Ever wondered what part of your loan payment actually reduces your debt? The answer lies in the loan principal. While many borrowers assume every payment chips away at their loan balance, the truth is more complex. Understanding how the principal works—and how it interacts with interest—can make all the difference in how quickly and effectively you repay your loan.

The principal of a loan represents the original amount you borrow from a lender, separate from the interest and fees that get added over time. Whether you take out a mortgage, student loan, car loan, or personal loan, the principal is the foundation of your debt. By understanding how it’s calculated, where to find it, and how repayments affect it, you can make smarter financial decisions and save significantly in the long run.

The principal is the foundation of your loan—it’s the amount you borrowed, and every smart repayment strategy starts here.

Many borrowers overlook the importance of managing their principal effectively. Small strategies, like making extra payments or shortening loan terms, can help you reduce the lifetime cost of your loan. Even better, knowing the difference between principal and interest gives you clarity on how much of your money actually reduces debt versus how much goes to the lender as profit.

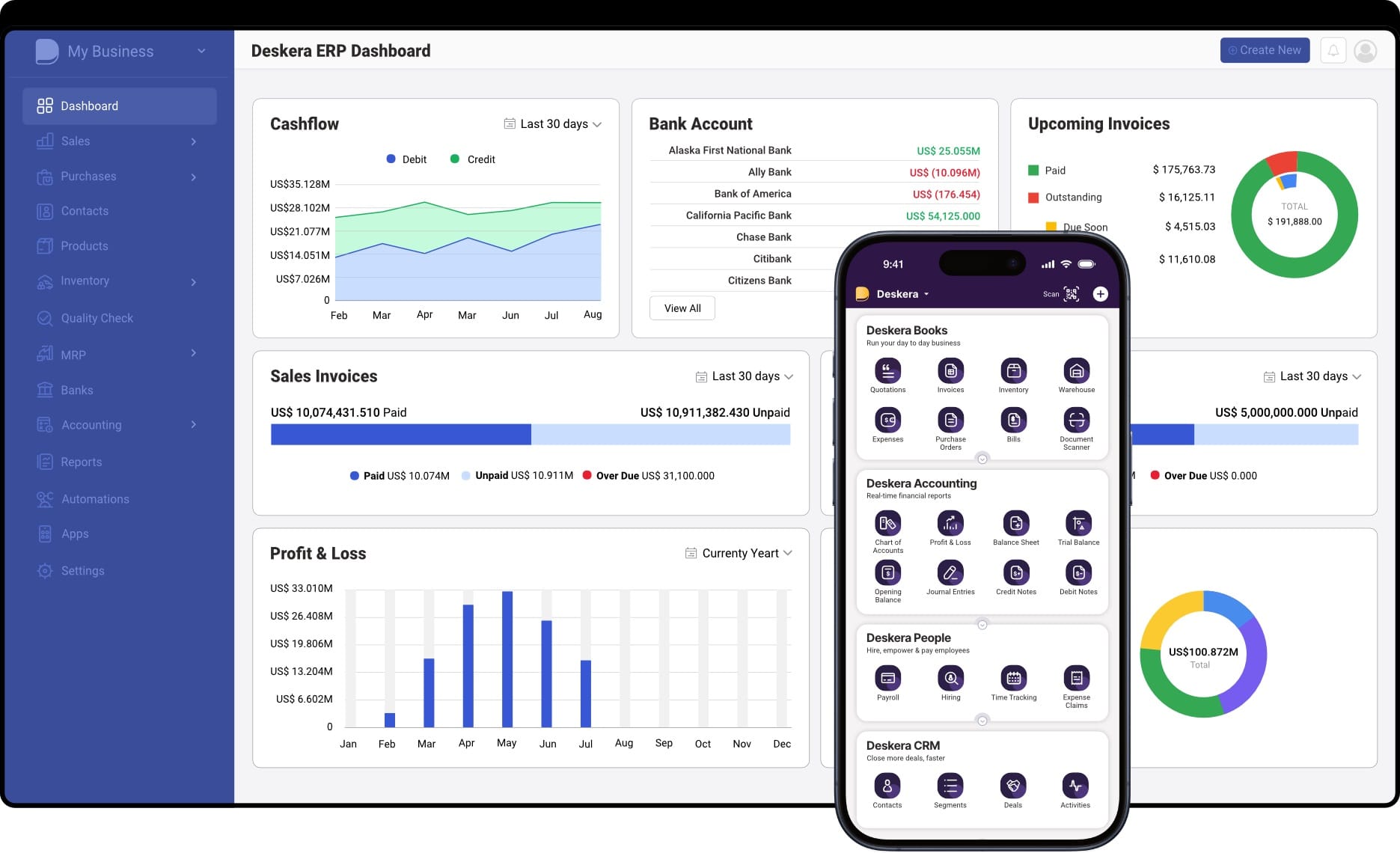

With ERP.AI, businesses can automate loan tracking, monitor repayment schedules, and gain insights into principal and interest breakdowns for smarter financial planning.

For businesses looking to streamline loan tracking and repayment planning, tools like Deskera ERP can be a game-changer. With its integrated accounting, financial reporting, and automation features, Deskera ERP helps organizations monitor loan principals, manage interest payments, and optimize cash flow with ease. By centralizing financial data, it empowers both individuals and businesses to stay in control of debt while focusing on long-term growth.

What is Loan Principal?

The term loan principal refers to the original sum of money that you borrow from a lender. In Latin, “principal” translates to “first in importance”, which makes sense because it forms the foundation of your loan. Whether you’re financing a car, buying a house, or paying for education, the principal is the starting amount that must eventually be repaid, along with any added interest and fees.

In simple terms, the principal is the money you receive from your lender, and it serves as the baseline for calculating interest and determining your repayment conditions. Over time, as you make regular payments, the principal balance decreases. However, only a portion of each installment goes directly toward reducing this principal—especially in the early stages of a loan, when more of your payment covers interest.

