Index

- P&L Statement: Use-Cases

- What is a P&L Statement?

- What are the Key Elements of a P&L Statement?

- What are the Different Types of P&L Statements?

- What is Not Covered in a P&L Statement?

A P&L statement is often referred to as a Profit & Loss Statement, an Income Statement, or a Statement of Operations. The different set of terms used to describe it show the two essential characteristics of a P&L Statement – it reflects the income being generated by a business and the financial health of its operations.

The P&L Statement gives you a deep understanding of what were the expenses incurred to earn the Net Income on the Gross Sales made by the company. Beyond that, an audited P&L statement can be used for the following purposes:

- Lenders and creditors would want to evaluate the creditworthiness of your business. They will use the P&L statement to formulate base-cases and conduct sensitivity tests on it. They will also check your business's profitability and see the potential for servicing the debt you are requesting.

- Investors, both public and private, want to see the P&L Statement to understand the earnings they can expect by investing in your company. They might use the P&L Statement to get a reasonable value of your company, keeping in mind its profitability.

- You can use the P&L Statement to establish the different cost-centers in your operations. It is not difficult to determine how much profit you are making or how much loss you incur. However, that standalone figure is an effect and not a cause. To fix it, you will have to understand which overheads are impacting your margins. A P&L Statement can serve that purpose.

Generally, the P&L Statement serves both internal and external decision-makers. Hence, it has to be prepared to keep mind the fiduciary duties and accounting standards in place.

What is a P&L Statement?

Now that you understand the use-cases of the P&L Statement, it would be easy to decipher that a P&L Statement is supposed to express the Net Income as a critical result. It does so by showing all the major expenses that have been incurred in line with the revenues.

Unlike a balance sheet, which generally shows a company's financial position on a particular day, the income statement is prepared for an entire period. For accounting purposes, this period might be divided into quarters or fiscal years. However, it is not uncommon for companies to monthly prepare internal P&L Statements to show the impact of the sales realized and the expenses incurred. In the simplest terms, your P&L Statement will take you from your Gross Revenues to the Net Income, clearly bifurcating each expense item in a structured manner.

Some companies also choose to prepare P&L Statements for different business units within the firm. For instance, if your company operates in two different product categories, it would not be unusual for your company to prepare two separate P&L Statements with each one showing the financial performance of one specific product category. Such statements are generally prepared for purposes like internal management review, performance review, cost analysis, etc. They are not sent as a set of audited financial statements to investors or creditors unless they specifically ask for it.

What are the Key Elements of a P&L Statement?

From a high level, a P&L Statement would show you all the expenses categorized in specific bifurcations. Cost of Goods Sold, Salary, General & Administrative Expenses, Interest Expenses, Depreciation and Amortisation, and so on. However, there are certain overheads and expense items pertinent to specific industries. You should look at the accounting standards and industry trends relevant to your industry and see the costs central to your industry. The local accounting standards governing body will give you a list of expenses and overheads that can be shown separately on your income statement to communicate performance more clearly.

Apart from the industry-specific overheads and expense items, here are the key elements arranged in the order in which they appear on a conventional P&L Statement:

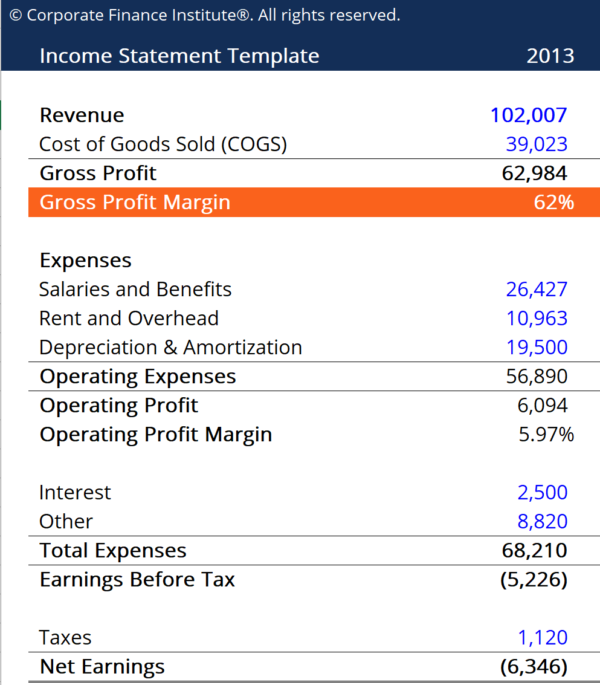

* Gross Revenues

These are also referred to as the top line of the business. The simplest mathematical way to get the Gross Revenues would be by multiplying the number of units sold with the selling price per unit. Since the line item is dependent entirely on sales, it is also referred to as Gross Sales making 'Sales' and 'Revenues' interchangeable terms. You might see a line item called Net Sales; it reflects the sales after calculating the impact of any returned products. Companies operating in retail industries tend to have this line item on their P&L Statement.

* Cost of Goods Sold (COGS)

This line item focuses explicitly on the direct expenses incurred to produce a good. It would include labor and raw material costs. Like distribution costs or salaries of the sales team, any other expense would not be included in this line item.

* Gross Profit

By deducting the COGS from the Gross Revenues, you get the Gross profit. As a percentage of the revenues, it is also referred to as the Gross Margin. It is essential to understand the difference between Gross, Operating, and Net Income. Gross Income or Gross Profits are the profits you get by considering only the cost of goods sold. Hence, they communicate how efficiently you are producing the goods. However, the cost of having a particular capital structure or having an extensive sales & marketing team is not reflected in the Gross Income. While informative, it is not always mandatory to show the Gross Profit on the income statement.

* Sales, General, and Administrative Expenses (SG&A)

This line item takes into account all the expenses incurred in running the operations of a business that do not go into manufacturing. Hence, almost all the indirect expenses like salaries, marketing budgets, rent, conveyance, etc. are recorded in this line item. By looking at it, you can evaluate how efficiently you are running an entire operation. R&D and Interest Expenses are not included here.

* R&D

These are the expenses you incur specifically for Research & Development purposes. Both US GAAP and IFRS have specific guidelines for capitalizing on R & D expenses and when they go for a single-period line item. Refer the guidelines as established by the local accounting body to understand whether you can capitalize on this line item or not. If you don't have a dedicated R&D practice, you would not need this line item.

