A proforma invoice can be referred to as an initial bill of sale shared with the buyers in advance, prior to delivery of goods or services, indicating a seller's intent to complete the sale. Whenever the word - proforma is used, it indicates that the document is just for the sake of form, or convention, and isn’t enforceable.

- Introduction to proforma invoice

- What are the objectives of a proforma invoice?

- Proforma invoice vs invoice

- Proforma invoice vs quotation

- How to create a proforma invoice

- To conclude

Proforma is derived from Latin words Pro - which roughly translates to ‘for the sake of’ and Forma, which translates to ‘form or appearance.’ A proforma invoice for advance payment, therefore, provides the buyer with an accurate price on the current transaction and helps avoid confusion or negotiations after the details of the transaction have been agreed upon.

However, this does not mean that the terms mentioned in the proforma invoice are final. It is merely a good-faith gesture by the selling entity.

A proforma invoice cannot be used for accounting purposes. It is merely a gesture, and good business practice, and not a proof of transaction, request for payment, and is a follow up to the agreed quotations. (differences between proforma invoice and quotations are listed in detail below).

What are the Objectives of a Proforma Invoice?

As mentioned earlier, a proforma invoice is issued by the selling entity to the buyers before the transaction is complete. For instance, in case of a custom order, the seller may choose to issue a proforma invoice to the buyer stating the terms of the transaction and proceed with fulfilling the order.

A proforma invoice usually has a pretty accurate fix on the price, including commissions, fees, or taxes (if any), to prevent the buyer from any unexpected price change shocks once the transaction is completed.

The proforma invoice is raised to achieve the following objectives:

- Confirmation of intent to sell for the buyer, and vice versa

- Accurate price fix to prevent the buyer from any hidden charges/fees

- Internal document kept by the sales department to keep track of future transactions

- For the sake of custom clearance, in case of cross-border transactions

- Provides both the parties with the exact expectations of the transaction and the price

It is necessary to note that no law mandates the proforma invoice to be a part of your billing cycle, but it is merely followed by many businesses because of the advantages it provides.

We’d recommend you incorporate proforma invoices as a part of your billing cycle, especially if you’re doing business with a company or an entity for the first time.

