In the business world, some costs are unavoidable, whether it be from a customer not paying their outstanding invoice, loss in value of an asset, malfunctioning appliances, or lawsuits.

To account for these costs, and to make sure they have money set aside for future expenses, businesses can make provisions.

Provisions in accounting are the money set aside to pay for expected future expenses.

In this guide, we will be explaining in detail what provisions in accounting are, the different types of provisions, examples for business, and everything else you need to know about recognizing provisions.

Read along to learn about:

- What Are Provisions in Accounting?

- How to Recognize Provisions in Accounting

- Types of Provisions in Accounting

- Accounting Provisions with Online Accounting Software

- Provisions in Accounting FAQ

What Are Provisions in Accounting?

Every business has a set of expected financial liabilities they will need to pay in the future, such as bad debt expenses, or customer refunds.

The amount set aside for these types of estimated future payments is known as provisions in accounting.

Because provisions account only for a particular set of expected expenses, they are not considered a form of saving. Instead, they’re a recognition of an upcoming liability in the future.

Recording Provisions in Accounting

In accounting, provisions are first recognized as a liability in the balance sheet. Then, after the liability occurs, the money is expensed on the income statement.

Now, you may be wondering: why do provisions need to get recognized twice, into two separate financial statements?

Well, this is because of an important accounting principle known as the matching principle.

The matching principle states that expenses should be recorded in the same financial year as the corresponding revenues. Therefore, provisions adjust the current year balance to make sure costs are recognized at the same year as the corresponding revenues.

Keep in mind that this principle only applies to businesses using accrual accounting.

If your small business uses cash accounting instead, these principles don’t apply, since expenses are recognized when they get paid, not when they incur.

If you want to learn more about the difference between these timing of documentations, and which one works best for your type of business, head over to our guide on the basis of accounting.

How to Recognize a Provision in Accounting

Businesses can’t record provisions in accounting whenever they think fit.

There are specific criteria, created by the International Financial Reporting Standards (IFRS), that need to be met first.

These requirements in recognizing provisions in accounting include:

- There’s a present obligation arising from a past event. To better illustrate this, let’s assume your business’ return and refund policy states that the customer has 30 calendar days to return a faulty product. During those 30 days, your business has a present obligation arising from the return policy, the past event.

- The settlement of the obligation is expected to result in an outflow of benefits. Again, if we take the return policy as an example, a great return policy encourages customers to commit to purchases and instills trust in the company.

- The business needs to make an accurate and reliable estimate of this amount of obligation. In the case of customer refund, the estimate of the provision would equal the price of the product eligible for a return, plus any other additional shipping fees.

Unsure on whether or not you should recognize a provision at all? Then, ask yourself one question: can I avoid the liability through my future actions?

If the answer is yes, then you do not need to recognize a provision. For instance, this can apply to deciding not to make provisions for employee training programs.

But if you cannot avoid provisions by any of your future actions, then a provision is always necessary. For example, if you promise warranty repairs to your customers, then you must always make a provision associated with the expected costs of these repairs.

Types of Provisions in Accounting

There are several types of provisions in accounting, that vary from business to business.

One of the most common types of provisions is a provision for bad debt. Bad debt expense is an incomplete, unrecoverable payment from clients who can’t pay for their past due invoices.

Businesses create a provision for these bad debts, by estimating an allowance based on previous bad debt amounts, as well as industry averages.

This predicted provision of uncollectible accounts is not only expected but also part of having a good credit policy.

Other types of provisions in accounting include:

- Depreciation is an operating expense that spreads out the cost of an asset over its estimated useful life. A provision for depreciation (also known as accumulated depreciation) is the collected value of all depreciation.

- Guarantees are promises to take responsibility for another business’ financial liabilities if they can’t meet these liabilities.

- Warranties are the amounts businesses will need to spend to repair or replace a product, during its warranty period.

- Income tax is the estimated amount that a tax-paying business expects to pay in taxes for the year.

- An accrued expense is a liability account that refers to accumulated past expenses that haven’t been billed yet.

- Customer refunds, etc.