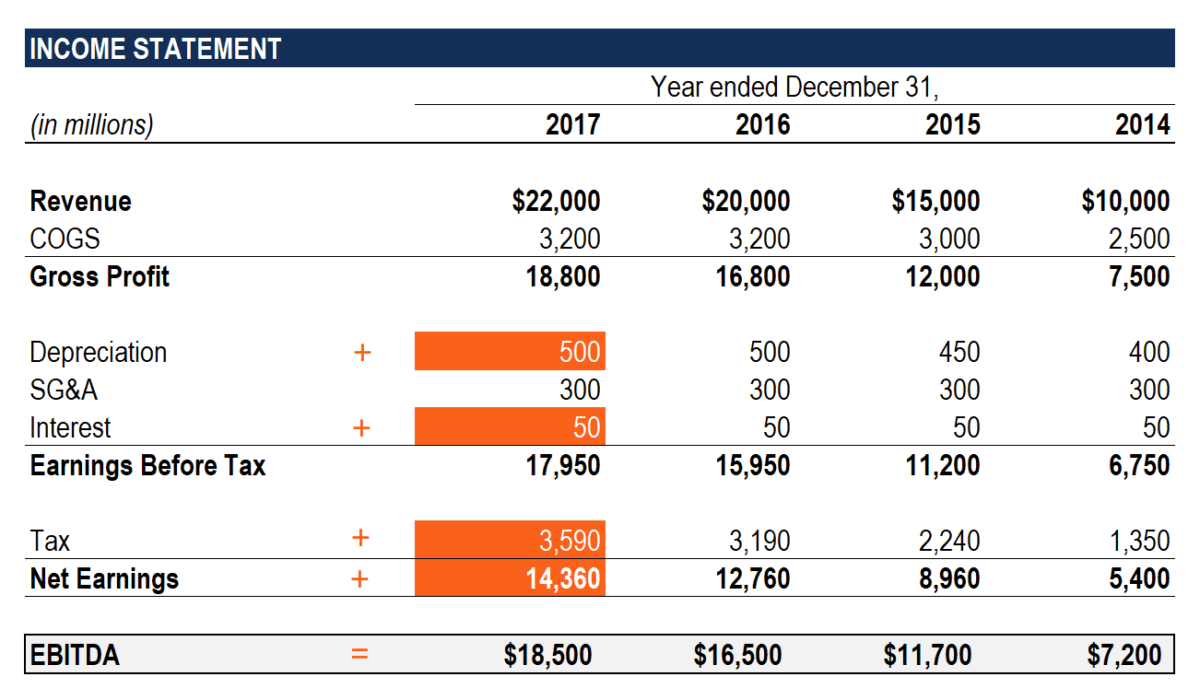

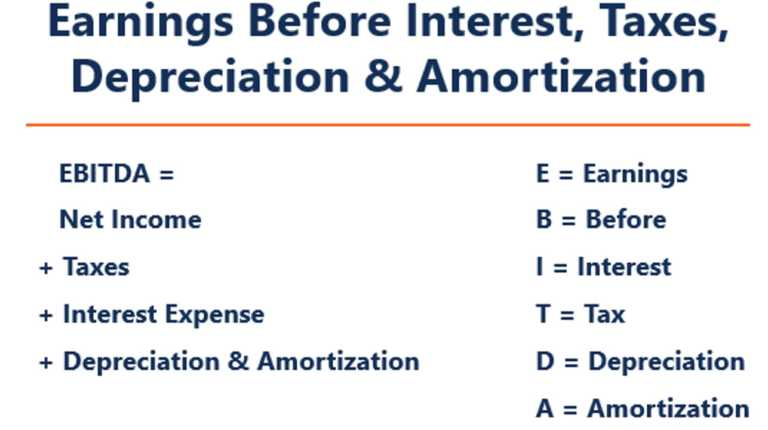

* EBITDA and Operating Profits

EBITDA stands for Earnings Before Interest, Tax, Depreciation, and Amortization. As the abbreviation shows, this line item is calculated by subtracting R&D and SG&A expenses from the Gross profit. EBITDA makes different industries comparable as the cost of having debt on the balance sheet or being a specific tax-economy does not impact the EBITDA. Operating Profits are closely related to EBITDA, except they also take into account the operating expenses like depreciation and amortization.

* Depreciation & Amortisation

D&A is considered to be one of the trickier items on the P&L Statement. It shows all the depreciation and amortization expenses you have incurred for a particular period. This helps you decrease your taxable income but also shows the aging nature of your major assets. There are methods like straight-line and double-decline, used to calculate the D&A. Both IFRS and US GAAP recommend different methods that are then adopted by the local accounting bodies.

* Interest Expense

This is the interest you have to pay on short term and long term debt. This is the first line item that shows the impact of your business's capital structure on your profits. It is calculated by adding all the interest you paid for a specific period on different debt instruments like bonds, lines of credits, etc. They also help you bring down the taxable income but show the indebtedness of your business. Too much credit can be harmful if not matched with equal or higher levels of cash flow.

* Profit Before Tax

PBT is a simple line item that shows you the profit you would make if you did not have to pay taxes on it. It shows how efficiently you have structured the company to take benefits of the tax policies put out by the jurisdiction you operate in. Unless you have several operating companies and business units scattered around the globe, this would be a straight forward line item.