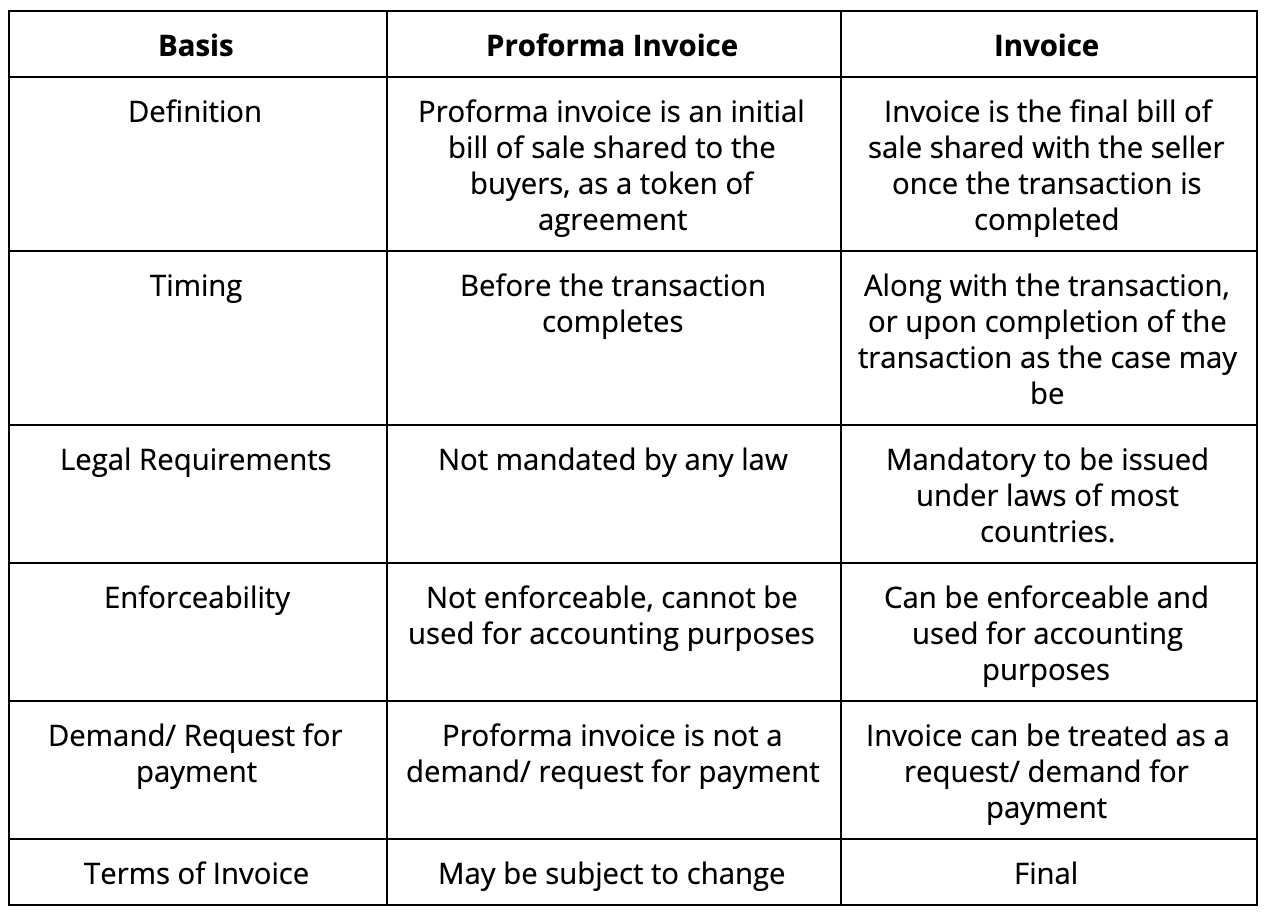

Proforma Invoice vs. Invoice

As mentioned earlier, a proforma invoice is not enforceable and is not the same as the final invoice that is issued for tax purposes. We have delved in detail into what invoicing is and the essential information on invoices. A tax invoice is mandatory to be issued as proof of sale. Here’s a table for a comprehensive list of differences for proforma invoice vs invoice.

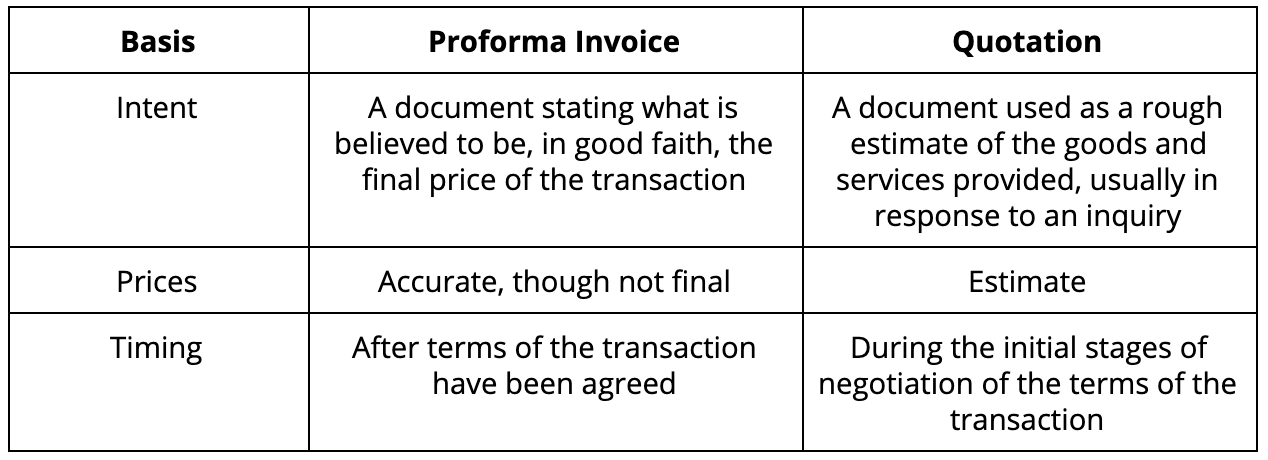

Proforma Invoice vs Quotation

After understanding that a proforma invoice is not an invoice, some people usually confuse it with quotations, while quotations and proforma invoices are two different documents. We have a detailed explanation of what quote or quotations are, and what it means, along with the different types of quotations, which can be viewed here.

A quotation is sent as a response to an inquiry regarding the services an entity provides, and the prices mentioned in the quotations are merely estimates. Let’s have a look at the differences for Proforma Invoice vs Quotation.

How To Create a Proforma Invoice / Proforma Invoice Template

As mentioned earlier, there are no strict requirements or rules governing how a proforma invoice should be. However, certain practices are agreed upon as healthy and should be kept in mind before making a proforma invoice.

- Should have a unique number (for reference purposes)

- Should contain the date

- Addresses of both the parties

- Description of goods/services to be provided with an accurate price

- Taxes, charges, commissions, fees, etc.

- Authorized signatory

There is no exact model specified for how a proforma invoice or even a proforma invoice template should look. If you desire a readymade template for your organization, use Deskera books for invoices for a beautiful proforma invoice template that looks like this:

To Conclude, Deskera continues to share high quality, educative articles regarding the various accounting principles and practices to educate small business owners. Check out the related topics below to get a deeper understanding of concepts related to invoicing and make sure to subscribe to our newsletter to ensure that you stay caught up on any new articles which will prove to be extremely useful for your small business.