There are two main types of principal balances:

- Initial Principal – The original loan amount borrowed, which sets the stage for interest calculations and your repayment schedule.

- Outstanding Principal – The remaining loan balance after some payments have been made. Interest is continually calculated on this outstanding amount until the loan is fully repaid.

For example, if you take out a car loan with an initial principal of $20,000, your outstanding principal might be $16,000 after one year of payments. Future interest will be based on this reduced balance. This means the size of the principal directly impacts the total cost of borrowing: a higher principal leads to higher overall interest payments if loan terms remain constant.

Beyond loans, the term “principal” can also apply to investments and bonds. In investments, it represents the original amount invested, while in bonds, it’s the face value that gets repaid to the bondholder at maturity. No matter the context, principal is pivotal in understanding your financial commitments and returns.

How to Identify the Loan Principal

When you borrow money, the loan principal is always clearly defined, but it’s easy to confuse it with the total loan balance. The principal is simply the original amount you borrowed from the lender, excluding any interest, service charges, or additional fees. Knowing how to identify the principal helps you track your debt more effectively and understand how your payments are applied.

The easiest way to spot your loan principal is by checking your loan agreement or promissory note. This document will state:

- The initial principal (the original amount borrowed).

- The repayment schedule (how payments are split between principal and interest).

- Any fees or charges that are separate from the principal.

As you begin repayment, you’ll also see your outstanding principal listed on monthly statements. This is the portion of your loan that still needs to be repaid. It gradually decreases as you continue making payments, though it shrinks faster if you make extra payments toward principal.

For example, if you take a $10,000 loan, your initial principal is $10,000. After a year of regular payments, your lender may show an outstanding principal of $8,000 on your statement. This figure excludes any interest you’ve paid, reflecting only the unpaid portion of your original loan.

Quick Ways to Identify Your Loan Principal

- Loan Agreement – Check your original contract for the initial principal.

- Monthly Statement – Look for the “outstanding principal” balance.

- Online Loan Account – Most lenders display a breakdown of principal vs. interest.

In short: your loan principal is always visible in your documents and statements—it’s the amount you still owe, before interest and fees are added.

