reimbursements from QSEHRAs:

- Expenses up to $5,450 per year (or $454.16 per month) for employee-only coverage

- Family coverage is up to $11,050 per year (or $920.83 per month)

How are QSEHRAs and Bank Accounts (HSA) different?

Please do not confuse between the terms QSEHRA and HSA or the Health Savings Account, as they are different. In contrast to Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA), a QSEHRA is not an account but an arrangement.

In other words, employers keep reimbursement money for a period of time until employees request reimbursement. QSEHRA reimbursements can be paid to a separate QSEHRA bank account, but it is not required. Generally, QSEHRA reimbursements are processed via payroll, much like the way you would reimburse for office equipment or other related expenses. Employers are free to decide the ways in which they want to reimburse their employees.

Which Businesses are Eligible?

Only small businesses are eligible to provide QSEHRA to their employees. Small businesses are the ones that have only up to 50 permanent employees working for them. Another critical point for a business to be eligible is that it should not have a group health plan or an FSA.

Any company that comes under medium or large business i.e., the businesses that have over 50 full-time employees cannot offer QSEHRA. However, they can certainly provide the traditional HRAs.

NOTE: If you are a small business that is currently offering a group health plan but wants to enroll for QSEHRA, you do not have to wait for the enrollment duration to end. To switch your plan, you can opt to do it right away.

Which Employees are Eligible?

All full-time or permanent employees who have MEC or the Minimum Essential Health Coverage are eligible for QSEHRA. The MEC is defined by the ACA (Affordable Care Act), a landmark health care reform act that took effect in March 2010 to provide subsidies to consumers.

To receive the MEC benefits, an individual must have health insurance coverage, such as purchasing a plan or enrolling in a parent or spouse's plan. Aside from Medicare Part A and Medicare Advantage, MEC also covers most Medicaid and significant medical plans.

Employers have the option to provide QSEHRA to part-time or seasonal employees, to employees with fewer than 90 days of service, and to employees under 25. Retired employees, family members, and friends of the company are not eligible.

Employees must meet the requirements, i.e. an individual must be a company's full-time employee. This is to say that all the people who receive their W-2 forms can be considered employees of the organization.

The employee's responsibility is to submit a claim to their employer with proof of spending on a qualified health expense. As an employer, be sure to notify your employees about the health reimbursement before you start QSEHRA. Remember to keep them in the loop about the changes they can expect in the current setting of their healthcare reimbursements.

Reimbursement Rules and Procedures

From determining the rates of reimbursements to the limits of reimbursements, there are diverse rules that employers must carefully comply with.

QSEHRA Limit for Reimbursements

The IRS sets a different annual maximum for single and family coverage, and employers reimburse employees monthly.

- The maximum amount that a single household can be reimbursed in 2022 is $5,450 annually or $454.16 of medical expenses per month

- The maximum reimbursement for a family household is $11,050 or $920.83 per month

Although these are the maximum limits up to which the reimbursements can be done, you as an employer can take a final call over the amount you want to reimburse within these limits. Your reimbursement allowances should not exceed the ones fixed by the IRS.

Determining Rates of Reimbursements

Employers must adequately record, communicate, and manage QSEHRAs and the rate of reimbursement. All full-time, regular employees at small businesses must have access to them on equal terms. These rules ensure that all the employees within the organization are treated fairly.

QSEHRA guidelines say that employers will be solely responsible for providing the reimbursement amounts, and none will go out of the employee's pocket.

Despite the requirement that the employer offer reimbursement on the same terms, employers have a lot of flexibility in designing their QSEHRA programs. Examples include:

- Provide the same amount and a standard maximum to all employees

- Provide the same amount for each individual and set a fixed amount for each family. This means that all individuals receive the same amount and all families also receive the same amount. An example can be: all individuals receive $300 per month and all families receive $700 per month

- Pay according to family size, with a reference plan. For example, singles get $300 per month, couples get $600 a month. Likewise, families can receive additional amounts per child. All these amounts must be set based on the IRS maximum guidelines

- You can also consider the employee's age to establish a reimbursement allowance limit. Some companies set a ratio of 1:3 where employees of age 26 get $100 whereas the ones at the age of 60 receive $300. The employees that come under the age group between these two can receive a separate amount.

