According to this statistic, project management accounting makes up for 36% percent of the workforce in this niche.

This says enough about the importance of project accounting. While it does sound like a different term altogether, project accounting isn't any different in the fundamentals it shares with the traditional accounting methods. There are certain aspects of project accounting that differ from normal accounting, which this article aims to discuss in detail.

Let's begin from scratch by discussing what project accounting actually is.

Project Accounting - What Does it Mean?

Every business has multiple active projects ongoing simultaneously - and not all of them have the same operational/non-operational expenses. Not all of them follow similar schedules or employ similarly skilled personnel. How, then, is an accountant supposed to keep track of the financial transactions happening with each project?

Not only does it become difficult to have unified accounts for all projects, it also attracts errors and ends up interfering with the final year-end tax regimes and financial statements.

To avoid this situation, enterprises make use of project accounting. It is nothing but accounting done individually for each project that is diverse enough to require it.

For example, if an enterprise handles construction for a residential complex, the labor costs, materials cost, equipment rentals, and everything else financial will be recorded as a separate account, while all other intra-business operations may have a unified account. This helps the hired accountants tally the figures efficiently in lesser time while avoiding confusion in accounts or statements.

Project accounting also involves keeping track of the financial transactions happening in the project, which allows the managerial professionals to streamline the timelines and manage budgets more economically. All in all, this method of accounting is one concept with many benefits.

Understanding Project Cost Accounting

Project cost accounting has a bit more in its scope, scaled down to the size of a project, as compared to financial accounting, which has a smaller scope but scaled up to the size of an entire enterprise.

Traditional financial accounting has a clearly defined purpose - to have certain visibility on the financial health of a business and to file taxes correctly without making any errors. Every action that then happens to record the transactions has attributes that are focused on the end goal.

In a similar way, project cost accounting works to track the expenses poured into completing a project in addition to recording its billing and working out project feasibility. The scale, while evidently smaller than enterprise-level accounting, covers more base insofar as the financial detail involved is concerned.

Project accounting, owing to a different scope as compared to traditional business accounting, has its own set of methods and concepts that accountants or "cost engineers" employ to work out project profitability. Essentially, project cost accounting methods should involve the following aspects.

- Accounting system - A separate system of accounting for each project with special needs goes a long way in creating reports that are accurate and spell out the expense and ROI scenario for each project individually.

- Frequency of reporting - Where a project walks on a tight timeline, project accountants increase the frequency of reporting the financial scene to make sure that the information stays updated. This ensures that deliverables go out as scheduled, and any setback is circumvented.

- KPIs - In project accounting, each project has its own specified and highly relevant key performance indicators. These KPIs are measured against benchmarked values and the schedule planned by the management. Project accounting helps to monitor and adjust the resources such that the KPIs stay within the desired range.

- Transaction specificities - There exists a uniqueness of transactions across all the projects that an enterprise undertakes. Project accounting takes into consideration this uniqueness and differentiates between each transaction taking place for ease of creating financial statements later.

- Forecasts - Since every project needs to convince the stakeholders of its feasibility and profitability, project accounting helps professionals forecast the progress and performance of the project.

Additionally, project accounting can be extended into the niche of resource management, since its scope includes forecasts and KPI monitoring.

Various Methods of Revenue Recognition in Project Accounting

Not all industries work according to a single standard. Each industry has its own channel and mode of earning revenue on the services it renders to its clients, or on the products it sells. Project accounting has a methodology that is accepted universally to identify and acknowledge the revenue that a business is earning on its products or services - all to fulfill tax obligations. This process is called Revenue Recognition. Below are some of the widely accepted methods of revenue recognition that project accountants use.

- Sales - This is a method where revenue is recognized when the service or good that is paid for is actually delivered. For example, for a pre-paid service, the company will only record a sale when that service is delivered to the purchaser.

- Installment - Installments are recorded uniquely in project accounting. Since the total payment is broken up into parts, the company records a revenue or recognizes revenue, each time the customer pays the subsequent installment.

- Percentage of completion - For projects that are long-term, companies need to extract payment according to the contractual terms of release of payment. For example, construction projects typically take over 6 months based on scale. Project accountants record revenue when the project hits a percentage completion milestone according to the contract.

- Completed project - The method of recognizing revenue when a project is complete and all the deliverables have gone out is used by project accountants when percentage completion is not an option.

- Cost recoverability - This method causes the revenue to be understated in the first stages of the project and overstated in the final stages - because the project accountants do not recognize revenue unless every expense is accounted for.

Benefits of Project Accounting

Project accounting brings a world of benefits for those who employ it in their business. This practice is specifically beneficial for big businesses with operations across various industries.

Not only does it become easy to keep the financial tracking separate, but also helps keep all the projects running as per schedule. Here are a few key benefits of using project accounting in addition to general financial accounting in your business.