Example: Breaking Down the Loan Principal

Understanding loan principal becomes easier when you see it in action. Let’s say you take out a $20,000 car loan at 6% annual interest for a term of 5 years. In this case:

- Initial Principal: $20,000 (the amount you borrowed).

- Monthly Payment: Around $386 (based on a standard amortization schedule).

- Each payment includes two parts: one portion goes toward interest, and the rest reduces the principal.

In the early months of the loan, a larger share of your payment goes to interest, while a smaller portion reduces your principal. Over time, as the outstanding principal shrinks, the interest charges decline and more of your payment is applied toward the principal.

Here’s a snapshot of how it works in the first year:

As you can see, after 12 months of regular payments, the outstanding principal decreases from $20,000 to $16,506. Interest is calculated on the remaining balance, so reducing the principal faster directly lowers the total interest you’ll pay over the life of the loan.

This example highlights why paying a little extra toward principal each month can help you save thousands in interest and shorten your repayment term.

Where You’ll Encounter Loan Principals

Loan principals aren’t limited to one type of borrowing—they appear in nearly every financial agreement where money is lent or invested. Understanding where you’ll encounter them can help you better interpret contracts and repayment schedules.

1. Mortgages

When you buy a house, the mortgage principal is the amount borrowed to cover the property’s cost (minus your down payment). Over time, each mortgage payment chips away at the outstanding principal, building equity in your home.

2. Auto Loans

For car financing, the loan principal is the purchase price you still owe after any down payment or trade-in value. The faster you reduce this principal, the less interest you’ll pay over the life of the loan.

3. Student Loans

In education loans, the principal is the original borrowed sum that covers tuition, books, and living expenses. Interest is charged on this balance until it’s paid off, making it essential for graduates to understand how principal reduction impacts long-term debt.

4. Personal Loans

Unsecured personal loans—used for medical bills, travel, or consolidating debt—also revolve around a principal amount. Since these loans often carry higher interest rates, reducing the principal quickly is crucial to avoid overpaying.

5. Business Loans

Companies that borrow for expansion, equipment, or working capital also deal with principals. These loan principals influence interest costs, repayment terms, and overall cash flow.

In short, any time you borrow money—whether for a home, car, education, or business—you’re dealing with a loan principal. It’s the foundation of your debt and directly affects how much you’ll end up repaying.

How Does Loan Principal Work?

The loan principal is not just a static number—it changes over time as you make repayments. To fully understand how it works, it’s important to look at the repayment process and how principal reduction happens gradually.

Repayment Process Over Time

When you take out a loan, your repayment schedule typically includes both principal and interest. Each monthly payment is divided into these two parts: one portion reduces the outstanding principal, and the other covers the interest charged by the lender. The principal balance decreases slowly at first, but as you keep paying, more of your money starts to go toward reducing the original amount.

Why Early Payments Mostly Go Toward Interest

In the early stages of a loan, especially with long-term loans like mortgages or student loans, most of your payment is applied to interest. That’s because interest is calculated on the current outstanding principal, which is largest at the beginning. Lenders front-load interest to ensure they recover their cost of lending early in the repayment process. This is why many borrowers are surprised to see only a small drop in principal after several payments.

Early payments mostly cover interest, but consistent repayments steadily chip away at the principal, bringing you closer to financial freedom.

How Principal Decreases Gradually

As the outstanding principal gets smaller, the interest charged also decreases. Over time, a larger share of your payment begins to apply directly to the principal balance.

This creates a compounding effect—once the principal is reduced enough, your payments work more efficiently to pay down the debt. Extra payments toward the principal can accelerate this process, saving you money on interest and helping you pay off the loan faster.

In essence, the loan principal works like the foundation of your repayment plan—it starts large, shrinks slowly, and eventually accelerates toward zero as long as you keep up with your scheduled payments.

Loan Principal vs. Loan Interest: What Sets Them Apart

Principal is your debt; interest is the price of borrowing it. Knowing the difference is key to smarter financial decisions.

When you borrow money, your repayment isn’t just about giving back what you borrowed. Every payment you make has two key components: loan principal and loan interest. Understanding the difference between the two is crucial for managing debt effectively.

