Michael has recently invested in a new business and wants to plan to anticipate, control, and analyze the risk involved with corporate funding. It’s a small business with not much investment, but he wants to understand current financial values and make calculated future forecasts.

This is where a Pro Forma Income Statement will help him. It is a forecasted financial analysis for a particular scenario that revolves around the "what if" factor for start-up founders giving you a glimpse into the future. Here we will know how Pro Forma Income Statement can help you determine the futuristic financial report of your business.

Table of Contents

- What is a Pro Forma Income Statement?

- What is the need for the Pro Forma Income Statement?

- Consider the following Example

- The Pro Forma Income Statement can be used for the following

- Types of Pro Forma Income Statement

- Type 1 - Pro Forma Income Statement (Historical)

- Type 2 - Pro Forma Income Statement (Futuristic)

- Why is a Pro Forma Income Statement critical for Start-up businesses?

- How to Create a Pro Forma Income Statement

- The different uses of the Pro Forma Income Statement

- Disadvantages of Pro Forma Income Statement

- Conclusion

- Key Takeaways

What is a Pro Forma Income Statement?

Firstly, the Pro Forma Income Statement is more relevant to start-ups and new businesses instead of the large organizations. The Pro Forma Income Statement is a document that is a way to show your company's income if you exclude some costs. These statements are logical assumptions and financial forecasts that are a useful tool for investors, start-up businesses, and key decision-makers to look at a company's future financial position.

However, the Pro Forma Income Statement has a different meaning in the context of a public company. Whether you are considering buying new equipment, taking on new debt, or acquiring another branch, you still need to prepare an income statement to establish the cause and effect of your decision.

In contrast, traditional financial statements show historical financial statements, while proforma financial statements, including income statements, show the future financial statements of start-ups.

What is the need for the Pro Forma Income Statement?

Consider the following Example

Michael has invested in a new top business, wherein he sells toys for all age groups. He sees that toys for toddlers are not selling for quite some time now and he is suffering losses because of this section which has given a big blow to his income. He quickly liquidates his inventory, sells all the toddler toys at break-even, and stops doing business with the vendor who was supplying toddler toys to him.

While he is suffering losses because of this section, the Pro Forma Income Statement shows the predicted health of his toy business after eliminating the toddler toys section, which looks quite profitable.

The Pro Forma Income Statement can be used for the following

- As an Estimated Income Statement to compare expected operating expenses with your current tax budget

- To estimate whether you need to expect higher costs in the first quarter compared to the second quarter

- To predict if you can expect above-average sales growth in a particular year

- Decide on the budget you want to spend for your marketing campaign in a particular month

- Helps investors by displaying the potential for profit growth

Types of Pro Forma Income Statement

There are two types of Pro Forma Income Statements based on the competition and size of the market, the growth rate, etc.

Type 1 - Pro Forma Income Statement (Historical)

When companies make a major decision based on historical data. For example, an eCommerce giant decides to remove its one-off costs, and stock-based compensation, to accurately display net income.

Type 2 - Pro Forma Income Statement (Futuristic)

Revenue forecasts in this Pro Forma Income Statement are based on assumptions like market size, future sales, growth rate, assumptions, competition, and more.

Why is a Pro Forma Income Statement critical for Start-up businesses?

Here are the reasons:

1. To show it to the Potential investors

By announcing future returns, you can attract the attention of potential investors to secure money and grow in the short term. Pro Forma Income Statement helps start-ups get the most appropriate financing options from investors.

2. To analyze risk

This statement helps new businesses to forecast best-case and worst-case financial scenarios while observing a range of realistic results you can expect from your income.

3. To Assess Possible limitations

Pro Forma Income Statements are based on knowledge-based “assumptions” but not on facts or accurate calculations. As an investor or a new business, you need to be careful while depending on the Pro Forma Income Statement.

4. To consider Rules and Regulations

Although the SEC (Securities and Exchange Commission) is applied to public companies, new businesses can follow the trends for constantly updating and changing strict rules and regulations regarding Pro Forma Income Statements.

How to Create a Pro Forma Income Statement

This section provides a quick, step-by-step approach to creating and calculating various aspects of the Pro Forma Income Statement

Step 1 – You can start by assuming the current state, and creating a baseline to understand the growth rate of revenues and expenses

Step 2 – You can add assumptions that could be applicable for a single financial year or even for 3-5 years. You can use the internal factors or historical data of the last 12 months for a better understanding of current and future earnings drivers

Step 3 – Consider the internal and external factors before making assumptions. Internal factors include sales, marketing, recruitment, etc., while external factors include competition, demand in the market, government regulations, etc. You can adopt cloud-based on-premises software, to give your business an edge as it saves you the time of repeating financial reports

Step 4 - The forecasted Pro Forma Income Statement should include both costs and revenue. You can isolate the costs that need to be incurred

Step 5 – You must ensure that your income, spending, and growth numbers make sense and are error-free. Ask efficient stakeholders to review the assumptions. Finally, set goals and plan stable and rational progress