* Tax

Also referred to as the Tax Expense, this line item shows how much tax you owe to the government, generally calculated as a percentage of your Profit Before Tax. Once again, if you don't have a globally scattered set of companies and subsidiaries, this would be a straight percentage on the PBT.

* Profit After Tax or Net Income

There might be some inconsequential line items between your PAT and the Net Income. However, they are taken on a case-by-case basis. Generally, this is the last line item on the Income Statement. It shows what your business is making in terms of profits after deducting all the Gross Revenues' expenses. Generally, when you want to measure the profitability of a business, you take the Net Income as a percentage of the Gross Revenues.

What are the Different Types of P&L Statements?

When you look at P&L Statements prepared by different companies, you will see differences in formats and the general information communicated in the statement. However, you are now well-aware of the basic principles common across all the P&L preparing formats.

Here are some types of P&L Statements that may communicate different forms of information:

- By Accounting Standards You would have to check between IFRS and US GAAP. Both the accounting standards have subtle differences in what can be included and how it should be presented in an income statement. While both the organizations are working on converging the accounting standards, there are still some considerable differences in how you can recognize revenue, ascertain depreciation, and a few other key calculations.

- Information Presentation You might see companies preparing different income statement formats like condensed income statement, single-step income statement, and so on. Generally, they use the same information covered in the conventional income statement, but make some additional calculations and presentation adjustments like clubbing certain line items or showing expenses at the bottom of the page.