Loan Principal

The loan principal is the original amount of money you borrow from the lender. For example, if you take a home loan of $150,000, that $150,000 is your principal. Over time, each payment you make reduces this balance, either partially or in full. The remaining principal balance is also what determines future interest charges.

Loan Interest

Loan interest is essentially the cost of borrowing money. It is calculated as a percentage of your outstanding principal. If your loan has an interest rate of 6%, the lender charges you 6% annually on the remaining balance. Interest payments don’t reduce the principal directly; instead, they compensate the lender for providing the loan.

Key Differences

- Purpose: Principal is the money you borrowed; interest is the cost of borrowing.

- Effect on Debt: Paying down the principal reduces your outstanding balance, while paying interest does not.

- Repayment Structure: In the early stages of repayment, a larger share of your payment goes to interest. Over time, more of it shifts toward reducing the principal.

- Impact on Loan Cost: A higher principal means more total interest paid over the life of the loan, assuming the same rate and term.

Simply put, the principal is your debt, and the interest is the price of carrying that debt. Together, they define how much you’ll ultimately pay back to the lender.

How the Loan Principal Gets Repaid

Repaying the loan principal is a gradual process that unfolds with every installment you make. While it might seem like your payments should directly reduce the borrowed amount, the reality is a bit more layered. Here’s how it works:

Monthly Installments Include Both Principal and Interest

Most loans—whether mortgages, student loans, or auto loans—are structured with fixed monthly payments. Each payment is split between interest and principal. At the beginning of the loan term, the interest portion is larger because it’s calculated on the full outstanding principal.

Principal Reduction Over Time

As you continue making payments, the balance of your outstanding principal decreases. Since interest is recalculated on this smaller balance, a larger portion of your monthly payment gradually shifts toward reducing the principal. This is why long-term loans feel slow at first but accelerate in reducing the balance over time.

The Role of Amortization

An amortization schedule shows how each payment is divided between principal and interest. It illustrates how, month by month, your loan principal shrinks while interest charges decline. By the final stages of repayment, the majority of your payment goes directly toward principal, with only a small fraction allocated to interest.

Mini Example: $10,000 Loan

Let’s say you borrow $10,000 at an 8% annual interest rate for 3 years (36 months). Your monthly payment would be about $313.36. Here’s what the first few months of repayment might look like:

Notice how, month by month, the interest portion gets smaller while the principal portion grows larger. This shift continues until the loan is fully repaid.

Making Extra Payments Toward Principal

One of the fastest ways to cut down your debt is by making additional payments directly toward the principal. These extra contributions lower the outstanding balance, which in turn reduces future interest charges and shortens the loan term. Many lenders allow this without penalty, but it’s important to check your loan agreement.

In short, loan principal repayment is a step-by-step process, where consistency and smart extra payments can significantly speed up debt reduction and lower total costs.

Why Reducing Loan Principal Early is Smart

Paying down principal early is like taking a shortcut on your debt journey—it saves interest, shortens the loan term, and gives you financial freedom sooner.

Paying off debt is not just about staying on schedule—it’s also about reducing the total cost of borrowing. Making extra payments toward your loan principal early on can have a powerful long-term impact. Here’s why:

Lower Interest Costs

Since interest is calculated on the outstanding principal, reducing that balance early means you’ll be charged interest on a smaller amount. Even a few extra payments in the beginning can save you thousands over the life of a loan.

Faster Loan Repayment

Extra payments directly toward principal shorten the repayment timeline. By lowering the outstanding balance faster, you reduce the number of months or years needed to fully repay the loan, helping you become debt-free sooner.

Improved Financial Flexibility

Reducing principal early frees up future cash flow. With a smaller balance and lower interest charges, you’ll have more flexibility to allocate money toward investments, savings, or other financial goals.

Builds Equity and Credit Health

For loans tied to assets like homes or cars, paying down principal builds equity faster. This not only strengthens your financial position but can also improve your credit profile by lowering your overall debt.