What if an Employee does not claim?

An employee who doesn't use up the maximum allowance you set within a month can rollover the rest to the subsequent month. Each month's allowance rolls over to the next.

An essential note here is that the employee loses the allowance if they do not use it by the end of the plan year. In such a scenario, any unclaimed funds are retained by the employer. The company retains the funds if the employee fails to submit a reimbursement claim or if their claim is not approved. Any unused reimbursements are no longer owed to the employer once the plan year ends.

QSEHRA Funds Usability

QSEHRA empowers employers to choose what they want to reimburse. Here are the options:

- Premiums of spouse’s group plan: Employers may allow employees to claim the premium for their spouse's traditional group health plan. In addition, employees will have to pay taxes on reimbursements for health insurance premiums paid by their spouses or parents' plan. Due to the fact that health insurance premiums are paid with pre-tax dollars, any reimbursement will be taxed.

- Insurance premiums: Includes individual health insurance, dental and vision healthcare

- Insurance premiums along with medical expenses: Includes prescriptions, visits to the clinic or hospital, etc.

IRS has provided a set of guidelines to offer clarity on the eligible expenses.

QSEHRA's Advantages

QSEHRA has seen impressive acceptance owing to its advantages to both employers and employees. Let’s list them down here:

- Flexibility for Employers

- Customized Plans for Employees

- Tax Benefits

Flexibility for Employers

Budgets are important to all small businesses. Typically, health arrangements require the employers to contribute a minimum amount for participation. With QSEHRA, employers are not bound by this condition and are free to contribute any number as a contribution.

In other words, employers can have complete control over the financial aspect. Apart from deciding the amounts, they can also increase or decrease the amount as they deem fit. Furthermore, employers can also cancel it when they want to.

Customized Plans for Employees

QSEHRA proves to be immensely beneficial for the employees as they can now choose the kind of plan they want to enroll for. There is no set plan which the employees must choose; instead, they can select a plan that caters to their individual medical needs.

Tax Benefits

In general, employers do not have to pay payroll tax on QSEHRA reimbursements. On the other end, the employees, usually receive them pretax, making them free of income taxes.

This brings us to discuss the situations in which the reimbursements will be taxed.

Only employees covered by health insurance plans that meet MEC will be eligible for these reimbursements tax-free.

The reimbursements of employees covered under the healthcare plan of their spouse or parent and who claim premiums through QSEHRA will also be taxed. Due to the fact that health insurance premiums are paid with pre-tax dollars, the reimbursement for those premiums will be taxed.

How does an Employer Set up a QSEHRA?

Once you have learned about the details and benefits that QSEHRA offers, you might now be looking forward to setting up QSEHRA for your employees. Let’s get a quick look at the steps the process entails:

- Ensure that you fall in the category of the eligible employers for QSEHRA

- Determine how you would like to manage your QSEHRA. Hiring a third-party of self-administering are the options you have

- Assess the employee eligibility

- Determine the allowance amount for reimbursement

- Select the expenses you would want to reimburse

- Select a start date. Selecting the first day of the month typically aids calculations

- Document important information and notify the same to all your employees

- Establish a process for running QSEHRA

- Keep the employees in the loop about the benefits they shall receive through QSEHRA

- Guide your employees to choose the right plan

The process involves you knowing everything about QSEHRA before opting to establish it in your company. Learn about setting up QSEHRA for small businesses to avoid confusion at later stages.