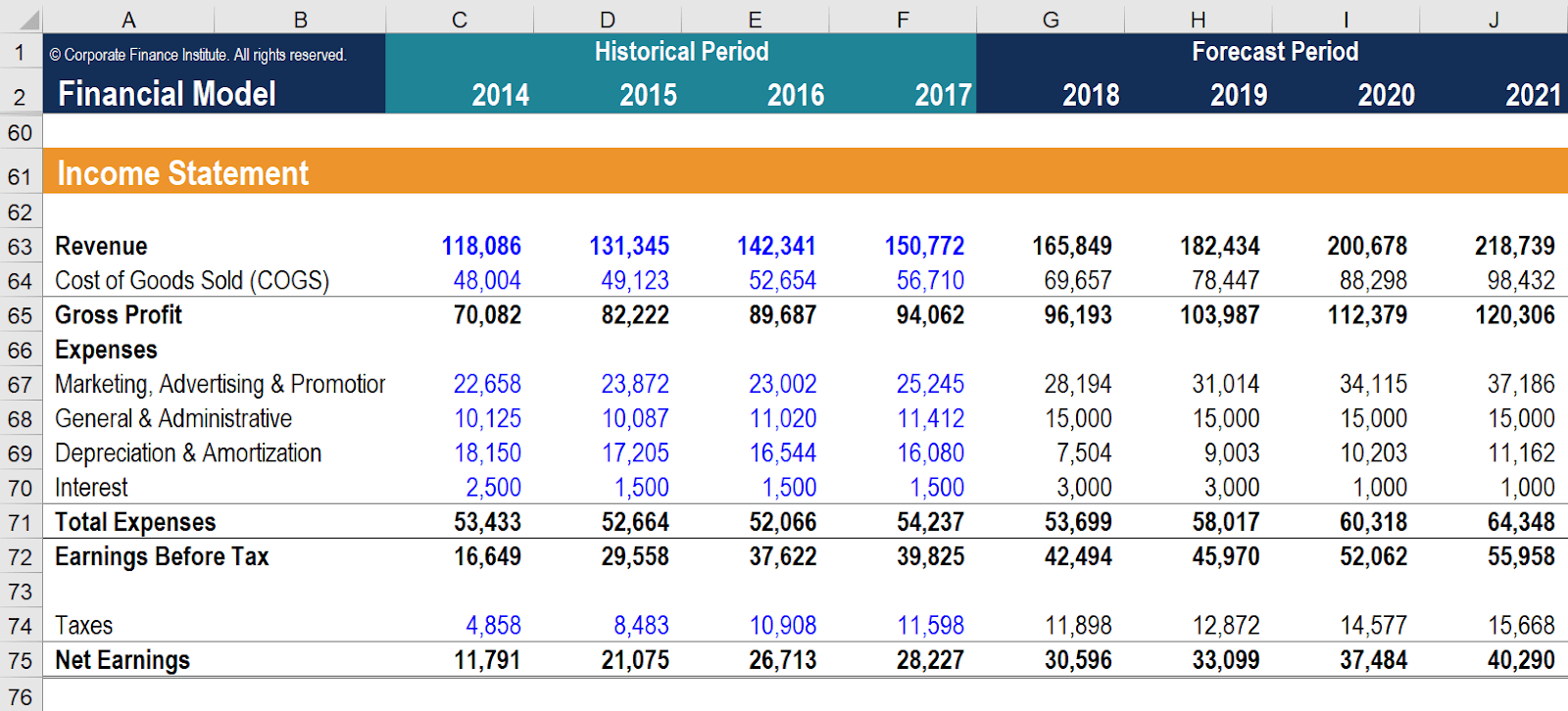

- Timeline As we established earlier, income statements or P&L statements are prepared for a certain period, not for a particular date. When you analyze the financial models being prepared, you will often see the income statement as a broader document that covers the same line items but shows the consecutive numbers for different years. This helps in unraveling key trends. Using such trends, analysts often prepare pro forma income statements that show the projected income of a business, given the satisfaction of certain assumptions.

What is Not Covered in the P&L Statement?

While quite comprehensive and informative, the P&L Statement does not take into account several key considerations like:

- The Cash Flow of a Business for a Given Period: You are focusing only on the profits; however, there might be a gap between the communicated profits and the actual cash received. The cash flow statement will give more information on this front.

- Capital Structure of a Business: While the income statement has the Interest Expense line item, it shows just the interest paid for a given period. You still have to see the business's indebtedness, and that can be seen only by looking at all the debt, shareholders' equity, retained income, and other line items available on the Balance Sheet.

- Timeliness of the Information: Since the income statement is prepared in retrospect, i.e., looking backward, it does not give you a lot of information about what are the developments for the future. For instance, if the tax policies have been changed right after the day you have prepared your quarterly income statement, you will not be able to record the policy change's impact on the statement already prepared for the quarter. On the other hand, Balance Sheet shows several long-term assets and liabilities. It can communicate insights for a larger period even if it communicates the financial position as per a particular day.

What Should You Keep in Mind While Preparing the P&L Statement?

Here are some 'hygiene tips' you can use to maintain an accurate P&L Statement.To know more about the preparation of the statement and see a few examples of P&L or income statement read this article

- Establish the purpose of making the P&L Statement: If it is for accounting purposes or audits, a professional accountant should do it.

- Understand the implications of the accounting standards: Make sure you are taking into account the different revenue recognition, accruals, deferrals, and other intricate accounting standard implications.

- Maintain consistency: It will help your bank and investors prepare the income statement in a consistent format for the years to come.

- Aggregate supporting documents: Since you will pull information from several accounts, teams, and individuals, make sure you have access to all the information necessary before you prepare the statement.

In Conclusion

The P&L Statement is a critical document that can help you understand your business' profitability and operational efficiency. Along with the balance sheet and the cash flow statement, it can let any investor, creditor, or analyst understand the intricacies of how your firm conducts its operations. Even if you are not preparing it for audit or accounting purposes, the statement and other financial reports should always be updated.

The right tools, templates, real-time data update functionalities, and visual presentations embedded on one platform can save a lot of time and help you create a professional-looking and insightful income statement in no time. There are multiple accounting softwares available that can make your life simpler by giving you access to an updated dashboard and reports anytime. If you are investing in a software it is a good idea to look for a cloud based accounting software like Deskera. It is safe, real time and gives you access to your data from anywhere, anytime.All you need is an internet connection - Click here for a Free Trial.