Numerical Example: The Power of Extra Payments

Imagine you take out a $200,000 mortgage with a 30-year term at 5% interest. Your standard monthly payment would be about $1,073. If you simply make the required payments, you’ll pay nearly $186,000 in interest over 30 years.

But if you add just $100 extra per month toward the principal, you could save over $30,000 in interest and cut your loan term by more than 5 years. That’s the power of targeting the principal early!

In essence, early principal reduction is like getting a head start in a marathon—you reach the finish line quicker and with far less cost.

Principal in Investments

In the world of investing, the term principal refers to the original sum of money that you invest. Whether you put money into stocks, bonds, mutual funds, or a fixed deposit, the principal is the amount you start with—the foundation upon which your potential earnings are built.

Principal vs. Returns

It’s important to distinguish between your principal and your investment returns. Returns include interest, dividends, or capital gains earned on your investment. For example, if you invest $10,000 in a bond and receive $500 in interest over a year, your principal remains $10,000, while the $500 is the return. Protecting the principal ensures that your base capital remains intact, allowing future returns to compound effectively.

Your principal is the backbone of your investment strategy—protect it, and your returns have room to grow.

Numerical Example: Growing Your Principal

Suppose you invest $5,000 in a fixed deposit with an annual interest rate of 6%. After one year, you earn $300 in interest. Your principal remains $5,000, but your total investment value becomes $5,300. If you reinvest the interest, the next year’s interest is calculated on $5,300, demonstrating the power of compounding. Protecting your principal allows your investment to grow steadily without losing the original capital.

Why Preserving Principal Matters

Preserving principal is a key principle in sound investment planning. Losing part of your principal due to high-risk investments or market volatility can significantly impact your long-term growth. Investors often balance risk and return to ensure that while returns grow, the original capital remains secure. This is especially important for goals like retirement planning, emergency funds, or education savings, where maintaining the initial investment is crucial.

In essence, your principal is the backbone of your investment strategy. By protecting it and understanding the difference between principal and returns, you can grow wealth steadily while minimizing unnecessary risk.

Loan Principal and Taxes: What You Should Know

When it comes to taxes, it’s important to understand the difference between loan principal and interest, because they are treated differently under most tax laws. Knowing this distinction can help you plan your finances more effectively and avoid misconceptions.

Principal Repayment Is Not Tax Deductible

The amount you pay toward the loan principal is considered repayment of borrowed funds, not an expense. Therefore, payments applied to principal do not reduce your taxable income. For example, if you pay $5,000 toward the principal of a personal loan in a year, that amount does not qualify for a tax deduction.

Interest May Be Deductible

Unlike principal, the interest portion of your loan payments may be tax-deductible under certain conditions. For instance:

- Mortgage interest: Homeowners can often deduct interest paid on mortgage loans within IRS or local regulations.

- Student loan interest: Interest on qualified education loans may be deductible up to a certain limit.

- Business loans: Interest on loans used for business purposes is typically deductible as a business expense.

Why This Matters

Understanding the tax treatment of principal vs. interest helps you plan your payments and budget more efficiently. Paying extra toward the principal reduces interest over time, which can lower potential deductions but saves money in the long run by decreasing the overall loan cost.

In short, principal payments are not deductible, but interest payments may be depending on the loan type. Being aware of this distinction helps you make smarter repayment decisions and optimize both your cash flow and tax planning.

Common Misconceptions About Loan Principal

Confusing principal with interest or underestimating extra payments can cost you thousands—clarity is the first step to smarter debt management.

Understanding loan principal is essential for smart debt management, but many borrowers have misconceptions that can lead to costly mistakes. Let’s clear up some of the most common myths:

1. “All Payments Go Toward Principal at the Beginning”

Many borrowers assume that every payment immediately reduces the principal. In reality, early payments mostly cover interest, especially on long-term loans. Over time, as the outstanding principal decreases, more of each payment goes toward reducing the principal balance.

2. “Extra Payments Won’t Make a Difference”

Some people think that paying a little extra won’t significantly affect their loan. In fact, even small extra payments toward principal can save thousands in interest and shorten the repayment period considerably, as the outstanding balance decreases faster.