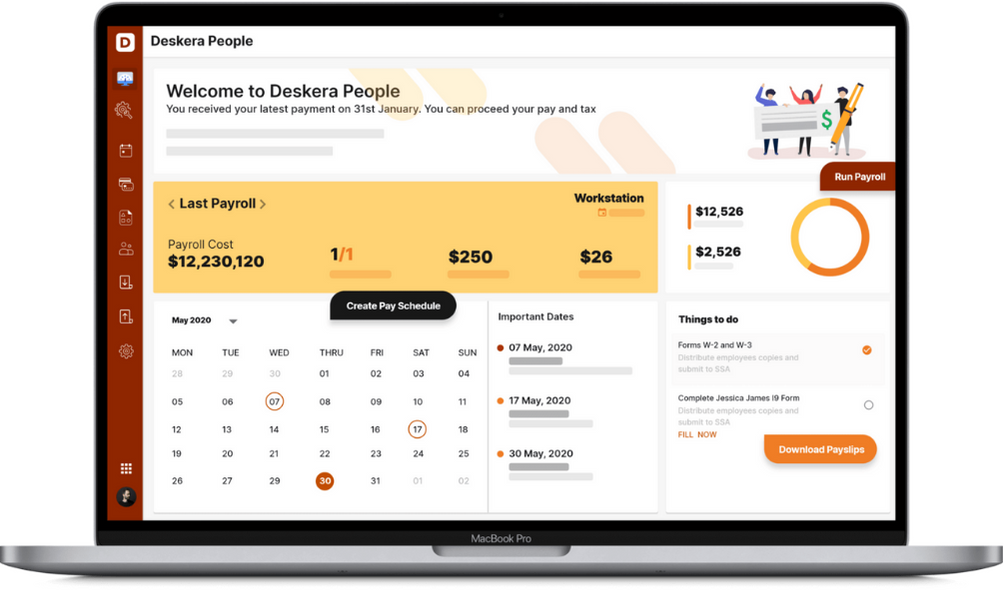

How can Deskera Help You?

Deskera People is an all-in-one platform that allows you to manage payroll, leave, attendance, and other expenses. The entire employee management process including generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

Following are the key highlights from the article:

- Businesses that do not offer a group health insurance plan can provide their employees with QSEHRA for covering their medical expenses

- When employees go through health care processes and incur expenses, they can produce the bills and receipts for the same. On confirming the authenticity of these bills, the employers reimburse the amounts

- These reimbursement amounts are tax-free for both employers and employees

- QSEHRA is not considered as a replacement for health insurance

- For qualifying to enroll for QSEHRA, the employees must get qualifying health insurance from the health insurance marketplace

- The employers also set a limit to the maximum allowance amount they will reimburse for employees. The reimbursement allowance provided by the employers must not exceed the one set by the IRS

- Any company that comes under medium or large business i.e., the businesses that have over 50 full-time employees cannot offer QSEHRA

- All full-time or permanent employees who have MEC or the Minimum Essential Health Coverage are eligible for QSEHRA

- The employee's responsibility is to submit a claim to their employer with proof of spending on a qualified health expense

- he IRS sets a different annual maximum for single and family coverage, and employers reimburse employees monthly

- Although these are the maximum limits up to which the reimbursements can be done, you as an employer can take a final call over the amount you want to reimburse within these limits

- Employers must adequately record, communicate, and manage QSEHRAs and the rate of reimbursement

- An employee who doesn't use up the maximum allowance you set within a month can rollover the rest to the subsequent month. Each month's allowance rolls over to the next

- QSEHRA empowers employers to choose what they want to reimburse: Premiums of spouse’s group plan, insurance premiums, or insurance premiums with medical bills

- Flexibility for employers, customized plans for employees, and tax benefits are some of the benefits of QSEHRA

- With QSEHRA, employers are not bound by this condition and are free to contribute any number as a contribution

- With QSEHRA, employers are not bound by the condition of contributing a minimum amount and are free to contribute any number as a contribution

Related Articles