Example of a Provision in Accounting

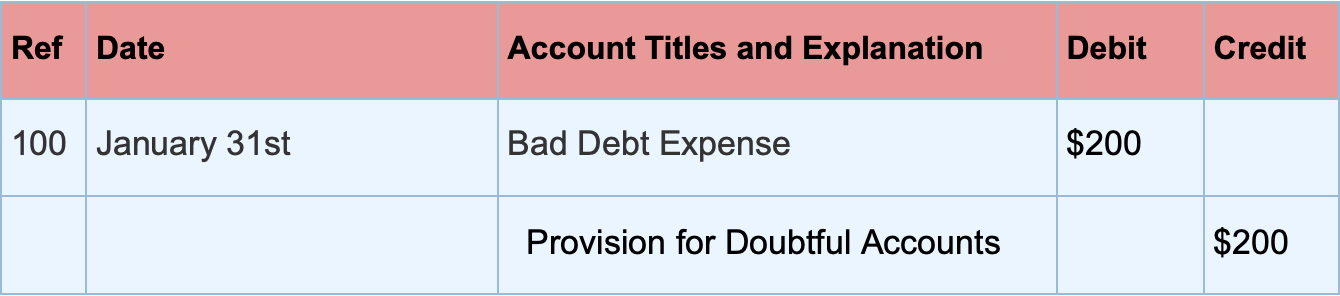

To put theory into practice, let’s check out a business example of a provision for bad debt, and how it gets recorded as a journal entry.

Assume company XYZ begins business on January 1st and makes most of its sales on account. On January 31st, the accounts receivable for that business amounts to $10,000.

The business owner estimates that approximately 2% of these accounts will prove to be uncollectible. So, the provision for bad debt for the month of January would be $200 (2% of 10,000).

You’d record the journal entry for this provision in your accounting journal like so:

Want to learn more about tracking and recording your financial transactions? Check out our guide on journalizing transactions, with definitions and examples for business.

Accounting Provisions with Online Accounting Software

Don’t want to go through the hassle of manually keeping track of your provisions? Then use cloud accounting software instead.

With Deskera, dealing with provisions and every other type of business expense is as easy as 1-2-3!

Using the platform, you can set up a Depreciation Schedule within seconds.

Just select the name of the asset, the financial year, method of depreciation, and press Post. The journal entry will then be automatically created for you, with the appropriate debit and credit balances.

Need to issue a sales return for a faulty product? No problem!

First, create a Sales Return to add back the returned goods into your selected warehouse.

Fill in the product details, where you want to ship it to, the return date, and you’re done!

Tax circulation can be automated just as easily.

Whether you’re issuing a VAT invoice or applying a sales tax in your transactions, Deskera applies tax automatically according to your local tax rules.

The best part?

The software is accessible at any time, anywhere, by simply downloading the Deskera mobile app.

Still not convinced Deskera is the right choice for your small business accounting?

Try the software out yourself, by signing up for our free trial. No credit card details necessary.

Provisions in Accounting FAQ

#1. Are Provisions in Accounting an Expense?

Provisions are first recorded as a current liability on the balance sheet. Later on, they are matched to the appropriate expense account, on the income statement.

They are usually recorded as bad debt, sales allowance, or inventory obsolescence.

If you want to learn more about the different types of accounts each financial statement represents head over to our guide on accounting reports.

#2. What Are Tax Provisions?

A tax provision is an estimated amount a business sets aside to pay for its income taxes.

Tax provisioning involves calculating the current and deferred value of tax assets and liabilities.

#3. What’s the Difference Between Provisions and Reserves?

Reserves are money a business puts away from its profits for unknown future liabilities. For example, reserves for expansion of the business, or general reserves for no particular purpose other than strengthening the business.

Provisions, on the other hand, are made to meet expected, specific liabilities, such as doubtful debt, taxation, repairs and renewals, and so on.

Key Takeaways

And that’s a wrap! We hope you found our guide helpful in understanding how to recognize and treat provisions in accounting.

Before leaving, let’s go over the main points we’ve covered today:

- Provisions are a set of expected financial liabilities, businesses will need to pay for in the future. They are recorded on the balance sheet.

- In order to record provisions three main criteria need to be met:

- A present obligation from a past event

- The obligation is expected to result in an outflow of benefits

- A reliable estimate of this obligation

- The most common type of provision in accounting is a provision for bad debt.

- Other types of provisions include accumulated depreciation, guarantees, warranties, income tax, accrued expenses.

- Streamline provisions and every other part of the accounting cycle with cloud-based software like Deskera.

Related Articles