3. “Principal and Interest Are the Same Thing”

Another common misconception is that principal and interest are interchangeable. Principal is the amount you borrowed, while interest is the cost of borrowing. Confusing the two can lead to poor financial planning and unnecessary interest payments.

4. “You Can’t Pay Off Principal Early Without Penalties”

Many borrowers believe they must stick strictly to the repayment schedule. While some loans do have prepayment penalties, many lenders allow additional payments toward principal, enabling you to reduce your debt faster without extra charges.

Understanding how principal actually works helps you make smarter repayment decisions, save on interest, and shorten your loan term. Avoiding these misconceptions is the first step toward better financial control.

Tips for Managing Loan Principal Effectively

Effectively managing your loan principal can save you money, reduce debt faster, and give you better control over your financial future. Here are some practical tips to help you manage your principal wisely:

1. Make Extra Payments Toward Principal

Even small additional payments directly applied to your principal can significantly impact the total interest you pay over the life of the loan. Each extra payment reduces the outstanding balance, which in turn lowers future interest calculations.

Over time, this approach can shorten your loan term by months or even years, helping you become debt-free faster. It also instills a disciplined approach to managing finances and encourages smarter money allocation.

2. Opt for Shorter Loan Terms When Possible

Choosing a shorter loan term may increase your monthly payment, but it allows you to pay down the principal faster and save on overall interest. By reducing the time the lender has to collect interest, you ensure that a larger portion of each payment goes toward principal rather than interest.

Shorter terms can be particularly effective for mortgages and personal loans, helping borrowers build equity or financial freedom more quickly while maintaining a structured repayment schedule.

3. Refinance for Lower Interest Rates

Refinancing your loan to secure a lower interest rate can free up more of your payment to go toward the principal. If market rates drop or your credit score improves, refinancing may significantly reduce your total interest paid over the loan’s life.

More of your monthly payment reduces the outstanding balance, shortening the repayment timeline. This approach is especially useful for long-term loans such as mortgages, car loans, or business loans, as it maximizes financial efficiency.

4. Track Your Loan Balance Regularly

Regularly monitoring your loan balance helps you stay aware of how much principal remains unpaid. By checking statements, online accounts, or financial tracking apps, you can see the impact of each payment on the outstanding balance.

This visibility allows you to plan additional payments, make adjustments to your repayment strategy, and stay motivated. Keeping an eye on your principal ensures you maintain control over debt reduction, avoid surprises, and achieve financial goals more effectively.

5. Avoid Missing Payments

Missing payments can allow interest to accumulate on the outstanding principal, increasing your overall loan cost and delaying debt reduction. Making at least the minimum payment on time ensures that the principal continues to decrease and that interest doesn’t compound unnecessarily.

Timely payments also help maintain a good credit score and avoid penalties, giving you flexibility for future borrowing. Consistent repayment is a simple yet powerful strategy to manage principal effectively and reduce long-term financial burden.

6. Use Financial Tools and Calculators

Using online calculators or financial tools allows you to simulate extra payments, see interest savings, and track principal reduction over time. Business solutions like Deskera ERP enable companies to monitor loans, track repayments, and plan cash flow efficiently.

These tools provide actionable insights, making it easier to manage multiple loans or large debts. By visualizing principal reductions and future obligations, you can make informed decisions that save money, reduce risk, and accelerate financial growth.

Actively managing your principal through extra payments, shorter terms, refinancing, tracking, and using financial tools can save interest, reduce debt faster, and improve financial control.

By understanding how each strategy impacts your outstanding principal, you can make smarter repayment choices, optimize cash flow, and gain peace of mind knowing you’re on track to becoming debt-free sooner. Proper planning and disciplined execution are key to maximizing the benefits of principal management.

Managing your principal proactively is not just about paying your debt—it’s about taking control of your financial future.

How AI Optimizes Financial Management

AI algorithms detect patterns in cash flow and spending, helping to identify the best times to make payments or refinance. By integrating loan data with broader financial operations, AI enhances budgeting accuracy, improves financial planning, and minimizes human error.