- Visibility - Every project runs better when there is visibility on daily expenses and revenues, cumulative and per-day both, to make better managerial decisions on planning labor, material, and other resources involved.

- Accuracy - Project accounting tracks all aspects related to a project - which means you get an accurate account of everything related to that project. It can be billing or expenses, revenue or accruals, etc.

- Tracking through fiscal differences - Project accounting tracks each project individually, which means that even if two projects fall under different fiscal years, or even if they belong to different departments, the year-end reports will be spot on.

Best Practices for Project Accounting

The following items, when checked regularly by management, create accurate project accounting reports that benefit the organization in the long run.

- Schedule of Values - This document, when updated regularly, can tell the management whether or not the works involved in the project align with the cost.

- MoM (Minutes of Meeting) - This document records all the panel discussions regarding a project. Reviewing these documents periodically helps to understand the progress of a project on a deeper level.

- Cost reports - Reviewing cost reports ensures that the numbers recorded in the cost log tally with the costs actually incurred.

- Change orders - If there is a change in the original scope of work, keeping a track of change orders helps to keep all reporting updated.

- Maintaining project schedule - Sometimes, there are unprecedented events that trigger delays in the project. Keeping the project schedule updated ensures that accounting stays on track.

Items to Include in a Project Accounting Report

The following items make a project accounting report more informative and meaningful.

- Table of contents and a summary that spells out what to expect from a report.

- Key performance indicators

- Histograms, graphs, and charts

- Data interpretation

- Strategies

- Projections

Who is a Project Accountant?

The role of a project accountant goes beyond creating reports and tracking project progress. This professional acts as the bridge between project staff, managerial panel, and everyone in between, which helps streamline communications regarding the project.

Project accountants have a responsibility towards the project in seeing that it stays on schedule and all the milestones stipulated in the PM schedule are achieved timely. In addition, the tracking that a project accountant undertakes covers costs, revenue, billing, resources, manpower, and modifications, which results in the creation of a report that provides a holistic view of where that project currently stands.

The importance of a project accountant is understood in his capability to drive a project to success by closely monitoring every little change happening on the frontline, middle-tier, and backend.

Duties of a project accountant include:

- Project revenue recognition

- Management of assets

- Reconciling expenses

- Creating reports for project financials

- Tracking project resources and invested hours

- Invoicing

Workings of Project Accounting

Various methods exist that help professionals prepare project oversights and recognize revenues effectively. Some of these methods are listed below:

- Cost-to-cost method. This method employs a ratio of the cost incurred to date and the total project cost. This method holds good for the projects that purchase a lot of materials for execution upfront so that the maximum revenue is recognized early on.

- Efforts expended method - When measuring your project in terms of man-hours expended to achieve the results desired, this method can be employed to generate accurate reports. For example, in consultancy businesses.

- Efforts expended calculation - A difference between estimated labor hours and hours complete to date gives the value for efforts expended on a project in terms of hours.

- Units of delivery method - The highly preferred GAAP method for project accounting is the units of delivery method, as it can be verified easily and is relatively simple to do. Through carefully counting output, the project accountants are able to measure input that goes into a project for production. It gives a relationship between the cost and result.

Project Accounting Made Simple for Small Businesses With Deskera Books

Project accounting involves a lot of complex activities that happen simultaneously and in tandem. In order to make sure that errors are completely avoided and accuracy is increased, automating the processes involved in the segregation, classification, and synthesis of project data goes a long way.

Especially in the case of small businesses, automation software for project accounting helps save costs on manpower, losses due to project delays, and inaccurate reporting.

Today, technology has presented holistic, well-stitched accounting solutions designed especially with tools that offer functionalities to customize data collection, interpretation, and reporting. Whether it be a project in construction or consultancy, in art, or in manpower, project accounting solutions offer a big bag of tools to the companies.

In addition, small businesses can benefit from project accounting software in the following ways:

- Data encryption for confidentiality and security

- A real-time picture of project progress and performance

- Tracking project timelines

- Reporting

- Availability of software across devices

- Reporting

- Cost and revenue tracking

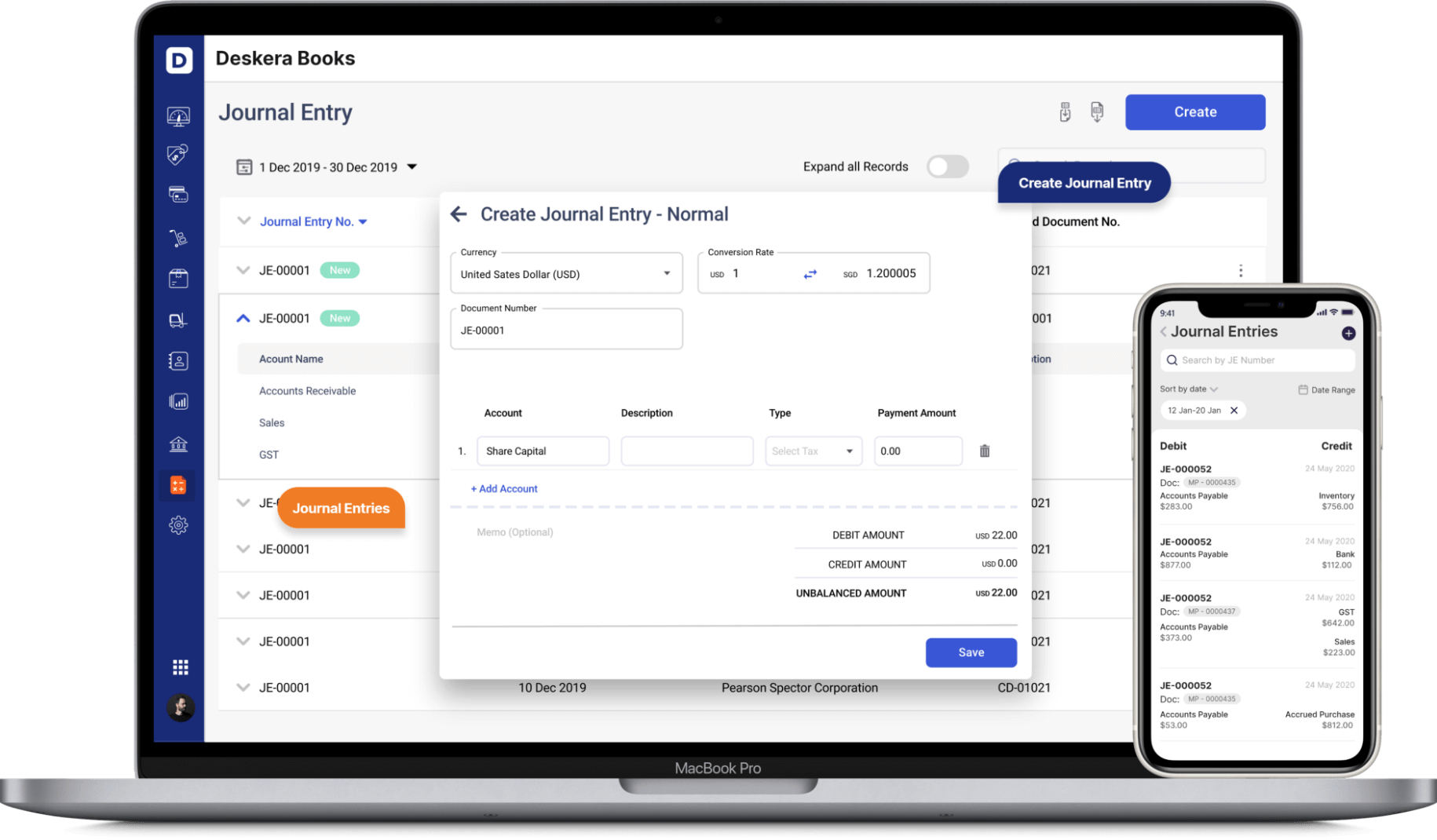

Deskera is a cloud system that brings automation and therefore ease in the business functioning. It reduces the admin time while also increasing efficiency. Deskera Books can be especially useful in improving cash flow for your business.

As a business owner, you can invest in accounting softwares that can help you keep track of your depreciating assets, scrape value, residual value, salvage value, journal entries, balance sheet, inventory and production costs. A successful business needs an efficient financing process that meets its specific needs.

Deskera Books is an online accounting software that your business can use to automate the process of journal entry creation and save time. The double-entry record will be auto-populated for each sale and purchase business transaction in debit and credit terms. Deskera has the transaction data consolidate into each ledger account. Their values will automatically flow to respective financial reports.

Through Deskera Books, reminders can be set with the invoices that are not being paid out, which are then sent out to the customers. Even in the case of recurring invoices, Deskera Books will become very handy especially with a payment link added to the invoice.

All in all, the follow-up system for all the invoices can be passed on to the system of Deskera Books and it will look into it for you. You can have access to Deskera's ready-made Profit and Loss Statement, Balance Sheet, and other financial reports in an instant. Such cloud systems substantially improve cash flow for your business directly as well as indirectly.

Project Accounting - The Ultimate Tool

If your organization is suffering from sloppy management of cost, expenses, and revenue, maybe it is time to switch your accounting methods.

Creating separate boxes for accounting for each project helps you sort through the clutter and extract values that matter. Project accountants are able to create unified views of all aspects of each project individually, and still maintain touchpoints that could be used for general finance purposes later.

This method of accounting makes it one hundred percent easier to manage resources being poured into a project. If your business is struggling from inaccurate reports, gaps in financial transaction records or overlaps in cost records, it is time to hire a project accountant and overhaul the entire financial scene - right from task level.

Related Articles