The different uses of the Pro Forma Income Statement

- One of the most difficult tasks for a business is to indulge in sales forecasting using realistic assumptions that can support predictions. The Pro Forma Income Statement is used to create cash flow statements and balance sheets, which are an important part of the business plan

- Pro Forma Income Statement can be used to analyze and predict transactions and is a great tool to predict the future growth, sales, and even expenses of the organization. This is specifically beneficial for investors. For example, company XYZ wants to takeover company ABC. It is mainly based on the Pro Forma Income Statement, that the tie-up can be financially analyzed and it can be estimated how the acquisition will affect the company’s finances

- Pro Forma Income Statement helps in estimating the financial ratio of the company

- In the case of companies bearing one-time costs, the Pro Forma Income Statement excludes it from its calculation so that analysts and investors get a better understanding of the company’s revenue model and growth

- The Pro Forma Income Statement specifically in a few businesses like the internet connection or cable company business, depending on their nature can provide a better picture of their performance

Disadvantages of Pro Forma Income Statement

- One of the biggest disadvantages of the Pro Forma Income Statement is that the future is unpredictable and this statement involves finances based completely on assumptions and forecasts. If there is any kind of error or fallacy in the assumption, it can lead to completely inaccurate management and execution. Businesses cannot always depend on historical data to assess the future growth of the company; thus the Pro Forma Income Statement is a vital

- Companies tend to manipulate financial gains using Pro Forma Income Statement because there are no set rules for creating them. Organizations can exclude major costs or any other expense that reflects the obscurity of their financial performance

- Some companies do not include inventory that is unsold from their accounts. This is a bit difficult to manage to create an unsellable inventory

- Not all companies manipulate profits. Therefore, it is imperative for new businesses and investors to carefully assess what is included or excluded in the Pro Forma Income Statement that is presented to them

Conclusion

The Pro Forma Income Statement gives a true picture of the financial situation, especially if the investors wisely dig deeper and analyze what's included, and what's excluded.

You can compare the proforma statement with the actual statement for a better understanding of the cost and revenue scenario of your business

How can Deskera Help You?

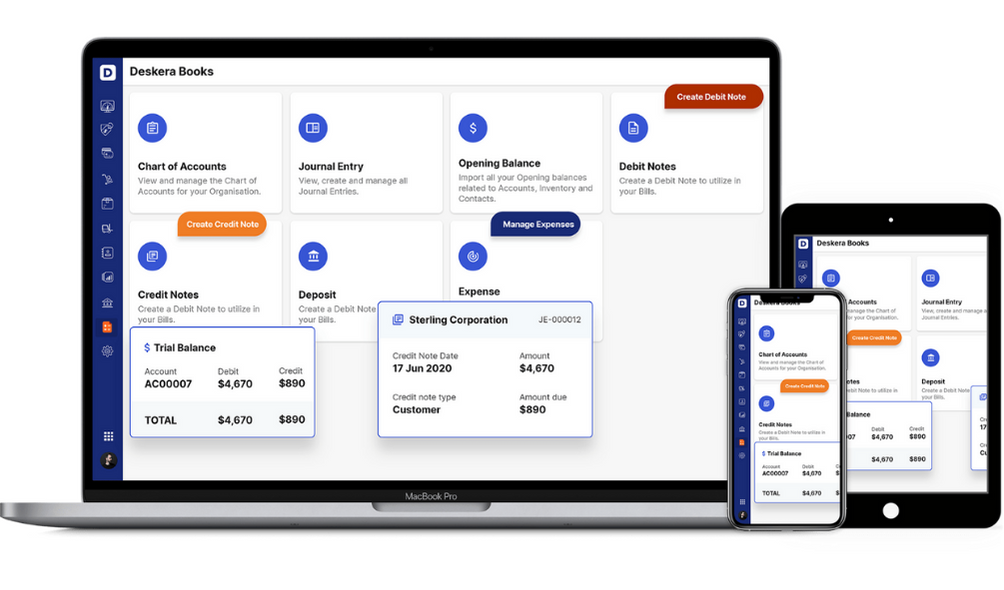

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution, it caters to all your business needs, from creating invoices and tracking expenses to viewing all your financial documents whenever you need them.

Key Takeaways

- Pro Forma Income Statements allow new businesses to create virtual forecasts of revenue and cost involved in a business

- The ground of the Pro Forma Income Statement is maintained on assumptions for making forecasting annual and quarterly income and expenses

- It is highly recommended to make a revenue model when creating the Pro Forma Income Statement to verify whether the assumptions that have been made related to different scenarios can be realized practically or not. It is substantial to compare actual results with assumptions considered in the Pro Forma Income Statement

- The Pro Forma Income Statement is an effective way to prepare for unexpected business hurdles, tax increases, growth plans, and acquisitions

- It is a great technique to attract investors, detail growth plans, be optimistic and raise funding for the business

Related Articles