Automated alerts and intelligent dashboards ensure timely repayments and complete transparency. Overall, AI transforms complex financial tasks into streamlined, strategic decisions—empowering businesses to maintain healthier balance sheets.

How Deskera ERP Can Help You Manage Loans

Deskera ERP turns complex loan management into a streamlined process, giving you real-time insights on principal, interest, and repayment schedules.

Managing loans, repayments, and principal balances can be complicated, especially for businesses handling multiple debts or large-scale financing. Deskera ERP simplifies this process by providing a centralized platform to monitor, track, and manage loans efficiently.

1. Centralized Loan Management

Deskera ERP allows you to record all loan details in one place, including principal, interest rates, repayment schedules, and outstanding balances. You can track multiple loans simultaneously without confusion, ensuring nothing is overlooked.

2. Automated Repayment Tracking

With Deskera ERP, each payment—whether toward principal or interest—is automatically recorded and updated in real time. The system can generate alerts for upcoming due dates, helping prevent missed payments and late fees, and ensuring timely principal reduction.

3. Amortization Schedules and Insights

The platform can generate amortization schedules showing how each payment affects principal and interest over time. This helps you understand how quickly your principal is reducing and plan extra payments strategically to save on interest.

4. Cash Flow Planning

By integrating loan management with overall financial data, Deskera ERP provides insights into cash flow. Businesses can forecast how loan repayments impact liquidity and make informed decisions about financing, investments, or operational expenses.

5. Reporting and Compliance

Deskera ERP generates detailed reports on outstanding principal, interest paid, and repayment history, which are essential for audits and compliance. You can easily review loan performance and demonstrate financial accountability to stakeholders.

Deskera ERP transforms loan management from a manual, error-prone process into a streamlined, automated system. By tracking principal, interest, and repayment schedules in real time, businesses gain better control over debt, optimize cash flow, and make smarter financial decisions.

Key Takeaways

- The loan principal is the original sum of money borrowed, forming the foundation for interest calculations and repayment schedules. Understanding principal helps borrowers grasp their debt obligations and plan repayments effectively.

- Check your loan agreement and monthly statements to distinguish the initial principal and the outstanding principal. This ensures clarity on how much you owe versus how much is interest.

- Loan payments are divided into interest and principal portions. Early payments mostly cover interest, but over time, the principal portion grows, reducing the outstanding balance and total interest paid.

- Loan principals are encountered in mortgages, auto loans, personal loans, student loans, and business financing. Recognizing the principal in each scenario helps in planning payments and managing debt efficiently.

- Loan principal decreases gradually over time as payments are made. Early payments primarily cover interest, while consistent repayments and extra contributions accelerate principal reduction, lowering total interest costs.

- Principal is the amount borrowed, while interest is the cost of borrowing. Understanding this distinction is crucial for managing debt effectively and minimizing unnecessary interest payments.

- Principal repayment occurs gradually through monthly installments. As the outstanding balance decreases, more of each payment is applied to principal, which shortens the loan term and reduces interest paid.

- Paying down principal early lowers future interest, shortens the loan term, and improves financial flexibility. Even small extra payments can significantly reduce total loan costs over time.

- In investments, principal refers to the original capital invested. Protecting this principal is vital, as returns (interest, dividends, capital gains) are earned on this base amount, and loss of principal can undermine long-term goals.

- Principal repayments are not tax-deductible, while interest payments may be. Understanding this difference helps borrowers plan repayments and optimize both cash flow and tax strategy.

- Many borrowers misunderstand principal, confusing it with interest or assuming extra payments have no impact. Clarifying these misconceptions ensures smarter debt management and reduces unnecessary interest costs.

- Strategies like making extra payments, opting for shorter loan terms, refinancing, monitoring balances, and using financial tools like Deskera ERP help manage principal efficiently, save interest, and accelerate debt reduction.

- Deskera ERP centralizes loan tracking, automates repayment schedules, generates amortization insights, supports cash flow planning, and ensures compliance—helping businesses monitor and manage principal and interest effectively.

Related Articles